Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsPart 4

Part 4

Uploaded by

lkCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Part 9Document76 pagesPart 9lkNo ratings yet

- Part 0Document6 pagesPart 0lkNo ratings yet

- Part 7Document48 pagesPart 7lkNo ratings yet

- Part 8Document12 pagesPart 8lkNo ratings yet

- Digestive System Study GuideDocument1 pageDigestive System Study GuidelkNo ratings yet

- Part 3Document18 pagesPart 3lkNo ratings yet

- Samar CompanyDocument1 pageSamar CompanylkNo ratings yet

- Part 2Document100 pagesPart 2lkNo ratings yet

- Ronalyn CompanyDocument2 pagesRonalyn CompanylkNo ratings yet

- Raven CompanyDocument1 pageRaven CompanylkNo ratings yet

- Roma CompanyDocument1 pageRoma CompanylkNo ratings yet

- Folk CompanyDocument1 pageFolk CompanylkNo ratings yet

- Kenya CompanyDocument2 pagesKenya CompanylkNo ratings yet

- Racelle CompanyDocument2 pagesRacelle CompanylkNo ratings yet

- Lee CompanyDocument1 pageLee CompanylkNo ratings yet

- Norway CompanyDocument1 pageNorway CompanylkNo ratings yet

- Mint CompanyDocument2 pagesMint CompanylkNo ratings yet

- Jazz CompanyDocument1 pageJazz CompanylkNo ratings yet

- Natasha CompanyDocument1 pageNatasha CompanylkNo ratings yet

- Orca CompanyDocument1 pageOrca CompanylkNo ratings yet

- Gibson CompanyDocument1 pageGibson CompanylkNo ratings yet

- Flame CompanyDocument1 pageFlame CompanylkNo ratings yet

- Hiligaynon CompanyDocument1 pageHiligaynon CompanylkNo ratings yet

- Flax CompanyDocument1 pageFlax CompanylkNo ratings yet

- Goddard CompanyDocument1 pageGoddard CompanylkNo ratings yet

- Ginger CompanyDocument1 pageGinger CompanylkNo ratings yet

- Dublin CompanyDocument1 pageDublin CompanylkNo ratings yet

- Gold CompanyDocument2 pagesGold CompanylkNo ratings yet

- Caroline CompanyDocument1 pageCaroline CompanylkNo ratings yet

- Dean CompanyDocument1 pageDean CompanylkNo ratings yet

Part 4

Part 4

Uploaded by

lk0 ratings0% found this document useful (0 votes)

23 views114 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

23 views114 pagesPart 4

Part 4

Uploaded by

lkCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 114

pART 4

Copporations

‘A: CORPORATION DEFINED

72, also kr

en ast an acca Ce Revised Corporation Code (RCC) of the Philippines defined

Cotte powers, atrbutes, ana ores Creaeen oF Ia, having the rghit of succession

existence. % @Nd properties expressly authorized by law or incidental to its

For taxation purposes, Corporation is defined under Section 22 of the Tax Code (RA 8424,)

js amended under RA 11534 or the Corpora

‘Act: (CREATE) and RR 5-2021 as follows: ‘Recovery and Tax Incentives for Enterprises

CORPORATION shall INCLUDE:

4) One Person Corporations (OPCs)

2) Partnerships, no matter 5

3 alge, rt how created:or érganized;

4) Joint accounts (cuentas en participacion);

5) Associations; or

6) Insurance companies

A one-person corporation (OPC) is a corporation with a single stockholder; Provided, That

ae faced pater tink anecas on dcae peoeeareaae '

BUT DOES NOT INCLUDE:

1) General professional partnerships; and

2) Joints ventures or consortiums formed for the purpose of undertaking:

‘a. Construction projects; or

b. Engaging in petroleum, coal, geothermal and other energy operations

pursuant to an operating or consortium agreement under a service contract

with the government.

JOINT VENTURE (1V) OR CONSORTIUM

Joint venture Is a commercial undertaking by two or more persons, differing

from a partnership In that it relates to the disposition of a single lot ‘of goods

or the completion of a single project. « :

IN GENERAL, a joint venture or consortium Is taxable as corporation unless it

refers to joint ventures described above. Additional requirements for tax

exemption are as follows: :

1, A joint-venture or ‘consortium formed for the purpose of undertaking

Construction projects is not considered a5 corporation (RR 10-2012,

effective June 2012) provided: ;

§) The joint venture was formed for the purpose of undertaking

construction project; and

173

SS

Coy

rion,

b) Should iavalve Jolning/pooting of resources by cen

Contracts; that |s, licensed as general contractor by the i Nocay

Coveractrs Acredtaton Board (PCA) ofthe Departmen Pn

and Industry (O71) Trade

©) The local contractors are engaged In construction business.

4) The Joint Venture itself must Whewse be duly licensed ss! @hd

the Phiippine Contractors Accredtation Board (Peagy Ut by

Department of Trade and Industry (OT1). of the

FOREIGN CONTRACTORS .

Joint ventures involving foreign contractors may also be treated =

taxable corporation provided: Bray,

* The member foreign contractor Is covered by & special f

contractor by the PCAB of DTI, i Sense as

* The construction project is certified by the appropriate Tend

(ovement office) that’ the project is’ a foreign eAD%y

Internationally funded project and that Intemational bidding jg sn°*4/

under the Bilateral Agreement entered into by and benetlMed

Prilpine “Government. and the foreign internationale,

Institution pursuant to’ the implementing rules and Teguatigne "2

Republic Act No, 4566 otherwise known as Contractor’ License ions °F

2. A Joint Genture or consortium fot engaging in petroteum,

Geothermal and other energy operations pursuant ta an or

Consortium agreement under a service contract with the gover

Coal,

perating

ment,

Oe ee

OF

Taxable Joint Venture

Non taxable Jont Vente b

Sean inet n Sted eorel bo ine

carporaion, hence, Nax-exerf” (refer asc la Page 184),

‘Under CREATE Law. eet 25% of 20% RCIT

"Under TRAIN Law: 30% RCIT

‘corporation fom nother domes

“IM Received by Individual Coventurers; Trea'ed as dnidend income fom

arpeaton whch a sutjecio 10% FAT. However, fe FHT rae shallbe 20% recaea

INRAET and 25% i recetved by NRANET.

JOINT STOCK COMPANIES

Joint stock companies are constbted when a group of indhiduals, acting Jointy,

‘estabish and operate business enterprise under an artificial name, with an Invest}

capital divided into transferable shares, an elected board of. directors, end other

‘corporate characteristics, but operating without formal government authority,

JOINT ACCOUNT COMPANIES

Joint account (cuentas en perticipacion) is constituted when one interests himself nthe

business of another by contributing capital thereto, and sharing in the profits orcsses

In the proportion agreed upon. They are not subject to any formality and may be

Privately contracted orally or in wring. The term “associations” includes. al

‘Organizations which have substantial the sallent features of a corporation ta be taxable

88 “corporation.”

174

Corporations

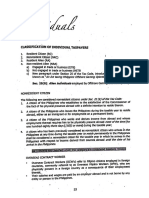

B. CLASSIFICATION OF CoRPon sre. TAXPAYERS

1) Domestic Corporation (oc)

0

2)

32

‘A corporation Created oF orgarized in the Phi

° MDE may a be deste as Aa Smal an Meduen Eur (ASHE)

Resident Foreign Corporation (RFC

© Acorporation created or organized in

engaged In business inthe Pippin 709" COUTREY Under laws 2nd

nes.

Nonresident Foreign Corporation (Nac)

9 A corporation created or organized In

5

engaged In business inthe Phang: °°" COME Under ts ows and isnot

(CORPORATIONS MAY BE CLASSIFIED FURTHER ITO:

4)

2)

Ordinary Corporations ~ corporations subject to requar corporate income tax Rom,

ae, Know 2s orm tax or base tar, at a ite of coer an ee

Sn foregn comport ae MNES Or 25%, for domestic corporations other than MSMEs

ind foreign corporations. Under the

the RCI rate was 30%, ‘TRAIN Law (From Jan. 3, 2018 to uy 1, 2020),

Special corporations ~ corporations subject to income tax rte which is Jowerthan the

‘equlr corporate Income tax (RCIT) rate of 20% or 25%, as Um case may be,

TRAIN Laws 10% (before July 1, 2020)

CREATE:

* 1%: July 1, 2020 to June 2023

* 10%: Beg. July 1, 2023

b. Resident Foreign Corporations '

+ Intemational carriers 2.59% of Gross Philippine Bilings

(CPB); however, it may be subject.

to a lower rate or exempt under

certain conditions

+1 Regional ting + TRAIN Law: 10% of net income.

Headquarters (ROHQs) + CREATE:

© 10% -uptoDec. 31, 2021

only

175+

on

ms

FE

yer pn

OR

Corpora, lion

(See

© _ Nonresident Foreign Corporations

+ Non-resident Gnematographic 25% Of Gross Income.

Film Owner, Lessor or

Distributor

‘+ Non-resident Owner or Lessor 4.5% Of Gross Income

Of Vessels Chartered by =

Philippine Nationals

+ Non-resident Owner or Lessor 7.5% of Gross Income

Of Aircraft, Machinertes and

EXEMPT CORPORATIONS

The following organizations shall not be subject to income tax

((Secben 20, RA 6424); National Internal Revenue Code):

Labor, agriauttural or horticuttural organization not organized principally for rote;

Mutual savings bank not having 2 captal stock represented by shares, a

bank whet cpl ck oar td pert fer ml papers sng te

pro Witho

A beneficiary socety, order or association, operating for the exclusive benefit

members such as a fraternal organization operating under the lodge system

‘mutual aid association or a non-stock corporation organized by employees provay,

for the payment of ie, sickness, accident, or other benefits excusively tothe mend

of such Society, order, or association, or nar-stock carporation or ther depengen =

Cemetery company owned and operated exclusvey forthe benefit of ts member

NNorestock corporation or association organized and operated exclusively for reigy

chantable, scenic, athletic, or cutturl purposes, or for the rehabilitation of vera

‘0 part of ts net income or asset shall belong to or inure tothe benefit of any ment”

organizer, officer or any specific person; a a

Business league, chamber of commerce, or board of trade, not organized for prt

no part of the net income of which inure to the benefit of any private stockhoyge

individual; : ve

Gvic league or organization not organized for profit but operated excuswely for tne

promotion of socal welfare; .

‘A non-stock and nonprofit educational institution;

Government educational instintion;

Farmers’ or ather mutual typhoon or fire insurance company, mutual ditch or irigatin

company, mutual or cooperative telephone company, or like organization of 3

local character, the income of which consists solely of assessments, dues, and fees

collected from members for the sole purpose of meeting its expenses; and

Farmers, fruit growers, or like assodation organized and operated asa sales agent fy

the purpose of marketing the products of its members and tuming back to them the

proceeds of sales, less the necessary selling expenses on the basis of quantity of

produce finished by them.

PROVIDED, hat the iicome of whatever Kind and character af the foregoing orgenizatons tom any

‘oftheir properties, real or personal o rom any cf their activities conducted fr proft regardless of

(he dispositon made of such income, shallbe subject io income tax.

176

a

Corporations

0 \yERNMENT-OWNED OR CONTROLLED CORPORATIONS (GOCCs)

15-202, Implementing the provsions of CREATE lon, provides that GOCS, 9°00

instrumentalities shall pay such rate of tax upon their taxable Income 25 are

Br corporations OF assoGatns engaged In a sida business, Indusuy, oF OCR,

excerT?

Government Service and Insurance System (GSIS)

3) socal Secutty System (555) .

3) _ Philippine Health Insurance Corporation (PHIC)

2) Local Water Disuicts (RA 10026)

5) Home Development Mutual Fund (HOMF; elso known as Pag-big)

NOTE uF oc Papi i exempt mic upon th eflcviyof CREATE Law cn Ape 11,2021.

= PCSO.and PAGCOR are taxable GOCE.

p, INCOME TAXES OF CORPORATIONS

GENERAL PRINCIPLES

A SOURCE OF INCOME SUBJECT TO TAX:

1. DC-We

2. RFC and NRFC— Within the Philippines only

B. BASIS OF INCOME SUBJECT TO TAX:

1

NRFCS: Final Withholding Tax (PWT)

2. Passive income we PWTs

‘3.Capital Gains on

Sale of shares of stock of 15% Capital Gains Tax (applicable to

domestic corporation all corporations)

Sold directly to a buyer;

and

Sale of real property in " 6% Capital Gains Tax (applicable

the Phitippines classied only t domestic coxporaion)

7

E. REGULAR CORPORATE INCOME TAX (RCIT)

ae

SMEs) RFCS

Gross income Pox Prat Pro irc

‘towable Deductions __ co) (v0! ox) NA

Taxable reome Pox Poo Pr a

Rate Ww 20% 25% 25%"

ROIT/FWT — Box Prox Prox a

—Pex

NOTE: '

* Effectivity of the RCIT rates under CREATE Law (RR 5-2021):

> For DC and RFC - Beginning July 1, 2020

> For NRFC- Beginning Jenuary 1, 2021,

CREATE aw, which was published on March 27, 2021, tool

21, ‘Aibeugh CREATE w ok tle ely on Api, 20a eo Forty,

provisions i tho law wt spect efectnty dle which ee eatin nas 88

£2021, such us the revised RCT rates for DCs and RFCS 8s wo ag gy,

PWT ate for RFCs, ‘erg

» Micro Small and Medium Enterprise (MSME)

> Refers to a domestic corporation with:

= Total assets of P100 rrilion and below; and

~ Net Income of PS million and below

0 The total assets excludes. ¥c ticular |

‘fc, ple end equpmert are sueled dung the taxable year ts

the taxis imposed, Thus the land is held primatiy forsale fern” ME

purposes, the value of is land tobe inched in teminog eae

Tegardless of whether the business of the company is the leasing otiang

© Incase there ar aress in he company’s ofc buldng that ae being

cout the percentage ofthe foo srea devoted to he company’s ote

‘mulled wih the total vel ofthe land in deter eg

bbe excluded inthe computation of total asses, ‘0

+ Allother “domestic” corporations are subject to RCIT rate of 25%

July 1, 2020, eineg

+ The 20% RCIT rate for MSME is not applicable to foreign corporations,

F, MINIMUM CORPORATE INCOME TAX (MCIT)

‘Section, 27(E)(1) and Section 28(2) [for DCs and RFCs, respectively], as amended,

under CREATE Law, provide:

‘A Minimum Corporate Income Tax NCIT of two percent (2%) of the gross

income a3 of the end of the taxable year is imposed upon any domestic corporations

nd resident foreign corporations beginning on the 4° taxable year immedatey

following the taxable year in which such corporation commenced its business

‘operations, when the MCIT is greater than RCIT, Provided: That effective July 1, 2020

until June 30, 2023, the rate shall be one percent (1%).

178

>

Corporations

‘THE MCTT SHALL BE IMPOSED wateniever:

The corporation has zero taxable income; or

+ The corporation has negative taxable income; or

+ Whenever the amount of MCIT is greater than the reguar corporate INcome

tax (RCTT) due from such corporation, Hence, MCIT 1s always computed and

‘compared to RCTT starting on the fourth year of operations.

MCIT RATES:

© TRAIN Law (beginning Jan. 1, 2018) 12%

* CREATE Law

ts 9 From July 1, 2020 to June 30, 2023: 1%

Beginning July 1, 2023 2%

MCTT Is not applicable to NRFCs, Special Corporations and corporations

subject to other types of Income tax regime such 2s PEZA registered entities.

CARRY FORWARD OF EXCESS MCIT (MCIT CARRY-OVER)

+ Any excess of the MCIT over RCIT shall be camied forward and credited

‘against the RCIT for the three (3) immediately succeeding taxable years.

RULES FOR DETERMINING THE PERIOD WHEN A CORPORATION BECOMES:

SUBJECT TO MCIT (RR 2-98 as amended under RR 9-98 and RMC 62-2021)

9 Question (as illustrated in Q10 of RMC 62-2021):

: What Is the reckoning date of determining the corporation's fourth year

coftoperation?

© Answer(as illustrated In Q10 of RMC 62-2021):

The phrase "4th year of business operations” should be construed to

‘mean “fourth taxable year immediately following the year In which such

Corporation commenced its business operation’ as Indicated under

‘Section 3 of RR No. 5-2024 on MCIT,

©» Mustration (as illustrated in Q1O of RMC 62-2021):

~ _ ABC Corporation commenced its business operations in 2017

~ _ MCIT shall be computed beginning 2021

~The MCIT shall be imposed beginning 2021 if it exceeds RTT

GROSS INCOME FOR MCIT PURPOSES

1) Seler of Goods

Gross Seles Pox

Sales Discounts (x)

‘Sales Retums and Alewances (a)

Costot Sales im)

Gross Income Pax

‘Add: Other Income subjectto RCT = _xx

Total Gross Income for MCIT purposes ax

179

2) Seler of Services

Gross

~ GOST OF:

‘

Marulactunng

Freight cost

Insurance premiums

‘Omer costo production

Tota!

Receipts

Sales Discounis and allowances,

Cost of Services

Gross Income

‘Add: Other Income subject 1o RIT

Total Gross Income for MCIT purposes

+ fase e

Salanesfmpeyee banat of pereroaconaanis and specs chet ending ty

Pe

Cost cies drecty uzedinprovideg th servca (0g, renal nd cost of suppian

Other croc costs end expences nacassayinced to provide the sances ay

sTOTAL a

© Incase of banks, ‘cost of srvicas halinlud interes expenes. ar

. RELIEF FROM THE MCIT

‘The Secretary of Finance Is authorized to suspend the postion oF the Mery

‘on any corporation which suffers lasses on account of

1) .' Prolonged labor dispute

2) Force ma]

3) Legitimate business reverses.

CORPORATIONS EXEMPT FROM MCIT

‘Special Corporations such

1

a. Propet educatnal Instutos and hospas

Intemational carrier

€ _ Regional Operating Headquarters (up to Dec. 31, 2022 only)

‘Nonresident Forelgn Corporations (NRFCS)

Corporations that are tax exempt’ under the law such as Regional or Area

Headquarters

Firms that are taxed under special tax regime (e.g. Covered by PEZA law &

Bases Conversion Development Act)

180

os

Corporations

NET OPERATING Loss canay,

“Net Operating Loss (NOL) means we MOLLO!

Income of the business in taadle

* _Fecarporuions adopting Fiscal Year prod, trate year 2029 and 2021 chal nce at

peaecrporbons wth cal years end oo bles dune 30,201, and June 30,202,

‘respectively (RR 25-2020),

REQUISITES FOR DEDUCTILIT

1, Atthe time of incurring net loss, the st not be from

tae ond loss, the taxpayer mi eempt

2 Tse 8,02 Substantal change inthe ownership of the business or

a) Not less than seventy-five (75%) In nominal value of outstanding

{sued shares, if the business i athe name ofa corporation ished

by or on behalf of the same persons; oF ¥

b) Not less than seventy-five (75%) of the paid-up capital of the

SDrPoraton, if the business is in the name of a corporation, is held

by or on behalf ofthe same persons,

Presentation of NOLCD in the Income Tax Return (ITA) and Unused NOLCO

In the Income Statement:

1. The NOLCO shall be separately shown in the taxpayer's (also shown In

the Reconclation Section ofthe Tax Return);

2 The Unused NOLO shall be presented In the Notes to Financial

Statements showing, In detal, the taxable year In which the net

‘operating loss was sustained or Incurred, and any amount thereof

claimed a5 NOLCO deduction within five (5) consecutive. years

Immediately folowing the year of such loss,

3. The NOLCO for taxable years 2020 and 2021 shall be presented In the

"Notes to the Financial Statements separately from the NOLCO for other

taxable years. :

181

RT oN

Corporatio Mtg

G. SUMMARY OF REVISED INCOME TAX RATES UNOER CREATE LAW (RR 5.2921)

Regular or Vinirom Corporate Teams

‘between the’

Trehiher between ne MCITY rales

GUAR

TYPE OF CORPORATION RE

uly 7, 20201

tune 30, 2023

5 “om | ouy 1.2028

a |

For corporalions with net taxable| 20% uy 1, 2020 1% | duly 1, 202010

‘income not exceeding Five une 30, 2023

Million Pesos (P5,000,000) ANO

{otal assets not exceeding One

Hundred Mion (P 2m °| suly 1.2023,

100,000,000), exctuding the land

con which the particular business:

entity's office, plant and

equipment are situated

Proprietary Educatonal | 1% | suly 1,2020t0 > Not Applicable

Institutions and Hospitals, dune 30,2023

40% | suly 1.2023

ak.

182

Coperane

{yPE OF CORPORATION

Tanuary 1, 2022 to June

30,2023

shy 1,202

Not applicable

Corporation

|. FINAL WITHHOLDING TAX (FWT) ON “CERTAIN” PASSIVE INCOME derived

from Philippine sources

Swans Gee

INTEREST INCOME/VIELDVOMher

= leet income n any casrency bank pack

= Yald or any monetary benef tom depost substi

Yield or any monetary bene rom st nd an other

siedar erangements

BRE [8

me .

oo 25%

20%

= Interest income derived from depository bank undor

‘expanded foruign currency deposit vnitsystem '

{FeDS/FCDU)

{

‘Peo t CREATE =

Pere CREATE Lae MRTCA erry bet 30% FT exc br neo oe CT,

rr tha FT lavas 75%

to noresidont :

bs mare eve Kom FCDSF.CD depo rl pei eer ech hg,

reomes

Siac ar any (7 MM MA compan tere hm ee ese ap

PASSIVE INCOME

© CREATE Law (beg Apnitt, 2021)

Geraraly, royaties wre considered Income te FT.

Nowe ne BF gh, doe Occoe ER

‘SeParaton'a prema purpose, the same is NOT passe nome Du

Seep

nde OR Ray he 0.

esate rennet ete al an nso wh

thepones ponte nts ha olcapret le Connon

inte tel ocr bars ann, neck

3) DIVIDENDS (RR 22021; RR 52021;RMC £2202)

+ FROMDC

‘Section 42(A)(() of Tax Coe s amended, proves:

‘nd on repent a hed

foie MT Te Raves ARE aK ie

‘rasa incoe of te freign corporation eto te yer

‘ihe cose of 83 lexabl your precedig the declaration of such

<@vidends ft for such pat of te pared asthe corporton bas been in

‘existence was derived orn sources win be Pippin,

Eramet Exar

Exempt Rem

184 «

Corporations

re TE Lew, RR 2-202'. Devcerd exceme receres

e Ane nub AM ete

shal

NREC which ar eqaraert to tases Geared

al en pacer (10%) afer Jaruary |, 2021, wtach

the diferonce between the jf he

oon lodhenna ra eee Cunt Se)

Grdends

FA ae of 15% so knw as Tax Spang Rt

Minos TexSprs- 25 O0N peru Gare

Wi Tax Spanng — 15%

s=-§TUS OF ONIDEND INDOME

@ FROM dome coperaton. name ened fon wd te Phppmes

0 FROMForeln Caran AUC 82.217 Secon czy

forvignaourced dMidend received by a domestic

corporation:

1) The deidends acualy received rete fo he Phlgpnes we reinvested n he buses

See ne samestecrparaion nahin Pret arbl yar fom te tne the reg

> Seeaoes =

2) The Teceive iy be used und the wortng capital requrements,

ends. died paynets, esi donestc baci, an maine

nerty percent (2%) in value of the

‘Absent any one ofthe above condtons, the forig-sourced dvdenda shall be considered

aa taxable Income (x ol the domestic corporation inthe year of actual receipt or

romance, sbjecto suche, tet and penalties, at appcable (RR 2071, RMCE2 2021)

© Theterm used under Secon 424)2) lhe Tax Code was forign carport, wihou dafncion

Soarenadeey ee SHPO Sresden or aonresen. Hence, ene deterng he

Seiten came fom reg capraton sl pio bulesden and nner

‘coporaton,

© Secton 2) of RR.52021 res tat. den inane recsked frm nenesdent fregn

‘paraiso ead as frgn sourced iden,

1

CAPITAL GAINS TAX (CGT)

Cina A

in CAPITAL GAINS derived from Philippine Sources

1) ONSALE OF

pret etrrirg et ale .

Under CREATE Law (beg.

Apa 11, 2021)

‘Based on Capital Gan, regardess of maint 1% 18%

14,

Under the TRAIN Law (Jan: §, 2018 to Apel 10, 2021)

eel 15%

On capita gain, regardless of

‘On Fert 100,000 capeat % a

an

On Captal Gan h excess of P1000. rt &

2) ON SALE OR EXC! OF LAND :

HANGE

: ‘OR DISPOSITION

Based on Soliing Prica or FMV, whichever Is.

NA

TT 6% Car repre beth aot aan ss 8 eC Woy

gain ox loss is iy

Saportnsaningades aren Mant ne to nlnpyen ate

stm eae Tax fe bayer be govenmenl, 8 Tr OPP We ne

. Fer purposes of computing ne 6% CGT on rl properties. he Far Mae Uae ae

Eager SS pein entree

tei acne ne roe

he FM deterred by independent paresis nt applicable for CGT poses. eR

© CGT is due within 30 days from date of sale.

CAPITAL GAINS TAX

¢ Capital Gains Tax on Sale of Land ‘and/or Buildings

Requisites:

1) The land andjor building must be capital asset; and

2) Te must be located in the Philippines, :

3) Repardless of whether the transaction resulted 10 again or loss *

FORMULA: ‘

- Tax Base Pox

-Rale _ 6%

CGT Prot

TAX BASE:

4, Seling Price

2. Fair Market Value

3, Zonal Value

186

3.

Corporalions

Capital Galns Tax on Sale of Shares of Stock of s Domestic Corporation

Te shes ck uh aes, ech cr Speed mut eto 4

domestic corporation,

2) The transaction must be not through the local sock

3) The seller should not be a dealer in securities (held as capital asset Of for

Investment purposes only)’

4) The transaction should resutt to a capital gain based on computation shown

below: -

FORMULA

Seling Price Po

Cost (2

Capital Gain Pex

fale pe

cot Por

NOTE. oc sharsol donee

through the cal sock exchange not subject to nace

‘tax but lo a “dusmness tax” of 6/10 of 1% (also inown 23 Stock Transacinn Tax) under Sec. 177 of

the Tax Code. +

(Sale of shares of stock by 2 dealer secures sch as brcheraye ka, regaries of wheticr he

shares were sold drecly lo a byer or trough the local stock exchange i subyec bo basic noe

vaxand value added tx.

‘SPECIAL CORPORATIONS

‘Special Corporations are corporations subject ta lower RCIT rates as compared to the.

20% or 25% on their regular or ordinary income by (previqusly at 30% under the

«TRAIN Law).

‘There are a total of six (6) special corporations under the Tax Code as amended,

namely:

Domestic Corporation

1, “Proprietary educational institutions

2. Hospitals which are non-profit

Resident Foreign Corporation

3. Intemational Carriers

Nonresident Foreign Corporation

4 Nonresident Cinematographic Film Owner, Lessor or Distributor

5. Nonresident Owner or Lessor of Vessels Chartered by Philippine Nationals

6, Nonresident Owner or Lessor of Aircraft, Machineries and Other Equipment

187

1. DOMESTIC CORPORATIONS (RMC 62-2021; RR

¢ Hospitals which arc: non-profit and Propri

Oo"

Corpor eon,

44-2021; RR 3-2022):

etary Eeveatona Intute og

3 wl 10 APY to Nasal wy,

. The rules applicable to ordinary.

are non prot and propretary eaucaonal institutions, €X unrelated income "1% based on laxable income

‘© Related income < unrelated incorne 25% RCIT; 20% if MSME

“Non-stock, Non-Profit Educational inatulion

whose,

member or spetfic person. * 3 ;

+ Related come> uneeed ncome 1% based on laxable income

Related Income < unvelaled incare ‘25% RCT; 20% (SME

nrtock, Non-Profit Educational inattaton

[NOT FALLING under Section 3 of RR 3-2022 (mesning HO PART

‘FAs ret income or assel shal being lo or ince fe banat of

any manber, organizer, oficeror any spect person)

© Qn the porton ofits revenues or aasels USED sclualy, Exempt from taxes and duties

ditectly, and exclusively for educational purposes. under See 4(3), Art. XIV of the

: Consitson and Sec 30 oft

‘Tax Code, as

*Onthe porn ofits revenves or assels NOT USED aca,

directly, end exchsively for educational puposes. 25% RCT; 20% 7 MSME

190

Corporations

i Educational lat tition (GE)

ow povereD by the prefrantal corpora cor Ls rte

Income from related acres

Coasts votes Sec. $40 oh

(Ba Tex Cote or by ts own

(On incoma not exempt by laa such a inca c nhstver

ind and charactor of te foregcing ergareatns fom any ‘Bite ROM, Z% A MSME

‘oftheir properti, real or porsonal,o ram any of tae #

cis | bel

‘rade of such income, 8 prided under Ser 30 the Tax,

Code.

NOTE:

Final wiholdng tes on passive incomes and capt gas tax

Foal wee ronan aac scandal pees

it Hospitals ep

Non td nce > une acme ‘based on tale income

Related Income < unrelated income Beg July 1, 2020, 25% RCMT; 20% ¢MSME

Hospitals organized FOR-PROFTT Bog, Wy 1,200 25% RCIT; 20% « MSUE

Phot ta duly 1, 2020: 30% RCIT

NOTE: a

+ The special tax rate for proprietary educational institutions and non-profit

hospitals shall be applied as follows:

eS Penton RATE

From July 1, 2020 to June 30, 203 1%

Beginning July 1, 2023, 10%

Prior to July 1, 2020 10%

Q_**Non-profit hospitals may also be exempt if all the Following conditions for

‘exemption as provided in the case of St. tuke’s Medical Center (SLMCI) vs.

CIR in the CTA Case No. 7857 dated June 3, 2011 are present:

+ It isa non-stock corporation

+ Itis operated exclusively for charitable purposes; and

* No part ofits net income or asset shall belong to or inure to the

benefit of any member, organizer, officer or any specific person.

‘The court provides that a “private” hospital organized as nonstock-

: onprofit that is operated for charitable and social welfare purposes is

exempt from income tax under Section 70 of the Tax Code provided all the

requisites for exemption are satisfied.

191

’ Crrperetioy

2, RESIDENT FOREIGN CORPORATIONS:

INTERNATIONAL CARRIERS

In common Carter refers to an Intemational Ale Carr

Irena Ca arene Secon 3 FR 15-2013, 2 fay

touched of wlenbon of

esr erwcnaacirs frm he Phipps lo Boywhere ne wor an

business me

trmapotaton

fonine | r orhaving menianed

ne oe ae ina Popes fr te sl of owned Kapaa

oouments or iiesipassage documents of ober shipping companies, which shpneg

eepunes operas widen any Papo pat. ae 288 fine ea,

INCOME TAX

* an intemational camier having’ fights or voyages ariginating from any

port oF point in the Phillppines, respective of the place where passage

documents are sold or issued, is subject to the Gross Philippine Bilings Tay

of two and one-half percent (2 ¥2 %) Imposed under Section 28(A)(3}2)

and (b) of the Tax Code, as amended, unless it. Is subject to a preferentisy

‘rate or exemption on the basis of an applicable tax treaty or Internationa

agreement to which’ the Philippines 15 a signatory or on the basis of

reciprocity” (Sec. 4, RR 15-2013).

FORMULAE

Gross Philippine Bilings™ = Pox

Role . ‘25m

Income Tax. Prot

s=inlematonal carers may aval of aower tax rate (preferential rate) or exemption

RA10378 on he basis of: :

a. Tax Treaty, or

b agreement; OF

Reciprocty = An intematonal cater, whose home county grants income tax

cexemplin to Philopine carers, shal iewise be exempt fom income tax.

192

Corporations

GROSS PHILIPPINE BILLINGS (cop)

Internavonal Air Carrer

Refers to the emaure of grozs revenue derived from cartage of

Persons, excess baggage, cargo and mail originating from the

septa rine

Or isoue and the place of Of the tucker oF

passage of document. es

International Shipping Carrier

Refers tothe amount of gross revenue whether for passenger, ergo

oF mall originating from the Pbilppines up to final destination,

PRBS Of the pace of Sle or paymerts ofthe passage or fresh

focuments,

Ne (Re 15.700, Gal Aa Co , Phi Branch v. Conmasines hema Reverse, GR. Ho. 182045, September

PHIL 493-505)

18.2 one PER wos kw alee Plea ead rie

. for ara dass, besress dea recency cess passe. 2s he cane nay be, ot

Ee ay neem APO pont fe Pgs tsa dearaton oy por

‘ar pani ofa ken cour,

For ths purpose, te Gross Phippre Béings shal be eierned by comping he rent ere

et belt capns el Sn ceed ae

passage (i2.frst cass, business lass, er econemy dass) and per lastcaten of passenger .c. achA, cull

cx efari) and mulphed by th coresponng tal nurber ol pesenger town fr Be mara es deored the

fight mantest g

= Tae evalidated, exchanged andiorindorsed be anche nieratona aifne lom pao he GPB da passenger

boards a lane na port or pontin he Phigpnes.

. which engnales from the Philipines, bu tansshipment of passenger thes place at any port outside the

bgt en eter sire oi ie cetpane toca te tee ee ee

the Philppines ta fhe port of ransshipment shal kom part of the GPE.

+ The gross everue on excess baggage which ongated for any port or pantn the Phippines and destned fo

aypetcle brig cnn ale onpdedboed nto seco th ee

recelpl or any simdar document forthe said transacSon.

‘+The grass revenue for freight or cargo aid mail shal be delemnined based onthe revenue realized from the

‘ariage theo! The amount realized high or caro shal be based onthe amex appearng on he away

193

Corporation,

xn0uARTERS (ROHOS)

7 “Gat no fnger be consdered as sper

Srporatcn, ConseUenIY, Ne ey

applicable t0 ordinary reser! toegy

orale sal Bt€3CY 2. Such 9

omar rate: 25% ofreincame derveg

from Phlppine soUcescniy, ang

9 MCIT (on gross income in the

Philippines):

PRIOR’ Considered as spec corporation subj

wlan’ Gone xl based on oc

4 REGIONAL OPERATINOH!

a) and Represeraive Otis (2

NOTE:

‘¢Regjonal or ea Headquarter (RHOIAK

are diferent fom ROHQS.

44 Regional or Area Headquaters (RHONAHOs) and Representa Or

(Rs) ere Laxexerpl and not nchded in the defion of corporaion £3

income lax purpeses.

24400) of the Ta ‘Code, as amended: a

se alo oe yeadqutes: shal mean 2 bach eslbished in

Phlppines by ‘conparves and which headquarters "

hah acl 5 SPENT, COMMUNAL ang

‘oornatng cenier for ther ails, “sutsidanes, or branches in the AsiaPac

Regan and other foregn martes

(A) if the Tax Code, ax amen

Se eainates pod Scton 200) hal be bet

Tncome fox

3, NON-RESIDENT FOREIGN CORPORATIONS:

opresitent inematapic Fm vrer, LesororDstibuor "Gloss eons

Naren ner Lessor cl Vessels Carre by PRIPPN® Gross rials, lease

Nationas corchaerfees 45%

Nomen Over or Lessor of Arf, Machines and ter Gross renal,

Equipment Li chartersiotherfees 7.5%

a

194

Corporations

ve BRANCH PROFTT REMITTANCES rx (Bonny op _

sae 2(AYS) ts Tat Coa endo poy,

taLh alba bse nga en i ab abies el em prt)

fer he lx component ere PH et temaad tee

A ata coat thou any dotuccn

COMO ). The tax, (@8 fegtered wth be Phi

secon oe Tax Gate reat tet wd pad ne te ter eon

remuneration fr techrical, rues, yen

oe caption Baer on sae, rece RET eet

rad as anh poten se Fon acs nao at

‘business in the Philippines, fectey corrected wh te conduct ts rade oF

NOTE: This provion was mt amended by CREATE Lay

FORMULA:

Profit Remittance Pox

Rate 1%

BPRT —

PROFIT REMITTANCE

"(ee ROBT

Connected with the conduct. of &S wade or APPLE TAK

business in the Phil

ppines ‘Subject to 15% BPRT

Others (L.¢., passive Income) Not subject to BPRT:

EXEMPT EATITIES

+ Activities registered with the folowi

shall rs

4) Philippine Economic Zane Author ann =

2), Subic Bay Metropolitan Authorty (SEMA)

3) Clark Development Authority (CDA)

BIR RULINGS

Branch it Remit Ta 1989

For purposes of the 15% proft remittance i form of remittance, drect orindirect, made o the

mmoet Company abroad shal be presumed hae batn made kom he accumuaied profs

the branch” #

6 Branch Profit Remittance Tax, BIR Ruling No, 583-68, December 19, 19

‘The 15% branch profit emitance tax in adélion fo the regular corporate income ax ue em

resident foreign corporation.

s. 9 Ph

{tis cardinal rein taxation that exemptions shouldbe constued stctssimi juris because itis

‘highly disfavored in law; and he who cms an exemption mustbe able tojustty his claim by the

leerest grant of organic state lew. An exemption fom the common burden cannal be

permited to exist upon vague impications,

195

he ee oe ta

Corperetiy Lg

OFFSHORE BANKING (oBu

See. 26/A)4) otermcne )

Repealed under CT TNTTETD

‘An OBU Is a branch, subsidiary or affiliate or a foreign banking

{Peated In a/an Offshore Financial Center (OFC) which Is duly authorized by

Danse offshore banking busines in the Phitppines (PD1034; BSP Craular ng, Sty

Us are allowed to Provide all tradivonal banking services to NOn-tesidents Rag

‘Sutrency other than Philippine national currency, lay

INCOME TAX OF OBUs

* Upon effoctivity of the CREATE Law

Under the CREATE Law, OBUs are now taxable just 4

ordinary resident foreign corporations. They a now subjecr ye 2"

Fevised RCTT, rate of 25% an thelr Income derived from sources withys C8

Philippines. the

‘* PRIOR to the effectivity of the CREATE Law

Income derived by offshore banking units (OBUs) from foreign

transactions shal be taxed 2s follows: Cure

‘couneR PARTY AE

Non-residents Exempt

‘Other OBU'S. Exempt

Local Commercial Banks Exempt

Branches of foreign banks Exempt

Other residents, 10% :

M. TAXATION OF POGO ENTITIES AND SERVICE PROVIDERS

RMC No. 107-2021, dated October 2021, was Issued to clrlarze Republic Ac (eq)

No. 11590 Entitled “An Act Taxing Phiippine Offshore Gaming Operations, ementin

for the Purpose Sections 22, 25, 27, 28, 106, 108, and adding New Sections 125.4 ang

288 (G) of the National Internal Revenue Code of 1997, as Amended, and For Other

Purposes”. .

‘The salient changes in the 1997 National Intemal Revenue Code (NIRC or the Tay

Code), as amended by RA 11590 in relation to corporate taxpayers are 2s follows:

+The definition of "offshore gaming licensee” was added to Section 22 of the

Tax Code and shall be constlered engaged In doing business in the

Philippines.

«The definition of “offshore gaming licensee-gaming agent” was added to

Section 22 of the Tax Code who acting as such, shall neither be involved with

tthe business operations of the offshore gaming licensee nor derive Income

- therefrom,

196

. Corporations

DEFINITION OF TERMS (Based on RR 20-2024 dated tlovember 26, 2071)

o

Philippine Offshore Gaming Operaten (POGO)

> Relea tothe opereton by an Otfshore Gaming Licensee ontne games of

ig chance o sparing even va ba inmel wr retard ricbane nore

xcusvely for ofshare cuslemeraplayers who ar nen Filpnos.

> The fer POGO shallaso refer OGLs and Acereded Service Providers

Offshore Gaming Licensee (OGL)

> ‘Refers fo an offshore gaming operator, whether arpanized in the Philippines

” Pilpietase) or sed (Sten. 9

customers.

> — OGLs, also known os Interactive Gaming Licensees, shall be considered engaged

{in dolng business I the Philppines.

‘Accredited Service Provider (ASP)

Y Refer lo any natural person regarcess of clizenship or residence, or urcal person

‘regardless of place cr erganizaton, which

POGO Licensing Autonty

rept by tet respect charters ss gaiegKenses and ecredtabo0

(061-Gaing Agent

> Refers toa represenatve nthe Phliphes of a forein based OGL who shal act

28 a resent agent forthe mere pupose of receiving summans, notices and other

{egal processes forthe OGL and lo camply wih the ciclosure requrements ofthe

197

Coperetny

TAX TREATHENT OF INCOME BY POGO ENTITIES (RR 20-2021)

INCOME FROM GAMING OPERATIONS site

INLIEVof ALL other direct and Indirect inter revenue taxes and locaj

tere shall be levied, assessed and coleced fro” OGLs (whether Pring

based or Foreign-based) a GAMING Later to (Whichever is pj

Gross Revenue (GGR);

© BM of Goss Gamig Rev ie minimum monty

© 5% of the

(AMM) from gaming operations

The Gaming Tax shall be directly remitted to the BIR not later than the 244

day following the end of each month.

even

FORMULA (RR 20-2021):

‘Gross wagers a

Less: Payouts

Gross Gaming Revenue (GR)

Vs. APMMR

Higher amount bet. GGR and APMMR. Pot

Gaming Tax rate

IG TAX

‘Goss Woges refer io he toll amour of money tat shore gaming

Payouts nero ll amour pad xt ofshre gang SIME fia

‘Agreed Prodolernined Mima i

the amount al ia danved alle dvd Ihe minum monthly fee oft eq cone

inpoend by a Phipine Ofdhore Gaming Operation (POGO) Ucersing ans

the ra of preserbed reqdatry fe by

‘© Income from Gaming Opéraions

on ier to renme or earnings eaized or derved from operzing onine

Ree in ers va he amel seg @ rena and stay

Progam.

6 Income from Non-Gaming Operations * . tae

2 Refers o any olher ncome of earings realized oF derived by OGLs that are py,

classified as incor from garnng operations.

eco

4 INCOME FROM NON-GAMING OPERATIONS

© Philippine-based OGL.

re Subject to 25% RCIT of taxable income derived from Sources within

‘2nd without the Philippines.

© Foreign-based OGL

‘© Subject to 25% RCIT of taxable Income: derived from sources withia

the Philippines only.

NOTE: The non-gaming revenues of operations of al OGLs shall be subject

aloe added tax (vat) or percentage tax, whichever Is applicable,

198

Oe

TAX TREATMENT OF INCOME By pogo Accredited Service Providers

(AR 20-2021)

6 ASP Organized In the Phiippines

° Subject to 25% RCIT of taxable ncome dered from sources withia

gad thou ve Phlpines, except as othernce proved a te Tae

0 ASP Organized outside the

ines

© Subjectto 25% RCTT of taxable Income derive from sources wthia

the Philippines, xCEpt as otherwise provided in the Tax Code,

‘TAXATION OF PAGCOR (RMC 32-2022 dated March 30, 2072)

1869, 25 amended, classified PAGCOR's Income Into two, namely:

Po "Income from gaming operations; ana f

2. Income from other related services

the case of PAGCOR vs CIR, et al (G.R. No. 215427, Dec. 10, 2014), the Supreme

Curt held that PAGCOR's Income from gaming opera at ,

ise tax while Its income from related services shall be subject to the corporate

toe tax provided In the Tax Code, as amended.

INCOME OF PAGCOR FROM GAMING OPERATIONS indudes, among others:

‘0 Income from its casino operations;

‘0 Income from dolar pit operations;

‘© Income from bingo operations, Including all variations thereof; and

© Incpme from mobile bingo operations operated by it, with agents on commission

basis. Provided, however, that the agent's commission income shall be subject to

regular Income ax, and consequent, to witolding tax under existing

regu

‘Accordingly, PAGCOR'S income from its operations and licensing of gambling casinos,

gaming clubs and other similar recreation or amusement places, gaming pools are, IN

LIEU OF ALL TAXES, subject to 5% Franchise Tax pursuant to PD 1869.

Is noteworthy to mention that Section 13(2)(a) of PD 1869, as amended, clearty gives

PAGCOR a blanket exemption to taxes on its income from Its operations under its

Franchise (also known a5 Income from gaming operations) with no distinction on

whether the taxes are Grect or indirect, ike value added tax (VAT). :

199

|

Coy aly, Ns

PAGCOR's income from "other related operations/services” shall be sub

Income tax (RCIT), vat and other appbcable taxes under the Tax Code ra

ed,

INCOME OF PAGCOR FROM OTHER RELATED OPERATIONS/SERVICES

9 Regulatory license fees Such as;

2 Regulatory/license fees from licensed private casinos

® Reguiatory/license fees from licensed private bingo operations, Inc

Variations thereof ding ay

© Regulatory/license fees from private internet casino gaming,

bettingand private mobile gaming operations;

© Regulatory/iicense fees from private poker operations

© Regulatory/license fees from private junket operations

. y/license Fees from SM demo units

$ license fees from all other electronic derivatives of brick ang

Games regulated by PAGCOR mor

© Income from other necessary and related services, shows and entertainmerit

PAGCOR's other income that are not connected with the foregoin,

Operations are likewise subject to corporate Income tax, VAT and other applica”

taxes under the NIRC, asamended. . .

PAGCOR Is constiuted.as a withholding agent for the government as

Fegards the compensation given to its employees subject to withholding tax on.

Compensation, and for payments made to individuals or corporations subject to the

withholding taxes at source as required under Chapter XIII and Section 57 of the

NIRG, as amended.

PAGCOR must also collect a qualifying fee from players and remit the same

In accordance with Executive Order No. 48, s. 1993, Revenue Regulations (RR) No,

06-93 and Revenue Memorandum Order (RMO) No. 14-93. Particularly, pursuant to

Section 6 of RR No.,06-93, PAGCOR shall issue a check, payable to the Bureau of

Treasury and to the creditof the account of the BIR, equivalent to the amount of

collections for a particular week. Thischeck, together with the necessary supporting

documents prescribed by the BIR, shall be Issued to the Bureau of Treasury nat later

than Tuesday following each week.. The Bureau offreasury shall then prepare

‘monthly the corresponding Joumal voucher and any other necessary document in

favor of the BIR, for the latter to record the amount of collections In its book of

accounts.

‘SUMMARY:

‘5% Franchise Tax

In LIEU of ALL other Taxes such

as income tax and vat.

© RCIT and other taxes Imposed

under the Tax Code such as vat.

™~

Corporations

TION OF PAGCOR CONTRACTEES AND LICENSEES

(auc ‘32-2022 dated March 30, 2022)

Income or paccon CONTRACTEES AND LICENSEES FROM GAMING

opi

P.D. No, 1869, as amended, expressly provides that the payment of the five

percent{5%) franchise tax of PAGCOR Inures to the benefit of its Contractees

and Ucensees (Bloomberry Resorts and Hotels, Inc. v. BIR, GR. 212530 dated

‘Aug. 10, 2016). Hence, following the ruling in Bloomberry, ike PAGCOR, Its

Contractees and Licensees shall be exempt from the payment of corporate income

tax realized from the operation of casinos upon payment of the five (5%) franchise

tax since the law ts clear that said exemption inures and extends to their benefit.

PD 1869 provides:

“SEC 13.- Exemptions:

(2) Income and olher taxes -

Ezanchisa and to Boss receiving compensation or altar remuneration

from the Corporation or operator a3 « result of essential facies

fumished and/or technical services rendered to the Corporation or

‘operator.

The fee dr remuneration of forvign entetainers contacted by the Corporation

‘or operator in pursuance of this provision shell be fee ofanytex.

NOTE: The 5% Franchise Tax is IN LIEU OF ALL TAXES whether the taxes are

direct or indirect, like value added tax (VAT). The 5% franchise tax shall be

payable directly to the BIR, speatically to the concerned Revenue District Office

(RDO) where the licensee Is registered. This franchise tax Is different and distinct

from the license/regulatory fees paid by licensees to PAGCOR.

INCOME FROM OTHER RELATED SERVICES/OPERATIONS

The “Income realized by PAGCOR's Ucensees from “other related

services/operations" shall be subject to the regular corporate Income tax, VAT

and other applicable taxes under the NIRC, as amended.

201

C :

Hor abio, tg

. TARASIITY OF ESABONG OPERATORS (ONC 25-2072 ted Mah yap,

oo)

© E-SABONG OPERATOR'S INCOME

Just Eke other PAGOOR bomnsees as Bustreted in the

ages, the gaming income of e-sabong operator is sitar ing

revenue

Franctese Tax which shall be in bew of ail internal taxes 25%

‘vat or percentage tax, depending on the threshold. Ore

Income from e-sbong operation (gaming income) refe

gamng andor service income from aco he

Suthortond under the e-sabeng leense issued By PAGODR, induc

(nck Emit to those derived from the a be

© | SERVICE and OTHER INCOME

threshold, wetholding taxes and other taxes, as may be on

‘eppropriate.

P. FILING OF TAX RETURNS

1 Regular Corporate Income Tax (RCIT) or Basic Income Tax

a) ‘Quarterly — on or before the 60° day following the end of the quarts,

b) Annual (Firat Quarter) — on or before April 15 of the succeeding yea,

2 Finel Withholding Tax on passive income

Month ie

3. Capital Gains Tax

2) Shares of stock

iL Ordinary Return - 30 days after each transaction

iL Final Consolidated Return - on or before April 15 of the following year

b) Real Property 30 days following each sale or other disposition

202

Corporations

2 the letter of the correct answer,

corporate TaxpayersPrinciples,

RRA 10963, herve Kaown es the Tax Plo bocleaton and ncksion bet (TRAM

+ Law) took effect on

; a. December 13, 2017

©. December 13, 2017

b. December 14, 2017 4. Servsary 1,208

1.

& Answer.D

RA 11534, otheswise known 28 fe CorprctsRecoveryand Tax hoartvestorErterpises

2 (CREATE Law) took eficct on

a. duty 1,2020 © March27, 2001

b. March 26,2021 4. Aga1t, 2001

@ Answer:D

9 The CPEATE Law took eect 11, 2071, bomen, Aes pomcces wee

‘pecialy race n tabe tse tn oie ee

Of bw revwed RCT rate cf 20%,

‘Section 115 ol be Tex Cate, as armrciod

fund

VIL Mutual fund companies

. Regional operating headquarters of mtnitional corporations

a landllonly © LIL ULV and V only

b. | Nandi onty d. Alol the above

> - Answer D .

203

Corporation

it mse In the business of anoth,

is constitute when one intrest er

ring capi ert, tsa nt poi oases 0 e Poporen gee

‘pon, They ao nol subject fo any fomalty and maybe oa oral or

writ .

. cc, Associations

2, Joint stock companies

. Joint account None of the above

© Ansver’B .

itincludes all organizations which have substantaly he salient feanires

Cf a corporation to be taxable as a “corporation.”

8, Joint stock companies cc, Associations

. Joint account - d. None of the above

Answer: C

g ‘Wich otha foo st male coro

8. General professional partnersti -

1b. _Ajoint venture or consortium formed forthe purpose of undertaking

©. Ajoint or consortium for engaging in petroleum, coal, geothermal and other

‘energy operations pursuant to an operating consortium agreement under a

service contrac with the goverment

Allofthe above

Answer:D

‘0 General, evoint Venture is txable asa corporation, except or eters C and p,

Statement 1: Partnerships, no matier how created or organized, are taxable as

‘corporations for income tax purposes. aig

Stalement 2: Associations and mutual fund companies, for income tax purposes, are

excluded in the definion of corporations.

Only statement 1 is correct

Only statement 2s correct iF

Both statements are correct

Both statements are incorrect

pe ee

°

Answer: A

9 *Nomattorhow create” simply refer to how the partnership was established, ther

coraly orn wring, registered or unregistered,

1. Which ofthe following s nota taxable corporation?

‘2, Ana, Loma and Fe agreéd fo contribute their money ino @ common fund to engage

. jin the business of buying and seling consumer goods. Their total investment

‘amdunted to P300,000 and they did not bother to register their business with the DTI

and the SEC.

204

Copan

p, Ped, Juan and Luna, all certified public

is ion, They have registered wth the SEC.

Bus i :

© enna it dy rg eo ee

efficiency of ullizing thet asses and to avoid the negate eet of competion, the

{wo companies agreed fo pool their resources together and operate 2s a single

company. :

Rody:and Allan, lawyer and certified public accountants respectively, agreed to

4 contribute their money, property and industy to a common fund to render service of

business process outsourcing.

> Answer:B

(© Pedro, Juan end Luna formed a GPP, coe of se oe

Sarre ‘one of the exclusions in the defintion

40. ‘Which is not a characteristic of corporate income tax:

. Wie" a. Progressive tax & General tax

b. Direct tax d. National tax

> Answer A

°

Corporate tx is NOT a progressive tax, but a proportional ax. A progressive

‘alo increases es the tax base increases. Examples of @

Direct tari @ type of tax where the incidence end inpac of taratin fll on the

‘same person, The burden of paying the tax canY be shited by the taxpayer to

‘someone else,

9 General tax refers to general levy by 3 goverment thal cfs no special benef?

{othe taxpayer, but only super fo govemmertal programs thal benef al. is

‘source of publ reverve. :

© Nabonal taxis a tax imposed by the National goverment

41, Which of the flloving is subject to income tax?

Answer:D

* © PCSOs taxable upon the efectvty ofthe TRAIN Law or begining January 1, 2018.

° HDMF or Pag-ibig is tax-exempt upon the effectiviy of CREATE Law.

205

fa.

+132.

Copperition

Mf

(noo tha along ramp fo incl

8. Proprietary educational instttions

© Gomme stor eos

& yment educational ins

4. Mutual savings bank nt Raving a copa tock represented by sharss

> Answer: C (Section 30 of the Tax Coe, os amended)

{ax are not subject fo income lay

connected with the Purposes

Statement 1: Corporations exempt from income

incomes received which are Incidenil or necessary

which thoy were organized and operating.

Statement 2; Corporations exempt from Ince tax are subject t incomes tax on ji

‘of whatever kind and character nit any of thelr properties (real ‘or personal) of from

clher aciviy conducted for prof, regardless of he dsposiion of such income, ny

Only statement 1 is corect

Only stalement 2's corect

Both statements are correct

Both statements are incorrect

pese

Answer: C

|. Which of the following statements is incorrect? “Joint Stock Companies" are con

when a group of individuals, acing joinly, establish and operate business enterprise

a. Under an artficial name.

b, With an invested capital divided into transferable shares.

¢. _Anelecléd board of directors, and other corporate characteristics,

d. Operating with formal government authority, i

> Answer:

|. A “Joint Account” is constituted when one interests himself in the business of another

byland

|. Contributing capita thereto.

1. Sharing inthe profits of losses in the propartin agreed upon.

Thay are not subject to any formality.

1. tmay be privately conlracled orally orn wring.

a. land Il only J, liland Vv

b, |, Hand IM only d. None of the above

> Answer: C

206

Copporations

1: Joint ventures, regardless of tho

- sila to tec Iho purpose by they were created, are gereeraly

alament 2: Tho sha ol a Covenuer corporation ite neincome of tx exer ort

9¢ consortium Is subject to corporate income tax,

venture Orly statement fi cored

b._Only statement 2isconect

cc. Bolh statements are correct

d. Both statements are incorrect

Answer: 8

oe, RFC and NRC

{tis important fo know the sources of income for tax purposes, ie, from within and without

{7 the Philippines, because:

Some individual and corporate taxpayers are taxed on ther worldwide income while

‘others are taxable only rom sources within the Philippines.

b. _ The Philippines imposes income tax only on income rom sources within.

¢. Some individual taxpayers are cizens while other are aliens,

d, Export sales are not subject to income tax.

> Answer: A

48, Wich of he following staterents i corect?

L

The term "domestic", when applied to a corporation, means created or organized in

the Philippines or under the laws of a foreign country as long as it maintains a

Philippine branch, :

11, A corporation which is not domestic may be a resident (erigaged in business in the

Philippines) or| ‘onresident corporation (not engaged in business in the Philippines).

i, Resident foreign corporations are subject to income tax based on nat income from

sources within the Philippines.

. a, Lonly Hand only

b. only | land th

“Answer: C '

19, Statement 1: Non-resident foreign corporat

trade or business within the Philippines,

Statement 2: Resident foreign corporation applies toa foreign corporation not engaged

Intrade or business in the Philippines,

a. Statements 1 and 2 are false

b. Statement 1 is true but stalement 2s false

¢, Statement 1 is false but statement 2is tue

d. Stalements 1 and 2 are tue

tion applies to a foreign corporation engaged in’

Answer: A

207

Cory

Val,

ee thin,

ee Of tho following ts taxablo based on Income tom all sourcas, wilhin an

dw

Corporation: "hour

Resident Foreign Carports

Non-resident Foreign Corporations A

Allol tho choicos

maak

> Answer: A

21. The term a : do or busi

1Pplies to a fornign corporalion engaged In trade or business in the

8. Resident foreign corporation Philbin,

Nonresident foreign corporation

Multinational corporation

Petroleum contractor

Answer: A

pes

22. Which of the following does not have the benefit of cating deductions in

income tax? mbutng

Domestic Corporations

Resident Foreign Corporations

‘Non-resident Foreign Corporations

All of the choices

peep

Answer. C \

23. Which of the folowing corporations shall pay a tax equal to twenty five percent (25%)

‘Foss from all sources within the Philippines?

a. Domestic corporation

b. Resident foreign corporation

¢. Nonresident foreign corporation

4d. - None of the choices

> Answer:C

24. Aside from the regular corporate income tax, what other tax(es) may be imposed on

‘corporations under tha Philippine income tax laws?

Minimum corporate income tax._¢. Capital gains tax |

b. Final tax on passive income 4. Allof the above

Answer:D

Corporations

a ew aera aT (RCIT

95, CREATE

A Inanctal Statements Includes. tho land costing

p50,000,000.00 and the building of P25,000,

situated, with 6n aggregate amount of P75,000,000.00 as Fixed Assets.

«How much fs the Iicome tax du n 20227

a, F125,000,

b. P138,000,000

Answer: C

Solution:

Gross sales

Cost of sales

Operating expenses

Taxable Net income

RCIT tale

Income Tax Due

«. P172,500.000

4, P207,000,0000

P1,400,000,000

(560,000,000)

(150,000,000)

‘P690,000,000

25%

‘P472,500,000

© The Company fs HOT dassified as MSME, hence, subject to the revised RCIT rate of

‘25% under CREATE Lew. The oa

the P1O0M threshold for MSME.

‘Company’ assets, excluding the land, is more than

Moreover, tha company’s net income also exceeded

the thrashold of PSM for MSME. r erat

© The 20% RCIT rate for domestic corporat

‘amended by CREATE Law shall ONLY ay

ons under Secton 27 of the Tax Code 43

the domeste corporation s dassfied

#8 MSME Wi he folowing equities:

The Corportca’s nel taxable Income should not be more than PSM; AND

The assets ofthe Corporaton should no be more than P100M.

126.’ Maasahan Corporation, a domestic corporation and a retailer of goods has gross sales of

14,000,000 with a cost of sales of P7,600,000 and alowable deductions of 2,500,000 for

the calendar year 2022. its total assets of P150,000,000 as of December 31, 2022 per

Audited Financial Statements includes the land costing P50,000,000 and the building of

25,000,000 in which tha business entity is situated, with an aggregate amount of

75,000,000 as Fixed Assets.

How much is the income tax due in 20227

a, P60,000,000 ©. P375,000

b. P780,000 4, P',170,0000

> Answer: B

209

oy Or ition,

s

4 Souton’

‘Gross 14,000,000

Cost of sles 7,80, 000)

Operating expenses an

Tarablo Net income A

RCI rae for MSMEs oe

Income Tax Due Frm

Company hance, subject tothe revised RCTT ra

oS is dase o USVE eo corparaion enous fie

ached total eat

purpoues of dolamining whether te company i 8s MSE. Ung,

EREATE Ln th RT al of 206 ap ares ponies hy

> The net income is not more than POM.

& The amount of ls axses [sna more fan PIOOM, gxcludlng Lend on wh

pertealar business ent’ ofc, plant, and eqUpmert are HUeled ding

taxable yearfor which the ln is imposed.

27. Forever Corporat ; ation and a retaller of goods has gross sal

14,000,000 a es PT 0000 nd atowable dducions of 2st ‘

the calendar year 2022. Its total assets of P150,000,000 a8 of December 31, 2022 per

Audited Financial Statements Includes the land casting PS0,000,000 and the building gy

25,000,000 in which the business enity (s siuated, with an aggregate amount oy

P75,000,000.as Fixed Assets.

How much Is the income tax due In 2022?

‘a, P60,000,000 . P975,000

b. P780,000 4, P4,170,0000

© Answer: C

Solution:

Gross sales 14,000,000

Cast of sales (7,600,000)

Operaling expenses (2,500,000)

Taxable Net Income * 3,800,000

RCI rele 25%

Income Tar Due PATS;000

0 NOTE: The 20% RCIT rale or MSME Is not applicable to loreign corporations.

28. Malatag Corporation, a domesiic corporation and a retailer of goods has gross salos of

14,000,000 with a cost of sales of P7,600,000 and allowable deductions of 2,500,000 for

the calendar year 2022, Its total assets of 150,000,000 as of December 31, 2022 per

‘Audited Financial Statements includes the land costing P40,000,000 and the building of

30,000,000 in which the business enity is siluated, with an aggregate amount of

70,000,000 as Fixed Assets,

210

Corporations

fs the Income tax dua in 20227

Howe 0000 ©. PS, 000

b, P780,000 4. P,t70.0000

& Answer:

‘Solulion:

2 Gross sales 14,000,000 .

Cost cee (7.800.000

pean erpenss (in,

a

« al 25%

Income Tax Due

PA15 000

© Although the net income of the company isnot more than the companys assets

exceeded th threshold of PIOOM, tus, tis NOT dered te :

is NOT classed as SME.

© Assets excluding and= PISOM ~ Peon = P4{oM,

[ATION OF RCIT BASED ON TRAIN LAW and CREATE LAW

de trensition period)

the data forthe next six(6

‘Ademestic corporation has the folowing income and expenses fo the yea

Phis

Pris. ‘Abroad

Gross sales 100,000,000 50,000,000

Cost of sales 40,000,000 20,000,000

Operating expenses 30,000,000 12,000,000

much i the income tax due assuming the taxable year is 20197

29, How 12,000000 «. P14,400,000

b. P13,200000 . P18,000,000

4 Answer:

Gross sales 150,000,000

Costot sales (60,000, 000)

Operating expenses (42,000,000)

Taxable Net income "P48.000,000-

RCIT rate (TRAIN Law) 0%

Income Tax Due + PRA 000

° ‘Domestic corporations are taxable on thei income derived for all sources within and

‘without the Philippines,

30. How much i the income tax due assuming he taxable year was 20207

a. P12,000,000 «. P14,400,000

b. 13,200,000 «. P8,000,000

m1

> Answer: B

‘Souiton

Gross tates 150,000,000 PETE Lay

Cost of salen (60,000,000)

Operating expenses (42,000000)

Jan. to June (TRAIN:

PABM x 6/12 130% 7,200,000

July to Dee, (CREATE):

POBM x 6/12 1 25% 4

Income Tax Due PHS 20 pg 0.00,

© The income tax due during the transition period may also be computed as foy,

© Income Tax Due = PASM x 27.5%" = P13,200,000 ons

CIT rate (ransion period) = (30% + 25%) /2= 27.5%"

hn the computalion of the taxable Income duriog_the tanetion poriog

‘should be no regard tothe doles ofthe rensactions within the calender ne, "0

Income and expenses forthe year shall be considered earned and ape{ a” Te

‘spent equaty for each month ofthe period. Tha corpora income

‘poked sabe ancurtcompted by elphng o uor of mona ees at

+ new rato win tho fiscal yoar by Iho laxable income of the corporaion for tne 2?

vided by twat Pere,

‘

© The RCIT rate for domestic corporations under the CREATE law was reduced fom:

to 25% begining duly 1, 2820. Moreover, f the domesic corporation is casting

Micro Small and Medium Enterprises (MSME), a lower rale of 20% should be apoieq

9 The 20% RCIT rte for MSMEs undor Secon 27 the Tax Code, as amended

apply ONLY IF he domest corporeton Is classified as MSME. A domes cones!

is classified os MSME under the GREATE law ifthe folowing conditions are present

{The corporation's net taxable income should not be more than 5M: AND

{D._The assets of the corporation should not be more than 100M

land on which the pacar busess ently’ ofce, plan, and earners

fre alveled ching the treble year for which the tx is imposed,

© Inthe given problem, the net taxable income of the Company Wes more than RSM, tg

25% RCIT rate shall be used forthe periods covered by CREATE law. :

212

Cone

How much I he incom tax due assuming ha taxable year is 20247

M.

‘a, P12,000,000 ©, P14,400,000 .

b, P13,200,000 . P18,000,000

Answers A

Gross sales 180,000,000

Casto sales (00,000,000)

Operating expenses, (42,000,000)

Taxable Net Income 'P48;000,0007

CIT ale (CREATE Law) 3%

Income Tax Due ~*~ P12,000;000_

ich Is the income tax due assuming the taxable year is 2021 and the Company's

2 Hen gasetsemouniod to PO milion oni?

‘a, P9,600,000 ©. P14,400,000

b, P12,000,000 4. P18,000,000

> Answer: B

Gross sales 150,000,000

Costof sales 160,000,000)

Operating expenses (42,000,000)

Taxable Net income 'P48,000,000

CIT rate (CREATE Lew) 25%

Income Tax Due —F12,000,000—

© The revised RCIT rate of 25% for comes: corporations under CREATE Law shal ba

since the Company's Net Income during the year amounted tp P48. The

domestic corporation is not classified ax MSME.

433. How much i the income tax due assuming?

ye The taxable year is 2021; and

= The Corporation isa resident foreign corporation

a. PT,500,000 ©. P14,400,000

b. P13,200,000 4. P18,000,000

“e@ Answer: A

Philippines

Gross sales 100,000,000

Cost of sales” (40,000,000)

Operating expenses (20,000,000),

Taxable Net Income 30,000,000

RCIT rate (CREATE Law) 2%

Income Tax Due __P7500,000_

© Foreign corporations are Laxable only on net income derived from Philippine sources.

°

The 20% RCIT rate under CREATE Law for MSME Is NOT applicable to foreign «

corporations.

213

Cor Oralig, Mg

M4. How much Is tho income tax duo assuming?

+ © Tholaxablo year is 2021;

= The Corporation isa nonresident foreign corporation

‘8, P7,500,000 , P14,4400,000

b. P13,200,000 d. P15,000,000

+ Answer: D

Gross sales - Phils. ‘P 100,000,000

Cost of sales ~ Pis. (40,000,000)

Operating expenses - Phis. _- not atowed_

GROSS INCOME 'P60,000,000

CIT rale (CREATE Law) 25%

INCOME TAX DUE; FHT, 'P15,000,000

© Beginning January 1,2021, NRFCs are subject lo Final Withholding Tax (FW) og

(on their gross Income derived from Phiippine sources only. 2%,

© The 20% RCIT rate under CREATE Law for MSMES 15 NOT epplicable to fog

Corporations (resident or nonresident). ‘an

35. CREATIVE Corporation, @ domestic corporation hs te folowing income and expen,

for 2022 taxable year. : ; =

SOunter — 24Gurfey Muar Oat

Gross sales 1,000,000 1,500,000 P2.500.000 P5009 59

Cost of sales 600,000 so000 1.400.000 2.200 94

Operating expenses. 200,000 500,000 ‘600,000 700,009

‘Addons! date:

+ “5. The company’s assets amounted fo P25,000,000.

How much is the income tax due?

a. P300,000 c, P600,000

b. 450,000 dd, P825,000

> Answer: C

Sokution; 2

Gross sales +P 10,000,000

Cost of sales (5,000,000)

Operating expenses '__ (2,000,000)

Taxable Net Income ‘P3000, 000

* RCTrle _ 20%,

Income Tax Due P5600, 000

0 The 20% RCIT rate shall apply because the domestic corporation is classified as MSME

{net income is was not more than PSM and the company’s assets ere not mora then

YOON).

214

Conta

the same dala the inmediatey preceding number and assuring futher that the

36 companys. resident fin comoraton, how mh ithe correct ncamnetx 606?

a. P300,000 ©, P750,000

b. P450,000 4. P825,000

‘Answer. C

7 Gross sales 10,000,000

(Cost of sles (5,000,009

Operating expenses 2000,000)

Taxable Net Income P0009

2%

RCIT ree

Income Tax Due

PT30,000

NOTE: The 20% RCIT rate

thal 10.0 domestic corporations dassiied #3

SME. Nis ot apkabltemgr rpc

1 foreign corporations (RFCs ard NRFCs).

{A domestic corporation has the folowing income and expenses for 2022 taxable year:

37. BOO" Gross sales 20,000,000

Cost of sales 10,000,000

Opérating expanses 3,800,000

Assets 48,0000,000

much i the income tax due?

Ft 124000 ¢. 1,860,000

b. P1.550,000 4. P3,000,000 ‘

Answer: B

‘Solution;

Gross sales 20,000,000 :

Costof sales (10,000,000)

Operating expenses (3,800,000),

Taxable Net Income P6200,000"

RCITrate 2%"

Income Tax Due 1,550,000

The RCT rate is 25% bet alt the assets of the company are not

. fe hes Pi 8 nel income needed ieatalnens id to be considered as

SME.

38. ABC Corporation, a domestic corporation has the following income and expenses for 2022

taxable year.

year:

Gross sales 20,000,000

Cost of sales 10,000,000

Operating expenses 6,500,000

215

Corporation,

How much fs the Income tax due?

8. 600,000 P800,000

b. P700,000 4. P875.000

> Answer.D

Gross aslo 20,000,000

Cont of aes (1.000.000)

Operating expenses 00

Taxable Net eae 73,500.00

RCIT rate 15%

Income Tax Ove Thais

0 Mthe problem rater te domestic emsportions MSME, Ait th

{eepiey ene 298 ROT it must be emphasized that the 20% rere

‘shal be apphed ONLY IF: a ‘aly

the corporation is classed as MSWE:

> Theproblem specially provdes Ihe

ri Y Pesto thal the domestic CxpOrabon sna in

‘more than PSM AND th Pemountotits assets are not more then P1OOM,

. 23 en offce, plan, and cadpmen

stusled during the table yor for which he taxis inposed.

39. Hananiah Corporation, 8 corporation engaged In business Inthe Philippines and

thas the following data for 2022 taxable year

Gross Income, Philippines P975,000

Expenses, Philppines 750,000

Gross Income, Malaysia ‘770,000

Expenses, Malaysia ,000