Professional Documents

Culture Documents

Fauzias Nor, N. Alias and Mohd H. Yaacob (2008)

Fauzias Nor, N. Alias and Mohd H. Yaacob (2008)

Uploaded by

rehamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fauzias Nor, N. Alias and Mohd H. Yaacob (2008)

Fauzias Nor, N. Alias and Mohd H. Yaacob (2008)

Uploaded by

rehamCopyright:

Available Formats

Jurnal Pengurusan 27(2008) 129-141

Corporate Restructuring: Firm Characteristics

and Performance

Fauzias Mat Nor

Norazlao Alias

Mohd Hasimi Yaacob

ABSTRACT

Theoretically, corporate restructuring is meant to remove firms' operating and

financial constraints and improve jimz perfonnance. However, corporate

restructuring announcement might be interpreted differently by the market.

Using event-study method, this study examines the impact of corporate

restructuring announcements made by selected ./inns on their stock prices.

Overall, the effect of the restructuring announcements, made by these companies

on stock prices was significant while the average two years of return on total

assets and return on operating cash flow in the post restructuring period were

mixed. Evidence also indicates that debt reduction, refocusing and alignment

of interest between management and shareholders through board of directors'

ownership do not constitute the main focus for some finns in the post

restructuring period.

ABSTRAK

Secara teori, penstrukturan semula bertujuan untuk mengalihkan kekangan

kewangan dan meningkatkan prestasi firma. Bagaimanapun, pengumuman

penstrukturan semula mungkin ditafsirkan berbeza~beza oleh pasaran.

Menggunakan kaedah kajian peristiwa, kajian ini mengkaji impak pengumuman

penstrukturan semula oleh beberapa firma terpilih. Secara keseluruhan,

pengumuman~pengumuman semula yang dibuat oleh firma~finna tersebut

tidak memberi kesan signifikan ke atas harga saham manakala purata dua

tahun pulangan atas aset dan alirtunai operasi selepas pengumuman adalah

bercampur~campur. Bukti juga menunjukkan pengurangan hutang, pemfokusan

semula dan pelarasan kepentingan antara pengurusan dan pernegang~pemegang

saham melalui pemilikan saham ahli lembaga pengarah tidak menjadi fokus

utama beberapa finna selepas penstrukturan semula.

STUDY BACKGROUND

The financial cnSIS in 1997 had largely affected the current economic

scenario that caused many finns in Malaysia to experience difficult time in

Electronic copy available at: https://ssrn.com/abstract=3409605

130 Jurnai Pengurusan 27

their business operations and financial position due to rising interest rates,

depreciating Ringgit against foreign currencies and declining share values.

Following the financial crisis, the number of finns that defaulted or undergoing

restructuring and the amount of debt involved in debt restructuring increased

sharply. However, it can be argued that firms restructure for several reasons

such as poor corporate governance, overdiversification and overleveraging.

In Malaysia, some finns had undertaken debt restructuring before the

financial crisis but the financial crisis in July 1997 escalated the amount of

restructured debt and number of firms involved in debt restructuring.

Previous studies argue that corporate restructuring is meant to correct firm

specific characteristics due to overdiversification, poor corporate governance

and overleveraging. In other words, the firm's characteristics such as

ownership structure, level of diversification and debt ratio affect the finn's

decision to undergo corporate restructuring. Rationally, corporate restructuring

will give meaning when firms make adjustments or corrections on specific

characteristics that exhibit weak governance, over diversification and high

leveraging to improve performance. Therefore do characteristics of the firm

such as ownership structure, level of diversification and debt ratio differ

before and after corporate restructuring to reflect the corporate restructuring

motive? Does corporate restructuring announcement affect stock price and

motivate the finn towards improved accounting perfonnance?

REVIEW OF PAST STUDIES

CORPORATE RESTRUCTURING PERFORMANCE

Corpora~e restructuring perfonnance is measured in the fonn of market

perfonnance and accounting performance (Bowman ei a!. 1999). In the

strand of literature that uses market perfonnance, Markides (1992) examined

whether the market value of firms that had refocused increases surrounding

their refocusing announcement. He found that over diversified firms that

made refocusing announcements consistently created statistically significant

positive abnormal returns. His study also implies that there is a limit to how

much a firm can diversify and firms that go beyond this limit will suffer

value decline. John and Ofek (1995) found that sell-offs' CAR are larger if

the parent is selling a division that is unrelated to the core industry of the

parent and are driven by a desire for parent firms to increase focus.

In another strand of literature that uses accounting ratios, Markides

(1995) investigated why finns reduce their diversification by refocusing on

their core businesses and found that refocusing is associated ex post with

profitability improvements. Lai and Sudarsanam (1997) find that both

profitability and cash flows of 297 UK finns which adopted different

restructuring strategies decline significantly in the decline year while Daley,

Electronic copy available at: https://ssrn.com/abstract=3409605

Corporate Restructuring: Firm Characteristics and Performance 131

Mehorotra and Siva Kumar (1997) showed that the announcement period

return of asset sales and the post issue operating perfonnance of spin offs

are higher when the parent and subsidiary have different SIC code. Zhao

(1998) finds that refocused firms experience higher post-period performance

than non-refocused firms for an perfonnance measures. Sell-off aimed at

increasing focus is also followed by improvements in profitability for the

remaining business of the parent.

CORPORATE RESTRUCTURING AND OWNERSHIP STRUCTURE

Ownership structure may involve the distribution of the firm's shares to the

managers or directors of the firm. Shareholders depend on managers to

maximize their wealth. However, maximization of managers' wealth rather

than shareholders' wealth will likely dominate the firm's management

actions at the expense of shareholders. The agency costs arise when managers

act as the agent rather than owner. The problem of agency cost associated

with the divergence of interest between shareholders and managers has been

researched numerously (Jensen & Meckling 1976; Morek et a1. 1988). In

other words, lack of managerial incentives and divergence of interest

between managers and ownership tends to lead to poor governance.

Board of directors' ownership is a result of the alignment of interest

between existing management and existing shareholders as board of director

tum to act as the owner-manager of the firm. If agency theory predicts that

corporate restructuring is partially to improve corporate govern.ance, board of

directors' ownership presence is expected to align the interest of managers and

shareholders following debt restructuring, thus reducing the agency problem.

Therefore, finns with board of directors' ownership are less likely to restructure

because they have been efficiently configured. With regards to the relationship

between ownership structure and corporate restructuring, Gibbs (1993) found

that finns with strong board powers are less likely to restructure, or at least,

restructure less. Meanwhile, Bethel and Liebeskind (1993) studied the effects

of ownership structure on corporate restructuring on a sample of 93 surviving

public Fortune sao firms during the period of 1981-1987. They find no

evidence of either insider owners or institutional investors except for block

share ownership on the association with the corporate restructuring. Lai and

Sudarsanarn (1997) finds that the dominated manager-owner firms are more

likely to choose capital expenditure and less interested to pursue operational

restructuring, acquisitions and managerial restructuring.

CORPORATE RESTRUCTURING AND DIVERSIFICATION

According to agency theory argument, the conflict of interest between

managers and shareholders exist when managers link personal incentives

Electronic copy available at: https://ssrn.com/abstract=3409605

132 iurnal Pengurusan 27

such as power and job security with fInn size. The managerial incentives

become higher as the firm becomes larger. Another argument is that

managers with excess cash view diversification as a means for firm to grow

beyond limited opportunities in their core businesses. Thus, the manager

chooses to diversify to enlarge firm size though this diversification strategy

destroys shareholder value when firms aTe diversified beyond optimal limit

(Markides 1992).

Amihud and Lev (1999) also relate the potentially detrimental effect of

agency problems on corporate strategy to generally result in corporate

diversification and value loss while focusing is value increasing. Mitton

(2002) suggests that the lower transparency of diversified firms in emerging

markets results in a higher level of asymmetric information that may allow

managers or controlling shareholders to more easily take advantage of

minority shareholders.

As a result of the diminishing effect of past diversification strategy on

firm value, a firm chooses to undergo corporate restructuring to correct past

mistake in the diversification strategy. Among the methods used to correct

the negative effect of diversification is by divesting unrelated business and

refocus on a finn's business portfolio around it's core capabilities (see Gibbs

1993; Markides 1990). Weston et al. (2001) also argued that refocusing will

make it easier for the managers to monitor and make better decisions when

the firm's business is more narrowly positioned

CORPORATE RESTRUCTURING AND LEVERAGE

Previous studies on the relation between a firm's capital structure and

corporate restructuring have documented mixed evidence. Jensen (1989)

examined the link between a firm's capital structure and restructuring. The

author finds that highly leveraged firms are more likely to restructure their

debt as firm value falls. Ofek (1993) tested the relation between capital

structure and a firm's response to short-term financial distress. He finds that

high leverage also significantly increases the probability of debt restructuring

following a short period of distress.

Consistent with Jensen (1989), Ofek (1993) also found that higher

leverage also significantly increases the probability that some operational

actions such as asset restructuring and employee lay-off will be taken in the

year of distress. However, Gilson, John and Lang (1990) find no relation

between leverage and debt restructuring following a long period of distress.

The rate of filing for bankruptcy is higher for firms experiencing along

period of distress than a short period of distress and leverage has no effect

on management turnover for firm in a short period of distress but has an

effect in along period of distress; highly pre-distressed leveraged firms react

faster to a decline in performance than do less pre-distressed leveraged firms

Electronic copy available at: https://ssrn.com/abstract=3409605

Corporate Restructuring: Firm Characteristics and Performance 133

that experience short periods of distress. Thus, the presence of debt allows

firms to some extent to avoid along period of losses with no response and

provide positive elements through a disciplining and monitoring action. In

a similar study, they also find that firms with a high ratio of bank debt are

more likely to successfully restructure their debt. Other studies (Denis &

Shome 2005; Lang et al. 1995; Markides & Singh 1997; Steiner 1997) that

discussed on the association between leverage and corporate restructuring.

Theoretically, when the debt level is beyond its optimal ratio, the benefits

of using debt (in particular tax-shield) are offset by the rising bankruptcy

related costs. In the worst scenario due to the constraints imposed by the

bankruptcy costs, the firms will be forced to liquidate. Therefore, the firms

would restructure their debts when they are experiencing debt servicing

problem due to escalating debt amount and interest commitment.

METHODOLOGY

Four cases of involuntary corporate restructuring of Bursa Malaysia listed

firms namely, Malaysian Resources Corporation Berhad (MRCB) Group,

uEM-Renong Group, Lion Group and Time Engineering constitute our

interest in this study.

These four group of companies are selected on the basis of:

1. Their corporate restructuring scheme announcements are viewed to be

comprehensive involving organisational restructuring, portfolio or asset

restructuring and financial restructuring. It is documented that different

types of restructuring may give a different impact on firm's performance.

Thus, a study having all firms with a comprehensive restructuring

scheme will be unbiased in relation to the restructuring outcomes.

2. They are among major listed firms in the Kuala Lumpur Composite

Index (KLCl) and their restructuring involved a considerably large

amount of financial outlay.

We follow the two different measurements discussed in Bowman et al.

(1999) to measure the corporate restructuring outcome. We calculate the

abnormal movements in the firm's stock price in the days after a restructuring

announcement to measure the market performance. The abnormal returns

reflect changes in a company's share price, adjusted for market trends that

can be attributed to the restructuring event.

Data for the daily prices and KLCI (Kuala Lumpur Composite Index)

price index for the event windows for the period of 2000-2003 are downloaded

from the Datastream. This study uses the daily stock return of the 13

companies for the period of 30 days before announcement (-30,0), during

announcement (-1,+1) and 30 days after announcement (0,+30).

Electronic copy available at: https://ssrn.com/abstract=3409605

134 Jurnal Pengurusan 27

To determine whether the announcements convey information to the

market, cumulative abnormal returns (CARS) are calculated based on the

simplified market model which constraints alpha and beta to 0 and l.

In determining the CARs we follow the standard market model event

study which contrains ex and ~ to equal to 0 and I, respectively such that RM "

(the KLCI) is company ith's expected return, Thus, the abnormal return

(AR,) for company i is the difference between the actual return on day t and

its expected return (RM ,,)'

ARj,1 ;;:: Ri,1 - (RM,,)

where the daily returns of stock i is calculated as follows;

p - P

t t-1 xlOO

Pt - 1

where P, is the price of stock i on trading day t and P'_I is its price one

trading day before that, Similarly, the market return equals to;

R = KLq - KLCl,_1 X 100

M, KLCl,_,

The cumulative abnormal returns (CAR) for company i is calculated as:

N

CARj" = IARi,t

1;1

It is important to determine if the announcements convey information to the

market at all. Following Baek et al. (2001), t-statistics is used to test the

hypothesis that the average CARs are significantly different from zero at each

event windows. Results of the t-tests are presented in Table 3.

We also identify the changes in the company's accounting performance

such as return on total assets (ROA) calculated as net income available to

shareholders divided by the total assets, return on operating cashflow (RCF)

calculated as operating cashflow divided by total assets and debt ratio

calculated as calculated as long term debt plus short term debt divided by

the total assets. ROA provides a measure of the efficiency of asset utilization

(see Lai & Sudarsanam 1997; Zhao 1998) while RCF is useful alternative

measure of operating performance because operating cash flows are a

primary component in net - present value (NPV) calculations used to value

a firm(see Kim et al. 2004),

Debt ratio has been widely used to measure financial leverage (see

Demsetz & Villalonga 2001; Gosh & Jain 2000). Changes in other finn's

characteristics such as board of directors' ownership and level of diversification

Electronic copy available at: https://ssrn.com/abstract=3409605

Corporate Restructuring: Finn Characteristics and Peifonnance 135

are also measured to examine whether corporate restructuring does motivate

finns towards enhancing their corporate governance mechanism through

board ownership and refocusing. The board of directors' ownership represents

insider or managerial shareholding in the finn. The influence of board of

directors' ownership in corporate policy setting and perfonnance has been

widely debated and documented (see Bethel & Liebeskind 1993; Gibbs

1993; Jensen & Meckling 1976; Kim et.a!. 2004; McConnell & Servaes

1990). The finn's level of diversification is measured by revenue- based

Herfindahl Index computed as the sum of the squares of each segment as a

proportion of total assets (see Comment & Jarrell 1995) as follows:

Fj, =:; ~ Xu,IN,

"J.'( ~X jjt

J

Value of one for Herfindahl index corresponds to very focus or non

diversified business activities. These changes are nonnally calculated over a

several-year window surrounding the restructuring event, therefore allowing

comparisons of post-restructuring accounting perfonnance with the pre-

restructuring perfonnance. In this study, we took an average of two years

of board of directors' ownership, revenue based Herfindahl index, debt ratio,

ROA and RCF before aud after the year of restructuring announcement of

each finn.

RESULTS AND DISCUSSION

As shown in Table I, for Renong Group, both UEM and Renong experienced

a decrease in ROA and RCF in the post restructuring announcement. For Lion

Group, Chocolate Product (CP) and Lion Corporation Berhad (LCB) experienced

an increase in ROA and RCF all perfonnance measures while Lion Industries

Corporation Berhad (LlCB) and SCB experienced a decrease in ROA and RCF.

However, ACB experienced an increase in ROA but a decrease in RCF while

Lion Forest Industries (LFI) experienced a decrease in ROA but an increase

in RCF. For MRCB Group, all companies experienced an increase in ROA but

a decrease in RCF. Meanwhile, Time experienced a decrease in both ROA and

RCF. In other words, not all finns have shown an improvement in average

ROA and RCF in the post restructuring announcement.

The restructuring announcements of UEM-Renong Group, Time

Engineering, MRCB Group and Lion Group were not conveyed to the market

as shown by insignificant price impacts for all event windows except for

LlCB and LFI of the Lion Group which showed a negatively significant price

impact during the announcement.

Electronic copy available at: https://ssrn.com/abstract=3409605

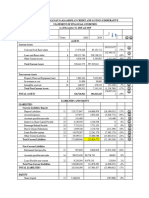

TABLE 1. Summary of Performance in Pre and Post Restructuring Period and Announcement Effect on Stock :price

Pre to Post Wealth Effect on

Group Companies Sector

ROA RCF Before Ann During Ann After Ann

Renong Group UEM Construction Decreased Decreased Insignificant Insignificant Insignificant

Renong Construction Decreased Decreased Insignificant Insignificant Insignificant

MRCB Group MRCB Construction Increased Decreased Insignificant Insignificant Insignificant

TV3 Trading and service Increased Decreased Insignificant Insignificant Insignificant

NSTP Trading and service Increased Decreased Insignificant Insignificant Insignificant

Time Trading and service Decreased Decreased Insignificant Insignificant Insignificant

Lion Group LCB Industrial Product Increased Increased Insignificant Insignificant Insignificant

ACB Industria1 Product Increased Decreased Insignificant Insignificant Insignificant

LICB Industrial Product Decreased Decreased Insignificant (+ve)significant Insignificant

SCB Consumer Product Decreased Decreased Insignificant Insignificant Insignificant

LFI Trading and service Decreased Increased Insignificant (+ve )significant Insignificant

CP Consumer Product Increased Increased Insignificant Insignificant Insignificant

Ann= announcement, Before Ann = event window (-30,0), During Ann = event window (-1,+1), After Ann = event window (0,+30).

Electronic copy available at: https://ssrn.com/abstract=3409605

Corporate Restructuring: Firm Characteristics and Performance 137

As shown in Table 2, we compared pre- and post-restructuring's debt

ratio. UEM and Renong experienced higher debt ratios in post restructuring as

compared with the pre-restructuring period. Time Engineering also experienced

a higher debt ratio in the post-restructuring period. For the MRCB Group, MRCB

and TV3 experienced higher debt ratio in the post-period while NSTP experienced

a lower debt ratio in the post-restructuring period. For the Lion Group, LCB,

LICB, ACB, SCB and CP experienced higher debt ratios while LFI experienced

a lower debt ratio in the post-restructuring period. This indicates that overall,

the corporate restructuring does not motivate the firms towards reducing their

debt two years after the announcement was made.

TABLE 2. Summary of Debt Ratio in Pre and Post Corporate

Restructuring Period

Group Company Sector Debt ratio (Pre)% Debt ratio (Post)%

UEM-Renong Renong Construction 61.87 87.10

UEM Construction 72.54 85.36

MRCB MRCB Construction 62.66 172.72

TV3 Trading and service 149.11 73.47

NSTP Trading and service 66.93 45.60

Time Time Trading and

Engineering Engineering service 60.17 95.26

Lion Group LCB Industrial Product 82.96 97.78

LICB Industrial Product 60.43 82.39

ACB Industrial Product 73.97 87.08

SCB Consumer Product 76.52 97.26

LFI Trading and service 12.63 6.85

CP Consumer Product 49.79 52.35

As shown in Table 3, we compared pre- and post-restructuring's levels

of diversification based on revenue based Herfindahl index. The evidence

shows that most of the firms' revenues are more concentrated into few

business segments, which implies that the corporate restructuring does

motivate the finns towards refocusing.

As shown in Table 4, we compared pre- and post-restructuring's

ownership structure represented by board of directors' ownership (BOD). The

results show that there are no significant changes in board of directors'

ownership before and after corporate restructuring for most of the firms. In

fact, the BOD became smaller. This indicates that the corporate restructuring

does not motivate the firms towards enhancing their corporate governance

mechanism through board of directors' ownership.

Electronic copy available at: https://ssrn.com/abstract=3409605

TABLE 3. Summary of Revenue Based Herfindahl Index in Pre and Post

Corporate Restructuring Period

Group Company Sector Herfindahl Index Herfindahl index

(pre) (post)

Renong UEM Construction 0.27 0.43

Renong Construction 0.20 0.17

MRCB MRCB Construction 0.28 0.46

TV3 Trading and Service 0.97 0.94

NSTP Trading and Service 0.47 0.41

Time Trading and service 0.28 0.43

Lion Group LCB Industrial Product 0.43 0.86

LlCB Industrial Product 0.21 0.76

ACB Industrial Product 0.21 0.25

SCB Consumer Product 0.34 0.44

LFJ Trading and service 0.65 0.63

CP Consumer Product 0.65 0.82

TABLE 4. Summary of Board of Director's Ownership in Pre and Post Corporate

Restructuring Period

Group Company Sector BOD's ownership BOD's ownership

(pre) (post)

UEM-Renong Renong Construction 3.500 3.530

UEM Construction 23.8 0.000

MRCB MRCB Construction 0.000 0.000

TV3 Trading and service 0.000 0.000

NSTP Trading and service 0.000 0.000

Time Time Trading and

Engineering Engineering service 0.000 0.000

Lion LCB Industrial Product 0.180 0.100

LlCB Industrial Product 0.112 0.111

ACB Industrial Product 0.110 0.060

SCB Consumer Product 0.303 0.090

LFI Trading and service 0.010 0.000

CP Consumer Product 0.000 0.000

Overall, the stock price reactions on the restructuring announcements

made by the fIrms were not signifIcant. The fact that these fIrms were

actually facing debt restructuring to enable them to reduce their fInancial

Electronic copy available at: https://ssrn.com/abstract=3409605

Corporate Restructuring: Firm Characteristics and Performance 13'fJ

commitment might not be attractive to the market. Most of the finns were

characterised by considerably high average debt ratio prior to restructuring.

The finns also exhibit different levels of efficiency with respect to generating

profit and cash flow when measured in ROA and RCF respectively. Some

finns consistently showed a decrease in both ROA and RCF such as UEM.

Renong, Time, LlCB and SCB while some finns consistently showed an

increase in both ROA and RCF such as LCB and CB. Other finns such as MRCB,

Tv3, NSTP, ACB and LFI showed mixed results two years after the restructuring

announcement was made.

Surprisingly, all finns except for LlCB and LFI experienced a higher debt

ratio in the post-restructuring period though these finns were forced to

restructure due to higher debt. In other words, theoretically we should

expect the leverage ratios of these firms to be reduced in the post-

restructuring period. There are two possible reasons for the increase in debt.

First, equity issuance may not be an attractive way to raise funds since these

finns were perceived to be troubled finns. Second, some finns became part

of the vehicle to raise debt to enable survival of other finns who were not

able to raise debt for their excessive current debt obligations. As a result, the

'vehicle' firm(s) experienced a higher debt ratio in the post-restructuring

period.

Refocusing or reducing diversification is argued to be one of the reasons

for firms to restructure. Surprisingly, UEM, Renong, NSTP, ACB and SCB did

not show a drastic turnaround strategy to be less diversified in the post-

restructuring period while MRCB and Time Engineering showed more effort

to become less diversified. LCB and LlCB appeared to be more focused while

TV3 remained focused in the post-restructuring period.

In the context of ownership structure, only UEM showed an increase in

board of directors' ownership percentage. If an increase in board of

directors' ownership percentage is expected to bring greater monitoring

effect and a reduction in agency cost as argued in the literature, we should

expect all firms to consider increasing their board of directors' ownership

two years after the restructuring announcement. This indicates that aligning

the interest of management to shareholders was viewed to be insignificant

in ensuring these troubled firms improve their performance.

CONCLUSION

In conclusion, the stock price reactions on the restructuring announcements

made by the firms were not significant and mixed results on accounting

performance measured in ROA and ReF. These firms have also shown some

changes in firm specific characteristics in terms of financial leverage

measured in debt ratio, level of diversification measured in revenue based

Electronic copy available at: https://ssrn.com/abstract=3409605

140 Jumai Pengurusan 27

Herfmdahl Index and corporate governance mechanism via board of directors'

ownership following to the corporate restructuring announcement. The

motives for corporate restructuring were inconclusive for all firms since not

all post restructuring outcomes were consistent with the argument that

corporate restructuring should result in more focus, improved corporate

governance through insider ownership and better debt management ratio.

The implication of these findings is that corporate restructuring framework

in Malaysia does not really focus to further strengthening the role of board

of directors through board of directors' ownership, emphasizing corporate

refocusing and reducing debt in the post restructuring period . Since this

paper revealed the descriptive and event study results, further research is

recommended to test on the relationships between firm's characteristics and

the likelihood of corporate restructuring and the relationship between post

firm characteristics and post restructuring performance.

REFERENCES

Amihud, Y & Lev, B. 1999. Does corporate ownership structure affects its strategy

towards diversification? Strategic Management Journal 20:1063-1069.

Baek, J., Kang, J. & Park, K.S. 200!. Economic shock, business group and

determination of firm value and restructuring: Evidence from the Korean

Crisis, Social Science Research Network:1-51.

Berger, Philip G. & Eli Ofek. 1995. Diversification's effect on finn value. Journal

of Financial Economics 37:39-65.

Bethel, J.E. & Liebeskind, 1. 1993. The effects of ownership structure on corporate

restructuring. Strategic Management Journal 14:15-31.

Bowman, E. H., Singh, H. Useem, M. & Bhadury, R. 1999. When does restructuring

improve economic performance. California Management- Review 41:33-52.

Comment, R. & Jarrell, G. 1995. Corporate focus and stock return. Journal of

Financial Economics 37:67-87.

Daley, L., Mehorotra V. & Sivakumar R. 1997. Corporate focus and value creation:

Evidence from spinoffs. Journal of Financial Economics 45(2):257-281.

Demsetz, H. & Villalonga, B. 200 1. Ownership structure and corporate performance,

Journal of Corporate Finance 7:209-233.

Denis, D.K. & Shome, D.K. 2005. An empirical investigation of corporate asset

downsizing. Journal of Corporate Finance 11(3):427-428.

Gibbs, P.A. 1993. Detenninants of corporate restructuring: the relative importance

of corporate governance, takeover threat, and free cash flow. Strategic

Management Journal 14:51-68.

Gilson, Stuart C., Kose John, & Lang, H.P. 1990. Troubled debt restructurings: An

empirical study of private reorganization of firms in default. Journal of

Financial Economics 27:419-444

Gosh, A. & Jain, P.e. 2000. Financial leverage changes associated with corporate

mergers. Journal of Corporate Finance 6:377-402.

Jensen, M.e. & Meckling, W.H. 1976. Theory of the finn: Managerial behaviour,

agency costs and ownership structure. Journal of Financial Economics 3:305-

360.

Electronic copy available at: https://ssrn.com/abstract=3409605

Corporate Restructuring: Firm Characteristics and Peiformance 141

Jensen, M.e. 1989. Active investors, LBO's and privatization of bankruptcy. Journal

of Applied Corporate Finance 2:35-44.

John, K. & Ofek, E. 1995. Asset sales and increase in corporate focus. Journal oj

Financial Economics 37:105-126.

Kim, K.A., Kitsabunnarrat, P. & Nofsinger, J.R. 2004. Ownership and operating

performance in an emerging market: Evidence from Thai IPO firms. Journal of

Corporate Finance 10:355-381.

Lai, J. & Sudarsanam, S. 1997. Corporate restructuring in response to performance

decline: Impact of ownership, governance and lenders. European Finance

Review 1:197-233.

Lang, H.P. Larry, Poulsen, A. & Stulz, R. 1995. Asset sales, firm performance and

the agency costs of managerial discretion. Journal of Financial Economics

37:3-37.

Markides, C.C. 1990. Corporate refocusing and economic performance, 1981-1987.

Doctoral dissertation, Harvard University Graduate School of Business

Administration, Boston.

Markides, C. C. 1992. Consequences of corporate refocusing: ex-ante evidence.

Academy of Management Journal 35(2):398-412.

Markides, C.C. 1995. Diversification, restructuring and economic performance.

Strategic Management Journal 16:101-118.

Markides, C.C. & Singh, H. 1997. Corporate restructuring: A symptom of poor

governance or a solution to past managerial mistakes? European Management

Journal 15(3):213-219.

Mitton, T. 2002. A cross-firm analysis of the impact of corporate governance on the

East Asian financial crisis. Journal of Financial Economics 64:215-241.

Morek, R., Shleifer, A. & Vishny, R.W. 1988. Management ownership and market

valuation: An empirical analysis. Journal of Financial Economics 20:293-315.

Morek, R., Shleifer, A. & Vishny, R.W. 1990. Do managerial objectives drive bad

acquisitions? Journal of Finance 45:31-48.

Ofek, Eli. 1993. Capital structure and firm response to poor performance: An

empirical analysis. Journal of Financial Economics 34:3-30.

Steiner, T.L. 1997. The corporate sell-off decision of diversified firms. The Journal

of Financial Research 20:231-241.

Weston, 1.F., Mitchell, M.L. & Mulherin, I.H. 2001. Takeovers, Restructuring, and

Corporate Governance, International ed (4th ed.). New Jersey: Prentice Hall.

Zhao, J. 1998. Corporate refocusing in the 1990s: an empirical investigation of its

performance consequences. PhD thesis, Southern Illinois University at Carbondale.

Fauzias Mat Nor, Norazlan Alias, Mohd Hasimi Yaacob

School of Business Management

Faculty of Economics and Business

Universiti Kebangsaan Malaysia

43600 UKM Bangi, Selangor D.E

Malaysia

Email: norazlan@ukm.my

Electronic copy available at: https://ssrn.com/abstract=3409605

Electronic copy available at: https://ssrn.com/abstract=3409605

You might also like

- Tiger GlobalDocument12 pagesTiger GlobalAnsh Lakhmani0% (1)

- Corporate RestructuringDocument48 pagesCorporate Restructuringdilerkhalsa88% (8)

- Responsible Restructuring: Creative and Profitable Alternatives to LayoffsFrom EverandResponsible Restructuring: Creative and Profitable Alternatives to LayoffsNo ratings yet

- Corporate Restructuring in India With Special Reference To Reliance Industries Limited (RIL) Santhosh Kumar A.V. Dinesh NDocument4 pagesCorporate Restructuring in India With Special Reference To Reliance Industries Limited (RIL) Santhosh Kumar A.V. Dinesh NChirag JaiswalNo ratings yet

- RetrieveDocument13 pagesRetrieve363331272No ratings yet

- Stock Performance or Entrenchment? The Effects of Mergers and Acquisitions On CEO CompensationDocument55 pagesStock Performance or Entrenchment? The Effects of Mergers and Acquisitions On CEO CompensationLoren SteffyNo ratings yet

- Expansion and Financial RestructuringDocument50 pagesExpansion and Financial Restructuringvikasgaur86100% (5)

- Organizational Restructuring and Economic Performance in Leveraged Buyouts: An Ex Post StudyDocument37 pagesOrganizational Restructuring and Economic Performance in Leveraged Buyouts: An Ex Post StudyPriyanka SinghNo ratings yet

- Reliance IndustriesDocument6 pagesReliance IndustriesGaurav ChauhanNo ratings yet

- Chap4 PDFDocument45 pagesChap4 PDFFathurNo ratings yet

- CDR StrategiesDocument10 pagesCDR StrategiesPrapti BhattacharyaNo ratings yet

- Impact of Corporate Restructuring On TheDocument11 pagesImpact of Corporate Restructuring On TherehamNo ratings yet

- Corporate Restructuring - Reconfiguring The FirmDocument10 pagesCorporate Restructuring - Reconfiguring The FirmShashank VihariNo ratings yet

- The Effect of Diversification On Firm Performance: The Role of Family OwnershipDocument6 pagesThe Effect of Diversification On Firm Performance: The Role of Family OwnershipNadeemNo ratings yet

- 43 Acj Dec 3122Document10 pages43 Acj Dec 3122Vedant MaskeNo ratings yet

- Corporate Restructuring: Reconfiguring The FirmDocument3 pagesCorporate Restructuring: Reconfiguring The FirmAditya JainNo ratings yet

- 43 Acj Dec 3122Document10 pages43 Acj Dec 3122Satyam SinghNo ratings yet

- Corporate Reconstruction: Restructuring Is TheDocument71 pagesCorporate Reconstruction: Restructuring Is Theekta chnadrakarNo ratings yet

- Unit 6 NotesDocument49 pagesUnit 6 NotesrajiNo ratings yet

- 3) What Is The Difference Between Financial Restructuring and Corporate StructuringDocument2 pages3) What Is The Difference Between Financial Restructuring and Corporate StructuringChenjerai ChikwangwanieNo ratings yet

- Corporate Restructuring Strategies in India - An Overview: February 2021Document10 pagesCorporate Restructuring Strategies in India - An Overview: February 2021Jayshree YadavNo ratings yet

- M&A Module 1Document56 pagesM&A Module 1avinashj8100% (1)

- Corporate Reconstruction: Restructuring Is TheDocument71 pagesCorporate Reconstruction: Restructuring Is ThePrateek PandeyNo ratings yet

- Restructuring: Corporate Management CompanyDocument13 pagesRestructuring: Corporate Management CompanyAmit SharmaNo ratings yet

- Restructur Ing: RestructuringDocument4 pagesRestructur Ing: RestructuringRuchiMuchhalaNo ratings yet

- MergersDocument11 pagesMergersSami YaahNo ratings yet

- Corporate Restructuring and Firm Value: Review of Evidence: Dr. Danson Musyoki Florence WamuyuDocument9 pagesCorporate Restructuring and Firm Value: Review of Evidence: Dr. Danson Musyoki Florence WamuyuruponsikderNo ratings yet

- Merger Acquisition and Corporate RestructuringDocument30 pagesMerger Acquisition and Corporate Restructuringtafese kuracheNo ratings yet

- Corporate RestructuringDocument26 pagesCorporate RestructuringAngna DewanNo ratings yet

- Corporate Restructuring, Firm Characteristics and Implications On Capital Structure: An Academic ViewDocument9 pagesCorporate Restructuring, Firm Characteristics and Implications On Capital Structure: An Academic ViewdanielkajerNo ratings yet

- Introduction To Corporate RestructuringDocument17 pagesIntroduction To Corporate RestructuringkigenNo ratings yet

- Corporate Management Company Demerger Bankruptcy Repositioning Buyout Debt RestructuringDocument8 pagesCorporate Management Company Demerger Bankruptcy Repositioning Buyout Debt Restructuringrushikesh kakadeNo ratings yet

- Module 1Document25 pagesModule 1Gowri MahadevNo ratings yet

- When Does Restructuring Improve Economic PerformanceDocument23 pagesWhen Does Restructuring Improve Economic PerformanceKashif KidwaiNo ratings yet

- B2. Corporate Restructuring Reconfiguring The FirmDocument11 pagesB2. Corporate Restructuring Reconfiguring The FirmAlex SanNo ratings yet

- Paper ADocument13 pagesPaper Afaheem khanNo ratings yet

- 1 s2.0 S2212567113000750 MainDocument10 pages1 s2.0 S2212567113000750 MainDevi RatnasariNo ratings yet

- Block 5Document77 pagesBlock 5vapici2379No ratings yet

- Organizational Restructuring StrategiesDocument15 pagesOrganizational Restructuring StrategiesTanim Hasan TanZzNo ratings yet

- In-Depth Analysis of Restructuring As A Business Transformation StrategyDocument7 pagesIn-Depth Analysis of Restructuring As A Business Transformation StrategyAhsan MubeenNo ratings yet

- Effects of Receivable On Profitabilty.2019Document12 pagesEffects of Receivable On Profitabilty.2019Rhona BasongNo ratings yet

- Bab I PendahuluanDocument19 pagesBab I PendahuluanDian Martini Gotama PutriNo ratings yet

- Corporate RestructuringDocument15 pagesCorporate Restructuringsuvansh majmudarNo ratings yet

- Assignment #3 Financial Distress and RestructuringDocument6 pagesAssignment #3 Financial Distress and Restructuringcharlie simo100% (2)

- Final Draft Mini ResearchDocument26 pagesFinal Draft Mini ResearchvitahazeNo ratings yet

- Notes On MergersDocument4 pagesNotes On MergersYaaseen InderNo ratings yet

- Corporate RestructuringDocument36 pagesCorporate RestructuringTaniya MahturNo ratings yet

- Corporate Restructuring and Its Effect On Employee Morale and PerformanceDocument9 pagesCorporate Restructuring and Its Effect On Employee Morale and PerformanceAbhishek GuptaNo ratings yet

- Term Paper On Corporate RestructuresDocument13 pagesTerm Paper On Corporate RestructuresRock BottomNo ratings yet

- Capital Structure and Firm PerformanceDocument15 pagesCapital Structure and Firm PerformanceAcademicNo ratings yet

- Chapter 1Document7 pagesChapter 1Amit KumarNo ratings yet

- Assignment-1: Sub: Strategic Financial ManagementDocument11 pagesAssignment-1: Sub: Strategic Financial ManagementAkhil JNo ratings yet

- Theories of MergersDocument17 pagesTheories of MergersDamini ManiktalaNo ratings yet

- Corporate Restructuring: Creating Value For The Organizations "Document9 pagesCorporate Restructuring: Creating Value For The Organizations "Rashi guptaNo ratings yet

- Good Corporate Governance, Leverage Terhadap Kinerja Keuangan PerusahaanDocument10 pagesGood Corporate Governance, Leverage Terhadap Kinerja Keuangan PerusahaanHalimahNo ratings yet

- Corporate Restructuring An OverviewDocument44 pagesCorporate Restructuring An OverviewUzair SoomroNo ratings yet

- Project Report-Corporate RestructuringDocument26 pagesProject Report-Corporate Restructuringchahvi bansal100% (1)

- Corporate Restructuring - Reconfiguration of A CorporationDocument18 pagesCorporate Restructuring - Reconfiguration of A Corporationishita pancholiNo ratings yet

- Edi & Ermi Wijaya (2022)Document20 pagesEdi & Ermi Wijaya (2022)heprieka wulandariNo ratings yet

- Allergan Case Question and AnswersDocument16 pagesAllergan Case Question and AnswersMallikharjuna Rao ChNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- Sample Notice of Resolution Non-Cumulative Convertible Preference Shares - WatermarkDocument3 pagesSample Notice of Resolution Non-Cumulative Convertible Preference Shares - WatermarkAdeline Lei MingNo ratings yet

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- GM Embroidery LedgerDocument4 pagesGM Embroidery LedgerSohaib ImtiazNo ratings yet

- Consent To Short Notice of An Annual General MeetingDocument1 pageConsent To Short Notice of An Annual General MeetingKenny NguyenNo ratings yet

- Financial StatementsDocument8 pagesFinancial Statementstrisha joy de laraNo ratings yet

- Electronic Credit LedgerDocument1 pageElectronic Credit Ledgerranjan.bora01No ratings yet

- Kabuhayan Sa Ganap Na Kasarinlan Credit and Savings CooperativeDocument4 pagesKabuhayan Sa Ganap Na Kasarinlan Credit and Savings CooperativeAngelica MijaresNo ratings yet

- The Most Effective Stock Trading Strategy in Indonesia Equity MarketDocument8 pagesThe Most Effective Stock Trading Strategy in Indonesia Equity Marketjon doeNo ratings yet

- Intermediate Accounting Volume 2 Canadian 9th Edition Kieso Test BankDocument41 pagesIntermediate Accounting Volume 2 Canadian 9th Edition Kieso Test BankJenniferMartinezbisoa100% (14)

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Quizzers 12Document13 pagesQuizzers 12Niña Yna Franchesca PantallaNo ratings yet

- 06B Investment in Debt SecuritiesDocument4 pages06B Investment in Debt Securitiesrandomlungs121223No ratings yet

- 4.1 Cost of Capital ExerciseDocument9 pages4.1 Cost of Capital ExerciseHTNo ratings yet

- Accounting BookDocument95 pagesAccounting BookHermixoneNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Statement JAN PDFDocument59 pagesStatement JAN PDFUmay DelishaNo ratings yet

- Unit IV Merchandising ConcernDocument27 pagesUnit IV Merchandising ConcernCamelia CanamanNo ratings yet

- Determinants of Price of Stock of Nepalese Commercial BanksDocument11 pagesDeterminants of Price of Stock of Nepalese Commercial BanksBishnu LamsalNo ratings yet

- GFA 712S - 2019 Test 1 MemoDocument8 pagesGFA 712S - 2019 Test 1 MemoNolan TitusNo ratings yet

- Test Bank For Financial Management Theory and Practice 3rd Canadian Edition Eugene F Brigham Michael C Ehrhardt Jerome Gessaroli Richard R NasonDocument21 pagesTest Bank For Financial Management Theory and Practice 3rd Canadian Edition Eugene F Brigham Michael C Ehrhardt Jerome Gessaroli Richard R Nasongisellesamvb3100% (26)

- Tests FiDocument27 pagesTests FiIce AgeNo ratings yet

- Fundamental Accounting Principles Wild 19th Edition Solutions ManualDocument43 pagesFundamental Accounting Principles Wild 19th Edition Solutions ManualCarolineAndersoneacmg100% (46)

- Suman Debnath by Jahin PDFDocument4 pagesSuman Debnath by Jahin PDFABDUL KHALIKNo ratings yet

- Wey FinIFRS 5e PPT Ch05Document95 pagesWey FinIFRS 5e PPT Ch05Zia ZahraNo ratings yet

- 2130-Accounting For ManagersDocument1 page2130-Accounting For Managerskrushnakakde884No ratings yet

- Unpaid Unclaimed Dividend IEPF-1Document138 pagesUnpaid Unclaimed Dividend IEPF-1raghavNo ratings yet

- Provision For Depreciation & DisposalDocument3 pagesProvision For Depreciation & DisposalKristen NallanNo ratings yet