Professional Documents

Culture Documents

10 Activity 1 MRLFJRD

10 Activity 1 MRLFJRD

Uploaded by

Murielle Fajardo0 ratings0% found this document useful (0 votes)

18 views1 pageThe document is an activity worksheet that asks the student to indicate whether 35 different items are exempt from value-added tax (VAT), subject to a percentage tax rate, or subject to VAT by checking the corresponding column. The items include various goods and service providers like agricultural producers, furniture shops, hospitals, schools, transportation services, manufacturers, and more. The student's responses show which categories various business activities and professions fall under in terms of VAT and tax treatment.

Original Description:

mm

Original Title

10 Activity 1 Mrlfjrd

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an activity worksheet that asks the student to indicate whether 35 different items are exempt from value-added tax (VAT), subject to a percentage tax rate, or subject to VAT by checking the corresponding column. The items include various goods and service providers like agricultural producers, furniture shops, hospitals, schools, transportation services, manufacturers, and more. The student's responses show which categories various business activities and professions fall under in terms of VAT and tax treatment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 page10 Activity 1 MRLFJRD

10 Activity 1 MRLFJRD

Uploaded by

Murielle FajardoThe document is an activity worksheet that asks the student to indicate whether 35 different items are exempt from value-added tax (VAT), subject to a percentage tax rate, or subject to VAT by checking the corresponding column. The items include various goods and service providers like agricultural producers, furniture shops, hospitals, schools, transportation services, manufacturers, and more. The student's responses show which categories various business activities and professions fall under in terms of VAT and tax treatment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

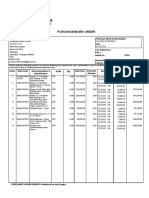

BM2215

NAME: FAJARDO, MURIELLE J. DATE: BSBA 401 SCORE:

ACTIVITY

Value-Added Tax (VAT) (35 POINTS)

Direction: Indicate whether the following items are EXEMPT, % TAX, or VATABLE by putting a check (✔) on

their corresponding columns.

EXEMPT % TAX VATABLE

1. Seller of agricultural food products ✔

2. Furniture shop ✔

3. Vegetable trader ✔

4. Private college ✔

5. Private hospital ✔

6. Dentist ✔

7. Hospital drugstore ✔

8. Non-profit elementary school ✔

9. Government College ✔

10. Restaurant ✔

11. Bus operator ✔

12. Hotel ✔

13. The operator of domestic sea travel ✔

14. Life insurance company ✔

15. Mall ✔

16. Domestic airliner ✔

17. Lessor vessels or aircraft ✔

18. Banks ✔

19. Taxi Operator ✔

20. International carriers ✔

21. Keepers of garage ✔

22. Book publisher ✔

23. Quasi-banks ✔

24. Dealer of household appliances ✔

25. Dealer of a commercial lot ✔

26. Insurance agent ✔

27. Employee ✔

28. Contractor ✔

29. Processor of sardines ✔

30. Auto parts dealer ✔

31. Manufacturer of hog feeds ✔

32. Seller of fertilizer and seeds ✔

33. Fisherman ✔

34. Fish vendor ✔

35. Textile manufacturer ✔

10 Activity 1 *Property of STI

Page 1 of 1

You might also like

- TB 1259186407 Project Management The Managerial Process With MS Project 6th Edition Erik Larson TBChap001Document8 pagesTB 1259186407 Project Management The Managerial Process With MS Project 6th Edition Erik Larson TBChap001Abdullah TalibNo ratings yet

- CHAPTER 6 7 and 8 TAXDocument38 pagesCHAPTER 6 7 and 8 TAXMark Lawrence Yusi100% (1)

- ACCA F6 Mock Exam QuestionsDocument22 pagesACCA F6 Mock Exam QuestionsGeo Don100% (1)

- Scope: Procter and GambleDocument30 pagesScope: Procter and GambleIrshad AhamedNo ratings yet

- Quiz TaxDocument1 pageQuiz TaxMaricar EgnpNo ratings yet

- 10 Activity 1Document1 page10 Activity 1Murielle FajardoNo ratings yet

- Waste Segregation List: QualificationDocument2 pagesWaste Segregation List: QualificationZyla Balandra SorillaNo ratings yet

- Bustax Answer KeyDocument18 pagesBustax Answer KeyMarchelle CaelNo ratings yet

- Daftar Inventaris RuanganDocument1 pageDaftar Inventaris RuanganAprilia Ayu SetyawatiNo ratings yet

- Determine If The Sale Is Either VATABLE ,%TAXDocument1 pageDetermine If The Sale Is Either VATABLE ,%TAXNerish PlazaNo ratings yet

- AEWEN EUCatalogue 220210Document69 pagesAEWEN EUCatalogue 220210Sanchita GuptaNo ratings yet

- Chapter 6Document3 pagesChapter 6Marichris AlbuferaNo ratings yet

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet

- Plaza, Nerish M. Bsa 3B Determine If The Sale Is Either VATABLE, %TAXDocument1 pagePlaza, Nerish M. Bsa 3B Determine If The Sale Is Either VATABLE, %TAXNerish PlazaNo ratings yet

- Zanini, Curtis & Company - August 2022Document27 pagesZanini, Curtis & Company - August 2022fredNo ratings yet

- MCS-150 Page 2Document3 pagesMCS-150 Page 2Galina NovahovaNo ratings yet

- Business Model: Large Cardamom Cultivation & MarketingDocument24 pagesBusiness Model: Large Cardamom Cultivation & MarketingPrayna RaiNo ratings yet

- Chapter 6Document21 pagesChapter 6Justin TempleNo ratings yet

- Taxation Chapter 6 Ad 7 Test BankDocument34 pagesTaxation Chapter 6 Ad 7 Test BankXyrene Keith MedranoNo ratings yet

- Get A Guide Today and Start Your Business.: (Payment Details)Document67 pagesGet A Guide Today and Start Your Business.: (Payment Details)Tips KenyaNo ratings yet

- Compliance Record Folder Checklist For Consultants/ ContractorsDocument1 pageCompliance Record Folder Checklist For Consultants/ ContractorsNijasNo ratings yet

- Coal Handling System: Conveyor #1Document17 pagesCoal Handling System: Conveyor #1AdRhy KiddArians SweetchildNo ratings yet

- Lorry Inspection Checklist1Document1 pageLorry Inspection Checklist1hafiz rahimNo ratings yet

- Life Stage Financial Planning Assessment SheetDocument1 pageLife Stage Financial Planning Assessment SheetirishNo ratings yet

- Naturland Processing StandardsDocument69 pagesNaturland Processing StandardsMarius VrajaNo ratings yet

- Coronavirus & Manufacturing CompaniesDocument20 pagesCoronavirus & Manufacturing Companiesyogesh patilNo ratings yet

- Marketing Strategy in Rural Market in IndiaDocument39 pagesMarketing Strategy in Rural Market in Indiavinit_kNo ratings yet

- Multinational Corporations: Pankaj Jain Lovely Professional UniversityDocument26 pagesMultinational Corporations: Pankaj Jain Lovely Professional UniversityPreeti KumariNo ratings yet

- Non-Chemical Pest Management: Field Guide ToDocument28 pagesNon-Chemical Pest Management: Field Guide ToAlvin WatinNo ratings yet

- Economic Reports 2007 08 NEWDocument164 pagesEconomic Reports 2007 08 NEWarjun kafleNo ratings yet

- The Difference Between Information & Knowledge: Confidential-For Kagashin Clients Only May, 2014Document89 pagesThe Difference Between Information & Knowledge: Confidential-For Kagashin Clients Only May, 2014VIHARI DNo ratings yet

- C and EN - 10120-Feature1Document7 pagesC and EN - 10120-Feature1Ofer SoreqNo ratings yet

- Global Mineral SlurriesDocument26 pagesGlobal Mineral SlurriesSérgio - ATC do BrasilNo ratings yet

- Entrepreneurs GuideDocument104 pagesEntrepreneurs Guiderojy77No ratings yet

- 1 Marijuana Business Plan ExampleDocument30 pages1 Marijuana Business Plan ExampleMikeRosen0% (1)

- (Module 1) Exercise PDFDocument4 pages(Module 1) Exercise PDFArriane Dela CruzNo ratings yet

- Vingroup - Corporate Presentation May 2020 PDFDocument54 pagesVingroup - Corporate Presentation May 2020 PDFQuach TuNo ratings yet

- Gabon Risk Assessment 17june20 - FRE - FinalDocument94 pagesGabon Risk Assessment 17june20 - FRE - FinaloyaneNo ratings yet

- Manufacturing Business Plan ExampleDocument24 pagesManufacturing Business Plan ExampleTanaka DoporaNo ratings yet

- Vendor Questionnaire TemplateDocument6 pagesVendor Questionnaire TemplatePaul RigorNo ratings yet

- Redi Natick PresentationDocument135 pagesRedi Natick PresentationNeal McNamaraNo ratings yet

- Agro Commodity Movement From Farm To Fork in IndiaDocument1 pageAgro Commodity Movement From Farm To Fork in IndiaVipul ShahNo ratings yet

- Doing Business in Africa: Seminário África NegóciosDocument19 pagesDoing Business in Africa: Seminário África NegóciosQuofi SeliNo ratings yet

- Domino's PizzaDocument11 pagesDomino's PizzaHồ Trúc HuệNo ratings yet

- เจริญกิจการเกษตร Project feasibilty Study and Evaluation - Aj. chaiyawat Thongintr. Mae Fah Luang University (MFU) 2010.Document127 pagesเจริญกิจการเกษตร Project feasibilty Study and Evaluation - Aj. chaiyawat Thongintr. Mae Fah Luang University (MFU) 2010.naamlinkin100% (1)

- ss07 Job OptionsDocument1 pagess07 Job Optionsredoctober24No ratings yet

- Group 5 - Final DraftDocument42 pagesGroup 5 - Final Draft007 NGUYỄN QUỲNH ANHNo ratings yet

- Cameroon: Insights From EntrepreneursDocument36 pagesCameroon: Insights From Entrepreneursabass nchareNo ratings yet

- TB 03-30-20 Web EditionDocument26 pagesTB 03-30-20 Web Editiondavid manleyNo ratings yet

- Group 14: Meet Mehta Umang Kumar Ayushi Jaiswal Ayon DasDocument18 pagesGroup 14: Meet Mehta Umang Kumar Ayushi Jaiswal Ayon DasUmang KNo ratings yet

- Channel of Distribution1Document27 pagesChannel of Distribution1kamsu JyothsnaNo ratings yet

- Common Spending Plan SystemsDocument17 pagesCommon Spending Plan SystemsKerri Jo ThainNo ratings yet

- Rubber Production in Tanintharyi RegionDocument43 pagesRubber Production in Tanintharyi RegionSawMinAungNo ratings yet

- Malak Sher Khan Daily Vehicle Inspection (04-02-17)Document1 pageMalak Sher Khan Daily Vehicle Inspection (04-02-17)Afareen KhanNo ratings yet

- 20240522_ Presentation_V.01 Wo RankingDocument67 pages20240522_ Presentation_V.01 Wo RankingCarolina PérezNo ratings yet

- 34 Advertising Groups You Should Be CallingDocument1 page34 Advertising Groups You Should Be CallingAndrew TeepleNo ratings yet

- FGIS-921-2, Booking#038CHI1412980 PDFDocument1 pageFGIS-921-2, Booking#038CHI1412980 PDFAnonymous KgmyrqNo ratings yet

- Vehicle and Trailer Checklist - Q1-14Document1 pageVehicle and Trailer Checklist - Q1-14gerald.owinoNo ratings yet

- Bonduelle & The Importance of Category ManagementDocument27 pagesBonduelle & The Importance of Category ManagementpragmusNo ratings yet

- The State of Mediterranean and Black Sea Fisheries 2018From EverandThe State of Mediterranean and Black Sea Fisheries 2018No ratings yet

- 10 Activity 2Document1 page10 Activity 2Murielle FajardoNo ratings yet

- Final Proctor and Gamble Strategy Case Analysis FinalDocument9 pagesFinal Proctor and Gamble Strategy Case Analysis FinalMurielle FajardoNo ratings yet

- Introduction Production StrategiesDocument2 pagesIntroduction Production StrategiesMurielle FajardoNo ratings yet

- Introduction Production StrategiesDocument2 pagesIntroduction Production StrategiesMurielle FajardoNo ratings yet

- 10 Activity 1Document1 page10 Activity 1Murielle FajardoNo ratings yet

- MAMAMOLAZADADocument2 pagesMAMAMOLAZADAMurielle FajardoNo ratings yet

- Statement of Assets and Liabilities Form-B PDFDocument5 pagesStatement of Assets and Liabilities Form-B PDFRana rocksNo ratings yet

- Engineering and Capital Goods: March 2020Document44 pagesEngineering and Capital Goods: March 2020lakshvamNo ratings yet

- ADL 56 Cost & Management Accounting V2Document8 pagesADL 56 Cost & Management Accounting V2solvedcareNo ratings yet

- HRM401 Compensation and BenefitsDocument2 pagesHRM401 Compensation and BenefitsM R AlamNo ratings yet

- Dpco 2013Document7 pagesDpco 2013Angel BrokingNo ratings yet

- Lectures 1 and 2 - Introduction and A First Application: The Minimum Wage Debate and Causal Inference in EconomicsDocument22 pagesLectures 1 and 2 - Introduction and A First Application: The Minimum Wage Debate and Causal Inference in EconomicsRagunatha Rao ANo ratings yet

- FinmarDocument67 pagesFinmarGabrielle Anne MagsanocNo ratings yet

- Unit-2 International Trade & Investment-1Document35 pagesUnit-2 International Trade & Investment-1Ashutosh PoudelNo ratings yet

- RA No. 11976 - Ease of Paying Taxes ActDocument22 pagesRA No. 11976 - Ease of Paying Taxes ActAnostasia NemusNo ratings yet

- LT Foods-Q4 FY21-RU-LKPDocument8 pagesLT Foods-Q4 FY21-RU-LKPP VinayakamNo ratings yet

- Assignment Far 560Document6 pagesAssignment Far 560annastasia luyahNo ratings yet

- Interest Rate FuturesDocument32 pagesInterest Rate FuturesNOR IZZATI BINTI SAZALINo ratings yet

- Concept+Tree Market+Research KochiDocument4 pagesConcept+Tree Market+Research KochisheizidireesNo ratings yet

- UAE Vision 2021: Axes of The National AgendaDocument3 pagesUAE Vision 2021: Axes of The National Agendanebhan100% (1)

- The ISB Governing Board: Grooming Generation NextDocument2 pagesThe ISB Governing Board: Grooming Generation NextsudhitNo ratings yet

- MAC3761 - Assignment01 - 2021Document16 pagesMAC3761 - Assignment01 - 2021Waseem KhanNo ratings yet

- Travancore - Revised - PO-1Document2 pagesTravancore - Revised - PO-1V.Sampath RaoNo ratings yet

- 1st PUC Business Studies Feb 2018Document2 pages1st PUC Business Studies Feb 2018Lokesh RaoNo ratings yet

- French Macroeconomic, Insolvency Update - 011013Document3 pagesFrench Macroeconomic, Insolvency Update - 011013megachameleon1989No ratings yet

- MultiChoice 1 AnswerDocument2 pagesMultiChoice 1 AnswerBảo Lê MinhNo ratings yet

- Economics and BiodiversityDocument212 pagesEconomics and BiodiversityDaisy100% (1)

- Final Report of Daniel The End 2Document77 pagesFinal Report of Daniel The End 2Daniel TsegayeNo ratings yet

- Order in The Matter of M/s.Peers Allied Corporation LTDDocument28 pagesOrder in The Matter of M/s.Peers Allied Corporation LTDShyam SunderNo ratings yet

- Barilla SPADocument8 pagesBarilla SPAarthurgerardsamNo ratings yet

- Analysis of Huaweis International Marketing Strategy Based On The SWOT Analysis PDFDocument4 pagesAnalysis of Huaweis International Marketing Strategy Based On The SWOT Analysis PDFJiarui FanNo ratings yet

- Shein Vi Grp2Document5 pagesShein Vi Grp2Pamela Nicole AlonzoNo ratings yet

- Article From S.directDocument8 pagesArticle From S.directmustefaNo ratings yet

- Project-Kotak BankDocument63 pagesProject-Kotak BankAli SaqlainNo ratings yet