Professional Documents

Culture Documents

T-Bill Note

T-Bill Note

Uploaded by

Faran khanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T-Bill Note

T-Bill Note

Uploaded by

Faran khanCopyright:

Available Formats

Criteria to Choose Yield for T-bill*

1. If T-bill is traded on the calculation day, an executed yield with no SL/NL flag

is used.

2. If T-bill is not traded on the calculation day, an averaged bid-offer yield is

then used instead.

- T-bill with a duration that falls between 2 tenors of those quoted in

table (1M/28 days, 3M/91 days, 6M/182 days and 1Y/364 days), its

yield is to be calculated by linear interpolation method.

4-Sep-06

Simple Yield * (%)

Treasury Bill

Bid Offer Average

T-BILL1M (28) days 4.821667 4.781667 4.801667

T-BILL3M (91) days 4.875 4.835 4.855

T-BILL6M (182) days 4.953333 4.916667 4.935

T-BILL1Y (364) days 5.106667 5.066667 5.086667

3. If duration of T-bill is less than 1 month (28/365 year), use the yield on the

day its duration equals 1 month (if that day is holiday, use the earlier working

day)

*These criteria have been used since on 4th September 2006, yields for T-bill were

from zero coupon yield curve.

Calculation Examples

For a T-bill with TTM of 60 days

(4.855 − 4.801667)

Yield = 4.801667 + x (60-28)

(91 − 28)

= 4.828757

For a T-bill with TTM of 147 days

(4.935 − 4.855)

Yield = 4.801667 + x (147-91)

(182 − 91)

= 4.904231

You might also like

- RJR NabiscoDocument17 pagesRJR Nabiscodanielcid100% (1)

- PRCL 03 Cumulating and Storing Time Wage Types in RTDocument4 pagesPRCL 03 Cumulating and Storing Time Wage Types in RTeurofighterNo ratings yet

- Calculating U.S. Treasury Futures Conversion Factors Final Dec 4Document5 pagesCalculating U.S. Treasury Futures Conversion Factors Final Dec 4connytheconNo ratings yet

- Tbills With Excel UCMDocument23 pagesTbills With Excel UCMLorenaNo ratings yet

- Financial Statement AnalysisDocument12 pagesFinancial Statement AnalysisPhạm Tuấn HùngNo ratings yet

- Week 9 Submission QuestionDocument2 pagesWeek 9 Submission QuestionVarun AbbineniNo ratings yet

- Lim B: Chapter 8 - Emerging Cashflows Used For Profit TestingDocument53 pagesLim B: Chapter 8 - Emerging Cashflows Used For Profit TestingGamatNo ratings yet

- EOQ Under Delay in Payments GoyalDocument5 pagesEOQ Under Delay in Payments Goyalaggarwalankit911No ratings yet

- Hedging Strategies Using FuturesDocument23 pagesHedging Strategies Using FuturesBiswajit SarmaNo ratings yet

- Topic 16 - Term StructureDocument36 pagesTopic 16 - Term StructureDweep KapadiaNo ratings yet

- Simulation Models S AsDocument7 pagesSimulation Models S AsngyncloudNo ratings yet

- Name of Ratio 2016 2017 Results Reason For ChangeDocument6 pagesName of Ratio 2016 2017 Results Reason For ChangeShamiiNo ratings yet

- 6 Safety Stock Formulas You Can Consider in Your Next Calculation CycleDocument4 pages6 Safety Stock Formulas You Can Consider in Your Next Calculation CycleSamNo ratings yet

- Sunu 2Document1 pageSunu 2ahmedNo ratings yet

- SU4 - TimeValue SolutionsDocument43 pagesSU4 - TimeValue Solutionsjaketan456No ratings yet

- Ilovepdf MergedDocument139 pagesIlovepdf MergedMaryam YusufNo ratings yet

- IandF CT1 201609 ExaminersReportDocument14 pagesIandF CT1 201609 ExaminersReportfeererereNo ratings yet

- Simple Interest and DiscountDocument7 pagesSimple Interest and DiscountNoor HananiNo ratings yet

- Chapter 05 2Document3 pagesChapter 05 2trevorsum123No ratings yet

- P11 ValuationDocument37 pagesP11 ValuationNILIAN ALIZHARNo ratings yet

- Lecture 2Document23 pagesLecture 2helmy habsyiNo ratings yet

- ExamDocument3 pagesExamMohamad IbrahimNo ratings yet

- OC & CCC Activity 1-4Document8 pagesOC & CCC Activity 1-4Maria Klaryce AguirreNo ratings yet

- Sanjeev Mul VMDocument4 pagesSanjeev Mul VMsanjeevr811No ratings yet

- Topic 3 - Homework3 SolutionDocument7 pagesTopic 3 - Homework3 SolutionTsz Wei CHANNo ratings yet

- Curs 03-04 Mathematical and Statistical FunctionsDocument27 pagesCurs 03-04 Mathematical and Statistical FunctionsAvadanei DanielNo ratings yet

- Frequently Asked Questions - NWPCDocument16 pagesFrequently Asked Questions - NWPCNap MissionnaireNo ratings yet

- For Tak Technologies PVT - Ltd. - Quotation For Facility Services (Noida)Document2 pagesFor Tak Technologies PVT - Ltd. - Quotation For Facility Services (Noida)rahul soodNo ratings yet

- Duration, Convexity Calculator For US TreasuriesDocument12 pagesDuration, Convexity Calculator For US TreasuriesThanh CongNo ratings yet

- Fimmda - Nse Debt Market (Basic) ModuleDocument31 pagesFimmda - Nse Debt Market (Basic) ModuleprathamNo ratings yet

- Day Count ConventionDocument7 pagesDay Count ConventionDiego GonzálesNo ratings yet

- CH 3 f3716sDocument40 pagesCH 3 f3716salbabtainbaderNo ratings yet

- OC CCC Activity 1 4Document8 pagesOC CCC Activity 1 4Jamilah Colleen Y. BautistaNo ratings yet

- Minemax Scheduler White PaperDocument12 pagesMinemax Scheduler White PaperManuel AragonNo ratings yet

- Chapter 5 Money MarketsDocument3 pagesChapter 5 Money MarketsRebecaNo ratings yet

- IandF CT1 201604 ExaminersReport WithMarksDocument14 pagesIandF CT1 201604 ExaminersReport WithMarksMaryam YusufNo ratings yet

- T Bill - Calculations 2Document3 pagesT Bill - Calculations 2Rimpy SondhNo ratings yet

- Forecasting & Capacity Planning PDFDocument50 pagesForecasting & Capacity Planning PDFVeronica premanandNo ratings yet

- Financial Mathematics For Actuaries: Bond Management Learning ObjectivesDocument63 pagesFinancial Mathematics For Actuaries: Bond Management Learning ObjectivesRehabUddinNo ratings yet

- Harley, S. (2007) - Squaring Price With Time (3 P.)Document4 pagesHarley, S. (2007) - Squaring Price With Time (3 P.)Chirag Shetty100% (1)

- A Return IndexDocument2 pagesA Return IndexDom DeSiciliaNo ratings yet

- Basic of FinanceDocument5 pagesBasic of FinanceKanitha MuniandyNo ratings yet

- Supplement To Chapter 4 Reliability: Teaching NotesDocument6 pagesSupplement To Chapter 4 Reliability: Teaching NotesSudip DhakalNo ratings yet

- Economia General 1Document11 pagesEconomia General 1Kevin Israel Guillen MollinedoNo ratings yet

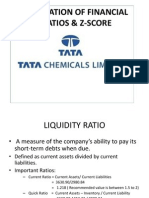

- Financial Ratios of Tata Chemicals and Z Score CalculationDocument10 pagesFinancial Ratios of Tata Chemicals and Z Score CalculationRaaj BajajNo ratings yet

- Summer Internship Project On Working Capital Management''Document15 pagesSummer Internship Project On Working Capital Management''Nimesh PatelNo ratings yet

- Pom Assignmnet 2Document4 pagesPom Assignmnet 2Zainab KashaniNo ratings yet

- Chap 8 Notes To Accompany The PP TransparenciesDocument5 pagesChap 8 Notes To Accompany The PP TransparenciesChantal AouadNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/32 May/June 2018Document17 pagesCambridge Assessment International Education: Accounting 9706/32 May/June 2018Tesa RudangtaNo ratings yet

- Omt FinalDocument10 pagesOmt Finalsayma0farihaNo ratings yet

- Statistics FC301: IME EriesDocument24 pagesStatistics FC301: IME Eriesibrahim fadelNo ratings yet

- Business MathematicsfinalDocument60 pagesBusiness MathematicsfinalKristine Inon AbadianoNo ratings yet

- CH 6 QaDocument2 pagesCH 6 QaHana LeeNo ratings yet

- CH 8 - Aggregate Planning in The Supply Chain PDFDocument24 pagesCH 8 - Aggregate Planning in The Supply Chain PDFsheela sinhaNo ratings yet

- ACCRINT FunctionDocument3 pagesACCRINT FunctionfrazbuttNo ratings yet

- Asset Management: 5. Investment Strategies: Felix Wilke Nova School of Business and EconomicsDocument31 pagesAsset Management: 5. Investment Strategies: Felix Wilke Nova School of Business and Economics47044No ratings yet