Professional Documents

Culture Documents

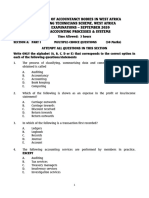

FINANCIAL ACCOUNT YEAR 10 2nd Term TERM TEST

FINANCIAL ACCOUNT YEAR 10 2nd Term TERM TEST

Uploaded by

Janet HarryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINANCIAL ACCOUNT YEAR 10 2nd Term TERM TEST

FINANCIAL ACCOUNT YEAR 10 2nd Term TERM TEST

Uploaded by

Janet HarryCopyright:

Available Formats

THAMES VALLEY COLLEGE

KILOMETRE 1O, SAGAMU-IKORODU ROAD, SAGAMU, OGUN STATE

NAME_______________________________________________ DURATION: 2HOUR 30MINS

INSTRUCTION: ANSWER ALL QUESTIONS

8. Which of the following is the principal

1. Cross referencing among different books book of account?

of account is achieved with the use of A. General Journal

___ B. Sales book

A. columns C. Purchases book

B. reference numbers D. Ledger

C. folio

D. margin 9. Which of the following is not contained

in the Ledger?

2. A ledger is a ___ A. date of transaction

A. summary of entries B. description of the transaction

B. book of original entry C. folio number of transaction

C. book of account D. address of the customer

D. double entry posting

10. A trial balance is a list of ___

3. The purchase of a typewriter for office A. current assets

use for N70, 000 should be debited to B. current liabilities

___ C. debit and credit balances

A. bank account D. debtors and creditors

B. purchases account

C. cash account 11. Which of the following is entered in the

D. equipment account general journal?

A. purchase of goods

4. Purchases in accounting refers to goods B. sales of goods on credit

bought for __ C. returns inwards

A. repairs D. acquisition of fixed assets

B. permanent use

C. resale 12. Which of the following is an example of

D. owner’s use a subsidiary book? ____

A. cash book

5. When goods are sold for cash, the credit B. bank statement

entry goes to the ___? C. trial balance

A. trader’s account D. suspense account

B. cash account

C. customer’s account 13. Which of the following is not a purpose

D. sales account of financial accounting ___

A. determining profit

6. Which of the following is not a source B. fixing prices

document? C. credit dealings

A. a debit note D. determining cash balance

B. a credit note

C. an invoice 14. The maximum level of cash held by a

D. a payment receipt cashier under an imprest system is a/an

7. The two fundamental books of account __

are ___ A. vote

A. Cash Book and Petty Cash Book B. float

B. Receipt and Invoice C. reimbursement

C. Journal and Ledger D. advance

D. Notes and Coins

YEAR 10 FINANCIAL ACCOUNTING SECOND MID TERM TEST Page 1

A. the first entry made in it is on the

15. When both debit and credit enry of a debit side

transaction are shown in the cash book, it B. there are more entries on the debit side

is described as __ than on the credit side

A. contra entry C. total value of debit entries is more

B. reversal entry than total value of credit entries

C. double entry D. there is no entry at all on the debit

D. single entry side

16. The purchase of a typewriter for office

use for N65, 000 should be debited to __

A. bank account

B. purchases account

C. cash account

D. equipment account

17. A trial balance is prepared to __

A. detect fraud

B. ascertain losses in a trading period

C. determine opening capital

D. test arithmetical accuracy of ledger

entries

18. Returns inwards is also called __

A. carriage inwards

B. carriage outwards

C. purchases returns

D. sales returns

19. The payment of ₦5,000 for rent was

debited to electricity account. This is an

error of __

A. principle

B. omission

C. original entry

D. commission

20. An account is said to have a debit

balance because __

YEAR 10 FINANCIAL ACCOUNTING SECOND MID TERM TEST Page 2

SECTION B- THEORY PART

Instruction: Answer any two questions from this section

1. From the following information write up a three column cash book of Favour Stores

balance off at the end of the month, and show the relevant discounts accounts as they

would appear in the general ledger:

2016

March 1 Balance brought forward:

Cash in hand ₦21,100

Cash at bank ₦89,840

“ 2 We paid each of the following accounts by cheque, in each case we deducted 5%

cash discount: T. Ankrah ₦8,000; Asafo ₦26,000; Kojo ₦44,000

“ 4 Talabi paid us a cheque for ₦9,800

“ 6 Cash sales paid direct into the bank ₦14,900

“ 7 Paid insurance by cash ₦6,500

“ 9 The following persons paid us the following accounts by cheque, in each case

1

deducted a discount of 2 %: Dambo ₦16,000; Apiah ₦6,400; Andrah ₦5,200

2

“ 12 Paid motor expenses by cash ₦10,000

“ 18 Cash sales ₦98,000

“ 21 Paid Salaries by cheque ₦12,000

“ 23 Paid rent by cash ₦6,000

“ 28 Received a cheque for ₦50,000 being a loan from Atadika

“ 31 Paid for stationery by cheque ₦8,700 (9 marks)

1b. Explain the following: (i) Trade discount (ii) Cash discount (iii) Trial balance

(6 marks)

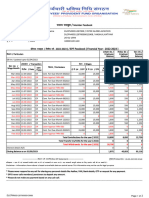

2. From the balances of Daniel Enterprises for the year ended 31st December, 2000

$

Bank Overdraft 7,000

Machinery 40,000

Debtors 8,000

Loan 5,000

Bill payable 3,752

Furniture and Fittings 33,361

Stock of goods 71,000

Purchases 100,000

Sales 250,000

Drawings 3,260

Discount Allowed 839

Carriage inwards 1,110

Discount received 254

Cash 18,000

Provision for bad debts 730

Bad debts 68

Rent 156

Bills receivable 5,000

Sundry expenses 300

Accumulated depreciated-Furniture 1,700

YEAR 10 FINANCIAL ACCOUNTING SECOND MID TERM TEST Page 3

Return inwards 2,130

Return outwards 1,250

Capital 9,000

Advertising 150

General Expenses 160

Creditor 5,000

Required

a. Classify the following transactions with Amounts above into Assets and Liabilities

(6 marks)

b. Prepare Trial balance as at 31st December, 2000 (9 marks)

3. The following information was extracted from the books for the month of January, 1997.

₦

Jan 1. Receipt 1,000

Jan 1. Petrol 40

Jan 2. Postage stamp 15

Jan 3. One realm of typing paper 30

Jan 4. Settlement of account- Dani 150

Jan 15. Office cleaning material 20

Jan 18. Travelling 40

Jan 20. Refunds of a clerk’s bus fare 20

Jan 21. Car polish 30

Jan 22. Petrol and oil 70

Jan 23. Petrol 140

Jan 24. Registered mail 30

Jan 25. Settlement of account- Brown 250

Jan 27. Settlement of account- Smith 60

Jan 28. Carbon paper 40

Required: (a) Enter the above transactions into Petrol, Postage Stamp, Office Expenses,

Transportation expenses, Personal ledger using imprest system and balance off the petty cash

book. (10 marks)

3b. Explain five reasons why a trader will grant discount to his customers (5 marks)

YEAR 10 FINANCIAL ACCOUNTING SECOND MID TERM TEST Page 4

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- Financial Accounting and Analysis - Question BankDocument18 pagesFinancial Accounting and Analysis - Question BankNMIMS GA50% (2)

- CAE 2 Financial Accounting and Reporting: L-NU AA-23-02-01-18Document8 pagesCAE 2 Financial Accounting and Reporting: L-NU AA-23-02-01-18Amie Jane Miranda100% (1)

- Lecture 9 - 25.04.2023 (Prof. Theissen) (1) 下午12.48.52Document53 pagesLecture 9 - 25.04.2023 (Prof. Theissen) (1) 下午12.48.52Edison LiNo ratings yet

- CAT L1 Assessment Exam (Batch May 2022) - 1Document9 pagesCAT L1 Assessment Exam (Batch May 2022) - 1Sofia Mae AlbercaNo ratings yet

- ACC 3rd QuizDocument12 pagesACC 3rd QuizJazzy Mercado55% (11)

- Engineering Economics: DepreciationDocument50 pagesEngineering Economics: DepreciationLeahlainne Ministerio100% (1)

- Bank and Banking PerspectivesDocument4 pagesBank and Banking PerspectivesMariel Crista Celda MaravillosaNo ratings yet

- Flavors of Fast Report 2020Document64 pagesFlavors of Fast Report 2020Viviane Bocalon100% (2)

- Level III NewDocument5 pagesLevel III NewElias TesfayeNo ratings yet

- Grade 10 AccountsDocument10 pagesGrade 10 AccountsJane MalhanganaNo ratings yet

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RiceNo ratings yet

- Jamb Principles-Of-Accounts Past Question 1994 - 2004Document38 pagesJamb Principles-Of-Accounts Past Question 1994 - 2004Chukwudinma IkechukwuNo ratings yet

- Theory (1) 1Document18 pagesTheory (1) 1Debela RegasaNo ratings yet

- Book Keeping Mdr1Document5 pagesBook Keeping Mdr1Nassrah JumaNo ratings yet

- Level Three Theory (Knowledge) ChoiceDocument17 pagesLevel Three Theory (Knowledge) ChoiceYaa Rabbii100% (1)

- Accounts Paper One Form Two Time: 1 Hrs Answer All QuestionsDocument7 pagesAccounts Paper One Form Two Time: 1 Hrs Answer All QuestionsMike ChindaNo ratings yet

- Mid Term Exam POA 2023 - Đề 2Document5 pagesMid Term Exam POA 2023 - Đề 2Anh Nguyễn MaiNo ratings yet

- Progress Test-4 (Chapters 1 and 2)Document4 pagesProgress Test-4 (Chapters 1 and 2)buraale94No ratings yet

- Principles of AccountsDocument38 pagesPrinciples of AccountsRAMZAN TNo ratings yet

- Accounting MCQsDocument7 pagesAccounting MCQssaeedqk100% (7)

- Grade 11 AccoountsDocument10 pagesGrade 11 AccoountsJane MalhanganaNo ratings yet

- Principle I COC Exam 2Document9 pagesPrinciple I COC Exam 2natinaelbahiru74No ratings yet

- Pilot TestDocument5 pagesPilot Testkhanhhung1112004No ratings yet

- Level Three Theory (Knowledge) Choice: C. Journalizing - Posting - Trial Balance - Financial StatementsDocument17 pagesLevel Three Theory (Knowledge) Choice: C. Journalizing - Posting - Trial Balance - Financial Statementseferem0% (1)

- PART-I-SEPT-2020-INSIGHT ExamDocument89 pagesPART-I-SEPT-2020-INSIGHT Examanyasandra77No ratings yet

- Mid Term POA - Test 01Document8 pagesMid Term POA - Test 01Trang Ca CaNo ratings yet

- Jamb Accounts Past QuestionsDocument96 pagesJamb Accounts Past QuestionsGlory100% (3)

- Pilot Test 2023Document7 pagesPilot Test 2023trthuytrang004No ratings yet

- Basic Accounting QuestionnaireDocument7 pagesBasic Accounting QuestionnaireSVTKhsiaNo ratings yet

- MCQ QuestionsDocument6 pagesMCQ QuestionsANo ratings yet

- FAR First Grading ExaminationDocument9 pagesFAR First Grading ExaminationRoldan ManganipNo ratings yet

- QUIZ 2. MC - Before Chap5Document9 pagesQUIZ 2. MC - Before Chap5minhhquyetNo ratings yet

- Quiz #1Document5 pagesQuiz #1octaviaNo ratings yet

- S3 MYE QP 2019-20 (Final)Document13 pagesS3 MYE QP 2019-20 (Final)XinYi ChenNo ratings yet

- Ss 1 Second Term AccountDocument7 pagesSs 1 Second Term AccountUzoma ObasiNo ratings yet

- Ss 1 First Term Account Examination-1Document7 pagesSs 1 First Term Account Examination-1Uzoma ObasiNo ratings yet

- Jamb Acct Questions 1 5Document54 pagesJamb Acct Questions 1 5jay736334No ratings yet

- Level 3 TheoryDocument19 pagesLevel 3 TheoryMarta GobenaNo ratings yet

- Choice 1-1Document17 pagesChoice 1-1Dagnachew WeldegebrielNo ratings yet

- Journal To Trial BalanceDocument8 pagesJournal To Trial BalanceRyou ShinodaNo ratings yet

- Accounts TR 10 MDTDocument4 pagesAccounts TR 10 MDTOluwatobi AkindeNo ratings yet

- Model Exam 1Document25 pagesModel Exam 1rahelsewunet0r37203510No ratings yet

- Accounting Past PaperDocument13 pagesAccounting Past PaperSolaarNo ratings yet

- Test BankDocument5 pagesTest BankAna Margaret MayolNo ratings yet

- Model ExamDocument25 pagesModel ExambinaNo ratings yet

- D PDF Sample Exam 2Document29 pagesD PDF Sample Exam 2seatow6No ratings yet

- Midterm Examination Suggested AnswersDocument9 pagesMidterm Examination Suggested AnswersJoshua CaraldeNo ratings yet

- Book Keeping FivDocument6 pagesBook Keeping FivALE MEDIANo ratings yet

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- NAU Accounting Skills Assessment Practice Exam Revised 0416Document11 pagesNAU Accounting Skills Assessment Practice Exam Revised 0416Danica VetuzNo ratings yet

- Accounting ReviewDocument4 pagesAccounting ReviewMike ChindaNo ratings yet

- Financial Accounting & Reporting ReviewerDocument21 pagesFinancial Accounting & Reporting ReviewerRosemarie GoNo ratings yet

- Acc. P 2 2021 RevisionDocument8 pagesAcc. P 2 2021 RevisionSowda AhmedNo ratings yet

- Acctg1 MidtermDocument6 pagesAcctg1 MidtermKevin Elrey Arce50% (4)

- JAMB ACCOUNTS PAST QUESTIONS - RemovedDocument95 pagesJAMB ACCOUNTS PAST QUESTIONS - Removedadedayomichael333No ratings yet

- M3W4 Entreprenuership 2ND Semester Module 4 BontilaoDocument24 pagesM3W4 Entreprenuership 2ND Semester Module 4 BontilaoRoshaine Esgana TaronaNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Mutual Fund Distributor Exam Nism Study Material PDFDocument56 pagesMutual Fund Distributor Exam Nism Study Material PDFamita YadavNo ratings yet

- IDFCFIRSTBankstatement 10111794196Document10 pagesIDFCFIRSTBankstatement 10111794196dabu choudharyNo ratings yet

- India Digital Economy Report 22 - Fintech EditionDocument15 pagesIndia Digital Economy Report 22 - Fintech EditionVinay AgarwalNo ratings yet

- Question For Task 1Document4 pagesQuestion For Task 1LaraNo ratings yet

- Swap Ratio Determination & Evaluation of Merger ProposalDocument21 pagesSwap Ratio Determination & Evaluation of Merger Proposalpriyasunil2008No ratings yet

- India Post Payments Bank: Delivering Banking Service at DoorstepDocument24 pagesIndia Post Payments Bank: Delivering Banking Service at DoorstepC K ParjapatiNo ratings yet

- Assessment - Revenue and Other ReceiptsDocument3 pagesAssessment - Revenue and Other ReceiptsKhryzell Guill Villanueva LagurinNo ratings yet

- Old in PDDocument2 pagesOld in PDFranco GrisafiNo ratings yet

- 8-8-25/41 Sri Anjanaya Nilayam, Idpl SND Residency, Hyderabad, Telengana 500037Document2 pages8-8-25/41 Sri Anjanaya Nilayam, Idpl SND Residency, Hyderabad, Telengana 500037RX100 PSYCO GAMINGNo ratings yet

- Motivation PlanDocument11 pagesMotivation PlanAnkur Dubey100% (1)

- DLCPM00312970000013908 2022Document2 pagesDLCPM00312970000013908 2022Anshul KatiyarNo ratings yet

- Baker Street Cinema Quiz 2a Student ResponseDocument15 pagesBaker Street Cinema Quiz 2a Student ResponseCool MomNo ratings yet

- Notice To Customers of HBL Bank Dormant AccountsDocument2 pagesNotice To Customers of HBL Bank Dormant Accountsshafiqrehman7No ratings yet

- BSA 23C-AFAR ReviewerDocument102 pagesBSA 23C-AFAR ReviewerKlint HandsellNo ratings yet

- Loan AmortizationDocument1 pageLoan AmortizationDaniela BarumanNo ratings yet

- Swissindo Instruction Germany Comptroller of The Currency 16 Apr 2013Document26 pagesSwissindo Instruction Germany Comptroller of The Currency 16 Apr 2013Sue Rhoades100% (6)

- SA20210817Document4 pagesSA20210817charlene maeNo ratings yet

- Exercise 7 To 9Document4 pagesExercise 7 To 9No NotreallyNo ratings yet

- R22 FIRM Q-BankDocument8 pagesR22 FIRM Q-BankparamrajeshjainNo ratings yet

- ACKNOWLEDGEMENT, Table ContentDocument3 pagesACKNOWLEDGEMENT, Table ContentnorshaheeraNo ratings yet

- Your Statement: Smart AccessDocument3 pagesYour Statement: Smart AccesscynthiaNo ratings yet

- AUZao 3 IPv 2 LR 2 AZIDocument7 pagesAUZao 3 IPv 2 LR 2 AZIrajarao001No ratings yet

- BSDP Mantri New Entry: Aspirasi Segmen MikroDocument12 pagesBSDP Mantri New Entry: Aspirasi Segmen MikroBoy Dwi Senner SianturiNo ratings yet

- UCO - GROUP CARE 360 APPLICATION FORM (Scheme For Customers of UCO Bank) (JULY-5th) - CompressedDocument2 pagesUCO - GROUP CARE 360 APPLICATION FORM (Scheme For Customers of UCO Bank) (JULY-5th) - CompressedRahulSinghNo ratings yet

- Classes and Kinds of CreditDocument20 pagesClasses and Kinds of CreditCharisa Samson86% (7)

- Basic Documents and Transactions Related To Bank DepositsDocument18 pagesBasic Documents and Transactions Related To Bank DepositsDiana Fernandez MagnoNo ratings yet