Professional Documents

Culture Documents

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Uploaded by

Phan GiápCopyright:

Available Formats

You might also like

- Original PDF Microeconomics Canada in The Global Environment10th Edition PDFDocument41 pagesOriginal PDF Microeconomics Canada in The Global Environment10th Edition PDFmonica.bass495100% (53)

- Project Finance Solar PV ModelDocument81 pagesProject Finance Solar PV ModelSaurabh SharmaNo ratings yet

- Case Submission 1Document3 pagesCase Submission 1api-519662845No ratings yet

- Eaton WACC FrameworkDocument6 pagesEaton WACC FrameworkSaraQureshiNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Tonihansen Support and ResistanceDocument54 pagesTonihansen Support and ResistanceBill Neil100% (1)

- FCF bảng CDocument3 pagesFCF bảng CĐình Thịnh LêNo ratings yet

- Kohler Group 5Document6 pagesKohler Group 5Prateek PatraNo ratings yet

- RF Spread To Treasury: Total RF (Consolidated) GivenDocument8 pagesRF Spread To Treasury: Total RF (Consolidated) GivenKunal JainNo ratings yet

- Datasonic 3QFY21 Result Update PDFDocument4 pagesDatasonic 3QFY21 Result Update PDFGiddy YupNo ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- The Presentation MaterialsDocument35 pagesThe Presentation MaterialsZerohedgeNo ratings yet

- Midlands Case StudyDocument5 pagesMidlands Case Studyjvbd dsvsdvNo ratings yet

- REM QuestionsDocument47 pagesREM QuestionsHimanshu SoniNo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Adobe ADBE Stock Dashboard 20100928Document1 pageAdobe ADBE Stock Dashboard 20100928Old School ValueNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- NPV Annuity PlansDocument10 pagesNPV Annuity PlansmayankNo ratings yet

- DCF Valuation Compact (Complete) - 3Document4 pagesDCF Valuation Compact (Complete) - 3amr aboulmaatyNo ratings yet

- Dimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %Document2 pagesDimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %bukubukuNo ratings yet

- Beta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDocument21 pagesBeta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDamion KenwoodNo ratings yet

- MulticapDocument2 pagesMulticapadithyaNo ratings yet

- Ashu 7Document16 pagesAshu 7Mansi ParmarNo ratings yet

- BLUE STAR LTD - Quantamental Equity Research Report-1Document1 pageBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarNo ratings yet

- Energy Turun 10%Document1 pageEnergy Turun 10%yayankedatongolfNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Mahesh DhalNo ratings yet

- 6.1 Stress Test - Sparkassen: RC NotesDocument21 pages6.1 Stress Test - Sparkassen: RC NoteserteNo ratings yet

- Group 2 Marriott SlideDocument47 pagesGroup 2 Marriott SlideIbraheem RabeeNo ratings yet

- Determinacion Del Wacc, Hoja 3Document32 pagesDeterminacion Del Wacc, Hoja 3Edi Flor CcansayaNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- Vaibhav - Mojidra - Tanla Platforms DCF ValuationDocument93 pagesVaibhav - Mojidra - Tanla Platforms DCF Valuation71 Vaibhav MojidraNo ratings yet

- BA Boeing Stock SummaryDocument1 pageBA Boeing Stock SummaryOld School ValueNo ratings yet

- Semana 4 IIDocument262 pagesSemana 4 IIElva Herlinda Lugo VillanuevaNo ratings yet

- WACC Analysis of Tata PowerDocument2 pagesWACC Analysis of Tata PowerShubhamShekharSinhaNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh Van100% (1)

- TV18 BroadcastDocument30 pagesTV18 Broadcastrishabh jainNo ratings yet

- Next Era Energy 1 PagerDocument1 pageNext Era Energy 1 PagerNikos DiakogiannisNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- UntitledDocument2 pagesUntitledShraboan AmirNo ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q4 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q4 FY 2021sahil gorpekarNo ratings yet

- Valuation Mergers ProjectDocument3 pagesValuation Mergers Projectsuraj nairNo ratings yet

- Weighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsDocument9 pagesWeighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsinoocentkillerNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- Financial Report On Apple Stock - Jan 2020Document13 pagesFinancial Report On Apple Stock - Jan 2020Adam LeclatNo ratings yet

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- 2009 Annual Financial ReportDocument287 pages2009 Annual Financial Reportpcelica77No ratings yet

- Perrigo Company: © Zacks Company Report As ofDocument1 pagePerrigo Company: © Zacks Company Report As ofjomanousNo ratings yet

- FCFF SederhanaDocument16 pagesFCFF SederhanaCOKDEHNo ratings yet

- VALUATIONDocument2 pagesVALUATIONmNo ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Punjab National Bank: Out PerformerDocument3 pagesPunjab National Bank: Out PerformerearnrockzNo ratings yet

- DCF PDFDocument2 pagesDCF PDFMd Rasel Uddin ACMANo ratings yet

- End Game To Estimate Pure Play Betas by Business, To Use in Estimating A Bottom Up Beta For A Project or A CompanyDocument11 pagesEnd Game To Estimate Pure Play Betas by Business, To Use in Estimating A Bottom Up Beta For A Project or A CompanyMario ObrequeNo ratings yet

- Regression Statistics: Assignment-1: Hero Motorcorp 1) Calculation of BetaDocument2 pagesRegression Statistics: Assignment-1: Hero Motorcorp 1) Calculation of BetaDivyansh SinghNo ratings yet

- Post Graduate Program in Technology & Business Management: Audited Placement Report - Cohort of 2021Document12 pagesPost Graduate Program in Technology & Business Management: Audited Placement Report - Cohort of 2021SpeakupNo ratings yet

- Monte Carlo Analysis PMP ResourcesDocument3 pagesMonte Carlo Analysis PMP Resourcesharishr1968No ratings yet

- BCTA-RR (2QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (2QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Inv Naik 10%Document1 pageInv Naik 10%yayankedatongolfNo ratings yet

- DuPont AnalysingDocument2 pagesDuPont AnalysingNiharika GuptaNo ratings yet

- Customer ValueDocument18 pagesCustomer ValueCarmilleah FreyjahNo ratings yet

- Case Analysis Strategic Management Ben Jerry S Download To View Full Presentation PDFDocument10 pagesCase Analysis Strategic Management Ben Jerry S Download To View Full Presentation PDFAbhishek GuptaNo ratings yet

- Icici BankDocument8 pagesIcici BankHarsh VardhanNo ratings yet

- Solved Krisha Can Pick 4 Pounds of Coffee Beans in An HourDocument1 pageSolved Krisha Can Pick 4 Pounds of Coffee Beans in An HourTuan Anh TranNo ratings yet

- Zara Case IiDocument2 pagesZara Case IiElisa PauluzziNo ratings yet

- Environmental MarketingDocument253 pagesEnvironmental MarketingKarenNo ratings yet

- Product Life Cycle of KelvinatorDocument21 pagesProduct Life Cycle of Kelvinatorankit talujaNo ratings yet

- F. (A Study of Flipkart and Amazon)Document42 pagesF. (A Study of Flipkart and Amazon)Chandan RouthNo ratings yet

- 1980 - in Defense of Thomas Aquinas and The Just Price - David FriedmanDocument9 pages1980 - in Defense of Thomas Aquinas and The Just Price - David Friedmanjm15yNo ratings yet

- Just Keep Buying Supporting PDFDocument62 pagesJust Keep Buying Supporting PDFAlexandra Constantinescu-AlbertNo ratings yet

- Acc FCFFDocument25 pagesAcc FCFFArchit PateriaNo ratings yet

- Jntuh BefaDocument109 pagesJntuh BefaNaresh Guduru89% (18)

- Invoice: Hurb CoDocument2 pagesInvoice: Hurb ComesrawrNo ratings yet

- Exercise For Product LevelsDocument3 pagesExercise For Product Levelsjulia_jayronwaldoNo ratings yet

- Freelancing Exercise 01Document4 pagesFreelancing Exercise 01Saif AnsariNo ratings yet

- Babu Banarasi Das University Lucknow: "A Study On The Level of Customer Satisfaction Towards AMAZON - IN in Lucknow City"Document38 pagesBabu Banarasi Das University Lucknow: "A Study On The Level of Customer Satisfaction Towards AMAZON - IN in Lucknow City"Diya LalwaniNo ratings yet

- SPBA106 Assessment-2Document4 pagesSPBA106 Assessment-2KrishnaNo ratings yet

- Helios Tower Prospectus 15oct2019Document300 pagesHelios Tower Prospectus 15oct2019FuManchu_vPeterSellersNo ratings yet

- Most Important Questions For JE (COMMERCIAL)Document23 pagesMost Important Questions For JE (COMMERCIAL)Manish KumarNo ratings yet

- SEBI v. Pan AsiaDocument99 pagesSEBI v. Pan AsiaR VigneshwarNo ratings yet

- J.P. Morgan Asset Management Global Liquidity Investment Survey 2011Document40 pagesJ.P. Morgan Asset Management Global Liquidity Investment Survey 2011alphathesisNo ratings yet

- Amazon 1Document1 pageAmazon 1NITINNo ratings yet

- MIS and Marketing ResearchDocument25 pagesMIS and Marketing Researchanurag ranaNo ratings yet

- 7 Ways Accounting Can Benefit Marketing Ops - MarketingProfsDocument3 pages7 Ways Accounting Can Benefit Marketing Ops - MarketingProfsarsyNo ratings yet

- Collocations in BusinessDocument2 pagesCollocations in BusinessBoddisatva Lofthouse-ArmatradingNo ratings yet

- Merger &acquisitionDocument150 pagesMerger &acquisitionMadhvendra BhardwajNo ratings yet

- Trading Channels Using AndrewsDocument6 pagesTrading Channels Using AndrewsAnonymous sDnT9yuNo ratings yet

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Uploaded by

Phan GiápOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Uploaded by

Phan GiápCopyright:

Available Formats

Discounted Cash Flow Model for Dam Phu My

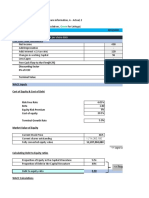

Unlevered beta = Asset beta = Equity beta * E/A + Debt beta *D/A

General data

(debt beta is assumed to be 0)

Share price as of last close 32.250,00 --> Asset beta = Equity beta*E/A OR Asset beta*A = Equity beta*E

Latest closing share price date 02/06/2023 With A = E+D*(1-t)

Latest basic share count 391.334.260,000

--> Asset beta = Equity beta*E/(E+D*(1-t))

Case Base case

--> Asset beta = Equity beta*1/(1+(D/E)*(1-t))

Industry average Beta calculation

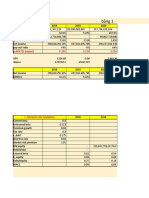

Observed b Share price Share count Market cap Debt Tax rate Unlev. b Relev. b

DCM 0,99 23.550,00 529.400.000,0 12.467.370.000.000 3.760.418.031.622 20,0% 0,80 0,96

LAS 1,41 10.100,00 112.856.400,0 1.139.849.640.000 594.910.708.655 20,0% 0,99 1,10

DPM 0,63 32.250,00 391.334.260,0 12.620.529.885.000 3.097.689.072.508 20,0% 0,53 0,92

Average Releverage Beta 0,78 Industry average unlevered beta 0,77

CAPM (Capital Asset Pricing Model): Cost of equity kE=Rf+beta*ERP with ERP=Equity Risk Premium=(RM-Rf+CRP) with CRP=Sovereign spr* Multiplier

Cost of equity Calculating ERP for Vietnam, using Damodaran's data & approach:

Observed beta 0,63 Multiplier 3,28

Select beta (observed or industry) Average Equity Risk Premium (RM-Rf) of US 5,9%

Beta selected 0,78 Method 1 Method 2

Risk-Free Rate (Rf) (US) 3,76% Sovereign spread 2,20% 3,13%

Equity Risk Premium 14,69% CRP (Equity Country Risk Premium) 7,22% 10,28%

Cost of equity 15,18% ERP (Equity risk premium) for Vietnam 13,16% 16,22%

ERP average for Vietnam 14,69%

WACC (Weighted Average Cost of Capital): WACC = kE* E/V + kD* (1-t)*D/V

Cost of capital Capital structure

Cost of debt before tax 12,0% Share price as of last close 32.250,00

Tax rate 20,0% Latest basic share count 391.334.260,00 %

Cost of debt after tax 9,6% Market value of equity 12.620.529.885.000 80,3%

Cost of capital (WACC) 14,1% Debt 3.097.689.072.508 19,7%

FCFF=CFO+Int*(1-t)-FCInv. (=Unlevered CFO-FCInv.) Assets = Enterprise Value +

=NI+all NCC-WCInv+Int*(1-t)-FCInv. + Cash (less trapped cash)

=(EBIT-Int)*(1-t)+NCC before EBIT-WCInv.+Int*(1-t)-FCInv. + Marketable securities

=EBIT*(1-t)+NCC-WCInv-FCInv. + Investment in affiliates

=EBIAT+NCC-WCInv-FCInv. Assets = Equity Value +

PV of FCFF = Enterprise Value = Value from core business (not including excess cash and assets for + Debt

+ Minority Interest

Free cash flow buildup

Fiscal year 2020A 2021A 2022A 2023P 2024P 2025P 2026P 2027P

Fiscal year end date 31/12/2020 31/12/2021 31/12/2022 31/12/2023 31/12/2024 31/12/2025 31/12/2026 31/12/2027

EBITDA 1.312 4.235 6.840 7.997 6.800 5.521 5.477 5.433

EBIT 763 3.698 6.325 7.462 6.310 5.077 5.077 5.078

Tax rate 19,7% 15,9% 17,1% 17,1% 18,0% 17,0% 16,0% 15,0%

EBIAT (NOPAT) 613 3.109 5.244 6.186 5.174 4.214 4.265 4.316

Plus: Depreciation and amortization 535 490 445 400 356

Plus: Stock based compensation 0 0 0 0 0

Less: change in Accounts receivable 28 28 28 28 28

Less: change in Inventory -1.096 -1.500 -2.000 -2.500 -2.500

Less: change in Other current assets (inc. non-trade receivables) -7 -7 -7 -7 -7

Less: change in Deferred tax assets (DTAs) -109 -109 -109 -109 -109

Plus: change in Accounts payable 98 98 98 98 98

Plus: change in Other payables & deferred revenues (current & non-current) 550 550 550 550 550

Plus: change in Deferred tax liabilities (DTLs) 0 0 0 0 0

Less: change in Other non current assets -40 -40 -40 -40 -40

Plus: change in Other non current liabilities 0 0 0 0 0

Unlevered CFO (unlevered CFO=CFO+int*(1-t)) 6.146 4.684 3.179 2.685 2.692

Less: Capital expenditures -52 -68 -75 -75 -75

Less: Purchases of intangible assets -1 -1 -1 -1 -1

FCFF (before adjustment for timing factor) 6.093 4.615 3.103 2.610 2.617

% growth (24,2%) (32,8%) (15,9%) 0,3%

Assume the above cash flows are generated at: End of Fiscal Year

Timing adjustment factor (multiply FCFF by) 1,00x

FCFF at End of Fiscal Year 6.093 4.615 3.103 2.610 2.617

Discount number of years 0,58 1,58 2,58 3,58 4,58

Present value of Unlevered FCFF 5.644 3.747 2.209 1.628 1.431

Computing Enterprise Value

Perpetuity approach Exit EBITDA multiple approach

Long term growth rate (g) 3,0% Terminal value EBITDA multiple 4,00x

Normalized FCFFt+1 2.695 Terminal year EBITDA 5.433

Terminal value 24.324 Terminal value 21.734

Present value of terminal value 13.303 Present value of terminal value 11.887

Present value of stage 1 cash flows 14.659 Present value of stage 1 cash flows 14.659

Enterprise value 27.963 Enterprise value 26.546

Implied TV exit EBITDA multiple 4,5x Implied TV perpetual growth rate 1,8%

Options / warrants data Equity Value and Fair Value per share

Number of exercisable options (mm) 0,00 Perpetuity EBITDA

Exercise price - Enterprise value 27.963 26.546

Current market price 32.250,00 Plus: Cash & marketable securities 1.879 1.879

Number of exercisable options in-the-money 0,00 Less: Trapped cash (enter as -) 0 0

Total proceeds ($mm) 0 Plus: Investment in affiliates 29 29

Number of shares repurchased (mm) 0,00 Less: Debt (ST+LT) (enter as -) -3.098 -3.098

Number of shares issued (mm) 0,00 Less: Preferred stock (enter as -) 0 0

Less: Minority Interest (enter as -) -188 -188

Basic shares outstanding 391.334.260,00 Equity value 26.584 25.168

Dilutuve impact of options/warrants 0,00 Diluted shares outstanding 391.334.260,000 391.334.260,000

Dilutive impact of shares from other securities 0 Equity value per share VND 67.932,526 VND 64.312,915

Net diluted shares outstanding 391.334.260,00 Market premium / (discount) to fair value (52,5%) (49,9%)

Net Debt = Debt + Preferred stock + Minority Interest -Cash & marketable securities - Investment in affiliates

Sensitivity analysis

Equity value per share

Long term growth rate (g):

VND67.932,526 2,00% 2,50% 3,00% 3,50% 4,00%

17,1% 54.153,7 53.344,7 53.344,7 54.153,7 55.944,09

16,1% 49.061,1 48.465,3 48.465,3 49.061,1 50.363,7

WACC: 15,1% 46.919,8 46.403,0 46.403,0 46.919,8 48.044,2

14,1% 46.919,8 46.403,0 46.403,0 46.919,8 48.044,2

13,1% 49.061,1 48.465,3 48.465,3 49.061,1 50.363,7

12,1% 54.153,7 53.344,7 53.344,7 54.153,7 55.944,1

Equity value per share

Exit EBITDA Multiple

VND64.312,915 2,00x 3,00x 4,00x 5,00x 6,00x

17,1% 45.676,7 38.934,4 38.934,4 45.676,7 59.161,4

16,1% 43.596,6 37.357,7 37.357,7 43.596,6 56.074,5

WACC: 15,1% 42.615,8 36.611,4 36.611,4 42.615,8 54.624,7

14,1% 42.615,8 36.611,4 36.611,4 42.615,8 54.624,7

13,1% 43.596,6 37.357,7 37.357,7 43.596,6 56.074,5

12,1% 45.676,7 38.934,4 38.934,4 45.676,7 59.161,4

Equity value per share

Exit EBITDA Multiple

EBITDA % of plan VND64.312,915 2,00x 3,00x 4,00x 5,00x

80% 4.347 46.088,0 40.013,1 40.013,1 46.088,0

90% 4.890 33.938,1 27.103,8 27.103,8 33.938,1

100% 5.433 18.750,7 11.157,0 11.157,0 18.750,7

110% 5.977 525,8 (7.827,3) (7.827,3) 525,8

120% 6.520 (20.736,6) (29.849,0) (29.849,0) (20.736,6)

130% 7.064 (45.036,4) (54.908,3) (54.908,3) (45.036,4)

Football field LTM EBITDA multiple

LTM calculations

DCF Valuation Summary Operating income 1.151

48,0442

D&A 330

50,00

Stock based compensation

45,00 54,6247 LTM EBITDA 1.481

46,9198 25,200

40,00 42,6158 Market cap 12.620.529.885.000

Enterprise value 15.718.218.957.508

35,00

EV/EBITDA 10613247101,6x

30,00 Comps derived EV/EBITDA 4,0x

31,2

25,00

20,00

15,00

10,00

5,00

,00

DCF Value at 002x-006x Exit DCF Value at 02%-04% 52 Week Market High/Low

EBITDA Range Perpetuity Range

Low Diff. High

DCF Value at 002x-006x Exit EBITDA Range 42,6 0,0 54,6

DCF Value at 02%-04% Perpetuity Range 46,9 1,1 48,0

52 Week Market High/Low 31,2 25,2 56,4

References value website https://valueinvesting.io/DPM.VN/valuation/dcf-ebitda-exit-5y

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

Sửa số multiplier 1.5 ở ô màu vàng trên cùng thành 2.01 cho Việt Nam (số 2.01 này lấy

từ 1 worksheet khác bên cạnh, được tính bằng sigma của VNI return chia sigma trái

phiếu CP VN phát hành bằng tiền $)

CRP Country Risk Premium = Sovereign spread x 2.01

(trong bảng thì Damodaran gọi Sovereign spread là Default spread, nhưng mình sẽ gọi

là sovereign cho rõ nghĩa hơn)

Damodaran tính Sovereign spread theo 2 phương pháp:

Một là bằng hiệu CDS spread của 10 year VN bond trừ 10 year US bond (=2.75%-

0.5518%=2.89%) (cột 7).

Hai là dựa trên rating của TPCP hạng B2, thì spread này được tính trung bình là 5,5%

(cột 4), chênh khá nhiều với phương pháp 1.

Sau đó Cost of equty = Rf + beta x (Rm-Rf+CRP) trong đó (Rm-Rf) là 5% (của US)

Rf là risk free rate của US, khoảng 2,4% (10 year T bond).

Vậy theo phương pháp 1 thì cost of equity của 1 cổ phiếu có beta=1 (market) là:

2.4%+1x(5%+(3.35%-0.46%)x2.01)=13.2%

Theo phương pháp 2 thì là 2.4%+1x(5%+5.5%x2.01)=18.5%

10 year T bond của VN khoảng 8%:

http://asianbondsonline.adb.org/vietnam.php

http://www.investing.com/rates-bonds/vietnam-10-year-bond-yield

For g changes Diff:

Min 46.403,0 46.403,0

25% 46.403,0 -

50% 46.919,8 516,81

75% 47.482,0 562,19

Max 48.044,2 562,19

48.044,2 For drawing football field chart with

percentile rankings, but it's not clearer

and more informative, so it's not

For EBITDA multiple recommended.

Diff:changes

Min 36.611,4 36.611,4

25% 36.611,4 -

50% 42.615,8 6.004,46

75% 48.620,3 6.004,46

Max 54.624,7 6.004,46

54.624,7

You might also like

- Original PDF Microeconomics Canada in The Global Environment10th Edition PDFDocument41 pagesOriginal PDF Microeconomics Canada in The Global Environment10th Edition PDFmonica.bass495100% (53)

- Project Finance Solar PV ModelDocument81 pagesProject Finance Solar PV ModelSaurabh SharmaNo ratings yet

- Case Submission 1Document3 pagesCase Submission 1api-519662845No ratings yet

- Eaton WACC FrameworkDocument6 pagesEaton WACC FrameworkSaraQureshiNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Tonihansen Support and ResistanceDocument54 pagesTonihansen Support and ResistanceBill Neil100% (1)

- FCF bảng CDocument3 pagesFCF bảng CĐình Thịnh LêNo ratings yet

- Kohler Group 5Document6 pagesKohler Group 5Prateek PatraNo ratings yet

- RF Spread To Treasury: Total RF (Consolidated) GivenDocument8 pagesRF Spread To Treasury: Total RF (Consolidated) GivenKunal JainNo ratings yet

- Datasonic 3QFY21 Result Update PDFDocument4 pagesDatasonic 3QFY21 Result Update PDFGiddy YupNo ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- The Presentation MaterialsDocument35 pagesThe Presentation MaterialsZerohedgeNo ratings yet

- Midlands Case StudyDocument5 pagesMidlands Case Studyjvbd dsvsdvNo ratings yet

- REM QuestionsDocument47 pagesREM QuestionsHimanshu SoniNo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Adobe ADBE Stock Dashboard 20100928Document1 pageAdobe ADBE Stock Dashboard 20100928Old School ValueNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- NPV Annuity PlansDocument10 pagesNPV Annuity PlansmayankNo ratings yet

- DCF Valuation Compact (Complete) - 3Document4 pagesDCF Valuation Compact (Complete) - 3amr aboulmaatyNo ratings yet

- Dimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %Document2 pagesDimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %bukubukuNo ratings yet

- Beta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDocument21 pagesBeta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDamion KenwoodNo ratings yet

- MulticapDocument2 pagesMulticapadithyaNo ratings yet

- Ashu 7Document16 pagesAshu 7Mansi ParmarNo ratings yet

- BLUE STAR LTD - Quantamental Equity Research Report-1Document1 pageBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarNo ratings yet

- Energy Turun 10%Document1 pageEnergy Turun 10%yayankedatongolfNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Mahesh DhalNo ratings yet

- 6.1 Stress Test - Sparkassen: RC NotesDocument21 pages6.1 Stress Test - Sparkassen: RC NoteserteNo ratings yet

- Group 2 Marriott SlideDocument47 pagesGroup 2 Marriott SlideIbraheem RabeeNo ratings yet

- Determinacion Del Wacc, Hoja 3Document32 pagesDeterminacion Del Wacc, Hoja 3Edi Flor CcansayaNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- Vaibhav - Mojidra - Tanla Platforms DCF ValuationDocument93 pagesVaibhav - Mojidra - Tanla Platforms DCF Valuation71 Vaibhav MojidraNo ratings yet

- BA Boeing Stock SummaryDocument1 pageBA Boeing Stock SummaryOld School ValueNo ratings yet

- Semana 4 IIDocument262 pagesSemana 4 IIElva Herlinda Lugo VillanuevaNo ratings yet

- WACC Analysis of Tata PowerDocument2 pagesWACC Analysis of Tata PowerShubhamShekharSinhaNo ratings yet

- Free Cash Flow To Firm DCF Valuation Model Base DataDocument3 pagesFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh Van100% (1)

- TV18 BroadcastDocument30 pagesTV18 Broadcastrishabh jainNo ratings yet

- Next Era Energy 1 PagerDocument1 pageNext Era Energy 1 PagerNikos DiakogiannisNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- UntitledDocument2 pagesUntitledShraboan AmirNo ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q4 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q4 FY 2021sahil gorpekarNo ratings yet

- Valuation Mergers ProjectDocument3 pagesValuation Mergers Projectsuraj nairNo ratings yet

- Weighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsDocument9 pagesWeighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsinoocentkillerNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- Financial Report On Apple Stock - Jan 2020Document13 pagesFinancial Report On Apple Stock - Jan 2020Adam LeclatNo ratings yet

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- 2009 Annual Financial ReportDocument287 pages2009 Annual Financial Reportpcelica77No ratings yet

- Perrigo Company: © Zacks Company Report As ofDocument1 pagePerrigo Company: © Zacks Company Report As ofjomanousNo ratings yet

- FCFF SederhanaDocument16 pagesFCFF SederhanaCOKDEHNo ratings yet

- VALUATIONDocument2 pagesVALUATIONmNo ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Punjab National Bank: Out PerformerDocument3 pagesPunjab National Bank: Out PerformerearnrockzNo ratings yet

- DCF PDFDocument2 pagesDCF PDFMd Rasel Uddin ACMANo ratings yet

- End Game To Estimate Pure Play Betas by Business, To Use in Estimating A Bottom Up Beta For A Project or A CompanyDocument11 pagesEnd Game To Estimate Pure Play Betas by Business, To Use in Estimating A Bottom Up Beta For A Project or A CompanyMario ObrequeNo ratings yet

- Regression Statistics: Assignment-1: Hero Motorcorp 1) Calculation of BetaDocument2 pagesRegression Statistics: Assignment-1: Hero Motorcorp 1) Calculation of BetaDivyansh SinghNo ratings yet

- Post Graduate Program in Technology & Business Management: Audited Placement Report - Cohort of 2021Document12 pagesPost Graduate Program in Technology & Business Management: Audited Placement Report - Cohort of 2021SpeakupNo ratings yet

- Monte Carlo Analysis PMP ResourcesDocument3 pagesMonte Carlo Analysis PMP Resourcesharishr1968No ratings yet

- BCTA-RR (2QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (2QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Inv Naik 10%Document1 pageInv Naik 10%yayankedatongolfNo ratings yet

- DuPont AnalysingDocument2 pagesDuPont AnalysingNiharika GuptaNo ratings yet

- Customer ValueDocument18 pagesCustomer ValueCarmilleah FreyjahNo ratings yet

- Case Analysis Strategic Management Ben Jerry S Download To View Full Presentation PDFDocument10 pagesCase Analysis Strategic Management Ben Jerry S Download To View Full Presentation PDFAbhishek GuptaNo ratings yet

- Icici BankDocument8 pagesIcici BankHarsh VardhanNo ratings yet

- Solved Krisha Can Pick 4 Pounds of Coffee Beans in An HourDocument1 pageSolved Krisha Can Pick 4 Pounds of Coffee Beans in An HourTuan Anh TranNo ratings yet

- Zara Case IiDocument2 pagesZara Case IiElisa PauluzziNo ratings yet

- Environmental MarketingDocument253 pagesEnvironmental MarketingKarenNo ratings yet

- Product Life Cycle of KelvinatorDocument21 pagesProduct Life Cycle of Kelvinatorankit talujaNo ratings yet

- F. (A Study of Flipkart and Amazon)Document42 pagesF. (A Study of Flipkart and Amazon)Chandan RouthNo ratings yet

- 1980 - in Defense of Thomas Aquinas and The Just Price - David FriedmanDocument9 pages1980 - in Defense of Thomas Aquinas and The Just Price - David Friedmanjm15yNo ratings yet

- Just Keep Buying Supporting PDFDocument62 pagesJust Keep Buying Supporting PDFAlexandra Constantinescu-AlbertNo ratings yet

- Acc FCFFDocument25 pagesAcc FCFFArchit PateriaNo ratings yet

- Jntuh BefaDocument109 pagesJntuh BefaNaresh Guduru89% (18)

- Invoice: Hurb CoDocument2 pagesInvoice: Hurb ComesrawrNo ratings yet

- Exercise For Product LevelsDocument3 pagesExercise For Product Levelsjulia_jayronwaldoNo ratings yet

- Freelancing Exercise 01Document4 pagesFreelancing Exercise 01Saif AnsariNo ratings yet

- Babu Banarasi Das University Lucknow: "A Study On The Level of Customer Satisfaction Towards AMAZON - IN in Lucknow City"Document38 pagesBabu Banarasi Das University Lucknow: "A Study On The Level of Customer Satisfaction Towards AMAZON - IN in Lucknow City"Diya LalwaniNo ratings yet

- SPBA106 Assessment-2Document4 pagesSPBA106 Assessment-2KrishnaNo ratings yet

- Helios Tower Prospectus 15oct2019Document300 pagesHelios Tower Prospectus 15oct2019FuManchu_vPeterSellersNo ratings yet

- Most Important Questions For JE (COMMERCIAL)Document23 pagesMost Important Questions For JE (COMMERCIAL)Manish KumarNo ratings yet

- SEBI v. Pan AsiaDocument99 pagesSEBI v. Pan AsiaR VigneshwarNo ratings yet

- J.P. Morgan Asset Management Global Liquidity Investment Survey 2011Document40 pagesJ.P. Morgan Asset Management Global Liquidity Investment Survey 2011alphathesisNo ratings yet

- Amazon 1Document1 pageAmazon 1NITINNo ratings yet

- MIS and Marketing ResearchDocument25 pagesMIS and Marketing Researchanurag ranaNo ratings yet

- 7 Ways Accounting Can Benefit Marketing Ops - MarketingProfsDocument3 pages7 Ways Accounting Can Benefit Marketing Ops - MarketingProfsarsyNo ratings yet

- Collocations in BusinessDocument2 pagesCollocations in BusinessBoddisatva Lofthouse-ArmatradingNo ratings yet

- Merger &acquisitionDocument150 pagesMerger &acquisitionMadhvendra BhardwajNo ratings yet

- Trading Channels Using AndrewsDocument6 pagesTrading Channels Using AndrewsAnonymous sDnT9yuNo ratings yet