Professional Documents

Culture Documents

Shashank CV

Shashank CV

Uploaded by

Shashank RaoCopyright:

Available Formats

You might also like

- ScriptDocument3 pagesScriptEnrico Cayme100% (9)

- Business Analyst in Banking Domain ResumeDocument6 pagesBusiness Analyst in Banking Domain ResumeOscar BasilNo ratings yet

- State Bank of India Bio Data FormatDocument2 pagesState Bank of India Bio Data FormatYashwant Garud80% (5)

- باسم يوسف العاجDocument1 pageباسم يوسف العاجباسم الحاجNo ratings yet

- Resume - Shailesh BudhiaDocument2 pagesResume - Shailesh BudhiaShadab Khan100% (1)

- Shashank Rao CV - CanadaDocument2 pagesShashank Rao CV - CanadaShashank RaoNo ratings yet

- Shashank Rao CV - Canada FormatDocument2 pagesShashank Rao CV - Canada FormatShashank RaoNo ratings yet

- Subrato ChakrabortyDocument2 pagesSubrato ChakrabortyJerryd Peter Marian DannyNo ratings yet

- Vikas CVDocument3 pagesVikas CVKhurram AzizNo ratings yet

- Teja Anil Kumar Reddy - Maddireddy - ResumeDocument3 pagesTeja Anil Kumar Reddy - Maddireddy - ResumeAnil ReddyNo ratings yet

- Naukri SandeepNishad (4y 5m)Document2 pagesNaukri SandeepNishad (4y 5m)sandeep nishadNo ratings yet

- Achukatla Baba FakruddinDocument6 pagesAchukatla Baba Fakruddinferoz acNo ratings yet

- Ashutosh Vasisht: Profile SummaryDocument2 pagesAshutosh Vasisht: Profile SummaryAnup PandeyNo ratings yet

- JoB AprilDocument1 pageJoB AprilAnonymous FnM14a0No ratings yet

- Naukri DipenShah (9y 0m)Document2 pagesNaukri DipenShah (9y 0m)Amit PathakNo ratings yet

- Rohit, Asst Manager GU, NoidaDocument2 pagesRohit, Asst Manager GU, NoidaDaminiNo ratings yet

- Sachin ShingareDocument2 pagesSachin ShingareShobhit GuptaNo ratings yet

- RaniPrajapati (4 0)Document3 pagesRaniPrajapati (4 0)milapdhamiNo ratings yet

- Rafia Abdul Sattar - CVDocument3 pagesRafia Abdul Sattar - CVsabaisNo ratings yet

- MycvDocument2 pagesMycvnilotpalkant kishoreNo ratings yet

- Question Bank Promotion ExamDocument3 pagesQuestion Bank Promotion Examrajan chauhan singhNo ratings yet

- Credit Head & Financial Due Diligence Vishal JoshiDocument3 pagesCredit Head & Financial Due Diligence Vishal JoshiInvesting WorkshopNo ratings yet

- Harkesh Garg: Assistant ManagerDocument3 pagesHarkesh Garg: Assistant ManagerPriya Rahul KalraNo ratings yet

- Profile Summary: Harkesh GargDocument4 pagesProfile Summary: Harkesh Gargharkesh gargNo ratings yet

- Curriculum Vitae 2022Document2 pagesCurriculum Vitae 2022kotarusaicharanNo ratings yet

- Asif RiazDocument5 pagesAsif Riazfaiza minhasNo ratings yet

- Sanaul - CECM 4th - Assignment 1Document6 pagesSanaul - CECM 4th - Assignment 1Sanaul Faisal100% (1)

- Priya Jaswal: Career ObjectiveDocument2 pagesPriya Jaswal: Career ObjectiveAshwani JaswalNo ratings yet

- DHIRAJRAMTEKERESUME1431Document4 pagesDHIRAJRAMTEKERESUME1431Aniket mishraNo ratings yet

- Curriculum Vitae: Career ObjectivesDocument5 pagesCurriculum Vitae: Career ObjectivesAlfie Group of InvestmentNo ratings yet

- Kumar Saurabh Singh: Professional ExperienceDocument3 pagesKumar Saurabh Singh: Professional ExperienceSaurabh RaghuvanshiNo ratings yet

- Campus JDDocument8 pagesCampus JDarjunrkaleNo ratings yet

- SBI Bank ProjectDocument150 pagesSBI Bank Projectee23258No ratings yet

- Ashish Mishra BaDocument3 pagesAshish Mishra BaAwanish TiwariNo ratings yet

- Objective: Sohel Reza HossainDocument5 pagesObjective: Sohel Reza HossainNishaNo ratings yet

- Punjab National BankDocument51 pagesPunjab National BankLeslie Sequeira100% (2)

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- Anitha ReportDocument28 pagesAnitha ReportWhatsapp stutsNo ratings yet

- Asad AbbasDocument3 pagesAsad AbbasRizviNo ratings yet

- Credit Appraisal and Risk Rating at PNBDocument87 pagesCredit Appraisal and Risk Rating at PNBVishnu Soni100% (2)

- RohitSushilKumarYadav (6 0)Document4 pagesRohitSushilKumarYadav (6 0)milapdhamiNo ratings yet

- Resume SampleDocument5 pagesResume SampleDashrath BawneNo ratings yet

- Abhyudaya GuptaDocument3 pagesAbhyudaya GuptaMuneendraNo ratings yet

- Hassan Zia Finance 11yrs of Exp (1) .Document3 pagesHassan Zia Finance 11yrs of Exp (1) .mba2135156No ratings yet

- 0 PDFDocument3 pages0 PDFAZAMNo ratings yet

- Javed Resume 999Document4 pagesJaved Resume 999VickyNo ratings yet

- Vignesh Final OneDocument2 pagesVignesh Final OneVignesh PeriyasamyNo ratings yet

- SIP ReportDocument39 pagesSIP ReportAditya ShankarNo ratings yet

- Punjab and Sind Bank Services of Risk ManagementDocument12 pagesPunjab and Sind Bank Services of Risk Managementiyaps427100% (1)

- Fatima Omer CVDocument2 pagesFatima Omer CVfionadanielNo ratings yet

- Suresh CVDocument3 pagesSuresh CVSuresh Chand SharmaNo ratings yet

- Curriculum Vitae - Rajin Sultani SiregarDocument2 pagesCurriculum Vitae - Rajin Sultani Siregarrajin sultani siregarNo ratings yet

- Mohammed Kaleem (Retail 21)Document2 pagesMohammed Kaleem (Retail 21)nothing nikalNo ratings yet

- Credit Appraisal ProcessDocument43 pagesCredit Appraisal ProcessAbhinav Singh100% (1)

- CV - Nikhil HemrajaniDocument3 pagesCV - Nikhil HemrajaniNikhil HemrajaniNo ratings yet

- Rajeev ResumeDocument2 pagesRajeev ResumerajeevNo ratings yet

- PNBDocument20 pagesPNBShuchita BhutaniNo ratings yet

- Srinivas Bandari SAP ResmeDocument3 pagesSrinivas Bandari SAP ResmeSreenivas BandariNo ratings yet

- HIS New 5-2020Document3 pagesHIS New 5-2020hasan_siddiqui_15No ratings yet

- Banking StandaloneDocument21 pagesBanking StandaloneAnusha RaviNo ratings yet

- Vaishnavi Dandekar - Financial Performance Commercial BankDocument67 pagesVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765No ratings yet

- Rishav Raj Project 4162024Document23 pagesRishav Raj Project 4162024Rajharsh SisodiaNo ratings yet

- Shashank ResumeDocument2 pagesShashank ResumeShashank RaoNo ratings yet

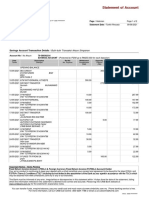

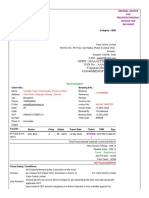

- VIL Bill 9833967054 2023-05-28Document4 pagesVIL Bill 9833967054 2023-05-28Shashank RaoNo ratings yet

- Resume (CV)Document2 pagesResume (CV)Shashank RaoNo ratings yet

- TAT Tracker Q4Document22 pagesTAT Tracker Q4Shashank RaoNo ratings yet

- WABAG Output Sheet FY22 13032023Document8 pagesWABAG Output Sheet FY22 13032023Shashank RaoNo ratings yet

- Sample CLDocument1 pageSample CLShashank RaoNo ratings yet

- Resume Template For Canada & USADocument2 pagesResume Template For Canada & USAShashank RaoNo ratings yet

- VIL Bill 9833967054 2023-02-28Document5 pagesVIL Bill 9833967054 2023-02-28Shashank RaoNo ratings yet

- Demonetization: Impact On Cashless Payemnt System: Manpreet KaurDocument6 pagesDemonetization: Impact On Cashless Payemnt System: Manpreet KaurKiran SoniNo ratings yet

- Insurance - MCQ Types QuestionsDocument5 pagesInsurance - MCQ Types Questionsdivya100% (1)

- PAMI Asia Balanced Fund Product Primer v3 Intro TextDocument1 pagePAMI Asia Balanced Fund Product Primer v3 Intro Textgenie1970No ratings yet

- Rs-Cfa: Tally Accounting NotesDocument8 pagesRs-Cfa: Tally Accounting NotesJakir HusainNo ratings yet

- Dissertation Topics On E-BankingDocument4 pagesDissertation Topics On E-BankingCollegePapersForSaleAnnArbor100% (1)

- Gmail - DropshippingDocument2 pagesGmail - DropshippingEli MentoNo ratings yet

- Sep2022 - Indus Ind-Statement PDFDocument5 pagesSep2022 - Indus Ind-Statement PDFChandrashekar BGNo ratings yet

- Statement of Account: Lot 127, Taman Aman 1 MDLD 2182, Jalan Silam Lahad Datu 91112 SABAHDocument2 pagesStatement of Account: Lot 127, Taman Aman 1 MDLD 2182, Jalan Silam Lahad Datu 91112 SABAHJer Emy JoerNo ratings yet

- Emergency Departments and Crowding in United States Teaching HospitalsDocument7 pagesEmergency Departments and Crowding in United States Teaching HospitalsMaria CarlsonNo ratings yet

- At A Glance c45 736624Document6 pagesAt A Glance c45 736624ShanehalNo ratings yet

- Internal Control Affecting Liabilities and EquityDocument2 pagesInternal Control Affecting Liabilities and EquityMagayon JovelynNo ratings yet

- Problem 1Document8 pagesProblem 1Mikaela JeanNo ratings yet

- DownloadDocument3 pagesDownloadChristina SalliNo ratings yet

- FP Markets CopyTrade Url2pdf - 65301bccc2e7fDocument6 pagesFP Markets CopyTrade Url2pdf - 65301bccc2e7fharissonrafandradeNo ratings yet

- Product Information Garanteed IncomeDocument104 pagesProduct Information Garanteed IncomeAdil AliNo ratings yet

- Sample Substantive Procedures AllDocument13 pagesSample Substantive Procedures AllCris LuNo ratings yet

- Cek LengkapDocument4 pagesCek LengkapYudha PrakosaNo ratings yet

- Dabur Amla Hair OilDocument10 pagesDabur Amla Hair OilPrashant KambleNo ratings yet

- Flight Invoice 1312230112851Document2 pagesFlight Invoice 1312230112851chhajermohitNo ratings yet

- Seminar Report (2105102031)Document20 pagesSeminar Report (2105102031)Cjck KckNo ratings yet

- Home Loans For Non-Resident Indians / Persons of Indian OriginDocument4 pagesHome Loans For Non-Resident Indians / Persons of Indian Originglobus1No ratings yet

- Exchange Letter Dated September 12, 2019Document7 pagesExchange Letter Dated September 12, 2019FNUNo ratings yet

- Xeam Ventures PVT LTD.: E-202 Phase 8-B, Sector 74A, Industrial Area, Mohali, Punjab - 160055Document5 pagesXeam Ventures PVT LTD.: E-202 Phase 8-B, Sector 74A, Industrial Area, Mohali, Punjab - 160055Chandan MondalNo ratings yet

- Infolink University Collge Coursetitle: Auditing Principles and Practics Ii Credit HRS: 3 Contact Hrs:3 InstructorDocument94 pagesInfolink University Collge Coursetitle: Auditing Principles and Practics Ii Credit HRS: 3 Contact Hrs:3 InstructorBeka AsraNo ratings yet

- 14-Trends and Issues in NursingDocument23 pages14-Trends and Issues in NursingFrancis Emman Santiago100% (1)

- Balance Cash HoldingsDocument34 pagesBalance Cash HoldingsSurafelNo ratings yet

- Customer Inquiry Report PDFDocument13 pagesCustomer Inquiry Report PDFIntekindo JatimNo ratings yet

Shashank CV

Shashank CV

Uploaded by

Shashank RaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shashank CV

Shashank CV

Uploaded by

Shashank RaoCopyright:

Available Formats

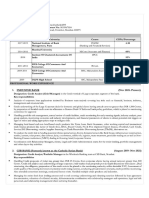

SHASHANK RAO

Unit 65,941 Gordon St, Guelph, ON, N1G 4R9 | +1 (647)702 9804 / +91 9833967054 | : raoshashank4293@gmail.com

https://www.linkedin.com/in/raoshashank4293/ | Visa Status: Holding Canada PR (via Express Entry)

ACADEMIC QUALIFICATIONS

MBA (Banking and Financial Services), National Institute of Bank Management, India, 2019

Master of Commerce (Accounts and Finance), Mumbai University, India, 2016

IPCC Group-1, Institute Of Chartered Accountants Of India (ICAI), 2014

Bachelor of Commerce, SIES College Of Commerce And Economics, India, 2014

PROFESSIONAL EXPERIENCE

Current Organization: INDUSIND BANK, India Nov 2021 –Present

Designation: Credit Analyst (Chief Manager) in the Credit Risk vertical of Corporate and Institutional Banking segment of the bank

Key responsibilities

Analysis of corporate loan applications initiated by Business/sales team majorly covering key risks such as financial, business,

industry, management and structural risk.

Credit underwriting of the Large Corporate deals for domestic and global clients having annual turnover greater than INR

15,000 Million, by preparation of detailed credit notes in adherence to Reserve Bank Of India and bank policy guidelines, which

is placed to sanctioning committee for approval.

Handling portfolio risk management, annual review of credit facilities, credit monitoring for early warning signals, industry

analysis, peer group analysis, monitoring economic and industry developments, and financial parameters of clients to detect

potential risk triggers or signs of stress and taking appropriate steps to mitigate risks.

Managing fund-based and non-fund based credit products like Term Loan, Bank Guarantee, other working capital and

international trade finance products like Letter of Credit (LC), SBLC, Buyers’ Credit, Pre & Post shipment Export finance,

Overdraft, Cash Credit, Invoice/Bill Discounting, vendor/supplier financing on Trade Receivables Discounting System (TReDS),

Managing derivatives like forward contracts for hedging commodities and foreign currency exposures and interest rate swaps.

To analyse the credit risk in funding potential clients spread across diverse domains/sectors like Real Estate, infrastructure

construction, textiles, cement, solar power, data-centres, dairy, e-commerce, edible oils, logistics, water treatment, pesticides

trading etc as well as Non-Banking Finance institutions (NBFC) dealing in Housing/retail/corporate finance

Efficient Coordination with Relationship Managers, clients, Legal and Credit Administration teams for the entire lending,

portfolio management and other day to day activities.

Past Organization: CSB BANK (Formerly known as The Catholic Syrian Bank), India Aug 2019 – Nov 2021

Designation: Credit Analyst/Portfolio Manager in the Wholesale Banking team at Corporate office, Mumbai.

Key responsibilities

Handling Credit proposals of ticket size greater than INR 250 Million, from corporate clients having annual turnover greater than

5,000 Million

Credit risk analysis and underwriting of large corporate /mid-market loan proposals post in-depth discussions with clients. Deal

structuring, due diligence, preparation of the credit note to be placed to the sanctioning authority within desirable TAT.

Assessment of credit quality of the existing borrowers via internal credit rating exercise, conducting annual review/ renewals,

credit portfolio monitoring. Also attended consortium meetings, conducted factory visits. Handled multiple credit products and

industries.

Managing the entire fresh loan lending process end-to-end covering underwriting and obtaining sanction followed by loan

agreement documentation, valuation of collateral security, disbursement in coordination with relationship managers and

operations, legal and risk personnel, and relationship management/client servicing thereafter.

Past Organization: AXIS BANK, India Jul 2014 – May 2016

Designation: Officer

Key responsibilities

As part of Retail Operations (Central Processing Unit) team, handled the onboarding of retail customers into the bank by

scrutinizing applications, ensuring KYC compliance and timely, error free checking account opening procedures with customer

due diligence

INTERNSHIPS

HDFC Bank : Summer Internship on project titled “Review of the Money Market, Investment, Primary Dealership and CSGL

processes at Treasury department”- (April-June 2018)

S. Raghunath and Associates Chartered Accountants: Interned at the audit firm and worked on accounting, auditing, and tax

advisory - (December 2012 – February 2013)

POSITIONS OF RESPONSIBILITY AND PROJECT DURING POST GRADUATION

Member Of Placement Committee & Student Council during MBA

Project on Assessing the Global impact of IFRS 9 (Financial Instruments) Implementation across European banks

CERTIFICATIONS & OTHER SKILLS

Accounting technician by virtue of clearing CA-CPT, IPCC

Credit Appraisal by CRISIL (a Standard & Poor company), Cash flow-based lending by CARE Ratings, Assessment of Fund/Non

fund based Working capital limits by NIBM, Programme on Trade Finance by Satyadevi Institute of Financial Learning

(Accredited by ACI FMA, Paris)

Strong interpersonal skills, client management, well versed with banking regulator guidelines, financial analysis, financial

modelling and knowledge of MS Office products.

ACTIVITIES & INTERESTS

Avid follower of various sports and a gourmand. Other hobbies include travelling, reading, playing cricket and badminton, word

games, and working out at gym, long-distance running.

IMMIGRATION/VISA STATUS

Secured Permanent Resident (PR) Visa for Canada in March 2023 under the Express Entry programme with a Comprehensive

Ranking System (CRS) score of 493.

You might also like

- ScriptDocument3 pagesScriptEnrico Cayme100% (9)

- Business Analyst in Banking Domain ResumeDocument6 pagesBusiness Analyst in Banking Domain ResumeOscar BasilNo ratings yet

- State Bank of India Bio Data FormatDocument2 pagesState Bank of India Bio Data FormatYashwant Garud80% (5)

- باسم يوسف العاجDocument1 pageباسم يوسف العاجباسم الحاجNo ratings yet

- Resume - Shailesh BudhiaDocument2 pagesResume - Shailesh BudhiaShadab Khan100% (1)

- Shashank Rao CV - CanadaDocument2 pagesShashank Rao CV - CanadaShashank RaoNo ratings yet

- Shashank Rao CV - Canada FormatDocument2 pagesShashank Rao CV - Canada FormatShashank RaoNo ratings yet

- Subrato ChakrabortyDocument2 pagesSubrato ChakrabortyJerryd Peter Marian DannyNo ratings yet

- Vikas CVDocument3 pagesVikas CVKhurram AzizNo ratings yet

- Teja Anil Kumar Reddy - Maddireddy - ResumeDocument3 pagesTeja Anil Kumar Reddy - Maddireddy - ResumeAnil ReddyNo ratings yet

- Naukri SandeepNishad (4y 5m)Document2 pagesNaukri SandeepNishad (4y 5m)sandeep nishadNo ratings yet

- Achukatla Baba FakruddinDocument6 pagesAchukatla Baba Fakruddinferoz acNo ratings yet

- Ashutosh Vasisht: Profile SummaryDocument2 pagesAshutosh Vasisht: Profile SummaryAnup PandeyNo ratings yet

- JoB AprilDocument1 pageJoB AprilAnonymous FnM14a0No ratings yet

- Naukri DipenShah (9y 0m)Document2 pagesNaukri DipenShah (9y 0m)Amit PathakNo ratings yet

- Rohit, Asst Manager GU, NoidaDocument2 pagesRohit, Asst Manager GU, NoidaDaminiNo ratings yet

- Sachin ShingareDocument2 pagesSachin ShingareShobhit GuptaNo ratings yet

- RaniPrajapati (4 0)Document3 pagesRaniPrajapati (4 0)milapdhamiNo ratings yet

- Rafia Abdul Sattar - CVDocument3 pagesRafia Abdul Sattar - CVsabaisNo ratings yet

- MycvDocument2 pagesMycvnilotpalkant kishoreNo ratings yet

- Question Bank Promotion ExamDocument3 pagesQuestion Bank Promotion Examrajan chauhan singhNo ratings yet

- Credit Head & Financial Due Diligence Vishal JoshiDocument3 pagesCredit Head & Financial Due Diligence Vishal JoshiInvesting WorkshopNo ratings yet

- Harkesh Garg: Assistant ManagerDocument3 pagesHarkesh Garg: Assistant ManagerPriya Rahul KalraNo ratings yet

- Profile Summary: Harkesh GargDocument4 pagesProfile Summary: Harkesh Gargharkesh gargNo ratings yet

- Curriculum Vitae 2022Document2 pagesCurriculum Vitae 2022kotarusaicharanNo ratings yet

- Asif RiazDocument5 pagesAsif Riazfaiza minhasNo ratings yet

- Sanaul - CECM 4th - Assignment 1Document6 pagesSanaul - CECM 4th - Assignment 1Sanaul Faisal100% (1)

- Priya Jaswal: Career ObjectiveDocument2 pagesPriya Jaswal: Career ObjectiveAshwani JaswalNo ratings yet

- DHIRAJRAMTEKERESUME1431Document4 pagesDHIRAJRAMTEKERESUME1431Aniket mishraNo ratings yet

- Curriculum Vitae: Career ObjectivesDocument5 pagesCurriculum Vitae: Career ObjectivesAlfie Group of InvestmentNo ratings yet

- Kumar Saurabh Singh: Professional ExperienceDocument3 pagesKumar Saurabh Singh: Professional ExperienceSaurabh RaghuvanshiNo ratings yet

- Campus JDDocument8 pagesCampus JDarjunrkaleNo ratings yet

- SBI Bank ProjectDocument150 pagesSBI Bank Projectee23258No ratings yet

- Ashish Mishra BaDocument3 pagesAshish Mishra BaAwanish TiwariNo ratings yet

- Objective: Sohel Reza HossainDocument5 pagesObjective: Sohel Reza HossainNishaNo ratings yet

- Punjab National BankDocument51 pagesPunjab National BankLeslie Sequeira100% (2)

- CV Archil JainDocument3 pagesCV Archil JainArchil JainNo ratings yet

- Anitha ReportDocument28 pagesAnitha ReportWhatsapp stutsNo ratings yet

- Asad AbbasDocument3 pagesAsad AbbasRizviNo ratings yet

- Credit Appraisal and Risk Rating at PNBDocument87 pagesCredit Appraisal and Risk Rating at PNBVishnu Soni100% (2)

- RohitSushilKumarYadav (6 0)Document4 pagesRohitSushilKumarYadav (6 0)milapdhamiNo ratings yet

- Resume SampleDocument5 pagesResume SampleDashrath BawneNo ratings yet

- Abhyudaya GuptaDocument3 pagesAbhyudaya GuptaMuneendraNo ratings yet

- Hassan Zia Finance 11yrs of Exp (1) .Document3 pagesHassan Zia Finance 11yrs of Exp (1) .mba2135156No ratings yet

- 0 PDFDocument3 pages0 PDFAZAMNo ratings yet

- Javed Resume 999Document4 pagesJaved Resume 999VickyNo ratings yet

- Vignesh Final OneDocument2 pagesVignesh Final OneVignesh PeriyasamyNo ratings yet

- SIP ReportDocument39 pagesSIP ReportAditya ShankarNo ratings yet

- Punjab and Sind Bank Services of Risk ManagementDocument12 pagesPunjab and Sind Bank Services of Risk Managementiyaps427100% (1)

- Fatima Omer CVDocument2 pagesFatima Omer CVfionadanielNo ratings yet

- Suresh CVDocument3 pagesSuresh CVSuresh Chand SharmaNo ratings yet

- Curriculum Vitae - Rajin Sultani SiregarDocument2 pagesCurriculum Vitae - Rajin Sultani Siregarrajin sultani siregarNo ratings yet

- Mohammed Kaleem (Retail 21)Document2 pagesMohammed Kaleem (Retail 21)nothing nikalNo ratings yet

- Credit Appraisal ProcessDocument43 pagesCredit Appraisal ProcessAbhinav Singh100% (1)

- CV - Nikhil HemrajaniDocument3 pagesCV - Nikhil HemrajaniNikhil HemrajaniNo ratings yet

- Rajeev ResumeDocument2 pagesRajeev ResumerajeevNo ratings yet

- PNBDocument20 pagesPNBShuchita BhutaniNo ratings yet

- Srinivas Bandari SAP ResmeDocument3 pagesSrinivas Bandari SAP ResmeSreenivas BandariNo ratings yet

- HIS New 5-2020Document3 pagesHIS New 5-2020hasan_siddiqui_15No ratings yet

- Banking StandaloneDocument21 pagesBanking StandaloneAnusha RaviNo ratings yet

- Vaishnavi Dandekar - Financial Performance Commercial BankDocument67 pagesVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765No ratings yet

- Rishav Raj Project 4162024Document23 pagesRishav Raj Project 4162024Rajharsh SisodiaNo ratings yet

- Shashank ResumeDocument2 pagesShashank ResumeShashank RaoNo ratings yet

- VIL Bill 9833967054 2023-05-28Document4 pagesVIL Bill 9833967054 2023-05-28Shashank RaoNo ratings yet

- Resume (CV)Document2 pagesResume (CV)Shashank RaoNo ratings yet

- TAT Tracker Q4Document22 pagesTAT Tracker Q4Shashank RaoNo ratings yet

- WABAG Output Sheet FY22 13032023Document8 pagesWABAG Output Sheet FY22 13032023Shashank RaoNo ratings yet

- Sample CLDocument1 pageSample CLShashank RaoNo ratings yet

- Resume Template For Canada & USADocument2 pagesResume Template For Canada & USAShashank RaoNo ratings yet

- VIL Bill 9833967054 2023-02-28Document5 pagesVIL Bill 9833967054 2023-02-28Shashank RaoNo ratings yet

- Demonetization: Impact On Cashless Payemnt System: Manpreet KaurDocument6 pagesDemonetization: Impact On Cashless Payemnt System: Manpreet KaurKiran SoniNo ratings yet

- Insurance - MCQ Types QuestionsDocument5 pagesInsurance - MCQ Types Questionsdivya100% (1)

- PAMI Asia Balanced Fund Product Primer v3 Intro TextDocument1 pagePAMI Asia Balanced Fund Product Primer v3 Intro Textgenie1970No ratings yet

- Rs-Cfa: Tally Accounting NotesDocument8 pagesRs-Cfa: Tally Accounting NotesJakir HusainNo ratings yet

- Dissertation Topics On E-BankingDocument4 pagesDissertation Topics On E-BankingCollegePapersForSaleAnnArbor100% (1)

- Gmail - DropshippingDocument2 pagesGmail - DropshippingEli MentoNo ratings yet

- Sep2022 - Indus Ind-Statement PDFDocument5 pagesSep2022 - Indus Ind-Statement PDFChandrashekar BGNo ratings yet

- Statement of Account: Lot 127, Taman Aman 1 MDLD 2182, Jalan Silam Lahad Datu 91112 SABAHDocument2 pagesStatement of Account: Lot 127, Taman Aman 1 MDLD 2182, Jalan Silam Lahad Datu 91112 SABAHJer Emy JoerNo ratings yet

- Emergency Departments and Crowding in United States Teaching HospitalsDocument7 pagesEmergency Departments and Crowding in United States Teaching HospitalsMaria CarlsonNo ratings yet

- At A Glance c45 736624Document6 pagesAt A Glance c45 736624ShanehalNo ratings yet

- Internal Control Affecting Liabilities and EquityDocument2 pagesInternal Control Affecting Liabilities and EquityMagayon JovelynNo ratings yet

- Problem 1Document8 pagesProblem 1Mikaela JeanNo ratings yet

- DownloadDocument3 pagesDownloadChristina SalliNo ratings yet

- FP Markets CopyTrade Url2pdf - 65301bccc2e7fDocument6 pagesFP Markets CopyTrade Url2pdf - 65301bccc2e7fharissonrafandradeNo ratings yet

- Product Information Garanteed IncomeDocument104 pagesProduct Information Garanteed IncomeAdil AliNo ratings yet

- Sample Substantive Procedures AllDocument13 pagesSample Substantive Procedures AllCris LuNo ratings yet

- Cek LengkapDocument4 pagesCek LengkapYudha PrakosaNo ratings yet

- Dabur Amla Hair OilDocument10 pagesDabur Amla Hair OilPrashant KambleNo ratings yet

- Flight Invoice 1312230112851Document2 pagesFlight Invoice 1312230112851chhajermohitNo ratings yet

- Seminar Report (2105102031)Document20 pagesSeminar Report (2105102031)Cjck KckNo ratings yet

- Home Loans For Non-Resident Indians / Persons of Indian OriginDocument4 pagesHome Loans For Non-Resident Indians / Persons of Indian Originglobus1No ratings yet

- Exchange Letter Dated September 12, 2019Document7 pagesExchange Letter Dated September 12, 2019FNUNo ratings yet

- Xeam Ventures PVT LTD.: E-202 Phase 8-B, Sector 74A, Industrial Area, Mohali, Punjab - 160055Document5 pagesXeam Ventures PVT LTD.: E-202 Phase 8-B, Sector 74A, Industrial Area, Mohali, Punjab - 160055Chandan MondalNo ratings yet

- Infolink University Collge Coursetitle: Auditing Principles and Practics Ii Credit HRS: 3 Contact Hrs:3 InstructorDocument94 pagesInfolink University Collge Coursetitle: Auditing Principles and Practics Ii Credit HRS: 3 Contact Hrs:3 InstructorBeka AsraNo ratings yet

- 14-Trends and Issues in NursingDocument23 pages14-Trends and Issues in NursingFrancis Emman Santiago100% (1)

- Balance Cash HoldingsDocument34 pagesBalance Cash HoldingsSurafelNo ratings yet

- Customer Inquiry Report PDFDocument13 pagesCustomer Inquiry Report PDFIntekindo JatimNo ratings yet