Professional Documents

Culture Documents

Noa-Iit Ob2120200629085533331

Noa-Iit Ob2120200629085533331

Uploaded by

Jay Maung MaungOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Noa-Iit Ob2120200629085533331

Noa-Iit Ob2120200629085533331

Uploaded by

Jay Maung MaungCopyright:

Available Formats

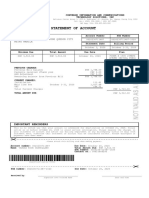

Tax Reference No : G6588940X NOTICE OF ASSESSMENT

Year of Assessment : 2020

Income Tax ORIGINAL

Date : 06 Jul 2020

Please quote the Tax Reference Number (eg. NRIC, FIN, etc) in full when corresponding with us.

MR JAY MAUNG MAUNG

8A ADMIRALTY STREET

#01-06/07

SINGAPORE 757437

55 Newton Road

(757437E) Revenue House

Singapore 307987

Tel: 1800-356 8300

Website: http://www.iras.gov.sg

e-Services: https://mytax.iras.gov.sg

1-1

OTHER 1. Your tax assessment is

S'PORE ($) COUNTRIES ($) TOTAL ($) based on information obtained

from the relevant organisations

EMPLOYMENT 32,160.00 32,160.00 and your last year's tax record,

if any. Please notify us of any

TOTAL INCOME 32,160.00 32,160.00 understatement or omission of

any income or of any excessive

ASSESSABLE INCOME 32,160.00 tax relief as there are penalties

LESS: PERSONAL RELIEFS for failing to do so.

Earned Income 1,000.00

2. You can view your total

TOTAL PERSONAL RELIEFS 1,000.00 outstanding income tax

payable, if any, via the View

CHARGEABLE INCOME 31,160.00 Account Summary e-Service.

FIRST 30,000.00 200.00 If the total outstanding tax

NEXT 1,160.00 @ 3.50% 40.60 240.60 payable is less than $10, the

amount will be carried forward

TAX PAYABLE BY 06 AUG 2020 240.60 DR to the next bill.

3. If you have any objection,

please submit your objection

If you need help with your tax payment, please check go.gov.sg/iras-difficulty-paying-tax online within 30 days via the

on how you may apply for a longer GIRO payment arrangement. Object to Assessment e-service

or email us at myTax Portal.

NG WAI CHOONG

COMPTROLLER OF INCOME TAX

Printed via myTax Portal https://mytax.iras.gov.sg

1-1 Page 1 of 1 301 CFN03101 106-13-649279634-0-9

You might also like

- PLAY - Should They File A Tax ReturnDocument9 pagesPLAY - Should They File A Tax ReturnAlanna100% (1)

- E Tax 20200504201259Document3 pagesE Tax 20200504201259monitganatra100% (1)

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do? $467.44wahleng ChewNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalAbdul HalimNo ratings yet

- Assesment Notice 2017Document1 pageAssesment Notice 2017Shounak KossambeNo ratings yet

- Calculate Completing A 1040Document2 pagesCalculate Completing A 1040api-4921774500% (1)

- Income Tax - Notice of Assessment (Original) : What Do You Need To Do?Document1 pageIncome Tax - Notice of Assessment (Original) : What Do You Need To Do?tehtarikNo ratings yet

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Quiz Taxation Yung May Red Na Highlist Is MaliDocument6 pagesQuiz Taxation Yung May Red Na Highlist Is MaliIrish EnriquezNo ratings yet

- Noa-Iit Ob2320190701042209hz8Document1 pageNoa-Iit Ob2320190701042209hz8Jay Maung MaungNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Notice of Assessment Original: Printed Via Mytax PortalDocument1 pageNotice of Assessment Original: Printed Via Mytax PortalNelly HNo ratings yet

- Noa-Iit Ob2320170627071310ufp PDFDocument1 pageNoa-Iit Ob2320170627071310ufp PDFjasper haiNo ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Noa-Iit Ob25202003170642261sf PDFDocument1 pageNoa-Iit Ob25202003170642261sf PDFSoon SoonNo ratings yet

- Notice of Assessment OriginalDocument1 pageNotice of Assessment OriginalWawan SaidNo ratings yet

- Notice of Assessment Amended: Printed Via Mytax PortalDocument1 pageNotice of Assessment Amended: Printed Via Mytax Portalmayoo1986No ratings yet

- Irs 2010Document1 pageIrs 2010eimanoNo ratings yet

- Noa-Iit Ob2220231215050837ibnDocument1 pageNoa-Iit Ob2220231215050837ibnFrankie TanNo ratings yet

- Noa-Iit Ob2620220516193754ktiDocument2 pagesNoa-Iit Ob2620220516193754ktiSelva SelvaNo ratings yet

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Noa-Iit Ob2620220530013620coDocument1 pageNoa-Iit Ob2620220530013620coChan Yin YenNo ratings yet

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoNo ratings yet

- Noa-Iit Ob26202204230848372gn PDFDocument1 pageNoa-Iit Ob26202204230848372gn PDFWalter SengNo ratings yet

- Noa-Iit Ob25202106140521020nzDocument1 pageNoa-Iit Ob25202106140521020nz江宗朋No ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Sudha 2022 PDFDocument1 pageSudha 2022 PDFBikash KumarNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103Document2 pagesNotice of Assessment - Year Ended 30 June 2020: MR Mohamadalamkhan Fajluraheman Pathan 583 Ipswich RD Annerley QLD 4103aalampathan76No ratings yet

- UntitledDocument3 pagesUntitledNisar AliNo ratings yet

- Noa-Iit Ob2420230527195835v3iDocument1 pageNoa-Iit Ob2420230527195835v3iRyan TanNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: MR Troy Tieppo 13 Witney ST Manoora QLD 4870Document2 pagesNotice of Assessment - Year Ended 30 June 2023: MR Troy Tieppo 13 Witney ST Manoora QLD 4870tieppotroyNo ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document4 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)Anand KumarNo ratings yet

- Tax I CasesDocument119 pagesTax I CasesJANINE MARIE BERNADETTE CASTRONo ratings yet

- Notice of Assessment 2021 04 01 17 31 56 853329Document4 pagesNotice of Assessment 2021 04 01 17 31 56 85332969j8mpp2scNo ratings yet

- Gurleen Kaur Mother 2 Year ItrDocument6 pagesGurleen Kaur Mother 2 Year ItrSajan SharmaNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- 80C CalculationDocument2 pages80C CalculationanandpurushothamanNo ratings yet

- 2015 Noa Elena - 1Document1 page2015 Noa Elena - 1Ded MarozNo ratings yet

- Deferred Tax CalculatorDocument2 pagesDeferred Tax Calculatoramitanshu chaturvediNo ratings yet

- It Reply Merge - PavaniDocument5 pagesIt Reply Merge - Pavanibharath reddyNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- Summary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789Document4 pagesSummary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789NKNo ratings yet

- PDF 311993080280623Document1 pagePDF 311993080280623Prabhakaran ANo ratings yet

- Income Tax - TRAINDocument27 pagesIncome Tax - TRAINSteveNo ratings yet

- Statement of Account: K-1St Street 131-A Kamuning Quezon City Metro ManilaDocument1 pageStatement of Account: K-1St Street 131-A Kamuning Quezon City Metro ManilaKhristin AllisonNo ratings yet

- Income Tax CalculatorDocument4 pagesIncome Tax CalculatorAchin AgarwalNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- Statement of Account: 0322 Adarna Ext. Unit V - Commonwealth Quezon City Metro ManilaDocument1 pageStatement of Account: 0322 Adarna Ext. Unit V - Commonwealth Quezon City Metro ManilaYsiad LlantosNo ratings yet

- Íxvyuè5Â Rinon Williamââââââââ R Çuâ"06Eî Mr. William Ruiz RinonDocument2 pagesÍxvyuè5Â Rinon Williamââââââââ R Çuâ"06Eî Mr. William Ruiz Rinonmadelyn CartasNo ratings yet

- Shivansh WarehouseDocument1 pageShivansh WarehouseAccounts DepartmentNo ratings yet

- Deepak Mittal CompDocument3 pagesDeepak Mittal Compsohanveers254No ratings yet

- Íxl È0Â Pacaâanas Richelleâââ D Ç0 +&5 - Î Mrs. Richelle Distrajo Paca AnasDocument2 pagesÍxl È0Â Pacaâanas Richelleâââ D Ç0 +&5 - Î Mrs. Richelle Distrajo Paca AnasReyno D. Paca-anasNo ratings yet

- P21 Balancing Statement 2021 1919455700005Document3 pagesP21 Balancing Statement 2021 1919455700005Mo IbrahimNo ratings yet

- Statement of Account: Christ The King Subd. Phase 1 B10 L8 Talon Kuatro Las Pi-As Metro ManilaDocument1 pageStatement of Account: Christ The King Subd. Phase 1 B10 L8 Talon Kuatro Las Pi-As Metro ManilaJessaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Clubbing of IncomeDocument2 pagesClubbing of IncomeDr. Mustafa KozhikkalNo ratings yet

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiNo ratings yet

- Individual Tax - ProblemsDocument5 pagesIndividual Tax - ProblemsJulienne Julio100% (1)

- GST101Document1 pageGST101ANKIT KUMAR IPM 2018 BatchNo ratings yet

- Payslip Airen ObenzaDocument1 pagePayslip Airen Obenzamiss_airenNo ratings yet

- TAX 1601 Answers Additions To TaxDocument4 pagesTAX 1601 Answers Additions To TaxAlrahjie AnsariNo ratings yet

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Mohammed RiyanNo ratings yet

- Exclusion From Gross Income: Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument4 pagesExclusion From Gross Income: Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested Answersikire123No ratings yet

- Vertical Analysis of Income Statement Excel TemplateDocument5 pagesVertical Analysis of Income Statement Excel TemplateAngelica MijaresNo ratings yet

- 02.APIT 2223 Table 01 TextDocument2 pages02.APIT 2223 Table 01 TextMufeesNo ratings yet

- 929 Vimala InvoicegstDocument1 page929 Vimala InvoicegstMugesh KumarNo ratings yet

- Sample Transfer LedgerDocument4 pagesSample Transfer LedgerEbrahiem EbiedNo ratings yet

- University of Rajasthan, Jaipur: ExaminationDocument1 pageUniversity of Rajasthan, Jaipur: ExaminationGodra English ClassesNo ratings yet

- Income Tax - Guidelines Financial Year 2022-23Document13 pagesIncome Tax - Guidelines Financial Year 2022-23Pradeep KVKNo ratings yet

- Chapter 13 Input Tax Credit (Mnemonics)Document2 pagesChapter 13 Input Tax Credit (Mnemonics)mohit lokhandeNo ratings yet

- Srinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)Document3 pagesSrinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)forty oneNo ratings yet

- Interim Financial Reporting-AssignmentDocument5 pagesInterim Financial Reporting-AssignmentLourdrandal AbellaNo ratings yet

- Tax Invoice-Cum-Receipt: Kerala Vision Broadband Private LimiDocument1 pageTax Invoice-Cum-Receipt: Kerala Vision Broadband Private LimiVivek AnandNo ratings yet

- Quizzer-Donor's TaxDocument4 pagesQuizzer-Donor's TaxVergel Martinez33% (3)

- 16 Roxas V CTA 23 SCRA 276 (1968) - DigestDocument8 pages16 Roxas V CTA 23 SCRA 276 (1968) - DigestKeith Balbin0% (1)

- Salary Slip: Startpoint Technologies 001Document1 pageSalary Slip: Startpoint Technologies 001PtesgNo ratings yet

- Al Malik Life Sciences Price List (Zoic) - 23Document10 pagesAl Malik Life Sciences Price List (Zoic) - 23Faiz ArchitectsNo ratings yet

- 2013 New Pre-Mid Dept ExamDocument6 pages2013 New Pre-Mid Dept ExamJulie Ann PiliNo ratings yet

- Holding and SubsidiaryDocument2 pagesHolding and SubsidiaryRizwana BegumNo ratings yet

- Longoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020Document1 pageLongoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020nelson menaNo ratings yet

- ACCT 254 Tut 2Document3 pagesACCT 254 Tut 2Aaron Tan Wayne JieNo ratings yet