Professional Documents

Culture Documents

Accounting Module 2 Accounting Concepts and Principles

Accounting Module 2 Accounting Concepts and Principles

Uploaded by

Rhudella OrmasaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Module 2 Accounting Concepts and Principles

Accounting Module 2 Accounting Concepts and Principles

Uploaded by

Rhudella OrmasaCopyright:

Available Formats

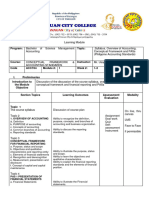

FM-AA-CIA-15 Rev.

0 10-July-2020

Study Guide in (Course Code and Course Title) Module No.__

STUDY GUIDE FOR MODULE NO. 2

Accounting Concepts and Principles

MODULE OVERVIEW

This chapter introduces the basic accounting concepts and principles, basic assumptions in

accounting, the fundamental qualities of accounting and enhancing fundamental qualities of

accounting.

MODULE LEARNING OBJECTIVES

At the end of this module, the learners should be able to identify and differentiate the different

accounting concepts and principles, determine the fundamental qualities of accounting and how to

enhance these fundamental qualities, and solve exercises on accounting principles as applied in

various cases.

LEARNING CONTENTS (ACCOUNTING CONCEPTS AND PRINCIPLES)

Accounting Concepts are important ideas that accountants take into account when recording

business transactions.

Accounting principles are those of primary importance, which broadly define actions that will best

achieve the objectives of accounting.

Basic Assumption in Accounting

Accounting assumptions provide the basis for the rational and systematic formulation of principles

and for the development of procedures and methods for the performance of accounting services.

Five basic assumptions form the basis of the financial accounting structure, namely: (1) economic

entity (2) going forward (3) monetary unit (4) periodicity (5) accrual basis.

1. Economic Entity Accountants regard a business enterprise as a separate and distinct entity

from the person or persons who own and operate it.

2. Going Concern Assumption is a concept that assumes the business entity will continue to

operate indefinitely for a period of time sufficient to meet its intended objectives, plans,

contracts and obligations, unless liquidation of the entity is imminent.

3. Monetary Unit Assumption. This accounting concept assumes that money is the common

denominator for measuring economic activity

4. Periodicity Assumption. Time period assumes that the company's life is divided into several

periods.

a. A time period is usually referred to as the accounting period. This is classified as (a)

calendar year, (b) fiscal year, or (c) interim year.

PANGASINAN STATE UNIVERSITY 1

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No.__

b. The calendar year shall be a twelve-month period beginning on 1 January and ending on

31 December of the financial year.

c. A fiscal year starts from any month other than January and complete the 12 months

period.

d. The interim period shall be the business period within the accounting period. When

financial reports are prepared at any date, even if the twelve-month period is not yet due,

they shall be referred to as interim reports because they are prepared within an interim

period.

5. Accrual-Base Assuming that the net profit of a business enterprise differs between revenue

and expenditure for the accounting period and not between cash receipts and cash

disbursements.

Basic Principles of Accounting

There are four basic accounting principles that are used to record and report business transactions,

namely: (1) (2) recognition of revenue (3) recognition of expenditure and (4) full disclosure.

Measurement Principles guide accountants on how assets and liabilities are valued. Accounting

uses two principles of measurement:

1. Principle of cost (also known as historical cost principle). As required by IFRS, business

entities are expected to account for and report many assets and liabilities on the basis of the

acquisition price.

2. The principle of fair value is defined as 'the amount for which the asset could be exchanged,

the liability could be settled, or the equity instrument granted could be exchanged between

knowledgeable and willing parties in an arm's length transaction.

Revenue Recognition Principle this is when goods are delivered or services are rendered or

performed and should be recognized in the accounting period

Expense Recognition The expenditure principle should be recognized in the accounting period in

which goods and services are used up to produce income and not when the entity pays for those

goods and services.

Full-Disclosure Principle requires the financial statements to report all relevant information

relating to the economic affairs of a business undertaking, including subsequent events.

LEARNING ACTIVITY 1

LEARNING CONTENTS (FUNDAMENTAL QUALITIES OF ACCOUNTING)

Fundamental Qualities of Accounting

1. Relevance. Accounting information must be relevant to be able to influence or make a

difference in economic decisions. Information is of relevance when it influences the

PANGASINAN STATE UNIVERSITY 2

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No.__

economic decisions of users by helping them to evaluate past, present or future events or to

adjust or correct their past assessments.

2. Faithful representation. Main objective of reliable representation is to build public trust and

confidence in the financial statements. It means accounting information must be complete,

neutral and free from material error.

Enhancing Qualities of Accounting

1. Understandability. A comprehensible accounting information. Accountants must provide

understandable financial accounting information by presenting data that can be understood

by different users of the information.

2. Verifiability. It occurs when independent measures use the same accounting methods and

still could arrive with the same results. The information proved their faithful representation as

shown in the financial reports through double-checking and corroboration

3. Timeliness. Accounting information must be available on time when needed. Timeliness is

crucial in making decisions. Lack of timeliness reduces relevance.

4. Comparability. It Enables users to identify similarities and differences of accounting

information between two, or more sets of economic circumstances.

LEARNING ACTIVITY

Multiple Choice. Encircle the correct answer.

1. Accounting is a service activity. Its function is to provide

a. Quantitative information

b. Qualitative information

c. Quantitative and qualitative information

d. None of the above.

2. The basic purpose of accounting is

a. To provide the information that the managers of an economic entity need to control its

operations

b. To provide information that the creditors of an economic entity can use in deciding

whether to make additional loans to the entity.

c. To measure the periodic income of the economic entity.

d. To provide quantitative financial information about a business enterprise that is useful in

making rational economic decision.

PANGASINAN STATE UNIVERSITY 3

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No.__

3. The main function is to establish and improve accounting standards that will be generally

accepted in the Philippines.

a. Accounting Standards Council

b. Professional Regulation Commission

c. Philippine Institute of CPAs

d. Board of Accountancy

4. The principle of objectivity includes the concept of

a. Summarization

b. Verifiability

c. Classification

d. Conservatism

5. The measurement phase of accounting is accomplished by

a. Storing data

b. Reporting to decision makers

c. Recording data

d. Processing data

6. Accounting changes are often made and the monetary impact is reflected in the financial

statements of a company even though, in theory, this may be a violation of the accounting

concept of

a. Materiality

b. Objectivity

c. Conservatism

d. Consistency

7. This principle requires relevant information to form part of financial statements for decision-

making purposes.

a. Objectivity

b. Materiality

PANGASINAN STATE UNIVERSITY 4

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No.__

c. Adequate disclosure

d. Accounting entity

8. The records of properties acquired and services availed of by a business are maintained in

accordance with the

a. Business entity concept

b. Cost principle

c. Proprietorship principle

d. Matching principle

9. Proponents of historical costs maintain that in comparison with all other valuation

alternatives for general purpose financial reporting, statements prepared using historical

costs are more

a. Objective

b. Relevant

c. Indicative of the entity’s purchasing power

d. Conservative

10. Objectivity is assumed to be achieved when an accounting transaction

a. Is recorded in a fixed amount of pesos

b. Involves the payment or receipt of cash

c. Allocates revenue or expenses in a rational and systematic manner

d. Involves an arm’s-length transaction between two independent parties.

SUMMARY

A set of logical ideas and procedures that guide the accountant in recording and

communicating economic information is called Accounting Concepts and principles (assumptions

and postulates).

Examples of basic accounting concepts are:

1. Separate entity concept 7. Time Period

2. Historical cost concept 8. Stable monetary unit

3. Going concern assumption 9. Materiality Concept

4. Matching 10. Cost-benefit

5. Accrual basis of accounting 11. Full disclosure principle

PANGASINAN STATE UNIVERSITY 5

FM-AA-CIA-15 Rev. 0 10-July-2020

Study Guide in (Course Code and Course Title) Module No.__

6. Prudence or conservatism 12. Consistency Concept

The accounting standards in the Philippines are represented by the Philippine Financial

Reporting Standards (PFRSs). These standards are patterned from the International Financial

Reporting Standards (IFRSs)

REFERENCES

Books:

Ferrer, Rodiel C. Millan, Zeus Vernon B.(2017). Fundamentals of Accountancy, Business and

Management Part 1

Ferrer, Rodiel C. Millan, Zeus Vernon B. (2017). Fundamentals of Accountancy, Business and

Management Part 2

Frias, Solita A. Pefianco, Erlinda C. (2016). Fundamentals of Accountancy, Business, and

Management: A Textbook in Basic Accounting 2

Ballada, Win (2010) Basic Accounting

Aliling, Leonardo E., MBA,CPA.2013. Fundamentals of Basic Accounting.

PANGASINAN STATE UNIVERSITY 6

You might also like

- Email 2011 A Level H2 CS 1 N 2 N EssaysDocument8 pagesEmail 2011 A Level H2 CS 1 N 2 N Essaysragul9650% (4)

- Customer Service Career Success Through Customer Loyalty 6th Edition Timm Test BankDocument5 pagesCustomer Service Career Success Through Customer Loyalty 6th Edition Timm Test Bankamandaretepc100% (34)

- Island Cruise NegotiationDocument1 pageIsland Cruise Negotiationphd2313100% (1)

- Derivatives in Plain WordsDocument172 pagesDerivatives in Plain WordsHoangdhNo ratings yet

- Integrated Accounting Fundamentals: Nu LagunaDocument12 pagesIntegrated Accounting Fundamentals: Nu Lagunaalthea nicole velezNo ratings yet

- Conceptual Framework PAS 1 With Answer KeyDocument12 pagesConceptual Framework PAS 1 With Answer KeyRichel Armayan33% (3)

- A Projct Report On Cooperative SocietyDocument6 pagesA Projct Report On Cooperative Societymonikaagarwalitm333073% (15)

- ACCT1006 Lecture 1: What Is Accounting?Document3 pagesACCT1006 Lecture 1: What Is Accounting?Anonymous rHsgVTuHncNo ratings yet

- Financial Accounting and Reporting Learning ModulesDocument126 pagesFinancial Accounting and Reporting Learning ModulesLovelyn Joy Solutan100% (2)

- Chapter-1: Introduction To AccountingDocument8 pagesChapter-1: Introduction To AccountingMinhaz UddinNo ratings yet

- A BudgetDocument6 pagesA BudgetnagamidashiraNo ratings yet

- Online Learning ModuleDocument7 pagesOnline Learning ModuleAnnie RapanutNo ratings yet

- ABMFABM1 q3 Mod2 Accounting-Guidelines v2Document15 pagesABMFABM1 q3 Mod2 Accounting-Guidelines v2Eduardo john DolosoNo ratings yet

- Online Learning Module ACCT 1026 (Financial Accounting and Reporting)Document7 pagesOnline Learning Module ACCT 1026 (Financial Accounting and Reporting)Annie RapanutNo ratings yet

- FRFSA Final Theory Suggestion With Answer For 2024Document35 pagesFRFSA Final Theory Suggestion With Answer For 2024subhagoswami100No ratings yet

- IM ACCO 20033 Financial Accounting and Reporting Part 1Document95 pagesIM ACCO 20033 Financial Accounting and Reporting Part 1Montales, Julius Cesar D.No ratings yet

- Unit 02 Conceptual FrameworkDocument17 pagesUnit 02 Conceptual FrameworkNixsan MenaNo ratings yet

- Accounting Principles Canadian Volume II 7th Edition Weygandt Test Bank Full Chapter PDFDocument50 pagesAccounting Principles Canadian Volume II 7th Edition Weygandt Test Bank Full Chapter PDFEdwardBishopacsy100% (17)

- Accounting 1Document117 pagesAccounting 1Mary Alyssa Claire Capate II100% (1)

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument86 pagesFundamentals of Accountancy Business and ManagementJosie Ann VelascoNo ratings yet

- Unit 2-Accounting Concepts, Principles and ConventionsDocument20 pagesUnit 2-Accounting Concepts, Principles and Conventionsanamikarajendran441998No ratings yet

- Module 1 - Accounting and BusinessDocument16 pagesModule 1 - Accounting and BusinessNiña Sharie Cardenas100% (1)

- Accountancy and ManagementDocument19 pagesAccountancy and ManagementLiwash SaikiaNo ratings yet

- Application: Unit 1 - Module 1.1 Topic 1: The Accountancy ProfessionDocument7 pagesApplication: Unit 1 - Module 1.1 Topic 1: The Accountancy ProfessionLi LiNo ratings yet

- Fa Unit 1 - Notes - 20200718004241Document21 pagesFa Unit 1 - Notes - 20200718004241Vignesh CNo ratings yet

- II Sem. - Financial Accounting - 2019 Admn. - 1Document128 pagesII Sem. - Financial Accounting - 2019 Admn. - 1SocalledlawyerNo ratings yet

- Learning Mod 1 CfasDocument20 pagesLearning Mod 1 CfasKristine CamposNo ratings yet

- Study Guide Module 1Document4 pagesStudy Guide Module 1Noreen GonzagaNo ratings yet

- Topic 2 Principles Assumptions and Elements of Financial Statements-ADocument28 pagesTopic 2 Principles Assumptions and Elements of Financial Statements-ABasilina OsitaNo ratings yet

- Fundamental of Accounting: Chapter 1-2Document31 pagesFundamental of Accounting: Chapter 1-2Renshey Cordova MacasNo ratings yet

- Chapter 2: Basic Accounting Concepts Learning Outcome at The End of The Learning, Student Should Be Able ToDocument21 pagesChapter 2: Basic Accounting Concepts Learning Outcome at The End of The Learning, Student Should Be Able ToNur Syazmira HarunNo ratings yet

- Guidelines in Fs PreparationDocument4 pagesGuidelines in Fs PreparationanacldnNo ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- IASB Conceptual Framework BSA12016Document11 pagesIASB Conceptual Framework BSA12016Fred MutesasiraNo ratings yet

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- ACC704 - Tutorial 1 QuestionsDocument4 pagesACC704 - Tutorial 1 QuestionsJake LukmistNo ratings yet

- Environment of Financial Accounting and Reporting: FalseDocument6 pagesEnvironment of Financial Accounting and Reporting: Falsekris mNo ratings yet

- Financial Accounting 1 Unit 2Document22 pagesFinancial Accounting 1 Unit 2AbdirahmanNo ratings yet

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- MAS 01 Management AccountingDocument6 pagesMAS 01 Management AccountingTin BulaoNo ratings yet

- ACCT 330-Intermediate Accounting 1Document81 pagesACCT 330-Intermediate Accounting 1Fer LeroyNo ratings yet

- Financial Accounting 3 /chapter 1 New Conceptual FrameworkDocument8 pagesFinancial Accounting 3 /chapter 1 New Conceptual FrameworkJouhara San JuanNo ratings yet

- ACCOUNTING 1 ReviewerDocument115 pagesACCOUNTING 1 ReviewerWendelyn JimenezNo ratings yet

- Jose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpDocument7 pagesJose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpAngelica CastilloNo ratings yet

- CFASDocument17 pagesCFASKie Magracia BustillosNo ratings yet

- FinanceDocument37 pagesFinanceSameer RainaNo ratings yet

- Accounting For Management (MBA) PDFDocument63 pagesAccounting For Management (MBA) PDFAbhijeet Menon100% (1)

- Introduction To AccountingDocument37 pagesIntroduction To AccountingRey ViloriaNo ratings yet

- Unit 2 - Accounting Principles, Concepts and ConventionsDocument20 pagesUnit 2 - Accounting Principles, Concepts and ConventionsowaisNo ratings yet

- Management AccountingDocument5 pagesManagement AccountingJAKAN67% (3)

- Lecture 1Document38 pagesLecture 1Preet LohanaNo ratings yet

- Financial Statements Provide Information About Economic Resources of The Reporting Entity, ClaimsDocument3 pagesFinancial Statements Provide Information About Economic Resources of The Reporting Entity, ClaimsAllaine ElfaNo ratings yet

- CPA-Financial ReportingDocument158 pagesCPA-Financial Reportingjbah saimon baptisteNo ratings yet

- TOPIC: A.) Conceptual Framework and Elements of Financial StatementsDocument6 pagesTOPIC: A.) Conceptual Framework and Elements of Financial StatementsADNo ratings yet

- MODULE 2 - BUSINESS ACCOUNTING RevisedDocument16 pagesMODULE 2 - BUSINESS ACCOUNTING RevisedArchill YapparconNo ratings yet

- Economy FaDocument25 pagesEconomy FaVenkata Naresh KachhalaNo ratings yet

- 11 Accountancy Theory - 2022-23 (EM)Document36 pages11 Accountancy Theory - 2022-23 (EM)kms195kds2007No ratings yet

- 1 - Financial AccountingDocument92 pages1 - Financial Accountingajbebera1999No ratings yet

- IC102 Accounting 1 (Week 7 M3-L3) - HandoutsDocument27 pagesIC102 Accounting 1 (Week 7 M3-L3) - HandoutsLj TvNo ratings yet

- Cfas NotesDocument16 pagesCfas NotesWillyn LachicaNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- Chapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsDocument15 pagesChapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsJue WernNo ratings yet

- Trial Balance - Problems & SolutionsDocument7 pagesTrial Balance - Problems & SolutionsAsok Kumar67% (3)

- Unfair Labor Practice - EmployersDocument29 pagesUnfair Labor Practice - EmployersJica GulaNo ratings yet

- Doing Business in Mexico Understanding CDocument18 pagesDoing Business in Mexico Understanding CmarcoNo ratings yet

- AS-Solved Past Paper Business 9609 P1 2023-2022Document51 pagesAS-Solved Past Paper Business 9609 P1 2023-2022TheOfficialTitaniumNo ratings yet

- SUGARDocument11 pagesSUGARRadhika SwaroopNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- How Ceos Can Create Values?Document5 pagesHow Ceos Can Create Values?Rabeea AsifNo ratings yet

- Understanding Market Capitalization Versus Market ValueDocument8 pagesUnderstanding Market Capitalization Versus Market ValuejunNo ratings yet

- Tokio Marine - Epayment Reg FormDocument2 pagesTokio Marine - Epayment Reg FormCaddyTanNo ratings yet

- F2 Syllabus Overview: Created By: Global CGMA University and Academic Center of ExcellenceDocument93 pagesF2 Syllabus Overview: Created By: Global CGMA University and Academic Center of Excellencesike1977No ratings yet

- SWOTDocument3 pagesSWOTJunaid SayedNo ratings yet

- Franchise Management System - FMS4Document14 pagesFranchise Management System - FMS4Jerry PrasetiaNo ratings yet

- KIIFB Manual of Business ProceduresDocument186 pagesKIIFB Manual of Business ProceduresSharat GopalNo ratings yet

- Paul-Barter - Parking Policy China PDFDocument62 pagesPaul-Barter - Parking Policy China PDFaldokrenaNo ratings yet

- (Community) Garden in The City Conspicuous Labor and GentrificationDocument25 pages(Community) Garden in The City Conspicuous Labor and GentrificationHAhaNo ratings yet

- Walmart Group BehaviourDocument3 pagesWalmart Group BehaviourgayaNo ratings yet

- Tapio Lappi-Seppälä - "Trust, Welfare and Political Economy"Document33 pagesTapio Lappi-Seppälä - "Trust, Welfare and Political Economy"Anonymous Yrp5vpfXNo ratings yet

- Trainig and Development of SupervisiorsDocument20 pagesTrainig and Development of Supervisiorskarthiba jeganNo ratings yet

- Different Theories of ProfitDocument2 pagesDifferent Theories of Profitchandu_jjvrp0% (1)

- MIAA Vs - CIty of ParanaqueDocument3 pagesMIAA Vs - CIty of ParanaqueKath Leen100% (2)

- Laporan Tahunan PT Nusa Raya Cipta TBK Tahun 2019Document249 pagesLaporan Tahunan PT Nusa Raya Cipta TBK Tahun 2019Fitriani WulandariNo ratings yet

- Proposed Resolution - Magna Carta For Agriculturist (AutoRecovered)Document2 pagesProposed Resolution - Magna Carta For Agriculturist (AutoRecovered)Eszikeil Luah ArthasNo ratings yet

- Temenos AR 2012Document132 pagesTemenos AR 2012al-xu100% (1)

- Financial Markets in IndiaDocument15 pagesFinancial Markets in IndiaVjay VijjuNo ratings yet