Professional Documents

Culture Documents

Attachment - 1 - 2022-12-09T043936.758

Attachment - 1 - 2022-12-09T043936.758

Uploaded by

Munyao JustusOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Attachment - 1 - 2022-12-09T043936.758

Attachment - 1 - 2022-12-09T043936.758

Uploaded by

Munyao JustusCopyright:

Available Formats

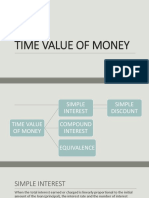

Recall our interest formulas.

Simple Interest: 𝐼 = 𝑃𝑟𝑡 𝐼 = interest

𝐴 = accumulated amount

𝑟 𝑛𝑡 𝑃 = principal

Compound Interest: 𝐴 = 𝑃 (1 + 𝑛)

𝑟 = rate

𝑡 = time (in years)

Continuous Interest: 𝐴 = 𝑃𝑒 𝑟𝑡

𝑛 = number of times the interest is compounded in a year

Your friend Nathan tells you that it is always best to invest in accounts that accumulate interest with continuous

interest. What are your initial thoughts about Nathan’s statement?

Given 𝑃 = $1000, 𝑟 = 10%, and 𝑡 = 2 𝑦𝑒𝑎𝑟𝑠, calculate interest for an account using simple interest, interest

compounded annually, semiannually, quarterly, monthly, and continuously.

After your calculations, do you currently agree or disagree with Nathan’s statement from earlier. Why?

Suppose you plan to invest $2,000 into one of two investments. Investment A has a rate of 9% and uses continuous

interest. Investment B has a rate of 9.2% and uses interest compounded monthly. Which one is the better

investment? Show your calculations.

Did your opinion of Nathan’s statement from earlier change? If so, what is your opinion now?

Which of the following two accounts would be a better investment. Investment A at 𝑟 = 6.2% compounded

continuously, or investment B at 𝑟 = 6.5%, compounded semiannually? Show your calculations.

What plays a more important factor in an investment and why, rate or compounding?

When comparing two different investment, what is important about the principal and the time?

You might also like

- Admission Letter APP 00491Document1 pageAdmission Letter APP 00491Munyao Justus0% (1)

- Topic 2-Continuous Compounding, Nominal and Effective Rate of ItenrestDocument7 pagesTopic 2-Continuous Compounding, Nominal and Effective Rate of ItenrestHENRICK IGLENo ratings yet

- Chapter 2-Part 2Document13 pagesChapter 2-Part 2Puji dyukeNo ratings yet

- GenMath11 - Q2 - WEEKS 5 To 6Document9 pagesGenMath11 - Q2 - WEEKS 5 To 6JOHN ROMEO ASILUMNo ratings yet

- Financial Mathematics Assignment 1 AliDocument8 pagesFinancial Mathematics Assignment 1 AliAli BarzamNo ratings yet

- Lesson 1Document37 pagesLesson 1Joshua Miguel MejiasNo ratings yet

- Simple and Compound InterestDocument2 pagesSimple and Compound InterestRaymond EdgeNo ratings yet

- Gen - Math 11Document15 pagesGen - Math 11Chrry MrcdNo ratings yet

- Compound Interest: Compounded Mo Re Than Once A Yea RDocument24 pagesCompound Interest: Compounded Mo Re Than Once A Yea RCristine CañeteNo ratings yet

- 2021 Sept 14 Lec Ch2 Part 1Document26 pages2021 Sept 14 Lec Ch2 Part 1dsfghNo ratings yet

- MOdule 4 Com Int, PV, Disc, NomEffDocument9 pagesMOdule 4 Com Int, PV, Disc, NomEffDarryll B. OdinebNo ratings yet

- Compound InterestDocument12 pagesCompound InterestJohnbob ToveraNo ratings yet

- A. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyDocument12 pagesA. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyArcon Solite BarbanidaNo ratings yet

- GEN419-1 - 6. InterestDocument20 pagesGEN419-1 - 6. InterestAhmedNo ratings yet

- Chap005 - V2Document66 pagesChap005 - V2Thủy Tiên Nguyễn ĐỗNo ratings yet

- Financial Maths SummaryDocument5 pagesFinancial Maths Summarymercykaranja218No ratings yet

- Compound Interest DiscussionDocument8 pagesCompound Interest DiscussionBaoooNo ratings yet

- WEEK3. Simple AnnuityDocument31 pagesWEEK3. Simple AnnuityMarquez FrancisNo ratings yet

- Mathematics of Investment Module 2Document5 pagesMathematics of Investment Module 2Kim JayNo ratings yet

- II. Compound InterestDocument21 pagesII. Compound InterestFrancis De GuzmanNo ratings yet

- Eng. Econ Chapter 2 InterestDocument25 pagesEng. Econ Chapter 2 InterestNancy CuevasNo ratings yet

- Interest and Credit BookletDocument46 pagesInterest and Credit BookletJehu PetersNo ratings yet

- Econ 3Document45 pagesEcon 3Trebob GardayaNo ratings yet

- Calculus 2 - Chapter 1 PDFDocument12 pagesCalculus 2 - Chapter 1 PDFSilverwolf CerberusNo ratings yet

- ECONDocument38 pagesECONjoeyNo ratings yet

- Mba 4 YerDocument3 pagesMba 4 YerRashidNo ratings yet

- Learning Activity Sheet q2w1-2Document4 pagesLearning Activity Sheet q2w1-2Mark Anthony Bell BacangNo ratings yet

- Examples: Simple and Compound InterestDocument3 pagesExamples: Simple and Compound InterestnonononowayNo ratings yet

- Simple and Compound Interest V.01Document13 pagesSimple and Compound Interest V.01FSR Uwu2419No ratings yet

- Chapter 2 - Compound InterestDocument18 pagesChapter 2 - Compound InterestPrincess Mae AgbonesNo ratings yet

- Directions: Complete The Financial Report Worksheet To Help You With Your Calculations To CreateDocument8 pagesDirections: Complete The Financial Report Worksheet To Help You With Your Calculations To CreateAshley GoletNo ratings yet

- Chapter 9: Mathematics of FinanceDocument55 pagesChapter 9: Mathematics of FinanceQuang PHAMNo ratings yet

- Simple and Compound InterestDocument23 pagesSimple and Compound InterestPhoebe Kate Sanchez de JesusNo ratings yet

- Tutorial 4Document17 pagesTutorial 4amirmahdian16No ratings yet

- Interest and Money Time RelationshipDocument13 pagesInterest and Money Time RelationshipJasper LumagbasNo ratings yet

- Interest and Money Time Relationship 1Document45 pagesInterest and Money Time Relationship 1john jkillerzsNo ratings yet

- Fin118 Unit 9Document25 pagesFin118 Unit 9ayadi_ezer6795No ratings yet

- Time ValueDocument6 pagesTime Valuechris david100% (1)

- Module 5 - Mathematics of FinanceDocument6 pagesModule 5 - Mathematics of FinanceBangunan Mengfie Jr.No ratings yet

- Money Time Relationships and Equivalence PDFDocument30 pagesMoney Time Relationships and Equivalence PDFpsstnopeNo ratings yet

- Finance Growth and Decay Author Maths at SharpDocument37 pagesFinance Growth and Decay Author Maths at SharpRhaiven Carl YapNo ratings yet

- 4 General AnnuitiesDocument141 pages4 General AnnuitiesMark Allen LabasanNo ratings yet

- Compound Interest FormulaDocument2 pagesCompound Interest FormulaЕлизавета ЛебедеваNo ratings yet

- Activity - Nominal Interest Rate - With AnswerDocument5 pagesActivity - Nominal Interest Rate - With AnswerRENZ ALFRED ASTRERONo ratings yet

- UNIT 2 Time and Money RelationshipDocument79 pagesUNIT 2 Time and Money Relationshipcuajohnpaull.schoolbackup.002No ratings yet

- Topic 20 Simple and Compound InterestDocument7 pagesTopic 20 Simple and Compound InterestCarl Eugene de LemosNo ratings yet

- 2nd Midterm ReviewDocument30 pages2nd Midterm ReviewkhanNo ratings yet

- Annual CompoundingDocument6 pagesAnnual CompoundingSreekar ParimiNo ratings yet

- FM I Chapter 3Document12 pagesFM I Chapter 3mearghaile4No ratings yet

- L1 TVMDocument14 pagesL1 TVMnarutobaNo ratings yet

- Chapter-05 __ Time Value of Money-IDocument11 pagesChapter-05 __ Time Value of Money-Ierror.sutNo ratings yet

- 2 CompoundDocument8 pages2 CompoundKEN GamingStreamNo ratings yet

- LESSON 6+ COMPOUND INTEREST StudentDocument15 pagesLESSON 6+ COMPOUND INTEREST StudentJohn Daniel BerdosNo ratings yet

- Simple and Compound InterestDocument4 pagesSimple and Compound InterestVivek PatelNo ratings yet

- Study Unit 2Document19 pagesStudy Unit 2Irfaan CassimNo ratings yet

- Mathematics of FinanceDocument20 pagesMathematics of FinancekeziaNo ratings yet

- General Mathematics: 11 GradeDocument19 pagesGeneral Mathematics: 11 GradeRhea Rose AlmoguezNo ratings yet

- WEEK+10+&+11+ +Simple+&+Compound+InterestDocument25 pagesWEEK+10+&+11+ +Simple+&+Compound+InterestNathalie TimbrezaNo ratings yet

- 7mathematics of Finance2Document12 pages7mathematics of Finance2Jemmuel BulataoNo ratings yet

- Bianca James KavekeDocument4 pagesBianca James KavekeMunyao JustusNo ratings yet

- Attachment - 1 - 2023-01-16T090321.509Document6 pagesAttachment - 1 - 2023-01-16T090321.509Munyao JustusNo ratings yet

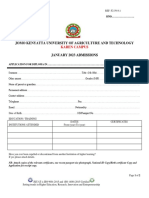

- Diploma Application Form January 2023Document2 pagesDiploma Application Form January 2023Munyao JustusNo ratings yet

- Answer 2Document2 pagesAnswer 2Munyao JustusNo ratings yet

- Attachment - 1 - 2023-02-19T030637.251Document1 pageAttachment - 1 - 2023-02-19T030637.251Munyao JustusNo ratings yet

- 5463bsav Lack of Ethical Behavior and Resulting Harm in Education and Nursing - EditedDocument11 pages5463bsav Lack of Ethical Behavior and Resulting Harm in Education and Nursing - EditedMunyao JustusNo ratings yet

- Laww EditedDocument6 pagesLaww EditedMunyao JustusNo ratings yet

- Untitled Document - EditedDocument10 pagesUntitled Document - EditedMunyao JustusNo ratings yet

- Untitled Document - EditedDocument3 pagesUntitled Document - EditedMunyao JustusNo ratings yet

- 5324pro31coll EditedDocument6 pages5324pro31coll EditedMunyao JustusNo ratings yet

- Environmental Health Part 2.editedDocument3 pagesEnvironmental Health Part 2.editedMunyao JustusNo ratings yet

- Untitled Document - EditedDocument1 pageUntitled Document - EditedMunyao JustusNo ratings yet