Professional Documents

Culture Documents

Assignment 1

Assignment 1

Uploaded by

Sumit VarugheseCopyright:

Available Formats

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- TaxationDocument13 pagesTaxationneshh16No ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha MamDocument9 pagesAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaNo ratings yet

- Residential StatusDocument24 pagesResidential StatusGaurav BeniwalNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Scope of Total IncomeDocument3 pagesScope of Total IncomeIshaan MehraNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- Class Work Problems On Scope of Total IncomeDocument2 pagesClass Work Problems On Scope of Total IncomeSakshi JainNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Bcom 402Document220 pagesBcom 402Prabhu SahuNo ratings yet

- Income Tax (2)Document3 pagesIncome Tax (2)Md ShazanNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- Practice Problems On Incidence of TaxDocument3 pagesPractice Problems On Incidence of TaxPratik DesaiNo ratings yet

- Question Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or FalseDocument69 pagesQuestion Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or Falselakshit_gupta100% (1)

- Incidence of Tax - IllustrationDocument16 pagesIncidence of Tax - IllustrationAnirban ThakurNo ratings yet

- Incidence and Residence ProblemsDocument9 pagesIncidence and Residence ProblemsTarunvir KukrejaNo ratings yet

- Paper 7Document30 pagesPaper 7keerthanashettigar03No ratings yet

- bc8fbc81-325c-4711-b012-8c696961dcc4 (1)Document43 pagesbc8fbc81-325c-4711-b012-8c696961dcc4 (1)Harnoor SinghNo ratings yet

- Income From House Property: Annual ValueDocument6 pagesIncome From House Property: Annual ValueSaddam KhanNo ratings yet

- Income Tax Residential Status PDFDocument16 pagesIncome Tax Residential Status PDFNagesha CSNo ratings yet

- Income Tax Law PracticeDocument16 pagesIncome Tax Law PracticeTholai Nokku [ தொலை நோக்கு ]No ratings yet

- Consolidated CsDocument43 pagesConsolidated Cssarathindia22No ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Question BankDocument146 pagesQuestion BankSanskriti JainNo ratings yet

- 819-C-82051-Assignment 2 CH 2Document3 pages819-C-82051-Assignment 2 CH 2ramankantjain07No ratings yet

- 3-Model-Question-BBS-3rd-Taxation-in-NepalDocument6 pages3-Model-Question-BBS-3rd-Taxation-in-Nepaldailymotiv292No ratings yet

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- CA. AJAY JAIN, 9310167881: Time Allowed - 3 Hours Maximum Marks - 100Document14 pagesCA. AJAY JAIN, 9310167881: Time Allowed - 3 Hours Maximum Marks - 100RishabNo ratings yet

- TaxDocument7 pagesTaxSaloni Jain 1820343No ratings yet

- Solution of CS PROFESSIONAL Income Tax Test by CA Vivek GabaDocument13 pagesSolution of CS PROFESSIONAL Income Tax Test by CA Vivek Gabaarohi guptaNo ratings yet

- IPCC - November 2014Document11 pagesIPCC - November 2014suhaib1282No ratings yet

- Itcst Nov06Document27 pagesItcst Nov06api-3825774No ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Income Tax 1Document26 pagesIncome Tax 1Vismaya CholakkalNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- CA INTER INCOME TAX TEST - 2Document2 pagesCA INTER INCOME TAX TEST - 2ap.quatrroNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- 16UCO5MC03Document4 pages16UCO5MC03Ñìkíl G KårølNo ratings yet

- END Examination:: Ar:: y - . IDocument2 pagesEND Examination:: Ar:: y - . Ivjkapoor1609No ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Tax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To TheDocument8 pagesTax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To ThePriya MalhotraNo ratings yet

- Tax AssignmentDocument4 pagesTax AssignmentkaRan GUptД100% (1)

- Paper - 7: Direct Taxes QuestionsDocument33 pagesPaper - 7: Direct Taxes QuestionsArjun GopalakrishnaNo ratings yet

- Paper 7-Direct Taxation: MTP - Intermediate - Syllabus 2012 - June2016 - Set 1Document7 pagesPaper 7-Direct Taxation: MTP - Intermediate - Syllabus 2012 - June2016 - Set 1Ankit ShawNo ratings yet

- National Income Extra QuestionsDocument34 pagesNational Income Extra QuestionsHari prakarsh NimiNo ratings yet

- Applied Direct Taxation Objective Questions and AnswersDocument11 pagesApplied Direct Taxation Objective Questions and AnswersAbhijit HoroNo ratings yet

- ch-11 Taxation of NRIsDocument25 pagesch-11 Taxation of NRIsdean.socNo ratings yet

- Income Tax Practice QuestionsDocument18 pagesIncome Tax Practice QuestionsNuman Rox0% (2)

- Ans Test1 P4 Taxation ABC PradhiCA Nov23Document8 pagesAns Test1 P4 Taxation ABC PradhiCA Nov23sweetlinjoy99No ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Problem On Scope of Total IncomeDocument2 pagesProblem On Scope of Total Incomegoli pandeyNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

Assignment 1

Assignment 1

Uploaded by

Sumit VarugheseOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Assignment 1

Uploaded by

Sumit VarugheseCopyright:

Available Formats

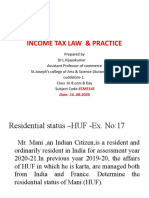

Assignment Questions 1. 2. 3. 4. 5. 6. 7. Name any 10 items of income exempted from tax u/s 10. Define Agriculture income.

What are the deductions available to Employees against Salary Income? Explain the treatment of un-realized rent under the head Income from House Property Distinguish between tax evasion and tax planning. Distinguish between application of income and diversion of income. What are the exempted situations where only one of the conditions mentioned under section 6(1) is applicable to ascertain the residential status? 8. Discuss the scope of total income of the following incomes if the assessee is (i) Resident and ordinarily Resident, (ii) Resident but not Ordinarily Resident, (iii) Non-Resident. a. Technical fees received from A Ltd. (an Indian company) in Germany for advice given by him in respect of a project situated in Iran Rs. 1,17,000 b. Income from business situated in Sri Lanka. (Goods are sold in Sri Lanka; sale consideration is received in Sri Lanka. But the business is controlled and managed partly from Sri Lank and Partly from India.) Rs. 2,17,000. c. Interest on German Development Bonds (2/5th is received in India) Rs. 60,000. d. Income from Agriculture in Nepal received there, but later on Rs. 50,000 is remitted to India ( Agriculture is controlled from Bangladesh) Rs. 1,81,000 e. Past untaxed profit of the 2000-01 brought to India in 2010-11 Rs. 10,43,000. f. Gift in foreign currency from a friend received in India on January 20, 2011. Rs. 80,000. g. Income from salary for services rendered in USA, paid by the Government of India. Rs. 1,95,000 h. Interest received from a non-resident. Rs. 65,000. ( The borrower has used the borrowed amount for purpose other than business or profession) i. Interest received from a resident. Rs. 80,000. (The borrower has used the borrowed amount for the purpose of carrying on a business in Australia.) j. Royalty received outside India from the Government of India. Rs. 17,000. 9. Calculate the gross annual value in the following cases for the assessment year 2011-12. (Amount in Rupees) X Y Z House Property Municipal Value 95,000 60,000 60,000 Fair Rent 96,000 54,000 55,000 Standard Rent 94,000 78,000 79,000 Actual Rent 93,000 1,06,000 78,000 The entire rent is realized. Properties are let out throughout the previous year.

10. Calculate the gross annual value in the following cases for the assessment year 2011-12. (Rupees in thousands) A B C D House Property Municipal Value 60 112 140 60 Fair Rent 68 117 150 65 Standard Rent 62 115 120 59 Actual Rent 66 120 96 72 Unrealized Rent (as per Rule 4) 2 50 Loss due to vacancy 80 6 No. of months the property remained 10 months 1 month vacant

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- TaxationDocument13 pagesTaxationneshh16No ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha MamDocument9 pagesAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaNo ratings yet

- Residential StatusDocument24 pagesResidential StatusGaurav BeniwalNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Scope of Total IncomeDocument3 pagesScope of Total IncomeIshaan MehraNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- Class Work Problems On Scope of Total IncomeDocument2 pagesClass Work Problems On Scope of Total IncomeSakshi JainNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Bcom 402Document220 pagesBcom 402Prabhu SahuNo ratings yet

- Income Tax (2)Document3 pagesIncome Tax (2)Md ShazanNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- Practice Problems On Incidence of TaxDocument3 pagesPractice Problems On Incidence of TaxPratik DesaiNo ratings yet

- Question Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or FalseDocument69 pagesQuestion Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or Falselakshit_gupta100% (1)

- Incidence of Tax - IllustrationDocument16 pagesIncidence of Tax - IllustrationAnirban ThakurNo ratings yet

- Incidence and Residence ProblemsDocument9 pagesIncidence and Residence ProblemsTarunvir KukrejaNo ratings yet

- Paper 7Document30 pagesPaper 7keerthanashettigar03No ratings yet

- bc8fbc81-325c-4711-b012-8c696961dcc4 (1)Document43 pagesbc8fbc81-325c-4711-b012-8c696961dcc4 (1)Harnoor SinghNo ratings yet

- Income From House Property: Annual ValueDocument6 pagesIncome From House Property: Annual ValueSaddam KhanNo ratings yet

- Income Tax Residential Status PDFDocument16 pagesIncome Tax Residential Status PDFNagesha CSNo ratings yet

- Income Tax Law PracticeDocument16 pagesIncome Tax Law PracticeTholai Nokku [ தொலை நோக்கு ]No ratings yet

- Consolidated CsDocument43 pagesConsolidated Cssarathindia22No ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Question BankDocument146 pagesQuestion BankSanskriti JainNo ratings yet

- 819-C-82051-Assignment 2 CH 2Document3 pages819-C-82051-Assignment 2 CH 2ramankantjain07No ratings yet

- 3-Model-Question-BBS-3rd-Taxation-in-NepalDocument6 pages3-Model-Question-BBS-3rd-Taxation-in-Nepaldailymotiv292No ratings yet

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- CA. AJAY JAIN, 9310167881: Time Allowed - 3 Hours Maximum Marks - 100Document14 pagesCA. AJAY JAIN, 9310167881: Time Allowed - 3 Hours Maximum Marks - 100RishabNo ratings yet

- TaxDocument7 pagesTaxSaloni Jain 1820343No ratings yet

- Solution of CS PROFESSIONAL Income Tax Test by CA Vivek GabaDocument13 pagesSolution of CS PROFESSIONAL Income Tax Test by CA Vivek Gabaarohi guptaNo ratings yet

- IPCC - November 2014Document11 pagesIPCC - November 2014suhaib1282No ratings yet

- Itcst Nov06Document27 pagesItcst Nov06api-3825774No ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Income Tax 1Document26 pagesIncome Tax 1Vismaya CholakkalNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- CA INTER INCOME TAX TEST - 2Document2 pagesCA INTER INCOME TAX TEST - 2ap.quatrroNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- 16UCO5MC03Document4 pages16UCO5MC03Ñìkíl G KårølNo ratings yet

- END Examination:: Ar:: y - . IDocument2 pagesEND Examination:: Ar:: y - . Ivjkapoor1609No ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Tax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To TheDocument8 pagesTax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To ThePriya MalhotraNo ratings yet

- Tax AssignmentDocument4 pagesTax AssignmentkaRan GUptД100% (1)

- Paper - 7: Direct Taxes QuestionsDocument33 pagesPaper - 7: Direct Taxes QuestionsArjun GopalakrishnaNo ratings yet

- Paper 7-Direct Taxation: MTP - Intermediate - Syllabus 2012 - June2016 - Set 1Document7 pagesPaper 7-Direct Taxation: MTP - Intermediate - Syllabus 2012 - June2016 - Set 1Ankit ShawNo ratings yet

- National Income Extra QuestionsDocument34 pagesNational Income Extra QuestionsHari prakarsh NimiNo ratings yet

- Applied Direct Taxation Objective Questions and AnswersDocument11 pagesApplied Direct Taxation Objective Questions and AnswersAbhijit HoroNo ratings yet

- ch-11 Taxation of NRIsDocument25 pagesch-11 Taxation of NRIsdean.socNo ratings yet

- Income Tax Practice QuestionsDocument18 pagesIncome Tax Practice QuestionsNuman Rox0% (2)

- Ans Test1 P4 Taxation ABC PradhiCA Nov23Document8 pagesAns Test1 P4 Taxation ABC PradhiCA Nov23sweetlinjoy99No ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Problem On Scope of Total IncomeDocument2 pagesProblem On Scope of Total Incomegoli pandeyNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)