Professional Documents

Culture Documents

The Impact of External Debt On Economic Growth in Egypt 2

The Impact of External Debt On Economic Growth in Egypt 2

Uploaded by

Walaa IbrahimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Impact of External Debt On Economic Growth in Egypt 2

The Impact of External Debt On Economic Growth in Egypt 2

Uploaded by

Walaa IbrahimCopyright:

Available Formats

The Impact of External Debt on Economic

Growth in Egypt During (1990-2019)

25 Oct 2022

Contents

1. EGYPT'S EXTERNAL DEBT.............................................................................................................. 2

3.1 Egypt’s External Debt Evolution (2)...................................................................................................2

3.2 Reasons Behind Egypt's Reliance on External Debt (2)....................................................................4

3.3 The External Debt Indicators........................................................................................................... 5

4.3.1 External debt to GDP ratio: (3)...................................................................................................6

4.3.2 External debt to Goods and Services Exports ratio: (3)..............................................................7

4.3.3 Average Percentage of External Debt Per Person (2)................................................................8

2. CONCLUSION (2).............................................................................................................................. 8

3. REFERENCES:................................................................................................................................ 9

List of Figures:

FIGURE 1: PERCENTAGE OF EXTERNAL DEBT TO GDP- EGYPT- BASED ON MACROTRENDS SITE...........................................12

FIGURE 2: PERCENTAGE OF EXTERNAL DEBT TO GOOD AND SERVICES EXPORTS- EGYPT - BASED ON MACROTRENDS

SITE.............................................................................................................................................................. 13

1. EGYPT'S EXTERNAL DEBT

3.1 Egypt’s External Debt Evolution (2)

As an introduction, Egypt first became aware of foreign debt in 1876 under the rule of Said Pasha.

Since then, foreign debt in Egypt has increased frequently for a variety of reasons, whether political

or economic. In the year 1987, Egypt began the structural stabilization program and debt schedule

with the International Monetary Fund, when it defaulted on its debts and was on the point of

bankruptcy, but soon slipped again, and the issue grew worse in 1990, and from this year until 2019,

it has been discovered that the foreign debt significantly affects the Egyptian national economy, as

well as its fluctuations in the economy and political events.

The Impact of External Debt on Economic Growth in Egypt Page 2 of 9

25 Oct 2022

The Egyptian economy is burdened by the country's rising external debt, which climbed during the

1990–2019 period from 33 billion dollars in 1990 to 115 billion dollars in 2019. This is an increase of

four times. The external debt was approximately $35 billion in 2007 with an annual growth rate of

1.9%, and it was $33.8 billion in 2008 with an annual growth rate of (-3.1%).

One of the most significant eras that saw a definite rise in the Egyptian external debt was the years

immediately following the January 25, 2011, revolution. The debt climbed from $34.9 billion in 2011 to

$79.33 billion in 2017, growing at an annual rate of 3.6%. In addition to the factional demands that

involved many sectors, Egypt's demand for loans during that time period coincided with the political

strikes that Egypt experienced after the January 25 revolution, the decline in the volume of foreign

investments, the decline in the volume of Egyptians' remittances abroad, and the decline in the

Egyptian tourism sector.

At the end of December 2019, the external debt balance was approximately 115 billion US dollars, up

almost 4 billion dollars (3.7%) over the previous month. There were around $0.3 billion worth of

foreign currencies borrowed against the US currency.

In terms of the costs associated with paying the external debt, they came to around 6.9 billion dollars

between July and December 2019/2020, with 4.9 billion paid in installments and 2 billion in interest.

Providing funds to stabilize the exchange rate, funding the import of essential commodities, and

financing projects with low rates of return are just a few examples from recent years.

The Impact of External Debt on Economic Growth in Egypt Page 3 of 9

25 Oct 2022

3.2 Reasons Behind Egypt's Reliance on External Debt (2)

There are a lot of factors that contributed to the recent rise in the external debt, some of them include

the following:

1- One of the main factors contributing to debt aggravation is the way loans are used. For example,

a large portion of loans are used to finance the budget deficit as well as the importation of

consumer goods, particularly food. regarding the economics of Egypt.

2- a reduction in capital flows as a result of using foreign reserves held by the central bank to

finance current activities instead of adding to them, which causes a steady loss in foreign

exchange reserves.

3- the dramatic rise in interest rates in global financial markets, which triggered a growth in debt.

4- Limited domestic resources to achieve the general budget's planned economic growth due to the

foreign exchange crisis brought on by the decline in export-related foreign exchange and the

inability of decision-makers to cut spending as a result of rising consumerism, which ultimately

resulted in a significant deficit in domestic revenue. Egypt's trade balance suffered in the early

1980s due to the oversupply of oil on the market, the economic stagnation in industrialized

nations, and a decline in the rates of trade exchange between Egypt and those nations. Due to a

large growth in Egypt's imports of consumer and recreational goods and a corresponding rise in

their pricing, Egypt had to turn to external borrowing to make up for this resource shortage.

5- In addition to the 1967 and 1973 wars, which cost the Egyptian economy enormous sums of

money from re-arming the army and building the Egyptian economy, which caused the external

debt to rise to 2.6 billion, Egypt's debts increased at a rapid rate between 1967 and 1975 as a

result of Egypt gaining its independence, prompting it to start looking for a way to raise living

standards. Prior to President Anwar Sadat's passing on October 6, 1981, Egypt's foreign debt had

increased by more than 8 times after the conflict and reached $22 billion.

6- As a result of the widening of the import door and the growing reliance on short-term external

funding resources, particularly banking facilities, there was an increase in foreign debt. Due to the

short term and high interest rate, which exceeded 20% and required enormous amounts of cash

to service its burdens, the increased access to short-term facilities caused the emergence of a

serious problem in the international liquidity of the Egyptian economy. In 1975, the value of the

receivables from these facilities (interests + installments) was approximately 2.184 billion dollars,

which is equivalent to 78% of the value of the proceeds. general.

Due to these and other factors, the external indebtedness increased from approximately 1.6 billion

dollars in 1971 to approximately 28.6 billion dollars in 1983. As a result, the period of economic

openness was characterized by the ongoing depletion of the state's limited resources in the form of

payments made to foreign creditors in repayment of loans. The amount of external debt climbed,

The Impact of External Debt on Economic Growth in Egypt Page 4 of 9

25 Oct 2022

going from 1.6 billion dollars in 1971 to approximately 2.1 billion dollars in 1973, then rising to 15

billion dollars in 1979, and finally reaching over 20 billion dollars in 1982, as a result of repaying those

loans' interests. It got to $28.6 billion in 1983.

Despite the fact that the arm of openness is to reduce the burdens on foreign loans and replace them

with foreign investments, the danger was that a sizable portion of the debt was spent on consumption

and was not directed to investment, that is, it did not generate a return that could be used to pay off

debts. The second phase between 1975 and 1980 witnessed a major boom in the increase in

indebtedness due to the benevolence of creditors after the transformation of the Arab countries, from

investments that did not exceed a total of $2 billion over the years from 1974 to 1979, at a time when

the volume of debts jumped dramatically. In relation to the eastern camp, Egypt's debts increased by

304.5% within five years due to internal imbalances and the unwillingness of Arab countries to reduce

public and private expenditures to the level of available resources, according to a study that attributed

this generosity to being a kind of implication and dependency on the capabilities of these countries.

3.3 The External Debt Indicators

The external debt indicators are among the crucial leading indicators used to track and direct

governments and nations at large. Most regional and global organizations place a high value on

these metrics. The relationship between external debt, exports, and GDP is all regarded to be a

useful indication in the process of evaluating foreign debt and the ability to pay. External debt

indicators are very sensitive to interest rates. potential and connected to the control of external debt.

These indications are typically used to determine whether or not the external debt has reached a

dangerous level or is still stable in a stage of safety. Additionally, how much of an impact it has on the

financial and economic position.

The most significant metrics used to assess Egypt's economy's capacity to service its foreign debts

are listed below:

The Impact of External Debt on Economic Growth in Egypt Page 5 of 9

25 Oct 2022

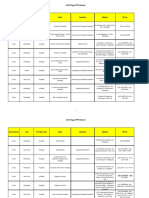

4.3.1 External debt to GDP ratio: (3)

This indicator is one of the most significant leading indicators that nations use to assess the debt in relation to economic activity and the capacity of the

government to repay it. Anytime the outstanding balance of external debt exceeds 40% of GDP, it is forbidden to increase it. And it is evident from Chart

No. 1 that between 2007 and 2016, the ratio of external debt to GDP averaged 16.84%, and that in recent years, this indicator has tended to drop by the

middle of 2018. 40%, indicating that the Egyptian foreign debt has reached a dangerous stage.

% External Debt to GDP

350 100%

87%

90%

Billion Of US $

or GDP

300

Debt77%

80%

74%

250

66%

70%

63%

% External Debt to GDP

56%

60%

200

47%

50%

40%

40%

38%

38%

150

38%

38%

36%

40%

35%

34%

34%

29%

29%

29%

27%

100 30%

21%

21%

19%

17%

16%

20%

15%

15%

14%

14%

50

10%

0 0%

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

FIGURE 1: PERCENTAGE OF EXTERNAL DEBT TO GDP- EGYPT- BASED ON MACROTRENDS SITE

The Impact of External Debt on Economic Growth in Egypt Page 6 of 9

25 Oct 2022

4.3.2 External debt to Goods and Services Exports ratio: (3)

This metric reveals the nation's capacity to pay and provide foreign exchange and can be used as a sustainability indicator because rising levels show that the

state's debts have outgrown its basic foreign exchange reserves, which suggests potential challenges in the state's capacity to meet its debt commitments.

This measure classifies a state's indebtedness as moderate if the foreign debt balance to total exports is less than 200% and as high if the external debt

balance is between 200 and 350% of total exports. The state's debt is described as rising by the Foreign Ministry's high indebtedness balance of 350%. As a

result, Egypt's external debt was low between (2000 - 2016) and increased during (2017-2019). This shows that Egypt may have difficulties meeting its

obligations to creditors because the external debt has replaced other sources of hard currency and is necessary to maintain the stability of the exchange rate.

% External Debt to Goods and Services Exports

377%

140 400%

Debt or Exports

(Billion of US $)

350%

317%

120

277%

300%

262%

255%

100

247%

% External Debt to Exports

235%

228%

227%

225%

250%

217%

212%

203%

201%

80

190%

181%

174%

200%

168%

141%

60

150%

115%

112%

96%

96%

95%

40

88%

87%

79%

100%

75%

72%

63%

20 50%

0 0%

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

FIGURE 2: PERCENTAGE OF EXTERNAL DEBT TO GOOD AND SERVICES EXPORTS- EGYPT - BASED ON MACROTRENDS SITE

The Impact of External Debt on Economic Growth in Egypt Page 7 of 9

25 Oct 2022

4.3.3 Average Percentage of External Debt Per Person (2)

Since most annual payments have not yet been due, due to the extended maturity periods (5-30

years), it is impossible to quantify the true burden on future generations with accuracy and clarity

because it depends on future political and economic developments (Abu Aida, 2012, p. 192). It is

presumptively true that each person's portion of the foreign debt is equal to the capabilities reflected

in their average share of the country's income. If a person's part of the external debt equals 50% of

his typical annual income, the proportionality is within the bounds of safety. As shown by Table No.

4's data, the average annual per capita income in 2019 was $3,105, or 33% of the total, while the per

capita external debt increased by a factor of two during the previous three years, reaching $1013.

average yearly salary for an individual.

Through the foregoing, it is noted that there is an increase in the size of the external debt, which

represents a crisis may facing the Egyptian economy in the future.

2. CONCLUSION (2)

To conclude, the issue of external debt is one of the contentious topics because it is unclear whether

it promotes or inhibits economic growth. External debt is a source of public revenue, and its

accumulation indicates a slowdown in the nation's economic growth because of the inability to meet

these debts' obligations. The total amount of public and private debts owing to non-residents is known

as external debt. They are redeemable for goods and services or in foreign currencies.

According to a World Bank analysis, Egypt is one of the developing nations with significant debt

issues (World Bank, 2018). The majority of its creditors are foreign governments and international

organizations, who give long-term loans for development projects. As a result, the following is

recommended:

By fostering international investment and establishing a suitable environment for it, as well as

by implementing a national strategy to draw in foreign capital, efforts should be made to

reduce external borrowing.

Extending the policies of transferring foreign debts for development investments to lessen the

burden of foreign debts; however, it is important to clarify the purpose of transferring foreign

debts in order to determine whether this policy aims to increase investments and raise

development rates or has detrimental effects on the independence of economic decisions.

Foreign debts should be used to fund dollar-returning projects or those that don't require

importation.

Work to keep inflation under control.

The Impact of External Debt on Economic Growth in Egypt Page 8 of 9

25 Oct 2022

Establishing a legislative cap on central bank borrowing from abroad as a proportion of cash

reserves and on external central bank borrowing as a percentage of gross domestic product.

Restructuring the debt to return to 90% of long-term obligations and to extend the repayment

terms. That is, over a five- to ten-year period of time.

3. REFERENCES:

(1) Reference: External debt and its impact on economic growth - the Arab Democratic Center

https://democraticac.de/?p=77228#_Toc74428040/

(2) Reference: The impact of external debt on economic growth in Egypt - A Standard Study- Manal

Moussa

https://journals.ekb.eg/article_132904.html#:~:text=%D8%B2%D8%A7%D8%AF

%20%D8%A7%D9%84%D8%AF%D9%8A%D9%86%20%D8%A7%D9%84%D8%AE

%D8%A7%D8%B1%D8%AC%D9%8A%20%D9%81%D9%8A

%20%D9%85%D8%B5%D8%B1,%D9%85%D9%86%2013%D9%85%D9%84%D9%8A

%D8%A7%D8%B1%20%D8%AF%D9%88%D9%84%D8%A7%D8%B1%20%D9%84%D8%AE

%D8%AF%D9%85%D8%A9%20%D8%A7%D9%84%D8%AF%D9%8A%D9%86

(3) Reference: Based on macrotrends site “

https://www.macrotrends.net/countries/EGY/egypt/external-debt-stock/

The Impact of External Debt on Economic Growth in Egypt Page 9 of 9

You might also like

- Asset Integrity Management in The North Amfrica Oil and GasDocument5 pagesAsset Integrity Management in The North Amfrica Oil and Gascderin2000No ratings yet

- Battle of Kadesh PDFDocument13 pagesBattle of Kadesh PDFkalugareni50% (2)

- Philipp - Mamluks in Egyptian Politics and Society PDFDocument160 pagesPhilipp - Mamluks in Egyptian Politics and Society PDFMo Za Pi0% (1)

- What Were We Called Before 1492 - Questions From The Zulu Nation For Taj Tarik BeyDocument16 pagesWhat Were We Called Before 1492 - Questions From The Zulu Nation For Taj Tarik BeyMarcus Explains100% (20)

- The Impact of External Debt On Economic Growth in Egypt 1Document8 pagesThe Impact of External Debt On Economic Growth in Egypt 1Walaa IbrahimNo ratings yet

- AI Data On GreeceDocument16 pagesAI Data On Greeceq3004657275No ratings yet

- MALAWIDocument10 pagesMALAWIBóng Đá LàngNo ratings yet

- Egypt Foreign Currency System's Crisis: by Sameh Al-Anani DecemberDocument34 pagesEgypt Foreign Currency System's Crisis: by Sameh Al-Anani DecemberShashank VarmaNo ratings yet

- David Tembo Proposal RevisedDocument32 pagesDavid Tembo Proposal RevisedMasela ChilibaNo ratings yet

- យុទ្ធសាស្ត្រការទូតសេដ្ឋកិច្ច ឆ្នាំ ២០២១-២០២៣ Economic Diplomancy Strategy 2021-2023Document26 pagesយុទ្ធសាស្ត្រការទូតសេដ្ឋកិច្ច ឆ្នាំ ២០២១-២០២៣ Economic Diplomancy Strategy 2021-2023Chan RithNo ratings yet

- Paper 1 - Ver3 - Final Debt Profile GA - AG August FINAL 2023Document28 pagesPaper 1 - Ver3 - Final Debt Profile GA - AG August FINAL 2023AlemayehugedaNo ratings yet

- Pakistan's Economy 1999/2000 - 2007/2008 An Objective AppraisalDocument51 pagesPakistan's Economy 1999/2000 - 2007/2008 An Objective AppraisalDesertNo ratings yet

- Public DebtDocument9 pagesPublic DebtRaheem MirzaNo ratings yet

- Global Financial CrisisDocument20 pagesGlobal Financial CrisisMohammed AbusalemNo ratings yet

- Dubai Debt Crisis: Summary of The CrisisDocument4 pagesDubai Debt Crisis: Summary of The CrisisHarsh ShahNo ratings yet

- HC Egypt Macro 14 December 2009Document82 pagesHC Egypt Macro 14 December 2009Hesham TabarNo ratings yet

- The Disruptions Caused by The COVIDDocument3 pagesThe Disruptions Caused by The COVIDfady GergesNo ratings yet

- Chapter Two 2.0 Background of The Study 2.1 Historical Background of Deficit Financing and Inflation in NigeriaDocument13 pagesChapter Two 2.0 Background of The Study 2.1 Historical Background of Deficit Financing and Inflation in NigeriaOlatunbosun LawalNo ratings yet

- Ra 2022 AngDocument359 pagesRa 2022 AngfghtgfNo ratings yet

- Business Finance - II: Submitted To Sir Khalid Jamil AnsariDocument8 pagesBusiness Finance - II: Submitted To Sir Khalid Jamil AnsariFari ScorpianNo ratings yet

- From The Great Lockdown To The Great Meltdown:: Developing Country Debt in The Time of Covid-19Document16 pagesFrom The Great Lockdown To The Great Meltdown:: Developing Country Debt in The Time of Covid-19Teymur DadashovNo ratings yet

- Deuda de Los Paises en Desarrollo en El Tiempo de Covid-19 UNCADDocument16 pagesDeuda de Los Paises en Desarrollo en El Tiempo de Covid-19 UNCADCristianMilciadesNo ratings yet

- Informe de La UNCTADDocument16 pagesInforme de La UNCTADTélamNo ratings yet

- Informe de La UNCTADDocument16 pagesInforme de La UNCTADTélamNo ratings yet

- The Making of Turkey's 2018-2019 Economic Crisis: Macro Economics (Mini Project)Document12 pagesThe Making of Turkey's 2018-2019 Economic Crisis: Macro Economics (Mini Project)ASHMEET KAUR MARWAHNo ratings yet

- Economic Bulletin For The Quarter Ending December 2020 Vol. Lii No. 4Document94 pagesEconomic Bulletin For The Quarter Ending December 2020 Vol. Lii No. 4Arden Muhumuza KitomariNo ratings yet

- Mid SemDocument11 pagesMid SemUdeshi ShermilaNo ratings yet

- External Position 81Document70 pagesExternal Position 81mahmoud.te.strategyNo ratings yet

- Post 25 JanDocument8 pagesPost 25 JanMohammad Salah RagabNo ratings yet

- Carbon Finance in Project Finance V 3Document8 pagesCarbon Finance in Project Finance V 3kharabevinayNo ratings yet

- ICMA Policy Note - Can Pakistan Avert Looming DefaultDocument7 pagesICMA Policy Note - Can Pakistan Avert Looming DefaultJamil KhanNo ratings yet

- Capital Flight From Emerging MarketsDocument5 pagesCapital Flight From Emerging MarketsUdbhavNo ratings yet

- 10 11648 J Ijber 20200904 22Document9 pages10 11648 J Ijber 20200904 22K60 Trương Khả DiNo ratings yet

- 2020 External Debt Sustainability and DevelopmentDocument22 pages2020 External Debt Sustainability and DevelopmentjamelNo ratings yet

- Bulletin 09 July 20Document10 pagesBulletin 09 July 20rodobejaranoNo ratings yet

- Report On India's Balance of Payments Crisis and It's ImpactsDocument31 pagesReport On India's Balance of Payments Crisis and It's ImpactsRavi RockNo ratings yet

- Debt and Debt Service Reduction in Cameroon by Mbarga PDFDocument14 pagesDebt and Debt Service Reduction in Cameroon by Mbarga PDFprince marcNo ratings yet

- External Debt and LiabilitiesDocument22 pagesExternal Debt and Liabilitieslaiba SultanNo ratings yet

- B23194 Assignment 5 Divyansh KhareDocument4 pagesB23194 Assignment 5 Divyansh KhareDivyansh Khare B23194No ratings yet

- Imf and EgyptDocument21 pagesImf and Egyptamrrashed2009No ratings yet

- Egyptians Are in Deeper Fiscal Hole As Economic Program Wraps UpDocument3 pagesEgyptians Are in Deeper Fiscal Hole As Economic Program Wraps UpNajwa FirdawsNo ratings yet

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- Egypte 2023 t4 EngDocument2 pagesEgypte 2023 t4 EngAhmedNo ratings yet

- Fetiya NuruDocument26 pagesFetiya Nuruhenokt129No ratings yet

- Financial Crisis: Bank Run. Since Banks Lend Out Most of The Cash They Receive in Deposits (See FractionalDocument8 pagesFinancial Crisis: Bank Run. Since Banks Lend Out Most of The Cash They Receive in Deposits (See FractionalRabia MalikNo ratings yet

- Africa EgyptDocument7 pagesAfrica EgyptMellownick AbaldeNo ratings yet

- Financial Structure of EgyptDocument28 pagesFinancial Structure of EgyptNesma HusseinNo ratings yet

- Development EconomicsDocument16 pagesDevelopment EconomicsMehrin MorshedNo ratings yet

- Mismanagement of Fiscal Policy: Greece's Achilles' HeelDocument9 pagesMismanagement of Fiscal Policy: Greece's Achilles' Heelabhilash191100% (1)

- Unit. 18 India'S Balance Payments: 18.0 ObjectivesDocument16 pagesUnit. 18 India'S Balance Payments: 18.0 ObjectivesRobert SkidelskyNo ratings yet

- FDI 2022 - Overview - enDocument48 pagesFDI 2022 - Overview - enBekele Guta GemeneNo ratings yet

- Digital India: Key FeaturesDocument14 pagesDigital India: Key FeaturesPhani Kumar MallelaNo ratings yet

- Effect of External Public Debt On The Exchange Rate in KenyaDocument22 pagesEffect of External Public Debt On The Exchange Rate in KenyaIJEBR100% (1)

- The Impact of Financial Globalization On Economic Growth in The Kurdistan Region of Iraq: An Empirical InvestigationDocument28 pagesThe Impact of Financial Globalization On Economic Growth in The Kurdistan Region of Iraq: An Empirical Investigationnweger2005No ratings yet

- Lebanon Economic SummaryDocument3 pagesLebanon Economic SummaryGerard ArabianNo ratings yet

- Foreign Debt, Balance of Payments, and The Economic Crisis of The Philippines in 1983-84Document26 pagesForeign Debt, Balance of Payments, and The Economic Crisis of The Philippines in 1983-84Cielo GriñoNo ratings yet

- Egypt and Covid 19Document7 pagesEgypt and Covid 19Walid Mohamed AnwarNo ratings yet

- Ethiopia Public Debt Portfolio Analysis No 21 - 2019-20Document82 pagesEthiopia Public Debt Portfolio Analysis No 21 - 2019-20Mk FisihaNo ratings yet

- External Debt08.pdDocument7 pagesExternal Debt08.pdUmme RubabNo ratings yet

- Complex Challenges in Developing-Country DebtDocument21 pagesComplex Challenges in Developing-Country DebtarfiandpNo ratings yet

- ME FileDocument8 pagesME FileDebojyoti RoyNo ratings yet

- A Study Reveals Corona's Impact On The Egyptian Economy: Merchandise ImportsDocument4 pagesA Study Reveals Corona's Impact On The Egyptian Economy: Merchandise ImportsMadellinNo ratings yet

- Greater Mekong Subregion COVID-19 Response and Recovery Plan 2021–2023From EverandGreater Mekong Subregion COVID-19 Response and Recovery Plan 2021–2023No ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Ahmed's ResumeDocument1 pageAhmed's ResumeAhmed GeneedNo ratings yet

- Connect 3 New FirstDocument164 pagesConnect 3 New FirstwaelNo ratings yet

- NewsStand - 25 of October 2021Document17 pagesNewsStand - 25 of October 2021Ahmed MansourNo ratings yet

- QNB FinalDocument39 pagesQNB FinalNadine El AshkarNo ratings yet

- Edgar OballanceDocument174 pagesEdgar OballanceHisham Zayat100% (2)

- Patterns of World Population Distribution and Its DeterminantsDocument40 pagesPatterns of World Population Distribution and Its DeterminantsAkbar Khan khilji100% (1)

- Lessons From The Jasmine and Nile Revolutions: Possibilities of Political Transformation in The Middle East?Document8 pagesLessons From The Jasmine and Nile Revolutions: Possibilities of Political Transformation in The Middle East?Crown Center for Middle East StudiesNo ratings yet

- Isimlik 1Document21 pagesIsimlik 1cehremuhammet9No ratings yet

- Egypt Tourism Reform ProgramDocument65 pagesEgypt Tourism Reform ProgramHesham ANo ratings yet

- Glosario MultilingüeDocument181 pagesGlosario MultilingüeFernando Plans100% (1)

- Reference Chart, 1 Periods of Egyptian HistoryDocument1 pageReference Chart, 1 Periods of Egyptian HistoryMO'MEN ROSHDYNo ratings yet

- 40 Matthew NepaliDocument51 pages40 Matthew NepaliJesus LivesNo ratings yet

- Cultural Diplomacy - Hard To Define - Schneider, CynthiaDocument14 pagesCultural Diplomacy - Hard To Define - Schneider, CynthiaVassilis LaliotisNo ratings yet

- Egypt Approved Medical Providers PharmaciesDocument115 pagesEgypt Approved Medical Providers PharmaciesAhmed AliNo ratings yet

- Engineering EmpireDocument27 pagesEngineering EmpireMariacarmela MontesantoNo ratings yet

- PDF The Buried An Archaeology of The Egyptian Revolution Peter Hessler Ebook Full ChapterDocument53 pagesPDF The Buried An Archaeology of The Egyptian Revolution Peter Hessler Ebook Full Chapterted.flores432100% (1)

- Egy LcaDocument94 pagesEgy LcasakashefNo ratings yet

- Agricultue in Ancient EgyptDocument32 pagesAgricultue in Ancient EgyptShaimaa AbouzeidNo ratings yet

- Hassan Aman CVDocument12 pagesHassan Aman CVArt2Write.com -100% (1)

- The David Project 1967 Six Day War April 2010Document6 pagesThe David Project 1967 Six Day War April 2010Aya K SuleimanNo ratings yet

- 25 Africa, India, and The New British EmpireDocument47 pages25 Africa, India, and The New British EmpireJonathan Daniel Keck100% (3)

- Zakaria, Fareed. 2004. "Islam, Democracy, and Constitutional Liberalism." Political Science Quarterly 119 (1) - 1-20Document21 pagesZakaria, Fareed. 2004. "Islam, Democracy, and Constitutional Liberalism." Political Science Quarterly 119 (1) - 1-20Rommel Roy RomanillosNo ratings yet

- De So 1 de Thi Cuoi Hoc Ki 2 Tieng Anh 11 Moi 1681377623Document4 pagesDe So 1 de Thi Cuoi Hoc Ki 2 Tieng Anh 11 Moi 1681377623Simp AlbedoNo ratings yet

- Engineering Economy 8th Edition Blank Solutions ManualDocument35 pagesEngineering Economy 8th Edition Blank Solutions Manualfoxysolon8cfh5100% (21)

- Sayce Egypt of The Hebrews and HerodotosDocument362 pagesSayce Egypt of The Hebrews and HerodotosRCEBNo ratings yet

- Egypt Gold .Document82 pagesEgypt Gold .mohamed mohyNo ratings yet