Professional Documents

Culture Documents

ITR Achkonwledgement

ITR Achkonwledgement

Uploaded by

dan0 ratings0% found this document useful (0 votes)

4 views2 pagesThis document is a declaration from Balaram Gondhali, an authorized signatory of SHREE GANESH ENTERPRISES, stating that they have filed their income tax returns on time for the past two years, their aggregate TDS and TCS exceeds 50,000 rupees, and their PAN is linked to their Aadhar number. This declaration is required to receive payments without higher tax deduction at source.

Original Description:

ITR Acknowledgement

Original Title

ITR achkonwledgement

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a declaration from Balaram Gondhali, an authorized signatory of SHREE GANESH ENTERPRISES, stating that they have filed their income tax returns on time for the past two years, their aggregate TDS and TCS exceeds 50,000 rupees, and their PAN is linked to their Aadhar number. This declaration is required to receive payments without higher tax deduction at source.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesITR Achkonwledgement

ITR Achkonwledgement

Uploaded by

danThis document is a declaration from Balaram Gondhali, an authorized signatory of SHREE GANESH ENTERPRISES, stating that they have filed their income tax returns on time for the past two years, their aggregate TDS and TCS exceeds 50,000 rupees, and their PAN is linked to their Aadhar number. This declaration is required to receive payments without higher tax deduction at source.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

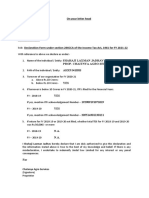

TO WHOMSOEVER IT MAY CONCERN

Declaration

I Balaram Gondhali Authorized Signatory of M/s SHREE GANESH

ENTERPRISES having PAN ACMFS2151A referring to the provisions of 206AB

of the Income Tax Act 1961 do here by make the following declaration as required for

receiving payments from the payer without deduction of tax at source at a higher rate:

1) We have filled our Income Tax return for below previous years as per he

specified due date u/s 139(1) of income tax act 1961.

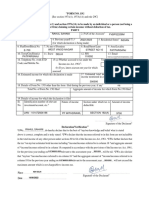

Previous Year ITR Acknowledgement Number Date of Filing

FY 2019-20 267147990041219 Dec 4, 2019

FY 2020-21 317133300300321 Mar 30, 2021

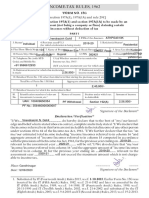

2) Aggregate of Tax deducted at source (TDS) and Tax collected (TCS) of last two

years has Exceeded IND 50000/-

3) In case you are an individual or proprietorship firm, whether you have linked

your PAN with your Aadhar number – YES/NO/NA

Yours Faithfully

Authorized Signatory

For SHREE GANESH ENTERPRISES

PLACE: PANVEL

DATE: 29.04.2022

You might also like

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- 15CADocument2 pages15CAavinash14 neereNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Declaration FormatsDocument5 pagesDeclaration Formatskirubkanchan96No ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- TdsDocument1 pageTdskaranNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Declaration 206AB and 206CCA For Vendor & CustomerDocument2 pagesDeclaration 206AB and 206CCA For Vendor & CustomerAbhimanyu100% (1)

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- NSEIT Declaration For Sec 206ABDocument1 pageNSEIT Declaration For Sec 206ABsam franklinNo ratings yet

- PTaxPaymentCertificate '192156969058'Document1 pagePTaxPaymentCertificate '192156969058'skmasudali041No ratings yet

- Declaration To Be Obtained From Vendors For 206AB - RevisedDocument1 pageDeclaration To Be Obtained From Vendors For 206AB - RevisedPraveen RanaNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Calling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFDocument1 pageCalling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFnsreddy3613No ratings yet

- RTKR20027ADocument1 pageRTKR20027Ajijaboy366No ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- Certificate of Collection or Deduction of Tax Issued Under Section 164 Read With Rules 42 of The Income Tax Ordinance, 2001Document1 pageCertificate of Collection or Deduction of Tax Issued Under Section 164 Read With Rules 42 of The Income Tax Ordinance, 2001Ashu MalikNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnganeshzenaNo ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitcesc festNo ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- Sodexo Rectification - 154 IT ActDocument2 pagesSodexo Rectification - 154 IT ActGaurav AgarwalNo ratings yet

- Afcan Reply 133Document1 pageAfcan Reply 133rajorajisunnyNo ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitluthfi musthofaNo ratings yet

- Form No.12bbDocument2 pagesForm No.12bbAccount Ayoni FoodsNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsanyogitasawant5No ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- Annexure B - BSID Collect TCS Us 206 (1H) & 206CCADocument1 pageAnnexure B - BSID Collect TCS Us 206 (1H) & 206CCAsabale xeroxNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- Vendor ITR Format - NewDocument1 pageVendor ITR Format - Newdixitaparmar21No ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- Certificate of Collection or Deduction of Tax Issued Under Section 164 Read With Rule 42 of The Income Tax Ordinance, 2001Document1 pageCertificate of Collection or Deduction of Tax Issued Under Section 164 Read With Rule 42 of The Income Tax Ordinance, 2001imranNo ratings yet

- Filing Extension LetterDocument2 pagesFiling Extension LetterTymmz AlloteyNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Tax Collector Correspondence1329480 2022Document8 pagesTax Collector Correspondence1329480 2022Jahanzaib MemonNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Guideline Answers: Professional ProgrammeDocument115 pagesGuideline Answers: Professional ProgrammeArham SoganiNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- 02 Manila Banking Corporation v. CIRDocument2 pages02 Manila Banking Corporation v. CIRCheska VergaraNo ratings yet

- Proposal Letter 148A (A) Shree Siddhivinayak Oil Foods - AY202021Document8 pagesProposal Letter 148A (A) Shree Siddhivinayak Oil Foods - AY202021basecandlesNo ratings yet

- Sub.: Circular Regarding Use of Functionality Under Section 206AB and 206CCA of The Income-Tax Act, 1961-RegDocument3 pagesSub.: Circular Regarding Use of Functionality Under Section 206AB and 206CCA of The Income-Tax Act, 1961-RegVsreddy CaNo ratings yet

- Basic ConceptsDocument4 pagesBasic ConceptsHarry IcwaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNishant VermaNo ratings yet

- The Rigours of TDS - An OverviewDocument31 pagesThe Rigours of TDS - An OverviewShaleenPatniNo ratings yet

- INCOME TAX MASTER FILEDocument28 pagesINCOME TAX MASTER FILEDIVYA RANINo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- TDS - TCSDocument55 pagesTDS - TCSBeing HumaneNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)