Professional Documents

Culture Documents

Swaps

Swaps

Uploaded by

Puja DuaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swaps

Swaps

Uploaded by

Puja DuaCopyright:

Available Formats

Swaps

are derivative instruments that represent an agreement between two parties to exchange a

series of cash flows over a specific period of time.

Swaps offer great flexibility in designing and structuring contracts based on mutual agreement.

This flexibility generates many swap variations, with each serving a specific purpose.

There are multiple reasons why parties agree to such an exchange:

Investment objectives or repayment scenarios may have changed.

There may be increased financial benefit in switching to newly available or alternative cash

flow streams.

The need may arise to hedge or mitigate risk associated with a floating rate loan repayment

Eg.

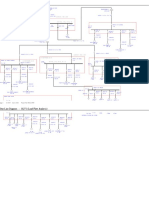

Assume Paul prefers a fixed rate loan and has loans available at a floating rate

(LIBOR+0.5%) or at a fixed rate (10.75%).

Mary prefers a floating rate loan and has loans available at a floating rate (LIBOR+0.25%) or

at a fixed rate (10%).

Due to a better credit rating, Mary has the advantage over Paul in both the floating rate

market (by 0.25%) and in the fixed rate market (by 0.75%).

Her advantage is greater in the fixed rate market so she picks up the fixed rate loan.

However, since she prefers the floating rate, she gets into a swap contract with a bank to

pay LIBOR and receive a 10% fixed rate.

Paul borrows at floating (LIBOR+0.5%), but since he prefers fixed, he enters into a swap

contract with the bank to pay fixed 10.10% and receive the floating rate.

Fixe

d Floating

he enters

into a

swap

contract

with the

bank to

pay fixed

10.10%

and

receive the

Pau 10.7 Libor+0.5 floating

l 5 % rate.

she gets

into a swap

contract

with a bank

to

pay LIBOR a Benefits:

Paul pays (LIBOR+0.5%) to the lender and 10.10% to the

nd receive a

bank, and receives LIBOR from the bank. His net payment is

Mar Libor+0.2 10% fixed

10.6% (fixed). The swap effectively converted his original

y 10% 5% rate. floating payment to a fixed rate, getting him the most

economical rate.

Similarly, Mary pays 10% to the lender and LIBOR to the bank and receives 10% from the bank. Her

net payment is LIBOR (floating). The swap effectively converted her original fixed payment to the

desired floating, getting her the most economical rate.

The bank takes a cut of 0.10% from what it receives from Paul and pays to Mary.

You might also like

- Chapter - 7 - Solution Hull Option, Futures and Other DerivativesDocument3 pagesChapter - 7 - Solution Hull Option, Futures and Other DerivativesAn Kou0% (1)

- Hull OFOD10 e Solutions CH 07Document12 pagesHull OFOD10 e Solutions CH 07Vishal GoyalNo ratings yet

- Rabocase 105019Document6 pagesRabocase 105019CfhunSaatNo ratings yet

- Interest Rate Swap IllustrationDocument15 pagesInterest Rate Swap IllustrationVaidyanathan RavichandranNo ratings yet

- Sample Questions For SWAPDocument4 pagesSample Questions For SWAPKarthik Nandula100% (1)

- Swap RevisedDocument36 pagesSwap RevisedrigilcolacoNo ratings yet

- Chapter 7Document10 pagesChapter 7rcraw87No ratings yet

- Swaps 1Document22 pagesSwaps 1Robert AxelordNo ratings yet

- Swaps: Fixed by Floating and Foreign Currency SwapsDocument34 pagesSwaps: Fixed by Floating and Foreign Currency SwapsGudikandula RavinderNo ratings yet

- A Presentation On Interest Rate Swap: Presented By: Priyank Shah Dhimant VyasDocument7 pagesA Presentation On Interest Rate Swap: Presented By: Priyank Shah Dhimant Vyaspriyank shahNo ratings yet

- Ch05 SwapsDocument41 pagesCh05 SwapsArjun GirishNo ratings yet

- Interest Rate Risk Management Solutions - RevisionDocument14 pagesInterest Rate Risk Management Solutions - RevisionAmrit NeupaneNo ratings yet

- Chapter 14 Interest Rate and Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument15 pagesChapter 14 Interest Rate and Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsBijay AgrawalNo ratings yet

- Swap - Worked Out Examples V02Document32 pagesSwap - Worked Out Examples V02Harshit DwivediNo ratings yet

- Chapter 14Document15 pagesChapter 14Ashwitha KarkeraNo ratings yet

- Week 07-Tutorial-Mishal Manzoor (Fins3616) - T3 2020Document76 pagesWeek 07-Tutorial-Mishal Manzoor (Fins3616) - T3 2020Kelvin ChenNo ratings yet

- Topic 5 Swaps Shorter VersionDocument25 pagesTopic 5 Swaps Shorter VersionAngie Natalia Llanos MarinNo ratings yet

- Finance 4040 C14Document2 pagesFinance 4040 C14Ravi PatelNo ratings yet

- Chapter 10 Interest Rate & Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument15 pagesChapter 10 Interest Rate & Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsAbdulrahman KhelefNo ratings yet

- Basis Swap: Presented by Ankita Gulab Rai (CIBOP - 85)Document16 pagesBasis Swap: Presented by Ankita Gulab Rai (CIBOP - 85)Pooja PadhiNo ratings yet

- Chap 014Document15 pagesChap 014Jitendra PatelNo ratings yet

- Currency and Interest Rate Swaps: Chapter TenDocument22 pagesCurrency and Interest Rate Swaps: Chapter TenEvan SwagerNo ratings yet

- Currency and Interest Rate Swaps: Chapter TenDocument22 pagesCurrency and Interest Rate Swaps: Chapter TenNitin MahindrooNo ratings yet

- Currency & Interest Rate Swaps: International Financial ManagementDocument34 pagesCurrency & Interest Rate Swaps: International Financial ManagementAlexandru DavidNo ratings yet

- Financial Swap: By: Marlene PuraDocument11 pagesFinancial Swap: By: Marlene PuraMarlene PuraNo ratings yet

- I R A C S: Nterest ATE ND Urrency WapsDocument16 pagesI R A C S: Nterest ATE ND Urrency WapsSurbhî GuptaNo ratings yet

- Lecture 6Document32 pagesLecture 6Nilesh PanchalNo ratings yet

- Example SwapDocument10 pagesExample SwapThanh Huyền TrầnNo ratings yet

- Swaps: Interest Rate SwapDocument9 pagesSwaps: Interest Rate Swapdinesh8maharjanNo ratings yet

- Swaps 130430045557 Phpapp01Document29 pagesSwaps 130430045557 Phpapp01Avanish VermaNo ratings yet

- Swaps: Problem 7.1Document4 pagesSwaps: Problem 7.1Hana LeeNo ratings yet

- Designing An Interest Rate SwapDocument8 pagesDesigning An Interest Rate SwapRohit Kumar PandeyNo ratings yet

- Chapter 4 - Swaps - 2022 - SDocument51 pagesChapter 4 - Swaps - 2022 - SĐức Nam TrầnNo ratings yet

- Swaps: Prof Mahesh Kumar Amity Business SchoolDocument27 pagesSwaps: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- FIN30014 - Week 9Document33 pagesFIN30014 - Week 9Jason DanielNo ratings yet

- How To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingDocument3 pagesHow To Design A Plain Vanilla Interest Rate Swap: Fixed FloatingaS hausjNo ratings yet

- Assignment 2 - Interest Rates and SwapsDocument3 pagesAssignment 2 - Interest Rates and SwapsRizwan JamilNo ratings yet

- SWAPsDocument41 pagesSWAPsFranklin XavierNo ratings yet

- Interest Rate Swaps Currency Swaps Chapter 9Document20 pagesInterest Rate Swaps Currency Swaps Chapter 9armando.chappell1005No ratings yet

- 1 Exercises On Swaps: 5:3% 5:4% Libor +0:6%Document6 pages1 Exercises On Swaps: 5:3% 5:4% Libor +0:6%Rimpy SondhNo ratings yet

- Interest Rate Swap ExplainDocument2 pagesInterest Rate Swap Explainb20fc1310No ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch07Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch07Kevin Molly KamrathNo ratings yet

- Slides8 StudentDocument39 pagesSlides8 StudentkmeetheebsNo ratings yet

- Swap Contract: What Is Swaps?Document12 pagesSwap Contract: What Is Swaps?Ubraj NeupaneNo ratings yet

- Different Types of Swaps: Swaps Cash Flows An Introduction To SwapsDocument4 pagesDifferent Types of Swaps: Swaps Cash Flows An Introduction To SwapsjithendraNo ratings yet

- Financial Derivatives - Chap3Document16 pagesFinancial Derivatives - Chap3Abdelhadi KaoutiNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch07Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch07Kevin Molly KamrathNo ratings yet

- Hull OFOD9e MultipleChoice Questions and Answers Ch07 PDFDocument7 pagesHull OFOD9e MultipleChoice Questions and Answers Ch07 PDFfawefwaeNo ratings yet

- Interest Rate SwapsDocument3 pagesInterest Rate SwapshamadeenooNo ratings yet

- 395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30Document6 pages395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30blazeweaverNo ratings yet

- Section 3 - SwapsDocument49 pagesSection 3 - SwapsEric FahertyNo ratings yet

- AP Topic 9 FuturesDocument35 pagesAP Topic 9 Futuressumail wangNo ratings yet

- Currency and Interest Rate SwapsDocument33 pagesCurrency and Interest Rate SwapsHiral PatelNo ratings yet

- Swaps: Prof Mahesh Kumar Amity Business SchoolDocument21 pagesSwaps: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Rbi Role CAMELSDocument1 pageRbi Role CAMELSPuja DuaNo ratings yet

- Difference Between Basel 1 2 and 3Document1 pageDifference Between Basel 1 2 and 3Puja DuaNo ratings yet

- Stress TestingDocument2 pagesStress TestingPuja DuaNo ratings yet

- Principles & Practices of Life InsuranceDocument1 pagePrinciples & Practices of Life InsurancePuja DuaNo ratings yet

- Methods of Volume StudyDocument13 pagesMethods of Volume StudyJaiminkumar SutharNo ratings yet

- Chapter 15 Part 2Document40 pagesChapter 15 Part 2omarNo ratings yet

- J Clojure Protocols PDFDocument17 pagesJ Clojure Protocols PDFsavio77No ratings yet

- Individual Reflection PaperDocument2 pagesIndividual Reflection PaperAHMAD AFIQ FIKRI MUHAMAD SAIFUDINNo ratings yet

- Irrigation System of Pakistan, Present Issues and Future Options by Muhammad Umer KarimDocument4 pagesIrrigation System of Pakistan, Present Issues and Future Options by Muhammad Umer KarimMuhammad Umer KarimNo ratings yet

- 3minute TalkDocument3 pages3minute TalkPramod Gowda BNo ratings yet

- CCC (NR) Supplementary Examination July-2010 Notification For 08,07Document8 pagesCCC (NR) Supplementary Examination July-2010 Notification For 08,07lakshmi03No ratings yet

- WTW TurbidityDocument6 pagesWTW TurbidityIndra AditamaNo ratings yet

- Developmental Reading 1Document17 pagesDevelopmental Reading 1api-310357012100% (1)

- Canary Global Sourcing - 2023Document24 pagesCanary Global Sourcing - 2023John LongNo ratings yet

- First Quarter Summative Test in English 7Document2 pagesFirst Quarter Summative Test in English 7Sena AngelicaNo ratings yet

- MassDocument2 pagesMassapi-222745762No ratings yet

- Twisted Pair, Coaxial Cable, Optical FiberDocument34 pagesTwisted Pair, Coaxial Cable, Optical Fiber7t854s6wd2No ratings yet

- Karpagam Academy of Higher Education: Minutes of Class Committee MeetingDocument3 pagesKarpagam Academy of Higher Education: Minutes of Class Committee MeetingDaniel DasNo ratings yet

- Balanced Literacy Strategies For TeachersDocument19 pagesBalanced Literacy Strategies For TeachersJonette Cano LandayanNo ratings yet

- Small-Angle Scattering: A View On The Properties, Structures and Structural Changes of Biological Macromolecules in SolutionDocument81 pagesSmall-Angle Scattering: A View On The Properties, Structures and Structural Changes of Biological Macromolecules in SolutiondibudkNo ratings yet

- Chapter 6 - Job Order CostingDocument63 pagesChapter 6 - Job Order CostingXyne FernandezNo ratings yet

- Sae J2534 - 2002-1116Document48 pagesSae J2534 - 2002-1116goldpen1234100% (1)

- List of Projects Offered For GRIP - Aug 2023Document7 pagesList of Projects Offered For GRIP - Aug 2023Abcd EfghNo ratings yet

- 2m Engl Isomerism 2021 For StudDocument96 pages2m Engl Isomerism 2021 For StudGhost ShooterNo ratings yet

- Government Engineering College Dahod: Dadhichi HostelDocument5 pagesGovernment Engineering College Dahod: Dadhichi HostelSandip MouryaNo ratings yet

- LESSON - PLANS Group 6 ACID BASEDocument6 pagesLESSON - PLANS Group 6 ACID BASEindah sinagaNo ratings yet

- Princeton Review Hit Parade SAT WordsDocument5 pagesPrinceton Review Hit Parade SAT WordsstantonstudentNo ratings yet

- WWW TSZ Com NP 2021 09 The-Bull-Exercise-Questions-And-Answers HTMLDocument11 pagesWWW TSZ Com NP 2021 09 The-Bull-Exercise-Questions-And-Answers HTMLAbhay PantNo ratings yet

- 2019 ASMPH Baccalaureate Mass and Commencement ExercisesDocument4 pages2019 ASMPH Baccalaureate Mass and Commencement Exercisesashchua21No ratings yet

- Commercial Book ListDocument6 pagesCommercial Book Listoto saviourNo ratings yet

- Chapter 4.5 SC f5Document7 pagesChapter 4.5 SC f5kwongyawNo ratings yet

- Broucher (2023)Document2 pagesBroucher (2023)Atta Ul Mustafa ZainNo ratings yet

- MGS & WipDocument2 pagesMGS & WipRoni HadyanNo ratings yet

- Common Nail Disorders J.clindermatol.2013.06.015Document9 pagesCommon Nail Disorders J.clindermatol.2013.06.015Vita BūdvytėNo ratings yet