Professional Documents

Culture Documents

Gatt Declaration

Gatt Declaration

Uploaded by

rupeshkumar084Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gatt Declaration

Gatt Declaration

Uploaded by

rupeshkumar084Copyright:

Available Formats

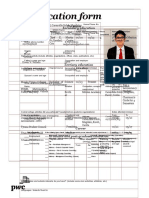

annexure I

DECLARATION FORM ORIGINAL (See Rule 10 of Customs Valuation Rules, 1988) DUPLICATE Note : This declaration shall not be required for goods imported as passengers' Baggage, goods imported for personal use upto value of Rs. 1000/-, Samples of no commercial value, or where the goods are subject to specific rate of duty. 1. 2. 3. Importers Name and Address : Five By Seven Solutions Pvt. Ltd., C4/5, Vasant Vihar, New Delhi 110058 Suppliers Name and Address : NO.122 Dongping Village 2,Siming Zone,Xiamen,Fujian,China Fuqing, Xiamen Of China Name and address of the agent, if any :

Description of goods : Handbag for Laptop Country of Origin : China 6. Port of Shipment: 7. AWB/BL Number and date : 8. IGM Number and date : Contact Number and Date : 10. Nature of Transaction (Sale, Consignment, Hire, Gift, etc.) Sale 11. Invoice Number and Date : 59268752 Date: 9th August, 2011 12. Invoice value : USD 1675/13. Terms of payment: 100% Advance 14. Currency of payment: USD 15. Exchange rate : 16. Terms of Delivery FOB 17. Relationship between buyer and seller [Rule 2 (2)]: 18. If related, what is the basis of declared value : 19. Conditions or Restrictions attached with the sale [Rule 4 (2)] 20. Valuation Method applicable, (See Rule 4 to 8): 21. Cost and services not included in the invoice value (Rule 9) (a) Brokerage and commissions : (b) Cost of container: (c) Packa ging cost: (d) Cost of goods and services supplied by the buyer: (e) Royalties and licence fees : (f) Value of proc eeds which accure to seller: (q) Freight: (h) Insurance : (i) Loading, unloading, handling charges : (i) Landing charges : (k) Other payments, if any : 22. Assessable Value in Rs : 23. Previous impots of in dentical / similar goods, if any : (a) Bill of Entr y Number and Date : (b) IGM Number and date : 24. Any other relevant in formation (A ttach separate sheet, if necessary): DECLARATION 1. I/We hereny declare that the information furnished above is true, complete and correct in every respect. 2. I/We also undertake to bring to the notice of proper office any particulars which subsequently come to my/our knowledge which will have a bearing on valuation. Place: New Delhi Date: 15/9/2011 FOR CUSTOMS HOUSE USE 1. Bill of Entry Number and Date : 2. Valuation Method Applied (See Rules 4 to 8): 3. If declared value not accepted, brief reasons : 4. 5. Reference Number and date of any previous decisions / ruling : Value Assessed Signature of Importer

A.O. Assistant Collector

Note : 1. Declaration form in duplicate duly signed by the impoter should be attached with original Bill of entry. 2. In case Order-in-Original (Speaking Order) is required, Impoter/CHA are requested to apply within 30 days. No request on this account will be considered after 30 days.

DECLARATION (To be signed by an Importer) With C.H.A. I. I/We declare lhat the contents of invoice(s) No.(s) dated of M/s. and of other documents relating to the goods covered by the said invoice(s) and presented herewith.are true and correct in every respect. OR Without C.H.A. 1. I/We declare that the contents of this bill of entry for goods imported against Bill of Lading No. dated ard in accordance with the invoice No. dated and other documents are true and correct in every respect. I/We declare lhat 1 / We have not received and do not know of any other documents or information showing a different price, value, (including local payments whether as commission or otherwise), quantity or description of the said goods and that if at any time hereafter. I / We discover any information showing a different state of facts. I / We will Immediately make the same known to the Commissioner of Customs. I / We declare that goods covered by the bill of entry have been imported on an out-ight purchase / consignment account. 1/We am/are not connected with the suppliers / manufacturers as : (a) Agent / Distributors indentor / Branch / Subsidiary / Concessionaire and (b) Collabora'tor entitled to the use of trade marks, patent or design : (c) Otherwise than as ordinary importers or buyers. 5. I/We declare that the method of invoicing has not changed since the dale on which my/our books of accounts and/or agreement with the suppliers were examined previously by Customs House, (s). N. B. :- Strike out whichever Is Inapplicable.

2.

3. 4.

Nsicodi Enterprise, cargo complex. Anceri 3

Signature of Importer Manager

You might also like

- High Sea Sales Agreement FormatDocument2 pagesHigh Sea Sales Agreement FormatMradul Bansal43% (7)

- Sap MM Tables & FieldsDocument2 pagesSap MM Tables & FieldsIshan Agrawal100% (7)

- Sale and Purchase AgreementDocument7 pagesSale and Purchase AgreementNaval Gupta100% (2)

- Ethiopia Import and Export ProceduresDocument4 pagesEthiopia Import and Export ProceduresYamral Wubetu96% (23)

- Bodyweight Sports TrainingDocument56 pagesBodyweight Sports TrainingJoshp3c100% (18)

- Frequently Asked Questions:: Bca Contractors Registration System (CRS)Document7 pagesFrequently Asked Questions:: Bca Contractors Registration System (CRS)Peter NgNo ratings yet

- GATT Declaration FormDocument2 pagesGATT Declaration FormAmandeep WaliaNo ratings yet

- Gatt Declaration FormDocument1 pageGatt Declaration FormUtsav Ethan PatelNo ratings yet

- Form A With DeclarationDocument3 pagesForm A With DeclarationRohish MehtaNo ratings yet

- Gatt Declaration For ImportDocument1 pageGatt Declaration For ImportrajaNo ratings yet

- Chapter 8Document35 pagesChapter 8Ankush KhuranaNo ratings yet

- Dore Bars Gold Spa Cif From EtsDocument17 pagesDore Bars Gold Spa Cif From EtsFarhan Sheikh100% (1)

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikNo ratings yet

- Export Import DocumentationDocument24 pagesExport Import DocumentationNimesh ShahNo ratings yet

- List of Documents Used in Garment Export ProcessDocument13 pagesList of Documents Used in Garment Export ProcessFaruk AhmedNo ratings yet

- Advance Import PaymentDocument8 pagesAdvance Import PaymentAshish GargNo ratings yet

- Assignment - 2 Q-2 IMDocument6 pagesAssignment - 2 Q-2 IMoishika boseNo ratings yet

- Application Form For Export of SCOMET ItemsDocument4 pagesApplication Form For Export of SCOMET Itemsakashaggarwal88No ratings yet

- Documents Usually Required For NegotiationDocument31 pagesDocuments Usually Required For NegotiationMd. Kaosar Ali 153-23-4468No ratings yet

- FCO For SellersDocument3 pagesFCO For SellersMarvin AworigoNo ratings yet

- Example of Full Corporate Order - For - SellersDocument3 pagesExample of Full Corporate Order - For - SellersazharNo ratings yet

- Letter of Credit (Fob)Document40 pagesLetter of Credit (Fob)Priya ShahNo ratings yet

- Documentation For LogisticsDocument10 pagesDocumentation For LogisticsNick NikhilNo ratings yet

- Export ProceduresDocument10 pagesExport ProceduresGenious GeniousNo ratings yet

- Purchasing 121Document11 pagesPurchasing 121ABDULLAHI AYUBA ABUBAKARNo ratings yet

- Custom Clearance ProcedureDocument5 pagesCustom Clearance Proceduremohan890No ratings yet

- AnswerDocument19 pagesAnswerAbdulrahman M. DukurayNo ratings yet

- Decleration LetterDocument1 pageDecleration LetterRT WorkNo ratings yet

- Customs Clearance in IndiaDocument16 pagesCustoms Clearance in IndiaAdNo ratings yet

- Export DocumentsDocument28 pagesExport DocumentsAmit PatelNo ratings yet

- Export Procedure & DocumentsDocument23 pagesExport Procedure & DocumentsPragati MehndirattaNo ratings yet

- Pon Sanger ExportsDocument11 pagesPon Sanger ExportsTaruna BhadanaNo ratings yet

- Bài thuyết trìnhDocument9 pagesBài thuyết trìnhHuyền TràNo ratings yet

- Procedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41Document23 pagesProcedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41niharaNo ratings yet

- Coo FormatDocument3 pagesCoo FormatKrishna KrishnaNo ratings yet

- CcvoDocument1 pageCcvoronniedsNo ratings yet

- DetailsDocument14 pagesDetailsTalha IdreesNo ratings yet

- Sales ContractDocument7 pagesSales Contracttrucmai2anhaNo ratings yet

- Export Import DocumentationDocument159 pagesExport Import DocumentationMohak NihalaniNo ratings yet

- Wa0008.Document7 pagesWa0008.amyashu22No ratings yet

- Export DocumentationDocument21 pagesExport DocumentationIndrani ThotaNo ratings yet

- Law of Taxation AssignmnetDocument13 pagesLaw of Taxation Assignmnetsohan h m sohan h mNo ratings yet

- I) Trade InterrogationDocument5 pagesI) Trade InterrogationMd Hasibul Karim 1811766630No ratings yet

- E&I MNGT Presentation Pradnya 06Document24 pagesE&I MNGT Presentation Pradnya 06Vaishali KakadeNo ratings yet

- Step I: Answer-Various Steps Involved in Processing of An Export Order Are Discussed BelowDocument6 pagesStep I: Answer-Various Steps Involved in Processing of An Export Order Are Discussed BelowTusharr AhujaNo ratings yet

- International Marketing Assignment: 20Bm63050 - Nandagopal GopalakrishnanDocument3 pagesInternational Marketing Assignment: 20Bm63050 - Nandagopal GopalakrishnanNandagopal GopalakrishnanNo ratings yet

- International Trade - Useful Vocabulary: October 18th, 2011Document19 pagesInternational Trade - Useful Vocabulary: October 18th, 2011Rubén José Olivares PuertasNo ratings yet

- Bước 2: tìm kiếm, đàm phán và ký kết hợp đồng ngoại thương với nhà xuất khẩuDocument11 pagesBước 2: tìm kiếm, đàm phán và ký kết hợp đồng ngoại thương với nhà xuất khẩutrantdlinh10No ratings yet

- International Trade Documentation At: Reva Textiles Pvt. LTDDocument30 pagesInternational Trade Documentation At: Reva Textiles Pvt. LTDMohnish NagpalNo ratings yet

- Cấu trúc bài kiểm tra dự kiến-môn NVNTDocument4 pagesCấu trúc bài kiểm tra dự kiến-môn NVNTHoa Trần Thị MaiNo ratings yet

- Review Questions On Documents and Payment MethodsDocument10 pagesReview Questions On Documents and Payment Methodsgdragon7012No ratings yet

- DocumentsDocument5 pagesDocumentsVimalanathan VimalNo ratings yet

- Export Import DoccumentationDocument25 pagesExport Import DoccumentationErik Treasuryvala0% (1)

- Export Procedure: The PreliminaryDocument34 pagesExport Procedure: The PreliminarySohel BangiNo ratings yet

- Spa First DraftDocument6 pagesSpa First Draft_scribd7No ratings yet

- Anf 1aDocument3 pagesAnf 1adkhatri01No ratings yet

- Trade PaymentsDocument29 pagesTrade Paymentssaikat55No ratings yet

- Documents For ExportDocument26 pagesDocuments For Exportnatrajang100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaFrom EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaNo ratings yet

- Nicole LabayneDocument3 pagesNicole LabaynePatrick GoNo ratings yet

- FCE Exam 3 ListeningDocument6 pagesFCE Exam 3 ListeningSaul MendozaNo ratings yet

- CH 20 - Program Design and Technique For Aerobic Endurance TrainingDocument20 pagesCH 20 - Program Design and Technique For Aerobic Endurance TrainingMarco RodriguezNo ratings yet

- Đề thi thử THPTQG 1Document5 pagesĐề thi thử THPTQG 1dnnnmmny9jNo ratings yet

- Vitamin B2Document10 pagesVitamin B2Rida IshaqNo ratings yet

- UCD Otolayrngology GuideDocument95 pagesUCD Otolayrngology GuideJames EllisNo ratings yet

- Viktoria Saat FPDocument41 pagesViktoria Saat FPdidacbrNo ratings yet

- Basic Science Jss 3 Second TermDocument27 pagesBasic Science Jss 3 Second Termjulianachristopher959No ratings yet

- Asia Bibi Blasphemy CaseDocument14 pagesAsia Bibi Blasphemy CaseRadovan SpiridonovNo ratings yet

- Love Marriage or Arranged Marriage Choice Rights and Empowerment For Educated Muslim Women From Rural and Low Income Pakistani Communities PDFDocument18 pagesLove Marriage or Arranged Marriage Choice Rights and Empowerment For Educated Muslim Women From Rural and Low Income Pakistani Communities PDFminaNo ratings yet

- Webinar Reflection PaperDocument3 pagesWebinar Reflection Paperqwert qwertyNo ratings yet

- Rcse9702 115 s1Document1 pageRcse9702 115 s1WayyuNo ratings yet

- EA and HalachaDocument63 pagesEA and HalachaAvraham EisenbergNo ratings yet

- NCERT Based Test Series 2024 Test - 1Document18 pagesNCERT Based Test Series 2024 Test - 1Arsaniya KumariNo ratings yet

- PTRO Company Profile-2024Document44 pagesPTRO Company Profile-2024Ivan geaNo ratings yet

- Potato ProductionDocument6 pagesPotato ProductionviamussNo ratings yet

- Coal Policy: Prevailing Prospecting / Mining Concessions ProceduresDocument13 pagesCoal Policy: Prevailing Prospecting / Mining Concessions ProceduresZubair KhanNo ratings yet

- Cambridge IGCSE: Information and Communication Technology 0417/03Document8 pagesCambridge IGCSE: Information and Communication Technology 0417/03EffNo ratings yet

- Sample Welingkar Welike ProjectDocument17 pagesSample Welingkar Welike Projectashfaq shaikhNo ratings yet

- NeutraceuticalsDocument36 pagesNeutraceuticalsMir ImranNo ratings yet

- Tos Language Programs and Policies in Multilingual SocietiesDocument2 pagesTos Language Programs and Policies in Multilingual SocietiesBernadette Barro Gomez100% (1)

- Application Form: Personal Secondary EducationDocument3 pagesApplication Form: Personal Secondary EducationRed PalustreNo ratings yet

- Pearls of Wisdom - A Study of Legal MaximsDocument5 pagesPearls of Wisdom - A Study of Legal Maximsnidhi_anand_2No ratings yet

- Unit IG2 - Risk Assessment: Element 9Document42 pagesUnit IG2 - Risk Assessment: Element 9Jithu RajuNo ratings yet

- Assignment 14Document2 pagesAssignment 14peter t. castilloNo ratings yet

- FM3 Module 3Document33 pagesFM3 Module 3Jay OntuaNo ratings yet