Professional Documents

Culture Documents

Business Taxation Final Term

Business Taxation Final Term

Uploaded by

zahid abbasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Taxation Final Term

Business Taxation Final Term

Uploaded by

zahid abbasCopyright:

Available Formats

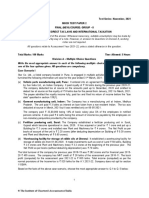

Department of Commerce

Emerson University Multan

Final-Term Examination

Degree Program: BS Commerce 3rd Date: 09-02-2023

Course Name: Business Taxation Course Instructor: Zahid Abbas

Total Marks: 50 Time Allowed: 2hours

Q.1 Answer the following short questions 2*3 = 06

i) Define Capital gain.

ii) Define resident person.

iii) Define the term appeal.

Q.2 06 Marks

Explain in detail the capital and revenue Receipts.

Q.3 08 Marks

From the following particulars of Mr.Gohar Mahmood Calculate the tax payable by him

for the year end 30th June 2023:

Salary Income 1055,000

Dividend Income 15,000

Prize on prize bonds 35,000

Zakat deduction from bank deposits 775

Verifiable personal medical expenses 15,000

Q.4 10 Marks

Explain in detail the Setoff of losses with examples.

Q.5 10 Marks

Write down the procedure of appeal to commissioner Inland Revenue and appellate

tribunal.

Q.6 10 Marks

Mr. Noman is chief accountant in multinational company. He is a Non filer.

Calculate the tax payable by him for the year end 30th June 2023:

Basic Salary = 12,00,000 Utility Allowance = 100,000

Bonus = 300,000 Zakat Paid = 180,000

House allowance = 500,000 Capital Gain (Holding period more than 12 months

but less than 24 month) = 70,000

Conveyance allowance = 200,000 Agriculture income = 400,000

Hint: Capital Gain

You might also like

- Practice Questions - Income Tax PDFDocument114 pagesPractice Questions - Income Tax PDFEmran100% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 012-Practice Questions - Income TaxDocument106 pages012-Practice Questions - Income Taxalizaidkhan29% (7)

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Business Taxation Mid TermDocument1 pageBusiness Taxation Mid Termzahid abbasNo ratings yet

- TX Zwe Examiner's Report June 2022Document10 pagesTX Zwe Examiner's Report June 2022Sean ChigagaNo ratings yet

- Tax Nov Dec 2023 - QuestionDocument6 pagesTax Nov Dec 2023 - QuestionMd HasanNo ratings yet

- Corporate Accounting - IIDocument5 pagesCorporate Accounting - IIjeganrajrajNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Bcoc 136Document4 pagesBcoc 136piyushsinha9829No ratings yet

- Bcoc 136Document4 pagesBcoc 136Pranav KarwaNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Taxation MalawiDocument15 pagesTaxation MalawiCean Mhango100% (1)

- Problem Solving. Provide Your Solutions at The Back of This PaperDocument2 pagesProblem Solving. Provide Your Solutions at The Back of This PaperErykaNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- Income Tax IISep Oct 2022Document15 pagesIncome Tax IISep Oct 2022supritha724No ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Document5 pagesRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Exam Module3 PDFDocument11 pagesExam Module3 PDFKen ChiaNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- GKJ Taxation Final (Sums)Document7 pagesGKJ Taxation Final (Sums)ankandas3498No ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Comprehensive Assignment FAR-IIDocument7 pagesComprehensive Assignment FAR-IISonu MalikNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Guideline Answers: Executive ProgrammeDocument80 pagesGuideline Answers: Executive ProgrammemkeyNo ratings yet

- Fca Tax Ican November 2023 Mock QuestionsDocument8 pagesFca Tax Ican November 2023 Mock QuestionsArogundade kamaldeenNo ratings yet

- Super 30 Questions For CA Inter MAY - 24 ExamsDocument63 pagesSuper 30 Questions For CA Inter MAY - 24 Examsmmukund1632No ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- PMliabilities InputDocument13 pagesPMliabilities InputAbigail Ann PasiliaoNo ratings yet

- ITL&P - Assignment 2Document3 pagesITL&P - Assignment 2Yashika JainNo ratings yet

- Compiler Additional Questions For Nov 22 ExamsDocument18 pagesCompiler Additional Questions For Nov 22 ExamsRobertNo ratings yet

- Tutorial 2 - Trust (Q)Document3 pagesTutorial 2 - Trust (Q)Xin RuNo ratings yet

- Sem - 4 - Jadavpur University Questions PaperDocument13 pagesSem - 4 - Jadavpur University Questions Papernishashams94No ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- 2023-Cacc012 - Final - Main Examination Question Paper - 27 Nov 2023 - Assignment To Supp StudentsDocument9 pages2023-Cacc012 - Final - Main Examination Question Paper - 27 Nov 2023 - Assignment To Supp Studentsnkgapelet46No ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Pe III Taxation II May Jun 2010Document3 pagesPe III Taxation II May Jun 2010swarna dasNo ratings yet

- JAN-21 PaperDocument17 pagesJAN-21 PaperDivyasha PathakNo ratings yet

- TaxDocument3 pagesTaxLet it beNo ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet

- Accountants of Pakistan: Assignment Questions - (Fall-2013 Session) Business Taxation Semester - 4Document8 pagesAccountants of Pakistan: Assignment Questions - (Fall-2013 Session) Business Taxation Semester - 4Adil HashmiNo ratings yet

- Suggested Answer On Tax Planning and Compliance Nov-Dec, 2023Document18 pagesSuggested Answer On Tax Planning and Compliance Nov-Dec, 2023Erfan KhanNo ratings yet

- MCSDocument20 pagesMCSMilind KaleNo ratings yet

- KL Taxtaion I May June 2012Document2 pagesKL Taxtaion I May June 2012asdfghjkl007No ratings yet

- Tax 1 Bsais Quiz4 Theories W AnsDocument6 pagesTax 1 Bsais Quiz4 Theories W AnsCyrss BaldemosNo ratings yet

- ICWAI Inter Direct Tax Solved June 2011Document15 pagesICWAI Inter Direct Tax Solved June 2011rk_rkaushikNo ratings yet

- CO3CRT07 - Corporate Accounting I (T)Document5 pagesCO3CRT07 - Corporate Accounting I (T)shemymuhammad289No ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Full Text 01Document304 pagesFull Text 01zahid abbasNo ratings yet

- Fact Sheet Aricle 4Document24 pagesFact Sheet Aricle 4zahid abbasNo ratings yet

- Erp Lecture 78Document36 pagesErp Lecture 78zahid abbasNo ratings yet

- Vendor Selection and ContractingDocument25 pagesVendor Selection and Contractingzahid abbasNo ratings yet

- HRM Mid TermDocument1 pageHRM Mid Termzahid abbasNo ratings yet