Professional Documents

Culture Documents

Chapter 6

Chapter 6

Uploaded by

yosef mechalCopyright:

Available Formats

You might also like

- 12 01 13 Mock Board Exam 1 With Answer PDFDocument13 pages12 01 13 Mock Board Exam 1 With Answer PDFDionico O. Payo Jr.100% (1)

- Textbook Exercises 14Document4 pagesTextbook Exercises 14Caitlene Lee Uy100% (1)

- 7-Entrepreneurship and New Venture ManagementDocument18 pages7-Entrepreneurship and New Venture ManagementBazla BzNo ratings yet

- Prin. of Acct II - Ch-5-CorporationDocument16 pagesPrin. of Acct II - Ch-5-CorporationfageenyakaraaNo ratings yet

- Accounting II - Chapter 5, Accounting For CorporationDocument16 pagesAccounting II - Chapter 5, Accounting For CorporationHawultu AsresieNo ratings yet

- Accounting For Corporation-FinalDocument13 pagesAccounting For Corporation-Finalgech95465195No ratings yet

- Edited CorporationDocument13 pagesEdited CorporationMesele AdemeNo ratings yet

- Company AccountDocument6 pagesCompany AccountADEYANJU AKEEMNo ratings yet

- Chapter 5 CorporationDocument12 pagesChapter 5 CorporationMamaru SewalemNo ratings yet

- Corpration Chapter FiveDocument19 pagesCorpration Chapter Fiveseneshaw tibebuNo ratings yet

- Lesson 8Document7 pagesLesson 8Aroa Oyarzabal puertasNo ratings yet

- Chapter 3-Statement of Changes in EquityDocument3 pagesChapter 3-Statement of Changes in EquityDan GalvezNo ratings yet

- Chapter Five-CorporationDocument6 pagesChapter Five-Corporationbereket nigussieNo ratings yet

- Accounting For Corporate Form of Business Organizations Chapter OutlinesDocument11 pagesAccounting For Corporate Form of Business Organizations Chapter Outlinesdejen mengstieNo ratings yet

- Topic 6 Accounting For CompaniesDocument55 pagesTopic 6 Accounting For Companiestwahirwajeanpierre50No ratings yet

- CorporationDocument14 pagesCorporationWonde BiruNo ratings yet

- Chapter 5 CorporationDocument14 pagesChapter 5 CorporationMathewos Woldemariam BirruNo ratings yet

- Issue of SharesDocument20 pagesIssue of SharesKhalid AzizNo ratings yet

- Learning Module InformationDocument40 pagesLearning Module InformationJamila MendozaNo ratings yet

- Learning Material 10Document16 pagesLearning Material 10Sheena Marie Jane ZafeNo ratings yet

- ShareholdersDocument7 pagesShareholderszhutilNo ratings yet

- Accounting For CorporationsDocument9 pagesAccounting For CorporationsUmar ZahidNo ratings yet

- Unit 3Document58 pagesUnit 3Hemanta PahariNo ratings yet

- Chapter 6 CorporationDocument7 pagesChapter 6 CorporationAmaa AmaaNo ratings yet

- Accounting For CorporationsDocument156 pagesAccounting For CorporationsAngelica CantorNo ratings yet

- Characteristics of A CorporationDocument23 pagesCharacteristics of A CorporationChan ChanNo ratings yet

- Article 202Document14 pagesArticle 202manoranjan838241No ratings yet

- 5 Major Differences Between A Corporation and A PartnershipDocument3 pages5 Major Differences Between A Corporation and A PartnershipdarylNo ratings yet

- Chapter 6Document8 pagesChapter 6Tasebe GetachewNo ratings yet

- Company Accounts-Updated-1Document44 pagesCompany Accounts-Updated-1cleophacerevivalNo ratings yet

- Accounting For Corporation For LMSDocument77 pagesAccounting For Corporation For LMSRosethel Grace Gallardo100% (1)

- ASSIGNMENT 01 Financial ManagementDocument12 pagesASSIGNMENT 01 Financial ManagementRabia Ch698No ratings yet

- Shareholder EquityDocument26 pagesShareholder Equityismailhasan85No ratings yet

- Characteristics of The Corporate Form of OrganizationDocument3 pagesCharacteristics of The Corporate Form of OrganizationShafqat MalikNo ratings yet

- Audit of EquityDocument76 pagesAudit of Equitydar •100% (1)

- Acc Ch-5 Lecture NoteDocument14 pagesAcc Ch-5 Lecture NoteBlen tesfayeNo ratings yet

- DepartmentDocument7 pagesDepartmenthamna MalikNo ratings yet

- Law On CorporationsDocument6 pagesLaw On Corporationsjokjok021904No ratings yet

- Stockholders Equity DiscussionDocument13 pagesStockholders Equity DiscussionJulie Ann Marie BernadezNo ratings yet

- LESSON 2 Company AccountsDocument13 pagesLESSON 2 Company AccountsBulelwa HarrisNo ratings yet

- Chapter 7Document11 pagesChapter 7Tesfahun tegegnNo ratings yet

- Company - Meaning: Voluntary Association Persons Capital Transferrable Shares Business Earn ProfitDocument44 pagesCompany - Meaning: Voluntary Association Persons Capital Transferrable Shares Business Earn ProfitVimala Selvaraj VimalaNo ratings yet

- Shareholder EquityDocument6 pagesShareholder EquityjoeyNo ratings yet

- Chapter # 3: Accounting For Company - Issuance of Shares & DebenturesDocument26 pagesChapter # 3: Accounting For Company - Issuance of Shares & DebenturesFahad BataviaNo ratings yet

- Leac201 PDFDocument73 pagesLeac201 PDFSubhamoy PradhanNo ratings yet

- Audit of Share CapitalDocument35 pagesAudit of Share CapitalHetal Bhanushali50% (6)

- Corporate Formation and The Stockholders - EquityDocument39 pagesCorporate Formation and The Stockholders - EquityChocochipNo ratings yet

- Introduction To StockholdersDocument18 pagesIntroduction To StockholderssirissNo ratings yet

- PA2C5 Corp NACFN EdDocument20 pagesPA2C5 Corp NACFN EdSelamNo ratings yet

- Week 1Document25 pagesWeek 1Mahroosh Khan004No ratings yet

- Financial Accounting 1 - Acc 301: Unit One Company AccountsDocument53 pagesFinancial Accounting 1 - Acc 301: Unit One Company AccountsTrishia ReditaNo ratings yet

- Shares in Company ActDocument5 pagesShares in Company ActMohnish ChaudhariNo ratings yet

- Stockholders' Equity SummaryDocument18 pagesStockholders' Equity SummaryJheza Mae PitogoNo ratings yet

- Chapter 7 CorprationDocument15 pagesChapter 7 CorprationSisay Belong To JesusNo ratings yet

- Chapter 20 Ia2Document24 pagesChapter 20 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Shareholders' Equity: Learning CompetenciesDocument41 pagesShareholders' Equity: Learning CompetenciesRaezel Carla Santos Fontanilla100% (3)

- Limited Liability CompanyDocument17 pagesLimited Liability CompanyAdrian RamsundarNo ratings yet

- Possible QuestionsDocument7 pagesPossible Questionsmae MoraldeNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Chapter 5: Accounting For CorporationsDocument36 pagesChapter 5: Accounting For CorporationsFeven WondayehuNo ratings yet

- Chapter 6 IcmDocument26 pagesChapter 6 IcmsknhNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Chapter ThreeDocument76 pagesChapter Threeyosef mechalNo ratings yet

- Foa Ii Individual AssignmentDocument3 pagesFoa Ii Individual Assignmentyosef mechalNo ratings yet

- Chapter 4Document11 pagesChapter 4yosef mechalNo ratings yet

- Chapter 5Document10 pagesChapter 5yosef mechalNo ratings yet

- The Workflow of One Specific OrganizationDocument8 pagesThe Workflow of One Specific Organizationyosef mechalNo ratings yet

- Intership Report of PPCBLDocument104 pagesIntership Report of PPCBLSehar IrfanNo ratings yet

- Application of Islamic Contracts in Islamic BankingDocument16 pagesApplication of Islamic Contracts in Islamic BankingWan RuschdeyNo ratings yet

- COC LEVEL-3 PracticalDocument81 pagesCOC LEVEL-3 PracticalMohammed AbduramanNo ratings yet

- Pengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaDocument25 pagesPengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaOptimis SelaluNo ratings yet

- Final Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Document11 pagesFinal Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Chuck Kalogianis100% (1)

- Withholding TaxDocument21 pagesWithholding TaxTres SanicamNo ratings yet

- OilandGas Tax Guide 2011 FINALDocument498 pagesOilandGas Tax Guide 2011 FINALhundudeNo ratings yet

- Caf Audit RTP May-24Document27 pagesCaf Audit RTP May-24sunil bohraNo ratings yet

- Raya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuDocument15 pagesRaya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuFantayNo ratings yet

- Estate Planning Basics732Document7 pagesEstate Planning Basics732anon_909251819No ratings yet

- Paper8 SolutionDocument17 pagesPaper8 SolutionEklavya reangNo ratings yet

- List of Lease Instruments With Isin No. - Ewyc-Wfc-2012Document12 pagesList of Lease Instruments With Isin No. - Ewyc-Wfc-2012Wajid100% (1)

- Valuation of BondsDocument30 pagesValuation of BondsRuchi SharmaNo ratings yet

- LI 01 Vetting ChecklistDocument1 pageLI 01 Vetting ChecklistAsyraf WajdiNo ratings yet

- CP11 September22 EXAMDocument5 pagesCP11 September22 EXAMElroy PereiraNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountArnav JoshiNo ratings yet

- Commercial Banking - Project Group 10 PDFDocument48 pagesCommercial Banking - Project Group 10 PDFSachin PowaniNo ratings yet

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiNo ratings yet

- m1 ExerciseDocument33 pagesm1 ExerciseWillowNo ratings yet

- SWOT Analysis For A BankDocument2 pagesSWOT Analysis For A BankAndrew Hoth KangNo ratings yet

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Ejercicio Nro 8 SolucionnnnnnDocument9 pagesEjercicio Nro 8 SolucionnnnnnSugar Leonardo Herrera CoaquiraNo ratings yet

- Explained: Hike in Telecom Prices: Introduction: Network Services Set To Get Expensive by About 40%Document3 pagesExplained: Hike in Telecom Prices: Introduction: Network Services Set To Get Expensive by About 40%saurabhNo ratings yet

- WACCDocument6 pagesWACCAbhishek P BenjaminNo ratings yet

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet

- Master Budgets and Performance Planning: QuestionsDocument67 pagesMaster Budgets and Performance Planning: QuestionsFrances Nicole MuldongNo ratings yet

- Ignou Fiscal Federalism 1Document16 pagesIgnou Fiscal Federalism 1luvlickNo ratings yet

Chapter 6

Chapter 6

Uploaded by

yosef mechalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6

Chapter 6

Uploaded by

yosef mechalCopyright:

Available Formats

PRINCIPLES OF ACCOUNTING II

Chapter 6

ACCOUNTING FOR CORPORATIONS

5.1 Nature of a Corporation

A corporation is a legal entity, an artificial legal “person”, created on the approval of the appropriate

governmental authority. To form a corporation, the incorporators (often at least three are required)

must apply for a charter. The incorporators prepare and file the articles of incorporation, which

delineate the basic structure of the corporation, including the purposes for which it is formed, the

amount of capital stock to be authorized, and the number of shares into which the stock is to be

divided. If the incorporators meet the requirements of the law, the government issues a charter or

certificate of incorporation. After the charter has been granted, the incorporators (or the subscribers

to the corporation’s capital stock) hold an organization meeting to elect the first board of directors

and adopt the bylaws of corporations.

Because assets are essential to corporate operations, the corporation issues certificates of capital stock

to obtain the necessary funds. As owners of the corporation, stockholders, or shareholders, are

entitled to a voice in the control and management of the company. Stockholders with voting stock

may vote at the annual meeting and participate in the election of the board of directors. The board of

directors is responsible for the overall management of the corporation. Normally the board selects

such corporate officers as a president, one or more vice-presidents, a controller, and a treasurer. The

officers implement the policies of the board of directors and actively manage the day to day affairs of

the corporation.

Creating a corporation is more costly than organizing a proprietorship or partnership. The

expenditures incurred to organize a corporation are charged to Organization Costs, an intangible

asset account. These costs include attorney’s fees, fees paid to the government, and costs of

promoting the enterprise. Organization costs typically are amortized.

5.2 Characteristics of Corporations

Separate Legal Entity: A business with a corporate charter is empowered to conduct business

affairs apart from its owners. The corporation, as a legal entity, may acquire assets, incur debt,

enter into contracts, sue, and be sued all in its own name. The owners, or stockholders, of the

corporation receive stock certificates as evidence of their ownership interests; the

stockholders, however, are separate and distinct from the corporation. This characteristic

contrasts with proprietorships and partnerships, which are accounting entities but not legal

entities apart from their owners. Owners of proprietorships and partnerships can be held

responsible separately and collectively for unsatisfied obligations of the business.

Lecture Notes on Principles of Accounting-II, Chapter V 1

Limited Liability: The liability of shareholders with respect to company affairs is usually

limited to their investment in the corporation. Because of this limited liability, laws restrict

distributions to shareholders. To protect creditors, the government controls the distribution of

contributed capital. Distributions of retained earnings (undistributed profits) are not legal

unless the board of directors formally declares a dividend. Because of the legal delineation of

owner capital available for distribution, corporations must maintain careful distinctions in

the accounts to identify the different elements of stockholders’ equity.

Transferability of Ownership: Shares in a corporation may be routinely transferred without

affecting the company’s operations. The corporation merely notes such transfers of ownership

in the stockholder records (ledger). Although a corporation must have stockholder records to

notify shareholders of meetings and to pay dividends, the price at which shares transfer

between owners is not recognized in the corporation’s accounts.

Continuity of Existence: Because routine transfers of ownership do not affect the affairs of a

corporation the corporation is said to have continuity of existence. In this respect, a

corporation is completely different from a partnership. In a partnership, any change in own -

ership technically results in dissolution of the old partnership and formation of a new one. In

a partnership, the individual partners’ capital accounts indicate their relative interests in the

business. The stockholders’ equity section of a corporate balance sheet does not present

individual stockholder accounts. A shareholder, however, can easily compute his or her

interest in the corporation by calculating the proportion of the total shares outstanding that

his or her shares represent.

For example, if only one class of stock is outstanding and it totals 1,000 shares, an individual owning

200 shares has a 20% interest in the total stockholders’ equity of the corporation, which includes all

contributed capital and retained earnings. The dollar amount of this interest, however, is a book

amount, rarely coinciding with the market value. A stockholder who liquidates his or her investment

would sell it at a price negotiated with a buyer or, if the stock is traded on a stock exchange, at the

exchange’s quoted market price.

Capital-raising Capability: The limited liability of stockholders and the ease with which

shares of stock may be transferred from one investor to another are attractive features to

potential stockholders. These characteristics enhance the ability of the corporation to raise

large amounts of capital by issuing shares of stock. Because both large and small investors

may acquire ownership interests in a corporation, a wide spectrum of potential investors

exists.

Taxation: As legal entities, corporations are subject to income taxes on their earn ings, whether

distributed or not. In addition, shareholders must pay income taxes on earnings received as

dividends. Therefore, corporate income is subject to double taxation.

Lecture Notes on Principles of Accounting-II, Chapter V 2

Regulation and Supervision: Corporations are subject to greater degrees of regulation and

supervision than are proprietorships and partnerships. The laws limit the powers a

corporation may exercise, identify reports that must be filed, and define the rights and

liabilities of stockholders. Furthermore, corporations whose stock is listed and traded on

organized security exchanges are subject to the various reporting and disclosure

requirements of these exchanges.

5.3 Nature and Types of Stock in a Corporation

The corporate charter may specify a face value, or par value, for each share of a stock of any class.

Par values are typically set at amounts well below the stock’s market value at date of issue. Par value

today, therefore, has no economic significance. However, par value may have legal implications. In

some countries, par value may represent the minimum amount that must be paid-in per share of

stock. If stock is issued at a discount (that is, at less than par value), the stockholder may have a

liability for the discount if creditors’ claims remain unsatisfied after the liquidation of the company.

Issuing stock at a discount is a rare event, because boards of directors have generally established par

values below market values at time of issue.

Par value may also be used in some laws to define the legal capital of a corporation. The legal capital

is the minimum amount of contributed capital that must remain in the corporation as a margin of

protection for creditors. A distribution of assets to stockholders would not be allowed if it reduced

stockholders’ equity below the amount of legal capital. Given the role that par value may play in

defining legal capital, accountants carefully segregate and record the par value of stock transactions

in an appropriate capital stock account.

The laws of most countries permit the issuance of stock without par value that is, no par stock. The

company’s board of directors usually sets a stated value for the no-par stock. In such cases, the stated

value will determine the corporation’s legal capital. Again, the stated value figure is usually set well

below market value at time of issue, but in contrast to par value, the stated value is not printed on the

stock certificate. For accounting purposes, stated value amounts are treated in a fashion similar to

par value amounts. In the absence of a stated value, the entire proceeds from the issuance of no-par

stock will likely establish the legal capital of the corporation.

5.4 Classification of Stock

The amounts and kinds of stock that a corporation may issue are enumerated in the company’s

charter. Providing for several class of stock permits the company to raise capital from different types

of investors. The charter also specifies the corporation’s authorized stock, the maximum number of

shares of each class of stock that may be issued. A corporation that wishes to issue more shares than

Lecture Notes on Principles of Accounting-II, Chapter V 3

its authorized number must first amend its charter. Shares that have been sold and issued to

stockholders constitute the issued stock of the corporation. The corporation may repurchase some of

this stock. Shares actually held by stockholders are called outstanding stock, whereas those

reacquired by the corporation (and not retired) are treasury stock. The stocks that are issues and held

by the corporation are referred to as outstanding stock.

5.4.1 Common Stock

When only one class of stock is issued, it is called common stock. Common shareholders compose the

basic ownership class. They have rights to vote, to share in earnings, to participate in additional

issues of stock, and in the case of liquidation to share in assets after prior claims on the corporation

have been settled. We now consider each of these rights. As the owners of a corporation, the

common shareholders elect the board of directors and vote on other matters requiring the approval

of owners. Common shareholders are entitled to one vote for each share of stock they own. Owners

who do not attend the annual stockholders’ meetings may vote by proxy (this may be the case for

most stockholders in large corporations). A common stockholder has the right to a proportionate

share of the earnings of the corporation that are distributed as dividends. All earnings belong to the

corporation, however, until the board of directors formally declares a dividend.

Each shareholder of a corporation has a preemptive right to maintain his or her proportionate

interest in the corporation. If the company issues additional shares of stock, current owners of that

type of stock receive the first opportunity to acquire, on a pro-rata basis, the new shares. In certain

situations, management may request shareholders to waive their preemptive rights. For example, the

corporation may wish to issue additional stock to acquire another company. Further, stockholders of

firms incorporated in some states do not receive preemptive rights.

A liquidating corporation converts its assets to a form suitable for distribution, usually cash, which it

then distributes to parties having claims on the corporate assets. Any assets remaining after all claims

have been satisfied belong to the residual ownership interest in the corporation the common

stockholders. These owners are entitled to the final distribution of the balance of the assets.

5.4.2 Preferred Stock

Preferred stock is a class of stock with various characteristics that distinguish it from common stock.

Preferred stock has one or more preferences over common stock, usually with reference to: (1)

Dividends and (2) Assets when the corporation liquidates.

To determine the features of a particular issue, we must examine the stock contract. The majority of

preferred issues, however, have certain typical features, which we discuss below.

Dividend Preference

Lecture Notes on Principles of Accounting-II, Chapter V 4

When the board of directors declares a distribution of earnings, preferred stockholders are entitled

to a certain annual amount of dividends before common stockholders receive any distribution. The

amount is usually specified in the preferred stock contract as a percentage of the par value of the

stock or in dollars per share if the stock does not have a par value. Thus, if the preferred stock has a

Br 100 par value and a 6% dividend rate, the preferred shareholders receive Br 6 per share in

dividends. However, the amount is owed to the stockholders only if declared.

Preferred dividends are usually cumulative—that is, regular dividends to the preferred stockholders

omitted in past years must be paid in addition to the dividend of the current year before any

distribution is made to common shareholders. For example, a dividend may not be declared in an

unprofitable year. If the Br 6 preferred stock dividend mentioned above is one year in arrears and a

dividend is declared in the current year, preferred shareholders would receive Br 12 per share

before common shareholders received anything.

If a preferred stock is non-cumulative, omitted dividends do not carry forward. Because investors

normally consider the non-cumulative feature unattractive, non-cumulative preferred stock is rarely

issued.

Dividends in arrears (that is, omitted in past years) on cumulative preferred stock are not an

accounting liability and do not appear in the liability section of the balance sheet. They do not

become an obligation of the corporation until the board of directors formally declares such

dividends. Any arrearages are typically disclosed to investors in a footnote to the balance sheet.

Asset Distribution Preference

Preferred stockholders normally have a preference over common stockholders as to the receipt of

assets when a corporation liquidates. As the corporation goes out of business, the claims of creditors

are settled first. Then, preferred stockholders have the right to receive assets equal to the par value of

their stock or a larger stated liquidation value per share before any assets are distributed to common

stockholders. The preferred stockholders’ preference to assets in liquidation also includes any

dividends in arrears. Preferred stocks may also be classified into participating and non-participating.

Participating preferred stock refers to preferred stock that has a right to a stated dividend and, after

common stock has been paid a dividend, can participate in any excess dividends. Nonparticipating

preferred stock does not have this right.

5.5 Issuance of Stocks

Capital stock may be issued at par, above par, or below par. Par value is not an indicator of market

value – it is strictly a legal matter. When stock is issued above or below par, the excess or deficiency

is recorded in a Premium Account called Paid-in Capital in Excess of Par, or, if no balance exists in

this account, in a Discount Account. Stock can be issued for cash, plant assets, legal services, or on

Lecture Notes on Principles of Accounting-II, Chapter V 5

account. Treasury stocks are those shares that are re-acquired and held by the corporation. The

number of shares currently owned by stockholders; that is, the number of shares authorized minus

the total number of un-issued shares and minus the number of treasury-shares.

Illustration 1, assume that the corporate charter of XYZ Company specifies "authorized capital stock,

100,000 shares, par value Br.1 per share. Further, assume that to date, XYZ Corporation has sold and

issued 30,000 shares of its capital stock.

The stocks can be summarized as follows:

Authorized shares 100,000

Issued shares 30,000

Un-issued shares 70,000

If the corporation has repurchased 1,000 shares to date, the authorized shares, treasury

stocks, un-issued stocks, and outstanding stocks will be as follows:

Authorized shares 100,000

Treasury stock (1,000)

Un-issued shares (70,000)

Outstanding shares 29,000 shares

The stockholders’ equity accounts of a corporation represent the two primary sources of

stockholders' equity:

1. Contributed capital from the sale of stock, which is the amount invested by stockholders through

the purchase of shares of stock from the corporation. Contributed capital has two distinct

components: (a) Par or Stated Value derived from the sale of capital stock, and

(b) Additional Contributed Capital in excess of par or stated value.

(This is often called Additional Paid-In Capital.)

2. Retained earnings generated by the profit-making activities of the company. This is the

cumulative amount of net income earned since the organization of the corporation less the

cumulative amount of dividends paid by the corporation since organization.

Most companies generate a significant part of their stockholders' equity from retained

earnings rather than from capital raised through the sale of stock.

Sale and Issuance of Capital Stock

Most sales of stock to the public are cash transactions.

Illustration 2, To illustrate accounting for an initial sale of stock, assume that on January 1, 20x5, M

Company sold 100,000 shares of its Br 0.10 par value stock for Br 22 per share.

The company records the following journal entry:

Lecture Notes on Principles of Accounting-II, Chapter V 6

Date Accounts Debit Credit

20X5, Jan. 1 Cash (100,000x Br 22) 2,200,000

Common stock (100,000 x Br. 0.10) 10,000

Paid In Capital in Excess of Par 2,190,000

Sale of Stock with No-Par-Value

Some corporations do not specify a par value for their stock. In these cases, depending on the

law, common stock is recorded under one of the following two approaches:

1. Using Stated Value: The corporation must specify in its bylaws a stated value per share as

legal capital. This stated value is used as a substitute for par value, and the sale of common

stock is recorded in a manner similar to the previous journal entry.

Date Accounts Debit Credit

20X5, Jan. 1 Cash (100,000x Br 22) 2,200,000

Common stock (100,000 x Br. 0.10) 10,000

Paid In Capital in excess of Stated Value 2,190,000

2.

Recording the whole proceeds as a Legal Capital: The corporation must record the total

proceeds received from each sale of no-par stock as legal capital. In this case, the total

proceeds are recorded in the Common Stock account and there is no account called

Capital in Excess of Par.

Date Accounts Debit Credit

20X5, Jan. 1 Cash (100,000 x Br 22) 2,200,000

Common stock (100,000 x Br 22) 2,200,000

5.6 Treasury Stock

Capital stock that is reacquired by a corporation is termed Treasury Stock. Treasury stock has no

voting, dividend, or other stockholder rights. Stock can be reacquired for various reasons, such as to

have shares available for distribution to employees under bonus plans, and to support the market

price of the stock by stimulating trading in it. If treasury stock is resold, no gain or loss is recognized

on the exchange because the corporation’s primary objective is not to make profit by trading in its

own stock. In addition, the treasury stocks are not assets; rather they are deductions from

stockholders equity. The recording of the purchase of treasury stock is based on the cost of the shares

that were purchased.

Illustration 5, Assume that On April 1, 20x5, M Company bought 100,000 shares of its stock in the

open market when it was selling for Br 22 per share.

Lecture Notes on Principles of Accounting-II, Chapter V 7

Using the cost method, the company records the following journal entry:

Date Accounts Debit Credit

20X5, Apr. 1 Treasury stock (100,000 x Br 22) 2,200,000

Intuitively,

Cash 2,200,000

many students

expect the Treasury Stock account to be reported as an asset. This is not the case because a company

cannot create an asset by investing in itself. The Treasury Stock account is actually a contra equity

account, which means that it is reported as a subtraction from the total stockholders' equity. This

makes sense because treasury stock is stock that is no longer outstanding, and therefore, should not

be included as part of stockholders' equity.

If M Company eventually sells its treasury stock; it will not report an accounting profit or loss on the

transaction even if it sells the stock for more or less than it paid. GAAP do not permit a corporation to

report income or losses from investments in its own stock because transactions with the owners are

not considered to be normal profit- making activities.

Illustration 6, Based on the previous example, assume that on April 15, M Company sold 10,000

shares of treasury stock for Br30 per share. Remember that the company had purchased the stock for

Br22 per share.

M Company records the following entry:

Date Accounts Debit Credit

20X5, Apr. 15 Cash (10,000 x Br 30) 300,000

Treasury Stock 220,000

Paid in capital from sale of treasury sock 80,000

If treasury stock were sold at a price below its purchase price (i.e., on a ‘loss’), the Paid in Capital

from sale of Treasury Stock account would be debited for the amount of the loss. Retained Earnings

would be debited for some or the entire amount of the ‘losses’ only if there were an insufficient

credit balance in the Paid in Capital from sales of Treasury Stock account. In some cases a

corporation may receive some of its stocks through donation. The Donated Capital account (or

Contributed Capital account) is credited for the market value of the shares at the date of acquisition.

Illustration 7, For example, assumes that on March 1, 20x5, M Company received 1000 shares form

stockholders in donation. If the market price per share is Br 100, the following entry would be

prepared:

Date Accounts Debit Credit

20X5, Mar. 1 Treasury Stock 100,000

Donated Capital [1,000 x Br 100] 100,000

Lecture Notes on Principles of Accounting-II, Chapter V 8

Neither the purchase nor sale of treasury stock affects the number of shares of stock that are

issued or un-issued. Treasury stock affects only the number of shares of outstanding stock; the

basic difference between treasury stock and un-issued stock is that treasury stock has been

sold at least once.

Therefore, the stockholders equity section could be presented as follows:

Paid in Capital:

Common Stock Br xxxxx

Capital in Excess of Par xxxxx xxxxx

Donated Capital xxxxx

Retained Earnings xxxxx xxxxx

Less: Treasury Stock xxxxx

Total Stockholders' Equity Br xxxxx

5.7 Cash Dividend

Investors who purchase preferred stock give up certain advantages that are available to investors in

common stock. Generally, preferred stockholders do not have the right to vote at the annual meeting,

nor do they share in increased earnings if the company becomes more profitable. To compensate

these investors, preferred stock offers some advantages not available to common stockholders.

Perhaps, the most important advantage is dividend preference.

You will frequently encounter the following dividend preferences:

1. Current dividend preference.

2. Cumulative dividend preference.

Preferred Stock always carries a current dividend preference. It requires that the current preferred

dividend be paid before any dividends are paid on the common stock. When the current dividend

preference has been met and no other preference is operative, dividends can be paid to the common

stockholders.

Declared Dividends must be allocated between the preferred and common stock. First, the

preferences of the preferred stock must be met, and then the remainder of the total dividend can be

allocated to the common stock.

Cumulative Preferred Stock has a cumulative dividend preference that states if all or a part of the

specified current dividend is not paid in full, the unpaid amount becomes dividends in arrears. The

amount of any cumulative preferred dividends in arrears must be paid before any common

dividends can be paid. Of course, if the preferred stock is non-cumulative, dividends never can be in

arrears. Therefore, the preferred stockholders lose permanently any dividends passed (i.e., not

declared). Because preferred stockholders are not willing to accept this unfavorable feature,

preferred stock is usually cumulative.

Lecture Notes on Principles of Accounting-II, Chapter V 9

Dividends are never an actual liability until the board of directors declares them. Dividends in

arrears are not reported on the balance sheet, but are disclosed in the notes to the statements. The

allocation of dividends between cumulative preferred stock and common stock should be strict in

accordance with the stock contract. But, generally, we follow the steps below:

Step 1: Allocate dividends in arrears to the preferred stock,

Step 2: Allocate current year dividend to the preferred stock,

Step 3: If the preferred stocks are participating, allocate matching dividends to common stock.

This is dividend comparable to the current year dividend of the preferred stock. For example, if

the current year dividend to preferred stock is 5 % of par, the common stock will also be entitled

to 5% of their stock’s par value. If the current year dividend to the preferred stock is Br 2 per

share, the comparable dividend will also be Br 2 per share to the common stock

Step 4: If there is a balance after step 3, it is allocated to both preferred and common stock.

If the preferred stocks are non-participating, the entire remaining amount after step 2 will be

given to common stock.

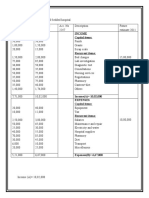

Illustration 9, Assume the following:

Preferred stock outstanding, 6%, par Br 20; 2,000 shares Br 40,000

Common stock outstanding, par Br. 10; 5,000 shares 50,000

Assume that the dividends are in arrears for 1 year, &

preferred stocks are cumulative and participating.

If the amount of cash dividend declared is Br 50,000 it will be allocated as follows:

Preferred Common Total .

Par Value Br 40,000 Br 50,000 Br 90,000

Total Dividend Br 50,000

1. Dividends in arrears [0.06x 40,000] 2,400 (2,400)

Remaining amount 47,600

2. Current year dividend to preferred 2,400 (2,400)

Remaining amount 45,200

3. Matching dividend to common stock [0.06 x 50,000] 3,000 (3,000)

Remaining amount 42,200

4. To both classes of shares:

[42,200/90,000=0.47] [0.47 x 40,000; 0.47 x 50,000] 18,756 23,444 (42,200)

Total 23,556 26,444 50,000

Notice that all the four steps are applied in this example because there were dividends in arrears and

the preferred stocks were cumulative and participating.

On the date of declaration of the dividends, say December 31, 20x5, the following entry

is prepared:

Lecture Notes on Principles of Accounting-II, Chapter V 10

Date Accounts Debit Credit

20X5, Dec. 31 Dividends 50,000

Dividend Payable: Preferred 23,556

Dividend Payable: Common 26,444

The dividends account would be closed as follows:

Date Accounts Debit Credit

20X5, Dec. 31 Retained Earnings 50,000

Dividends 50,000

If the dividends are paid out on January 1, 20x6, the following entry would be prepared:

Date Accounts Debit Credit

20X6, Jan 1 Dividend Payable: Preferred 23,556

Dividend Payable: Common 26,444

Cash 50,000

If we assume that the preferred stocks are non-cumulative non-participating, the dividends

would be allocated as follows:

Preferred Common Total .

Par Value Br 40,000 Br 50,000 Br 90,000

Total Dividend Br 50,000

1. Current year dividend to preferred 2,400 (2,400)

Remaining amount 47,600

2. All the remaining amounts to Common Stock ____ 47,600 (47,600)

Total 2,400 47,600 50,000

5.8 The Statement of Stockholders’ Equity

The statement of stockholders’ equity is prepared periodically to summarize the changes that have

occurred in the stockholders’ equity of the corporation. In some cases, the statement of retained

earnings is prepared instead of the statement of Stockholders’ equity. This represents a fairly typical

statement of changes in retained earnings. Under rare circumstances, you may see a statement that

includes an adjustment to the beginning balance of retained earnings. This adjustment is called a

prior period adjustment, which is a correction of an accounting error that occurred in the financial

statements of a prior period.

Lecture Notes on Principles of Accounting-II, Chapter V 11

5.9 Equity Per-Share

Equity per share (EPS) is the ratio of stockholder's equity to the related number of shares of stock

outstanding. If there is only one class of shares (common stock), equity per share is computed as

follows:

EPS= Total Stockholder's Equity

No. of Shares Outstanding

If there are both common and preferred shares, we have to allocate the total equity to preferred and

common stock. The equity to preferred stock is the liquidation value. The liquidation value is the

amount that the preferred stockholders can claim if the corporation is liquidated. The equity to

preferred stock includes the dividends in arrears. If the equity to the preferred stock is determined,

the common equity is computed by deducting equity to preferred stock from the total equity.

Then, EPS would be computed as follows:(If both are there)

Preferred EPS = Equity Allocated to Preferred Stock .

No. of Outstanding Shares of Preferred Stock

Common EPS = Equity Allocated to Common Stock .

No. of Outstanding Shares of Common Stock

The Retained Earnings account is a stockholders’ equity account with a normal credit balance. As a

result of net losses, however, a debit balance in Retained Earnings may occur. Such a balance is

called a deficit. The deficit reduces the total stockholders’ equity of the corporation.

Illustration 10, Assume that the following balances appear on the balance sheet of ABC Company:

Common stock, Br 10 par Br 600,000

Paid in Capital in excess of par 120,000

Deficit 75, 000

Total stockholders’ equity is Br 645,000 (Br 600,000 + Br 120,000 – Br 75,000) and the number of

share is 60,000 (Br 600,000/Br 10). The business has only common stock and hence, the EPS is:

645,000/60,000 = 10.75

Illustration 11, Assume the following data:

Preferred, 10% stock, Br 50 par Br. 2,500,000

Premium on preferred stock 275,000

Common stock, Br. 25 par 3,750,000

Lecture Notes on Principles of Accounting-II, Chapter V 12

Deficit 1,240,000

Assume also that Preferred stock has prior claim to assets on liquidation to the extent of 110% of par.

To compute EPS, let us first split the total equity into the two classes of shares:

Total Equity:

Preferred, 10% stock, Br 50 par Br. 2,500,000

Premium on preferred stock 275,000

Common stock, Br. 25 par 3,750,000

Deficit (1,240,000) Br 5,285,000

Less: Equity to preferred stock (110% x 2,500,000) 2,750,000

Equity to Common Stock Br 2,535,000

Therefore, Preferred EPS = Br 2,750,000 = Br 55.00

2,500,000/Br 50

Common EPS = Br 2,535,000 = Br 16.90

3,750,000/Br 25

Lecture Notes on Principles of Accounting-II, Chapter V 13

You might also like

- 12 01 13 Mock Board Exam 1 With Answer PDFDocument13 pages12 01 13 Mock Board Exam 1 With Answer PDFDionico O. Payo Jr.100% (1)

- Textbook Exercises 14Document4 pagesTextbook Exercises 14Caitlene Lee Uy100% (1)

- 7-Entrepreneurship and New Venture ManagementDocument18 pages7-Entrepreneurship and New Venture ManagementBazla BzNo ratings yet

- Prin. of Acct II - Ch-5-CorporationDocument16 pagesPrin. of Acct II - Ch-5-CorporationfageenyakaraaNo ratings yet

- Accounting II - Chapter 5, Accounting For CorporationDocument16 pagesAccounting II - Chapter 5, Accounting For CorporationHawultu AsresieNo ratings yet

- Accounting For Corporation-FinalDocument13 pagesAccounting For Corporation-Finalgech95465195No ratings yet

- Edited CorporationDocument13 pagesEdited CorporationMesele AdemeNo ratings yet

- Company AccountDocument6 pagesCompany AccountADEYANJU AKEEMNo ratings yet

- Chapter 5 CorporationDocument12 pagesChapter 5 CorporationMamaru SewalemNo ratings yet

- Corpration Chapter FiveDocument19 pagesCorpration Chapter Fiveseneshaw tibebuNo ratings yet

- Lesson 8Document7 pagesLesson 8Aroa Oyarzabal puertasNo ratings yet

- Chapter 3-Statement of Changes in EquityDocument3 pagesChapter 3-Statement of Changes in EquityDan GalvezNo ratings yet

- Chapter Five-CorporationDocument6 pagesChapter Five-Corporationbereket nigussieNo ratings yet

- Accounting For Corporate Form of Business Organizations Chapter OutlinesDocument11 pagesAccounting For Corporate Form of Business Organizations Chapter Outlinesdejen mengstieNo ratings yet

- Topic 6 Accounting For CompaniesDocument55 pagesTopic 6 Accounting For Companiestwahirwajeanpierre50No ratings yet

- CorporationDocument14 pagesCorporationWonde BiruNo ratings yet

- Chapter 5 CorporationDocument14 pagesChapter 5 CorporationMathewos Woldemariam BirruNo ratings yet

- Issue of SharesDocument20 pagesIssue of SharesKhalid AzizNo ratings yet

- Learning Module InformationDocument40 pagesLearning Module InformationJamila MendozaNo ratings yet

- Learning Material 10Document16 pagesLearning Material 10Sheena Marie Jane ZafeNo ratings yet

- ShareholdersDocument7 pagesShareholderszhutilNo ratings yet

- Accounting For CorporationsDocument9 pagesAccounting For CorporationsUmar ZahidNo ratings yet

- Unit 3Document58 pagesUnit 3Hemanta PahariNo ratings yet

- Chapter 6 CorporationDocument7 pagesChapter 6 CorporationAmaa AmaaNo ratings yet

- Accounting For CorporationsDocument156 pagesAccounting For CorporationsAngelica CantorNo ratings yet

- Characteristics of A CorporationDocument23 pagesCharacteristics of A CorporationChan ChanNo ratings yet

- Article 202Document14 pagesArticle 202manoranjan838241No ratings yet

- 5 Major Differences Between A Corporation and A PartnershipDocument3 pages5 Major Differences Between A Corporation and A PartnershipdarylNo ratings yet

- Chapter 6Document8 pagesChapter 6Tasebe GetachewNo ratings yet

- Company Accounts-Updated-1Document44 pagesCompany Accounts-Updated-1cleophacerevivalNo ratings yet

- Accounting For Corporation For LMSDocument77 pagesAccounting For Corporation For LMSRosethel Grace Gallardo100% (1)

- ASSIGNMENT 01 Financial ManagementDocument12 pagesASSIGNMENT 01 Financial ManagementRabia Ch698No ratings yet

- Shareholder EquityDocument26 pagesShareholder Equityismailhasan85No ratings yet

- Characteristics of The Corporate Form of OrganizationDocument3 pagesCharacteristics of The Corporate Form of OrganizationShafqat MalikNo ratings yet

- Audit of EquityDocument76 pagesAudit of Equitydar •100% (1)

- Acc Ch-5 Lecture NoteDocument14 pagesAcc Ch-5 Lecture NoteBlen tesfayeNo ratings yet

- DepartmentDocument7 pagesDepartmenthamna MalikNo ratings yet

- Law On CorporationsDocument6 pagesLaw On Corporationsjokjok021904No ratings yet

- Stockholders Equity DiscussionDocument13 pagesStockholders Equity DiscussionJulie Ann Marie BernadezNo ratings yet

- LESSON 2 Company AccountsDocument13 pagesLESSON 2 Company AccountsBulelwa HarrisNo ratings yet

- Chapter 7Document11 pagesChapter 7Tesfahun tegegnNo ratings yet

- Company - Meaning: Voluntary Association Persons Capital Transferrable Shares Business Earn ProfitDocument44 pagesCompany - Meaning: Voluntary Association Persons Capital Transferrable Shares Business Earn ProfitVimala Selvaraj VimalaNo ratings yet

- Shareholder EquityDocument6 pagesShareholder EquityjoeyNo ratings yet

- Chapter # 3: Accounting For Company - Issuance of Shares & DebenturesDocument26 pagesChapter # 3: Accounting For Company - Issuance of Shares & DebenturesFahad BataviaNo ratings yet

- Leac201 PDFDocument73 pagesLeac201 PDFSubhamoy PradhanNo ratings yet

- Audit of Share CapitalDocument35 pagesAudit of Share CapitalHetal Bhanushali50% (6)

- Corporate Formation and The Stockholders - EquityDocument39 pagesCorporate Formation and The Stockholders - EquityChocochipNo ratings yet

- Introduction To StockholdersDocument18 pagesIntroduction To StockholderssirissNo ratings yet

- PA2C5 Corp NACFN EdDocument20 pagesPA2C5 Corp NACFN EdSelamNo ratings yet

- Week 1Document25 pagesWeek 1Mahroosh Khan004No ratings yet

- Financial Accounting 1 - Acc 301: Unit One Company AccountsDocument53 pagesFinancial Accounting 1 - Acc 301: Unit One Company AccountsTrishia ReditaNo ratings yet

- Shares in Company ActDocument5 pagesShares in Company ActMohnish ChaudhariNo ratings yet

- Stockholders' Equity SummaryDocument18 pagesStockholders' Equity SummaryJheza Mae PitogoNo ratings yet

- Chapter 7 CorprationDocument15 pagesChapter 7 CorprationSisay Belong To JesusNo ratings yet

- Chapter 20 Ia2Document24 pagesChapter 20 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Shareholders' Equity: Learning CompetenciesDocument41 pagesShareholders' Equity: Learning CompetenciesRaezel Carla Santos Fontanilla100% (3)

- Limited Liability CompanyDocument17 pagesLimited Liability CompanyAdrian RamsundarNo ratings yet

- Possible QuestionsDocument7 pagesPossible Questionsmae MoraldeNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Chapter 5: Accounting For CorporationsDocument36 pagesChapter 5: Accounting For CorporationsFeven WondayehuNo ratings yet

- Chapter 6 IcmDocument26 pagesChapter 6 IcmsknhNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Chapter ThreeDocument76 pagesChapter Threeyosef mechalNo ratings yet

- Foa Ii Individual AssignmentDocument3 pagesFoa Ii Individual Assignmentyosef mechalNo ratings yet

- Chapter 4Document11 pagesChapter 4yosef mechalNo ratings yet

- Chapter 5Document10 pagesChapter 5yosef mechalNo ratings yet

- The Workflow of One Specific OrganizationDocument8 pagesThe Workflow of One Specific Organizationyosef mechalNo ratings yet

- Intership Report of PPCBLDocument104 pagesIntership Report of PPCBLSehar IrfanNo ratings yet

- Application of Islamic Contracts in Islamic BankingDocument16 pagesApplication of Islamic Contracts in Islamic BankingWan RuschdeyNo ratings yet

- COC LEVEL-3 PracticalDocument81 pagesCOC LEVEL-3 PracticalMohammed AbduramanNo ratings yet

- Pengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaDocument25 pagesPengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaOptimis SelaluNo ratings yet

- Final Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Document11 pagesFinal Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Chuck Kalogianis100% (1)

- Withholding TaxDocument21 pagesWithholding TaxTres SanicamNo ratings yet

- OilandGas Tax Guide 2011 FINALDocument498 pagesOilandGas Tax Guide 2011 FINALhundudeNo ratings yet

- Caf Audit RTP May-24Document27 pagesCaf Audit RTP May-24sunil bohraNo ratings yet

- Raya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuDocument15 pagesRaya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuFantayNo ratings yet

- Estate Planning Basics732Document7 pagesEstate Planning Basics732anon_909251819No ratings yet

- Paper8 SolutionDocument17 pagesPaper8 SolutionEklavya reangNo ratings yet

- List of Lease Instruments With Isin No. - Ewyc-Wfc-2012Document12 pagesList of Lease Instruments With Isin No. - Ewyc-Wfc-2012Wajid100% (1)

- Valuation of BondsDocument30 pagesValuation of BondsRuchi SharmaNo ratings yet

- LI 01 Vetting ChecklistDocument1 pageLI 01 Vetting ChecklistAsyraf WajdiNo ratings yet

- CP11 September22 EXAMDocument5 pagesCP11 September22 EXAMElroy PereiraNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountArnav JoshiNo ratings yet

- Commercial Banking - Project Group 10 PDFDocument48 pagesCommercial Banking - Project Group 10 PDFSachin PowaniNo ratings yet

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiNo ratings yet

- m1 ExerciseDocument33 pagesm1 ExerciseWillowNo ratings yet

- SWOT Analysis For A BankDocument2 pagesSWOT Analysis For A BankAndrew Hoth KangNo ratings yet

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Ejercicio Nro 8 SolucionnnnnnDocument9 pagesEjercicio Nro 8 SolucionnnnnnSugar Leonardo Herrera CoaquiraNo ratings yet

- Explained: Hike in Telecom Prices: Introduction: Network Services Set To Get Expensive by About 40%Document3 pagesExplained: Hike in Telecom Prices: Introduction: Network Services Set To Get Expensive by About 40%saurabhNo ratings yet

- WACCDocument6 pagesWACCAbhishek P BenjaminNo ratings yet

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet

- Master Budgets and Performance Planning: QuestionsDocument67 pagesMaster Budgets and Performance Planning: QuestionsFrances Nicole MuldongNo ratings yet

- Ignou Fiscal Federalism 1Document16 pagesIgnou Fiscal Federalism 1luvlickNo ratings yet