Professional Documents

Culture Documents

Cgtmse Loans

Cgtmse Loans

Uploaded by

Narayanan Venkatachalam0 ratings0% found this document useful (0 votes)

43 views3 pagesThe CGTMSE scheme provides credit guarantees for loans to micro, small, and medium enterprises. It aims to strengthen credit access for entrepreneurs without collateral requirements. Eligible businesses can receive loans of up to Rs. 2 crores with the credit guarantee covering 75% of the loan. Certain women-led businesses and those in remote northeast regions may receive guarantees of 80% or 85%. Lenders include banks, NBFCs, and development finance institutions. Documentation required includes business and loan applications as well as incorporation documents.

Original Description:

CFTMSE Loan Understanding

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe CGTMSE scheme provides credit guarantees for loans to micro, small, and medium enterprises. It aims to strengthen credit access for entrepreneurs without collateral requirements. Eligible businesses can receive loans of up to Rs. 2 crores with the credit guarantee covering 75% of the loan. Certain women-led businesses and those in remote northeast regions may receive guarantees of 80% or 85%. Lenders include banks, NBFCs, and development finance institutions. Documentation required includes business and loan applications as well as incorporation documents.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

43 views3 pagesCgtmse Loans

Cgtmse Loans

Uploaded by

Narayanan VenkatachalamThe CGTMSE scheme provides credit guarantees for loans to micro, small, and medium enterprises. It aims to strengthen credit access for entrepreneurs without collateral requirements. Eligible businesses can receive loans of up to Rs. 2 crores with the credit guarantee covering 75% of the loan. Certain women-led businesses and those in remote northeast regions may receive guarantees of 80% or 85%. Lenders include banks, NBFCs, and development finance institutions. Documentation required includes business and loan applications as well as incorporation documents.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

CGTMSE Loans

Credit Guarantee Funds Trust for Micro and Small Enterprises

(CGTMSE) launched in 2000 is a trust established by the Government

of India, under the Ministry of Micro, Small and Medium Enterprises

(MSME) and Small Industries Development Bank of India (SIDBI).

Availability of bank credit without the hassles of collaterals / third

party guarantees would be a major source of support to the first

generation entrepreneurs to realize their dream of setting up a unit of

their own Micro and Small Enterprise (MSE). The government of India

launched Credit Guarantee Scheme (CGS) to strengthen the credit

delivery system and facilitate the flow of credit to the MSE sector.

The main objective is that the lender should give importance to

project viability and obtain both term loans and working capital

facilities from a single agency.

What is a Credit Guarantee under CGTMSE?

Credit Guarantee Fund Scheme for Micro and Small Enterprises was

started to promote SME and MSME sector in India. Both new and

existing micro and small enterprises including service enterprises are

eligible for a collateral-free loan with a maximum credit cap of Rs. 2

crores.

The interest rate depends upon the applicant’s profile, business

requirements, and project cost and is comparatively low, as compared

to other direct loan schemes. The credit guarantee coverage is

offered a maximum of up to 75% of the total project cost.

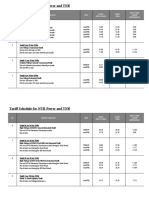

Features of the Credit Guarantee Scheme:

The stand out features of the CGTMSE scheme is:

Guaranteed repayment of 75% or 85% in some cases for the

defaulted principal loan amount up to Rs.50 lakh.

The maximum guarantee is 50% for a loan amount greater than

Rs.50 lakh but under Rs.1 crore.

Provides for 85% repayment for loans up to Rs.5 lakhs to micro-

enterprises.

The guarantee amount for repayment is 80% of the loan amount

in case the MSME is promoted by a woman or the location of the

unit is in the North East Region (NER).

The repayment procedure covers the entire loan amount

inclusive of the interest component for 3 months.

Rs.1 crore as support to the lender if the business failure is

beyond the control of the management.

What are the Eligibility for the CGTMSE Scheme?

Let us look at the eligibility criteria for the CGTMSE loan scheme for

credit providers and credit borrowers.

Eligible entities

Sole Proprietorship Firms, Partnership Firms, Private Limited

Companies, Public Limited Companies

Lending Borrowers

All Existing and New Small and Medium Enterprises (SMEs)

Lending Institutions

Scheduled Commercial Banks (SCBs)

Regional Rural Banks (RRBs)

Small Finance Banks (SFBs)

Non-banking Financial Companies (NBFCs)

Small Industrial Development Bank of India (SIDBI)

National Small Industries Corporation (NSIC)

North Eastern Development Finance Corporation Ltd. (NEDFi)

Small and micro-enterprises operated by women are eligible for a

guarantee cover of 80% whereas all the credit/loans in the North East

Region (NER) for credit facilities are eligible for a guarantee of Rs. 50

lakh. Educational institutions, agriculture, training institutions, and

Self-Help Groups (SHGs) are not eligible for guarantee cover under

CGTMSE. s.

What are the Documents required for Loan under CGTMSE Scheme?

Documents required for a Loan under the CGTMSE scheme and its

coverage:

CGTMSE loan application form with Passport-sized photographs

Business Plan

Business incorporation letter / Company registration certificate

Business Project Report

CGTMSE Loan Coverage Letter

Copy of loan approval from the bank

Any other document required by the bank

CGTMSE also provides recovery support to the business units. The

scheme covers the loan for rehabilitation within the credit cap of Rs. 1

Crore if a business unit is beyond the control of the management.

You might also like

- Test Bank For Sociology For The 21st Century Census Update 5th Edition Tim CurryDocument10 pagesTest Bank For Sociology For The 21st Century Census Update 5th Edition Tim CurryNathan Cook100% (30)

- Ashtapathi TamilDocument78 pagesAshtapathi TamilNarayanan Venkatachalam100% (12)

- Schemes For Women EntrepreneursDocument40 pagesSchemes For Women EntrepreneursEkta Paliwal100% (1)

- CGTMSEDocument4 pagesCGTMSEPrasath KumarNo ratings yet

- Ede 6 PRDocument6 pagesEde 6 PRsingaporeid006No ratings yet

- Loans To Smes and Msmes Collateral Free LoansDocument3 pagesLoans To Smes and Msmes Collateral Free LoansShatir LaundaNo ratings yet

- Introduction To Credit GuaranteeDocument1 pageIntroduction To Credit Guaranteessr68No ratings yet

- EDP Pr-11 (CM6I - 92 Ankita Adam)Document4 pagesEDP Pr-11 (CM6I - 92 Ankita Adam)02 - CM Ankita AdamNo ratings yet

- Practical 8: Visit A Bank/financial Institution To Enquire About Various Funding Schemes For Small Scale EnterpriseDocument4 pagesPractical 8: Visit A Bank/financial Institution To Enquire About Various Funding Schemes For Small Scale Enterprise02 - CM Ankita Adam83% (6)

- Practical No. 5Document7 pagesPractical No. 5Omkar KhutwadNo ratings yet

- Brochure For Government SchemesDocument4 pagesBrochure For Government SchemesvinitNo ratings yet

- Assignment No 6Document4 pagesAssignment No 61346 EE Omkar PrasadNo ratings yet

- Inc42 Media: Skip To ContentDocument39 pagesInc42 Media: Skip To Contentshashi shekhar dixitNo ratings yet

- Government Schemes For StartupDocument4 pagesGovernment Schemes For StartupSahil GaudeNo ratings yet

- T 4 CQKV 4 D2 TSDH I3 MK8 KQ FSN YPw 6 RTBBSMH 7 P 449 DDocument4 pagesT 4 CQKV 4 D2 TSDH I3 MK8 KQ FSN YPw 6 RTBBSMH 7 P 449 DAnish PuthusseryNo ratings yet

- MSMEDocument7 pagesMSMERitika SharmaNo ratings yet

- A Personal Loan Is A Credit Instrument That Helps A Borrower To Get Quick Financing For Any Kind Personal RequirementDocument17 pagesA Personal Loan Is A Credit Instrument That Helps A Borrower To Get Quick Financing For Any Kind Personal RequirementneelamNo ratings yet

- Credit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESDocument2 pagesCredit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESsachinoilNo ratings yet

- IPR RegistrationsDocument21 pagesIPR RegistrationsSSNo ratings yet

- Can Startups Get Bank Loan Without Any Collateral Security?: Working Capital Loan From BanksDocument3 pagesCan Startups Get Bank Loan Without Any Collateral Security?: Working Capital Loan From BanksrajNo ratings yet

- SMEDocument24 pagesSMEKetan AhirNo ratings yet

- Credit Guarantee Fund Trust For MicroDocument1 pageCredit Guarantee Fund Trust For MicrojadejachanduNo ratings yet

- What Is Microcredit?Document10 pagesWhat Is Microcredit?hiteshNo ratings yet

- Assignment 6EDEDocument5 pagesAssignment 6EDEKunal HarinkhedeNo ratings yet

- CGTMSEDocument28 pagesCGTMSETareshwar SinghNo ratings yet

- CGTMSEDocument43 pagesCGTMSEAnkur Datta100% (1)

- Ede 4.1Document17 pagesEde 4.1Aditee PatilNo ratings yet

- Government Loan For Business Startups in IndiaDocument6 pagesGovernment Loan For Business Startups in Indiashashi shekhar dixitNo ratings yet

- Sbi Smart Products For SmeDocument30 pagesSbi Smart Products For SmeRAJEEV THAKURNo ratings yet

- History of Stand Up IndiaDocument15 pagesHistory of Stand Up IndiaPragathi MittalNo ratings yet

- Sme ProductDocument22 pagesSme ProductAnila BaburajanNo ratings yet

- 10.2 Stand Up SchemeDocument9 pages10.2 Stand Up Schemedesh1endlaNo ratings yet

- RMA Against Bank Guarantee: 1A) Benefits Extended To Mses Having Valid RegistrationDocument8 pagesRMA Against Bank Guarantee: 1A) Benefits Extended To Mses Having Valid RegistrationVijaysinh ChavanNo ratings yet

- Stand Up India SchemeDocument3 pagesStand Up India SchemeDSP VarmaNo ratings yet

- Credit Guarantee Fund Scheme For Micro and Small EnterprisesDocument3 pagesCredit Guarantee Fund Scheme For Micro and Small EnterprisesSuprio NandyNo ratings yet

- Aatmanirbhar Bharat: Policy HighlightsDocument3 pagesAatmanirbhar Bharat: Policy HighlightsVidya KoliNo ratings yet

- How Does Tiic Help First Generation EntrepreneursDocument5 pagesHow Does Tiic Help First Generation EntrepreneursNagaraja SNo ratings yet

- Assignment - 5Document3 pagesAssignment - 5Sneha DhavaleNo ratings yet

- A Systematic ReviewDocument9 pagesA Systematic ReviewMustafa MahiNo ratings yet

- Tanvi Goel - Professional Practices - Government Scheme (CGFTMSE)Document6 pagesTanvi Goel - Professional Practices - Government Scheme (CGFTMSE)Tanvi GoelNo ratings yet

- Bank Finance Sme ProjectDocument19 pagesBank Finance Sme ProjectkhushbooNo ratings yet

- CGTMSE SchemesDocument20 pagesCGTMSE SchemesarulbankofindiaNo ratings yet

- SIDBI PresentationDocument34 pagesSIDBI PresentationNarendra KumarNo ratings yet

- PRADHANA MANTRI MUDRA YOJANA-grp12Document22 pagesPRADHANA MANTRI MUDRA YOJANA-grp12Anaswara C ANo ratings yet

- Circ 36Document8 pagesCirc 36Harsh MehtaNo ratings yet

- Credit Guranatee Fund Trust Scheme For MicroDocument4 pagesCredit Guranatee Fund Trust Scheme For MicroAnitha GirigoudruNo ratings yet

- Basic Details About CGTMSEDocument3 pagesBasic Details About CGTMSEhemalNo ratings yet

- CGTMSE Information Booklet 2015Document56 pagesCGTMSE Information Booklet 2015Puneet AgarwalNo ratings yet

- WWW - Cgtmse.In: Tolani Institute of Management StudiesDocument16 pagesWWW - Cgtmse.In: Tolani Institute of Management StudiesFenil ThakkarNo ratings yet

- SME Credit: Loans at Low Interest To Fuel Your Sme BusinessDocument5 pagesSME Credit: Loans at Low Interest To Fuel Your Sme Businessnishaantdec13No ratings yet

- Credit Guarantee Fund Trust For Micro and Small EnterprisesDocument43 pagesCredit Guarantee Fund Trust For Micro and Small EnterprisesriteshnirmaNo ratings yet

- Banking Operartions Isa-2 (Group-1)Document12 pagesBanking Operartions Isa-2 (Group-1)Analize PintoNo ratings yet

- Sidbi BVB302Document17 pagesSidbi BVB302679shrishti SinghNo ratings yet

- Anjuman Polytechnic: Sadar, Nagpur 2021-22Document10 pagesAnjuman Polytechnic: Sadar, Nagpur 2021-22Faizan FA AnsariNo ratings yet

- Dr. Shakuntala Misra Nationa Rehabilitation: Submitted To: Submitted byDocument14 pagesDr. Shakuntala Misra Nationa Rehabilitation: Submitted To: Submitted byshashi shekhar dixitNo ratings yet

- Small Business LoansDocument2 pagesSmall Business Loanskirandasi123No ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Content of Project ReportDocument2 pagesContent of Project ReportNarayanan VenkatachalamNo ratings yet

- MSME Policy 2017-18Document9 pagesMSME Policy 2017-18Narayanan VenkatachalamNo ratings yet

- Otv-Sc2: A Compact and Well-Balanced High-Resolution Video System With High CompatibilityDocument2 pagesOtv-Sc2: A Compact and Well-Balanced High-Resolution Video System With High CompatibilityNarayanan VenkatachalamNo ratings yet

- In-Scope Services & Sla: Service Listing Covered Within Scope Description of Service Covered Within Scope Slas, If AnyDocument5 pagesIn-Scope Services & Sla: Service Listing Covered Within Scope Description of Service Covered Within Scope Slas, If AnyNarayanan VenkatachalamNo ratings yet

- Dolotsavam PudukottaiDocument38 pagesDolotsavam PudukottaiNarayanan VenkatachalamNo ratings yet

- TACE16 Report EnglishDocument42 pagesTACE16 Report EnglishNarayanan VenkatachalamNo ratings yet

- IBM - Intelligent Notification SystemDocument16 pagesIBM - Intelligent Notification SystemNarayanan VenkatachalamNo ratings yet

- Koteeswara Iyer - Melakarta KritisDocument35 pagesKoteeswara Iyer - Melakarta KritisNarayanan VenkatachalamNo ratings yet

- Commets Muhammed ProposalDocument38 pagesCommets Muhammed ProposalMohammed HussenNo ratings yet

- Naval Mines/Torpedoes Mines USA MK 67 SLMM Self-Propelled MineDocument2 pagesNaval Mines/Torpedoes Mines USA MK 67 SLMM Self-Propelled MinesmithNo ratings yet

- TTSB Company Profile (Full Set - 1 of 3)Document18 pagesTTSB Company Profile (Full Set - 1 of 3)zaihasren0% (1)

- Module 24Document140 pagesModule 24api-278516771No ratings yet

- RomanticismDocument2 pagesRomanticismbeckyinmnNo ratings yet

- The Ultimate Beginner S Guide To Feng ShuiDocument8 pagesThe Ultimate Beginner S Guide To Feng Shuibilldockto_141471063No ratings yet

- Rizal Life Works BL Guide Quiz 12 and PrelimDocument15 pagesRizal Life Works BL Guide Quiz 12 and PrelimCarla Mae Alcantara100% (1)

- Mindanao Development Authority v. CADocument14 pagesMindanao Development Authority v. CAKadzNitura0% (1)

- Grammar g3Document3 pagesGrammar g3Future Stars SchoolNo ratings yet

- FA REV PRB - Prelim Exam Wit Ans Key LatestDocument13 pagesFA REV PRB - Prelim Exam Wit Ans Key LatestLuiNo ratings yet

- capstone-LRRDocument15 pagescapstone-LRRronskierelenteNo ratings yet

- Hommage A René GirardDocument24 pagesHommage A René GirardSerge PlantureuxNo ratings yet

- UNIT 8 Types of Punishment For Crimes RedactataDocument17 pagesUNIT 8 Types of Punishment For Crimes Redactataanna825020No ratings yet

- B.A (English) Dec 2015Document32 pagesB.A (English) Dec 2015Bala SVDNo ratings yet

- T5 Benchmark - Collaboration and Communication Action PlanDocument3 pagesT5 Benchmark - Collaboration and Communication Action PlanYou don't need to knowNo ratings yet

- Swift PDF DataDocument618 pagesSwift PDF DataSaddam Hussaian Guddu100% (1)

- 3 MicroDocument4 pages3 MicroDumitraNo ratings yet

- BAHAWALNAGARDocument9 pagesBAHAWALNAGAREhtisham Shakil KhokharNo ratings yet

- Pres Level 2 Application Form Dublin 2024Document3 pagesPres Level 2 Application Form Dublin 2024maestroaffairsNo ratings yet

- Attendance DenmarkDocument3 pagesAttendance Denmarkdennis berja laguraNo ratings yet

- How Tax Reform Changed The Hedging of NQDC PlansDocument3 pagesHow Tax Reform Changed The Hedging of NQDC PlansBen EislerNo ratings yet

- SV - ComplaintDocument72 pagesSV - ComplaintĐỗ Trà MyNo ratings yet

- Critical Analysis On Legal Research in Civil Law Countries and Common Law CountriesDocument6 pagesCritical Analysis On Legal Research in Civil Law Countries and Common Law CountriesAnonymous XuOGlMi100% (1)

- TNB and NUR Tariff DifferencesDocument2 pagesTNB and NUR Tariff DifferencesAzree Mohd NoorNo ratings yet

- Exploring Rfid'S Use in Shipping: Prepared For Kennesaw State University's Information Technology Students and StaffDocument22 pagesExploring Rfid'S Use in Shipping: Prepared For Kennesaw State University's Information Technology Students and Staffcallaway20No ratings yet

- Holy Spirit in Christianity - WikipediaDocument21 pagesHoly Spirit in Christianity - WikipediaSunny BautistaNo ratings yet

- Luigi PivaDocument2 pagesLuigi PivaLuigi PivaNo ratings yet

- Interlinking of RiverDocument15 pagesInterlinking of RiverDIPAK VINAYAK SHIRBHATENo ratings yet

- Markov Chain PoetryDocument24 pagesMarkov Chain PoetryBea MillwardNo ratings yet