Professional Documents

Culture Documents

2022 Financial Management

2022 Financial Management

Uploaded by

arjun gupta0 ratings0% found this document useful (0 votes)

25 views4 pagesFinancial management book

Original Title

2022_Financial_Management

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial management book

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

25 views4 pages2022 Financial Management

2022 Financial Management

Uploaded by

arjun guptaFinancial management book

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 4

[This question paper contains 4 printed pages.]

Your Roll Ni

Sr.No. of Question Paper : 5709

Unique Paper code : 61011406

Name of the Paper Financial Management

Name of the Course Bachelor of Management Studies (BMS),

2022 LOCF

Semester : ow

Duration : 3 Hours

Maximum Marks B98

Instructions for Candidates

1. Write your Roll No. on the top immediately on receipt of this question paper,

Attempt any five questions.

Alll questions carry equal marks.

Attempt parts of a question together.

Show your workings clearly as a part of the solution.

awep

Use of Simple calculator is allowed.

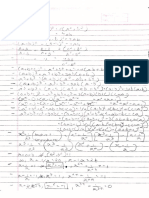

1. A2Z Lid. is considering the replacement of one of its machine. The firm wants to expand its

and hence requires bigger machine. The existing machine is in good operating

condition, but is smaller. It is 3 years old, has @ current salvage value of Rs, 4,00,000 and a

remaining life of 5 years. The machine was initially purchased for Rs. 20 lacs and is being

depreciated at 20% on the WDV basis. It’s salvage value at the end of its useful life is estimated

to be negligible.

‘The new machine will cost Rs. 40 lacs and will be subject to the same method as well as the

same rate of depreciation. It is expected to have the useful life of 5 years. The management

anticipates that with the expanded operations there will be a need of an additional net working

capital of Rs. 1,00,000 at the beginning. The new machine will allow the firm to expand the

current operations and thereby increase its cash annual revenue by Rs. 25,00,000. Variable cost

will be 50 percent of sale. Annual fixed cash costs are likely to increase by Rs. 1,00,000 in the

first three years of its operation and Rs. 1,50,000 thereafter. it is estimated that new machine can

be sold for Rs. 6,00,000 at end of its useful life, The corporate tax rate is 30%. Firm’s cost of

capital is 10%. The company has several machines in the block of 20% depreciation. Using NPV

technique, comment whether the company should replace the existing machine. (Round off your

calculations to nearest rupee).

PIF at 10% cost of capital are given below for your ready reference:

Year 1 2 3 4 z

PVIF at 10% 0.909 0.826 0.751 0.683 (0.621

(15 marks)

PT.O

5709 2

2. The capital structure of XYZ Lid. is as under:

Rs.

Equity shares (face value Rs. 10 per share) 10,00,000

11% Preference shares 5,00,000

9% Debentures 5,00,000

~20,00,000

Additional Information:

(0 Rs. 100 per debenture redeemable at par, has 2% flotation cost and 10 years of maturity

‘The market price per debenture is Rs. 98.

(ii) Rs. 100 per preference share redeemable at par, has 3% flotation cost and 10 years of

maturity. The market price per preference share is Rs. 90.

(i Equity share has Rs. 4 flotation cost and market price per share of Rs. 25. The expected

dividend is Rs. 2 per share with annual growth of 6%.

(i) Corporate income tax rate is 30%

Caleulate weighted average cost of capital (WAC) using book value and market value weights.

(15 marks)

3. (@) Explain the objectives of holding cash for a business enterprise. (5 marks)

(b) Company X is making sales of Rs. 45,00,000 and it extends eredit of 90 days to its

Customers. However, it is considering tightening its credit policy. The proposed terms of credit

and expected sales are given below:

Policy Term Sales

I 75 days Rs. 41,00,000

u 60 days Rs. 39,00,000

mm 45 days Rs. 38,50,000

‘The firm has a variable cost of 80% and fixed cost of Rs. 1,00,000. ‘The cost of capital is 15%,

Evaluate different proposed policies and indicate which policy should be adopted. (Assume 360

days ina year and round off your calculations to nearest rupee).

(10 marks)

4. (2) Briefly explain the permanent and temporary working capital requirement. (5 marks)

(®) The management of MN Ltd. has called for a statement showing the working capital needs to

finance a level of activity of 1,80,000 units of output for the year. The cost structure for the

company’s product for the above mentioned activity level is detailed below:

Cost/unit (Rs)

Raw materials 20

Direct labour 3

Overheads (including depreciation of Rs $ unit) 15

Total cost 40

5709 3

Profit 10

Selling price 30

Additional information:

i. Minimum desired cash balance is Rs. 40,000

Rew materials arc held in stock on an average for 3 months.

‘Work-in-progress (assume 50% completion stage) will approximate to half-a-month's

Production. Complete raw material is introduced in the beginning of the production cycle.

iv. Finished goods remain in warehouse on an average for two months,

¥. Suppliers of material extend a month’s eredit and debtors are provided two months credit:

Cash sales are 20% of total sales.

vi, There is a time-lag in payment of wages of a month and half-a-month in case of

overheads.

From the above facts, you are required to prepare a statement showing working capital needs of

the firm,

(10 marks)

5. (@) Explain the concept of time value of money and its relevance in computing the present

value of a rupee and an annuity.

(5 marks)

(b)From the following forecast of income and expenditure prepare cash budget for the three

‘months ending on June 2020.

Month Sales (Rs.) Purchases(Rs) Wages(Rs) Misc.(Rs)

Feb 1,20,000 84,000 10,000 7,000

March 1,30,000 — 1,00,000 12,000 8,000

April 80,000 —1,04,000 8,000 6,000

May — 1,16,000 —1,06,000 10,000 12,000

June 88,000 80,000 8,000 6,000

Additional information:

(i) Sales: 25% realized in the month of sales, discount allowed 2% in cash on the sales

realized in the month of sale; balance realized equally in two subsequent months.

Purchases: These are paid in the month following the month of supply.

‘Wages: 30% paid in the arrears following month.

Misc. Expenses: Paid a month in arrears,

Rent: Rs1,000 per month paid quarterly in advance, due in Apzil.

Income tax: First installment of advance tax Rs. 25,000 due on of before 15 June to

be paid within the month,

(vii) Income from investment; Rs. 5,000 received quarterly in April, July ete.

(viii) Cash in hand Rs, 25,000 on April 1.

(ix) Depreciation: Rs 5000 for the month of April.

(x) Sale of old machinery at Rs. $0,000 in June,

(10 marks)

PT.O

5709

6.

Attempt any fio of the following:

“The total value of a firm remains unchanged regardless of variations in its financing

mix.” Discuss the statement and point out the role of homemade leverage and arbitrage.

ABC Co. Ltd. belongs to a risk class of which the appropriate capitalization rate is 10%.

It currently has 1,00,000 shares selling at Rs. 100 each. The firm is contemplating the

declaration of a Rs. 6 dividend at the end of the current fiscal year that has just begun.

‘What will be the price of shares at the end of the year as per MM model and assumption

of no taxes if dividend is declared? Also compute the number of new shares that must be

issued assuming that the firm pays the dividend, has a net income of Rs. 10,00,000 and

makes new investments of Rs. 20,00,000 during the period.

SS Ltd. wants to implement a project for which Rs 30 lakhs is required to be raised from

the market as a means of financing the project. The following financing plans and options

are at hand: (Number in thousands)

Particulars Plan A. Plan B Plan C

Option I:

Equity shares 30 30 30

Option 2.

Equity shares 1s 20 10

12% Preference shares Nil 10 10

10% Non-convertible debentures 15 Nil 10

Assuming corporate tax to be 30 per cent and the face value of all the shares and

debentures to be Rs 100 each, calculate the indifference points and earnings per share

(EPS) for cach of the financing plans. Which plan should be accepted by the company?

(7.5*2=15 marks)

7. Attempt any fwo of the following:

iii,

The finance department of a corporation provides the following information:

(a) Annual Carrying costs per unit of inventory are Rs. 10

(b) The fixed ordering cost per order is Rs. 20.

(©) The number of units required is 30,000 per year.

Determine Economic Order Quantity, total number of orders in a year and the time gap

between two orders assuming 365 working days per year.

Explain the Net Operating Income approach of Capital Structure with the help ofa

diagram.

Describe risk-return trade off in investment, financing and dividend decisions under

financial management.

(7.5*2=15 marks)

(800)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Class Test-3Document1 pageClass Test-3arjun guptaNo ratings yet

- Class Test-2Document1 pageClass Test-2arjun guptaNo ratings yet

- DRM II Chapter-5Document47 pagesDRM II Chapter-5arjun guptaNo ratings yet

- DRM II Chapter-6Document22 pagesDRM II Chapter-6arjun guptaNo ratings yet

- FormulaeDocument8 pagesFormulaearjun guptaNo ratings yet

- Convexity and ImmunizationDocument8 pagesConvexity and Immunizationarjun guptaNo ratings yet

- ResponseDocument11 pagesResponsearjun guptaNo ratings yet

- Output PDFDocument13 pagesOutput PDFarjun guptaNo ratings yet

- Biology Revision Notes (English) by RaMO SirDocument18 pagesBiology Revision Notes (English) by RaMO Sirarjun guptaNo ratings yet

- Computer RbeDocument123 pagesComputer Rbearjun guptaNo ratings yet