Professional Documents

Culture Documents

Itax Blank Format 22-23

Itax Blank Format 22-23

Uploaded by

DSEU Campus GBPIT OkhlaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itax Blank Format 22-23

Itax Blank Format 22-23

Uploaded by

DSEU Campus GBPIT OkhlaCopyright:

Available Formats

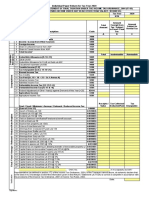

Office of the ----------------------------------------------------------

Salary and Deduction Detail for FY : 2022-23

Name : PAN : TAN: Bank A/c :

Post : SI No : GPF No: Mobile No. :

ROP (If any, put the

Other Allowance 1

Other Allowance 2

Other Deduction 2

Other Deduction1

CM Corona Relief

Income Tax / TDS

Group Insurance

Washing Allow.

value in minus)

Bill No. - Date

SI LOAN + INT

Dearness Pay

Net Payment

Gross Salary

Hitkari Nidhi

Month /

Leave Pay

Accidental

Deduction

GPF LOAN

Basic Pay

Spl. Pay

TV No. - Date

H.R.A.

RGHS

Total

D.A.

GPF

LIC

SI

Mar-2022

Apr-2022

May-2022

Jun-2022

Jul-2022

Aug-2022

Sep-2022

Oct-2022

Nov-2022

Dec-2022

Jan-2023

Feb-2023

TOTAL

Signature of Employee Signature of DDO

() www.rssrashtriya.org

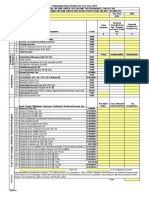

Office of the ----------------------------------------------------------

Old Tax

Old Tax Regime

Regime

vk;dj x.kuk izi= o"kZ 2022-23 ¼dj fu/kkZj.k o"kZ 2023-24½

1 uke deZpkjh % in % PAN :

2 vk; % o"kZ&2022-23 esa izkIr dqy osru ¼ dj ;ksX; lqfo/kkvksa ds eqY; lfgr ½ ₹ -

3 x`g fdjk;k] /kkjk 10 (13A) ds vUrxrZ ,oa /kkjk 10 (14) ds vUrxrZ vU; Hkrs tks dj eqDÙk gSA ₹ -

4 'ks"k (2-3) ₹ -

5 ¼i½ LVs.MMZ fMMsD'ku (Standard Deduction) 50,000 ¼vf/kdre½ /kkjk 16 (ia)

¼ii½ euksjt

a u Hkrk /kkjk 16 (ii) ds vUrxrZ ¼ vf/kdre lhek : 5,000 ½

¼iii½ O;olk; dj /kkjk 16 (iii) ds vUrxrZ

;ksx (5) ₹ -

6 'ks"k (4-5) ₹ -

7 ¼v½ x`g lEifr ls vk;% ¼1½ Loa; ds mi;ksx esa &'kwU; ¼2½ izkIr fdjk;k #-

fdjk;s dk 30% x`g _.k ij C;kt x`gdj ;ksx 7¼c½

¼c½ ?kVk;sa

'ks"k &@$¼ 7¼v½ ,oa ;ksx 7¼c½ dk½ ₹ -

8 dqy 'ks"k &@$ ¼6 ,oa 7½ ₹ -

9 vU; vk; ₹ -

10 ldy vk; ;ksx (8+9) ₹ -

11 ?kVkb;s dVkSSfr;k¡ %& /kkjk US 80C, 80CCC,80CCD (1)

(A) vf/kdre lhek 1]50]000@& ¼/kkjk 80CCE ½ ] ¼/kkjk 80CCD (2), ds vykok

(i) jkT; chek ¼SI) ₹ - (xi) ljdkjh is'a ku ;kstuk esa va'knku ECPF

₹ -

(ii) thou chek izhfe;e ¼LIC) ₹ - vf/kdre osru dk 10 % /kkjk 80CCD(1)

(iii) jk"Vªh; cpr i= ¼NSC) ₹ - (xii) is'a ku Iyku gsrq va'knku ¼/kkjk 80CCC½ ₹ -

(iv) yksd Hkfo"; fuf/k ¼PPF) ₹ - (xiii) jk"Vªh; cpr i= ij vnr C;kt ₹ -

(v) jk"Vªh; cpr Ldhe ¼NSS) ₹ - (xiv) V;w'ku Qhl ₹ -

(vi) Gen.Provident Fund (GPF) ₹ - (xv) bfDoVh fyad lsfoax Ldhe ₹ -

(vii) lkewfgd chek izhfe;e ¼G.Ins.) ₹ - (xvi) LFkfxr okf"kZdh ¼Defferred Annuty) ₹ -

(viii) ;w- ,y- vkbZ- ih-@okf"kZd Iyku ₹ - (xvii) ih-,y-vkbZ- ¼PLI) ₹ -

(ix) x`g _.k fdLr ¼HBA Premium) ₹ - (xviii) vU; tek jkf'k ¼/kkjk 80 lh ds vUrxZr½ ₹ -

(x) lq d U;k le`f ) ;ks t uk es a tek jkf'k ₹ - (xix) ;ksx ( i ls xviii ) ₹ -

vf/kdre dVkSrh dh jkf'k 1.50 yk[k #i, rd ₹ -

(B) ?kVkb;s& /kkjk 80CCD(2) fu;ksDrk }kjk is'a ku va'knku dh jkf'k ¼vf/kdre osru dk 10%) i`Fkd ls NwV ₹ -

(C) ?kVkb;s & /kkjk 80CCD (1B) uohu is'a ku ;kstuk esa vfrfjDr va'knku ¼vf/kdre :- 50,000) ₹ -

;ksx 11(A+B+C) ₹ -

12 vU; dVkSfr;k¡

1- /kkjk 80 D fpfdRlk chek izhfe;e ¼Lo;a]ifr@iRuh o cPpksa ds fy, : 25000] ekrk&firk ds fy, : 25,000 lhfu;j flVhtu : 50,000½ ₹ -

2- /kkjk 80 DD fodykax vkfJrksa ds fpfdRlk mipkj ¼vf/kdre 75,000 rFkk 80% ;k vf/kd fodykaxrk 125,000½ ₹ -

3- /kkjk 80 DDB fof'k"V jksaxksa ds mipkj gsrq dVkSrh ¼vf/kdre : 40,000] lhfu;j flVhtu gsrq : 100,000½ ₹ -

4- /kkjk 80 E mPp f'k{kk gsrq fy, _.k dk C;kt ₹ -

5- /kkjk 80 G /kekZFkZ laLFkkvksa vkfn dks fn;s nku ¼ d Js.kh esa 100 izfr'kr ,oa [k Js.kh esa 50 izfr'kr½ ₹ -

6- /kkjk 80 U LFkkbZ :i ls 'kkjhfjd vleFkZrrk dh n'kk esa ¼vf/kdre 75,000 rFkk vf/kfu;e 1995 ds vuqlkj 125,000½ ₹ -

7- /kkjk 80 TTA cpr [kkrs ij C;kt dh vf/kdre NwV :- 10,000 U/S 194(IA) ₹ -

8- /kkjk 80 TTB - aofj"B ukxfjdksa dks lHkh izdkj ds C;kt ij vf/kdre NwV& 50,000 :- U/S 194(A) ₹ -

9- /kkjk 80 GGC jktuhfrd ik0 gsrq fn;k x;k nku ₹ -

dqy ;ksx 12 ¼ 1 ls 9 rd ½ ₹ -

13 dqy dVkSrh ( 11 + 12) ₹ -

14 dj ;ksX; vk; ( 10 - 13 ) ₹ -

15 dqy vk; dh jkf'k dks lEiw.kZ djuk ¼ nl ds xq.kd esa ½ /kkjk 288 A ₹ -

16 vk;dj dh x.kuk mijksDr dkWye 15 ds vk/kkj ij

,d O;fDr dj nkrk ofj"B ukxfjd ¼60 ls 80 o"kZ rd½ 80 o"kZ ;k vf/kd vk;q

2,50,000 rd Nil 3,00,000 rd Nil ₹ -

2,50,001-5,00,000 5% 3,00,001-5,00,000 5% 5,00,000 rd Nil ₹ -

5,00,001-10,00,000 20% 5,00,001-10,00,000 20% 5,00,001-10,00,000 20% ₹ -

10,00,000 ls vf/kd 30% 10,00,000 ls vf/kd 30% 10,00,000 ls vf/kd 30% ₹ -

¼1½ ;ksx vk;dj ₹ -

¼2½ NwV ?kkjk 87 A ¼2.50 yk[k ls 5 yk[k rd dh dj ;ksX; vk; ij vk;dj dh NwV vf/kdre :- 12,500 rd½ ₹ -

¼3½ 'ks"k vk;dj (1-2) ₹ -

¼4½ f'k{kk midj 2% ,oa mPp f'k{kk ds fy, vf/kHkkj 2% (;ksx 4%) ₹ -

dqy vk;dj (3+4) ₹ -

17 ?kVkb;s %& jkgr /kkjk 89 ds rgr ₹ -

18 dqy 'ks"k vk;dj ₹ -

19 flrEcj 2022 vDVwcj ls fnlEcj tuojh 2023 Qjojh 2023 Vh-Mh-,l- dqy VSDl dVkSrh

vk;dj dVkSrh rd :i;s 2022 :i;s :i;s

:i;s :Ik;s ;ksx dkWye 19

dk fooj.k

₹ -

Income Tax Payble/Refundable (Old Tax Regime) ₹ -

Signature of Employee Signature of DDO

www.rssrashtriya.org

Office of the ----------------------------------------------------------

NewTax

Old Tax Regime

Regime

vk;dj x.kuk izi= o"kZ 2022-23 ¼dj fu/kkZj.k o"kZ 2023-24½

1 uke deZpkjh % in % PAN :

2 vk; % o"kZ& 2022-23 esa izkIr dqy osru ¼dj ;ksX; lqfo/kkvksa ds eqY; lfgr ½ ₹ -

3 x`g fdjk;k] /kkjk 10(13 A) ds vUrxrZ ,oa /kkjk 10(14) ds vUrxrZ vU; Hkrs tks dj eqDÙk gSA ₹ -

4 'ks"k ¼2&3½ ₹ -

5 ¼i½ LVs.MMZ fMMsD'ku (Standard Deduction) 50,000 ¼vf/kdre½ /kkjk 16 (ia)

¼ii½euksjatu Hkrk /kkjk 16 (ii) ds vUrxrZ ¼ vf/kdre lhek : 5000 ½

¼iii½ O;olk; dj /kkjk 16 (iii) ds vUrxrZ

;ksx (5) ₹ -

6 'ks"k (4-5) ₹ -

7 ¼v½ x`g lEifr ls vk;% ¼1½ Loa; ds mi;ksx esa &'kwU; ¼2½ izkIr fdjk;k #-

fdjk;s dk 30% x`g _.k ij C;kt x`gdj ;ksx 7¼c½

¼c½ ?kVk;sa

'ks"k &@$¼7¼v½ ,oa ;ksx 7¼c½ dk½ ₹ -

8 dqy 'ks"k &@$ ¼6 ,oa 7½ ₹ -

9 vU; vk; ₹ -

10 ldy vk; ;ksx (8 + 9) ₹ -

11 ?kVkb;s dVkSSfr;k¡ %&

(A) /kkjk US 80C, 80CCC,80CCD (1) vf/kdre dVkSrh dh jkf'k ₹ -

(B) ?kVkb;s& /kkjk 80CCD(2) fu;ksDrk }kjk is'a ku va'knku dh jkf'k ¼vf/kdre osru dk 10%) i`Fkd ls NwV ₹ -

(C) ?kVkb;s & /kkjk 80CCD (1B) uohu is'a ku ;kstuk esa vfrfjDr va'knku ¼vf/kdre :- 50,000) ₹ -

;ksx 11(A+B+C) ₹ -

12 vU; dVkSfr;k¡

1- /kkjk 80 D ,fpfdRlk chek izhfe;e ¼Lo;a]ifr@iRuh o cPpksa ds fy, : 25000] ekrk&firk ds fy, : 25000]lhfu;j flVhtu : 50000½ ₹ -

2- /kkjk 80DD fodykax vkfJrksa ds fpfdRlk mipkj ¼vf/kdre 75,000 rFkk 80% ;k vf/kd fodykaxrk 125,000½ ₹ -

3- /kkjk

80DDB fof'k"V jksx a ksa ds mipkj gsrq dVkSrh ¼vf/kdre : 40,000] lhfu;j flVhtu gsrq : 100,000) ₹ -

4- /kkjk

80E mPp f'k{kk gsrq fy, _.k dk C;kt ₹ -

5- /kkjk

80G /kekZFkZ laLFkkvksa vkfn dks fn;s nku ¼ d Js.kh esa 100 izfr'kr ,oa [k Js.kh esa 50 izfr'kr½ ₹ -

6- /kkjk

80U LFkkbZ :i ls 'kkjhfjd vleFkZrrk dh n'kk esa ¼vf/kdre 75,000 rFkk vf/kfu;e 1995 ds vuqlkj 125,000½ ₹ -

7- /kkjk

80 TTA cpr [kkrs ij C;kt dh vf/kdre NwV :- 10,000 U/S 194(IA) ₹ -

8- /kkjk

80 TTB - aofj"B ukxfjdksa dks lHkh izdkj ds C;kt ij vf/kdre NwV& 50000 :- U/S 194(A) ₹ -

9- /kkjk

80 GGA vuqeksfnr oSKkfud] lkekftd] xzkeh.k fodkl vkfn gsrq fn;k x;k nku ₹ -

dqy ;ksx 12 ¼ 1 ls 9 rd ½ ₹ -

13 dqy dVkSrh ( 11 + 12) ₹ -

14 dj ;ksX; vk; ( 10 - 13 ) ₹ -

15 dqy vk; dh jkf'k dks lEiw.kZ djuk ¼ nl ds xq.kd esa ½ /kkjk 288A ₹ -

16 vk;dj dh x.kuk mijksDr dkWye 15 ds vk/kkj ij

80 o"kZ ;k vf/kd vk;q ofj"B ukxfjd ¼ 60 ls 80 o"kZ rd½ ,d O;fDr dj nkrk ¼vk;q 60 o"kZ rd½

3,00,000 rd Nil 3,00,000 rd Nil 2,50,000 rd - Nil ₹

3,00,001-5,00,000 5% 3,00,001-5,00,000 5% 2,50,001-5,00,000 - 5% ₹

5,00,001-7,50,000 10% 5,00,001-7,50,000 10% 5,00,001-7,50,000 10% - ₹

7,50,001 - 10,00,000 15% 7,50,001 - 10,00,000 15% 7,50,001 - 10,00,000 15% - ₹

10,00,001 - 12,50,000 20% 10,00,001 - 12,50,000 20% 10,00,001 - 12,50,000 20% - ₹

12,50,001 - 15,00,000 25% 12,50,001 - 15,00,000 25% 12,50,001 - 15,00,000 25% - ₹

15,00,000 ls vf/kd 30% 15,00,000 ls vf/kd 30% 15,00,000 ls vf/kd 30% - ₹

¼1½ ;ksx vk;dj - ₹

¼2½ NwV ?kkjk 87(A) ¼2.50 yk[k ls 5 yk[k rd dh dj ;ksX; vk; ij vk;dj dh NwV vf/kdre :- 12,500 rd½ - ₹

¼3½ 'ks"k vk;dj ¼1&2½ - ₹

¼4½ f'k{kk midj 2% ,oa mPp f'k{kk ds fy, vf/kHkkj 2% (;ksx 4%) - ₹

dqy vk;dj (3 + 4) - ₹

17 ?kVkb;s %& jkgr /kkjk 89 ds rgr - ₹

18 dqy 'ks"k vk;dj - ₹

19 flrEcj 2022 vDVwcj ls fnlEcj tuojh 2023 Qjojh 2023 Vh-Mh-,l- dqy VSDl dVkSrh

vk;dj dVkSrh rd :i;s 2022 :i;s :i;s

:i;s :Ik;s ;ksx dkWye 19

dk fooj.k

₹ -

Income Tax Payble/Refundable ₹ -

Signature of Employee Signature of DDO

www.rssrashtriya.org

You might also like

- Fakhruddin General Trading Co. LLCDocument1 pageFakhruddin General Trading Co. LLCMusab AhmadNo ratings yet

- Trainors Training On Parent Effectiveness SeminarDocument49 pagesTrainors Training On Parent Effectiveness SeminarBigg Clicks96% (50)

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Document8 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Nitesh YNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2022-23Document5 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2022-23Nitesh YNo ratings yet

- Incometax Calculation 2022 23 For MobileDocument10 pagesIncometax Calculation 2022 23 For Mobileanuj palNo ratings yet

- Form BDocument2 pagesForm BPower MuruganNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2020-21Document9 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2020-21Nihit SandNo ratings yet

- Wage Account November 2020M HN-1Document12 pagesWage Account November 2020M HN-1Pavel ViktorNo ratings yet

- Income Tax Calculation 2022 2023Document9 pagesIncome Tax Calculation 2022 2023GungamerNo ratings yet

- Bengalore: Ree U'sDocument1 pageBengalore: Ree U'sR ChandruNo ratings yet

- Salary Tds Computation Sheet Sec 192bDocument1 pageSalary Tds Computation Sheet Sec 192bpradhan13No ratings yet

- InvoiceDocument2 pagesInvoiceTaufik RohmanNo ratings yet

- Proforma Invoice: Currency in Indonesia Rupiah ExplanationDocument1 pageProforma Invoice: Currency in Indonesia Rupiah Explanationdar darmanNo ratings yet

- FBR Tax FilingDocument48 pagesFBR Tax FilingMuhammad Waqas Hanif100% (1)

- Annual Pay Slip: Month: September 2020 April 2019 ToDocument2 pagesAnnual Pay Slip: Month: September 2020 April 2019 ToVinay JainNo ratings yet

- Income Tax Calculator For IndiaDocument4 pagesIncome Tax Calculator For Indiamahalakshmi muruganNo ratings yet

- 811 - GST Invoice - XXXXXXX86830 - 27220124049XXXXX - 1Document1 page811 - GST Invoice - XXXXXXX86830 - 27220124049XXXXX - 1cryptocasper223No ratings yet

- Individual Paper Return For Tax Year 2019: SignatureDocument10 pagesIndividual Paper Return For Tax Year 2019: SignatureEngr Saad Bin SarfrazNo ratings yet

- Form BDocument1 pageForm BPrateek BaruahNo ratings yet

- Reading 29 - Income TaxDocument1 pageReading 29 - Income Taxmaimaitaan120201No ratings yet

- Ja RawalDocument1 pageJa Rawalfigigob267No ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- April28-30 DifferentialDocument1 pageApril28-30 DifferentialPraise BuenaflorNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Lorraine Steffany BanguisNo ratings yet

- SingleWindow Annex C1 C2 C3Document7 pagesSingleWindow Annex C1 C2 C3EduardoNo ratings yet

- Dewas Cube Test PoDocument2 pagesDewas Cube Test PoSHAGUN AGARWALNo ratings yet

- Lcris Report (Dry-18)Document8 pagesLcris Report (Dry-18)Janet Macanaya DomingoNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Charge On GSTDocument1 pageCharge On GSTKN NetworkNo ratings yet

- Issue Date: Rating Area Locality Due Date YearDocument2 pagesIssue Date: Rating Area Locality Due Date YearAqeel AhmedNo ratings yet

- Particulars of Cost of AccidentsDocument2 pagesParticulars of Cost of AccidentsBhagat DeepakNo ratings yet

- Work Program Format NEWDocument2 pagesWork Program Format NEWmarjgumate1214No ratings yet

- Appendix 33 - Payroll - April 2021Document2 pagesAppendix 33 - Payroll - April 2021Praise BuenaflorNo ratings yet

- Income Tax Calculator 2018-2019Document1 pageIncome Tax Calculator 2018-2019Muhammad Hanif SuchwaniNo ratings yet

- + Zero Fee: RewardsDocument2 pages+ Zero Fee: RewardsSuraj personalNo ratings yet

- Manual Return 2023Document28 pagesManual Return 2023arsalanghuralgtNo ratings yet

- Liquidation JHSDocument16 pagesLiquidation JHSRio Ferdinand P. MarcelinoNo ratings yet

- Dec-17Document2 pagesDec-17Darshan BhansaliNo ratings yet

- Tax Monthly DeclarationDocument14 pagesTax Monthly DeclarationFaîez RekikNo ratings yet

- SPS-19 After Balance QtyDocument2 pagesSPS-19 After Balance QtyAbhishek BhandariNo ratings yet

- Individual Paper Returnfor Tax Year 2022Document25 pagesIndividual Paper Returnfor Tax Year 2022abdul karimNo ratings yet

- Sis 873 Rel Interfield Const Corp 03 13 18Document3 pagesSis 873 Rel Interfield Const Corp 03 13 18dean winterNo ratings yet

- 8 Declaración de Renta-USDocument1 page8 Declaración de Renta-USSofía Martínez GómezNo ratings yet

- Adobe Scan 05 Oct 2023Document1 pageAdobe Scan 05 Oct 2023infoprincemachinesNo ratings yet

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- CRSI Summary Claim & Technical Data 20210323154154Document3 pagesCRSI Summary Claim & Technical Data 20210323154154jefry sitorusNo ratings yet

- MRR Package 20 July 2019Document18 pagesMRR Package 20 July 2019K KARTHIKNo ratings yet

- Business MathDocument4 pagesBusiness MathAislinn Sheen AcasioNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2380101884002700000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2380101884002700000sarath potnuriNo ratings yet

- Liste in Tret in EreDocument5 pagesListe in Tret in EreFlorin PodNo ratings yet

- ReportDocument3 pagesReportabdukarimu abdallahNo ratings yet

- Appendix 20 - Sabudb - Far 2Document1 pageAppendix 20 - Sabudb - Far 2pdmu regionixNo ratings yet

- GST Handwritten Notes Charts Etc 30032018Document90 pagesGST Handwritten Notes Charts Etc 30032018Prasad Rao60% (5)

- Neon PolityDocument1 pageNeon PolityNirajThakurNo ratings yet

- Muhammad Afzal Nazir Ahmed Chak No 121 S-Hill NTN: 00000000000Document1 pageMuhammad Afzal Nazir Ahmed Chak No 121 S-Hill NTN: 00000000000Mian Jobs Sangla HillNo ratings yet

- Policy D083915524Document2 pagesPolicy D083915524ZishanNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320101184001300000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320101184001300000sarath potnuriNo ratings yet

- Safari - 02-Jan-2023 at 3:29 PMDocument1 pageSafari - 02-Jan-2023 at 3:29 PMSardar mohammadNo ratings yet

- Tamilnadu Genera Tion and Distribution Corpora Tion: I. Security Deposit DetailsDocument1 pageTamilnadu Genera Tion and Distribution Corpora Tion: I. Security Deposit DetailssamaadhuNo ratings yet

- Exam Fee Order 4,6,8 SemDocument2 pagesExam Fee Order 4,6,8 SemDSEU Campus GBPIT OkhlaNo ratings yet

- Freshers VacanciesDocument1 pageFreshers VacanciesDSEU Campus GBPIT OkhlaNo ratings yet

- Digiital Forensic Part 1Document41 pagesDigiital Forensic Part 1DSEU Campus GBPIT OkhlaNo ratings yet

- Application Form ADAM 2023-24Document2 pagesApplication Form ADAM 2023-24DSEU Campus GBPIT OkhlaNo ratings yet

- Campus PresentationDocument10 pagesCampus PresentationDSEU Campus GBPIT OkhlaNo ratings yet

- 2014BestICTStartupAward - Award BookletDocument18 pages2014BestICTStartupAward - Award BookletisochkNo ratings yet

- Anders Grimstad INMANY23Document38 pagesAnders Grimstad INMANY23sachdevagNo ratings yet

- Answer To The Question No: 1Document6 pagesAnswer To The Question No: 1Kazi TanimNo ratings yet

- Setup GuideDocument5 pagesSetup GuideBiwott MNo ratings yet

- Bersa TPR9 Threaded BarrelDocument2 pagesBersa TPR9 Threaded BarrelDicko Perdana PutraNo ratings yet

- Paper8 - PendingDocument9 pagesPaper8 - PendingApooNo ratings yet

- Meredith Rosenberg ResumeDocument2 pagesMeredith Rosenberg ResumeMeredith Rosenberg-AlexanderNo ratings yet

- PNP Memorandum Circular No 2021-16Document5 pagesPNP Memorandum Circular No 2021-16Dong Lupz100% (2)

- Intertechnique: Within The Quality Aerospace EnvironmentDocument32 pagesIntertechnique: Within The Quality Aerospace EnvironmentwonchoiNo ratings yet

- Foreign Lang NewsletterDocument1 pageForeign Lang Newsletterapi-544334671No ratings yet

- Volunteer Assignment Description VAD Peace CorpsDocument10 pagesVolunteer Assignment Description VAD Peace CorpsAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Mpa 504 - Inherent Human ValuesDocument4 pagesMpa 504 - Inherent Human ValuesMarinela Jade ManejaNo ratings yet

- A Political History of The Kingdom of Kazembe (Zambia) : Giacomo MacolaDocument256 pagesA Political History of The Kingdom of Kazembe (Zambia) : Giacomo Macolatemborhodah45No ratings yet

- Lokpal and Lokayukta Act 2013Document5 pagesLokpal and Lokayukta Act 2013you tube keedaNo ratings yet

- Quieting of TitleDocument9 pagesQuieting of TitleLoNo ratings yet

- Writing Women's Rites: Excision in Experimental African LiteratureDocument11 pagesWriting Women's Rites: Excision in Experimental African LiteratureM. L. LandersNo ratings yet

- Further Exercises Cambridge Practice Test 15 Test 3 A. ListeningDocument8 pagesFurther Exercises Cambridge Practice Test 15 Test 3 A. ListeningNguyễn Hải NgọcNo ratings yet

- May 2025 Ib Examinations ScheduleDocument7 pagesMay 2025 Ib Examinations ScheduleZain GamingNo ratings yet

- Notes On The Ninth Degree of AMORC With Additional CommentaryDocument17 pagesNotes On The Ninth Degree of AMORC With Additional Commentarycharly charly50% (2)

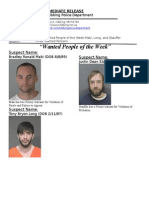

- Wanted People of The Week-Maki, Stauffer, LongDocument2 pagesWanted People of The Week-Maki, Stauffer, LongHibbing Police DepartmentNo ratings yet

- SDGS and 7th Five Year PlanDocument32 pagesSDGS and 7th Five Year PlanMahmuda BegumNo ratings yet

- Special Operations ExecutiveDocument15 pagesSpecial Operations ExecutiveSadiq KerkerooNo ratings yet

- Andaya, A History of Malaysia.Document24 pagesAndaya, A History of Malaysia.CQOT92No ratings yet

- Telecomevolution-Olawale Ige170402Document49 pagesTelecomevolution-Olawale Ige170402sisaara.aeroNo ratings yet

- Old Exam AEDocument12 pagesOld Exam AEaaaaaNo ratings yet

- Philisophy of EducationDocument35 pagesPhilisophy of EducationHilux23100% (1)

- Outcomes of Teacher Education: Module No. and Title Lesson No. and Title Learning OutcomesDocument8 pagesOutcomes of Teacher Education: Module No. and Title Lesson No. and Title Learning OutcomesAriel BobisNo ratings yet

- Now Platform™: Single Data Model Multi-InstanceDocument3 pagesNow Platform™: Single Data Model Multi-InstanceMarcusViníciusNo ratings yet

- Mulund College of CommerceDocument20 pagesMulund College of CommerceAashay DagdeNo ratings yet