Professional Documents

Culture Documents

State Universities and Colleges 2012 Budget Briefer

State Universities and Colleges 2012 Budget Briefer

Uploaded by

Kabataan Party-ListCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Layton Skyline Owners ManualDocument3 pagesLayton Skyline Owners ManualJeremy EllisNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Marx's Theory of Scientific Knowledge - Patrick MurrayDocument297 pagesMarx's Theory of Scientific Knowledge - Patrick Murraysergevictor100% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Municipal Ordinance No. 03 Market CodeDocument12 pagesMunicipal Ordinance No. 03 Market CodeBlithe CarthusianNo ratings yet

- Mactan Cebu International Airport Authority v. MarcosDocument2 pagesMactan Cebu International Airport Authority v. MarcosKabataan Party-List100% (5)

- HR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsDocument2 pagesHR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsKabataan Party-ListNo ratings yet

- Hexcrawl BasicsDocument26 pagesHexcrawl BasicsMrToad100% (9)

- 5 - Corporate Governance AmendedDocument24 pages5 - Corporate Governance AmendednurhoneyzNo ratings yet

- HR 2069 - Inquiry On Permit Granted To SM Development Corporation Allowing For The Cutting of TreesDocument2 pagesHR 2069 - Inquiry On Permit Granted To SM Development Corporation Allowing For The Cutting of TreesKabataan Party-ListNo ratings yet

- PS: State of Phil. EducationDocument4 pagesPS: State of Phil. EducationKabataan Party-ListNo ratings yet

- HR 1996 - Condemning Violent Dispersal of Occupy Mendiola ProtestersDocument2 pagesHR 1996 - Condemning Violent Dispersal of Occupy Mendiola ProtestersKabataan Party-ListNo ratings yet

- PS: EDSA Babies UniteDocument3 pagesPS: EDSA Babies UniteKabataan Party-ListNo ratings yet

- HR 1764 - Investigation On Study Now Pay Later Program of SWUDocument4 pagesHR 1764 - Investigation On Study Now Pay Later Program of SWUKabataan Party-ListNo ratings yet

- HB 4932 - Free Access To MuseumsDocument2 pagesHB 4932 - Free Access To MuseumsKabataan Party-ListNo ratings yet

- HR 1763 - Investigation On Scholarships For SK Officials and Children of Barangay OfficialsDocument2 pagesHR 1763 - Investigation On Scholarships For SK Officials and Children of Barangay OfficialsKabataan Party-List100% (1)

- HB 4791 - Anti No Permit No Exam BillDocument3 pagesHB 4791 - Anti No Permit No Exam BillKabataan Party-List100% (1)

- Del Rosario-Igtiben V RepublicDocument1 pageDel Rosario-Igtiben V RepublicGel TolentinoNo ratings yet

- Encyclopedia of Chinese PantheonDocument200 pagesEncyclopedia of Chinese PantheonKula100% (14)

- FEAPA Guidelines EnglischDocument4 pagesFEAPA Guidelines EnglischMarta MoreiraNo ratings yet

- Mvno - Encik KunciDocument15 pagesMvno - Encik KunciJolliffe NicholasNo ratings yet

- Links 8400peliculasDocument385 pagesLinks 8400peliculasjulio floresNo ratings yet

- Group 3 - Transportation Market FailureDocument5 pagesGroup 3 - Transportation Market Failurejadyn nicholasNo ratings yet

- Rcse9702 115 s1Document1 pageRcse9702 115 s1WayyuNo ratings yet

- Source Rock Identification by IsotopeDocument11 pagesSource Rock Identification by IsotopeNdeye Khady NdiayeNo ratings yet

- Verbal Communic-WPS OfficeDocument4 pagesVerbal Communic-WPS Officechandy RendajeNo ratings yet

- Project Management For ConstructionDocument468 pagesProject Management For ConstructionchileNo ratings yet

- Materials Management NotesDocument82 pagesMaterials Management NotesMohammed AneesNo ratings yet

- Sociology Module B1 2017Document3 pagesSociology Module B1 2017Aerielle CanoNo ratings yet

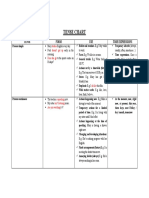

- TENSE CHART (Present Simple Vs Present Continuous)Document1 pageTENSE CHART (Present Simple Vs Present Continuous)Fmga GaNo ratings yet

- Chapter 4 Referenes Arranged AlphabeticalDocument5 pagesChapter 4 Referenes Arranged AlphabeticalJoselito GelarioNo ratings yet

- List Obat pbf-1Document195 pagesList Obat pbf-1widnyana ngurahNo ratings yet

- 3GPP LTE (Long Term Evolution) : University of Kansas - School of EngineeringDocument39 pages3GPP LTE (Long Term Evolution) : University of Kansas - School of Engineeringخالد ياسر مواسNo ratings yet

- Martinez Vs Van BuskirkDocument2 pagesMartinez Vs Van BuskirkMinato NamikazeNo ratings yet

- 3 Chapter 3 Part 1 Foundations.Document40 pages3 Chapter 3 Part 1 Foundations.Enanye AragawNo ratings yet

- RTK Service Installation GuideDocument23 pagesRTK Service Installation GuideMagdiel Omar Zavala GutierrezNo ratings yet

- Colour Magazine - London 1Document103 pagesColour Magazine - London 1iccang arsenal100% (1)

- Chanakya National Law University: Project of Law of History On "Property Rights of Women in Modern India "Document20 pagesChanakya National Law University: Project of Law of History On "Property Rights of Women in Modern India "Vibhuti SharmaNo ratings yet

- People Vs Que Po LayDocument3 pagesPeople Vs Que Po LayJet jet NuevaNo ratings yet

- UCD Otolayrngology GuideDocument95 pagesUCD Otolayrngology GuideJames EllisNo ratings yet

- 5.00 FD An1 s1 CE Chemistry 23-24Document4 pages5.00 FD An1 s1 CE Chemistry 23-24imsNo ratings yet

State Universities and Colleges 2012 Budget Briefer

State Universities and Colleges 2012 Budget Briefer

Uploaded by

Kabataan Party-ListOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Universities and Colleges 2012 Budget Briefer

State Universities and Colleges 2012 Budget Briefer

Uploaded by

Kabataan Party-ListCopyright:

Available Formats

STATE UNIVERSITIES AND COLLEGES 2012 POLICY AND BUDGET BRIEFER

THE POLICY OF INTENSIFYING COMMERCIALIZATION AND PRIVATIZATION

We are gradually reducing the subsidy to SUCs to push them toward becoming self-sufficient and financially independent, given their ability to raise their income and to utilize it for their programs and projects. (President Benigno Aquino III, Budget Message 2011) The Aquino administration's declarations regarding public higher education tell the grim prospect of our state universities and colleges. It is a path directed towards greater privatization and commercialization of higher education in the country, one which is not entirely different from the path that previous administrations have pursued the past decades, and one which has only lead to a worsening crisis in higher education in the Philippines. It is a path paved by a global neoliberal political economic trend that has been wreaking havoc on people's welfare around the world through the withdrawal of hard-won rights to social service benefits, through state budget cuts and austerity measures. In President Aquino's Philippine Development Plan 2011-2016 (PDP 2011-2016), the general framework of the government regarding public higher education, as with other social and economic services of the government, is privatization. This is done by allowing the private sector to gain more control of public services such as higher education. This economic policy purports to present the effective and efficient path towards economic progress, but is really nothing more than a mechanism to perpetuate the control of the ruling few over the worlds political and economic establishments. This dogma of privatization and deregulation makes a direct attack at higher education, pressuring governments to privatize state colleges and raise tuition fees with the aim of freeing governments from their responsibility of providing sufficient funding to state schools. Spending on higher education has been treated as more of a burden than a responsibility the government has to fulfil. As the Aquino administration reduces funding for state universities and colleges, it increasingly allows the private sector to control higher education and create profit from social services. As it is, more than 70 percent of all tertiary education institutions in the country is owned by private profiteers. "Harness private-sector resources in the delivery and monitoring of, social marketing and advocacy for education, especially higher education." (PDP 2011-2016) With the declining number of state universities and colleges that should ideally offer affordable quality education to the Filipino youth, young Filipinos and their families are left with no alternative but to surrender to the whims of the private sector where tuition and other fees are exorbitant and largely deregulated, or not enroll in college at all. This manifests in staggering figures admitted by the government's education agencieseighty percent (80%) of Filipino youth are not able to enter college or even technical-vocational schools. In many state universities, there is also a trend where student services are being privatized and sold to private businesses. For example, in universities such as the University of the Philippines Diliman, dilapidated dormitories are left to rot while new dormitories are being opened up by private corporations for profit. Other services such as food, transportation and maintenance services, are being contracted out to private companies that begin to charge higher rates for student services that used to be free or at least affordable to ordinary students. Increases in public funding, if any, are now being channeled through direct financial assistance programs, through scholarships, so that poor but deserving youth may enroll in college, most of them ending up in private schools. In essence, instead of fully subsidizing the education of state scholars, building infrastructure for schools and adequately funding researches and other demands of the state universities, government funds are instead channeled through scholarship dole-outs. "Pursue an integrated system of all publicly-funded forms of student financial assistance in postbasic education The bulk of public resources for post-basic education shall be channeled directly

to students through efficient and effective governance and clientele targeting of financing schemes (e.g. voucher system, expanded scholarships, student loans)." (PDP 2011-2016) This scheme is no different from what the government is doing with the people's health care. Instead of building more hospitals, the Aquino government is allowing public hospitals to decay without adequately meeting the needs of Filipinos. It resorts to dole-out schemes like funding health insurance cards like PhilHealth, which is grossly inadequate and in fact leads to higher expenses and hospital bills. UP's experience with the STFAP (Student Financial Assistance Program) is a reminder, not only of the inadequacies of scholarship dole-outs, but its reverse effect and its real role in state abandonment of higher education. The STFAP was implemented (in 1989) and restructured (in 2007) alongside the tuition increases that beset the national university in order to help smokescreen the increases by claiming that sufficient safety nets will be put in place to protect the interests of those who will be unable to pay the increased rates. Two decades into its implementation, however, the number of students who are granted full tuition subsidies have fallen by 90%. From 20% of students in 1991, only 1% of UP students are granted full tuition subsidies. Meanwhile, students applying for tuition loans, an indication that tuition rates in UP have become exorbitant to many, have surged to 2,300, its highest in two decades. The austerity being implemented by the government with regards to SUCs is in stark contrast to the hefty increases it is allotting to military spending, debt servicing, government dole-outs through the CCT (Conditional Cash Transfer) program, PPP (Private-Public-Partnerships) programs and other private sector-gain policies. For 2012, debt payments will amount to a staggering P 738.6 billion. Military spending will amount to 113.1 billion.

DECREASING STATE SUBSIDY

Despite nominal increases in state subsidies, its real value has constantly been declining, taking into consideration inflation and the increasing number of students enrolling in state universities due to the high cost of education in private schools. This disproves any spin by the government that it is prioritizing public tertiary education because in reality, whatever funding the government provides is worth less and less than before. Year Direct State Subsidy (General Appropriations Act, in thousand pesos) 15,712,283 15,712,283 17,371,355 19,638,337 22,829,078 22,402,271 22,035,085 21,888,523 Real Value of State Subsidy (Constant 2000 Prices, in thousand pesos) 12,104,995 11,393,969 12,250,603 12,669,895 14,268,174 13,487,219 12,678,415 12,066,440

2005 2006 2007 2008 2009 2010 2011 2012

SUCs' budgets slashed For the year 2012, the Aquino administration proposed to cut the subsidies of fifty-one (51) SUCs. Their combined decreases amount to as much as P573.96 million. The ten SUCs with the worst budget cuts are as follows:

State Universities and Colleges 1. University of the Philippines System 2. Mariano Marcos State University 3. Don Mariano Marcos Memorial State University 4. Technological University of the Philippines 5. Catanduanes State Colleges 6. Bicol University 7. Camarines Norte State College 8. Philippine Normal University 9. Mindanao University of Science & Technology 10. Nueva Ecija University of Science & Technology

Decrease in Budget 208,228,000 45,419,000 44,030,000 36,860,000 23,069,000 19,383,000 13,380,000 12,835,000 12,273,000 11,805,000

On the other hand, fifty-eight (58) SUCs will suffer cuts in personal services (PS), the budget for salary and benefits of employees, for a total cut of P403.32 million, and forty-five (45) SUCs will suffer cuts in maintenance and other operating expenses (MOOE) for a total reduction of P257.25 million. Still no capital outlay For a second year in a row, government is not allotting a single centavo for the capital outlay budget of all SUCs in the country. This means, SUCs have no state subsidy to construct much-needed infrastructure to meet the growing demands of their constituents. No new classrooms, no new equipment. Personal Services cut The large cut of P403.32 million in the Personal Services budget of fifty-eight (58) SUCs is due to the non-inclusion of funds for unfilled positions. For 2012, DBM removed the allocations for unfilled positions and placed them under the Miscellaneous Personnel Benefits Fund (MPBF). This puts in uncertainty the funds that used to be utilized by SUCs to pay the salaries of non-regular faculty and other contractual employees. The practice was SUCs were given full control of the funds, even for the salaries of employees yet to be hired, and the savings from which SUCs are able to augment such extraneous but necessary expenses in their operations, such as the payment for contractual services of non-regular faculty and staff. This huge cut is even worse than apparent because this year is the 3rd year that the Salary Standardization Law (SSL) is implemented, which means government employees' salaries are to be increased from the previous rates. Yet despite such legislated salary increases among employees of SUCs, the funds have been drastically cut. Grossly insufficient to the actual funding needs of SUCs According to data from the Philippine Association of State Universities and Colleges (PASUC), the combined proposals of all SUCs to the national government amounts to as much as P45.90 billion. The Aquino administration-approved budget proposed to Congress (P21.89 billion), is only less than half that amount. Some SUCs will even be receiving much less in proportion to their actual funding needs. In National Capital Region, for example, here are the figures:

State Universities and Colleges

SUC proposed DBM approved and budget (2012) proposed budget (in thousand pesos) (in thousand pesos) 17,471,623 1,993,519 754,991 654,845 451,562 5,543,743 734,783 284,956 360,483 165,216

Percent Approved

University of the Philippines System Polytechnic University of the Philippines Philippine Normal University Technological University of the Philippines Rizal Technological University

31.7% 36.9% 37.7% 55.0% 36.6%

SHIFTING THE BURDEN TO STUDENTS AND THEIR FAMILIES The lack of government subsidies means that SUC administrators are increasingly relying on internally-generated income in order to finance the operations of state universities. From almost 90% before 2000, the share of government subsidy in the total operating budgets of SUCs have dwindled to just 65.58% in 2012. This means, more than a third of the finances of state universities are now being shouldered through income generating mechanisms such as tuition and other fees. This is in line with the policy of the government to push state universities to generate their own income to pave the way for reduction in state subsidies. This is shifting of burden is evident in the increasing rate of tuition in state universities. Some SUCs that have increased their tuition during the last decade are Bicol University, which increased its tuition from P9 per unit to P175 per unit; Philippine Normal University, which raised its tuition from P10 per unit to P50 per unit; and the University of the Philippines which hiked its tuition rates by 300%, from P300 per unit up to P1,500 per unit. Aside from the increasing tuition rates, SUC students are also burdened by increasing miscellaneous and other fees. Most SUCs impose miscellaneous fees to shoulder the cost of laboratory expenses and other maintenance and other operations expenses which are otherwise subsidized by the government through the school's MOOE budget which has consistently been cut by the government. Year Internally Generated Share of Internally Income Generated Income (in thousand pesos) 2,176,365 12.26% 2,708,491 15.86% 2,934,108 15.60% 3,903,024 17.90% 3,990,748 19.31% 5,668,025 23.96% 6,624,920 26.00% 7,994,834 28.18% 9,649,692 29.77% 10,641,136 28.03% 11,124,481 32.65% 11,894,386 33.69% 12,395,425 34.42% Share of State Subsidy 87.74% 84.14% 84.40% 82.10% 80.69% 76.04% 74.00% 71.82% 70.23% 71.97% 67.35% 66.31% 65.58%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Layton Skyline Owners ManualDocument3 pagesLayton Skyline Owners ManualJeremy EllisNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Marx's Theory of Scientific Knowledge - Patrick MurrayDocument297 pagesMarx's Theory of Scientific Knowledge - Patrick Murraysergevictor100% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Municipal Ordinance No. 03 Market CodeDocument12 pagesMunicipal Ordinance No. 03 Market CodeBlithe CarthusianNo ratings yet

- Mactan Cebu International Airport Authority v. MarcosDocument2 pagesMactan Cebu International Airport Authority v. MarcosKabataan Party-List100% (5)

- HR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsDocument2 pagesHR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsKabataan Party-ListNo ratings yet

- Hexcrawl BasicsDocument26 pagesHexcrawl BasicsMrToad100% (9)

- 5 - Corporate Governance AmendedDocument24 pages5 - Corporate Governance AmendednurhoneyzNo ratings yet

- HR 2069 - Inquiry On Permit Granted To SM Development Corporation Allowing For The Cutting of TreesDocument2 pagesHR 2069 - Inquiry On Permit Granted To SM Development Corporation Allowing For The Cutting of TreesKabataan Party-ListNo ratings yet

- PS: State of Phil. EducationDocument4 pagesPS: State of Phil. EducationKabataan Party-ListNo ratings yet

- HR 1996 - Condemning Violent Dispersal of Occupy Mendiola ProtestersDocument2 pagesHR 1996 - Condemning Violent Dispersal of Occupy Mendiola ProtestersKabataan Party-ListNo ratings yet

- PS: EDSA Babies UniteDocument3 pagesPS: EDSA Babies UniteKabataan Party-ListNo ratings yet

- HR 1764 - Investigation On Study Now Pay Later Program of SWUDocument4 pagesHR 1764 - Investigation On Study Now Pay Later Program of SWUKabataan Party-ListNo ratings yet

- HB 4932 - Free Access To MuseumsDocument2 pagesHB 4932 - Free Access To MuseumsKabataan Party-ListNo ratings yet

- HR 1763 - Investigation On Scholarships For SK Officials and Children of Barangay OfficialsDocument2 pagesHR 1763 - Investigation On Scholarships For SK Officials and Children of Barangay OfficialsKabataan Party-List100% (1)

- HB 4791 - Anti No Permit No Exam BillDocument3 pagesHB 4791 - Anti No Permit No Exam BillKabataan Party-List100% (1)

- Del Rosario-Igtiben V RepublicDocument1 pageDel Rosario-Igtiben V RepublicGel TolentinoNo ratings yet

- Encyclopedia of Chinese PantheonDocument200 pagesEncyclopedia of Chinese PantheonKula100% (14)

- FEAPA Guidelines EnglischDocument4 pagesFEAPA Guidelines EnglischMarta MoreiraNo ratings yet

- Mvno - Encik KunciDocument15 pagesMvno - Encik KunciJolliffe NicholasNo ratings yet

- Links 8400peliculasDocument385 pagesLinks 8400peliculasjulio floresNo ratings yet

- Group 3 - Transportation Market FailureDocument5 pagesGroup 3 - Transportation Market Failurejadyn nicholasNo ratings yet

- Rcse9702 115 s1Document1 pageRcse9702 115 s1WayyuNo ratings yet

- Source Rock Identification by IsotopeDocument11 pagesSource Rock Identification by IsotopeNdeye Khady NdiayeNo ratings yet

- Verbal Communic-WPS OfficeDocument4 pagesVerbal Communic-WPS Officechandy RendajeNo ratings yet

- Project Management For ConstructionDocument468 pagesProject Management For ConstructionchileNo ratings yet

- Materials Management NotesDocument82 pagesMaterials Management NotesMohammed AneesNo ratings yet

- Sociology Module B1 2017Document3 pagesSociology Module B1 2017Aerielle CanoNo ratings yet

- TENSE CHART (Present Simple Vs Present Continuous)Document1 pageTENSE CHART (Present Simple Vs Present Continuous)Fmga GaNo ratings yet

- Chapter 4 Referenes Arranged AlphabeticalDocument5 pagesChapter 4 Referenes Arranged AlphabeticalJoselito GelarioNo ratings yet

- List Obat pbf-1Document195 pagesList Obat pbf-1widnyana ngurahNo ratings yet

- 3GPP LTE (Long Term Evolution) : University of Kansas - School of EngineeringDocument39 pages3GPP LTE (Long Term Evolution) : University of Kansas - School of Engineeringخالد ياسر مواسNo ratings yet

- Martinez Vs Van BuskirkDocument2 pagesMartinez Vs Van BuskirkMinato NamikazeNo ratings yet

- 3 Chapter 3 Part 1 Foundations.Document40 pages3 Chapter 3 Part 1 Foundations.Enanye AragawNo ratings yet

- RTK Service Installation GuideDocument23 pagesRTK Service Installation GuideMagdiel Omar Zavala GutierrezNo ratings yet

- Colour Magazine - London 1Document103 pagesColour Magazine - London 1iccang arsenal100% (1)

- Chanakya National Law University: Project of Law of History On "Property Rights of Women in Modern India "Document20 pagesChanakya National Law University: Project of Law of History On "Property Rights of Women in Modern India "Vibhuti SharmaNo ratings yet

- People Vs Que Po LayDocument3 pagesPeople Vs Que Po LayJet jet NuevaNo ratings yet

- UCD Otolayrngology GuideDocument95 pagesUCD Otolayrngology GuideJames EllisNo ratings yet

- 5.00 FD An1 s1 CE Chemistry 23-24Document4 pages5.00 FD An1 s1 CE Chemistry 23-24imsNo ratings yet