Professional Documents

Culture Documents

CapitalInv Daily Report (Jun 19) EN

CapitalInv Daily Report (Jun 19) EN

Uploaded by

Ahmad Abu shanabCopyright:

Available Formats

You might also like

- VSA GuideDocument59 pagesVSA GuideCryptoFX96% (50)

- Economics Unit 3 Frequently Asked QuestionsDocument19 pagesEconomics Unit 3 Frequently Asked QuestionsachinthaNo ratings yet

- Summer Internship Report Aim India 2019Document72 pagesSummer Internship Report Aim India 2019Rishabh Bamal100% (1)

- Trading Ebook - Options - Strategy - PosterDocument1 pageTrading Ebook - Options - Strategy - PosterHeemanshu Shah100% (1)

- Options Strategy PosterDocument1 pageOptions Strategy PosterMark Taylor86% (7)

- Equiti Securities Currencies Brokers LLC Letterhead English-95Document9 pagesEquiti Securities Currencies Brokers LLC Letterhead English-95Sam PupkinNo ratings yet

- Smart Report XauUsdDocument26 pagesSmart Report XauUsdGaspar CanoNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Getto PangandoyonNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25mrrrkkkNo ratings yet

- Economic and Fundamental Developments 14-07-2020: Securities SecuritiesDocument11 pagesEconomic and Fundamental Developments 14-07-2020: Securities Securitiesotto walikwaNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Jake VillaNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25mrrrkkkNo ratings yet

- Appendix X: Symbol Description Value RationaleDocument4 pagesAppendix X: Symbol Description Value RationaleqazwsxedcrfvwNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Trading CentralDocument7 pagesTrading Centralnamyadnan21No ratings yet

- VIP Analytics Global 190923Document9 pagesVIP Analytics Global 190923ovonoleunkeuNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Jun GomezNo ratings yet

- FX Commentary and Technical ViewsDocument2 pagesFX Commentary and Technical ViewsMuhammad Hasnain YousafNo ratings yet

- Daily MCX Newsletter 07 May 2014Document9 pagesDaily MCX Newsletter 07 May 2014Jeffrey PateNo ratings yet

- Daily MCX Newsletter 21 May 2014Document9 pagesDaily MCX Newsletter 21 May 2014Jeffrey PateNo ratings yet

- 2014-07-20 George Lea Web99 - Routines and Prep..Document41 pages2014-07-20 George Lea Web99 - Routines and Prep..Lisa KrissNo ratings yet

- Options Strategies PosterDocument1 pageOptions Strategies PosterFrank Ferrao100% (2)

- Daily Option News Letter: 24/june/ 2013Document7 pagesDaily Option News Letter: 24/june/ 2013api-218721197No ratings yet

- The Tsupitero Newsletter 12-02-2013Document7 pagesThe Tsupitero Newsletter 12-02-2013Cresjon MacalsNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- MCX Newsletter-Daily: 11-JULY-2013Document9 pagesMCX Newsletter-Daily: 11-JULY-2013api-230785654No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-248643986No ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Jake VillaNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-247872246No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Daily Iforex Report 29th OCTOBER 2013: Trading TipsDocument10 pagesDaily Iforex Report 29th OCTOBER 2013: Trading Tipsapi-212478941No ratings yet

- VOLUME PROFILE - 部分5Document5 pagesVOLUME PROFILE - 部分5xufdddNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Options Trading (Advanced) ModuleDocument11 pagesOptions Trading (Advanced) ModuleavinashkakarlaNo ratings yet

- VIP Analytics Global 030124Document9 pagesVIP Analytics Global 030124chibambomechakNo ratings yet

- The Tsupitero Newsletter 06-17-2016 PDFDocument7 pagesThe Tsupitero Newsletter 06-17-2016 PDFJake VillaNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Daily MCX Newsletter: 1 1 1 17 7 7 7 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013Document9 pagesDaily MCX Newsletter: 1 1 1 17 7 7 7 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013api-230785654No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- FD Lecture IDocument34 pagesFD Lecture IAnkit JainNo ratings yet

- Investment Analysis and Portfolio ManagementDocument31 pagesInvestment Analysis and Portfolio ManagementRajaram SrinivasanNo ratings yet

- Analysis of FuturesDocument8 pagesAnalysis of FuturesytrahulpradeepNo ratings yet

- Derivative Report Erl 30-11-2016Document8 pagesDerivative Report Erl 30-11-2016Anjali SharmaNo ratings yet

- VIP_analytics_Global_250124Document9 pagesVIP_analytics_Global_250124Dhimas AdiputraNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Daily Technical Analysis Report 22 May 2011Document34 pagesDaily Technical Analysis Report 22 May 2011santhosh5948289No ratings yet

- Dangerous Iron Condor Given WebinarDocument16 pagesDangerous Iron Condor Given Webinariopdodo0% (1)

- Investment Analysis and Portfolio Management: Gareth MylesDocument32 pagesInvestment Analysis and Portfolio Management: Gareth MyleshoalongkiemNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-192953649No ratings yet

- Daily MCX Newsletter 28 May 2014Document9 pagesDaily MCX Newsletter 28 May 2014Jeffrey PateNo ratings yet

- Article of Derivative Strategist)Document3 pagesArticle of Derivative Strategist)Sanju GohilNo ratings yet

- Please Don't Get Cocky: April 2013 Volume 4, No. 7Document6 pagesPlease Don't Get Cocky: April 2013 Volume 4, No. 7Marites Mayo CuyosNo ratings yet

- Daily Option News Letter 18 July 2013Document7 pagesDaily Option News Letter 18 July 2013Rakhi Sharma Tips ProviderNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- FIFA 16 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!From EverandFIFA 16 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!No ratings yet

- FIFA 15 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!From EverandFIFA 15 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!Rating: 5 out of 5 stars5/5 (1)

- Chapter 1&2 Agricultural MarketingDocument44 pagesChapter 1&2 Agricultural Marketingzelalemmekonnen823100% (1)

- Advani Hotels AR2023Document227 pagesAdvani Hotels AR2023Sriram RanganathanNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaDocument15 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaebeanandeNo ratings yet

- Trading in Securities and RegulationsDocument25 pagesTrading in Securities and Regulationsgunn RastogiNo ratings yet

- Business Strategies and Competitive Advantage: The Role of Performance and InnovationDocument31 pagesBusiness Strategies and Competitive Advantage: The Role of Performance and InnovationNeeraj KumarNo ratings yet

- Volkswagen CI ManualDocument21 pagesVolkswagen CI ManualBarkerNo ratings yet

- Module 2 Shareholders Equity Students ReferenceDocument7 pagesModule 2 Shareholders Equity Students ReferencecynangelaNo ratings yet

- ACT 15 Finanzas InternacionalesDocument3 pagesACT 15 Finanzas InternacionalesVanessa HuitzNo ratings yet

- Fintech Regulations CIA-1 Semester 6Document10 pagesFintech Regulations CIA-1 Semester 6Yash KhandelwalNo ratings yet

- PgoldDocument12 pagesPgoldMaria Christine TorionNo ratings yet

- Cost of Capital (Practice Questions)Document2 pagesCost of Capital (Practice Questions)Wais Deen NazariNo ratings yet

- Latest-Digital-Marketing-Strategies-of-SMEs-in-Capas-Tarlac (Research Sample)Document35 pagesLatest-Digital-Marketing-Strategies-of-SMEs-in-Capas-Tarlac (Research Sample)paulmackelziecordovaNo ratings yet

- Trading JourneyDocument19 pagesTrading Journeysap.dosapatiNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/23 October/November 2021Document16 pagesCambridge International AS & A Level: Accounting 9706/23 October/November 2021Seham HameedNo ratings yet

- Chapter 6 Develop IT Business Plan and Lean Startup Canvas by Doc EVYDocument25 pagesChapter 6 Develop IT Business Plan and Lean Startup Canvas by Doc EVYitssamandezraNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (29)

- Chapter+12 Parkin PowerPointDocument19 pagesChapter+12 Parkin PowerPointkrcxpgsb47No ratings yet

- Money TheoryDocument10 pagesMoney Theoryetebark h/michaleNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- F2 Mock 2Document12 pagesF2 Mock 2Areeba alyNo ratings yet

- Q2 FY22 Financial TablesDocument13 pagesQ2 FY22 Financial TablesDennis AngNo ratings yet

- Q3 2023 Fintech Payments Public Comp Sheet and Valuation GuideDocument25 pagesQ3 2023 Fintech Payments Public Comp Sheet and Valuation GuidehojunxiongNo ratings yet

- Pricing Strategy Course NotesDocument11 pagesPricing Strategy Course NotesjosswayarmylopNo ratings yet

- BhavikaDocument131 pagesBhavikaAnupNo ratings yet

- Important Yt LinksDocument3 pagesImportant Yt Linksrosesingh00610No ratings yet

- Simple Loan Calculator and Amortization Table1Document7 pagesSimple Loan Calculator and Amortization Table1Justine Jay Chatto AlderiteNo ratings yet

- 1 Author Sachin Shahaji Suryawanshi Bharati Vidyapeeth Deemed University 11 PUBLICATIONS 1 CITATIONDocument5 pages1 Author Sachin Shahaji Suryawanshi Bharati Vidyapeeth Deemed University 11 PUBLICATIONS 1 CITATIONSarath MNo ratings yet

- Semifinal BSA Partnership CorporationDocument5 pagesSemifinal BSA Partnership Corporationycalinaj.cbaNo ratings yet

CapitalInv Daily Report (Jun 19) EN

CapitalInv Daily Report (Jun 19) EN

Uploaded by

Ahmad Abu shanabOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CapitalInv Daily Report (Jun 19) EN

CapitalInv Daily Report (Jun 19) EN

Uploaded by

Ahmad Abu shanabCopyright:

Available Formats

Jun 16, 2023

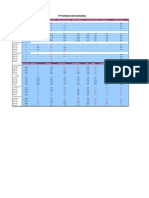

Economic and fundamental developments 19-6-2023

• The US dollar index settled near 102.33points.

• Gold prices witnessed a limited decline today, trading at levels around $1956.

• The morning trading saw notable differences in oil prices, with Brent trading at $76,

up 0.87%, while WTI fell to $70, down 1.05%.

• The markets are awaiting several important economic data releases this week, including

Federal Reserve Chairman Jerome Powell's testifies, as well as decisions from the Bank

of England.

Smart Reports

How they work:

Every day we outline a scenario that our technical analysis suggests has a 60-75% chance of

happening. Should this not occur, we offer a second scenario we believe to have 60-75%

probability if the first scenario does not happen.

The second scenario comes online only if the price of the security quoted falls below the

maximum price given in the second scenario. If this happens, the first scenario is no longer

‘live’.

These reports and analysis are not intended to replace your own analysis; independent research is

recommended.

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 1

Jun 16, 2023

XAUUSD19 Jun Trend: Up

Time frame: 60 mins

Current Price: 1956.39

Scenario one: Buy gold around 1961.00 with a target price of 1982.00

Alternative: Sell gold around 1952.00 with a target price of 1930.00

Comment: Trading above the support line and moving averages favors the rise

XAGUSD19 Jun Trend: Up

Time frame: 60 mins

Current Price: 24.10

Scenario one: Buy silver around 24.01with a target price of 24.52

Alternative: Sell silver around 23.75with a target price of 23.25

Comment: Trading above the support line and moving averages favors the rise

WTI USOILROLL19 Jun Trend: Up

Time frame: 60 mins

Current Price: 70.89

Scenario one: Buy Oil around 70.16with a target price of 72.18

Alternative: Sell Oil around 69.45with a target price of 67.43

Comment: Trading above the support line and moving averages favors the rise

WTI USOILQ3 Future Contract19 Jun Trend: Up

Time frame: 60 mins

Current Price: 70.91

Scenario one: Buy Oil around 70.18with a target price of 72.20

Alternative: Sell Oil around 69.34with a target price of 67.33

Comment: Trading above the support line and moving averages favors the rise

BRENT UKOILLROLL19 Jun Trend: Up

Time frame: 60 mins

Current Price: 75.46

Scenario one: Buy Oil around 75.03with a target price 77.05

Alternative: Sell Oil around 74.32a target price of 72.30

Comment: Trading above the support line and moving averages favors the rise

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 2

Jun 16, 2023

BRENT UKOILQ3 Future Contract19 Jun Trend: Up

Time frame: 60 mins

Current Price: 75.47

Scenario one: Buy Oil around 74.98with a target price of 77.01

Alternative: Sell Oil around 74.27with a target price of 72.25

Comment: Trading above the support line and moving averages favors the rise

EURUSD19 Jun Trend: Up

Time frame: 60 mins

Current Price: 1.0932

Scenario one: Buy the pair around 1.0916with a target price of 1.0968

Alternative: Sell the pair around 1.0890with a target price of 1.0841

Comment: Trading above the support line and moving averages favors the rise

GBPUSD19 Jun Trend: Up

Time frame: 60 mins

Current Price: 1.2810

Scenario one: Buy the pair around 1. 2793with a target price of 1.2854

Alternative: Sell the pair around 1. 2759with a target price of 1.2697

Comment: Trading above the support line and moving averages favors the rise

USDJPY19 Jun Trend: Up

Time frame: 60 mins

Current Price: 141.55

Scenario one: Buy the pair around 141.30with a target price of 142.35

Alternative Sell the pair around 140.82with a target price of 139.79

Comment: Trading above the support line and moving averages favors the rise

US30 19Jun Trend: Down

Time frame: 60 mins

Current Price: 34229.00

Scenario one: Sell the index around 34255.00 with a target price of 33954.00

Alternative: Buy the index around 34374.00 with a target price of 34674.00

Comment: Trading below the resistance and moving averages favors the fall.

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 3

Jun 16, 2023

US500 19Jun Trend: Down

Time frame: 60 mins

Current Price: 4403.00

Scenario one: Sell the index around 4406.00 with a target price of 4375.00

Alternative Buy the index around 4422.00 with a target price of 4454.00

Comment: Trading below the resistance and moving averages favors the fall.

UT100 19Jun Trend: Down

Time frame: 60 mins

Current Price: 15088.00

Scenario one: Sell the index around 15135.00 with a target price of 14981.00

Alternative: Buy the index around 15234.00 with a target price of 15388.00

Comment: Trading below the resistance and moving averages favors the fall.

DE30 (Dax) 19Jun Trend: Up

Time frame: 60 mins

Current Price: 16261.00

Scenario one: Buy the index around 16275.00 with a target price of 16428.00

Alternative: Sell the index around 16197.00 with a target price of 16044.00

Comment: Trading above the support line and moving averages favors the rise

JP225 (Nikkei) 19Jun Trend: Down

Time frame: 60 mins

Current Price: 33310.00

Scenario one: Sell the index around 33568.00 with a target price of 33114.00

Alternative: Buy the index around 33798.00 with a target price of 34239.00

Comment: Trading below the resistance and moving averages favors the fall.

UK100 (FTSE100) 19Jun Trend: Down

Time frame: 60 mins

Current Price: 7604.00

Scenario one: Sell the index around 7607.00 with a target price of 7567.00

Alternative: Buy the index around 7628.00 with a target price of 7668.00

Comment: Trading below the resistance and moving averages favors the fall.

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 4

Jun 16, 2023

EU50 (EURO Stoxx 50) 19Jun Trend: Down

Time frame: 60 mins

Current Price: 4370.00

Scenario one: Sell the index around 4377.00 with a target price of 4336.00

Alternative: Buy the index around 4398. 00with a target price of 4436.00

Comment: Trading below the resistance and moving averages favors the fall.

VIXRoll 19Jun Closed

USDCHF19 Jun Trend: Down

Time frame: 60 Mins

Current Price: 0.8942

Scenario one: Sell the pair around 0. 8944with a target price of 0.8902

Alternative Buy the pair around 0. 8965with a target price of 0.9006

Comment: Trading below the resistance and moving averages favors the fall.

USDCAD19 Jun Trend: Down

Time frame: 60mins

Current Price: 1.3215

Scenario one: Sell the pair around 1. 3244with a target price of 1.3202

Alternative: Buy the pair around 1. 3264with a target price of 1.3309

Comment: Trading below the resistance and moving averages favors the fall.

AUDUSD19 Jun Trend: Up

Time frame:60mins

Current Price: 0.6851

Scenario one: Buy the pair around 0. 6840with a target price of 0.6880

Alternative: Sell the pair around 0. 6819with a target price of 0.6778

Comment: Trading above the support line and moving averages favors the rise

NZDUSD19 Jun Trend: Up

Time frame:60mins

Current Price: 0.6213

Scenario one: Buy the pair around 0. 6206with a target price of 0.6246

Alternative: Sell the pair around 0. 6185with a target price of 0.6145

Comment: Trading above the support line and moving averages favors the rise

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 5

Jun 16, 2023

GBPJPY19 Jun Trend: Up

Time frame: 60 mins

Current Price: 181.37

Scenario one: Buy the pair around 180.91with a target price of 181.95

Alternative: Sell the pair around 180.41with a target price of 179.40

Comment: Trading above the support line and moving averages favors the rise

EURJPY19 Jun Trend: Up

Time frame: 60 mins

Current Price: 154.76

Scenario one: Buy the pair around 154.07with a target price of 155.10

Alternative: Sell the pair around 153.57with a target price of 152.55

Comment: Trading above the support line and moving averages favors the rise

EURGBP 19Jun Trend: Down

Time frame: 60 mins

Current Price: 0.8531

Scenario one: Sell the pair around 0. 8538a target price of 0.8507

Alternative: Buy the pair around 0. 8552with a target price of 0.8580

Comment: Trading below the resistance and moving averages favors the fall.

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 6

Jun 16, 2023

The tools used in this technical analysis today:

Classical technical analysis is the basic of predicting price movements, which is derived from

statistical and computational studies. Classical technical analysis is based on price action, peaks

and bottoms, along with price channels, support and resistance, and much Fibonacci ratios are

used.

Fibonacci ratios for use in the study of price movements, discovered by Leonardo Fibonacci in his

statistical and mathematical studies, tested for financial markets and price movements, and gave

excellent results for the prediction of wave propagation and wave interruption during the historical

test stages.

The exponential moving averages are instrumental in determining price trends and can be followed

to identify intersections that cause potential change of direction. In addition, moving averages of

different types represent support and resistance.

AROON is a pointer that determines whether the price is moving in a channel or not, and the

indicator also identifies potential reversal points in directions and also shows how strong the trend

is. Consists of the ascending line and the descending line, and their divergence indicates a channel

in favor of the upper line between them, and their proximity indicates the possibility of reversal or

trading in a weak direction.

The MACD is a momentum and oscillator, and exponential moving averages are used for its

calculation, and the convergence and divergence between these averages is calculated. Therefore,

one of the most important indicators used to integrate it between the measurement of torque and

trends together.

Disclaimer: The information and opinions contained in this document have been compiled in good faith from

sources believed to be reliable. Capital Investments makes no warranty as to the accuracy and completeness of

the information contained herein. All opinions and estimates included in this report constitute and reflect our

independent judgment as of the date published on the report and are subject to change without notice. Capital

Investments accepts no liability whatsoever for any loss of any kind arising out of the use of all or any part of

this report. Capital Investments and its related companies may have performed or seek to perform any

financial or advisory services for the companies mentioned in this report. Capital Investments, its funds, or its

employees may from time to time take positions or effect transactions in the securities issued by the companies

mentioned in this report. This document may not be reproduced in any form without the expressed written

permission of Capital Investments. The opinions contained within the report are based upon publicly available

information at the time of publication and are subject to change without notice. Prior to investing, investors

should seek independent financial, tax and legal advice.

For any further inquiries kindly contact us on +96265508309

DAILY FUNDAMENTAL AND TECHNICAL ANALYSIS 7

You might also like

- VSA GuideDocument59 pagesVSA GuideCryptoFX96% (50)

- Economics Unit 3 Frequently Asked QuestionsDocument19 pagesEconomics Unit 3 Frequently Asked QuestionsachinthaNo ratings yet

- Summer Internship Report Aim India 2019Document72 pagesSummer Internship Report Aim India 2019Rishabh Bamal100% (1)

- Trading Ebook - Options - Strategy - PosterDocument1 pageTrading Ebook - Options - Strategy - PosterHeemanshu Shah100% (1)

- Options Strategy PosterDocument1 pageOptions Strategy PosterMark Taylor86% (7)

- Equiti Securities Currencies Brokers LLC Letterhead English-95Document9 pagesEquiti Securities Currencies Brokers LLC Letterhead English-95Sam PupkinNo ratings yet

- Smart Report XauUsdDocument26 pagesSmart Report XauUsdGaspar CanoNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Getto PangandoyonNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25mrrrkkkNo ratings yet

- Economic and Fundamental Developments 14-07-2020: Securities SecuritiesDocument11 pagesEconomic and Fundamental Developments 14-07-2020: Securities Securitiesotto walikwaNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Jake VillaNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25mrrrkkkNo ratings yet

- Appendix X: Symbol Description Value RationaleDocument4 pagesAppendix X: Symbol Description Value RationaleqazwsxedcrfvwNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Trading CentralDocument7 pagesTrading Centralnamyadnan21No ratings yet

- VIP Analytics Global 190923Document9 pagesVIP Analytics Global 190923ovonoleunkeuNo ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Jun GomezNo ratings yet

- FX Commentary and Technical ViewsDocument2 pagesFX Commentary and Technical ViewsMuhammad Hasnain YousafNo ratings yet

- Daily MCX Newsletter 07 May 2014Document9 pagesDaily MCX Newsletter 07 May 2014Jeffrey PateNo ratings yet

- Daily MCX Newsletter 21 May 2014Document9 pagesDaily MCX Newsletter 21 May 2014Jeffrey PateNo ratings yet

- 2014-07-20 George Lea Web99 - Routines and Prep..Document41 pages2014-07-20 George Lea Web99 - Routines and Prep..Lisa KrissNo ratings yet

- Options Strategies PosterDocument1 pageOptions Strategies PosterFrank Ferrao100% (2)

- Daily Option News Letter: 24/june/ 2013Document7 pagesDaily Option News Letter: 24/june/ 2013api-218721197No ratings yet

- The Tsupitero Newsletter 12-02-2013Document7 pagesThe Tsupitero Newsletter 12-02-2013Cresjon MacalsNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- MCX Newsletter-Daily: 11-JULY-2013Document9 pagesMCX Newsletter-Daily: 11-JULY-2013api-230785654No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-248643986No ratings yet

- BPI Savings Account No. 3149-0491-25Document7 pagesBPI Savings Account No. 3149-0491-25Jake VillaNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-247872246No ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Daily Iforex Report 29th OCTOBER 2013: Trading TipsDocument10 pagesDaily Iforex Report 29th OCTOBER 2013: Trading Tipsapi-212478941No ratings yet

- VOLUME PROFILE - 部分5Document5 pagesVOLUME PROFILE - 部分5xufdddNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Options Trading (Advanced) ModuleDocument11 pagesOptions Trading (Advanced) ModuleavinashkakarlaNo ratings yet

- VIP Analytics Global 030124Document9 pagesVIP Analytics Global 030124chibambomechakNo ratings yet

- The Tsupitero Newsletter 06-17-2016 PDFDocument7 pagesThe Tsupitero Newsletter 06-17-2016 PDFJake VillaNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Daily MCX Newsletter: 1 1 1 17 7 7 7 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013Document9 pagesDaily MCX Newsletter: 1 1 1 17 7 7 7 - OCT OCT OCT Oct. - . - 2013 2013 2013 2013api-230785654No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-258080611No ratings yet

- FD Lecture IDocument34 pagesFD Lecture IAnkit JainNo ratings yet

- Investment Analysis and Portfolio ManagementDocument31 pagesInvestment Analysis and Portfolio ManagementRajaram SrinivasanNo ratings yet

- Analysis of FuturesDocument8 pagesAnalysis of FuturesytrahulpradeepNo ratings yet

- Derivative Report Erl 30-11-2016Document8 pagesDerivative Report Erl 30-11-2016Anjali SharmaNo ratings yet

- VIP_analytics_Global_250124Document9 pagesVIP_analytics_Global_250124Dhimas AdiputraNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-230785654No ratings yet

- Daily Technical Analysis Report 22 May 2011Document34 pagesDaily Technical Analysis Report 22 May 2011santhosh5948289No ratings yet

- Dangerous Iron Condor Given WebinarDocument16 pagesDangerous Iron Condor Given Webinariopdodo0% (1)

- Investment Analysis and Portfolio Management: Gareth MylesDocument32 pagesInvestment Analysis and Portfolio Management: Gareth MyleshoalongkiemNo ratings yet

- Daily MCX NewsletterDocument9 pagesDaily MCX Newsletterapi-192953649No ratings yet

- Daily MCX Newsletter 28 May 2014Document9 pagesDaily MCX Newsletter 28 May 2014Jeffrey PateNo ratings yet

- Article of Derivative Strategist)Document3 pagesArticle of Derivative Strategist)Sanju GohilNo ratings yet

- Please Don't Get Cocky: April 2013 Volume 4, No. 7Document6 pagesPlease Don't Get Cocky: April 2013 Volume 4, No. 7Marites Mayo CuyosNo ratings yet

- Daily Option News Letter 18 July 2013Document7 pagesDaily Option News Letter 18 July 2013Rakhi Sharma Tips ProviderNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- FIFA 16 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!From EverandFIFA 16 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!No ratings yet

- FIFA 15 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!From EverandFIFA 15 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!Rating: 5 out of 5 stars5/5 (1)

- Chapter 1&2 Agricultural MarketingDocument44 pagesChapter 1&2 Agricultural Marketingzelalemmekonnen823100% (1)

- Advani Hotels AR2023Document227 pagesAdvani Hotels AR2023Sriram RanganathanNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaDocument15 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaebeanandeNo ratings yet

- Trading in Securities and RegulationsDocument25 pagesTrading in Securities and Regulationsgunn RastogiNo ratings yet

- Business Strategies and Competitive Advantage: The Role of Performance and InnovationDocument31 pagesBusiness Strategies and Competitive Advantage: The Role of Performance and InnovationNeeraj KumarNo ratings yet

- Volkswagen CI ManualDocument21 pagesVolkswagen CI ManualBarkerNo ratings yet

- Module 2 Shareholders Equity Students ReferenceDocument7 pagesModule 2 Shareholders Equity Students ReferencecynangelaNo ratings yet

- ACT 15 Finanzas InternacionalesDocument3 pagesACT 15 Finanzas InternacionalesVanessa HuitzNo ratings yet

- Fintech Regulations CIA-1 Semester 6Document10 pagesFintech Regulations CIA-1 Semester 6Yash KhandelwalNo ratings yet

- PgoldDocument12 pagesPgoldMaria Christine TorionNo ratings yet

- Cost of Capital (Practice Questions)Document2 pagesCost of Capital (Practice Questions)Wais Deen NazariNo ratings yet

- Latest-Digital-Marketing-Strategies-of-SMEs-in-Capas-Tarlac (Research Sample)Document35 pagesLatest-Digital-Marketing-Strategies-of-SMEs-in-Capas-Tarlac (Research Sample)paulmackelziecordovaNo ratings yet

- Trading JourneyDocument19 pagesTrading Journeysap.dosapatiNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/23 October/November 2021Document16 pagesCambridge International AS & A Level: Accounting 9706/23 October/November 2021Seham HameedNo ratings yet

- Chapter 6 Develop IT Business Plan and Lean Startup Canvas by Doc EVYDocument25 pagesChapter 6 Develop IT Business Plan and Lean Startup Canvas by Doc EVYitssamandezraNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (29)

- Chapter+12 Parkin PowerPointDocument19 pagesChapter+12 Parkin PowerPointkrcxpgsb47No ratings yet

- Money TheoryDocument10 pagesMoney Theoryetebark h/michaleNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- F2 Mock 2Document12 pagesF2 Mock 2Areeba alyNo ratings yet

- Q2 FY22 Financial TablesDocument13 pagesQ2 FY22 Financial TablesDennis AngNo ratings yet

- Q3 2023 Fintech Payments Public Comp Sheet and Valuation GuideDocument25 pagesQ3 2023 Fintech Payments Public Comp Sheet and Valuation GuidehojunxiongNo ratings yet

- Pricing Strategy Course NotesDocument11 pagesPricing Strategy Course NotesjosswayarmylopNo ratings yet

- BhavikaDocument131 pagesBhavikaAnupNo ratings yet

- Important Yt LinksDocument3 pagesImportant Yt Linksrosesingh00610No ratings yet

- Simple Loan Calculator and Amortization Table1Document7 pagesSimple Loan Calculator and Amortization Table1Justine Jay Chatto AlderiteNo ratings yet

- 1 Author Sachin Shahaji Suryawanshi Bharati Vidyapeeth Deemed University 11 PUBLICATIONS 1 CITATIONDocument5 pages1 Author Sachin Shahaji Suryawanshi Bharati Vidyapeeth Deemed University 11 PUBLICATIONS 1 CITATIONSarath MNo ratings yet

- Semifinal BSA Partnership CorporationDocument5 pagesSemifinal BSA Partnership Corporationycalinaj.cbaNo ratings yet