Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

13 viewsForex Beginner Guide

Forex Beginner Guide

Uploaded by

Kier LictagThis document provides an introduction to Forex trading. It discusses what Forex is, how currency exchange works, and how individuals can participate through brokers that provide leverage. Liquidity and volatility are also covered as important market characteristics. Brokers allow smaller traders to access the market through mini lots and micro lots, while leverage multiplies potential profits and risks. Understanding currency pairs, pips, points and how to calculate potential profits based on pip movements is essential to Forex trading.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Licence To TradeDocument92 pagesLicence To TradeImrana Saleh88% (8)

- Introduction To Forex Trading PDFDocument25 pagesIntroduction To Forex Trading PDFEdy Engl100% (2)

- Ebook Basic TradesmartfxDocument47 pagesEbook Basic TradesmartfxDanny P100% (1)

- Week 8 Seminar - Nike and KakdungDocument6 pagesWeek 8 Seminar - Nike and KakdungCha FraNo ratings yet

- The Advanced Forex Trading Guide: Follow the Best Beginner Forex Trading Guide for Making Money Today! You’ll Learn Secret Forex Market Strategies to the Fundamental Basics of Being a Currency Trader!From EverandThe Advanced Forex Trading Guide: Follow the Best Beginner Forex Trading Guide for Making Money Today! You’ll Learn Secret Forex Market Strategies to the Fundamental Basics of Being a Currency Trader!Rating: 5 out of 5 stars5/5 (8)

- Forex Trading For Dummies 2013Document24 pagesForex Trading For Dummies 2013Forex2013No ratings yet

- 100 Pip Daily by Karl DittmanDocument18 pages100 Pip Daily by Karl DittmanVinícius Oliveira100% (2)

- The Forex Profit SystemDocument10 pagesThe Forex Profit SystempetefaderNo ratings yet

- Basic of Forex TradingDocument7 pagesBasic of Forex TradingdafxNo ratings yet

- Introduction To Foreign ExchangeDocument17 pagesIntroduction To Foreign Exchangepstmdrn2gNo ratings yet

- Forex For Beginners To Forex TradingDocument42 pagesForex For Beginners To Forex TradingMake Money BossNo ratings yet

- Forex Trading 15 Minute Turbocourse Ultimate CollectionDocument23 pagesForex Trading 15 Minute Turbocourse Ultimate CollectionLinda Taylor50% (2)

- ForeX EducationDocument56 pagesForeX EducationRJ Zeshan AwanNo ratings yet

- Investopedia Forex WalkthroughDocument339 pagesInvestopedia Forex WalkthroughJohnette Ricchetti100% (4)

- BB MacdDocument42 pagesBB MacdElan Araújo100% (1)

- iFOREX TutorialDocument20 pagesiFOREX TutorialAmjath ShariefNo ratings yet

- Introduction FX NewDocument17 pagesIntroduction FX NewRahul ChalisgaonkarNo ratings yet

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.From EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.No ratings yet

- Forex Tutorial: Introduction To Currency Trading: Sponsor: MUST-READ Forex Report, Get Yours NowDocument20 pagesForex Tutorial: Introduction To Currency Trading: Sponsor: MUST-READ Forex Report, Get Yours NowbkennethyNo ratings yet

- Forex WalkthroughDocument342 pagesForex WalkthroughPhuthuma Beauty SalonNo ratings yet

- 6185fd0597999e52Document3 pages6185fd0597999e52Mohamed MasoudNo ratings yet

- Advanced Introduction Notes PDFDocument9 pagesAdvanced Introduction Notes PDFInternet VideosNo ratings yet

- Forex InformationDocument14 pagesForex Informationravi_nyse93% (15)

- Introduction To TradingDocument29 pagesIntroduction To TradingMario Galindo QueraltNo ratings yet

- Forex ContentDocument12 pagesForex ContentselamoraymondNo ratings yet

- IntroToForexGuide MTDocument25 pagesIntroToForexGuide MTroggery102010No ratings yet

- How To Go Clear With Forex TradingDocument71 pagesHow To Go Clear With Forex TradingsyxdamenaceNo ratings yet

- Foreign Exchange Markets: What Is Forex?Document11 pagesForeign Exchange Markets: What Is Forex?Hades RiegoNo ratings yet

- Forex Beginner's GuideDocument42 pagesForex Beginner's GuideRvnthah RvnthahNo ratings yet

- KTE FOREX Free BasicDocument39 pagesKTE FOREX Free Basickhannoujs4No ratings yet

- Forex 101Document13 pagesForex 101Manojkumar NairNo ratings yet

- Foreign Exchange Trade Cycle: Table of ContentDocument11 pagesForeign Exchange Trade Cycle: Table of ContentAbhishek BeheraNo ratings yet

- Forex Profit SystemDocument10 pagesForex Profit SystemvinodNo ratings yet

- Euro EconomyDocument26 pagesEuro EconomyJinal ShahNo ratings yet

- Forex 4 UDocument25 pagesForex 4 US N Gautam100% (2)

- Institutional For Ex SystemDocument60 pagesInstitutional For Ex SystemTommyT32No ratings yet

- Price ActionDocument100 pagesPrice Actionchelle100% (3)

- Forex PDF TrainingDocument66 pagesForex PDF TrainingFahrur RoziNo ratings yet

- Forex - An Introduction: HedgingDocument24 pagesForex - An Introduction: HedgingAjay DhawalNo ratings yet

- If C Markets BookDocument12 pagesIf C Markets BookRahul SingrolyNo ratings yet

- The Complete Guide To Forex: Chapter 1: Introduction To Forex Chapter 3: Introduction To Technical AnalysisDocument22 pagesThe Complete Guide To Forex: Chapter 1: Introduction To Forex Chapter 3: Introduction To Technical AnalysisRewa Shankar100% (3)

- Lesson No. 1: What Is Forex Trading?Document8 pagesLesson No. 1: What Is Forex Trading?Zubair AhmedNo ratings yet

- Trading-Forex System ProfitDocument10 pagesTrading-Forex System ProfitRaja PenawarNo ratings yet

- Forex and Crypto: The Ultimate Guide to Trading Forex and Cryptos. How to Make Money Online By Trading Forex and Cryptos in 2020.From EverandForex and Crypto: The Ultimate Guide to Trading Forex and Cryptos. How to Make Money Online By Trading Forex and Cryptos in 2020.No ratings yet

- Welcome To Cbs FX TradeDocument80 pagesWelcome To Cbs FX TradeRoy TongNo ratings yet

- Introduction To Currency Trading: Foreign Exchange Central Banks CurrenciesDocument25 pagesIntroduction To Currency Trading: Foreign Exchange Central Banks Currenciesarunchary007No ratings yet

- Forex 101 L1Document16 pagesForex 101 L1Charles Vincent AguilaNo ratings yet

- Introduction - Foreign Exchange What Is Forex?Document5 pagesIntroduction - Foreign Exchange What Is Forex?mohamad hifzhanNo ratings yet

- Impress Your Date With Forex LingoDocument5 pagesImpress Your Date With Forex LingoThines KumarNo ratings yet

- Training 1Document15 pagesTraining 1QHELILE SIBANDANo ratings yet

- Forex para Principiantes - AvaTrede - Es (English) PDFDocument17 pagesForex para Principiantes - AvaTrede - Es (English) PDFAlb GerardNo ratings yet

- Forex GuideDocument6 pagesForex GuideMukund FarjandNo ratings yet

- Learnforeximpress Your Date With Forex LingoDocument10 pagesLearnforeximpress Your Date With Forex Lingolewgraves33No ratings yet

- iFOREX TutorialDocument18 pagesiFOREX Tutorialvish.jaatNo ratings yet

- Forex Trading For Beginners: A Step by Step Guide to Making Money Trading Forex: Day Trading Strategies That Work, #1From EverandForex Trading For Beginners: A Step by Step Guide to Making Money Trading Forex: Day Trading Strategies That Work, #1No ratings yet

- Tested Forex Strategies And Advanced Technical Analysis For Forex: Enter And Exit The Market Like A Pro With Powerful Strategies For ProfitsFrom EverandTested Forex Strategies And Advanced Technical Analysis For Forex: Enter And Exit The Market Like A Pro With Powerful Strategies For ProfitsRating: 5 out of 5 stars5/5 (4)

- PROJECTDocument13 pagesPROJECTRoshiney AntonittaNo ratings yet

- Position and Rights of A Minor in Partnership Firm PDFDocument4 pagesPosition and Rights of A Minor in Partnership Firm PDFamritam yadavNo ratings yet

- 2.11 Milestone Review - Phase 1Document7 pages2.11 Milestone Review - Phase 1nsadnanNo ratings yet

- Be17280324 17840043 FiDocument2 pagesBe17280324 17840043 FiJay WalkerNo ratings yet

- IIML PGP-SM Summer PlsBro 2021-23-9th DraftDocument25 pagesIIML PGP-SM Summer PlsBro 2021-23-9th DraftPriyanka MishraNo ratings yet

- Larsen & Toubro Limited: Case StudyDocument36 pagesLarsen & Toubro Limited: Case Studyarvind2431No ratings yet

- The Basics of Chapter 11 BankruptcyDocument1 pageThe Basics of Chapter 11 BankruptcyTâm Anh MạcNo ratings yet

- Shubh Nivesh Single PagerDocument2 pagesShubh Nivesh Single PagerANIL TIWARINo ratings yet

- Case Study 5Document2 pagesCase Study 5Mythes JicaNo ratings yet

- Company Profile: Pt. Indo Utama Services The Reliable Engineering Company With Services InnovationDocument21 pagesCompany Profile: Pt. Indo Utama Services The Reliable Engineering Company With Services InnovationAnonymous H9Qg1iNo ratings yet

- National Agriculture Market (ENAM) and ENWRDocument34 pagesNational Agriculture Market (ENAM) and ENWRsatishchpantNo ratings yet

- Part A (Answer Any Four) : InstructionsDocument2 pagesPart A (Answer Any Four) : InstructionsYousufNo ratings yet

- GENBUL - Next Generation Registration ProcessDocument2 pagesGENBUL - Next Generation Registration ProcessGailNo ratings yet

- Great Eastern Life Assurance (Malaysia) Berhad: MR EngineerDocument31 pagesGreat Eastern Life Assurance (Malaysia) Berhad: MR EngineerLeong VicNo ratings yet

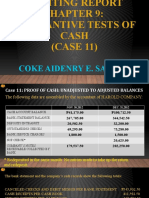

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Accenture Outlook Brazil On The MoveDocument8 pagesAccenture Outlook Brazil On The MoveHayley LeeNo ratings yet

- LME Policy On Responsible Sourcing of LME Listed Brands 2Document28 pagesLME Policy On Responsible Sourcing of LME Listed Brands 2satya.ibsNo ratings yet

- SR No Particulars Sum Insured Gross Premium: M/S. Banco Aluminium Ltd. GST - 24AAACB8629B1Z2 Summary of PoliciesDocument45 pagesSR No Particulars Sum Insured Gross Premium: M/S. Banco Aluminium Ltd. GST - 24AAACB8629B1Z2 Summary of PoliciesSaumil PatelNo ratings yet

- PDF Retail Ux PlaybookDocument62 pagesPDF Retail Ux PlaybooksebaNo ratings yet

- Mother Earth News 004Document102 pagesMother Earth News 004Jan PranNo ratings yet

- Environmental Forces Redesigning Management PracticesDocument53 pagesEnvironmental Forces Redesigning Management PracticesMarie Sheryl Fernandez100% (2)

- Course Map MA2Document7 pagesCourse Map MA2Areeb AhmadNo ratings yet

- Install STEP7 WinCC V18 enUSDocument124 pagesInstall STEP7 WinCC V18 enUSJulian David Rocha OsorioNo ratings yet

- Multichannel Closed Loop Marketing Digitally Transforming The Life SciencesDocument40 pagesMultichannel Closed Loop Marketing Digitally Transforming The Life Sciencessukeshprasad2005No ratings yet

- Certificate of Registration - Ohsms - Sa - 01Document1 pageCertificate of Registration - Ohsms - Sa - 01Arun KumarNo ratings yet

- Business Project - Guidelines and RubricDocument2 pagesBusiness Project - Guidelines and RubricHoney May RetritaNo ratings yet

- Resort PlanningDocument32 pagesResort PlanningLehn Cruz Miguel50% (8)

- Introduction To HULDocument7 pagesIntroduction To HULvaibhhav1234567890100% (1)

- HIgh Level Political Forum On Sustainable DevelopmentDocument3 pagesHIgh Level Political Forum On Sustainable DevelopmentFrank KaufmannNo ratings yet

Forex Beginner Guide

Forex Beginner Guide

Uploaded by

Kier Lictag0 ratings0% found this document useful (0 votes)

13 views22 pagesThis document provides an introduction to Forex trading. It discusses what Forex is, how currency exchange works, and how individuals can participate through brokers that provide leverage. Liquidity and volatility are also covered as important market characteristics. Brokers allow smaller traders to access the market through mini lots and micro lots, while leverage multiplies potential profits and risks. Understanding currency pairs, pips, points and how to calculate potential profits based on pip movements is essential to Forex trading.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an introduction to Forex trading. It discusses what Forex is, how currency exchange works, and how individuals can participate through brokers that provide leverage. Liquidity and volatility are also covered as important market characteristics. Brokers allow smaller traders to access the market through mini lots and micro lots, while leverage multiplies potential profits and risks. Understanding currency pairs, pips, points and how to calculate potential profits based on pip movements is essential to Forex trading.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views22 pagesForex Beginner Guide

Forex Beginner Guide

Uploaded by

Kier LictagThis document provides an introduction to Forex trading. It discusses what Forex is, how currency exchange works, and how individuals can participate through brokers that provide leverage. Liquidity and volatility are also covered as important market characteristics. Brokers allow smaller traders to access the market through mini lots and micro lots, while leverage multiplies potential profits and risks. Understanding currency pairs, pips, points and how to calculate potential profits based on pip movements is essential to Forex trading.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 22

FOREX TRADER VIP GROUP

Welcome to the first lesson of our Forex Basic course

In this lesson you will learn:

what Forex is and how you can earn on it

what liquidity is and why is it an important feature of Forex

how a broker helps you enter the Forex market

what volatility is and how to benefit from it.

What Forex is

Forex is an abbreviation of FOReign EXchange. It describes the conversion of one

currency into another currency, and also refers to the global financial market,

where currencies are traded online around the clock. There is a misconception that

to start trading Forex you need either be a millionaire or Harvard graduate. Let’s

dispel it. Thousands of people buy and sell currencies without notice while

professional traders consciously benefit from it. Think about when you’ve travelled

abroad on holiday. To pay for local goods and services you needed to exchange

your money. If while you were on holiday the unemployment rate in the US fell

and the dollar increased in value by 5%, then when you exchanged your surplus

foreign currency back, you’d make a 5% profit in your local currency. In this way

you’ve earned on a difference of currency rates by buying and selling currencies.

The same process applies even with corporations. For example, an American

company needs to buy machinery in Germany. To pay for them they need to obtain

the local currency first, just like you do when going on holiday. The only

difference is that companies exchange much larger amounts and create supply and

demand on a particular currency. Supply and demand can move market prices.

When the world needs more euros, the price of the euro increases, and when there

are too many dollars circulating, the price drops. To balance the market, central

banks regulate the overall volume of their national currencies by adjusting the

refinancing rate. That's why traders constantly monitor world news.

Liquidity

Assume you hold two currencies - dollars and tenge - which one is more liquid, or

which one will be sold faster? You will surely find a buyer for a dollar

immediately, as it is the most exchanged currency in the world. However tenge

will stay with you for a while, until you find a buyer who needs such an exotic

currency. What if you need to sell 1 million of dollars as soon as possible? That

would not be a challenge on Forex. In Forex, liquidity means the possibility to buy

or sell significant volumes of currency at market price without any delays. The

Forex market is so liquid because the main Forex players such as banks, central

banks, hedge funds and corporations constantly buy and sell huge amounts. This

creates another question: How you can enter the market without having such huge

amounts of currency?

Meet a broker

A broker is an intermediary between traders and other Forex market players.

Exness/Ig.com broker helps people to enter the market with smaller amounts of

currency. Exness/Ig.com provides its traders with the most beneficial quotes by

combining price quotations from several market participants and liquidity

providers. That is possible because of electronic communications network (ECN)

technology. Such networks allow instant order execution, cooperation with trading

platforms, automated trading processes and secure transactions. Exness/Ig.com

provides you with a leverage which allows you to multiply your profit. With up-to-

date trading apps you can trade online 24/5, and from anywhere you wish.

How you can earn on Forex

If you look at the EURUSD chart, you can see that the price of the euro against the

dollar is constantly changing. Economic news and market events influence the

price all the time. Assume you know in advance that according to the ‘National

Statistics Service report’ the unemployment rate in Europe has decreased, then the

price of the euro will increase and you should buy euros. Or if you know that due

to the latest records of ‘Statistics Portugal’ there is a deficit in the trade balance

and that will make the value of euro fall, you should sell your euros.

Volatility

Volatility measures price variations over a specified period of time. It increases

when macroeconomic factors such as inflation, unemployment and GDP become

more variable. Higher volatility creates trading opportunities you can benefit from

by keeping up with financial news. For example, if you know from news that the

inflation rate in Europe will decrease then you can earn by buying EURUSD at the

lowest point, and selling at the highest point.

Let’s summarise what we’ve learned from this lesson:

1. Forex is the global financial market where currencies are traded online

around the clock.

2. Even if you’re not trading on the Forex market you can earn on a difference

of currency rates by buying and selling currencies.

3. Liquidity means the possibility to buy or sell any volume of currency

instantly at the market price. It is the main positive feature of Forex.

4. Exness/Ig.com helps people to trade Forex providing the most beneficial

quotes with the help of ECN technology and up-to-date trading applications.

5. Volatility is a measurement of price variations over a specified period of

time. A volatile market gives an opportunity to earn more profit, but to

benefit from it you need to monitor market news. In the next lesson you will

learn how to calculate the potential profit and risks of your order and how to

control huge amounts of currency without investing heavily.

Welcome to the second lesson of our Forex Basic course.

In this lesson you will learn:

what currency pairs and quotes are

what pips and points are

what a lot is and how to calculate the profit on your order

how to operate huge amounts without investing them

Currency pairs

In the Forex market, currencies are quoted in pairs. In these pairs, the first currency

is named ‘base currency’ and the second one is named ‘quote currency’. The price

of a pair indicates the amount of the quote currency required to buy or sell one unit

of the base currency. For instance, if the price of EUR/USD is 1.18165, then to buy

1 EUR you need to spend 1.18165 USD.

Pip and point

Prices constantly change in the Forex market. However, they usually tend to only

vary by a very small percentage. These tiny changes are represented by changing

of the last two digits in quotes. The fourth digit after the point is called a pip, and

the fifth digit after the point is called a point. To see, how it appears in a live

example, take a look at the quote EUR/USD amounting 1.18165: ‘5’ stands for

points and ‘6’ for pips. Let’s presume that the price for this example has changed

from 1.18165 to 1.18175 it means that it has increased by 1 pip or 10 points.

Quotes generally have five-digit pricing, except some currency pairs. The most

widely-spread are the pairs with Japanese yen. They have three-digit pricing, for

example, USD/JPY. In this case, the last digit in the quote also stands for a point

and the second last stands for a pip. Therefore we have an example: a change in

USD/JPY quote from 109.455 to 109.462 means that the price has increased by 0.7

pips or 7 points.

What is a lot, mini lot, and micro lot?

The main market players are constantly exchanging hundreds of millions of

currencies. To make calculations faster and easier, they measure these amounts in

lots. One standard lot equals 100,000 units of base currency. For a long time, the

lot size was a minimum order volume, which is indeed an overwhelming amount.

This barrier to entry made Forex an exclusive playground for central banks and

financial institutions. Most individual traders couldn’t trade such vast amounts of

currency.

Later on, brokers opened the doors of the Forex market to all comers. The

Exness/Ig.com broker makes Forex accessible by offering two important options. It

is introduced reduced order volumes called mini lots and micro lots. While one lot

equals 100,000 units of a base currency, a mini lot equals 10,000 units of a base

currency, and a micro lot equals 1,000 units of base currency. For example, if

EUR/USD quote amounts 1.18165, this means one lot costs 118,165 USD;

accordingly, one mini lot costs 11816.5 USD and one micro lot costs 1181.65

USD.

What is leverage?

Leverage is an individual loan extended to a trader at the time when he or she

opens an order. Let’s say you are applying leverage of 1:500. This means you can

trade one lot of EUR/USD by only investing $236.38 of your own money.

Accordingly, to trade one mini lot, you need $23.64. And to trade one micro lot of

EUR/USD, you can invest as low as $2.36 of your funds.

In summary, the leverage of 1:500 allows you to open orders that are 500 times

bigger than your investment. So you only lay an insignificantly low amount of

your money at stake. That is how Exness/Ig.com allows you to build an effective

strategy without taking excessive risks.

How to calculate your potential profit

To calculate an outcome of your order, you need to know the cost of one pip. This

will also help you to forecast possible risks. A pip’s value is expressed in the

currency of your trading account: this may be either USD or EUR. If you open a

USD trading account, it makes it easier for you to measure pip prices for pairs that

include USD as a quote currency. For example, if we take the EUR/USD pair, the

monetary expression of one pip for a standard lot on your account is calculated as

follows:

100,000 units of base currency × $0.0001 = $10

Hence, the pip’s price for a mini lot is $1, and the pip’s price for a micro lot is

$0.1.

In such a manner, you can calculate that if you buy one lot of EUR/USD, and the

price increases by ten pips, you earn $100. If you trade a currency pair where USD

is not the quote currency, the pip price will firstly be counted in the quote currency

and then converted into USD according to the Forex exchange rate.

To determine the potential profit of your order before placing one, you can

conveniently use the profit calculator on the Exness/Ig.com website. View it,

choose a currency pair, and fill in the details of your order—that’s all you need to

do to get approximate numbers. Here is how it works: if you buy one lot of

USDJPY, and price increases by ten pips, your profit amounts $89.95.

Now let’s summarise what we’ve learned from this lesson:

Currencies are quoted in pairs. You can buy or sell the base currency for the

quote currency.

Each pair has five-digit pricing except USD/JPY, which has three-digit

pricing. The last digit called a point and the second to last, a pip.

The standard volume for trading on Forex is called a lot and equals to

100,000 units of base currency. Exness allows you to divide a lot into mini

lots and micro lots.

Exness/Ig.com provides you with leverage to trade Forex without vast

amounts of personal investment. It allows you to open orders 500 times

bigger than your initial investment.

Welcome to the third lesson of our Forex Basic course.

In this lesson you will learn:

how to use a leverage and earn 500 times more than with your regular

investments

what a margin is and why a margin call and stop out are not the things you’d

like to experience

how to calculate your equity and why it is so important.

How to use leverage

During the last decade there have been several major economic events that had a

massive effect on the Forex market. For instance, the surprise move by the SNB in

January 2015—aka ‘francogeddon’—that caused the Swiss franc to soar by around

30 per cent in value against the euro within minutes.

In October 2016, the British Pound dropped 9% against the US dollar within

seconds in overnight trading. The incident was described as a ‘flash crash’.

Such events allow traders to achieve large revenues in a short period of time.

But usually, currency quotes tend to change in a very small percentage.

To earn a tangible amount on Forex, you might have to wait for a next major

economic event, invest a huge amount of your personal funds, and ignore all rules

of money management.

Luckily, there exists such thing as leverage, and your broker is ready to offer it to

you any time you open an order.

Leverage is a loan that multiplies your initial investment and is provided at the

moment you open an order.

Leverage is expressed in ratios.

If the leverage is 1:2, it means that you can hold a position twice bigger than your

initial investment.

The leverage 1:100 allows you to open positions 100 bigger.

Exness/Ig.com offers a wide range of leverage: you can set its amount up to 1:500

depending on your skills and asset you’re trading.

Let’s see how leverage works

Assume you have $2,000 on your trading balance and you wish to invest it in

USDJPY without leverage. That enables you to trade 2 micro lots of the pair. You

have made a market analysis, checked economic news, and expect the price to raise

significantly in the next few days. You open a buy order at the price 110.872 and

hold the trade about 37 hours till you close it at 112.482. During that time, the

price has increased by 161 pips. The price of a pip, in this case, is $0.09. This way

you have earned $28.98. 1.5% of profit is a satisfactory outcome considering the

time and funds you’ve put in the trade.

But let’s see what you can get from this trade using the leverage of 1:50.

Your $2,000 allows you to hold $100,000 of capital. That enables you to trade a

full-size lot of USD/JPY. Each pip in the pair is now worth $9.09. If you make

161 pips, you earn $1,463. Hence, you have increased your balance by 75%,

lifting it to $3,463. You can only achieve such an impressive outcome on the Forex

market by applying leverage.

Leverage strengths

Using leverage can be advantageous in two ways:

1. It can help a trader maximise profits per trade.

2. A leveraged trader with limited resources can trade in expensive assets. Without

leverage, it would not be viable for a trader with a $1,000 account to trade in gold,

which is currently trading at $1,200.

The size of leverage a trader uses is very important in determining the success.

When trades go well, a highly leveraged trader can make more money than a trader

with lower leverage.

Managing leverage risk

However, do not forget about risks. If you lose 161 pips in your USD/JPY trade,

you lose $1,463, and your balance goes down to $537.

Using high levels of leverage, you can quickly double your account, but you can

equally fast do the opposite and reduce your account to zero.

That is why you should not invest a substantial part of your balance in one trade no

matter how much you could potentially earn. In the trading world, you often hear

that leverage is a double-edged sword.

Proper distribution of funds on your balance is called risk management and you

will learn about it in our next lessons.

Margin and margin call

To offer you leverage, your broker needs a guarantee that you’re able to cover a

potential loss of the trade.

In Forex, this is called a margin, and it is an amount of money required to open and

maintain open positions.

Once you open an order, the margin used will be held by a broker until you close

your order.

When you open a 1-lot size order with the leverage 1:50 your margin equals

$2,000, which amounts to your balance total. Hence, you cannot open new orders

until you close this one.

But if you trade 1 mini lot ($10,000) with 1:50 leverage, then, to control that size,

you will only need $200.

This way you will have $1,800 left for trading.

Leverage is expressed as a ratio (such as 1:50), while margin is expressed in

percentage terms. Your margin makes 2% of the order volume if you apply 1:50

leverage. And your margin only makes 1% of the order volume if your apply 1:100

leverage. Like the leverage ratios, margin requirements vary for different currency

pairs.

Equity

Assume, you decide to trade mini and micro lots and open many orders.

Good: some of them are profitable and you can get that profit if you close the

orders right now.

However, some fruitless order may bring you losses.

If you look at your balance, you will see it still equals $2,000, as it will not change

until you close all your open orders.

But how can you track the total outcome of open orders?

For this matter, you need to monitor your account equity.

It represents what your account balance would be if all orders were closed at that

time.

Account equity includes your initial investment and floating profit or loss that your

open positions have accrued.

Let’s see what you’ve got. It looks like you’ve picked a strategy that works well

for you, and the profit that you got from winning orders is bigger than expenses

from your lost deals.

Always track your equity. If it gets less than the margin required for all your open

orders, you will get a margin call.

Margin call is triggered when the amount of money in your account will soon be

not enough to cover your potential loss.

Once it happens, you need either to top up your account balance and increase your

equity or to close the position and fix the loss.

If you do not increase your balance after the margin call, stop out will be triggered

and your orders will be closed automatically. This way your broker protects you

from potential losses that you cannot cover with your own investments.

Exness/Ig.com uses balance protection so that you cannot lose more than your

initial deposit, even when trading in a highly volatile market.

Using the trading calculator on Exness/Ig.com , you can see your required margin

based on the currency pair you are trading and the amount of leverage you are

using. It also shows the pip value for each currency pair.

For example, if you are trading 1 full-size lot in EUR/USD using 1:50 leverage,

your required margin is $2,355. In the case of EUR/USD, the calculator shows the

value of 1 pip on a full-size lot of EUR/USD, which is $10.

Let’s summarise what we’ve learned from this lesson:

Leverage allows you to trade several times larger volumes than you could

with your initial deposit. It can multiply your profits but it also multiplies

your risks. Leverage is expressed in ratios.

A margin is a deposit required to maintain your orders open with leverage.

Margin covers potential losses of your trade to a broker.

A margin call is a message from a broker, triggered when your losses are

about to become bigger than your margin. When you get a margin call you

should either close your trade with a loss or add extra funds to your account

to support your margin.

Stop out is the automatic close of your trade when your losses become equal

to your margin. It is required to provide the negative balance protection of

your account.

Welcome to the fourth lesson of our Forex Basic Course.

In this lesson, you will learn:

what the most common types of charts are

how to read a Japanese Candlestick chart

what timeframe to choose to understand market movements better and make

more realistic forecasts.

Types of charts

Charts of different types are used for analysing changes of the price and

forecasting future trends in Forex. The charts are created Y-axis of the chart

represents a price and X-axis of the chart represents a timespan. Line charts and

Japanese Candlesticks are the most commonly used in Forex. Let’s have a closer

look at them both.

Line charts

Line Charts are the simplest, as they only connect closing prices over a given time

period and depict the general price trend.

You can use this type of chart as an overlay or for comparing charts when

performing an intermarket analysis. For example, you might compare the prices of

the Australian dollar and gold using a line chart.

Line charts can additionally be used for determining support and resistance levels

and searching out various patterns.

Candle charts

Japanese Candlesticks offer the most popular form of charting. The candle chart

bears much more information than the line chart. Japanese candlestick explicitly

represents the market environment.

Japanese Candlesticks include two parts: a body and a shadow. The body marks

the area between the open and the close price. If price closes above the open, the

body is hollow. If price ends up closing lower, the body is solid.

The narrow line - called a shadow - shows the price range for the set time period.

The hollow candle is referred to as white, and the solid candle is called black,

though in reality, the chart can be shown in any color.

One Japanese candlestick is basically a linear chart representing a price for a

selected timeframe but shown in a more compact form.

What timeframe to choose to understand market movements better and make

more realistic forecasts

Traders use monthly, weekly, daily, 4-hour, hourly, 15-minute, and even 1-minute

timeframes.

Ideally, traders pick the main timeframe they are interested in, and then choose a

longer and a shorter timeframe to complement the main one.

The longer timeframes typically contain fewer and more reliable signals.

The shorter timeframes usually contain more signals with less accuracy.

There are several types of traders, and they have different trading styles.

Swing or position traders prefer holding trades for days or weeks. They mainly

focus on the daily charts for their trades. They can also make use of a weekly chart

when defining the long-term trend. They track a 4-hour chart when defining the

immediate short-term trend.

Intraday traders, who enter and exit the market the same day, pay more attention to

shorter timeframes such as the hourly and 4-hour charts for entry signals, and the

daily chart for the broader trend.

Let’s summarise what we’ve learned from this lesson:

You can use the line chart to make an intermarket analysis, but to analyse

the price of the symbol you’re trading you should use the candle chart.

The candles can be of two colours: white (bullish) where the closing price is

higher than the opening price, and black (bearish) where the closing price is

lower than the opening price.

Use bigger timeframes to find strong support and resistance lines or a trend

and smaller ones to make your final decision.

Welcome to the fifth lesson of our Forex Basic course.

In this lesson, you will learn about:

the costs that a trader may incur when trading Forex

the remuneration that brokers charge for their services, and how the spread is

related to it

the swap, and how to avoid paying it when you trade overnight

tricks dishonest brokers use, and what fees you don’t need to pay.

When trading the Forex market, a trader can face two types of costs:

losses caused by unprofitable orders

expenses associated with trading itself

Have a good look at this equation:

Trader’s profit = % of your profitable orders × your average profit – % of

your losing orders × your average loss – trading costs

you’ll need it when you start testing trading strategies on your OctaFX demo

trading account.

Losses caused by unprofitable orders

In order to minimise the effect of loss-making orders, stick to two simple rules:

Regularly optimise your trading strategy and increase the success rate of

your orders.

Estimate your possible risk to be no more than ⅓ of your expected profit

when planning a trade.

You can lock particular order in a loss using a Stop Loss order. We’ll explain how

that works in our lesson ‘How to trade Forex in just 20 minutes a day’.

Expenses associated with trading

Expenses associated with trades are generally an inevitable part of accessing Forex

trading.

By the way, Exness/Ig.com is the kind of broker that does not charge commission

for trading on MetaTrader, or for making deposits and withdrawals.

Further on, we’ll have a closer look at what spreads and swaps are.

Spread

Spread is the difference between the bid and ask prices.

A currency quotation is represented by two prices: ask price and bid price. Ask

price is a price for opening a buy order or closing a sell order. Bid price is a price

for opening a sell order or closing a buy order.

The chart that you can see in the MetaTrader window always represents the bid

price.

You pay the first part of the spread when you open an order and the second part

when you close it.

Spread usually amounts from 1 to 2 pips or from 0.0001 to 0.0002 of the base

currency.

This is a small quantity for a trader, but a real broker makes money on traded

volumes. Exness/Ig.com and other major brokers conduct hundreds of orders with

an aggregated volume of tens of million dollars every minute.

Spread encourages cooperation between the trader and the broker.

The more a trader earns, the greater the trading volume, and the higher the brokers’

income. Thanks to the spread, the broker is always interested in the success of his

traders and always works on providing help to them.

However, always bear in mind that you cannot open an order and immediately

close it at the same price.

When important news breaks, spread tends to grow. This happens because prices

may experience acute fluctuations during this time. The broker is risking to open

an order for a loss: for instance, to open an order at a below-market price.

Swap

Swap is charged when you open an order using leverage and hold it for several

days. It may amount from 0.01 to 2.46 pips a day (or approximately from $0.1 to

$18 per lot).

Swap appears because of a standard Forex order, named SPOT. You can see how it

works on your screen.

According to the SPOT order conditions, you need to provide the full amount of

the currency on the second business day.

When the broker provides leverage for your order, he borrows money from a bank.

Therefore you can’t make an actual delivery of the currency against your order.

So how can you earn money on a difference in rates without an actual delivery?

To avoid actual delivery of the currency, the broker closes the position at the end

of the day and reopens it again at its current rate.

This order is called a swap.

But why does this mean the trader is obliged to pay?

When a swap order is executed, the bank charges commission for using leverage

and deducts the difference between the interest rates of the currency pairs you

trade.

If you bought a currency with a lower interest rate, you owe the difference to the

bank. If you bought a currency with a much higher interest rate, the bank pays you.

Special conditions for swaps

If you trade with Exness/Ig.com , you can set a tariff where swaps are only charged

on a three-day basis .You won’t pay any commission if you close your deals within

three days.In this way, Exness/Ig.com allows you to hold deals open overnight

without a swap.

Another option for dealing with swaps is a swap-free account. Whenever you open

an order within this account, you pay a fixed fee instead of a swap. The fee is not

interest and depends on the direction of your order.

Let’s take Exness/Ig.com as an example and have a look at the actual costs of

a trader.

Imagine you’ve opened a Buy order for EUR/USD amounting 1 lot and closed it

on the next day with a 70 pips profit. To open such an order with a leverage ratio

of 1:500, you need $200.

1 pip in this order is 0.0001 multiplied by 100,000 and equals $10.

The profit is 70 pips multiplied by $10 and equals $700.

The expenses are:

payment of the first half of the spread upon the order opening, which

amounts to 0.4 pips or $12

$0 swap payment for holding a position overnight, as one is not due

payment of the second half of the spread upon the order closing, which

amounts to 0.5 pips or $15.

In total, the net income amounts to $673.

Note: you should never pay commission to a broker for depositing or withdrawing

funds. We recommend you avoid brokers who charge either of these.

Let’s summarise what we’ve learnt from this lesson:

For traders, spread is the most profitable kind of broker remuneration.

Spread is the slight difference between Buy and Sell prices. It ordinarily

amounts to 1 pip but may increase during highly volatile markets.

Swap is a technical order in the course of which the broker closes and

reopens the position you opened, in order to release you from an obligation

to deliver actual currency against your order.

Every time a swap is made, the trader pays a commission for one day of the

leverage use. This commission is also called a swap.

Exness/Ig.com charges swap once per three days, which means you can

avoid paying a swap for a deal you hold overnight.

Some brokers may charge additional commissions to their traders. Be

vigilant and do not pay more than necessary.

In this lesson you will learn:

What the difference is between orders opened by market price and pending

orders.

How Stop Loss and Take Profit work.

How to place pending buy and sell orders.

Orders opened and closed by market price

The ability to work with pending orders will save you dozens of hours every day.

You can go about your business and benefit from market movements that you have

pre-calculated.

In the previous lesson, you learnt how to open and close orders in MetaTrader 4.

At that stage, you opened and closed your orders by market price. Opening and

closing an order by market price means executing it at current Ask and Bid prices.

Whenever you open and close your orders by market price, you need to constantly

be in front of your computer to track market movement, keep control of your

losses, and lock in your profits.

Pending execution for Open Order and Close Order

Every time you open an order via the MetaTrader platform, you can specify upper

and lower price levels at which this order will be automatically closed. These

thresholds are called ‘Take Profit’ and ‘Stop Loss’. We recommend you specify

them both for every order.

You can also create pending orders. These open automatically when the price hits

the level you specified. These orders are called ‘Limit Order’ and ‘Stop Order’.

Take Profit and Stop Loss

Whenever you open an order, remember that you can always arrive at two possible

outcomes:

1. Your prediction will be correct, and you will make a profit.

2. The market will go in the opposite direction, and your order will make a loss.

Stop Loss marks the maximum level of loss you can bear for the order, if the price

goes against your prediction.

Take Profit marks the price level at which you agree to close your order and fix the

profit.

Why do you need Stop Loss?

You may not have the MetaTrader charts in front of you at the moment the market

starts moving against your forecast.

Stop Loss will help you keep the majority of your account balance.

Sometimes emotions may take over and you will be tempted to wait for the price

trend to reverse, thus losing more and more money. Stop Loss will help you stay

cool headed and close the losing trade.

This is where an important rule of successful trading comes into the picture:

Never move your Stop Loss level further from the price level of the order you’ve

already opened.

Why do you need Take Profit?

The price often hits its maximum level quicker than you expect. Then it turns

around, and you are too late to close the order at the most profitable price level.

Take Profit helps you close orders at the moment the price reaches the level you

predicted.

If you have something more entertaining to do rather than gazing at the chart and

waiting the priсe to reach the level you want, use Take Profit to switch off from

MetaTrader.

How to set Stop Loss and Take Profit thresholds

If you open a buy order:

Set the Take Profit value above the opening price.

Set the Stop Loss value below the opening price.

If you open a sell order:

Set the Take Profit value below the opening price.

Set the Stop Loss value above the opening price.

The second important rule of successful trading:

Whenever you open an order, your expected profit should be three times bigger

than your estimated loss. Remember the formula for profit that we introduced in

the lesson ‘How to avoid paying extra to a broker’.

It follows that your Stop Loss level should be three times closer to the initial order

price than your Take Profit level.

How to set Stop Loss and Take Profit in MetaTrader 4

For desktop and web versions of MetaTrader 4:

Enter the price levels in the corresponding fields and confirm opening the order.

For the Android version of MetaTrader 4:

Enter the Stop Loss level in the field underlined with red and the Take Profit level

in the field underlined with green.

For iOS version of MetaTrader 4:

Enter the Stop Loss and Take Profit levels in the fields with the corresponding

labels.

Pending orders

There are two types of pending orders:

Limit Order

Stop Order

To open a pending Buy order, you need to do the following:

Open a Buy Stop Order if you want to set the price above the current price.

Open a Buy Limit Order if you want to set the price below the current price.

To open a pending Sell order, you need to do the following:

Open a Sell Stop Order if you want to set the price below the current price.

Open a Sell Limit Order if you want to set the price above the current price.

How you can use pending orders in trading

Limit Order

A price tends to reverse its direction after hitting its limit. Limit Order triggers at

that point, allowing you to open an order at the most advantageous price

automatically.

Stop Order

A Stop Order is applied when the price is about to surpass a specific level, at which

point it is likely to start growing. Imagine that the ‘stop’ in Stop Order prompts

you to stop waiting: when it triggers, we stop waiting and open an order.

Now let’s summarise what we’ve learned from this lesson:

You can open and close orders by market price. This kind of Forex trading

requires you track the price in MetaTrader continuously.

Setting a Stop Loss limits your losses. It closes a loss-making orders at a

predefined price. Stop Loss helps you stick to your initial strategy and

protects your nerves in the case of uncertainty.

Take Profit allows you to get the most out of the deal. It closes your

profitable orders at the set price.

If you want an order to open automatically at a certain price level, apply

pending Limit and Stop Orders.

If you create a pending Sell order, apply a Sell Stop Order for the prices

above the current price and a Sell Limit Order for the prices below the

current price.

If you create a pending Buy order, apply a Buy Stop Order for the prices

below the current price and a Buy Limit Order above the current price.

Welcome to the eighth lesson of our Forex Basic course.

In this lesson you’ll learn:

If it is possible to trade successfully without managing your risks.

What a series of drawdowns and a floating drawdown are.

What the problem is with replenishing your equity.

Three basic rules of risk management that will help you make a profit on

Forex.

Can you make money on Forex without risk management?

Only 15% of Forex traders manage their risks. However, ignoring risk

management makes the whole process a Forex gamble instead of Forex trading.

10% of all traders earn money steadily in Forex, while 90% of traders

eventually lose all their investments.

The traders who make steady income in Forex are all among the 15% of

traders who apply risk management.

Conclusion:Risk management does not guarantee you a success in Forex, but

without risk management, you will lose your investment for sure. Let’s take a

closer look at how this happens.

Series of drawdowns

Drawdown is a decrease of the equity in your trading account caused by a losing

order.

Without managing risks, a trader usually loses the majority of their investment

after a series of drawdowns. However, a series of drawdowns is quite common in

the Forex market. Even if you use a highly effective strategy that has an 80%

success rate, at some point you can run into a series of losing trades.

You’ll be able to preserve a significant part of your investment even after a series

of drawdowns if you are prepared for it. That’s where you need risk management.

Drawdown may be fixed or floating.

Fixed drawdown is a loss on an order that you’ve already closed.

You have fixed your losses, and their amount stops increasing.

Your account balance has decreased by the drawdown amount.

Floating drawdown is a loss on an order that is still open.

If the market persists against your prediction, your losses continue to grow.

Your account balance remains unchanged as the order is still open.

Floating drawdown is the most dangerous one because many traders continue to

estimate the success of their trading activity by their balance amount and ignore

their equity.

An issue of replenishing your equity

The most important issue with a series of drawdowns is that the more you lose, the

harder it is to make it back to your original account volume. That the percent of the

equity you need to return to recover your balance grows drastically.

Risk management

Three basic rules of risk management:

Set a Stop Loss level for each order to limit your floating drawdown.

Open orders only when your potential income is three times larger than your

possible loss.

Set the tolerable losses of your orders at 2% of your equity or lower (a Two-

Percent Rule).

Limiting your floating drawdown

Whenever you open an order, always set Stop Loss. In this case, the drawdown of

your order will never exceed the level that you preset.

It is often not that easy to convince yourself to close a losing order. MetaTrader’s

Stop Loss will make that decision for you.

Important! Do not adjust the Stop Loss level of an order you’ve already opened!

This would mean you deviate from your strategy in the emotion of the moment.

You now set your maximum tolerable losses for all your orders. But how can you

determine their level? To calculate it, apply the rule Stop Loss = ⅓ Take Profit.

Stop Loss = ⅓ Take Profit

Remember the formula for profit that we introduced in the lesson ‘How to avoid

paying extra to a broker’. We’ll now take a closer look at its core section. You can

increase your profit by either increasing the percentage of your profitable orders or

managing your average profit and average loss.

Increasing the percentage of your profitable orders

It is not as simple as one might think. 80% of traders make less than a half of their

trades profitable. Yet this is enough to gain when trading Forex. Your trading

strategy is actually successful even if slightly more than 50% of the orders you

open are profitable. Surviving through certain events on the Forex market with a

success rate that is slightly below 50% may also be acceptable.

Managing your average profit and loss

To increase your average profit and decrease your average loss, apply the rule:

Stop Loss = ⅓ Take Profit.

Calculate your potential profit before opening an order. Set your Take Profit at this

price level. Your maximum tolerable loss should not exceed ⅓ of your potential

profit. Set Stop Loss at the corresponding price level. If your strategy does not

allow you to set Stop Loss at that level, do not open the order.

Two-Percent Rule

Maximum allowable losses on your new order may not exceed 2% of your current

equity. If you can see that the maximum level of losses on the order you are about

to open may amount more than 2% of your equity, you need to decrease this

order’s volume (lower the number of lots).

The Two-Percent Rule allows you to preserve the major part of your investment

and keep to your strategy even after a series of drawdowns.

How Two-Percent Rule works:

Let’s suppose that you have $2,000 in your trading account.

If you make 5 losing orders in a row, you’ll have $1,807 in your account.

If your losing streak grows to 10 orders, you’ll have $1,634 in your account.

After 20 losing orders, you will have $1,335 remaining.

After 30 losing orders, you will still have $1,090 in your account balance—55% of

your initial investment.

If you violate the Two-Percent Rule and risk 10% of your equity for every order,

you will face the following:

After a series of just 5 losing orders, you will have $1,181 remaining in your

account.

After 10 losing orders, you will have your balance decreased to $697.

After 20 losing orders, you will only have $243 in your account.

In the end, 30 losing orders will reduce your investment almost to zero.

Let’s repeat what we’ve learnt in this lesson:

1. You won’t succeed in trading without risk management.

2. You may face multiple drawdowns with any strategy. They sometimes may

last for quite a long time. You need to learn how to overcome them when

you trade.

3. You may face multiple drawdowns with any strategy. They sometimes may

last for quite a long time. You need to learn how to overcome them when

you trade.

4. Apply the Two-Percent Rule every time you open an order: the maximum

amount of loss on the order should not exceed 2% of your trading account

equity.

5. Open an order only if your potential profit is three times your possible loss.

Stop Loss = ⅓ Take Profit.

You might also like

- Licence To TradeDocument92 pagesLicence To TradeImrana Saleh88% (8)

- Introduction To Forex Trading PDFDocument25 pagesIntroduction To Forex Trading PDFEdy Engl100% (2)

- Ebook Basic TradesmartfxDocument47 pagesEbook Basic TradesmartfxDanny P100% (1)

- Week 8 Seminar - Nike and KakdungDocument6 pagesWeek 8 Seminar - Nike and KakdungCha FraNo ratings yet

- The Advanced Forex Trading Guide: Follow the Best Beginner Forex Trading Guide for Making Money Today! You’ll Learn Secret Forex Market Strategies to the Fundamental Basics of Being a Currency Trader!From EverandThe Advanced Forex Trading Guide: Follow the Best Beginner Forex Trading Guide for Making Money Today! You’ll Learn Secret Forex Market Strategies to the Fundamental Basics of Being a Currency Trader!Rating: 5 out of 5 stars5/5 (8)

- Forex Trading For Dummies 2013Document24 pagesForex Trading For Dummies 2013Forex2013No ratings yet

- 100 Pip Daily by Karl DittmanDocument18 pages100 Pip Daily by Karl DittmanVinícius Oliveira100% (2)

- The Forex Profit SystemDocument10 pagesThe Forex Profit SystempetefaderNo ratings yet

- Basic of Forex TradingDocument7 pagesBasic of Forex TradingdafxNo ratings yet

- Introduction To Foreign ExchangeDocument17 pagesIntroduction To Foreign Exchangepstmdrn2gNo ratings yet

- Forex For Beginners To Forex TradingDocument42 pagesForex For Beginners To Forex TradingMake Money BossNo ratings yet

- Forex Trading 15 Minute Turbocourse Ultimate CollectionDocument23 pagesForex Trading 15 Minute Turbocourse Ultimate CollectionLinda Taylor50% (2)

- ForeX EducationDocument56 pagesForeX EducationRJ Zeshan AwanNo ratings yet

- Investopedia Forex WalkthroughDocument339 pagesInvestopedia Forex WalkthroughJohnette Ricchetti100% (4)

- BB MacdDocument42 pagesBB MacdElan Araújo100% (1)

- iFOREX TutorialDocument20 pagesiFOREX TutorialAmjath ShariefNo ratings yet

- Introduction FX NewDocument17 pagesIntroduction FX NewRahul ChalisgaonkarNo ratings yet

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.From EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.No ratings yet

- Forex Tutorial: Introduction To Currency Trading: Sponsor: MUST-READ Forex Report, Get Yours NowDocument20 pagesForex Tutorial: Introduction To Currency Trading: Sponsor: MUST-READ Forex Report, Get Yours NowbkennethyNo ratings yet

- Forex WalkthroughDocument342 pagesForex WalkthroughPhuthuma Beauty SalonNo ratings yet

- 6185fd0597999e52Document3 pages6185fd0597999e52Mohamed MasoudNo ratings yet

- Advanced Introduction Notes PDFDocument9 pagesAdvanced Introduction Notes PDFInternet VideosNo ratings yet

- Forex InformationDocument14 pagesForex Informationravi_nyse93% (15)

- Introduction To TradingDocument29 pagesIntroduction To TradingMario Galindo QueraltNo ratings yet

- Forex ContentDocument12 pagesForex ContentselamoraymondNo ratings yet

- IntroToForexGuide MTDocument25 pagesIntroToForexGuide MTroggery102010No ratings yet

- How To Go Clear With Forex TradingDocument71 pagesHow To Go Clear With Forex TradingsyxdamenaceNo ratings yet

- Foreign Exchange Markets: What Is Forex?Document11 pagesForeign Exchange Markets: What Is Forex?Hades RiegoNo ratings yet

- Forex Beginner's GuideDocument42 pagesForex Beginner's GuideRvnthah RvnthahNo ratings yet

- KTE FOREX Free BasicDocument39 pagesKTE FOREX Free Basickhannoujs4No ratings yet

- Forex 101Document13 pagesForex 101Manojkumar NairNo ratings yet

- Foreign Exchange Trade Cycle: Table of ContentDocument11 pagesForeign Exchange Trade Cycle: Table of ContentAbhishek BeheraNo ratings yet

- Forex Profit SystemDocument10 pagesForex Profit SystemvinodNo ratings yet

- Euro EconomyDocument26 pagesEuro EconomyJinal ShahNo ratings yet

- Forex 4 UDocument25 pagesForex 4 US N Gautam100% (2)

- Institutional For Ex SystemDocument60 pagesInstitutional For Ex SystemTommyT32No ratings yet

- Price ActionDocument100 pagesPrice Actionchelle100% (3)

- Forex PDF TrainingDocument66 pagesForex PDF TrainingFahrur RoziNo ratings yet

- Forex - An Introduction: HedgingDocument24 pagesForex - An Introduction: HedgingAjay DhawalNo ratings yet

- If C Markets BookDocument12 pagesIf C Markets BookRahul SingrolyNo ratings yet

- The Complete Guide To Forex: Chapter 1: Introduction To Forex Chapter 3: Introduction To Technical AnalysisDocument22 pagesThe Complete Guide To Forex: Chapter 1: Introduction To Forex Chapter 3: Introduction To Technical AnalysisRewa Shankar100% (3)

- Lesson No. 1: What Is Forex Trading?Document8 pagesLesson No. 1: What Is Forex Trading?Zubair AhmedNo ratings yet

- Trading-Forex System ProfitDocument10 pagesTrading-Forex System ProfitRaja PenawarNo ratings yet

- Forex and Crypto: The Ultimate Guide to Trading Forex and Cryptos. How to Make Money Online By Trading Forex and Cryptos in 2020.From EverandForex and Crypto: The Ultimate Guide to Trading Forex and Cryptos. How to Make Money Online By Trading Forex and Cryptos in 2020.No ratings yet

- Welcome To Cbs FX TradeDocument80 pagesWelcome To Cbs FX TradeRoy TongNo ratings yet

- Introduction To Currency Trading: Foreign Exchange Central Banks CurrenciesDocument25 pagesIntroduction To Currency Trading: Foreign Exchange Central Banks Currenciesarunchary007No ratings yet

- Forex 101 L1Document16 pagesForex 101 L1Charles Vincent AguilaNo ratings yet

- Introduction - Foreign Exchange What Is Forex?Document5 pagesIntroduction - Foreign Exchange What Is Forex?mohamad hifzhanNo ratings yet

- Impress Your Date With Forex LingoDocument5 pagesImpress Your Date With Forex LingoThines KumarNo ratings yet

- Training 1Document15 pagesTraining 1QHELILE SIBANDANo ratings yet

- Forex para Principiantes - AvaTrede - Es (English) PDFDocument17 pagesForex para Principiantes - AvaTrede - Es (English) PDFAlb GerardNo ratings yet

- Forex GuideDocument6 pagesForex GuideMukund FarjandNo ratings yet

- Learnforeximpress Your Date With Forex LingoDocument10 pagesLearnforeximpress Your Date With Forex Lingolewgraves33No ratings yet

- iFOREX TutorialDocument18 pagesiFOREX Tutorialvish.jaatNo ratings yet

- Forex Trading For Beginners: A Step by Step Guide to Making Money Trading Forex: Day Trading Strategies That Work, #1From EverandForex Trading For Beginners: A Step by Step Guide to Making Money Trading Forex: Day Trading Strategies That Work, #1No ratings yet

- Tested Forex Strategies And Advanced Technical Analysis For Forex: Enter And Exit The Market Like A Pro With Powerful Strategies For ProfitsFrom EverandTested Forex Strategies And Advanced Technical Analysis For Forex: Enter And Exit The Market Like A Pro With Powerful Strategies For ProfitsRating: 5 out of 5 stars5/5 (4)

- PROJECTDocument13 pagesPROJECTRoshiney AntonittaNo ratings yet

- Position and Rights of A Minor in Partnership Firm PDFDocument4 pagesPosition and Rights of A Minor in Partnership Firm PDFamritam yadavNo ratings yet

- 2.11 Milestone Review - Phase 1Document7 pages2.11 Milestone Review - Phase 1nsadnanNo ratings yet

- Be17280324 17840043 FiDocument2 pagesBe17280324 17840043 FiJay WalkerNo ratings yet

- IIML PGP-SM Summer PlsBro 2021-23-9th DraftDocument25 pagesIIML PGP-SM Summer PlsBro 2021-23-9th DraftPriyanka MishraNo ratings yet

- Larsen & Toubro Limited: Case StudyDocument36 pagesLarsen & Toubro Limited: Case Studyarvind2431No ratings yet

- The Basics of Chapter 11 BankruptcyDocument1 pageThe Basics of Chapter 11 BankruptcyTâm Anh MạcNo ratings yet

- Shubh Nivesh Single PagerDocument2 pagesShubh Nivesh Single PagerANIL TIWARINo ratings yet

- Case Study 5Document2 pagesCase Study 5Mythes JicaNo ratings yet

- Company Profile: Pt. Indo Utama Services The Reliable Engineering Company With Services InnovationDocument21 pagesCompany Profile: Pt. Indo Utama Services The Reliable Engineering Company With Services InnovationAnonymous H9Qg1iNo ratings yet

- National Agriculture Market (ENAM) and ENWRDocument34 pagesNational Agriculture Market (ENAM) and ENWRsatishchpantNo ratings yet

- Part A (Answer Any Four) : InstructionsDocument2 pagesPart A (Answer Any Four) : InstructionsYousufNo ratings yet

- GENBUL - Next Generation Registration ProcessDocument2 pagesGENBUL - Next Generation Registration ProcessGailNo ratings yet

- Great Eastern Life Assurance (Malaysia) Berhad: MR EngineerDocument31 pagesGreat Eastern Life Assurance (Malaysia) Berhad: MR EngineerLeong VicNo ratings yet

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Accenture Outlook Brazil On The MoveDocument8 pagesAccenture Outlook Brazil On The MoveHayley LeeNo ratings yet

- LME Policy On Responsible Sourcing of LME Listed Brands 2Document28 pagesLME Policy On Responsible Sourcing of LME Listed Brands 2satya.ibsNo ratings yet

- SR No Particulars Sum Insured Gross Premium: M/S. Banco Aluminium Ltd. GST - 24AAACB8629B1Z2 Summary of PoliciesDocument45 pagesSR No Particulars Sum Insured Gross Premium: M/S. Banco Aluminium Ltd. GST - 24AAACB8629B1Z2 Summary of PoliciesSaumil PatelNo ratings yet

- PDF Retail Ux PlaybookDocument62 pagesPDF Retail Ux PlaybooksebaNo ratings yet

- Mother Earth News 004Document102 pagesMother Earth News 004Jan PranNo ratings yet

- Environmental Forces Redesigning Management PracticesDocument53 pagesEnvironmental Forces Redesigning Management PracticesMarie Sheryl Fernandez100% (2)

- Course Map MA2Document7 pagesCourse Map MA2Areeb AhmadNo ratings yet

- Install STEP7 WinCC V18 enUSDocument124 pagesInstall STEP7 WinCC V18 enUSJulian David Rocha OsorioNo ratings yet

- Multichannel Closed Loop Marketing Digitally Transforming The Life SciencesDocument40 pagesMultichannel Closed Loop Marketing Digitally Transforming The Life Sciencessukeshprasad2005No ratings yet

- Certificate of Registration - Ohsms - Sa - 01Document1 pageCertificate of Registration - Ohsms - Sa - 01Arun KumarNo ratings yet

- Business Project - Guidelines and RubricDocument2 pagesBusiness Project - Guidelines and RubricHoney May RetritaNo ratings yet

- Resort PlanningDocument32 pagesResort PlanningLehn Cruz Miguel50% (8)

- Introduction To HULDocument7 pagesIntroduction To HULvaibhhav1234567890100% (1)

- HIgh Level Political Forum On Sustainable DevelopmentDocument3 pagesHIgh Level Political Forum On Sustainable DevelopmentFrank KaufmannNo ratings yet