Professional Documents

Culture Documents

Direct Tax Report

Direct Tax Report

Uploaded by

giri007670980 ratings0% found this document useful (0 votes)

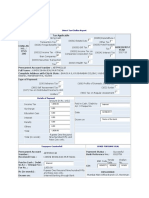

7 views1 pageThis document is a tax challan receipt for Manxxxxuparambil Jijith for the 2019-20 tax year. It shows a self-assessment tax payment of Rs. 10.00 through ICICI Bank internet banking on August 27, 2019. The challan is for income tax applicable to individuals, not companies. Key details provided include the taxpayer's name, PAN, address, payment amount and status, bank reference number, and tax year.

Original Description:

tax

Original Title

DirectTaxReport

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a tax challan receipt for Manxxxxuparambil Jijith for the 2019-20 tax year. It shows a self-assessment tax payment of Rs. 10.00 through ICICI Bank internet banking on August 27, 2019. The challan is for income tax applicable to individuals, not companies. Key details provided include the taxpayer's name, PAN, address, payment amount and status, bank reference number, and tax year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageDirect Tax Report

Direct Tax Report

Uploaded by

giri00767098This document is a tax challan receipt for Manxxxxuparambil Jijith for the 2019-20 tax year. It shows a self-assessment tax payment of Rs. 10.00 through ICICI Bank internet banking on August 27, 2019. The challan is for income tax applicable to individuals, not companies. Key details provided include the taxpayer's name, PAN, address, payment amount and status, bank reference number, and tax year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

CHALLAN NO.

Tax Applicable Assessment

/ ITNS Year

✔ (0021) INCOME-TAX (OTHER THAN (0020) INCOME-TAX ON

ITNS 280 COMPANIES) COMPANIES(CORPORATION TAX) 2019-20

PAN : AEFPJ0024A

Full Name : MANXXXXUPARAMBIL JIJITH

Complete ITR MARUVAPPADAM 10 PALAKKAD KERALA TAMILNADU-678701

Address with

City & State :

Tel. No. : 0

Type of Payment

(100) ADVANCE TAX (106) PROFITS OF DOMESTIC COMPANIES

✔ (300) SELF ASSESSMENT TAX (102) SURTAX

(107) TAX ON DISTRIBUTED INCOME TO UNIT (400) TAX ON REGULAR ASSESSMENT

HOLDERS

(800) TDS ON SALE OF PROPERTY

Details of Payment FOR USE IN RECEIVING BANK

Amount (in Rs. only) Debit to A/c / Cheque credited on

Income Tax: 10.00 27/08/2019 (dd/MM/yyyy)

Surcharge: 0.00 Payment Status : Success

Education Cess: 0.00 Bank Reference No. : 1784668190

Interest: 0.00 SPACE FOR BANK SEAL

Penalty: 0.00 ICICI Bank

Others: 0.00 Uttam Nagar, New Delhi

Total: 10.00 CIN

Total (in words): BSR Code : 6390340

Crores Lakhs Thousands Hundreds Tens Units Tender Date : 270819

Zero Zero Zero Zero One Zero Challan Serial No. : 53092

Debit to A/c: 001601516774

Date: 27/08/2019 Rs : 10.00

Internet Banking Payment through

Drawn on: ICICI Bank

Taxpayers Counterfoil Payment Status : Success

PAN: AEFPJ0024A Bank Reference No. : 1784668190

Received From : MANXXXXUPARAMBIL JIJITH SPACE FOR BANK SEAL

Paid in Cash / Debit to 001601516774 ICICI Bank

A/c / Cheque No : Uttam Nagar, New Delhi

For Rs. : 10.00 CIN

Rs (in words) : Rupees Ten and Zero paise only BSR Code : 6390340

Internet Banking Payment through

Drawn On : Tender Date : 270819

ICICI Bank

Challan Serial No. : 53092

(0021) INCOME-TAX (OTHER THAN

On Account of : COMPANIES)

Type of Payment : (300) SELF ASSESSMENT TAX Rs : 10.00

For the Assessment 2019-20

Year :

You might also like

- TDS Challan 06-05-18Document1 pageTDS Challan 06-05-18sandipgargNo ratings yet

- DirectTaxReport Challan 1 Cp203Document1 pageDirectTaxReport Challan 1 Cp203Madhyam JeswaniNo ratings yet

- Direct Taxes 639034001021902385Document1 pageDirect Taxes 639034001021902385Raghava KruthiventiNo ratings yet

- UntitledDocument1 pageUntitledw sNo ratings yet

- TaxDocument1 pageTaxSUNYYRNo ratings yet

- #A#c#0#47m - 639034022092104544 - Itns280 - 22092021 - Aveva Information Technology India Private LimitedDocument1 page#A#c#0#47m - 639034022092104544 - Itns280 - 22092021 - Aveva Information Technology India Private LimitedVinayak DhotreNo ratings yet

- TDS ChalanDocument1 pageTDS ChalanRAKHAL BAIRAGINo ratings yet

- View Tax Payment Details: Reference Number: 29973328Document1 pageView Tax Payment Details: Reference Number: 29973328arjuntyagi22No ratings yet

- View Tax Payment Details: Reference Number: 29973456Document2 pagesView Tax Payment Details: Reference Number: 29973456arjuntyagi22No ratings yet

- Blrp25916c 639034031072221993 Itns281 31072022 Plaxxxxsters Moulding Private LimitedDocument1 pageBlrp25916c 639034031072221993 Itns281 31072022 Plaxxxxsters Moulding Private LimitedAMIE ELCIT JOSE 20212065No ratings yet

- Mrts18865a - 639034006082151575 - Itns281 - 06082021 - Sigxxxxre OverseasDocument1 pageMrts18865a - 639034006082151575 - Itns281 - 06082021 - Sigxxxxre OverseasCA Akash AgrawalNo ratings yet

- TDS ChalanDocument1 pageTDS ChalanRAKHAL BAIRAGINo ratings yet

- Direct Tax Challan ReportDocument2 pagesDirect Tax Challan ReportVivek MurtadakNo ratings yet

- Direct Taxes 639034004081721340Document1 pageDirect Taxes 639034004081721340AshishNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentramuNo ratings yet

- 23040900089042SBIN ChallanReceiptDocument1 page23040900089042SBIN ChallanReceiptbhargava ram gottamNo ratings yet

- 23051400030376SBIN ChallanReceiptDocument1 page23051400030376SBIN ChallanReceiptgandvssNo ratings yet

- Direct Tax Challan Report: Save PrintDocument2 pagesDirect Tax Challan Report: Save PrintRavi JujjavarapuNo ratings yet

- #U#a#5#45g - 639034028042233809 - Itns281 - 28042022 - Aveva Information Technology India PVT LTDDocument1 page#U#a#5#45g - 639034028042233809 - Itns281 - 28042022 - Aveva Information Technology India PVT LTDVinayak DhotreNo ratings yet

- CBDTSMChallanForm28 04 2019 PDFDocument1 pageCBDTSMChallanForm28 04 2019 PDFSanjeev Kumar ChauhanNo ratings yet

- CBDTSMChallanForm28 04 2019 PDFDocument1 pageCBDTSMChallanForm28 04 2019 PDFSanjeev Kumar ChauhanNo ratings yet

- 23042000194169SBIN ChallanReceiptDocument1 page23042000194169SBIN ChallanReceiptTamarala SrimanNo ratings yet

- CBDTSMChallanForm02 09 2022Document1 pageCBDTSMChallanForm02 09 2022asok maitiNo ratings yet

- 23050700045811HDFC ChallanReceiptDocument1 page23050700045811HDFC ChallanReceiptVishal GoyalNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentArun KambleNo ratings yet

- Uk Knitting ChallanDocument1 pageUk Knitting Challankavinkandasamy95No ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Acc PDFDocument4 pagesAcc PDFShakir MujtabaNo ratings yet

- 23031500648647ICIC ChallanReceiptDocument1 page23031500648647ICIC ChallanReceiptUpendra BardhanNo ratings yet

- ChallanFormDocument1 pageChallanFormiemjalaalNo ratings yet

- No:-0013826418 - Issue Date 10.09.2020: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0013826418 - Issue Date 10.09.2020: Alliance Broadband Services Pvt. LTDIrfan AzmiNo ratings yet

- Income Tax Challan 280Document2 pagesIncome Tax Challan 280RamarNo ratings yet

- ePayDirectTaxPaymentCyberReceipt - Aug 12 - 205447Document1 pageePayDirectTaxPaymentCyberReceipt - Aug 12 - 205447Sujan SamantaNo ratings yet

- Itr PaymentDocument1 pageItr PaymentAjit GuptaNo ratings yet

- Broadband Bill Dec 2020Document1 pageBroadband Bill Dec 2020Irfan AzmiNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaAshwani TiwariNo ratings yet

- No:-0015560174 - Issue Date 08.03.2021: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0015560174 - Issue Date 08.03.2021: Alliance Broadband Services Pvt. LTDAbignale VostroeNo ratings yet

- 23042500276569SBIN ChallanReceiptDocument1 page23042500276569SBIN ChallanReceiptNarayani ChhatriNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan Receiptchatore's ChaatNo ratings yet

- Medipath TDS 1st Oct 22Document1 pageMedipath TDS 1st Oct 22asok maitiNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentKailash PandeyNo ratings yet

- 23051400029648SBIN ChallanReceiptDocument1 page23051400029648SBIN ChallanReceiptgandvssNo ratings yet

- Sss Hemant 562Document1 pageSss Hemant 562msNo ratings yet

- 23031500094781KKBK ChallanReceiptDocument1 page23031500094781KKBK ChallanReceiptHARSH KUMAR SINGHNo ratings yet

- App 7000034 TXN 172882049 TMPLT 995Document2 pagesApp 7000034 TXN 172882049 TMPLT 995tamil maran.uNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan ReceiptRinku TyagiNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentPWD HIGHWAYNo ratings yet

- No:-0019540753 - Issue Date 11.03.2022: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0019540753 - Issue Date 11.03.2022: Alliance Broadband Services Pvt. LTDShrNo ratings yet

- 23030900204760CNRB ChallanReceiptDocument1 page23030900204760CNRB ChallanReceiptkajalNo ratings yet

- ChallanFormDocument1 pageChallanFormomNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan ReceiptMansi JainNo ratings yet

- Short Note of GKDocument1 pageShort Note of GKSymon RoyNo ratings yet

- 23031100012487UTIB ChallanReceiptDocument1 page23031100012487UTIB ChallanReceiptAditi GoelNo ratings yet

- Tax Payer Counterfoil: State Bank of IndiaDocument1 pageTax Payer Counterfoil: State Bank of IndiaInspiring IndiaNo ratings yet

- Tax Invoice: Original For RecipientDocument3 pagesTax Invoice: Original For RecipientMridupaban DuttaNo ratings yet

- BroadBand Invoice Apr 24Document1 pageBroadBand Invoice Apr 24Subhra Prakash NaskarNo ratings yet

- Prabhakar Challan - 2022Document1 pagePrabhakar Challan - 2022KATTA VENKATA KRISHNAIAHNo ratings yet

- Original: N 0004898912 - Issue Date 19.10.2016Document1 pageOriginal: N 0004898912 - Issue Date 19.10.2016Soham ChaudhuriNo ratings yet

- AAFHH9372D 23061100002934ICIC DTAX 11062023 TaxPayerDocument1 pageAAFHH9372D 23061100002934ICIC DTAX 11062023 TaxPayerSamyak DahaleNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- IT AigetoaDocument512 pagesIT Aigetoagiri00767098No ratings yet

- Benign Diseases of CervixDocument30 pagesBenign Diseases of Cervixgiri00767098No ratings yet

- Acute MiDocument45 pagesAcute Migiri00767098100% (1)

- Vdedk FebDocument4 pagesVdedk Febgiri00767098No ratings yet