Professional Documents

Culture Documents

Paslc 43079 2022 Atrm

Paslc 43079 2022 Atrm

Uploaded by

Mr AndersonCopyright:

Available Formats

You might also like

- M&T Bank Statement - 1Document2 pagesM&T Bank Statement - 1Matt DerrickNo ratings yet

- TD Bank StatementDocument1 pageTD Bank StatementBaba d100% (2)

- Complete FreedomDocument24 pagesComplete Freedomelatucker1No ratings yet

- Premier Checking: Account # 5780027801Document1 pagePremier Checking: Account # 5780027801Nurul IslamNo ratings yet

- Bank STDocument1 pageBank STnurulamin00023No ratings yet

- M&T Bank StatementDocument1 pageM&T Bank StatementrolphcourtenayNo ratings yet

- TD Business Premier Checking: Account SummaryDocument3 pagesTD Business Premier Checking: Account SummaryJohn Bean75% (4)

- ACFrOgAsVvp8FSzbeM2VRGWjClHn9HJlWODlJCAZ4hQSuEM-1BESC96nqQyNyoQ7B PA4mSAZCXFyOacuu6fpjru6LIUdnot ICvca0FlISnGGmU88PzGP5Ye6FlM62FVx2Hy-0GWPEUog27I7GjDocument1 pageACFrOgAsVvp8FSzbeM2VRGWjClHn9HJlWODlJCAZ4hQSuEM-1BESC96nqQyNyoQ7B PA4mSAZCXFyOacuu6fpjru6LIUdnot ICvca0FlISnGGmU88PzGP5Ye6FlM62FVx2Hy-0GWPEUog27I7GjRonald MwewaNo ratings yet

- Glendale Police Department Training Documents: DT Instructor ManualDocument316 pagesGlendale Police Department Training Documents: DT Instructor ManualMichael_Roberts2019100% (1)

- William Richardson TD-Bank-StatementDocument5 pagesWilliam Richardson TD-Bank-StatementJonathan Seagull Livingston100% (1)

- TD Mar 2021Document8 pagesTD Mar 2021James FranklinNo ratings yet

- Collier County Tigertail Beach Park Concessionaires On Marco Island - March 9, 2021Document17 pagesCollier County Tigertail Beach Park Concessionaires On Marco Island - March 9, 2021Omar Rodriguez OrtizNo ratings yet

- Paslc 84681 2023 TrimDocument2 pagesPaslc 84681 2023 TrimphantomhabzicNo ratings yet

- Broward County Real Estate 504209 18 0434 2022 Installment Bill 1Document1 pageBroward County Real Estate 504209 18 0434 2022 Installment Bill 1skycastleoaksNo ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572hanhNo ratings yet

- Dallas County Briefing and Court Order PDFDocument3 pagesDallas County Briefing and Court Order PDFThe TexanNo ratings yet

- TD Bank Statement - Scott W Springer#2Document2 pagesTD Bank Statement - Scott W Springer#2fehijan689No ratings yet

- 2022 Ococ0594962002Document1 page2022 Ococ0594962002john yorkNo ratings yet

- NRSC - Gross ComplaintDocument10 pagesNRSC - Gross ComplaintJacob OglesNo ratings yet

- Patricia Fairclough-Staggers' Conflicting TRIM NoticesDocument1 pagePatricia Fairclough-Staggers' Conflicting TRIM NoticesBen KellerNo ratings yet

- Net Pay: 541.40: Rate Hours/Units Current Period Year To Date EarningsDocument8 pagesNet Pay: 541.40: Rate Hours/Units Current Period Year To Date EarningslplclcircNo ratings yet

- Kossuth County Iowa FY 25 Full Budget - ApprovedDocument16 pagesKossuth County Iowa FY 25 Full Budget - ApprovedLocal 5 News (WOI-TV)No ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572Abdelali ArabNo ratings yet

- Bills List For 10-12-10Document4 pagesBills List For 10-12-10Ewing Township, NJNo ratings yet

- 22bca20044 Exp1Document2 pages22bca20044 Exp1Yash SiwachNo ratings yet

- 07.2022 - PPS Pampanga - SSS PRNDocument2 pages07.2022 - PPS Pampanga - SSS PRNSharmaine Jane SanoriasNo ratings yet

- DownloadDocument2 pagesDownloadChelsea KayeNo ratings yet

- Faith Il SepDocument4 pagesFaith Il SephittaNo ratings yet

- TD BankDocument1 pageTD BankShaggy Shag0% (1)

- December 2022Document5 pagesDecember 2022NURSAJIDANo ratings yet

- Statement of Idbi Statites 1980 1 - 2003Document6 pagesStatement of Idbi Statites 1980 1 - 2003Gaurav Kumar MishraNo ratings yet

- DELTA CCU Business Premier Checking: Account SummyarDocument1 pageDELTA CCU Business Premier Checking: Account SummyarSAMNo ratings yet

- Premier Checking: Account # 60731767Document1 pagePremier Checking: Account # 60731767nurulamin00023No ratings yet

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNo ratings yet

- DELTA CCU Business Premier Checking: Account SummyarDocument1 pageDELTA CCU Business Premier Checking: Account SummyarSAMNo ratings yet

- Agency Description HSL AgencyDocument40 pagesAgency Description HSL AgencyHazraphine LinsoNo ratings yet

- Bank Statement ChequingDocument2 pagesBank Statement ChequingRitu SainiNo ratings yet

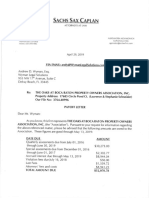

- Payoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners AssociationDocument4 pagesPayoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners Associationlarry-612445100% (1)

- Toa 3Document1 pageToa 3rashfordkunleNo ratings yet

- Miami Dade Tangible Property 20 159220 2023 Annual BillDocument1 pageMiami Dade Tangible Property 20 159220 2023 Annual Billp13607091No ratings yet

- Adjusted Trial Balance 12.31.22Document6 pagesAdjusted Trial Balance 12.31.22qhi.cgmacatiagNo ratings yet

- EStatement 2021 06 25 56667Document6 pagesEStatement 2021 06 25 56667Keith HollyNo ratings yet

- Account StatementDocument12 pagesAccount StatementAli RazaNo ratings yet

- Financial Statment Feb 7 2021Document6 pagesFinancial Statment Feb 7 2021Haileleul TeshomeNo ratings yet

- Trail BalanceDocument22 pagesTrail BalanceDennis lugodNo ratings yet

- Shubham TiwariDocument8 pagesShubham Tiwarikirasasan01.rsa.infraNo ratings yet

- Truth in Mileage For Kelvin StaggersDocument1 pageTruth in Mileage For Kelvin StaggersBen KellerNo ratings yet

- 2022 11 01 - 2023 10 31 - TransactionDocument40 pages2022 11 01 - 2023 10 31 - TransactionChidinma NnoliNo ratings yet

- Lightfield Less Lethal Research Contract With Allegheny County JailDocument30 pagesLightfield Less Lethal Research Contract With Allegheny County JailAllegheny JOB WatchNo ratings yet

- TD Bank Statement Usa Bank StatementsDocument1 pageTD Bank Statement Usa Bank StatementsEllerNo ratings yet

- 2017 Statement of TaxesDocument2 pages2017 Statement of TaxesJohnnyLarsonNo ratings yet

- Statement 3Document8 pagesStatement 3GeminiCrescentNo ratings yet

- 2 NDDocument3 pages2 NDwaqar aslamNo ratings yet

- PNB Project SOA Jan 2021Document1 pagePNB Project SOA Jan 2021Nia Grace Lee AtalinNo ratings yet

- Proyecto y Departamento de Carlos Loret, Están Registrados en 2 PARAISOS FISCALES Parte 1Document1 pageProyecto y Departamento de Carlos Loret, Están Registrados en 2 PARAISOS FISCALES Parte 1enlapolitikaNo ratings yet

- 07.2022 - PPS Tarlac - SSS PRNDocument2 pages07.2022 - PPS Tarlac - SSS PRNSharmaine Jane SanoriasNo ratings yet

- Delores Douglas Paystub 091222-092522Document1 pageDelores Douglas Paystub 091222-092522Otega Overere VictorNo ratings yet

- 21 AprilDocument1 page21 AprilAshokNo ratings yet

- Cash ManagementDocument30 pagesCash ManagementankitaNo ratings yet

- A Study On Customer Satisfaction With Special Refrence To All A'S and P'S of Marketing at Mandovi Motors in Banglore'Document9 pagesA Study On Customer Satisfaction With Special Refrence To All A'S and P'S of Marketing at Mandovi Motors in Banglore'Shubham YadavNo ratings yet

- Phimosis N ParaphimosisDocument14 pagesPhimosis N ParaphimosisDhella 'gungeyha' RangkutyNo ratings yet

- TSB 2000010 Technical Overview of The STERILIZABLEBAGDocument4 pagesTSB 2000010 Technical Overview of The STERILIZABLEBAGdatinjacabNo ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- 801 Fish MenuDocument1 page801 Fish MenuNancy StilesNo ratings yet

- HospitalDocument18 pagesHospitalJeffrey ViernesNo ratings yet

- Puntel Metafísica Um TradicionalDocument22 pagesPuntel Metafísica Um TradicionalAlexandroNo ratings yet

- Rob Corry Letter About Driving Under The Influence of Drugs BillDocument2 pagesRob Corry Letter About Driving Under The Influence of Drugs BillMichael_Lee_RobertsNo ratings yet

- Ipo Sylabus and BooksDocument3 pagesIpo Sylabus and BooksNaseema Chan ShaikNo ratings yet

- Proc Q and A - 2022updated V1Document47 pagesProc Q and A - 2022updated V1dreamsky702243No ratings yet

- Poranek (Peer Gynt)Document21 pagesPoranek (Peer Gynt)Katarzyna ChronowskaNo ratings yet

- Proof in Mathematics - An Introd - Albert DaoudDocument116 pagesProof in Mathematics - An Introd - Albert DaoudCindy100% (1)

- Descriptive Survey ResearchDocument6 pagesDescriptive Survey ResearchAbdullah HashmiNo ratings yet

- Lesson 9: The Discipline of Communication: Part I. Learning Module InformationDocument6 pagesLesson 9: The Discipline of Communication: Part I. Learning Module Informationcindy juntong100% (1)

- Affirmations To Balance Meridians and EmotionsDocument2 pagesAffirmations To Balance Meridians and EmotionsMario L M Ramos100% (1)

- STARBUCKS Market AnalysisDocument11 pagesSTARBUCKS Market AnalysisMirela GrNo ratings yet

- Educational Implications of Classical ConditioningDocument2 pagesEducational Implications of Classical Conditioningmekit bekeleNo ratings yet

- Johnrey For Demo DLPDocument8 pagesJohnrey For Demo DLPmelany r. malvarosaNo ratings yet

- 114 Layout Secrets For Your Framing Square PDFDocument2 pages114 Layout Secrets For Your Framing Square PDFHomerSimsonnakis100% (1)

- Case Analysis MASICAPDocument12 pagesCase Analysis MASICAPJanice ManansalaNo ratings yet

- Film ArtsDocument29 pagesFilm ArtsRoselyn Estrada MunioNo ratings yet

- Ito 2015Document8 pagesIto 2015laurabarbosamedNo ratings yet

- 2021-07-01.09-51-45.atom Amp Instructions en 06292021Document7 pages2021-07-01.09-51-45.atom Amp Instructions en 06292021Alessio PolonaraNo ratings yet

- 02b. BANDO Conveyor Belt Rubber Sheet Rubber Lagging Presentation PDFDocument41 pages02b. BANDO Conveyor Belt Rubber Sheet Rubber Lagging Presentation PDFYuliantoNo ratings yet

- Classification of FolkdanceDocument2 pagesClassification of FolkdanceMica CasimeroNo ratings yet

- 1-To-8 4K HDMI Distribution Amplifier: HD-DA8-4K-EDocument3 pages1-To-8 4K HDMI Distribution Amplifier: HD-DA8-4K-EthomvalensiNo ratings yet

- Cost Efficient Construction: Chapter OneDocument21 pagesCost Efficient Construction: Chapter Onemequanent adinoNo ratings yet

Paslc 43079 2022 Atrm

Paslc 43079 2022 Atrm

Uploaded by

Mr AndersonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paslc 43079 2022 Atrm

Paslc 43079 2022 Atrm

Uploaded by

Mr AndersonCopyright:

Available Formats

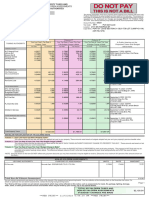

AMENDED

PROPOSED OR ADOPTED NON-AD VALOREM ASSESSMENTS

DO NOT PAY

Parcel ID 3419-545-0039-000-1

THIS IS NOT A BILL

The taxing authorities which levy property taxes against your property will soon hold

PUBLIC HEARINGS to adopt budgets and tax rates for the next year. The purpose of

the PUBLIC HEARINGS is to receive opinions from the general public and to answer

questions on the proposed tax change and budget PRIOR TO TAKING FINAL

ACTION. Each taxing authority may AMEND OR ALTER its proposals at the hearing.

Account Number: 43079

Tax Code: 0002 Saint Lucie County

Ryan M Melendy / Margaret T Melendy

Location: 705 SE AIROSO BLVD

705 SE Airoso BLVD Legal Desc: RIVER PARK-UNIT 6- BLK 58 LOT 1 (MAP 34/28S)

Port Saint Lucie, FL 34983-2008

Column 1* Column 2* Column 3*

Your Last Year's Tax Rate & Your Tax Rate & Taxes This Year Your Tax Rate & Taxes This Year A Public Hearing on the

TAXING AUTHORITY

Property Taxes If No Budget Change is Made If Budget Change is Made Proposed Taxes and Budget

Tax Rate Tax Amount Tax Rate Tax Amount Tax Rate Tax Amount will be held:

GENERAL COUNTY

SLC General Fund 4.2077 154.54 3.7118 145.98 4.2077 165.48 September 8, 2022 6:00 PM

Jail,Law Enf 2.9824 109.53 2.6419 103.90 2.7294 107.34 2300 Virginia Ave 3rd Floor, Fort Pierce

Erosion Dist E 0.1763 6.47 0.1544 6.07 0.1763 6.93 (772) 462-1670

Mosquito Control 0.1352 4.97 0.1185 4.66 0.1352 5.32

SLC Stormwater 0.4731 17.38 0.4293 16.88 0.4731 18.61

Community Dev MSTU 0.4300 15.79 0.3902 15.35 0.4300 16.91

Law Enforc MSTU 0.9103 33.43 0.8260 32.48 0.9103 35.80

County Parks 0.2313 8.49 0.2023 7.96 0.1813 7.13

County Transit 0.1269 4.66 0.1111 4.37 0.1269 4.99

PUBLIC SCHOOLS

By State Law 3.6050 222.53 2.9505 189.80 3.2310 207.84 September 13, 2022 5:01 PM

By Local Board 3.2480 200.49 2.6583 171.00 3.2480 208.94 9461 Brandywine Ln, PSL

(772) 429-3970

MUNICIPALITY

WATER MANAGEMENT

S FL Wtr Mgmt Dist 0.1061 3.90 0.0948 3.73 0.0948 3.73 September 8, 2022 5:15 PM

SFWMD-Okee Basin 0.1146 4.21 0.1026 4.04 0.1026 4.04 3301 Gun Club Rd Bldg B-1, WPB

Everglades Project 0.0365 1.34 0.0327 1.29 0.0327 1.29 (561) 686-8800

INDEPENDENT DISTRICTS

SLC Fire Dist 3.0000 110.18 2.6276 103.34 3.0000 117.98 September 7, 2022 5:01 PM

5160 NW Milner Dr, PSL

(772) 621-3400

FL Inland Nav Dist 0.0320 1.18 0.0287 1.13 0.0320 1.26 September 8, 2022 5:05 PM

221 SW 3rd Ave MIASF Bldg, Ft Laud

(561) 627-3386

Children`s Services 0.4544 16.69 0.3980 15.65 0.4025 15.83 September 6, 2022 5:01 PM

546 NW University Blvd, PSL

(772) 408-1100

VOTER APPROVED DEBT SERVICE

Total Property Taxes $915.78 $827.63 $929.42

SEE BELOW FOR EXPLANATION OF THE COLUMNS ABOVE.

*Column 1 - "Your Last Year's Tax Rate & Property Taxes"

This column shows the tax rate and taxes that applied last year to your property. These amounts were based on budgets adopted last year and your property's previous taxable value.

*Column 2 - "Your Tax Rate & Taxes This Year If No Budget Change is Made"

This column shows what the tax rate and your taxes will be this year IF EACH TAXING AUTHORITY DOES NOT CHANGE ITS PROPERTY TAX LEVY. These amounts are based on last

year's budgets and your current assessment.

*Column 3 - "Your Tax Rate & Taxes This Year If Budget Change is Made"

This column shows what the tax rate and your taxes will be this year under the BUDGET ACTUALLY PROPOSED by each local taxing authority. The proposal is NOT final and may be

amended at the public hearings shown above. The difference between columns 2 and 3 is the tax change proposed by each local taxing authority and is NOT the result of higher

assessments.

*NOTE: Amounts shown on this form DO NOT reflect early payment discounts you may have received or may be eligible to receive. (Discounts are a maximum of 4 percent of the amounts shown on

this form.)

NON-AD VALOREM ASSESSMENTS

LEVYING AUTHORITY PURPOSE OF ASSESSMENT UNITS RATE AMOUNT

County Solid Waste Waste Disposal Services (772) 462-1631 12.00000 23.330 279.96

River Park 1 Street Lights (772) 462-3500 1.00000 25.000 25.00

Total Non-Ad Valorem Assessment $304.96

Non-ad valorem assessments are placed on this notice at the request of the respective local governing boards. Your tax collector will be including them on the November tax notice. For

details on particular non-ad valorem assessments, contact the levying local governing board.

Page 1

Your final tax bill may contain non-ad valorem assessments which may not be reflected on this notice, such as assessments for roads, fire, garbage, lighting, drainage,

water, sewer, or other governmental services and facilities which may be levied by your county, city or any special district.

TOTAL AD VALOREM TAXES AND TOTAL AD VALOREM TAXES AND

NON-AD VALOREM ASSESSMENTS $9,403.08 NON-AD VALOREM ASSESSMENTS $1,234.38

FROM LAST YEAR IF BUDGET CHANGES ARE MADE

**WEB PRINT** 6/23/2023 3:37:40 PM **WEB PRINT**

DO NOT PAY - THIS IS NOT A BILL

Michelle Franklin

Certified Florida Appraiser

3419-545-0039-000-1

Tax Code: 0002 Saint Lucie County Account Number: 43079

Location: 705 SE AIROSO BLVD Legal Desc: RIVER PARK-UNIT 6- BLK 58 LOT 1 (MAP 34/28S)

Property Valuation

Last Year This Year

Market Value

153,800 206,700

Assessed Value Exemptions Taxable Value

Taxing Authority Last Year This Year Last Year This Year Last Year This Year

County 86,727 89,328 50,000 50,000 36,727 39,328

Public Schools 86,727 89,328 25,000 25,000 61,727 64,328

Municipality

Water Management 86,727 89,328 50,000 50,000 36,727 39,328

Independent Districts 86,727 89,328 50,000 50,000 36,727 39,328

Voter Approved Debt Service

Assessment Reductions / Portability Applies to Value

Save Our Homes All Funds 117,372

Exemptions* Applies to Last Year This Year

First Homestead All Funds 25,000 25,000

Additional Homestead Non-School Funds 25,000 25,000

*Where more than one value exists, county value of exemption will be indicated

If you feel that the market value of your property is inaccurate or does not If the property appraiser's office is unable to resolve the matter as to market

reflect fair market value, or if you are entitled to an exemption or value, classification, or an exemption, you may file a petition for adjustment

classification that is not reflected on this form, contact the with the Value Adjustment Board. Petition forms are available from the

Saint Lucie County Property Appraiser at: County Property Appraiser and must be filed

2300 Virginia Ave Rm 121, Fort Pierce, FL 34982 ON OR BEFORE:

or (772) 462-1021 September 12, 2022

Market Value: Market (also called "just") value is the most probable sale price for your property in a competitive, open market. It is based on a willing buyer

and a willing seller.

Assessed Value: Assessed value is the market value of your property minus any assessment reductions. The assessed value may be different for levies

made by different taxing authorities.

Assessment Reductions / Portability:

Properties can receive an assessment reduction for a number of reasons. Some of the common reasons are below.

•There are limits on how much the assessment of your property can increase each year. The Save Our Homes program and the limitation for

non-homestead property are examples.

•Certain types of property, such as agricultural land and land used for conservation, are valued on their current use rather than their market value.

•Some reductions lower the assessed value only for levies of certain taxing authorities.

If your assessed value is lower than your market value because limits on increases apply to your property or because your property is valued based on its

current use, the amount of the difference and reason for the difference are listed in the box titled "Assessment Reductions".

Exemptions: Exemptions that apply to your property are listed in this section along with its corresponding exemption value. Specific dollar or percentage

reductions in assessed value may be applicable to a property based upon certain qualifications of the property or property owner. In some cases, an

exemption's value may vary depending on the taxing authority. The tax impact of an exemption may also vary for the same taxing authority, depending on

the levy (e.g., operating millage vs. debt service millage).

Taxable Value: Taxable value is the value used to calculate the tax due on your property. Taxable value is the assessed value minus the value of your

exemptions and discounts.

Our Promise to You... www.paslc.gov

Superior Service, Trusted Results (772) 462-1021

Page 2

**WEB PRINT** 6/23/2023 3:37:40 PM **WEB PRINT**

You might also like

- M&T Bank Statement - 1Document2 pagesM&T Bank Statement - 1Matt DerrickNo ratings yet

- TD Bank StatementDocument1 pageTD Bank StatementBaba d100% (2)

- Complete FreedomDocument24 pagesComplete Freedomelatucker1No ratings yet

- Premier Checking: Account # 5780027801Document1 pagePremier Checking: Account # 5780027801Nurul IslamNo ratings yet

- Bank STDocument1 pageBank STnurulamin00023No ratings yet

- M&T Bank StatementDocument1 pageM&T Bank StatementrolphcourtenayNo ratings yet

- TD Business Premier Checking: Account SummaryDocument3 pagesTD Business Premier Checking: Account SummaryJohn Bean75% (4)

- ACFrOgAsVvp8FSzbeM2VRGWjClHn9HJlWODlJCAZ4hQSuEM-1BESC96nqQyNyoQ7B PA4mSAZCXFyOacuu6fpjru6LIUdnot ICvca0FlISnGGmU88PzGP5Ye6FlM62FVx2Hy-0GWPEUog27I7GjDocument1 pageACFrOgAsVvp8FSzbeM2VRGWjClHn9HJlWODlJCAZ4hQSuEM-1BESC96nqQyNyoQ7B PA4mSAZCXFyOacuu6fpjru6LIUdnot ICvca0FlISnGGmU88PzGP5Ye6FlM62FVx2Hy-0GWPEUog27I7GjRonald MwewaNo ratings yet

- Glendale Police Department Training Documents: DT Instructor ManualDocument316 pagesGlendale Police Department Training Documents: DT Instructor ManualMichael_Roberts2019100% (1)

- William Richardson TD-Bank-StatementDocument5 pagesWilliam Richardson TD-Bank-StatementJonathan Seagull Livingston100% (1)

- TD Mar 2021Document8 pagesTD Mar 2021James FranklinNo ratings yet

- Collier County Tigertail Beach Park Concessionaires On Marco Island - March 9, 2021Document17 pagesCollier County Tigertail Beach Park Concessionaires On Marco Island - March 9, 2021Omar Rodriguez OrtizNo ratings yet

- Paslc 84681 2023 TrimDocument2 pagesPaslc 84681 2023 TrimphantomhabzicNo ratings yet

- Broward County Real Estate 504209 18 0434 2022 Installment Bill 1Document1 pageBroward County Real Estate 504209 18 0434 2022 Installment Bill 1skycastleoaksNo ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572hanhNo ratings yet

- Dallas County Briefing and Court Order PDFDocument3 pagesDallas County Briefing and Court Order PDFThe TexanNo ratings yet

- TD Bank Statement - Scott W Springer#2Document2 pagesTD Bank Statement - Scott W Springer#2fehijan689No ratings yet

- 2022 Ococ0594962002Document1 page2022 Ococ0594962002john yorkNo ratings yet

- NRSC - Gross ComplaintDocument10 pagesNRSC - Gross ComplaintJacob OglesNo ratings yet

- Patricia Fairclough-Staggers' Conflicting TRIM NoticesDocument1 pagePatricia Fairclough-Staggers' Conflicting TRIM NoticesBen KellerNo ratings yet

- Net Pay: 541.40: Rate Hours/Units Current Period Year To Date EarningsDocument8 pagesNet Pay: 541.40: Rate Hours/Units Current Period Year To Date EarningslplclcircNo ratings yet

- Kossuth County Iowa FY 25 Full Budget - ApprovedDocument16 pagesKossuth County Iowa FY 25 Full Budget - ApprovedLocal 5 News (WOI-TV)No ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572Abdelali ArabNo ratings yet

- Bills List For 10-12-10Document4 pagesBills List For 10-12-10Ewing Township, NJNo ratings yet

- 22bca20044 Exp1Document2 pages22bca20044 Exp1Yash SiwachNo ratings yet

- 07.2022 - PPS Pampanga - SSS PRNDocument2 pages07.2022 - PPS Pampanga - SSS PRNSharmaine Jane SanoriasNo ratings yet

- DownloadDocument2 pagesDownloadChelsea KayeNo ratings yet

- Faith Il SepDocument4 pagesFaith Il SephittaNo ratings yet

- TD BankDocument1 pageTD BankShaggy Shag0% (1)

- December 2022Document5 pagesDecember 2022NURSAJIDANo ratings yet

- Statement of Idbi Statites 1980 1 - 2003Document6 pagesStatement of Idbi Statites 1980 1 - 2003Gaurav Kumar MishraNo ratings yet

- DELTA CCU Business Premier Checking: Account SummyarDocument1 pageDELTA CCU Business Premier Checking: Account SummyarSAMNo ratings yet

- Premier Checking: Account # 60731767Document1 pagePremier Checking: Account # 60731767nurulamin00023No ratings yet

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNo ratings yet

- DELTA CCU Business Premier Checking: Account SummyarDocument1 pageDELTA CCU Business Premier Checking: Account SummyarSAMNo ratings yet

- Agency Description HSL AgencyDocument40 pagesAgency Description HSL AgencyHazraphine LinsoNo ratings yet

- Bank Statement ChequingDocument2 pagesBank Statement ChequingRitu SainiNo ratings yet

- Payoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners AssociationDocument4 pagesPayoff Letter From Gonzalez, Counsel Sachs Sax Caplan For Oaks at Boca Raton Property Owners Associationlarry-612445100% (1)

- Toa 3Document1 pageToa 3rashfordkunleNo ratings yet

- Miami Dade Tangible Property 20 159220 2023 Annual BillDocument1 pageMiami Dade Tangible Property 20 159220 2023 Annual Billp13607091No ratings yet

- Adjusted Trial Balance 12.31.22Document6 pagesAdjusted Trial Balance 12.31.22qhi.cgmacatiagNo ratings yet

- EStatement 2021 06 25 56667Document6 pagesEStatement 2021 06 25 56667Keith HollyNo ratings yet

- Account StatementDocument12 pagesAccount StatementAli RazaNo ratings yet

- Financial Statment Feb 7 2021Document6 pagesFinancial Statment Feb 7 2021Haileleul TeshomeNo ratings yet

- Trail BalanceDocument22 pagesTrail BalanceDennis lugodNo ratings yet

- Shubham TiwariDocument8 pagesShubham Tiwarikirasasan01.rsa.infraNo ratings yet

- Truth in Mileage For Kelvin StaggersDocument1 pageTruth in Mileage For Kelvin StaggersBen KellerNo ratings yet

- 2022 11 01 - 2023 10 31 - TransactionDocument40 pages2022 11 01 - 2023 10 31 - TransactionChidinma NnoliNo ratings yet

- Lightfield Less Lethal Research Contract With Allegheny County JailDocument30 pagesLightfield Less Lethal Research Contract With Allegheny County JailAllegheny JOB WatchNo ratings yet

- TD Bank Statement Usa Bank StatementsDocument1 pageTD Bank Statement Usa Bank StatementsEllerNo ratings yet

- 2017 Statement of TaxesDocument2 pages2017 Statement of TaxesJohnnyLarsonNo ratings yet

- Statement 3Document8 pagesStatement 3GeminiCrescentNo ratings yet

- 2 NDDocument3 pages2 NDwaqar aslamNo ratings yet

- PNB Project SOA Jan 2021Document1 pagePNB Project SOA Jan 2021Nia Grace Lee AtalinNo ratings yet

- Proyecto y Departamento de Carlos Loret, Están Registrados en 2 PARAISOS FISCALES Parte 1Document1 pageProyecto y Departamento de Carlos Loret, Están Registrados en 2 PARAISOS FISCALES Parte 1enlapolitikaNo ratings yet

- 07.2022 - PPS Tarlac - SSS PRNDocument2 pages07.2022 - PPS Tarlac - SSS PRNSharmaine Jane SanoriasNo ratings yet

- Delores Douglas Paystub 091222-092522Document1 pageDelores Douglas Paystub 091222-092522Otega Overere VictorNo ratings yet

- 21 AprilDocument1 page21 AprilAshokNo ratings yet

- Cash ManagementDocument30 pagesCash ManagementankitaNo ratings yet

- A Study On Customer Satisfaction With Special Refrence To All A'S and P'S of Marketing at Mandovi Motors in Banglore'Document9 pagesA Study On Customer Satisfaction With Special Refrence To All A'S and P'S of Marketing at Mandovi Motors in Banglore'Shubham YadavNo ratings yet

- Phimosis N ParaphimosisDocument14 pagesPhimosis N ParaphimosisDhella 'gungeyha' RangkutyNo ratings yet

- TSB 2000010 Technical Overview of The STERILIZABLEBAGDocument4 pagesTSB 2000010 Technical Overview of The STERILIZABLEBAGdatinjacabNo ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- 801 Fish MenuDocument1 page801 Fish MenuNancy StilesNo ratings yet

- HospitalDocument18 pagesHospitalJeffrey ViernesNo ratings yet

- Puntel Metafísica Um TradicionalDocument22 pagesPuntel Metafísica Um TradicionalAlexandroNo ratings yet

- Rob Corry Letter About Driving Under The Influence of Drugs BillDocument2 pagesRob Corry Letter About Driving Under The Influence of Drugs BillMichael_Lee_RobertsNo ratings yet

- Ipo Sylabus and BooksDocument3 pagesIpo Sylabus and BooksNaseema Chan ShaikNo ratings yet

- Proc Q and A - 2022updated V1Document47 pagesProc Q and A - 2022updated V1dreamsky702243No ratings yet

- Poranek (Peer Gynt)Document21 pagesPoranek (Peer Gynt)Katarzyna ChronowskaNo ratings yet

- Proof in Mathematics - An Introd - Albert DaoudDocument116 pagesProof in Mathematics - An Introd - Albert DaoudCindy100% (1)

- Descriptive Survey ResearchDocument6 pagesDescriptive Survey ResearchAbdullah HashmiNo ratings yet

- Lesson 9: The Discipline of Communication: Part I. Learning Module InformationDocument6 pagesLesson 9: The Discipline of Communication: Part I. Learning Module Informationcindy juntong100% (1)

- Affirmations To Balance Meridians and EmotionsDocument2 pagesAffirmations To Balance Meridians and EmotionsMario L M Ramos100% (1)

- STARBUCKS Market AnalysisDocument11 pagesSTARBUCKS Market AnalysisMirela GrNo ratings yet

- Educational Implications of Classical ConditioningDocument2 pagesEducational Implications of Classical Conditioningmekit bekeleNo ratings yet

- Johnrey For Demo DLPDocument8 pagesJohnrey For Demo DLPmelany r. malvarosaNo ratings yet

- 114 Layout Secrets For Your Framing Square PDFDocument2 pages114 Layout Secrets For Your Framing Square PDFHomerSimsonnakis100% (1)

- Case Analysis MASICAPDocument12 pagesCase Analysis MASICAPJanice ManansalaNo ratings yet

- Film ArtsDocument29 pagesFilm ArtsRoselyn Estrada MunioNo ratings yet

- Ito 2015Document8 pagesIto 2015laurabarbosamedNo ratings yet

- 2021-07-01.09-51-45.atom Amp Instructions en 06292021Document7 pages2021-07-01.09-51-45.atom Amp Instructions en 06292021Alessio PolonaraNo ratings yet

- 02b. BANDO Conveyor Belt Rubber Sheet Rubber Lagging Presentation PDFDocument41 pages02b. BANDO Conveyor Belt Rubber Sheet Rubber Lagging Presentation PDFYuliantoNo ratings yet

- Classification of FolkdanceDocument2 pagesClassification of FolkdanceMica CasimeroNo ratings yet

- 1-To-8 4K HDMI Distribution Amplifier: HD-DA8-4K-EDocument3 pages1-To-8 4K HDMI Distribution Amplifier: HD-DA8-4K-EthomvalensiNo ratings yet

- Cost Efficient Construction: Chapter OneDocument21 pagesCost Efficient Construction: Chapter Onemequanent adinoNo ratings yet