Professional Documents

Culture Documents

Management Accounting (Mac)

Management Accounting (Mac)

Uploaded by

RHITIK AYESHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management Accounting (Mac)

Management Accounting (Mac)

Uploaded by

RHITIK AYESHCopyright:

Available Formats

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Acknowledgement

I'd want to show my gratitude to Mr. Krishen, my lecturer, for providing me with the

wonderful opportunity to write this report, which allowed me to conduct considerable

study and learn a great deal. Second, I'd want to express my gratitude to my parents

to finish my project accurately.

NILAKSHAN RAJASEKARAN / KBM322111 1|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Table of Contents

Acknowledgement..............................................................................................................................1

TABLE OF TABLE..............................................................................................................................3

FIGURES OF TABLE.........................................................................................................................3

LO 1 and LO 2.....................................................................................................................................4

01) Introduction to management accounting..............................................................................4

Task 01.................................................................................................................................................4

01) The principles and responsibilities of the management accounting function..................4

A) Planning................................................................................................................................4

B) Decision making..................................................................................................................4

C) Budgeting.............................................................................................................................5

D) Variance analysis................................................................................................................5

E) Costing.................................................................................................................................6

Task 02.................................................................................................................................................7

1) How cost can be classified within an organization?...........................................................7

Variable costs..................................................................................................................................7

Fixed costs-:....................................................................................................................................8

Semi-variable costs-:......................................................................................................................9

2) How cost behave in the short run and long run?................................................................9

a) Cost behavior –Short Run......................................................................................................9

b) Cost behavior-Long Run...........................................................................................................9

Task 03...............................................................................................................................................11

1) Explain how management accounting adds value to other functions within the

organization...................................................................................................................................11

Conclusion.........................................................................................................................................16

LO3.....................................................................................................................................................17

Task 01...........................................................................................................................................17

1) Conflicts..................................................................................................................................17

2) Causes of conflicts................................................................................................................17

3) Conflicts faced by organization...........................................................................................18

4) Conflict management strategies to adopted by organization..........................................19

5) Managing stakeholders conflicts.........................................................................................21

NILAKSHAN RAJASEKARAN / KBM322111 2|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

LO4.....................................................................................................................................................22

Task 02...........................................................................................................................................22

A) Benchmarking....................................................................................................................22

Key performance Indicator (KPI)................................................................................................24

B) The balanced scorecard...................................................................................................25

1. Financial perspectives..........................................................................................................25

2. Customer................................................................................................................................26

3. Internal business...................................................................................................................26

4. Learning and growth.............................................................................................................26

Conclusion.........................................................................................................................................28

.........................................................................................................................................................28

References........................................................................................................................................30

TABLE OF TABLE

Table 1- Budgeting.............................................................................................................................5

Table 2- Variance analysis................................................................................................................6

Table 3- Costing..................................................................................................................................6

Table 4- Operations/manufacturing................................................................................................13

FIGURES OF TABLE

Figure 1- Variable costs.....................................................................................................................7

Figure 2- Fixed costs..........................................................................................................................8

Figure 3- Cost behavior –Short Run................................................................................................9

Figure 4- Cost behavior- Long Run................................................................................................10

Figure 5 - Mendelow's Matrix..............................................................................................................21

Figure 6 - Diagram of benchmarking concept...............................................................................22

Figure 7 - The balanced scorecard.......................................................................................................25

NILAKSHAN RAJASEKARAN / KBM322111 3|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

LO 1 and LO 2

01)Introduction to management accounting

The process of finding, collecting, analyzing, understanding, and communicating

financial data to managers in order to fulfill a company's goals is known as

management accounting. Management accounting differ beyond financial accounting

in that its purpose is to assist organizational users in making well-informed business

choices. (TUOVILA, 2021)

How Does It Work?

A big part of management accounting is cost accounting. It evaluates the variable

and fixed costs of each manufacturing phase in order to determine the company's

total production costs. The cost and sales profits of the company's goods and

services are used by the management accountant.

Task 01

01)The principles and responsibilities of the management

accounting function.

A) Planning - Planning include developing short- and long-term strategies and

actions to reach a specific goal. A budget is a financial plan that shows how

resources will be acquired and spent over a set period of time.

Management accounting supports managers in planning by giving data that

measure the impact of various operations on a company's capacity to achieve its

goals. For example, if a company sets a profit goal for the year, it must also figure

out how to get there.

Ex-: Daryn's Dairy is a significant producer of organic dairy products in the

Midwest, and one of its strategic goals is to increase market share. Daryn's

planning process entails the steps the company wants to follow in order to

increase market share. These plans include current-year plans, five-year plans,

and ten-year plans, among others. (Anon., n.d.)

B) Decision making -In management accounting, decision-making can be

simply defined as choosing a method of action from a collection of options. If

there are no alternative options, there is no need to make a decision.

NILAKSHAN RAJASEKARAN / KBM322111 4|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Management accounting provides information about an entity's internal flows,

resulting in a total analysis that, in addition to financial accounting, which gives

data about external flows, is a valuable tool in the decision-making process.

(Anon., n.d.)

Ex-: Choosing production facilities is one of the most common examples of

managerial decision-making. If your company grows and demand increases,

you'll need to increase productivity. The next stage would be to determine how

much power is required to appropriately meet demand.

C) Budgeting - Budgeting is used in companies for a variety of purposes, with

planning (decision making) and control being the most important. Budgets can be

used to project profitability, distribute resources, and share professional

experience about one element of an organization with other parts of the company

for planning purposes. (Butz, 2010)

Budgeting is the primary function of management accounting. Budgets serve as a

roadmap for all spending in a small business As a result, a management

accountant must evaluate previous data in order to provide an accurate forecast

of a year's spending.

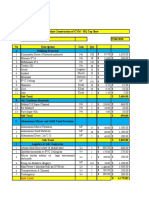

Ex-: We budgeted Rs. 120 million in income and Rs. 50 million in expenses for

the month of December, resulting in a Rs. 70 million surplus. However, if our

budget is set for Rs. 120 million in income and Rs. 150 million in expenses, we

can have a Rs. 30 million deficit, indicating that budgeting can support in

determining our expected monthly surplus and deficit.

INCOME EXPENSES SURPLUS

Rs.120 million Rs.70 million Rs.50 million(+)

Rs.120 million Rs.150 million Rs.30 million (-)

D) Variance analysis -In budgeting and management accounting, variance

analysis is the study of differences between actual and projected or planned

Table 1- Budgeting behavior. This is primarily concerned with how the

differences between actual and planned behaviors reflects

how business performance is affected. (Anon., 2021)

The goal of variance analysis is to break down the difference between the two

quantities into achievable steps. Expenses and cost allowances for various levels

NILAKSHAN RAJASEKARAN / KBM322111 5|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

of activity the separation of variations into meaningful areas is directly influenced

by responsibility accounting. (Butz, 2010)

Ex-: If your sales budget is $10,000 and your expense is $8,000, but your actual

sales are $8,000 (variance analysis reveals a $2,000 variance) and your expense is

$7000, you can determine that your revenue has been negative while your expense

has been positive.

BUDGET ACTUAL VARIANCE

INCOME $10,000 $8,000 $2,000(A)

EXPENSE $8,000 $7000 $1000(F)

E) Costing -Costs is the branch of accounting that deals with costing. Cost data

analysis and communication to the organization at all levels of management;

accounting for current, standard, and future expenses. It refers to the method and

procedure for calculating costs. Standard costing,

Table 2- Variance analysis budget management, inventory management, marginal

costing, and other instruments are provided by the cost accounting system to

ensure that these functions are carried out efficiently. (Anon., n.d.)

Ex-: Monthly expenses of January

Rent Rs.1500

Phone bill Rs.100

Internet bill Rs.340

Groceries Rs.1500

Total Cost Rs.3440

Table 3- Costing

NILAKSHAN RAJASEKARAN / KBM322111 6|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Task 02

1) How cost can be classified within an organization?

Costs can be categorized based on how they behave, which helps with costing

system. Classification based on availability is crucial for accurate costing of jobs and

units generated. Classification is important for decision-making because it helps

managers identify expenses that are related to a particular option. ( Obaidullah Jan,

ACA, CFA , 2019)

The main classification of costs are Fixed costs, variable costs, or mixed costs

Variable costs

A variable cost is a commercial expense that varies depending on the amount of

product or service that the company produces or sells. Variable costs grow or fall in

line with a company's production or sales volume they rise as output rises and fall as

output decreases. (KENTON, 2021)

Variable costs differ with output in the short term. Employee salary and raw material

expenses are examples of variable costs. Short-term costs rise or fall in response to

variable costs as well as production rate.

Ex-: Wages

Commissions

Packaging

Figure 1- Variable costs

NILAKSHAN RAJASEKARAN / KBM322111 7|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

In graph 1 as the activity level grows, the total variable cost increases in a

continuous straight line from zero. As output levels rise, this variable continues to

raise costs and in graph 2 the variable cost of each output level is the same on a

line parallel to the horizontal axis of activity, even if the output level increases, the

variable cost per unit does not change.

Fixed costs-: A fixed cost is one that remains continuous regardless of the

quantity of products or services produced or sold.

Fixed costs, such as buildings and machinery, cannot be modified in the short term.

Fixed inputs do not move in the short term, and fixed costs are expenses that

remain constant whatever of production levels. Increasing or reducing the variable

inputs is the main way to increase or reduce output in the long term, there are no

fixed costs since the long run is long enough for all short-run fixed inputs to become

variable. (Anon., n.d.)

Ex-: Mortgage,

Salary

Insurance

Property taxes

Figure 2- Fixed costs

In graph 1, Depending on whether output changes over time, overall fixed costs stay

unchanged. Where the line is perpendicular to the axis of level of activity. The total

fixed cost does not begin at zero so if operations stops, the fixed cost will not return

to zero. Depending on whether output picks up or not, the fixed must be provided

and in graph 2 the fixed cost per unit lowers as the outflow level rises. The fixed cost

NILAKSHAN RAJASEKARAN / KBM322111 8|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

is calculated by the output level to achieve the fixed cost per unit as the output level

rises. When a result, as the output volume grows, the fixed cost per unit falls.

Semi-variable costs-: The term “Semi-variable costs " refers to a cost that

includes both fixed and variable elements. Costs remain constant until a specific

amount of output or consumption is reached, at which point they become variable.

Semi cost remain constant over short periods of time but change over time in long

term.

Ex-: Repairs, Charges for telephone service on a monthly, Fuel, indirect labor

2) How cost behave in the short run and long run?

a) Cost behavior –Short Run

The Short-run Cost is a cost in the manufacturing process that has a short-term impact, it is

used over a limited speed variety. These are costs that are incurred only once and cannot be

reused, such as wages, raw material costs. The fixed cost (which does not fluctuate with

the level of output) and variable cost (which does change with the level of output) are

both included in the short-run cost (that varies with the variations in the level of output).

(Anon., n.d.), (businessjargons, 2019)

Figure 3- Cost behavior –Short Run

As can be seen from the U-shaped curve, the main regions are growing returns to

scale, in which costs reduce as output increases and fixed costs are dispersed over

a larger quantity of output. As a result, the Maximum efficiency point has been

reached, and the returns to scale are decreasing. The cost rises as the output rises.

b) Cost behavior-Long Run

The long run is a period of time during which all production processes and costs are subject

to change. Companies could vary all costs over time, but they can only affect pricing inside

NILAKSHAN RAJASEKARAN / KBM322111 9|Page

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

the short term by modifying output levels. Furthermore, while a company may be a monopoly

in the short run, it may face competition in the long run. (GRANT, 2021)

Figure 4- Cost behavior- Long Run

Economic of sales -: The percentage change in cost is divided by the

percentage change in output to get at this figure. A cost elasticity value of the less

than one suggests the presence of economies of scale. When an increase in output

is projected to result in a drop in unit cost while keeping input costs constant,

economies of scale exist.

Constant Returns to scale-: When an increase in input produces a

corresponding increase in output, this is called a constant returns to scale. When the

output grows at a faster rate than the input, this is called increasing returns to scale.

Diseconomic of sales -: When a corporation or business expands to the point

where its costs per unit rise. Using this theory, instead of continuing to reduce

expenses while increasing output, a company will observe an increase in costs as

output rises.

NILAKSHAN RAJASEKARAN / KBM322111 10 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Task 03

1) Explain how management accounting adds value to other

functions within the organization

a) Human resource management

HR managers are in charge of developing and monitoring departmental budgets.

They are better prepared to think about budget issues like training, recruitment,

personnel, incentives, and performance appraisal in regards of the cost and

economic benefit to the organization because they have an accounting

background. (Anon., n.d.)

They'll help the guys in deciding on or developing a financial plan or budget for

their monthly income and expenses... As a result, when you look at the income in

the Hr. department, you'll notice that they don't make much money because they

don't sell anything and their expenses are very expensive. The department is in

charge of salary, bonus, and overtime payments, among other things. As a result,

when you look at the income in the hr. department, you'll notice that they don't

make much money because they don't sell anything and their expenses are very

expensive. The department is in charge of salary, bonus, and overtime payments,

among other things.

They're also concerned in headcount planning, and management accounting

improves human resources professionals in forecasting what types of employers

and how many employees will be needed in the future. Headcount planning is a

systematic process that ensures that an organization's partners and

organizational structure can satisfy short- and long-term objectives while staying

within a certain budget. Headcount planning helps CEOs manage succession

plans, and it incorporates a business's awareness of its present organization

development, labor expenses, performance, and human resource management.

"Cost benefit analysis" is one of the most necessary elements of management

accounting. This method was used to calculate the advantages of making a

choice or taking action with the expenses of doing so. If the company decides to

pay a bonus at the end of the year, the HR department will say sure, let us pay

the bonus, since every time you offer a cash reward, the employees' excitement

will improve. Although, in their thoughts, HR guys will talk about bonuses, and

they want to accurately determine how paying bonuses will affect our bank's profit

and loss and cash flow balance. Companies can calculate the benefits of a

decision using cost benefit analysis. It includes actual financial data such as

money generated and costs avoided as an outcome of pursuing a plan.

NILAKSHAN RAJASEKARAN / KBM322111 11 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

b) Marketing

In company as an accountant, pricing is the element of the marketing mix you will

most frequently come into contact with. Rather than keeping your relationship with

price at a purely practical level, though, it can be beneficial to grasp the thinking

behind it. The considered worth of a product is determined by its price. Some

companies believe that the price of their product is the most important factor, and

they are willing to lower it to compete with competitors and win market share. Part of

your job as an accountant may be to search for methods to minimize costs by

improving processes, allowing for competitive pricing drops. (Barlow, 2015)

Marketing budgeting -: A small business's marketing department is in charge of

developing the company's advertising and promotion tactics. The marketing

department's budget is generally monitored by accounting, which issues regular

financial reports that show whether budgeting plans are on track or even have

incurred huge costs. These actions support the marketing department in staying

within budget. Marketing and accounting work to identify an acceptable budget for

promotional measures and to calculate the expected return on investment.

(McQuerrey, n.d.)

ROMI (Return on Marketing Investment)

Return on Marketing Investment (ROMI) is a method to calculate the financial value

associated to a certain set of marketing activities (net of marketing spending),

divided by the marketing ‘invested' or risked for those actions. It is usually applied in

many companies because it: adds a level of management to future cash flows;

improves marketing performance; and gives a specific method to marketing

management that helps finance departments gain confidence and understanding.

(Alan S Dunk, 2003)

ROMI = ((marketing income – cost of goods – marketing expenses) / marketing

expenses) * 100. If the ROMI is less than 100%, marketing investments were

wasteful; if it is greater than 100%, marketing investments were profitable. (Velikiy,

2018)

c) Operations/manufacturing

Manufacturing cost accounting includes everything that has to do with production

and inventory valuation. These operations can greatly increase a company's

earnings while also bringing it into line with accounting requirements. Manufacturing

accounting is the primary responsibility of the cost accountant. All parts of

manufacturing cost accounting are listed here. Requirement analysis is the most

significant because proper management of a company's limit is the most crucial

source of profit. Inventory valuation and cost of goods sold are two of the most

important aspects of manufacturing accounting. (Anon., 2021)

NILAKSHAN RAJASEKARAN / KBM322111 12 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Ex-: Product-: Cup of coffee

Manufacturing Cost Standard quantity * Standard costing = Cost

information summary

Per unit

Direct material

Material(Coffee ground) 0.5 ounces $.50 per ounce $.0.25

Direct labor

Barista 1 minute $.0.20 per unit $.0.20

Manufacturing

overhead

(Variable overhead) 1 minute $.0.05 per direct labor minute $. 0.05

(Fixed overhead) 1 minute $.0.10 per direct labor minute $.0.10

Standard cost per cup of coffee

$ .0 .60/¿

Table 4- Operations/manufacturing

Management accountants are huge amount of people of a company's financial

team. TQM is responsible for controlling the company's past, present, and future

costs using structured accounting system, standard costing, and general

accounting.Kaizen is a method of continuous improvement that focuses on tiny,

systematic changes to the system. It generally involves a significant section of an

organization's workforce. Kaizen is most typically used in manufacturing

processes, however it may be used elsewhere in a company. The goal of these

improvements is to increase the quality and efficiency of a company by focusing

on principles like job standardization, waste elimination, and just-in-time activities.

(Anon., 2021)

Because management accountants are involved in decision-making, they

understand how to put plans in place. Implementing kaizen and TQM, for

example, is a long-term plan, and management accountants would understand

how to put long-term plans in place within the business.

Negotiating with suppliers

When management accountants engaged negotiating with suppliers, they had to

be concerned about the quality of the goods they were receiving as well as the

price they were receiving from their suppliers. They would know what kind of

quality raw material they require, such as A, B, or C grade raw material, for

NILAKSHAN RAJASEKARAN / KBM322111 13 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

example. They do not, however, have a clear understanding of how to conduct

raw material pricing negotiations. If the raw material is of high quality, the price

will be high, and we can't afford to pay too much even if the raw material is of

high quality, so we must figure out how much we should pay, and then negotiate

with the supplier. Since managing accountants are familiar with finance, they will

take the initiative on pricing. Because management accountants understand the

quality of a raw material and the importance of cost, they will carry out their duties

for suppliers.

d) IT

When it comes to financial transactions that include the sharing of information,

information technology plays an essential role in business and in all operations.

Information technology has transformed the way we behave in the world in

unanticipated ways, such as allowing us to deliver products to our front door

while we are at home. Accounting management has a beneficial and simple

impact on technology since it allows for the payment of shares to be done at the

consumer's fingertips and is digitized, which improves accounting.

The IT budget can and will be used as a budgeting tool to help the entire

business prepare for future technology demands and convey the priorities that

those needs will support to internal and external stakeholders. Management

accounting provides good IT budget process which sets budget guidelines for IT

investments. A bad IT budgeting process, on the other hand, can lead to

governments investing in technology that add layers of complexity or a poor

infrastructure in technology that is crucial to operations. (Anon., 2013)

Negotiation with suppliers - When you buy a system, you must perform

maintenance on it on a monthly basis. When trying to fix a bug, you must also

maintain IT service providers, so when choosing an IT maintenance service

provider, we must first determine how much we will spend on a monthly basis,

and as such all of these calculations with respect to monthly IT spend and

ensuring that we purchase systems that introduce value to organizations is the

primary responsibility of accounting.

e) R&D

Setting R&D Budgets - Management accountant’s looks at how much such

engagement is linked to two things: first, a focus on financial concerns when

setting R&D budgets, and second, the importance of budget targets for R&D

managers. However, research has been done on the influence of management

involvement on R&D budgeting. Third, the research looks at how that

involvement affects R&D performance evaluation. The study's findings show that

these three criteria have an impact on R&D budgeting. (Alan S Dunk, 2003)

So, while calculating research costs and capitalizing development expenses,

you're spending money without knowing the outcome, which means that if you

NILAKSHAN RAJASEKARAN / KBM322111 14 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

want to launch a new product, you'll need to first create a prototype, which will

then need to be tested to determine if it works.

Consider the following scenario: we have spent 5 cores on the prototype to

create this product, but if we test the prototype and it does not work, we will pay

research and development costs on the P/L statement as an expense. However, if

we spend 5 cores on the prototype and it works perfectly, the money we spent will

be recorded as an asset on the balance sheet. Management accountants will be

on hand to decide if the expense is an asset or an expense.

NILAKSHAN RAJASEKARAN / KBM322111 15 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Conclusion

In the above mentioned report, I have the management accounting function's

principles and responsibilities as the first task.

The second task clearly shows how costs can be categorized and represented in a

graph, as well as cost behavior in the short and long term.

Explain how management accounting helps other functions inside the organization in

the third task.

NILAKSHAN RAJASEKARAN / KBM322111 16 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

LO3

Task 01

To - Chief Executive Officer

From - Assistant Accountant

Subject- Conflict Resolution and management Tools

1) Conflicts

A conflict of interest arises when private or self-serving interests meet with

business responsibilities and duties, making a business or individual untrustworthy.

In business, a clash of interest occurs when a person favors personal benefit over

responsibilities to the company or a stakeholder group, or if they use their status for

personal benefit in certain manner. (SEGAL, 2020)

Disagreement among two or more parties, including such individuals, groups,

organizations, countries, or department, is referred to as a conflict. People may have

conflict within themselves. In politics, conflict may relate to uprisings or other

conflicts, as well as wars involving the use of military force. Conflicts in various

situations that are not properly resolved can cause stress and tension among various

stakeholders. When two people are engaged in an emotional disagreement, the

impact is significantly greater. (Anon., 2015)

Personal, race, social, caste, political, and international factors can all contribute

to conflict. Conflict in groups keeps taking a set pattern. An early conflict, usually

generated by differing views, disagreements among members, or a shortage of

resources, affects routine group engagement.

2) Causes of conflicts

Conflicts can arise due to a variety of factors, including disagreement, missing

information, history, differing abilities, and discussion. Several works are performed

inside an organization for clear motives of differing ideas, resulting in confrontations.

Misunderstanding -: Misunderstandings are the biggest common cause of conflict.

Misunderstanding may happen whenever particular news is presented, yet lack for

ability to understand and act on as directed is a source of disagreement. This can

happen among individuals, including across an organization department, either

among any two parties. As a result, each of them charges the other of being

misinformed.

Miscommunication - When anything bad happens at work, it's all too simple for

people to blame each other. People are sometimes ignorant of their responsibilities

NILAKSHAN RAJASEKARAN / KBM322111 17 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

on a task. Maybe there is a lack of trust in place related to bad management. In any

case, a lack of responsibility might lead to miscommunications.

Ex -: He may believe he is charming a female employee by telling her how lovely

she dresses, but she may misunderstand his statements as sexual misconduct.

When employees make jokes about a coworker's ethnicity, these may occur.

(Munroe, 2018)

Different power levels -: Individuals had various views of the authority, and they

think others should respect and know whatever they think is correct and what they

really want to achieve. When managers would conduct anything stupid, and

individuals under their level of management or supervision will doing the similar, they

are more likely to set rules and use authority, resulting in disagreements between

two levels of discussion on what they think is correct.

Personality clashes -: A personality clash in the organization occurs when

employees are at conflict with just one another because of mismatched personalities,

perspective in life, conflicting professional methods, or simply a different perspective

on life. A personality clash happens when 2 or more people come into conflict

beyond a basic disagreement in their personalities, ways to issues, or way of life,

rather than on a specific problem or event. Because personality clashes are

generally difficult for organizations to deal with, there isn't always a clear problem

that creates the disagreement. (Briggs, 2021)

As a result, the clashing characteristics of an introvert and an extroverted person

may contribute to frustration or harassment, with most being ignored and separated.

Extrovert is defined as a personality feature in which one seeks fulfillment largely

from sources other than oneself. Extraverts are passionate, energetic, aggressive,

and social people who like human contact.

An introvert is a person who displays features of the introverted personality type,

which indicates they concentrate on their inner emotions and views or what is going

on around them.

3) Conflicts faced by organization

Interdepartmental -: When departmental managers participate in empire

building, there is an interdepartmental conflict. When supervisors attempt to

constantly motivate their staff by informing team members or the organization's

owners that their department is much more essential than many others, it can occur.

(White, n.d.)

As a result, they establish an environment where employees accept and dismiss the

work of teammates in other departments. This causes disagreement as a result of a

lack of regard for other people's work. Managers must prevent bringing other

NILAKSHAN RAJASEKARAN / KBM322111 18 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

departments behind and educate staff about their value in the larger business to

minimize this sort of conflicts.

Ex-: When the marketing department is usually concerned in advertising and

investing a big sum of cash, and finance is tasked with recognizing the company's

budgets and costs, a conflict might arise.

Intradepartmental -: When conflict occurs in the organization, it might be intra-

group conflict, which occurs among individuals of the same department or team, or

inter-group conflict, which occurs among members of two separate departments and

units. These disagreements can emerge as a result of a lack of teamwork, and then

they go unseen because they are hidden behind personal issues, reducing

performance because a team worker is at the basis of company. (Anon., n.d.)

Ex-: A personal matter involving how talented or educated every person are, what

people feel, and also what people feel they must be rewarded for performing a good

performance.

Stakeholders -: Stakeholder conflict occurs when the goals of multiple

stakeholders are conflicting. It is an "issue" for the company since it may have an

impact on its productivity and profitability. Companies must properly handle

stakeholders’ concerns in order to avoid conflict. Not because all stakeholders are

important to the company's success.

Ex-: Owners, in general, want to make a lot of money, therefore they may be afraid

to pay their employees a lot of money. A company decision to transfer production to

another country may result in lower labor expenses.

4) Conflict management strategies to adopted by organization

Interdepartmental conflicts management

a. Interdepartmental training

Conflict resolution focuses greatly on training. Training improves productivity and

success by raising understanding, developing knowledge of departmental tasks and

duties, and promoting the importance of each department to the organization. These

must been no conflict as a result of the training. Training improves morale, improves

departmental involvement, and helps organizations fulfill a main task.

b. Setting super ordinate goals

Superordinate goals are a technique of gathering together different groups of people

and setting a collective aim that moves everyone to set their differences elsewhere

and work against a common purpose that helps everybody. They're goals which

could really be reached if the various parties work together to attain a common goal

NILAKSHAN RAJASEKARAN / KBM322111 19 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

while remaining open to each other's views. This encourages people to put behind

their differences and work together to achieve a common objective.

c. Having office parties and trips

In a reason, parties and travels enable people to meet and engage in a variety of

surroundings, as well as make their own minds up to discuss about and appreciate

their characteristics. These support workers from various departments in achieving

how many are just like them, and in developing new relationships between

departments when people come together, resulted in less disagreements.

d. Member rotation

Employees should been provided a duration of rotations and execute that work in

several of situations, that would help them to build special abilities and meet people.

It could even form strong bonds among those that seem to just be hard to manage

with, which workplace skills gain a new viewpoint, plan for changing, communicate

with various people, plus handle problems more quickly.

Intradepartmental conflicts management

a. Negotiation and agreement

Negotiation supports in the development of greater thinking and relationships, the

development of short solutions instead of temporary ones, and the reduction of

future conflicts and difficulties. (Queensland Government, 2020)

The agreement confirms the fact that such members had decided to avoid more

misunderstandings, allowing them to operate in a good and relaxing manner

because they realize it's all safe and within management.

b. office trips and parties

Getting apart from workplace allows teammates learning more one someone else’s

characteristics as well as explain any mistakes, and their common experience of

satisfaction could let them engage in innovative ways. Employee interaction can help

to resolve intra departmental conflicts.

c. Third party consultation

Third-party discussion is a way for studying and resolving social conflict in organized

teams. A summary of studies concerning social identity conflict resolution in

organization, community, and international situations is preceded by a summary of

the method's main components.

NILAKSHAN RAJASEKARAN / KBM322111 20 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

5) Managing stakeholders conflicts

Mendelow's Matrix

Mendelow's Matrix is a method for analyzing stakeholders and their perspectives. It

would come into play aspects such as a stakeholder's level of engagement in a

project's or organization's chosen strategy, as well as when they are going to use

these their authority to affect this.

Figure 5 - Mendelow's Matrix

– Strategies

■ Key player - These stakeholders get a great deal of strength and a lot of special

interests. Top leadership, directors, key investors, or partnerships may fall into

this category. They will want that communication and participation in decision-

making be given top importance.

■ Keep Satisfied - People with a lot of authority, yet who aren't particularly

interested (Keep Satisfied): Do enough effort with all such people to maintain

them happy, but not so many that the idea becomes boring to them.

■ Keep informed - Low-power, high-interest individuals (Keep Informed):

sufficiently educate and converse with these individuals to ensure that no serious

concerns arise.

■ Minimal effort - Stakeholders in this group are uninterested in the organization

and lack power. Suppliers through which the organization is doing a limited

amount of business are an instance of this. These stakeholders' choices get a

minimal effect. (Manuel, 2019)

NILAKSHAN RAJASEKARAN / KBM322111 21 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

LO4

Task 02

A) Benchmarking

Benchmarking is a procedure of considering an organization 's existing operations

before locating, appreciating, and applying best business techniques with others

organizations.

Benchmarking is a systematic method for comparing an organization’s achievement

with its greatest within its business. So prevent "reinventing the wheel," study that

other perform well and then follow it.

Diagram of benchmarking concept

Figure 6 - Diagram of benchmarking concept

Reasons to benchmarking

Set clear business objectives - Benchmarking on some kind of basis will help you

define better business objectives for your company. Knowing why the business is

performing will provide you with key information that will help you to set focuses on

the tasks by performing better, plan new ways to make an impact, and improve your

life against each target over time.

Create new opportunities for learning - Benchmarking is also significant in

business because it allows you to find new chances for higher continued success.

This is also key if your company is stopped or not growing as you would like.

Benchmarking helps you to find areas where your business may grow in order to

NILAKSHAN RAJASEKARAN / KBM322111 22 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

keep up with the development and achievement of other similar businesses. You

should create a plan to improve productivity and taking use of new chances by

understanding how other businesses will do to become profitable. (Indeed Editorial

Team, 2021)

Boost your company's sales performance - Good sales boost a company's

successfulness, but just not knowing the correct information to understanding your

sales growth might be an obstacle for your company. Benchmarking allows you to

check your sales data and match them to those of the top profitable companies in

your area of business.

Improve your understanding of the competition - Benchmarking is useful in

business because it helps you to gain a greater understanding of your competitors

overall. Knowing how your competitors operate and what factors contribute to their

general performance helps in growing your ongoing operations while also improving

overall power and quality.

Steps of the benchmarking process

Decide what to benchmark - Decide if you'll benchmark procedures inside your

own company, against a competitor, or against a company from a different

industry.

When benchmarking a direct competitor, it may be difficult to collect all of the

information you need. As a result, you must choose lots of individual

organizations to research in order to obtain the information you require.

Understand current performance - We must know our current procedures in

order to identify opportunities for improvement and compare them to the chosen

organization or competition.

Plan - Make a plan to make the improvements you've determined are the most

effective in closing achievement gaps. Overall view from the top down is required

for success.

Study others - To gather the knowledge we require, we must engage in a variety

of organizations. We must collect data from a number of areas to provide the

most complete picture of the organization we've decided to investigate.

Learn from the data - We learned about business processes through our study.

We can put our records on top of our such or track out our competitors'

procedures seeing where we've fallen back. As we examine the similarities, we

must also help to identify what causes the difference in our operations.

Use the finding - Improvements and personnel behavior should be closely

monitored. Identify areas that need to be modified if new procedures are not

working smoothly as planned. We must guarantee that all personnel are aware of

their responsibilities, are well-trained, and possess the necessary experience to

execute their given tasks. (Lucid Content Team, n.d.)

NILAKSHAN RAJASEKARAN / KBM322111 23 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Types of benchmarking

Internal benchmarking discusses a company's performance, methods, and

practices against those of other departments (e.g. different teams, business units,

groups or even individuals).

Ex-: Benchmarks can been applied to comparing procedures in one retail store to

being in the other in the same chain.

Competitive benchmarking is a strategy for individuals who wish to stay ahead of

the competition by knowing what they are. It's a method of using a collection of

measurements to determine the optimal methods, strategies, and tactics for reaching

your business goals. (SHANG, 2021)

Ex-: If you wish to check your pricing approach, look at goal-specific data like

average price increase. In our essay on competitive benchmarking, you'll find

practical advice and examples. (Winik, 2021)

The practice of measuring a company's business performance or practices to those

of other companies who is generally in the similar market is known as generic

benchmarking.

Ex-: Every company wants to be a successful learner, because such a company is

better able to handle obstacles and react to changing market conditions.

Key performance Indicator (KPI)

A set of measurable data used to judge a company's current long-term success is

referred to as key performance indicators (KPIs). KPIs are used to decide a

company’s managerial, financial, and operational successes, especially when

matched to other companies in the same industry. (TWIN, 2021)

Ex-: Cost of gaining a customer. Customer Lifetime Value is the amount of money a

customer spends over the course Customer satisfaction level is a tool that measures

how satisfied customers are with a product or service. (Actual/Proposed) Sales

Target Percentage. (Anon., n.d.)

Critical Success factors - CSFs are major parts that a company, team, or

department need focused on and correctly perform in order to achieve its business

goals. The successful implementation of these performance elements must result in

a favorable outcome and add significant value to the company. (Anon., n.d.)

NILAKSHAN RAJASEKARAN / KBM322111 24 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Ex-: An organization can decide that a suggested effort will not help affect a certain

success element and, as a result, will take attention away from their main

performance planning, waste time, and waste resources.

Strategic aims - We use these tools to plan and concentrate our various tasks. We

must include detailed objectives and goals for each Strategic Aim in the Corporate

Plan.

B) The balanced scorecard

Figure 7 - The balanced scorecard

A balanced

scorecard (BSC) is a success tool for identifying, improving, and controlling the

various operations and results of an organization. BSCs are first created for for-profit

businesses, but they have since been transformed used by nonprofits and

government entities. To produce provable results, managers and executives should

gather and accept data. Company staff could be able to use that details to create

Under the heading of balanced scorecard, there are four sections. The following are

the details:

1. Financial perspectives

According to (Dahiru, 2014)The financial perspective of a company is to verify that

this really produces a return on its investments but maintaining controlling significant

risks connected with operating the business. Return on Investment (ROI), Cash

Flow, Net Operating Income, and Increased Revenues are the most common

success statistics featured in this approach. The financial perspective looks at

NILAKSHAN RAJASEKARAN / KBM322111 25 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

whether stockholders see the reward payout ratio, operational cost reductions, profit

after tax, return on capital employed (ROCE), and overall sales development.

Operating profit margins suggest how successful a company's management has

been in making money from its operations. Considering the needs of all stakeholders

in the company, namely shareholders, consumers, and suppliers, is one way to

achieve the goals. Financial data like as sales, expenses, and income are used to

measure financial results (OP margin). Financial measurements include dollar

amounts, profitability statements, budget changes, and profit targets.

2. Customer

One of the viewpoints of the balanced scorecard is the customer, who is among the

most significant groups of stakeholders and has always been at the center of the

organization's attention. So, in order to attain long performance, the business

determines its client groups and interacts with them in order to identify the needs and

transform them into strategic goals and activities. Customers, also known as clients,

are absolutely necessary to any organization; lacking them, this would stop existing.

Customer opinion is obtained to identify consumer experience with the performance,

cost, and purchase of the product or service. Customers provide opinions on how

satisfied they are with their present product.

3. Internal business

According to (Pari, 2021) The procedures that develop and distribute the service

offering are the focus of the internal process perspective. It concentrates on all of the

operations and essential procedures that are needed for the organization to thrive at

delivering the value that customers demand in a successful and motivated manner.

Answering the question, "What do us well at?" is a crucial part of this strategy. The

response can support the business in building business strategies and promoting

developments that promote the growth of finding better ways to meet customer

needs. These are done to analyses the quality of the products. Operational

management keeps control of gaps, delays, bottlenecks, shortages, and waste.

4. Learning and growth

The learning and growth viewpoint is the foundation of any plan, focusing on an

organization's marketable securities, particularly the internal skills and talents

needed to maintain importance internal processes. The business world is very

changing, and in order to survive, much alone grow, a company must react

constantly. In order to realize goals such as expanding market share, leadership

must focus on developing the company's plans. Before taking action, R&D usually

applies a balanced scorecard to evaluate innovative initiatives and prospects.

Balanced scorecards generally analyses prospects in context, failing to account for

the various scenarios, uncertainty, and risk that innovation projects involve.

NILAKSHAN RAJASEKARAN / KBM322111 26 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

The company's goals in terms of learning and growth, as well as internal procedures

that are critical in R&D activities, will be those that, very short, support it in meeting

its strategic goals relating to customer and shareholder fulfillment. In the Balanced

Scorecard, return on investment is a high quality financial measurement. The

percentage of repeat customers and sales volume to current customers are typically

important statistics from a customer perspective. Balanced Scorecard is planned to

provide with the knowledge and techniques necessary to assist your organization in

increasing focus on strategic plan and results, improving organizational

achievement, linking work with strategic plan, focusing on developing performance

drivers, and improving connectivity of the organization's vision.

NILAKSHAN RAJASEKARAN / KBM322111 27 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Conclusion

The report of Lo 01 and Lo 2 (task 01 and task 02) concludes that the Introduction

of management accounting with the principles and responsibilities of the

management accounting function. Management accounting provides choice with

timely availability to important data. The Principles provide guidelines on recognizing

past, present, and future information from various sources, including financial and

non-financial data. This covers information on social, environmental, and economic

issues.

Planning - Management accounting is closely interwoven in planning both

because it provides information for decision-making and because the entire

budgeting process is developed around accounting-related reports.

.

Design making - The goal of decision-making is to earn profits by employing the

best option approach available. Management accounting improves decision in

financial matters. Accounting data is used to solve a variety of management issues.

Every company must make the correct decision at the appropriate moment

Variance analysis - By comparing planned and actual costs, variance analysis

helps keep a project's costs under control. Variance analysis may help a business in

identifying patterns, difficulties, opportunities, and risks to its short & long growth.

Costing - Cost accounting is concerned with the calculation and measurement of

costs and expenses incurred in the purchase or production of a product.

In the task 02, I have included how cost (Variable costs, fixed costs, Semi-variable

costs) can be classified within an organization. In addition, I used a relevant diagram

to show how costs act in the short and long run. In accounting, understanding

between the short and long run is significant since it teaches businesses what to do

at various times. With the net loss, if the company's marginal sales exceed its

marginal cost in the short run, it can keep producing.

In the task 03, I have included how management accounting adds value to other

functions within the organization (Human resource management, Marketing,

Operations/manufacturing, IT, R&D)

In the lo 3, Conflicts, Causes of conflicts, Conflicts faced by organization, Conflict

management strategies to adopted by organization Managing stakeholders conflicts

and Managing stakeholders conflicts are well explained and clearly mentioned

In the lo 4, I have included and clearly mention below facts;

NILAKSHAN RAJASEKARAN / KBM322111 28 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Benchmarking - is been explained. Benchmarking is a method for identifying

shortcomings and increasing market share in business by matching best practice to

the organization's procedures. Benchmarking can be used to measure any company

process, approach, function, or product.

Key performance Indicator (KPI) - which is important in providing teams with goals

to strive for, checkpoints to track progress, and data to help everyone in the

company plan for the future

The balanced scorecard - provides an effective process for defining and gives a

general. It means that important advisers or promoters of future results, as well as

business results, are recognized to produce an overall picture of the strategies.

Four sections of financial perspectives, customer, internal business and

learning and growth also included in balanced scoreboard with a good note.

NILAKSHAN RAJASEKARAN / KBM322111 29 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

References

Obaidullah Jan, ACA, CFA , 2019. Cost Classifications. [Online]

Available at: https://xplaind.com/209931/cost-classifications

[Accessed 1 September 2021].

Alan S Dunk, A. K., 2003. TOP MANAGEMENT INVOLVEMENT IN R&D BUDGET SETTING: THE

IMPORTANCE OF FINANCIAL FACTORS, BUDGET TARGETS, AND R&D PERFORMANCE EVALUATION.

[Online]

Available at: https://www.emerald.com/insight/content/doi/10.1016/S1474-7871(02)11008-2/full/

html?skipTracking=true

[Accessed 1 September 2021].

Anon., 2013. Budgeting for information technology. [Online]

Available at: https://www.bakertilly.com/insights/budgeting-for-information-technology

[Accessed 1 September 2021].

Anon., 2015. Conflict Is The Disagreement Between Two Parties Religion Essay. [Online]

Available at: https://www.ukessays.com/essays/religion/conflict-is-the-disagreement-between-two-

parties-religion-essay.php

[Accessed 11 October 2021].

Anon., 2021. Definition of 'Variance Analysis'. [Online]

Available at: https://economictimes.indiatimes.com/definition/variance-analysis

[Accessed 1 September 2021].

Anon., 2021. Kaizen definition. [Online]

Available at: https://www.accountingtools.com/articles/what-is-kaizen.html

[Accessed 1 September 2021].

Anon., 2021. Manufacturing cost accounting definition. [Online]

Available at: https://www.accountingtools.com/articles/what-is-manufacturing-cost-

accounting.html

[Accessed 1 September 2021].

Anon., n.d. 170 KPI Examples And Templates. [Online]

Available at: https://www.qlik.com/us/kpi/kpi-examples

[Accessed 14 October 2021].

Anon., n.d. Costs in the Short Run. [Online]

Available at: https://opentextbc.ca/principlesofeconomics2eopenstax/chapter/costs-in-the-short-

run/

[Accessed 1 September 2021].

Anon., n.d. Define Managerial Accounting and Identify the Three Primary Responsibilities of

Management. [Online]

NILAKSHAN RAJASEKARAN / KBM322111 30 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Available at: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/define-managerial-

accounting-and-identify-the-three-primary-responsibilities-of-management/

[Accessed 1 september 2021].

Anon., n.d. Fixed cost. [Online]

Available at: https://en.wikipedia.org/wiki/Fixed_cost

[Accessed 1 September 2021].

Anon., n.d. How Will Accounting Make You Be a Better Human Resource Manager?. [Online]

Available at: https://work.chron.com/accounting-make-better-human-resource-manager-2836.html

[Accessed 1 September 2021].

Anon., n.d. Management Accounting and Decision-Making. [Online]

Available at: http://www.microbuspub.com/pdfs/chapter2.pdf

[Accessed 1 September 2021].

Anon., n.d. Management Accounting: Definition, Functions, Objectives, Roles. [Online]

Available at: https://www.iedunote.com/management-accounting#:~:text=Costing%20is%20a

%20branch%20of,are%20the%20basic%20managerial%20functions.

[Accessed 1 September 2021].

Anon., n.d. What Are Critical Success Factors for a Project?. [Online]

Available at: https://cmoe.com/glossary/critical-success-factors/

[Accessed 14 October 2021].

Anon., n.d. What Inter and Intra Mean in the Workplace. [Online]

Available at: https://www.indeed.com/hire/c/info/inter-vs-intra

[Accessed 12 October 2021].

Barlow, P., 2015. THE RELATIONSHIP BETWEEN MARKETING AND ACCOUNTING: KOTLER’S

MARKETING MIX. [Online]

Available at: https://babington.co.uk/blog/accounting/accounting-kotlers-marketing-mix/

[Accessed 1 September 2021].

Briggs, M., 2021. Tricky issues: How to deal with personality clashes in the workplace. [Online]

Available at: https://www.shoosmiths.co.uk/insights/articles/tricky-issues-how-to-deal-with-

personality-clashes-in-the-workplace

[Accessed 11 October 2021].

businessjargons, 2019. Short-run Cost. [Online]

Available at: https://businessjargons.com/short-run-cost.html

[Accessed 1 September 2021].

Butz, C., 2010. Role and Effects of Budgeting in Managerial Practice. [Online]

Available at: https://www.grin.com/document/176624

[Accessed 1 September 2021].

NILAKSHAN RAJASEKARAN / KBM322111 31 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

Dahiru, 2014. Balanced Scorecard financial measurement of organizational. [Online]

Available at: https://iosrjournals.org/iosr-jef/papers/vol4-issue6/A0460110.pdf

[Accessed 12 November 2021].

GRANT, M., 2021. Long Run. [Online]

Available at: https://www.investopedia.com/terms/l/longrun.asp

[Accessed 1 September 2021].

Indeed Editorial Team, 2021. 7 Reasons Why Benchmarking in Business Is Important. [Online]

Available at: https://www.indeed.com/career-advice/career-development/benchmarking-in-

business

[Accessed 8 November 2021].

KENTON, W., 2021. Variable Cost. [Online]

Available at: https://www.investopedia.com/terms/v/variablecost.asp

[Accessed 1 September 2021].

Lucid Content Team, n.d. 8 Steps of the Benchmarking Process. [Online]

Available at: https://www.lucidchart.com/blog/8-steps-of-the-benchmarking-process

[Accessed 8 November 2021].

Manuel, M., 2019. MENDELOW’S MATRIX. [Online]

Available at: http://zeritenetwork.com/mendelows-matrix/#:~:text=Minimal%20effort

%20(A),stakeholders%20have%20a%20low%20impact.

[Accessed 13 October 2021].

McQuerrey, L., n.d. Relationship Between Accounting & Marketing. [Online]

Available at: https://yourbusiness.azcentral.com/relationship-between-accounting-marketing-

25785.html

[Accessed 1 September 2021].

Munroe, S., 2018. Examples of Miscommunication at the Workplace. [Online]

Available at: https://careertrend.com/examples-miscommunication-workplace-2667.html

[Accessed 11 October 2021].

Pari, 2021. SM Asy 14.08 | PDF | Strategic Management | Business - Scribd. [Online]

Available at: https://www.scribd.com/document/520500055/SM-ASY-14-08

[Accessed 12 Novemeber 2021].

Queensland Government, 2020. Negotiating successfully. [Online]

Available at: https://www.business.qld.gov.au/running-business/marketing-sales/managing-

relationships/negotiating

[Accessed 13 October 2021].

SEGAL, T., 2020. Conflict of Interest. [Online]

Available at: https://www.investopedia.com/terms/c/conflict-of-interest.asp

[Accessed 11 October 2021].

NILAKSHAN RAJASEKARAN / KBM322111 32 | P a g e

Unit 05/ MANAGEMENT ACCOUNTING

(MAC)

BM 33

SHANG, J., 2021. What is Competitive Benchmarking?. [Online]

Available at: https://www.adroll.com/blog/growth-marketing/what-is-competitive-benchmarking.

[Accessed 14 October 2021].

TARVER, E., 2021. Balanced Scorecard (BSC). [Online]

Available at: https://www.investopedia.com/terms/b/balancedscorecard.asp

[Accessed 14 October 2021].

TUOVILA, A., 2021. Managerial Accounting. [Online]

Available at: https://www.investopedia.com/terms/m/managerialaccounting.asp

[Accessed 1 September 2021].

TWIN, A., 2021. Key Performance Indicators (KPIs). [Online]

Available at: https://www.investopedia.com/terms/k/kpi.asp

[Accessed 14 October 2021].

Velikiy, A., 2018. Evaluating the effectiveness of advertising campaigns: ROMI, ROI and ROAS.

[Online]

Available at: https://blog.rontar.com/evaluating-the-effectiveness-of-ad-campaigns-romi-roi-roas

[Accessed 1 September 2021].

White, M., n.d. Interdepartmental Conflict. [Online]

Available at: https://yourbusiness.azcentral.com/interdepartmental-conflict-9537.html

[Accessed 12 October 2021].

Winik, M., 2021. 7 Benchmarking Types for Better Business Decisions [+ Examples]. [Online]

Available at: https://www.similarweb.com/corp/blog/research/business-benchmarking/

benchmarking-types/

[Accessed 14 October 2021].

NILAKSHAN RAJASEKARAN / KBM322111 33 | P a g e

You might also like

- D365 BC - Finance Essentials PDFDocument99 pagesD365 BC - Finance Essentials PDFJames Sanabria100% (1)

- Microsoft Dynamics Sure Step Training PDFDocument66 pagesMicrosoft Dynamics Sure Step Training PDFDario BaezNo ratings yet

- Sample Project Report On Financial AnalysisDocument66 pagesSample Project Report On Financial AnalysisAmit Kumar GhoshNo ratings yet

- Summary of TFIN50 SAP Course Part 2Document41 pagesSummary of TFIN50 SAP Course Part 2Ershow100% (3)

- ADC Business Plan 2009 Final VersionDocument54 pagesADC Business Plan 2009 Final VersionSivasakti MarimuthuNo ratings yet

- BSBFIM501 Learner Guide V1.1Document66 pagesBSBFIM501 Learner Guide V1.1Angela .ANo ratings yet

- Business Finance II (Content) PDFDocument327 pagesBusiness Finance II (Content) PDFLouis ChinNo ratings yet

- Universal Basic Income - EditedDocument4 pagesUniversal Basic Income - Editedcollins kirimiNo ratings yet

- Estimation Coffeteria & Gym - Fooqa SareDocument9 pagesEstimation Coffeteria & Gym - Fooqa SareEng Abdi Shakur Yusuf100% (1)

- Mark Scheme (Provisional) Summer 2021Document16 pagesMark Scheme (Provisional) Summer 2021Tahmid AliNo ratings yet

- The Big Book of EMS Use Cases: Celonis Execution Management SystemDocument32 pagesThe Big Book of EMS Use Cases: Celonis Execution Management SystemsaromjNo ratings yet

- Updated - Module 2Document31 pagesUpdated - Module 2jasoosimardNo ratings yet

- MFB Ration AnalysisDocument45 pagesMFB Ration AnalysisRahila ShahNo ratings yet

- Accounting FinalDocument208 pagesAccounting Finalabdul abdulNo ratings yet

- Managing Successful Business Project (MSBP)Document62 pagesManaging Successful Business Project (MSBP)RHITIK AYESHNo ratings yet

- Budgt Adminisn CasDocument55 pagesBudgt Adminisn Casayele eshete100% (4)

- Basic Financial and Accounting Systems ToolkitDocument78 pagesBasic Financial and Accounting Systems ToolkitAhsin KhanNo ratings yet

- ESBMDocument46 pagesESBMRHITIK AYESHNo ratings yet

- Employee Satisfaction of Premier Bank LimitedtedDocument39 pagesEmployee Satisfaction of Premier Bank LimitedtedashirNo ratings yet

- ABM312 Financial Accounting 2015 ModuleDocument77 pagesABM312 Financial Accounting 2015 ModuleDAVY SIMONGANo ratings yet

- Financial Statement AnalysisDocument441 pagesFinancial Statement Analysisirf86% (14)

- Habib Metropolitan Bank LTDDocument54 pagesHabib Metropolitan Bank LTDM Adil BhattiNo ratings yet

- Business and Business Environmen1Document42 pagesBusiness and Business Environmen1RHITIK AYESHNo ratings yet

- Manual Platinum Solutions Control Software - Reference Guide PDFDocument64 pagesManual Platinum Solutions Control Software - Reference Guide PDFAyaaz PuttarooNo ratings yet

- DG Ac Fna210 Y2 SGDocument86 pagesDG Ac Fna210 Y2 SGM CNo ratings yet

- APMM AR 2021 - 20220209 No iXBRLDocument152 pagesAPMM AR 2021 - 20220209 No iXBRLEric LopesNo ratings yet

- Business Continuity BIA DRPDocument38 pagesBusiness Continuity BIA DRPKunal ChaudhryNo ratings yet

- MO 07 Preparing, Matching and Process RecieptDocument70 pagesMO 07 Preparing, Matching and Process RecieptJemal SeidNo ratings yet

- Livelihoods Impact Assessment 2019Document43 pagesLivelihoods Impact Assessment 2019Sunder RajagopalanNo ratings yet

- Managing OperationDocument27 pagesManaging OperationRHITIK AYESHNo ratings yet

- Financial Accounting Basic ToolkitDocument78 pagesFinancial Accounting Basic ToolkitStephen Ortencio100% (1)

- Preparing - The - Pro - Forma - Real Estate PDFDocument63 pagesPreparing - The - Pro - Forma - Real Estate PDFhelgerson.mail4157100% (1)

- Financial Decision Making For ManagersDocument3 pagesFinancial Decision Making For ManagersSajib DevNo ratings yet

- BSBINN601 Learner Guide V1.5Document103 pagesBSBINN601 Learner Guide V1.5hossain alviNo ratings yet

- BookKeeping Training ManualDocument59 pagesBookKeeping Training ManualGanea FlorentinaNo ratings yet

- Tutorial Letter 102/3/2022: Application of Management Accounting TechniquesDocument29 pagesTutorial Letter 102/3/2022: Application of Management Accounting TechniquesDonavan BalgobindNo ratings yet

- 5 Accounting Final (UPSC EPFO 2023)Document13 pages5 Accounting Final (UPSC EPFO 2023)Suraj PrakashNo ratings yet

- Study Guide.Document145 pagesStudy Guide.MapsipiexNo ratings yet

- Na50 Enus Fin TocDocument4 pagesNa50 Enus Fin Tocxodobid106No ratings yet

- Mac3701 2024 TL103 3 BDocument80 pagesMac3701 2024 TL103 3 BRodney MahlanguNo ratings yet

- Sura SiinqeeDocument64 pagesSura SiinqeeArega OljiraNo ratings yet

- Business Continuity, BIA DRPDocument39 pagesBusiness Continuity, BIA DRPRahul Govind Dwivedi100% (2)

- Adv Fin Acc Sample 2014Document50 pagesAdv Fin Acc Sample 2014samuel hailuNo ratings yet

- Mac4865 2023 TL 001 0 BDocument124 pagesMac4865 2023 TL 001 0 BfatimahNo ratings yet

- ACC222Document181 pagesACC222Marjorie AugustoNo ratings yet

- Health and Safety Management Plan Linmac 57 PDFDocument57 pagesHealth and Safety Management Plan Linmac 57 PDFCarl Williams100% (1)

- JOSHCO 2018-19 Business PlanDocument83 pagesJOSHCO 2018-19 Business PlanMichael MatshonaNo ratings yet

- Vision For Nation Finacial ManualDocument66 pagesVision For Nation Finacial Manualvision generationNo ratings yet

- Jonathan Mutukwa Second ReportDocument40 pagesJonathan Mutukwa Second ReportRUVARASHE TENDAYINo ratings yet

- SHR SG BudgetDocument156 pagesSHR SG BudgetRam ShuklaNo ratings yet

- Fmds0532 Data CentersDocument51 pagesFmds0532 Data CentersWERMERMNo ratings yet

- AgriBusiness Sample Business Plan PaperDocument28 pagesAgriBusiness Sample Business Plan PaperAhmed Adem100% (1)

- 1439 - 20211123 BR Plan - CNA Published 23112021Document58 pages1439 - 20211123 BR Plan - CNA Published 23112021EnhleNo ratings yet

- Thèse MasterDocument7 pagesThèse MasterYasmine NyouriNo ratings yet

- Summary of TFIN52 ZRH PDFDocument45 pagesSummary of TFIN52 ZRH PDFejascbitNo ratings yet

- Business English Writing: Effective Business Writing Tips and Will Help You Write Better and More Effectively at WorkFrom EverandBusiness English Writing: Effective Business Writing Tips and Will Help You Write Better and More Effectively at WorkNo ratings yet

- How Useful is the Information Ratio to Evaluate the Performance of Portfolio Managers?From EverandHow Useful is the Information Ratio to Evaluate the Performance of Portfolio Managers?No ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- The Strategy Gap: Leveraging Technology to Execute Winning StrategiesFrom EverandThe Strategy Gap: Leveraging Technology to Execute Winning StrategiesNo ratings yet

- Corporate Management, Corporate Social Responsibility and Customers: An Empirical InvestigationFrom EverandCorporate Management, Corporate Social Responsibility and Customers: An Empirical InvestigationNo ratings yet

- Neuromarketing in the B-to-B-Sector: Importance, potential and its implications for Brand ManagementFrom EverandNeuromarketing in the B-to-B-Sector: Importance, potential and its implications for Brand ManagementNo ratings yet

- Assessment Templates BSBPMG522 Undertake Project Work: Student's DeclarationDocument14 pagesAssessment Templates BSBPMG522 Undertake Project Work: Student's DeclarationMiguel MolinaNo ratings yet

- Lata Internship Report 1 1Document45 pagesLata Internship Report 1 1FahimNo ratings yet

- APGLIDocument7 pagesAPGLIskssahul59No ratings yet

- FIDIC Clause 14.2 - Advance PaymentDocument4 pagesFIDIC Clause 14.2 - Advance Paymentaashik.esnNo ratings yet

- About Rtgs & NeftDocument5 pagesAbout Rtgs & NeftAbdulhussain JariwalaNo ratings yet

- Contoh Laporan Arus KasDocument9 pagesContoh Laporan Arus KasPutri LestariNo ratings yet

- Zeeman's Family ExpansionDocument16 pagesZeeman's Family ExpansionColinNo ratings yet

- PRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionDocument4 pagesPRIA FAR - 016 Share-Based Payments (PFRS 2) Notes and SolutionEnrique Hills RiveraNo ratings yet

- China Rail Cons - 2012 Annual Results Announcement PDFDocument359 pagesChina Rail Cons - 2012 Annual Results Announcement PDFalan888No ratings yet

- Palletizing Systems Market (2014-2020)Document16 pagesPalletizing Systems Market (2014-2020)Sanjay MatthewsNo ratings yet

- "Scenarios For Mongolia: Building A Positive Future" GuidebookDocument13 pages"Scenarios For Mongolia: Building A Positive Future" GuidebookEconomic Policy and Competitiveness Research CenterNo ratings yet

- CABINAS - Partnership Formation & OperationDocument16 pagesCABINAS - Partnership Formation & OperationJoshua CabinasNo ratings yet

- International Financial Mgnt-TCHE425 For 2023-2025 - For 6 GroupsDocument17 pagesInternational Financial Mgnt-TCHE425 For 2023-2025 - For 6 GroupsSơn HoàngNo ratings yet

- Technology and Operation Management Home Assignment 1Document4 pagesTechnology and Operation Management Home Assignment 1Puspita RamadhaniaNo ratings yet