Professional Documents

Culture Documents

BBK 2020-Q1-Results

BBK 2020-Q1-Results

Uploaded by

Manil UniqueOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBK 2020-Q1-Results

BBK 2020-Q1-Results

Uploaded by

Manil UniqueCopyright:

Available Formats

Absa Bank Kenya PLC

The Board of Directors of Absa Bank Kenya PLC is pleased to announce the unaudited group results

for the period ended 31 March 2020

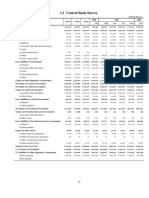

BANK GROUP

March December March March December March March December March

2019 2019 2020 2019 2019 2020 2019 2019 2020

Shs '000 Shs '000 Shs '000 Shs '000 Shs '000 Shs '000 Shs '000 Shs '000 Shs '000

Unaudited Audited Unaudited Unaudited Audited Unaudited Unaudited Audited Unaudited

I STATEMENT OF FINANCIAL POSITION III OTHER DISCLOSURES

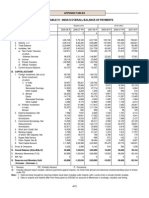

A ASSETS 1) Non-performing loans and advances

1 Cash balances (both local and foreign) 4,499,813 7,091,076 6,017,150 4,499,813 7,091,076 6,017,150 a) Gross non-performing loans and advances 15,415,660 13,518,692 17,334,399

2 Balances due from Central Bank of Kenya 17,578,406 21,716,447 16,307,091 17,578,406 21,716,446 16,307,091 b) Less: Interest in suspense 2,995,035 2,601,418 2,378,272

3 Kenya government and other securities held for dealing purposes 33,840,168 43,774,296 43,114,786 33,840,168 43,774,296 43,114,786 c) Total non performing loans and advances 12,420,625 10,917,274 14,956,127

4 Financial assets at fair value through profit and loss - - - - - - d) less: loan loss provisions 7,454,825 7,807,800 8,794,546

5 Investment securities: - - - - e) Net non performing loans(c-d) 4,965,800 3,109,474 6,161,581

a) Held to maturity: - - - - - f) Discounted value of securities 2,367,319 1,981,629 2,097,740

a. Kenya government securities - - - - - - g) Net NPLs (excess) / exposure (e-f) 2,598,481 1,127,845 4,063,841

b. Other securities - - - - - - 2) Insider loans and advances

b) Fair value through other comprehensive income (FVOCI) 82,693,442 78,785,265 81,850,333 83,110,015 79,221,471 82,267,415 a) Directors ,shareholders and associates 40,286 39,330 38,796

a. Kenya government securities 82,693,442 78,785,265 81,850,333 83,110,015 79,221,471 82,267,415 b) Employees 10,457,027 10,340,168 10,264,813

b. Other securities - - - - - c) Total insider loans and advances 10,497,313 10,379,498 10,303,609

6 Deposits and balances due from local banking Institutions 102,295 2,000,000 525,750 102,295 2,000,000 525,750 3) Off balance sheet items

7 Deposits and balances due from banking Institutions abroad 2,457,444 1,803,084 1,526,623 2,457,444 1,803,084 1,526,623 a) Letters of credit ,guarantees, acceptances 22,212,163 23,208,133 22,428,834

8 Tax recoverable - 292,160 - - 424,950 - b) Forwards, swaps and options 67,256,267 103,646,010 105,254,274

9 Loans and advances to customers(net) 180,498,811 194,894,941 202,959,640 180,498,811 194,894,941 202,959,640 c) Other contingent liabilities

10 Balances due from banking institutions in the group 9,142,333 9,203,788 13,139,854 9,142,333 8,702,992 12,648,041 Total contingent liabilities 89,468,430 126,854,143 127,683,108

11 Investment in associates - - - - - - 4) Capital strength

12 Investment in subsidiary companies 362,761 372,761 372,761 - - - a) Core capital 38,489,401 38,706,623 39,622,302

13 Investment in joint ventures - - - - - - b) Minimum statutory capital 1,000,000 1,000,000 1,000,000

14 Investment properties - - - - - - c) Excess / (Deficiency) 37,489,401 37,706,623 38,622,302

15 Property and equipment 3,167,197 2,889,187 3,349,411 3,167,497 2,889,401 3,349,609 d) Supplementary capital 5,040,122 7,601,251 7,886,246

16 Prepaid operating rental leases 45,486 35,299 35,299 45,486 35,299 35,299 e) Total capital 43,529,523 46,307,874 47,508,548

17 Intangible assets 745,775 538,836 453,966 805,246 617,994 532,486 f) Total risk weighted assets 263,256,798 277,812,947 288,089,488

18 Deferred tax 2,468,813 3,097,482 2,928,757 2,497,036 3,123,014 2,964,893 g) Core capital / total deposit liabilities 17.3% 16.3% 16.6%

19 Retirement benefit asset - - - - - - h) Minimum statutory ratio 8.0% 8.0% 8.0%

20 Other assets 7,900,116 7,614,578 9,111,535 7,683,582 7,686,827 9,271,976 i) Excess/(deficiency) 9.3% 8.3% 8.6%

21 TOTAL ASSET 345,502,860 374,109,200 381,692,956 345,428,132 373,981,791 381,520,759 j) Core capital / total risk weighted assets 14.6% 13.9% 13.8%

k) Minimum statutory ratio 10.5% 10.5% 10.5%

B LIABILITIES l) Excess/(deficiency) 4.1% 3.4% 3.3%

m) Total capital / total risk weighted assets 16.5% 16.6% 16.5%

22 Balances due to Central Bank of Kenya - - - - - - n) Minimum statutory ratio 14.5% 14.5% 14.5%

23 Customers' deposits 223,982,507 238,291,230 239,406,298 223,982,507 237,738,654 238,713,526 o) Excess/(deficiency) 2.0% 2.1% 2.0%

24 Deposits and balances due to banking institutions (local) 6,304,816 3,753,767 2,766,843 6,304,816 3,753,767 2,766,843 p) Adjusted Core Capital/Total Deposit Liabilities* 17.5% 16.8% 17.0%

25 Deposits and balances due to banking institutions (foreign) 940,340 329,655 2,129,849 940,340 329,655 2,129,849 q) Adjusted Core Capital/Total Risk Weighted Assets* 14.8% 14.3% 14.0%

26 Other money market deposits - - - - - - r) Adjusted Total Capital/Total Risk Weighted Assets* 16.7% 17.0% 16.7%

27 Borrowed funds - - - - - - 5) Liquidity

28 Balances due to banking institutions in the group 55,638,779 72,688,316 74,619,285 55,638,779 71,977,669 73,846,688 a) Liquidity ratio 41.1% 39.8% 37.9%

29 Tax payable 1,229,738 - 431,564 1,205,757 - 350,773 b) Minimum statutory ratio 20.0% 20.0% 20.0%

30 Dividends payable - - 4,888,382 - 4,888,382 c) Excess / (Deficiency) 21.1% 19.8% 17.9%

31 Deferred tax liability - - - - - -

32 Retirement benefit liability 5,424 - 5,126 5,424 - 5,126 Message from the Directors:

33 Other liabilities 12,257,992 14,966,818 16,388,249 11,295,816 14,992,630 16,533,186

34 Total liabilities 300,359,596 330,029,786 340,635,596 299,373,439 328,792,375 339,234,373 The statement of financial position, the statement of comprehensive income and the disclosures presented above

have been prepared from the financial records of the bank and its subsidiaries. These published statements are

C SHAREHOLDERS' FUNDS also available on the bank’s website www.absabank.co.ke and at its headquarters on Waiyaki Way, Nairobi.

35 Paid up/assigned capital 2,715,768 2,715,768 2,715,768 2,715,768 2,715,768 2,715,768

Following separation of the Absa Group from Barclays PLC and the launch of a new brand, the bank has made,

36 Share premium/(discount) - - - - - -

and will continue to make over the next two years, substantial investments in systems and in rebranding its

37 Revaluation reserves 671,353 275,528 305,421 673,747 281,247 306,767

operations. The bank will also over this transition period continue to acquire, at arm’s length, various services

38 Retained earnings/(accumulated losses) 36,673,782 35,990,855 37,823,328 37,582,817 37,095,138 39,051,008

from Barclays PLC. These separation costs have been disclosed separately as exceptional items on the statement

39 Statutory loan loss reserve - - - - - -

of comprehensive income above.

40 Other reserves 193,979 208,881 212,843 193,979 208,881 212,843

41 Proposed dividend 4,888,382 4,888,382 - 4,888,382 4,888,382 - Absa is responding to the evolving COVID-19 crisis

42 Capital grants - - - - - -

43 Total shareholders' funds 45,143,264 44,079,414 41,057,360 46,054,693 45,189,416 42,286,386 On 11 March 2020, the World Health Organization declared COVID-19 (novel coronavirus) a pandemic. This serious

44 Minority Interest - - - public health and economic crisis requires decisive and coordinated action from all spheres of society. The level of

45 Total liabilities and total shareholders funds 345,502,860 374,109,200 381,692,956 345,428,132 373,981,791 381,520,759 uncertainty relating to this crisis is high and unprecedented, and its impact on markets and the global economy is

already profound. This will have a negative impact on businesses globally including the banking industry in Kenya.

II STATEMENT OF COMPREHENSIVE INCOME The banking industry will feel the covid impact from April and most likely continue throughout the year.

1.0 INTEREST INCOME

Absa responded immediately to protect the health of our employees, customers, clients and other stakeholders.

1.1 Loans and advances to customers 5,415,186 22,544,646 5,468,471 5,415,186 22,544,646 5,468,471

Our response included measures to educate, protect and inform our employees about the COVID-19 virus,

1.2 Government securities 1,933,065 8,065,268 2,072,110 1,937,435 8,101,769 2,082,473

including heightened cleaning protocols in line with expert guidelines from health agencies. We have put in place

1.3 Deposits and placements with banking institutions 63,632 377,506 69,357 63,632 377,506 69,357

various measures for our customers ranging from waiving fees on digital transactions to providing loan relief

1.4 Other interest income - - - - - -

options, including loan repayment relief of up to twelve months. For our community, we have donated KES 50

1.5 Total interest income 7,411,883 30,987,420 7,609,938 7,416,253 31,023,921 7,620,301

million in support of the efforts by the government and other Kenyans of goodwill against the COVID 19

2.0 INTEREST EXPENSES

pandemic. These funds will be used for the acquisition of Personal Protective Equipment (PPEs), psychosocial

2.1 Customer deposits 1,760,848 6,466,845 1,538,216 1,760,848 6,454,616 1,528,850

support programs, business resilience training, and mentorship programs for SMEs to help them survive through

2.2 Deposits and placements with banking institutions 269,006 1,255,049 411,369 266,001 1,252,044 411,369

this difficult time.

2.3 Other interest expenses - 138,722 47,552 - 138,722 47,552

2.4 Total interest expenses 2,029,854 7,860,616 1,997,137 2,026,849 7,845,382 1,987,771 They were approved by the board on Wednesday 27th May, 2020 and signed on its behalf by:

3.0 NET INTEREST INCOME 5,382,029 23,126,804 5,612,801 5,389,404 23,178,539 5,632,530

4.0 NON - INTEREST INCOME Chairman Managing Director

4.1 Fees and commissions income on loans & advances 359,090 1,410,349 390,703 359,090 1,410,349 390,703 Charles Muchene Jeremy Awori

4.2 Other fees and commissions 989,684 4,125,135 902,201 1,160,116 4,710,388 1,125,756

4.3 Foreign exchange trading income 775,710 3,640,577 1,143,129 775,710 3,640,577 1,143,129

4.4 Dividend income - - - - - -

4.5 Other income 269,218 841,964 313,056 269,218 826,998 309,315

4.6 Total non-interest income 2,393,702 10,018,025 2,749,089 2,564,134 10,588,312 2,968,903

5.0 Total operating income 7,775,731 33,144,829 8,361,890 7,953,538 33,766,851 8,601,433

6.0 OPERATING EXPENSES

6.1 Loan loss provision 636,675 4,199,411 1,114,502 636,675 4,200,588 1,115,689

6.2 Staff costs 2,301,689 9,999,145 2,431,687 2,336,106 10,158,447 2,491,078

6.3 Directors emoluments 37,167 172,623 45,013 38,707 178,783 47,241

6.4 Rental charge 156,477 92,887 23,734 148,511 93,371 23,734

6.5 Depreciation on property and equipment 281,926 1,069,667 263,810 281,926 1,069,728 263,826

6.6 Amortisation charges 100,606 391,749 99,731 100,606 392,501 102,046

6.7 Other operating expenses 1,369,951 5,361,876 1,113,559 1,382,407 5,392,198 1,127,552

7.0 Total operating expenses 4,884,491 21,287,358 5,092,036 4,924,938 21,485,616 5,171,166

Profit before tax and exceptional items 2,891,240 11,857,471 3,269,854 3,028,600 12,281,235 3,430,267

8.0 Exceptional items 243,410 1,528,986 552,056 243,410 1,528,986 552,056

9.0 Profit after exceptional items 2,647,830 10,328,485 2,717,798 2,785,190 10,752,249 2,878,211

10 Current tax (1,134,948) (3,884,767) (728,269) (1,181,590) (4,021,267) (775,159)

11 Deferred tax 287,416 717,727 (155,942) 296,050 725,095 (147,184)

12 Profit after tax and exceptional items 1,800,298 7,161,445 1,833,587 1,899,650 7,456,077 1,955,868

13 OTHER COMPREHENSIVE INCOME

13.1 Gains/(losses) from translating the financial statements of - - - - - -

foreign operations

13.2 Fair value changes in FVOCI financial assets 203,853 (361,612) 42,704 205,414 (355,299) 36,457

13.3 Revaluation surplus on property,plant and equipment - - - -

13.4 Share of other comprehensive income of associates - - - -

13.5 Income tax relating to components of other comprehensive (61,156) 108,484 (12,811) (61,624) 106,590 (10,937)

income

14 Other comprehensive Income for the year net of tax 142,697 (253,128) 29,893 143,790 (248,709) 25,520

15 Total comprehensive income for the year 1,942,995 6,908,317 1,863,480 2,043,440 7,207,368 1,981,388

Earnings per share (Shs) 0.33 1.32 0.34 0.35 1.37 0.36

Dividends per share (Shs) - 1.10 - - 1.10 -

Absa Bank Kenya PLC company registration no. C18208, is regulated by the Central Bank of Kenya.

You might also like

- Financial Reporting First Take - Ron KingDocument340 pagesFinancial Reporting First Take - Ron KingYuan Fu100% (1)

- F3 Study Textbook-421-545Document125 pagesF3 Study Textbook-421-545Van Tu To100% (1)

- Afar05 Consolidated Financial Statements Part 1 ReviewersDocument13 pagesAfar05 Consolidated Financial Statements Part 1 ReviewersLara0% (1)

- Final Balance Sheet As On 31.03.2021... 06.12.2021Document101 pagesFinal Balance Sheet As On 31.03.2021... 06.12.2021Naman JainNo ratings yet

- BBK 2015 q1 FinancialsDocument1 pageBBK 2015 q1 FinancialsManil UniqueNo ratings yet

- Stanbic Bank Q3 2023 Financial ResultsDocument1 pageStanbic Bank Q3 2023 Financial Resultskaranjamike565No ratings yet

- ABSA Bank Kenya PLC - Unaudited Group Results For The Period Ended 30-Sep-2023Document1 pageABSA Bank Kenya PLC - Unaudited Group Results For The Period Ended 30-Sep-2023karanjamike565No ratings yet

- Ke SCB Limited Financial Statements 2023Document1 pageKe SCB Limited Financial Statements 2023JamesMMureithiNo ratings yet

- KCB 2021 FY FinancialsDocument1 pageKCB 2021 FY Financialsmika piusNo ratings yet

- BBK 2016 q3 Financials v9Document1 pageBBK 2016 q3 Financials v9Manil UniqueNo ratings yet

- 0000184074-01 - Family Bank LTDDocument1 page0000184074-01 - Family Bank LTDSoko DirectoryNo ratings yet

- Equity Group Holdings PLC Financial Statements For The Year Ended 31st December 2022Document1 pageEquity Group Holdings PLC Financial Statements For The Year Ended 31st December 2022shadehdavNo ratings yet

- PakdebtDocument1 pagePakdebtkashifzieNo ratings yet

- EGH PLC Financial Statements For The Period Ended 31st March 2022Document2 pagesEGH PLC Financial Statements For The Period Ended 31st March 2022Saeedullah KhosoNo ratings yet

- Balsheet 29032021052755PMDocument1 pageBalsheet 29032021052755PMbhanuprakash.ctoNo ratings yet

- Barclays Results q1 2014Document2 pagesBarclays Results q1 2014Manil UniqueNo ratings yet

- Diamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Document6 pagesDiamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Anonymous KAIoUxP7100% (1)

- Financial Data Year 2019-20Document9 pagesFinancial Data Year 2019-20Sabarna ChakrabortyNo ratings yet

- Money CreditDocument14 pagesMoney CreditAdil IshaqueNo ratings yet

- BBK 2017 H1-Results-V6-TwinDocument1 pageBBK 2017 H1-Results-V6-TwinManil UniqueNo ratings yet

- Proforma Balance SheetDocument24 pagesProforma Balance SheetBarbara YoungNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- TTIL Annual Report 2021Document148 pagesTTIL Annual Report 2021DY LeeNo ratings yet

- Published Mar 2023Document17 pagesPublished Mar 2023sei jrNo ratings yet

- RAB Financials 2020Document7 pagesRAB Financials 2020029 Anil ReddyNo ratings yet

- Rastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09Document1 pageRastriya Banijya Bank Limited Singhdurbar Plaza, Kathmandu Unaudited Financial Results (Quarterly) As at 1St Quarter of Fiscal Year 2008-09gonenp1No ratings yet

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Document14 pagesRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraNo ratings yet

- Audited Financial Results For The Quarter and Year Ended March 31, 2023Document6 pagesAudited Financial Results For The Quarter and Year Ended March 31, 2023vikaspawar78No ratings yet

- Chapter 5Document12 pagesChapter 5Arjun Singh ANo ratings yet

- NCC Urban May Fair - Financial Statements - Dec 31, 2023Document5 pagesNCC Urban May Fair - Financial Statements - Dec 31, 2023sri rajani swarna lathaNo ratings yet

- Balance Sheet As at 31st March 2015Document1 pageBalance Sheet As at 31st March 2015Mrigul UppalNo ratings yet

- Appendix Table 8: India'S Overall Balance of PaymentsDocument1 pageAppendix Table 8: India'S Overall Balance of PaymentsPandu PrasadNo ratings yet

- Standalone Financial Statements of Nagarro SE: (For The Financial Year 2021 in Accordance With German Gaap)Document20 pagesStandalone Financial Statements of Nagarro SE: (For The Financial Year 2021 in Accordance With German Gaap)PolloFlautaNo ratings yet

- Ebl 2016 Is BSDocument3 pagesEbl 2016 Is BSAasim Bin BakrNo ratings yet

- Q4 - Interim Financial StatementsDocument20 pagesQ4 - Interim Financial Statementsshresthanikhil078No ratings yet

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaNo ratings yet

- Management Accounting: Assignment 1Document8 pagesManagement Accounting: Assignment 1franky_pawanNo ratings yet

- AB Bank - 2022Document131 pagesAB Bank - 2022Mostafa Noman DeepNo ratings yet

- EFRESHDocument14 pagesEFRESHAnjiReddy DurgampudiNo ratings yet

- 3.nuventures CFS FINALoldDocument32 pages3.nuventures CFS FINALoldNagendra KoreNo ratings yet

- Rafiki MFB Audited Financials FY 2022 31.03.2023Document1 pageRafiki MFB Audited Financials FY 2022 31.03.2023EdwinNo ratings yet

- ' in LakhsDocument53 pages' in LakhsParthNo ratings yet

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Document3 pagesNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7No ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Financial Accounting AssignmentDocument49 pagesFinancial Accounting AssignmentNirmal E ParetNo ratings yet

- Trial Questions For 100Document8 pagesTrial Questions For 100Peter AdjeteyNo ratings yet

- Operational Statistics 2021-22Document45 pagesOperational Statistics 2021-22Vishwanath PatilNo ratings yet

- MS08092022Document3 pagesMS08092022Hoàng Minh ChuNo ratings yet

- Fy2023 Analysis of Revenue and ExpenditureDocument24 pagesFy2023 Analysis of Revenue and ExpenditurePutri AgustinNo ratings yet

- Quarter Report April 20 2022Document29 pagesQuarter Report April 20 2022Binu AryalNo ratings yet

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiNo ratings yet

- Analisa Stockbid KeystatDocument27 pagesAnalisa Stockbid KeystatVirgie FabianNo ratings yet

- Bank of Tanzania: TZS '000 TZS '000Document1 pageBank of Tanzania: TZS '000 TZS '000MKUTA PTBLDNo ratings yet

- Debt 3Document16 pagesDebt 3mohsin.usafzai932No ratings yet

- Clavax Power - TAR - 2023 - Provisional - 10.09Document7 pagesClavax Power - TAR - 2023 - Provisional - 10.09Naresh nath MallickNo ratings yet

- Bop PDFDocument1 pageBop PDFLoknadh ReddyNo ratings yet

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102022Document45 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102022mnbvcxzqwerNo ratings yet

- Business Valuation Model (Template)Document16 pagesBusiness Valuation Model (Template)m.qunees99No ratings yet

- EBL 2016 - L&A Note (7.b.10)Document1 pageEBL 2016 - L&A Note (7.b.10)Anindita SahaNo ratings yet

- Anaven LLPDocument12 pagesAnaven LLPNaveenNo ratings yet

- Fourth Quater Financial Report 2075-76-2Document27 pagesFourth Quater Financial Report 2075-76-2Manish BhandariNo ratings yet

- Contemporary Mathematics For Business and Consumers: By: Robert A. BrechnerDocument23 pagesContemporary Mathematics For Business and Consumers: By: Robert A. BrechnerManan PatelNo ratings yet

- Analysis and Interpretation of DataDocument35 pagesAnalysis and Interpretation of DataAswath ChandrasekarNo ratings yet

- ICAEW-Accounting-QB-2023-chapter 12Document3 pagesICAEW-Accounting-QB-2023-chapter 12daolengan03No ratings yet

- 1101AFE Final Exam Practice Paper SEM 1Document10 pages1101AFE Final Exam Practice Paper SEM 1张兆宇No ratings yet

- SOLUTION TO ASSIGNMENT FOR DISCUSSION (Chapters 1,2,3 and 4)Document17 pagesSOLUTION TO ASSIGNMENT FOR DISCUSSION (Chapters 1,2,3 and 4)ArtisanNo ratings yet

- The Ansh Bakery Store Date TransactionsDocument9 pagesThe Ansh Bakery Store Date Transactionsgaurav sahuNo ratings yet

- Sneaker SolutionDocument19 pagesSneaker SolutionSuperGuyNo ratings yet

- Accounting For Notes PayableDocument10 pagesAccounting For Notes PayableLiza Mae MirandaNo ratings yet

- Accounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentDocument6 pagesAccounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentEmad WajehNo ratings yet

- Chapter 1 - Excercises Solutions Part BDocument5 pagesChapter 1 - Excercises Solutions Part BHECTOR ORTEGANo ratings yet

- 3-Statement Model (Complete)Document16 pages3-Statement Model (Complete)jangan opo? jangan sayurNo ratings yet

- Acf MCQDocument3 pagesAcf MCQShahrukhNo ratings yet

- Important Questions For Accountancy 12th ComDocument17 pagesImportant Questions For Accountancy 12th ComAnkit RoyNo ratings yet

- Depreciation DBM DDBM SYDM For UploadDocument15 pagesDepreciation DBM DDBM SYDM For UploadSabellano, Athena Winna – DalapagNo ratings yet

- Account TestDocument2 pagesAccount Testajay chaudhary0% (1)

- Bad Debts, Depreciation, Pre-Payments & Accruals: AS AccountancyDocument35 pagesBad Debts, Depreciation, Pre-Payments & Accruals: AS AccountancySteve JonzieNo ratings yet

- Practice QuestionsDocument353 pagesPractice QuestionsAwais MehmoodNo ratings yet

- Generally Accepted Accounting Principles Refer To TheDocument55 pagesGenerally Accepted Accounting Principles Refer To TheVimala Selvaraj VimalaNo ratings yet

- Minggu 2 - 3 - Time Value of MoneyDocument79 pagesMinggu 2 - 3 - Time Value of MoneylisdhiyantoNo ratings yet

- 1 Adoption - of - IFRS - Spain PDFDocument31 pages1 Adoption - of - IFRS - Spain PDFJULIO CESAR MILLAN SOLARTENo ratings yet

- Glossary of Financial TermsDocument7 pagesGlossary of Financial TermsCalvin Chavez IIINo ratings yet

- Chapter 14 Financial StatemDocument198 pagesChapter 14 Financial StatemDan Andrei BongoNo ratings yet

- Chapter 12 BudgetDocument9 pagesChapter 12 BudgetJensen SantosNo ratings yet

- Chapter 9 Exercises Acc101Document7 pagesChapter 9 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- EmbutidoDocument46 pagesEmbutidoFrances Mae Ortiz MaglinteNo ratings yet

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document7 pagesFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- UFCW LM-2 2011 Labor Organization Annual ReportDocument255 pagesUFCW LM-2 2011 Labor Organization Annual ReportUnion MonitorNo ratings yet