Professional Documents

Culture Documents

EFM Three Statement Model

EFM Three Statement Model

Uploaded by

Amr El-BelihyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EFM Three Statement Model

EFM Three Statement Model

Uploaded by

Amr El-BelihyCopyright:

Available Formats

Company Valuation

Financial Model Template

Project name

Three Statement Model

Last updated

May 17th, 2018

Powered by

www.efinancialmodels.com

Disclaimer: eFinancialModels.com provides the template as is and assumes no liability for any eventual

mistakes within the model nor ommissions of it. All eventual data erves as example only and cannot be relied

upon. Each template needs to be adjusted for the individual project and customized by the user. The user is

self responsible to thoroughly review and adjust the model. However eFinancialModels.com appreciates your

feedback.

Confidential

Confidential 1/5 06/12/2023

Three Statement Model May 17th, 2018

Confidential

Abbreviations

A Actual figure

CAPEX Capital Expenditures

COGS Cost of goods sold

DCF Discounted Free Cash Flows

D&A Depreciation & Amortization

EBIT Earnings before interest and taxes

EBITDA Earnings before interest, taxes, depreciation and amortization

EV Enteprise Value

F Forecasted figure

NPV Net Present Value

OPEX Operating costs

P/B Price to Book Ratio

P/E Price Earnings Ratio

ROE Return on Equity

ROIC Return on Invested Capital

t Tax rate %

TV Terminal Value

USD United States Dollar

Powered by

www.efinancialmodels.com

Confidential 2/5 06/12/2023

Three Statement Model May 17th, 2018

Confidential

All amounts in USD

Executive Summary

Financial Projections

USD

Revenues EBITDA EBITDA Margin

8,000,000 25.0%

7,000,000

20.0%

6,000,000

5,000,000 15.0%

4,000,000

3,000,000 10.0%

2,000,000

5.0%

1,000,000

0 0.0%

2016 A 2017 A 2018 A 2019 A 2020 A 2021 A 2022 A 2023 A

All amounts in USD

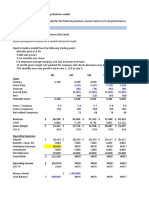

Financial Overview 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Revenues USD 3,800,000 4,500,000 5,000,000 5,500,000 5,775,000 6,063,750 6,366,938 6,685,284

Revenue growth % NA 18.4% 11.1% 10.0% 5.0% 5.0% 5.0% 5.0%

COGS USD (1,800,000) (2,500,000) (2,600,000) (2,970,000) (3,118,500) (3,274,425) (3,438,146) (3,610,054)

Gross Profit USD 2,000,000 2,000,000 2,400,000 2,530,000 2,656,500 2,789,325 2,928,791 3,075,231

GP Margin % 52.6% 44.4% 48.0% 46.0% 46.0% 46.0% 46.0% 46.0%

OPEX USD (1,190,000) (1,010,000) (1,580,000) (1,675,000) (1,800,000) (1,640,000) (1,860,000) (1,980,000)

EBITDA USD 810,000 990,000 820,000 855,000 856,500 1,149,325 1,068,791 1,095,231

EBITDA Margin % 21.3% 22.0% 16.4% 15.5% 14.8% 19.0% 16.8% 16.4%

Net Income USD 536,667 687,500 522,000 422,750 405,875 606,494 532,093 440,423

Net Margin % 14.1% 15.3% 10.4% 7.7% 7.0% 10.0% 8.4% 6.6%

CAPEX USD 0 300,000 520,000 450,000 500,000 400,000 500,000 400,000

Financial Debt USD 3,900,000 4,000,000 3,500,000 3,400,000 3,200,000 3,000,000 2,800,000 2,600,000

Debt/EBITDA x 4.8x 4.0x 4.3x 4.0x 3.7x 2.6x 2.6x 2.4x

Confidential 3/5 06/12/2023

All amounts in USD

Assumptions

General Assumptions

Currency USD

First Forecast Year Year 2019

Interest rate % 4%

Tax rate % 25%

Days Receivables Days Sales 60

Days Inventory Days COGS 70

Days Payables Days COGS 45

Powered by

www.efinancialmodels.com

Confidential 4/5 06/12/2023

Three Statement Model May 17th, 2018

Confidential

All amounts in USD

Income Statement Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Revenues USD 3,800,000 4,500,000 5,000,000 5,500,000 5,775,000 6,063,750 6,366,938 6,685,284

Growth 18% 11% 10% 5% 5% 5% 5%

COGS USD (1,800,000) (2,500,000) (2,600,000) (2,970,000) (3,118,500) (3,274,425) (3,438,146) (3,610,054)

Gross Margin USD 2,000,000 2,000,000 2,400,000 2,530,000 2,656,500 2,789,325 2,928,791 3,075,231

% % 52.6% 44.4% 48.0% 46.0% 46.0% 46.0% 46.0% 46.0%

Sales & Marketing USD (290,000) (330,000) (450,000) (459,000) (500,000) (600,000) (600,000) (690,000)

General & Admin USD (300,000) (350,000) (800,000) (816,000) (900,000) (600,000) (800,000) (850,000)

Other operating expenses USD (600,000) (330,000) (330,000) (400,000) (400,000) (440,000) (460,000) (440,000)

OPEX USD (1,190,000) (1,010,000) (1,580,000) (1,675,000) (1,800,000) (1,640,000) (1,860,000) (1,980,000)

EBITDA USD 810,000 990,000 820,000 855,000 856,500 1,149,325 1,068,791 1,095,231

% % 21.3% 22.0% 16.4% 15.5% 14.8% 19.0% 16.8% 16.4%

Depreciation & Amortization USD (200,000) (200,000) (220,000) (153,333) (183,333) (216,667) (243,333) (400,000)

EBIT USD 610,000 790,000 600,000 701,667 673,167 932,658 825,458 695,231

% % 16.1% 17.6% 12.0% 12.8% 11.7% 15.4% 13.0% 10.4%

Interest payment USD (13,333) (40,000) (48,000) (138,000) (132,000) (124,000) (116,000) (108,000)

Interest rate % 4.0% 4.0% 4.0% 4.0% 4.0%

EBT USD 596,667 750,000 552,000 563,667 541,167 808,658 709,458 587,231

% % 15.7% 16.7% 11.0% 10.2% 9.4% 13.3% 11.1% 8.8%

Tax rate % 10% 8% 5% 25% 25% 25% 25% 25%

Taxes paid USD (60,000) (62,500) (30,000) (140,917) (135,292) (202,165) (177,364) (146,808)

Net Income USD 536,667 687,500 522,000 422,750 405,875 606,494 532,093 440,423

% % 14.1% 15.3% 10.4% 7.7% 7.0% 10.0% 8.4% 6.6%

All amounts in USD

Balance Sheet Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Cash USD 200,000 937,500 679,500 348,049 181,881 346,896 361,270 537,587

Receivables USD 600,000 550,000 600,000 904,110 949,315 996,781 1,046,620 1,098,951

Inventory USD 450,000 550,000 600,000 569,589 598,068 627,972 659,371 692,339

Fixed Assets USD 1,900,000 2,000,000 2,300,000 2,596,667 2,913,333 3,096,667 3,353,333 3,353,333

Total Assets USD 3,150,000 4,037,500 4,179,500 4,418,414 4,642,598 5,068,315 5,420,593 5,682,210

Payables USD 230,000 330,000 450,000 366,164 384,473 403,696 423,881 445,075

Financial debt USD 3,900,000 4,000,000 3,500,000 3,400,000 3,200,000 3,000,000 2,800,000 2,600,000

Equity USD (980,000) (292,500) 229,500 652,250 1,058,125 1,664,619 2,196,712 2,637,135

Liabilities & Shareholder's Equity USD 3,150,000 4,037,500 4,179,500 4,418,414 4,642,598 5,068,315 5,420,593 5,682,210

Check 0 0 0 0 0 0 0 0

All amounts in USD

Cash Flow Statement Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Cash Flow from Operations (CFO)

Net income USD NA 687,500 522,000 422,750 405,875 606,494 532,093 440,423

Addback interest USD NA 40,000 48,000 138,000 132,000 124,000 116,000 108,000

Addback D&A USD NA 200,000 220,000 153,333 183,333 216,667 243,333 400,000

Change in receivables USD NA 50,000 (50,000) (304,110) (45,205) (47,466) (49,839) (52,331)

Change in inventory USD NA (100,000) (50,000) 30,411 (28,479) (29,903) (31,399) (32,969)

Change in payables USD NA 100,000 120,000 (83,836) 18,308 19,224 20,185 21,194

CFO USD NA 977,500 810,000 356,549 665,832 889,015 830,374 884,318

Investing Cash Flow (CFI)

CAPEX USD (300,000) (520,000) (450,000) (500,000) (400,000) (500,000) (400,000)

CFI USD (300,000) (520,000) (450,000) (500,000) (400,000) (500,000) (400,000)

Cash Flow from Financing

Change in Financial debt USD 100,000 (500,000) (100,000) (200,000) (200,000) (200,000) (200,000)

Interest charges USD (40,000) (48,000) (138,000) (132,000) (124,000) (116,000) (108,000)

Equity financing USD 0 0 0 0 0 0 0

Dividends USD 0 0 0 0 0 0 0

CFI USD 60,000 (548,000) (238,000) (332,000) (324,000) (316,000) (308,000)

Change in Cash USD 737,500 (258,000) (331,451) (166,168) 165,015 14,374 176,318

Cash beginning USD 200,000 937,500 679,500 348,049 181,881 346,896 361,270

Cash end of month USD 937,500 679,500 348,049 181,881 346,896 361,270 537,587

All amounts in USD

Key Financial Ratios Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

Financial Debt / EBITDA x 4.8x 4.0x 4.3x 4.0x 3.7x 2.6x 2.6x 2.4x

EBIT/Interest x 45.8x 19.8x 12.5x 5.1x 5.1x 7.5x 7.1x 6.4x

Current Ratio x 5.4x 6.2x 4.2x 5.0x 4.5x 4.9x 4.9x 5.2x

Days Receivables Days Sales 58 45 44 60 60 60 60 60

Days Inventory Days COGS 91 80 84 70 70 70 70 70

Days Payables Days COGS 47 48 63 45 45 45 45 45

EBITDA Margin % 21.3% 22.0% 16.4% 15.5% 14.8% 19.0% 16.8% 16.4%

Revenue growth % NA 18.4% 11.1% 10.0% 5.0% 5.0% 5.0% 5.0%

ROE % -54.8% -108.1% -1657.1% 95.9% 47.5% 44.6% 27.6% 18.2%

Revenues/Assets x 1.2x 1.1x 1.2x 1.2x 1.2x 1.2x 1.2x 1.2x

Invested Capital USD 2,720,000 2,770,000 3,050,000 3,704,201 4,076,244 4,317,723 4,635,443 4,699,548

All amounts in USD

Tangible Fixed Assets Unit 2016 A 2017 A 2018 A 2019 F 2020 F 2021 F 2022 F 2023 F

CAPEX USD NA 300,000 520,000 450,000 500,000 400,000 500,000 400,000

Fixed Assets (Gross) USD 2,300,000 2,750,000 3,250,000 3,650,000 4,150,000 4,550,000

Depreciation period Years 15

Depreciation

2018 A 2,300,000 153,333 153,333 153,333 153,333 153,333

2019 F 450,000 30,000 30,000 30,000 30,000

2020 F 500,000 33,333 33,333 33,333

2021 F 400,000 26,667 26,667

2022 F 500,000 33,333

Depreciation USD 153,333 183,333 216,667 243,333 400,000

Accumulated depreciation USD 0 153,333 336,667 553,333 796,667 1,196,667

Fixed Assets (Net) USD 2,300,000 2,596,667 2,913,333 3,096,667 3,353,333 3,353,333

Powered by

www.efinancialmodels.com

Confidential 5 / 06/12/2023 06/12/2023

You might also like

- Clinic Financial Model Excel Template v10 DEMODocument77 pagesClinic Financial Model Excel Template v10 DEMOdeddyNo ratings yet

- Seagate 2Document5 pagesSeagate 2Bruno Peña Jaramillo33% (3)

- FIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IDocument9 pagesFIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IAlison JcNo ratings yet

- Model Project Report For Cash Credit, Overdraft LimitsDocument21 pagesModel Project Report For Cash Credit, Overdraft LimitsPraneeth Cheruvupalli100% (2)

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Saito Solar - Discounted Cash Flow ValuationDocument8 pagesSaito Solar - Discounted Cash Flow ValuationSana BatoolNo ratings yet

- Fundraising Model V02Document8 pagesFundraising Model V02fvfvfsNo ratings yet

- Theory & Practice of Financial Management Faraz Naseem Sunday, April 19th, 2020Document12 pagesTheory & Practice of Financial Management Faraz Naseem Sunday, April 19th, 2020Hassaan KhalidNo ratings yet

- EFM Simple DCF Model 4Document3 pagesEFM Simple DCF Model 4Anonymous xv5fUs4AvNo ratings yet

- Poultry Farming - 4 LITEDocument18 pagesPoultry Farming - 4 LITEAnonymous tW1zTL2ltNo ratings yet

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeBEACH SCUBA DETECTINGNo ratings yet

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeEdner PatricNo ratings yet

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- Financial Projections Model v6.8.4Document28 pagesFinancial Projections Model v6.8.4george.komnasNo ratings yet

- ValuationDocument4 pagesValuationRhea Mae CarantoNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- MCD IU FactSheet Nov 2020Document5 pagesMCD IU FactSheet Nov 2020Swati SNo ratings yet

- PNB Housing Finance Liquidity Update - 1st Oct 18Document9 pagesPNB Housing Finance Liquidity Update - 1st Oct 18swanand samantNo ratings yet

- FM LMS Based AssessmentDocument11 pagesFM LMS Based AssessmentHassaan KhalidNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- Unit TestDocument3 pagesUnit TestKetty De GuzmanNo ratings yet

- Household Savings Financial Savings Non Financial Savings Savings in Equities % of Equities in Financial SavingsDocument12 pagesHousehold Savings Financial Savings Non Financial Savings Savings in Equities % of Equities in Financial SavingsAvengers HeroesNo ratings yet

- CASE-STUDY Growing PainsDocument9 pagesCASE-STUDY Growing PainsZion EliNo ratings yet

- Bwcu Htsqwn00sorvupdk.3Document22 pagesBwcu Htsqwn00sorvupdk.3JoshKernNo ratings yet

- Evaluation of Digital Realty Trust IncDocument18 pagesEvaluation of Digital Realty Trust Incwafula stanNo ratings yet

- Analysis and Interpretation - BalladaDocument4 pagesAnalysis and Interpretation - BalladaClaire Evann Villena EboraNo ratings yet

- Axial 5 Minute DCF ToolDocument11 pagesAxial 5 Minute DCF ToolziuziNo ratings yet

- Q1 2020-21 Fact Sheet PDFDocument27 pagesQ1 2020-21 Fact Sheet PDFJose CANo ratings yet

- Alle FSA ExercisesDocument11 pagesAlle FSA Exercisesmsoegaard.kristensenNo ratings yet

- FINAL Case Study 2 Growing PainsDocument15 pagesFINAL Case Study 2 Growing PainsCheveem Grace Emnace100% (1)

- RatiosDocument25 pagesRatiosJarin Tasnim LiraNo ratings yet

- Cash Flow ModelDocument1 pageCash Flow ModelVinay KumarNo ratings yet

- 2018 Capital Spending Machine Tools ReportDocument8 pages2018 Capital Spending Machine Tools ReportPonce MrlnNo ratings yet

- Gabriel IndiaDocument137 pagesGabriel IndiaIshaan MakkerNo ratings yet

- Presentación User Valuation DamodaranDocument42 pagesPresentación User Valuation Damodaranfrank bautistaNo ratings yet

- Gestion-Ecommerce-Marketplaces OKDocument121 pagesGestion-Ecommerce-Marketplaces OKCarlos Samper BaidezNo ratings yet

- Valuation Insurance GPI HoldingDocument15 pagesValuation Insurance GPI HoldingGiorgi MeskhishviliNo ratings yet

- Sensitivity Model - CompleteDocument7 pagesSensitivity Model - CompleteJames BondNo ratings yet

- Wal-Mart Stores, Inc. - Summary of Financial Statements: Historical Projected 2012 RevenueDocument18 pagesWal-Mart Stores, Inc. - Summary of Financial Statements: Historical Projected 2012 RevenueRakshana SrikanthNo ratings yet

- General Motors Corp: ISIN: US37045V1008 WKN: 37045V100 Asset Class: StockDocument2 pagesGeneral Motors Corp: ISIN: US37045V1008 WKN: 37045V100 Asset Class: StockGate Bennet4No ratings yet

- Us37045v1008 2019 12 10 PDFDocument2 pagesUs37045v1008 2019 12 10 PDFGate Bennet4No ratings yet

- Financial PlanDocument10 pagesFinancial Planapi-25978665No ratings yet

- SiemensDocument9 pagesSiemensCam SNo ratings yet

- vAJ1-DCF Spreadsheet FreeDocument6 pagesvAJ1-DCF Spreadsheet FreesumanNo ratings yet

- Criterion Weight Word In-House Press Financial Third PartyDocument9 pagesCriterion Weight Word In-House Press Financial Third PartyArdia salsabilaNo ratings yet

- Annual Letter 2017Document24 pagesAnnual Letter 2017Incandescent CapitalNo ratings yet

- Nisha PPT 1Document13 pagesNisha PPT 1Anonymous Fr37v90cqNo ratings yet

- Summary Prospectus Tradewale Managed Fund 022019Document8 pagesSummary Prospectus Tradewale Managed Fund 022019hyenadogNo ratings yet

- INE N: Franchisee Financial Controls Investment TemplateDocument2 pagesINE N: Franchisee Financial Controls Investment TemplatePatrick D'souzaNo ratings yet

- Finance Case Study For Tech Startup Video.01Document10 pagesFinance Case Study For Tech Startup Video.01koenigNo ratings yet

- Philbin Financial GroupDocument13 pagesPhilbin Financial GroupakbarNo ratings yet

- Why WACC Is Important To Consider For CompaniesDocument8 pagesWhy WACC Is Important To Consider For Companiesfarhann JattNo ratings yet

- 1 1 4欧洲站简介Document32 pages1 1 4欧洲站简介calvinianzNo ratings yet

- NP EX 4 SunriseDocument13 pagesNP EX 4 SunriseakbarNo ratings yet

- Cash Flow Statement Data 2015 2016 2017Document9 pagesCash Flow Statement Data 2015 2016 2017milzamamelNo ratings yet

- Fina Sample ReportsDocument61 pagesFina Sample ReportsqNo ratings yet

- File 19-Class Wrap-Ups 17Document7 pagesFile 19-Class Wrap-Ups 17alroy dcruzNo ratings yet

- File 19-Class Wrap-Ups 16Document7 pagesFile 19-Class Wrap-Ups 16alroy dcruzNo ratings yet

- Acer Q3 2010 Investor ConferenceDocument19 pagesAcer Q3 2010 Investor ConferenceHsin-Hung YuNo ratings yet

- BAJAJ AUTO LTD - Quantamental Equity Research ReportDocument1 pageBAJAJ AUTO LTD - Quantamental Equity Research ReportVivek NambiarNo ratings yet

- S&P 500 Earnings Dashboard - Dec. 6Document11 pagesS&P 500 Earnings Dashboard - Dec. 6Anonymous V7Ozz1wnNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Asian Paints: Prepared byDocument54 pagesAsian Paints: Prepared bylaxmi joshiNo ratings yet

- Individual Financial ModellingDocument15 pagesIndividual Financial ModellingVinayak SharmaNo ratings yet

- ALS Annual Report 2019Document98 pagesALS Annual Report 2019Scott SchonbergerNo ratings yet

- Calculations Tata NanoDocument5 pagesCalculations Tata NanovighneshmehtaNo ratings yet

- FinalDocument26 pagesFinalHarshit MehtaNo ratings yet

- Investment Opportunity: Kikbit Foods India Pvt. LTDDocument18 pagesInvestment Opportunity: Kikbit Foods India Pvt. LTDAlexNo ratings yet

- Victoria Novak Case ScenarioDocument67 pagesVictoria Novak Case ScenarioAstanaNo ratings yet

- Siloam International Hospitals - 2Q20 Company PresentationDocument57 pagesSiloam International Hospitals - 2Q20 Company PresentationFerry TimothyNo ratings yet

- Solution Manual For Fundamentals of Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Bradford JordanDocument38 pagesSolution Manual For Fundamentals of Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Bradford Jordandepartbuildatm8100% (13)

- 2022 01 24 Draft SCB MittonDocument8 pages2022 01 24 Draft SCB MittonJayNo ratings yet

- Financial Applications For Eicher Motors PDFDocument43 pagesFinancial Applications For Eicher Motors PDFLogesh KumarNo ratings yet

- Foreign ExchangeDocument30 pagesForeign ExchangeAmy SorensenNo ratings yet

- Ratios & Interpretation 2022Document12 pagesRatios & Interpretation 2022Uma NNo ratings yet

- Indigo PaintsDocument16 pagesIndigo PaintsParthNo ratings yet

- Fito Company Frutarom Company OverviewDocument40 pagesFito Company Frutarom Company OverviewprocopiodelllanoNo ratings yet

- Kaushal Kumar Agarwal: The Manager The ManagerDocument33 pagesKaushal Kumar Agarwal: The Manager The ManagerGurjeevNo ratings yet

- Chemicals - Sector Update - 03 Oct 22Document48 pagesChemicals - Sector Update - 03 Oct 22Davuluri OmprakashNo ratings yet

- Valuations Chapter 05 ProblemsDocument6 pagesValuations Chapter 05 Problemsdakis cherishjoyfNo ratings yet

- Excel Files For Case 12 Value PublishingDocument12 pagesExcel Files For Case 12 Value PublishingOmer KhanNo ratings yet

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document11 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Akshay rajNo ratings yet

- Chapter 12. Tool Kit For Financial Planning and Forecasting Financial StatementsDocument57 pagesChapter 12. Tool Kit For Financial Planning and Forecasting Financial StatementsHenry RizqyNo ratings yet

- Results r04Document36 pagesResults r04Logan paulNo ratings yet

- LB 4Document39 pagesLB 4priyanshuNo ratings yet

- Cheat Sheet For ValuationDocument4 pagesCheat Sheet For ValuationRISHAV BAIDNo ratings yet

- Asked: QuestionsDocument15 pagesAsked: QuestionsTushar NegiNo ratings yet