Professional Documents

Culture Documents

File Structure

File Structure

Uploaded by

TestCopyright:

Available Formats

You might also like

- MYOB Payslip TemplateDocument1 pageMYOB Payslip Templatejack smith100% (1)

- PF PassbookDocument2 pagesPF Passbookvinayak tiwari100% (1)

- Uk Sample Tenancy AgreementDocument2 pagesUk Sample Tenancy Agreementkommsu0% (1)

- Full Help File PDFDocument2 pagesFull Help File PDFBhavik PatelNo ratings yet

- WPLCaseStudy Solution ShareafteraweekDocument52 pagesWPLCaseStudy Solution ShareafteraweekYogendra RathoreNo ratings yet

- Digits: (Only Alphabets and Space)Document8 pagesDigits: (Only Alphabets and Space)biplab kumarNo ratings yet

- Digits: (Only Alphabets and Space)Document8 pagesDigits: (Only Alphabets and Space)Srini VashNo ratings yet

- Federal Democratic Republic of Ethiopia Ethiopian Revenue and Customs AuthorityDocument1 pageFederal Democratic Republic of Ethiopia Ethiopian Revenue and Customs Authorityashe100% (1)

- MC Template1Document8 pagesMC Template1mn_sundaraamNo ratings yet

- Item Rate Boq: Validate Print HelpDocument6 pagesItem Rate Boq: Validate Print HelpRahul SamaddarNo ratings yet

- Latihan 7 MExcelDocument6 pagesLatihan 7 MExcelmuhamad eggy saputraNo ratings yet

- 21abtfa8874a1zd gstr1 Return Jun 2022Document67 pages21abtfa8874a1zd gstr1 Return Jun 2022Ashtavinayak AutomobilesNo ratings yet

- 21abtfa8874a1zd gstr1 Return Aug 2022Document67 pages21abtfa8874a1zd gstr1 Return Aug 2022Ashtavinayak AutomobilesNo ratings yet

- GSTR1 Excel Workbook Template V1.5 June 19Document85 pagesGSTR1 Excel Workbook Template V1.5 June 19Kuch BhiNo ratings yet

- GSTR1 Excel Workbook Template V1.5Document92 pagesGSTR1 Excel Workbook Template V1.5OmPrakashRoyNo ratings yet

- GSTR1 Excel Workbook Template V1.5Document98 pagesGSTR1 Excel Workbook Template V1.5Iyengar PrasadNo ratings yet

- GSTR1 Excel Workbook Template V1.5Document96 pagesGSTR1 Excel Workbook Template V1.5Anonymous 0BCDlBNo ratings yet

- Master - SalaryDocument7 pagesMaster - SalaryKiran KNo ratings yet

- GSTR1 Excel Workbook Template V2.0Document63 pagesGSTR1 Excel Workbook Template V2.0ShyamPrasadNo ratings yet

- Payroll Report Template 01Document1 pagePayroll Report Template 01Bombay BugzbeNo ratings yet

- GSTR1 Excel Workbook Template V2.0Document65 pagesGSTR1 Excel Workbook Template V2.0harelakash95No ratings yet

- 18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Document3 pages18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Mohamad FadzliNo ratings yet

- UI19Document2 pagesUI19OctaviaNo ratings yet

- GSTR1 Excel Workbook Template V1.4Document84 pagesGSTR1 Excel Workbook Template V1.4vassudevanrNo ratings yet

- ECR ForEmployers FileStructure OLDDocument5 pagesECR ForEmployers FileStructure OLDceoNo ratings yet

- GSTR1 Excel Workbook Template V1.8Document64 pagesGSTR1 Excel Workbook Template V1.8Tax NatureNo ratings yet

- Gstr-1-24aczpv3178m1zh-Gurukrupa TextileDocument64 pagesGstr-1-24aczpv3178m1zh-Gurukrupa TextileChutiya LodaNo ratings yet

- GSTR1 AprilDocument65 pagesGSTR1 AprilUHB Production'sNo ratings yet

- GSTR1 Excel Workbook Template-V1.3Document40 pagesGSTR1 Excel Workbook Template-V1.3gaurav_bagdiaNo ratings yet

- GSTR1 Excel Workbook Template-V1.2Document40 pagesGSTR1 Excel Workbook Template-V1.2jaiswalnilesh5132No ratings yet

- GSTR1 Excel Workbook Template-V1.2Document40 pagesGSTR1 Excel Workbook Template-V1.2vkpamulapatiNo ratings yet

- 1 8770079894 PDFDocument30 pages1 8770079894 PDFSatyam MaramNo ratings yet

- Class On Pay Fixation in 8th April.Document118 pagesClass On Pay Fixation in 8th April.Crick CompactNo ratings yet

- Form PDF 592155080270921Document8 pagesForm PDF 592155080270921AnilKumarNo ratings yet

- DT-2008 PAYE Return FormDocument9 pagesDT-2008 PAYE Return FormMarvin JeaNo ratings yet

- GSTR1 Excel Workbook Template-V1.0Document39 pagesGSTR1 Excel Workbook Template-V1.0palanisathiyaNo ratings yet

- Project Work AssignmentDocument8 pagesProject Work AssignmentdelightadvertisementNo ratings yet

- Form 12-B Updt23Document4 pagesForm 12-B Updt23Durga prasad DashNo ratings yet

- GSTR1 Excel Workbook Template V2.0Document63 pagesGSTR1 Excel Workbook Template V2.0GAURAV SHARMANo ratings yet

- Dol 4 NDocument3 pagesDol 4 Njobs1526No ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

- Finance Assignment 3Document10 pagesFinance Assignment 3Kara IrfanNo ratings yet

- ACCRINT FunctionDocument3 pagesACCRINT FunctionfrazbuttNo ratings yet

- GSTR1 GstinDocument87 pagesGSTR1 GstinKuldeep SharmaNo ratings yet

- GSTR1 Excel Workbook Template V1.7Document63 pagesGSTR1 Excel Workbook Template V1.7Nagaraj SettyNo ratings yet

- Nov gstr1Document63 pagesNov gstr1Ravi KumarNo ratings yet

- GSTR 1Document70 pagesGSTR 1vassudevanrNo ratings yet

- The Subtle Art of Not Giving A FuckDocument15 pagesThe Subtle Art of Not Giving A FuckArun Magha Rajha0% (1)

- WR Kets With Description EnglishDocument6 pagesWR Kets With Description Englishpulkit sharmaNo ratings yet

- FORM 12B - Previous Employment Income DeclarationDocument3 pagesFORM 12B - Previous Employment Income DeclarationsudhakarNo ratings yet

- US Internal Revenue Service: F940ez - 1994Document4 pagesUS Internal Revenue Service: F940ez - 1994IRSNo ratings yet

- Private Org. Pension Form AyanyuDocument3 pagesPrivate Org. Pension Form Ayanyugirma1299No ratings yet

- Quickbooks and Co. - in - GSTR1Document65 pagesQuickbooks and Co. - in - GSTR1DevendraNo ratings yet

- GSTR 1Document69 pagesGSTR 1admin bhagirathiNo ratings yet

- Offline Tool LucknowDocument77 pagesOffline Tool LucknowKPS SQUARE CONSULTING SERVICESNo ratings yet

- GSTR2 Excel Workbook TemplateNew V1.1Document57 pagesGSTR2 Excel Workbook TemplateNew V1.1Tax NatureNo ratings yet

- CFA - Module 6 - Week 11 - Learning TaskDocument2 pagesCFA - Module 6 - Week 11 - Learning Taskjames paul baltazarNo ratings yet

- 2021 01 10 22 32 14 198 - Dicpa9585b - 2020Document60 pages2021 01 10 22 32 14 198 - Dicpa9585b - 2020Ayush AgarwalNo ratings yet

- Uploading Format GSTNDocument28 pagesUploading Format GSTNChetan TandelNo ratings yet

- Salary and Bank Information Form - EnglishDocument2 pagesSalary and Bank Information Form - EnglishArayaselasie TechaluNo ratings yet

- Employees' Pension Scheme (Prargraph 20 (4) ) The Employees' Provident Funds & Misc. Provision Act, 1952Document2 pagesEmployees' Pension Scheme (Prargraph 20 (4) ) The Employees' Provident Funds & Misc. Provision Act, 1952savita17julyNo ratings yet

- Employment Application FormDocument4 pagesEmployment Application FormRakesh Kumar SinghNo ratings yet

- Learn Excel Functions: Count, Countif, Sum and SumifFrom EverandLearn Excel Functions: Count, Countif, Sum and SumifRating: 5 out of 5 stars5/5 (4)

- Simple Interest AutosavedDocument77 pagesSimple Interest AutosavedStephanie Regatcho BetasoloNo ratings yet

- Wall Street Courier Services Inc. Payslip: Earnings AdjustmentDocument1 pageWall Street Courier Services Inc. Payslip: Earnings AdjustmentFerdinand Salvador SrNo ratings yet

- Rent Agreement Format MakaanIQDocument2 pagesRent Agreement Format MakaanIQShikha AroraNo ratings yet

- Pandurang Shigvan Mumbai Vidyavihar Quality Checker: Sector 30A, Vashi, Navi Mumbai, Maharashtra 400705Document15 pagesPandurang Shigvan Mumbai Vidyavihar Quality Checker: Sector 30A, Vashi, Navi Mumbai, Maharashtra 400705DS Ghatkopar EastNo ratings yet

- SALARY Theory EnglishDocument17 pagesSALARY Theory EnglishDilip JaviyaNo ratings yet

- Landlord Tenant RulesDocument3 pagesLandlord Tenant Rulesapi-479624655No ratings yet

- UADC SALARY LOGBOOK UpdatedDocument4 pagesUADC SALARY LOGBOOK UpdatedYameteKudasaiNo ratings yet

- Q PP 4 BondsDocument1 pageQ PP 4 BondsJoebel CristalesNo ratings yet

- Total Compensation Framework Template (Annex A)Document2 pagesTotal Compensation Framework Template (Annex A)Noreen Boots Gocon-GragasinNo ratings yet

- Lecture Cases On Consolidation With Intercompany Sale of InventoryDocument2 pagesLecture Cases On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Module 2Document22 pagesModule 2margieNo ratings yet

- Private & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeDocument1 pagePrivate & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeIrfhaenmahmoedChildOfstandaloneNo ratings yet

- Gen Math LQ 2nd Quarter PDFDocument31 pagesGen Math LQ 2nd Quarter PDFJennifer DamascoNo ratings yet

- Microlink Institute of Science and Technology, Inc.: 1-Jul-19 15-Jul-19Document18 pagesMicrolink Institute of Science and Technology, Inc.: 1-Jul-19 15-Jul-19Dudz MatienzoNo ratings yet

- Assignment3 7QsDocument2 pagesAssignment3 7QsavirgNo ratings yet

- Maharshi ParikhDocument3 pagesMaharshi Parikhsanket shahNo ratings yet

- Form11 1633872532769Document2 pagesForm11 1633872532769Pratham NishadNo ratings yet

- Break Even AnalysisDocument2 pagesBreak Even AnalysisanupsuchakNo ratings yet

- Form CutiDocument3 pagesForm Cutidiaspora mahagrahaNo ratings yet

- Activity StatementDocument13 pagesActivity StatementElvie BangcoyoNo ratings yet

- Book 5Document174 pagesBook 5Anonymous hsZanpCNo ratings yet

- Dhok Roza Payroll JulyDocument1 pageDhok Roza Payroll Julymuhammad jamilNo ratings yet

- Simple and Compound Interest - SSC - CDSDocument14 pagesSimple and Compound Interest - SSC - CDSphysicspalanichamyNo ratings yet

- PayslipDocument4 pagesPayslipJanin Aizel GallanaNo ratings yet

- Sri Fy 2023 Payroll St. Bernard Dist. I and IiDocument10 pagesSri Fy 2023 Payroll St. Bernard Dist. I and IiWynoaj LucaNo ratings yet

- Income Tax Calculation (SAP Library - Payroll India (PY-IN) )Document6 pagesIncome Tax Calculation (SAP Library - Payroll India (PY-IN) )Pradeep KumarNo ratings yet

- FMA Time Value of MoneyDocument5 pagesFMA Time Value of MoneyAvani TomarNo ratings yet

File Structure

File Structure

Uploaded by

TestOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

File Structure

File Structure

Uploaded by

TestCopyright:

Available Formats

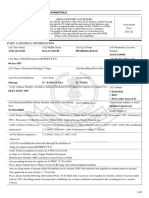

HIGHER WAGES FILE STRUCTURE

Validations for the document to be uploaded by employer for adding Monthly Wage Details:

1. The Higher Wages file should be in txt format only.

2. File size should not be greater than 2 MB. If the file size is greater than 2 MB, a single text file in ZIP format will be

accepted.

3. Monthly Wage Details should be added only against months that fall under the period of service details declared by the

member while opting for pension on higher wages i.e. Wage month should be between the Date of Joining EPS and

the Date of Exit EPS-95 or upto the previous wage month, which are declared by the member.

4. Each line in the text file contains details of single months only.

5. The separator between fields should be #~# (Hash Tilda Hash).

6. In case a member has active service, Wage details will be available till the previous month.

7. Column Number 4 should be 8.33% of the column 3 “wages on which PF contribution was paid”

8. Column Number 5 should be 1.16% of the difference of, wages and 15000, for the wage months on or after Sept 2014

9. For the wage months prior to Sept 2014, column 5 “Pension contribution from employee @1.16% received on such

wages with effect from 01/09/2014” should be 0. Any entry given in this field will be ignored if wage month is prior to

Sept 2014.

Sl. Field Name Field Width Mandatory Remarks

No.

1 Member Id Character (22) Yes 22-character long valid member id

2. Wage Month (all the Character (7) Yes • Valid month in mm/yyyy format

months from date of

joining to date of leaving) • A wage month must fall between DOJ

EPS and DOE EPS, including DOJ

EPS and DOE

EPS. If DOE EPS is not available, it

must beless than the current month.

3. Wages on which Number (8,2) Yes • The total number of digits should not

PF contribution exceed 10 including two digits for the

was paid fractional part,if applicable.

Pension Contribution

from employer @ 8.33% • The total number of digits should not

4. due on such Wages as in Number (8,2) Yes exceed 10 including two digits for the

column 3 fractional part,if applicable.

Pension Contribution

from employee @ 1.16% • For Pensioners, the value should be 0

5. receivedon such wages Number (8,2) Yes or willbe ignored even if provided.

with effect from

01.09.2014

Pension ContributionPaid • The total number of digits should not

6. by the employer earlier. Number (8,2) Yes exceed 10 including two digits for the

fractional part,if applicable.

Pension Contribution to

7. bepaid along with • The total number of digits should not

interest Number (8,2) Yes exceed 10 including two digits for the

fractional part,if applicable.

Yearly PF Interest rate • Rate of interest in XX.YY format

8. forPF-exempt Number (1,2) No (fractionalpart is optional).

establishments

You might also like

- MYOB Payslip TemplateDocument1 pageMYOB Payslip Templatejack smith100% (1)

- PF PassbookDocument2 pagesPF Passbookvinayak tiwari100% (1)

- Uk Sample Tenancy AgreementDocument2 pagesUk Sample Tenancy Agreementkommsu0% (1)

- Full Help File PDFDocument2 pagesFull Help File PDFBhavik PatelNo ratings yet

- WPLCaseStudy Solution ShareafteraweekDocument52 pagesWPLCaseStudy Solution ShareafteraweekYogendra RathoreNo ratings yet

- Digits: (Only Alphabets and Space)Document8 pagesDigits: (Only Alphabets and Space)biplab kumarNo ratings yet

- Digits: (Only Alphabets and Space)Document8 pagesDigits: (Only Alphabets and Space)Srini VashNo ratings yet

- Federal Democratic Republic of Ethiopia Ethiopian Revenue and Customs AuthorityDocument1 pageFederal Democratic Republic of Ethiopia Ethiopian Revenue and Customs Authorityashe100% (1)

- MC Template1Document8 pagesMC Template1mn_sundaraamNo ratings yet

- Item Rate Boq: Validate Print HelpDocument6 pagesItem Rate Boq: Validate Print HelpRahul SamaddarNo ratings yet

- Latihan 7 MExcelDocument6 pagesLatihan 7 MExcelmuhamad eggy saputraNo ratings yet

- 21abtfa8874a1zd gstr1 Return Jun 2022Document67 pages21abtfa8874a1zd gstr1 Return Jun 2022Ashtavinayak AutomobilesNo ratings yet

- 21abtfa8874a1zd gstr1 Return Aug 2022Document67 pages21abtfa8874a1zd gstr1 Return Aug 2022Ashtavinayak AutomobilesNo ratings yet

- GSTR1 Excel Workbook Template V1.5 June 19Document85 pagesGSTR1 Excel Workbook Template V1.5 June 19Kuch BhiNo ratings yet

- GSTR1 Excel Workbook Template V1.5Document92 pagesGSTR1 Excel Workbook Template V1.5OmPrakashRoyNo ratings yet

- GSTR1 Excel Workbook Template V1.5Document98 pagesGSTR1 Excel Workbook Template V1.5Iyengar PrasadNo ratings yet

- GSTR1 Excel Workbook Template V1.5Document96 pagesGSTR1 Excel Workbook Template V1.5Anonymous 0BCDlBNo ratings yet

- Master - SalaryDocument7 pagesMaster - SalaryKiran KNo ratings yet

- GSTR1 Excel Workbook Template V2.0Document63 pagesGSTR1 Excel Workbook Template V2.0ShyamPrasadNo ratings yet

- Payroll Report Template 01Document1 pagePayroll Report Template 01Bombay BugzbeNo ratings yet

- GSTR1 Excel Workbook Template V2.0Document65 pagesGSTR1 Excel Workbook Template V2.0harelakash95No ratings yet

- 18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Document3 pages18 Application Form WORKMEN'S COMPENSATION Insurance V1.0 2018Mohamad FadzliNo ratings yet

- UI19Document2 pagesUI19OctaviaNo ratings yet

- GSTR1 Excel Workbook Template V1.4Document84 pagesGSTR1 Excel Workbook Template V1.4vassudevanrNo ratings yet

- ECR ForEmployers FileStructure OLDDocument5 pagesECR ForEmployers FileStructure OLDceoNo ratings yet

- GSTR1 Excel Workbook Template V1.8Document64 pagesGSTR1 Excel Workbook Template V1.8Tax NatureNo ratings yet

- Gstr-1-24aczpv3178m1zh-Gurukrupa TextileDocument64 pagesGstr-1-24aczpv3178m1zh-Gurukrupa TextileChutiya LodaNo ratings yet

- GSTR1 AprilDocument65 pagesGSTR1 AprilUHB Production'sNo ratings yet

- GSTR1 Excel Workbook Template-V1.3Document40 pagesGSTR1 Excel Workbook Template-V1.3gaurav_bagdiaNo ratings yet

- GSTR1 Excel Workbook Template-V1.2Document40 pagesGSTR1 Excel Workbook Template-V1.2jaiswalnilesh5132No ratings yet

- GSTR1 Excel Workbook Template-V1.2Document40 pagesGSTR1 Excel Workbook Template-V1.2vkpamulapatiNo ratings yet

- 1 8770079894 PDFDocument30 pages1 8770079894 PDFSatyam MaramNo ratings yet

- Class On Pay Fixation in 8th April.Document118 pagesClass On Pay Fixation in 8th April.Crick CompactNo ratings yet

- Form PDF 592155080270921Document8 pagesForm PDF 592155080270921AnilKumarNo ratings yet

- DT-2008 PAYE Return FormDocument9 pagesDT-2008 PAYE Return FormMarvin JeaNo ratings yet

- GSTR1 Excel Workbook Template-V1.0Document39 pagesGSTR1 Excel Workbook Template-V1.0palanisathiyaNo ratings yet

- Project Work AssignmentDocument8 pagesProject Work AssignmentdelightadvertisementNo ratings yet

- Form 12-B Updt23Document4 pagesForm 12-B Updt23Durga prasad DashNo ratings yet

- GSTR1 Excel Workbook Template V2.0Document63 pagesGSTR1 Excel Workbook Template V2.0GAURAV SHARMANo ratings yet

- Dol 4 NDocument3 pagesDol 4 Njobs1526No ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

- Finance Assignment 3Document10 pagesFinance Assignment 3Kara IrfanNo ratings yet

- ACCRINT FunctionDocument3 pagesACCRINT FunctionfrazbuttNo ratings yet

- GSTR1 GstinDocument87 pagesGSTR1 GstinKuldeep SharmaNo ratings yet

- GSTR1 Excel Workbook Template V1.7Document63 pagesGSTR1 Excel Workbook Template V1.7Nagaraj SettyNo ratings yet

- Nov gstr1Document63 pagesNov gstr1Ravi KumarNo ratings yet

- GSTR 1Document70 pagesGSTR 1vassudevanrNo ratings yet

- The Subtle Art of Not Giving A FuckDocument15 pagesThe Subtle Art of Not Giving A FuckArun Magha Rajha0% (1)

- WR Kets With Description EnglishDocument6 pagesWR Kets With Description Englishpulkit sharmaNo ratings yet

- FORM 12B - Previous Employment Income DeclarationDocument3 pagesFORM 12B - Previous Employment Income DeclarationsudhakarNo ratings yet

- US Internal Revenue Service: F940ez - 1994Document4 pagesUS Internal Revenue Service: F940ez - 1994IRSNo ratings yet

- Private Org. Pension Form AyanyuDocument3 pagesPrivate Org. Pension Form Ayanyugirma1299No ratings yet

- Quickbooks and Co. - in - GSTR1Document65 pagesQuickbooks and Co. - in - GSTR1DevendraNo ratings yet

- GSTR 1Document69 pagesGSTR 1admin bhagirathiNo ratings yet

- Offline Tool LucknowDocument77 pagesOffline Tool LucknowKPS SQUARE CONSULTING SERVICESNo ratings yet

- GSTR2 Excel Workbook TemplateNew V1.1Document57 pagesGSTR2 Excel Workbook TemplateNew V1.1Tax NatureNo ratings yet

- CFA - Module 6 - Week 11 - Learning TaskDocument2 pagesCFA - Module 6 - Week 11 - Learning Taskjames paul baltazarNo ratings yet

- 2021 01 10 22 32 14 198 - Dicpa9585b - 2020Document60 pages2021 01 10 22 32 14 198 - Dicpa9585b - 2020Ayush AgarwalNo ratings yet

- Uploading Format GSTNDocument28 pagesUploading Format GSTNChetan TandelNo ratings yet

- Salary and Bank Information Form - EnglishDocument2 pagesSalary and Bank Information Form - EnglishArayaselasie TechaluNo ratings yet

- Employees' Pension Scheme (Prargraph 20 (4) ) The Employees' Provident Funds & Misc. Provision Act, 1952Document2 pagesEmployees' Pension Scheme (Prargraph 20 (4) ) The Employees' Provident Funds & Misc. Provision Act, 1952savita17julyNo ratings yet

- Employment Application FormDocument4 pagesEmployment Application FormRakesh Kumar SinghNo ratings yet

- Learn Excel Functions: Count, Countif, Sum and SumifFrom EverandLearn Excel Functions: Count, Countif, Sum and SumifRating: 5 out of 5 stars5/5 (4)

- Simple Interest AutosavedDocument77 pagesSimple Interest AutosavedStephanie Regatcho BetasoloNo ratings yet

- Wall Street Courier Services Inc. Payslip: Earnings AdjustmentDocument1 pageWall Street Courier Services Inc. Payslip: Earnings AdjustmentFerdinand Salvador SrNo ratings yet

- Rent Agreement Format MakaanIQDocument2 pagesRent Agreement Format MakaanIQShikha AroraNo ratings yet

- Pandurang Shigvan Mumbai Vidyavihar Quality Checker: Sector 30A, Vashi, Navi Mumbai, Maharashtra 400705Document15 pagesPandurang Shigvan Mumbai Vidyavihar Quality Checker: Sector 30A, Vashi, Navi Mumbai, Maharashtra 400705DS Ghatkopar EastNo ratings yet

- SALARY Theory EnglishDocument17 pagesSALARY Theory EnglishDilip JaviyaNo ratings yet

- Landlord Tenant RulesDocument3 pagesLandlord Tenant Rulesapi-479624655No ratings yet

- UADC SALARY LOGBOOK UpdatedDocument4 pagesUADC SALARY LOGBOOK UpdatedYameteKudasaiNo ratings yet

- Q PP 4 BondsDocument1 pageQ PP 4 BondsJoebel CristalesNo ratings yet

- Total Compensation Framework Template (Annex A)Document2 pagesTotal Compensation Framework Template (Annex A)Noreen Boots Gocon-GragasinNo ratings yet

- Lecture Cases On Consolidation With Intercompany Sale of InventoryDocument2 pagesLecture Cases On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Module 2Document22 pagesModule 2margieNo ratings yet

- Private & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeDocument1 pagePrivate & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeIrfhaenmahmoedChildOfstandaloneNo ratings yet

- Gen Math LQ 2nd Quarter PDFDocument31 pagesGen Math LQ 2nd Quarter PDFJennifer DamascoNo ratings yet

- Microlink Institute of Science and Technology, Inc.: 1-Jul-19 15-Jul-19Document18 pagesMicrolink Institute of Science and Technology, Inc.: 1-Jul-19 15-Jul-19Dudz MatienzoNo ratings yet

- Assignment3 7QsDocument2 pagesAssignment3 7QsavirgNo ratings yet

- Maharshi ParikhDocument3 pagesMaharshi Parikhsanket shahNo ratings yet

- Form11 1633872532769Document2 pagesForm11 1633872532769Pratham NishadNo ratings yet

- Break Even AnalysisDocument2 pagesBreak Even AnalysisanupsuchakNo ratings yet

- Form CutiDocument3 pagesForm Cutidiaspora mahagrahaNo ratings yet

- Activity StatementDocument13 pagesActivity StatementElvie BangcoyoNo ratings yet

- Book 5Document174 pagesBook 5Anonymous hsZanpCNo ratings yet

- Dhok Roza Payroll JulyDocument1 pageDhok Roza Payroll Julymuhammad jamilNo ratings yet

- Simple and Compound Interest - SSC - CDSDocument14 pagesSimple and Compound Interest - SSC - CDSphysicspalanichamyNo ratings yet

- PayslipDocument4 pagesPayslipJanin Aizel GallanaNo ratings yet

- Sri Fy 2023 Payroll St. Bernard Dist. I and IiDocument10 pagesSri Fy 2023 Payroll St. Bernard Dist. I and IiWynoaj LucaNo ratings yet

- Income Tax Calculation (SAP Library - Payroll India (PY-IN) )Document6 pagesIncome Tax Calculation (SAP Library - Payroll India (PY-IN) )Pradeep KumarNo ratings yet

- FMA Time Value of MoneyDocument5 pagesFMA Time Value of MoneyAvani TomarNo ratings yet