Professional Documents

Culture Documents

Final Test 1 Sol.

Final Test 1 Sol.

Uploaded by

Akanksha UpadhyayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Test 1 Sol.

Final Test 1 Sol.

Uploaded by

Akanksha UpadhyayCopyright:

Available Formats

EKATVAM ACADEMY

CA/CMA FINAL TEST PAPER 1 SOLUTIONS

BASICS OF INCOME TAX CALCULATION + RETURN OF INCOME

SOLUTION 1

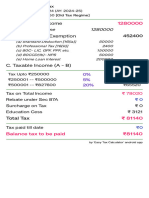

Computation of tax liability of Mr. Raja for the A.Y. 2022-23

(A) Tax payable including surcharge on total income of ₹ 51,50,000

₹ 2,50,000 – ₹ 5,00,000@5% ₹ 12,500

₹ 5,00,000 – ₹10,00,000@20% ₹ 1,00,000

₹ 10,00,000 – ₹ 51,50,000@30% ₹ 12,45,000

Total ₹ 13,57,500

Add: Surcharge @10% ₹1,35,750 ₹ 14,93,250

(B) Tax Payable on total income of ₹ 50 lakhs

(₹ 12,500 plus ₹ 1,00,000 plus ₹ 12,00,000) ₹ 13,12,500

(C) Total Income less ₹ 50 lakhs ₹ 1,50,000

(D) Tax payable on total income of ₹ 50 lakhs plus the excess of total income over ₹ 50 lakhs (B+C) ₹ 14,62,500

(E) Tax payable: Lower of (A) and (D) ₹ 14,62,500

Add: Health and education cess @4% ₹58,500

Tax Liability ₹ 15,21,000

(F) Marginal Relief (A – D) ₹ 30,750

Alternative Method:

(A) Tax payable including surcharge on total income of ₹ 51,50,000

₹ 2,50,000 – ₹ 5,00,000@5% ₹ 12,500

₹ 5,00,000 – ₹10,00,000@20% ₹ 1,00,000

₹ 10,00,000 – ₹ 51,50,000@30% ₹ 12,45,000

Total ₹ 13,57,500

Add: Surcharge @10% ₹ 1,35,750 ₹ 14,93,250

(B) Tax Payable on total income of ₹ 50 lakhs(₹ 12,500 plus ₹1,00,000 plus ₹ 12,00,000) ₹ 13,12,500

(C) Excess tax payable (A)-(B) ₹ 1,80,750

(D) Marginal Relief (₹ 1,80,750 – ₹ 1,50,000, being the amount of income in excess of ₹ 30,750

₹ 50,00,000)

(E) Tax payable (A)-(D) ₹ 14,62,500

Add: Health and education cess @4% ₹ 58,500

Tax Liability ₹ 15,21,000

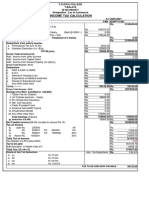

SOLUTION 2 Computation of tax liability of Mr. Rajesh for the A.Y. 2022-23

(A) Tax payable including surcharge on total income of ₹ 5,02,00,000

₹ 2,50,000 – ₹ 5,00,000@5% ₹ 12,500

₹ 5,00,000 – ₹ 10,00,000@20% ₹ 1,00,000

₹ 10,00,000 – ₹ 5,02,00,000@30% ₹ 1,47,60,000

Total ₹ 1,48,72,500

Add: Surcharge @37% ₹ 55,02,825 ₹ 2,03,75,325

(B) Tax Payable on total income of ₹ 5 crore(₹ 12,500 plus ₹ 1,00,000 plus ₹

1,47,00,000) ₹ 1,48,12,500

Add: Surcharge @25% ₹ 37,03,125

₹ 1,85,15,625

(C) Total Income less ₹ 2 crore ₹ 2,00,000

CA VIJAY SARDA | 8956784251/52/53 www.ekatvamacademy.com

Tax payable on total income of ₹ 5 crore plus ₹ 1,87,15,625

(D) the excess of total income over ₹ 5 crore (B+C)

(E) Tax payable: Lower of (A) and (D) ₹ 1,87,15,625

Add: Health and education cess @4% ₹ 7,48,625

Tax Liability ₹ 1,94,64,250

(F) Marginal Relief (A – D) ₹ 16,59,700

Alternative Method:

(A) Tax payable including surcharge on total income of ₹ 5,02,00,000

₹ 2,50,000 – ₹ 5,00,000 @5% ₹ 12,500

₹ 5,00,000 – ₹ 10,00,000 @20% ₹ 1,00,000

₹ 10,00,000 – ₹ 5,02,00,000 @30% ₹ 1,47,60,000

Total ₹ 1,48,72,500

Add: Surcharge @37% ₹ 55,02,825 ₹ 2,03,75,325

(B) Tax Payable on total income of ₹ 5 crore

(₹ 12,500 plus ₹ 1,00,000 plus ₹ 1,85,15,625

₹ 1,47,00,000) plus surcharge @15%

(C) Excess tax payable (A)-(B) ₹ 18,59,700

(D) Marginal Relief (₹ 18,59,700 – ₹ 2,00,000,being the amount of income in excess

of ₹ 5,00,00,000) ₹ 16,59,700

Tax payable (A) - (D) ₹ 1,87,15,625

Add: Health and education cess @4% ₹ 7,48,625

Tax Liability ₹ 1,94,64,250

SOLUTION 3

The tax payable on total income of ₹1,01,00,000 of X Ltd. computed @32.1%(including surcharge @7%) is ₹ 32,42,100.

However, the tax cannot exceed

₹ 31,00,000 (i.e., the tax of ₹ 30,00,000 payable on total income of ₹ 1 crore plus

₹ 1,00,000, being the amount of total income exceeding ₹ 1 crore). Therefore, thetax payable on ₹ 1,01,00,000 would be ₹

31,00,000. The marginal relief is

₹ 1,42,100 (i.e., ₹ 32,42,100 - ₹ 31,00,000).

SOLUTION 4

As per the provisions of section 139(3), any person who has sustained loss under the head ‘Profit and gains of business or profession’ is

allowed to carry forward such a loss under section 72(1) or section 73(2), only if he has filed the return of loss within the time allowed under

section 139(1). Also, the provisions of section 80 specify that a loss which has not been determined as per the return filed under section

139(3) shall not be allowed to be carried forward and set-off under, inter alia, section 72(1) (relating to business loss) or section 73(2) (losses

in speculation business) or section 74(1) (loss under the head “Capital gains”) or section 74A(3) (loss from the activity or owning and

maintaining race horses) or section 73A (loss relating to a “specified business”). However, there is no such condition for carry forward

of loss from house property under section71B or unabsorbed depreciation under section 32.

In the given case, the assessee has filed its return of loss in response to notice under section 142(1). As per the provisions stated above,

assessee furnished return in response to notice under section 142(1) after the due date specified under section 139(1) and therefore, the

benefit of carry forward of business loss under section 72(1) or section 73(2) or section 73A shall not be available.

The assessee shall, however be entitled to carry forward the unabsorbed depreciation as per provisions of section 32(2).

CA VIJAY SARDA | 8956784251/52/53 www.ekatvamacademy.com

SOLUTION 5

This proposition is correct. A return of income filed within the due date under section 139(1) or a belated return filed under section 139(4)

may be revised by filing a revised return under section 139(5) where the assessee finds any omission or wrong statement in the original

return subject to satisfying other conditions. There is no provision in the Income-tax Act, 1961, to make changes or modification in the

return of income by filing a letter before the Assessing Officer. The revisedreturn can be filed at any time before three months

prior to the end of the relevant assessmentyear or before completion of assessment, whichever is earlier. In a case where a return of

income has been filed within the due date under section 139(1) or a belated return is filed under section 139(4), the only option available

to the assessee to make an amendment to such return is by wayof filing a revised return under section 139(5). Therefore, a fresh claim

can be made before the Assessing Officer only by filing a revised return and not otherwise. The Supreme Court, in Goetze (India) Ltd. vs.

CIT (2006) 284 ITR 323, has held that there is no power available under the provisions of the Income-tax Act, 1961 enabling the Assessing

Officer to allow a claim made by the assessee except by way of filing a revised return.

CA VIJAY SARDA | 8956784251/52/53 www.ekatvamacademy.com

You might also like

- Writing Popular Fiction Dean KoontzDocument128 pagesWriting Popular Fiction Dean KoontzJared Vargas89% (9)

- Judicial AffidavitDocument4 pagesJudicial AffidavitEmmanuel Carasaquit100% (2)

- Service InvoiceDocument5 pagesService InvoiceMohamed Mostafa IbrahimNo ratings yet

- Basic Concepts - QuestionsDocument6 pagesBasic Concepts - QuestionsbadalNo ratings yet

- Basic Concepts PDFDocument14 pagesBasic Concepts PDFsumitNo ratings yet

- Income Tax Sums Book ShrestaDocument272 pagesIncome Tax Sums Book ShrestaINTER SMARTIANSNo ratings yet

- Correction in Income Tax Volume 1Document12 pagesCorrection in Income Tax Volume 1CrcNo ratings yet

- Income Tax Complete Question BankDocument281 pagesIncome Tax Complete Question BankNoorul Zaman KhanNo ratings yet

- Introduction To Income TaxDocument8 pagesIntroduction To Income TaxKartikNo ratings yet

- Solution 15 To 21Document9 pagesSolution 15 To 21pratham kannanNo ratings yet

- Taxation 100 Imp Questions 1642662172Document160 pagesTaxation 100 Imp Questions 1642662172riyatada16No ratings yet

- DT Must Do List!! (Apr - 2023) - 230228 - 125036Document129 pagesDT Must Do List!! (Apr - 2023) - 230228 - 125036Ameen AhmadNo ratings yet

- FAQ On New Tax Regime - V3Document6 pagesFAQ On New Tax Regime - V3ash tiwariNo ratings yet

- Tax Slabs: Ca. Dipayan DasDocument4 pagesTax Slabs: Ca. Dipayan DasNoob GamerNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Easy TaxDocument1 pageEasy TaxSiva GaneshNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- 12lpa Tax ComputationDocument1 page12lpa Tax ComputationSai KrishnaNo ratings yet

- Azreaal: Eqe WD Raipur Chhattisgarh 492007 IndiaDocument2 pagesAzreaal: Eqe WD Raipur Chhattisgarh 492007 IndiaAditya AgrawalNo ratings yet

- Salary TemplateDocument1 pageSalary Templatemistersandeep604No ratings yet

- Salary TemplateDocument1 pageSalary Templatedavidmashiya12No ratings yet

- Salary TemplateDocument1 pageSalary Templatebholachaudhri786No ratings yet

- Income Tax Must Do Questions by Vinit Mishra SirDocument109 pagesIncome Tax Must Do Questions by Vinit Mishra SirHenil DharodNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- Mini TemplateDocument1 pageMini TemplateRobert KasujaNo ratings yet

- Example of Tax PlanningDocument10 pagesExample of Tax PlanningGangothri Asok100% (1)

- CORPORATE TAX PLANNING AND MANAGEMENT CiaDocument4 pagesCORPORATE TAX PLANNING AND MANAGEMENT CiaAaronNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Union Budget - 2023-24 - Direct Tax Proposals (K&Co)Document54 pagesUnion Budget - 2023-24 - Direct Tax Proposals (K&Co)Charul ChhajerNo ratings yet

- DT May 23 in 50 PagesDocument15 pagesDT May 23 in 50 PagesShivaji hariNo ratings yet

- UCC E-Filling SolutionDocument5 pagesUCC E-Filling SolutionSibam BanikNo ratings yet

- Income Tax Question Bank by CA Pranav ChandakDocument338 pagesIncome Tax Question Bank by CA Pranav Chandakchaudhariatharva2512No ratings yet

- 01 Leverages Solution Set (Not To Print)Document17 pages01 Leverages Solution Set (Not To Print)Tanay shuklaNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- Quizzer On Withholding of Monthly Tax Compensation IncomeDocument10 pagesQuizzer On Withholding of Monthly Tax Compensation IncomeRyDNo ratings yet

- 2023 BudgetDocument1 page2023 Budgetmisyel deveraNo ratings yet

- Old Vs New Tax Regime Comparative AnalysisDocument11 pagesOld Vs New Tax Regime Comparative AnalysisAkchu KadNo ratings yet

- Estimated Revenues, Profits and Expenditure For Next Three YearsDocument6 pagesEstimated Revenues, Profits and Expenditure For Next Three YearsRajeev Kumar GottumukkalaNo ratings yet

- PGBP Part 2 SolutionDocument14 pagesPGBP Part 2 SolutionDhruv SetiaNo ratings yet

- Annual Plan 2Document7 pagesAnnual Plan 2bansal_shivangiNo ratings yet

- Salary - Tax CalculatorDocument7 pagesSalary - Tax CalculatorsonamNo ratings yet

- Batch 1: Group Members: Akansha Mittal Jasneet Shivani Pandey Somansh Vivaswath K VDocument32 pagesBatch 1: Group Members: Akansha Mittal Jasneet Shivani Pandey Somansh Vivaswath K VJasneet SinghNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Basic SolDocument3 pagesBasic SolADARSH MISHRANo ratings yet

- Elijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD AmountDocument1 pageElijah Jayie: Rate Hours Amount Amount YTD Hours YTD Amount YTD Amountmdyafi8084No ratings yet

- Practical Practice QuestionsDocument17 pagesPractical Practice QuestionsGungun SharmaNo ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Dividend Policy Question and AnswerDocument7 pagesDividend Policy Question and AnswerBella CynthiaNo ratings yet

- TAX LIABILITY PDF) OkDocument7 pagesTAX LIABILITY PDF) OksaeNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- Chapter 1-Solution To ProblemsDocument7 pagesChapter 1-Solution To ProblemsawaisjinnahNo ratings yet

- Salary TemplateDocument1 pageSalary Templateumeshkavreti523No ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- Volume 1 Answer KeyDocument116 pagesVolume 1 Answer KeyCrcNo ratings yet

- Income Current Deductions: STAY: Old Tax Regime Is Better by Rs. 62400Document8 pagesIncome Current Deductions: STAY: Old Tax Regime Is Better by Rs. 62400Sahil SNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Indian Ocean Histories The Many Worlds of Michael Naylor Pearson (Rila Mukherjee, Radhika Seshan)Document289 pagesIndian Ocean Histories The Many Worlds of Michael Naylor Pearson (Rila Mukherjee, Radhika Seshan)Karthika S.ANo ratings yet

- AF Sanchez Brokerage v. CA (147079)Document4 pagesAF Sanchez Brokerage v. CA (147079)Josef MacanasNo ratings yet

- SSC Idp ProjectDocument4 pagesSSC Idp ProjectRayNo ratings yet

- Kolkata City Bus RoutesDocument16 pagesKolkata City Bus RoutesSarat Das100% (2)

- Philippine HistoryDocument37 pagesPhilippine HistoryAiko GarridoNo ratings yet

- The Auditing ProfessionDocument10 pagesThe Auditing Professionmqondisi nkabindeNo ratings yet

- Note Summary Step 1: Meaning of LegislatureDocument4 pagesNote Summary Step 1: Meaning of LegislaturemarcusfunmanNo ratings yet

- Ready Referencer On Standards-13.12.2019Document15 pagesReady Referencer On Standards-13.12.2019KanpattiNo ratings yet

- Test Bank For Principles of Corporate Finance 13th Edition Brealey Isbn10 1260013901 Isbn13 9781260013900Document19 pagesTest Bank For Principles of Corporate Finance 13th Edition Brealey Isbn10 1260013901 Isbn13 9781260013900hightpiprall3cb2No ratings yet

- Filing A Claim in Labour Office ResearchDocument2 pagesFiling A Claim in Labour Office Researchanistasnim25No ratings yet

- User Manual - Credit Control On DaysDocument7 pagesUser Manual - Credit Control On DaysArafathNo ratings yet

- Full Bench Main List For The Friday Dated 24/02/2023 CR No 1Document6 pagesFull Bench Main List For The Friday Dated 24/02/2023 CR No 1ROBIN SINGH MALIKNo ratings yet

- Medical & Dental Practitioners ActDocument40 pagesMedical & Dental Practitioners ActMijja Coll BulamuNo ratings yet

- The Oriental Insurance Company Limited: Particulars of Insured VehicleDocument3 pagesThe Oriental Insurance Company Limited: Particulars of Insured VehiclehancyboxNo ratings yet

- Faq LL2Document2 pagesFaq LL2Mini VNo ratings yet

- Chapter 3 MCQs On DepreciationDocument14 pagesChapter 3 MCQs On DepreciationGrace StylesNo ratings yet

- Ridgiduct Power Class 2 Datasheet - Issue 4 Aug 18Document2 pagesRidgiduct Power Class 2 Datasheet - Issue 4 Aug 18ike BlaccNo ratings yet

- Teologi Politik IslamDocument18 pagesTeologi Politik IslamMuhammad Rahmat HidayatNo ratings yet

- Theorizing Contemporary Practices of Slavery, GordonDocument28 pagesTheorizing Contemporary Practices of Slavery, GordonMichael Beyer100% (1)

- Affidavit Age ChangeDocument206 pagesAffidavit Age ChangeMir ImranNo ratings yet

- Albilad Credit Card Application-EnDocument6 pagesAlbilad Credit Card Application-EnHABEEB RAHMANNo ratings yet

- Council Agenda 22 March 2021Document205 pagesCouncil Agenda 22 March 2021Horsham TimesNo ratings yet

- REVIEWER IN SOCSS1aDocument3 pagesREVIEWER IN SOCSS1aTricia Larisse DavidNo ratings yet

- Digest - Paloma vs. MoraDocument2 pagesDigest - Paloma vs. MoraKaye MendozaNo ratings yet

- PM Modi - Foreign TripsDocument4 pagesPM Modi - Foreign Tripsdev_1989No ratings yet

- Aecom Code of Conduct ENGLISHDocument47 pagesAecom Code of Conduct ENGLISHashwinNo ratings yet

- Kalasdaran SBTDocument2 pagesKalasdaran SBTRatheesh KumarNo ratings yet