Professional Documents

Culture Documents

Acc406 - Acc07 Test 2 QS Feb 2022

Acc406 - Acc07 Test 2 QS Feb 2022

Uploaded by

Assignments HelperOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc406 - Acc07 Test 2 QS Feb 2022

Acc406 - Acc07 Test 2 QS Feb 2022

Uploaded by

Assignments HelperCopyright:

Available Formats

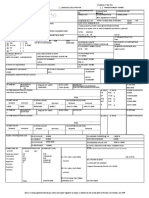

CONFIDENTIAL 1 AC/FEB 2022/ACC407/ACC406

UNIVERSITI TEKNOLOGI MARA

TEST 2

COURSE : FUNDAMENTAL FINANCIAL ACCOUNTING AND

REPORTING/INTERMEDIATE FINANCIAL

ACCOUNTING AND REPORTING

COURSE CODE : ACC407/ACC406

EXAMINATION : FEB 2022

TIME : 2 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of THREE (3) QUESTION 1 (7 marks)

Questions: QUESTION 2 (8 marks)

QUESTION 3 (32 marks)

QUESTION 4 (13 marks)

2. Answer ALL questions in the Answer Booklet.

4. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 6 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/FEB 2022/ACC407/ACC406

QUESTION 1

1) Differentiate between trade discount and cash discount

(2 marks)

2) Identify the double entry for payment of salary of RM5,00 by cheque

(2 marks)

3) Record the following transaction in the appropriate account:

Transaction

Started business with cash RM50,000

Bought goods by cheque RM10,000

Sold goods on credit to Tok Trading for RM3,000

(3 marks)

(Total: 7 marks)

QUESTION 2

This question consists of SIX (8) Multiple Choice Questions. Choose the best answer.

1. A credit note received from a supplier would be recorded in the ____________.

A. Return Inward Journal

B. Return Outward Journal

C. Sales Journal

D. Purchase Journal

(1 mark)

2. General Journal is used to ________________.

A. Opening and closing entry

B. Depreciation of non-current asset

C. Drawing of goods

D. All of the above

(1 mark)

3. Purchase of goods on credit from Amin Trading would be recorded in the __________.

A. Cash Receipt Journal

B. Cash Payment Journal

C. Sales Journal

D. Purchase Journal

(1 mark)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/FEB 2022/ACC407/ACC406

4. Payment of electricity bills and water by cash would be recorded in the ______.

A. Return Inward Journal

B. Return Outward Journal

C. Cash Receipt Journal

D. Cash Payment Journal

(1 mark)

5. Sales Journal is used to record __________.

A. Return Inward Journal

B. Return Outward Journal

C. Sales Journal

D. Purchase Journal

(1 mark)

6. A return of goods from Maulana Trading would be recorded in the _________.

A. Return Inward Journal

B. Return Outward Journal

C. Sales Journal

D. Purchase Journal

(1 mark)

7. Which of the following is NOT related to the legal status of a partnership business

entity?

A. It is not a separate legal entity from the business owners

B. The partners are personally liable for all the business debts.

C. The partners are not liable for the business profit and losses.

D. It can sue or be sued in the partners’ names

(1 mark)

8. The maximum number of general partnerships business entity is ____________.

A. 2 partners

B. 20 partners

C. 25 partners

D. 50 partners

(1 mark)

(Total: 8 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/FEB 2022/ACC407/ACC406

QUESTION 3

The following was the trial balance for MajuTrading as at 31 December 2021.

List of Accounts Debit (RM) Credit (RM)

Accounts receivable 38,000

Accounts payable 23,600

Capital 215,450

Motor Van 145,000

Furniture 46,000

Accumulated depreciation:

Motor van 25,650

Furniture 4,600

Water and electricity 5,800

Salaries 11,650

Interest on loan 9,000

Loan from bank 230,000

8% Fixed Deposit 80,000

Rental received 7,500

Bank 157,000

Cash 35,050

Discount received 2,500

Discount allowed 2,300

Allowance for doubtful debts 700

Sales 150,000

Purchases 88,700

Sales return 3,000

Purchase return 2,800

Drawings 1,500

Inventory on 1 January 2021 35,000

Carriage expenses 4,800

TOTAL 662,800 662,800

Additional information:

1. Inventory at year end was valued at RM45,000.

2. Depreciation for fixed assets was calculated using the following basis:

Motor van -10% using reducing balance method

Furniture - 10% using straight line method

3. The interest on loan available in the trial balance was for the period of 12 months

starting 1 May 2021.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/FEB 2022/ACC407/ACC406

4. The following adjustments are to be considered for the period:

Accruals RM Prepayments RM

Rental received 1,500 Water and electricity 500

5. During the year, RM1,500 was written off as bad debt as the debtor was

nowhere to be found. In addition, the allowance for doubtful debt needs to be

increased by RM2,200.

6. 65% from the total carriage expenses was the cost to transport the goods sold to

the customers' premises.

7. The 8% fixed deposit was invested by the business starting on 1 January 2021.

The interest was still accrued and year end.

8. The owner took goods worth RM1,000 from the business for his own personal

use.

Required:

a) Prepare Statement of Profit or Loss for the year ended 31 December 2021 for Maju

Trading.

b) Prepare Statement of Financial Position as at 31 December 2021 for Maju Trading.

Note: Use vertical format presentation

(32 marks)

QUESTION 4

ZZ, SB and KAY are brothers who formed a partnership business named as ZSK which

ventures in fast food industry. Their production facility is in Bangi, Selangor and has been

established for more than a year. Below are the terms agreed by the brothers prior to the

commencement of their partnership business:

i. Interest on closing capital is to be allowed at 10% per annum.

ii. ZZ and SB are entitled to receive a monthly salary of RM3,000.

iii. Profits or losses are to be shared between ZZ, SB and KAY in the ratio of 3:2:1

respectively.

iv. Interest of 5% per annum is to charge on drawings.

v. The partners are entitled to 8% interest per annum on any advance provided to the

partnership.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/FEB 2022/ACC407/ACC406

Additional information:

1. The partners’ capital accounts as at 1 January 2021:

ZZ RM80,000

SB RM60,000

KAY RM70,000

On 1 August 2021, SB contributed an additional capital of RM20,000 to the

partnership.

2. The partners’ current accounts as at 1 January 2021:

ZZ RM20,000

SB RM10,000

KAY RM11,000

3. ZZ withdrew RM6,000 cash on 1 November 2021 for his personal consumption.

4. On 1 July 2021, ZSK received an advance from ZZ amounted to RM10,000.

5. The business reported a net profit of RM220,000 for the year ended 31 December

2021.

6. Depreciation on office equipment amounted to RM40,000 is yet to be considered in

the computation of the above net profit.

Required:

a) The Appropriation Statement for the year ended 31 December 2021.

(8 marks)

b) Partners’ current account for the year ended 31 December 2021.

(5 marks)

Note 1: Calculate to the nearest RM.

(Total: 13 marks)

(Total marks: 60 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- ISB511 - GA1 - Ar-Rahnu Muamalat and Ar-Rahnu AgrobankDocument17 pagesISB511 - GA1 - Ar-Rahnu Muamalat and Ar-Rahnu AgrobankSiti SurayaNo ratings yet

- Acc407 - Final Project (Simulation) - InstructionsDocument2 pagesAcc407 - Final Project (Simulation) - InstructionsAmirul AmriNo ratings yet

- 5 FIN555 2 Format Assignment 1 Chap 11-16 2022 PJJDocument11 pages5 FIN555 2 Format Assignment 1 Chap 11-16 2022 PJJAzrul IkhwanNo ratings yet

- Tax317 Group Project SSTDocument23 pagesTax317 Group Project SSTNik Syarizal Nik MahadhirNo ratings yet

- MKT 420 - Marketing TestDocument5 pagesMKT 420 - Marketing TestmrmashaNo ratings yet

- Mini Case 3 - 264831Document13 pagesMini Case 3 - 264831Rubiatul AdawiyahNo ratings yet

- BBPM 2103 Marketing Management 1Document1 pageBBPM 2103 Marketing Management 1isqmaNo ratings yet

- The Balanced Scorecard Required Develop A Balanced Scorecard With Three orDocument2 pagesThe Balanced Scorecard Required Develop A Balanced Scorecard With Three orAmit PandeyNo ratings yet

- Acc407 Test 2 Feb 2022 QQ (1) EpjjDocument6 pagesAcc407 Test 2 Feb 2022 QQ (1) EpjjShahrillNo ratings yet

- HRM533 Assignment 1 (Group 4) PDFDocument12 pagesHRM533 Assignment 1 (Group 4) PDFMUHD MUKHRIZ MD YAZIDNo ratings yet

- Account Final ProjectDocument18 pagesAccount Final ProjectAzymah Eyzzaty D'redRibbon100% (1)

- Faculty of Business Management Bachelor of Business Administration (Hons) Operation Management (Ba244)Document6 pagesFaculty of Business Management Bachelor of Business Administration (Hons) Operation Management (Ba244)Fitrah LemanNo ratings yet

- Hrm533 Group Assignment Current Issue March 2023Document15 pagesHrm533 Group Assignment Current Issue March 2023Sybl ZhdiNo ratings yet

- Assignment 2 - N4am2261a - Group4Document27 pagesAssignment 2 - N4am2261a - Group4zuewaNo ratings yet

- Group Assignment 2 (Report) HRM554 - Group 3Document9 pagesGroup Assignment 2 (Report) HRM554 - Group 3Mohd Rozi AmbranNo ratings yet

- Acc407 Quiz 1 Introduction To Accounting (Question)Document7 pagesAcc407 Quiz 1 Introduction To Accounting (Question)Tuan AinnurNo ratings yet

- Acc407 Project 1 ReportDocument12 pagesAcc407 Project 1 ReportYUSRINA SYAKIRAH MOHD YUSOF100% (1)

- Mkt558 Individual Assignment ReportDocument10 pagesMkt558 Individual Assignment ReportAINA SYAZWANINo ratings yet

- Fin533 Chapter 6 NotesDocument15 pagesFin533 Chapter 6 NotesNurul AinNo ratings yet

- Assignment Report Fin544 Sem 3Document12 pagesAssignment Report Fin544 Sem 3Sharil Afiq bin Turiman100% (1)

- FIN546 GROUP 7 Assignment 1Document19 pagesFIN546 GROUP 7 Assignment 1ZAINOOR IKMAL MAISARAH MOHAMAD NOORNo ratings yet

- Management 111204015409 Phpapp01Document12 pagesManagement 111204015409 Phpapp01syidaluvanimeNo ratings yet

- Report Case Study Fin534 Group AssignmentDocument15 pagesReport Case Study Fin534 Group Assignment‘Alya Qistina Mohd ZaimNo ratings yet

- ReportDocument10 pagesReportmarcie pieNo ratings yet

- Individual Assignment ReflectionDocument11 pagesIndividual Assignment ReflectionAimi Najihah100% (1)

- ASSESSMENT LAW 299 EditedDocument1 pageASSESSMENT LAW 299 Editedsyahiir syauqiiNo ratings yet

- Ioi Group BackgroundDocument1 pageIoi Group Backgroundscribdoobidoo100% (1)

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- ICT501 Group3 Final ReportDocument69 pagesICT501 Group3 Final ReportMUHAMMAD AKMAL MOHD ZAHARNo ratings yet

- ADS512R - GROUP1 - The Delayed of Project ECRLDocument29 pagesADS512R - GROUP1 - The Delayed of Project ECRLMuhammad Zulhamizy RahmatNo ratings yet

- Student Name Student No. Group: Noorkhairunnisa Binti Hassan 2022770469 CS2402BDocument7 pagesStudent Name Student No. Group: Noorkhairunnisa Binti Hassan 2022770469 CS2402BNisa HassanNo ratings yet

- Fin 552 Individual AssignmentDocument14 pagesFin 552 Individual Assignment2022978231No ratings yet

- Top Glove Human Resources Presentation PDFDocument21 pagesTop Glove Human Resources Presentation PDFHALIZANo ratings yet

- Field Report Pac671 Template (New) - Cover Page - TocDocument2 pagesField Report Pac671 Template (New) - Cover Page - TocAiman FaezNo ratings yet

- Final Project Report CSC186Document20 pagesFinal Project Report CSC186wafihafizi733No ratings yet

- (6 July Updated) Project Proposal Ads 512 - Group 5 - Namaf8aDocument21 pages(6 July Updated) Project Proposal Ads 512 - Group 5 - Namaf8asyafiqahmikaNo ratings yet

- MGT420Document3 pagesMGT420Ummu Sarafilza ZamriNo ratings yet

- Issues of Ar RahnuDocument6 pagesIssues of Ar RahnuNass AzwadiNo ratings yet

- Guidelines & Rubric For Sta104 Group ProjectDocument5 pagesGuidelines & Rubric For Sta104 Group ProjectFarah HusnaNo ratings yet

- FIN242 REPORT Group 3Document32 pagesFIN242 REPORT Group 3Izzat FarhanNo ratings yet

- Solution Acc406 Jun 2019Document6 pagesSolution Acc406 Jun 2019sarah izatiNo ratings yet

- Mpu3223 - v2 - Entrepreneurship 2Document10 pagesMpu3223 - v2 - Entrepreneurship 2Simon RajNo ratings yet

- Bank Rakyat Law CaseDocument17 pagesBank Rakyat Law CaseDeena YosNo ratings yet

- Ibm 553Document2 pagesIbm 553Nurul NajwaNo ratings yet

- Final Report Ade444Document11 pagesFinal Report Ade444Hannah HuzaimyNo ratings yet

- Case Study Maf661Document12 pagesCase Study Maf661Nur Dina AbsbNo ratings yet

- Law346 Chapter 1 & 2Document25 pagesLaw346 Chapter 1 & 2rumaisyaNo ratings yet

- Ent300 Individual AssignmentDocument12 pagesEnt300 Individual AssignmentAhmad Aqeef Kamar ZamanNo ratings yet

- FIN420 Individual Assignment 20214Document3 pagesFIN420 Individual Assignment 20214Admin & Accounts AssistantNo ratings yet

- MAF 551 - Exercise 2 - Answer Question 1 - Seri Melur Institution - Ridzuan Bin Saharun 2017700141Document3 pagesMAF 551 - Exercise 2 - Answer Question 1 - Seri Melur Institution - Ridzuan Bin Saharun 2017700141RIDZUAN SAHARUNNo ratings yet

- Yuhana Afifah Binti Mohd Ali (2022660666) Individual Assignment 2Document4 pagesYuhana Afifah Binti Mohd Ali (2022660666) Individual Assignment 2yuhanaNo ratings yet

- Fin552 - GP AssignmentDocument45 pagesFin552 - GP AssignmentWAN NUR AYUNI ISNINNo ratings yet

- Questionnaire Result On How UiTM Seri Iskandar Students Spend Their WeekendDocument9 pagesQuestionnaire Result On How UiTM Seri Iskandar Students Spend Their WeekendIkmal Ahmad100% (1)

- Main Business and IFA IMPIANADocument7 pagesMain Business and IFA IMPIANAAlia NursyifaNo ratings yet

- Proposal csc264 Group Assingment 1 - CompressDocument22 pagesProposal csc264 Group Assingment 1 - CompressIsyraf AzriNo ratings yet

- Ads560 Group Assignment-Timor Leste CrisisDocument18 pagesAds560 Group Assignment-Timor Leste CrisisFatin AqilahNo ratings yet

- Tuto5 BKAL DoneDocument8 pagesTuto5 BKAL DoneThe Four Incredible Hulks100% (1)

- Format - Business Plan ReportDocument9 pagesFormat - Business Plan ReportmuhammadNo ratings yet

- Topic 9 Case Study ADM510Document2 pagesTopic 9 Case Study ADM510haha kelakarNo ratings yet

- Opm 537 Individual AssignmentDocument1 pageOpm 537 Individual Assignmentbyunputri03No ratings yet

- Open Book Examination Course: Principles of Financial Accounting I Course Code: PAC1103 Duration: 2 HoursDocument7 pagesOpen Book Examination Course: Principles of Financial Accounting I Course Code: PAC1103 Duration: 2 HoursNUR BALQIS BINTI MOHD TAJUDDIN BGNo ratings yet

- Bso ExamDocument4 pagesBso ExamAssignments HelperNo ratings yet

- Tax FinalDocument8 pagesTax FinalAssignments HelperNo ratings yet

- Managerial Accounting - Assignment 1Document3 pagesManagerial Accounting - Assignment 1Assignments HelperNo ratings yet

- Assignment 1 - MPIS7103 - 202305Document7 pagesAssignment 1 - MPIS7103 - 202305Assignments HelperNo ratings yet

- 2023 05 RM Assign1Document1 page2023 05 RM Assign1Assignments HelperNo ratings yet

- VAHAN 4.0 (Online Appointment)Document1 pageVAHAN 4.0 (Online Appointment)Ashutosh PendkarNo ratings yet

- 2.declaration TypeDocument1 page2.declaration TypeTaha KhuzemaNo ratings yet

- CinePro CaseDocument4 pagesCinePro Casemoshe1.bendayanNo ratings yet

- Working Capital Management of SBIDocument76 pagesWorking Capital Management of SBIDr Sachin Chitnis M O UPHC AiroliNo ratings yet

- Jasso 4950 Spring 2021exam OneDocument1 pageJasso 4950 Spring 2021exam OneОстап ЖолобчукNo ratings yet

- 01 Paraphrasing - UTS - StsDocument5 pages01 Paraphrasing - UTS - StsMai TrangNo ratings yet

- New Normal Online Selling Business Risks and Prevention PracticesDocument39 pagesNew Normal Online Selling Business Risks and Prevention PracticesJohneen DungqueNo ratings yet

- Muthu Resume (3) ..Document2 pagesMuthu Resume (3) ..arun kNo ratings yet

- Faculty - Law - 2011 - Sessi 2 - Law240 - 231PDF - 230105 - 082647Document10 pagesFaculty - Law - 2011 - Sessi 2 - Law240 - 231PDF - 230105 - 0826472021202082No ratings yet

- Putri Yuanita: SachikoDocument1 pagePutri Yuanita: SachikoBobby AndreasNo ratings yet

- Final - OYO CompanyDocument4 pagesFinal - OYO CompanySHEHLA GULNo ratings yet

- Project Management Notes-1Document43 pagesProject Management Notes-1MrugendraNo ratings yet

- Budget Driving Institute Prob 2&3Document94 pagesBudget Driving Institute Prob 2&3Ma Sophia Mikaela EreceNo ratings yet

- Demand and Supply AssignmentDocument2 pagesDemand and Supply Assignmentmoon musicNo ratings yet

- Academy: 481 Assignment No. 2 (Unit 5-9) Total Marks: 100 Pass Marks For BA/ B. Com: 40 Pass Marks For AD/BS: 50Document11 pagesAcademy: 481 Assignment No. 2 (Unit 5-9) Total Marks: 100 Pass Marks For BA/ B. Com: 40 Pass Marks For AD/BS: 50AFAQ AHMADNo ratings yet

- Black BookDocument49 pagesBlack BookKiran PatilNo ratings yet

- Performance Dashboard TemplateDocument24 pagesPerformance Dashboard TemplateEkta ParmarNo ratings yet

- Times Pass List Jan 2020-1Document1 pageTimes Pass List Jan 2020-1antiqurrNo ratings yet

- Retail Store LayoutDocument32 pagesRetail Store Layoutsumitpanwar007100% (12)

- What Not To Do When Preparing A Project ScheduleDocument2 pagesWhat Not To Do When Preparing A Project ScheduleCristian Steven SilvaNo ratings yet

- Intellectual Property RightsDocument33 pagesIntellectual Property Rightsapi-374226386% (7)

- Cost Accounting BCM-203Document444 pagesCost Accounting BCM-203Himanhsu BansalNo ratings yet

- TPM Listing (Done Excel, Done CC)Document32 pagesTPM Listing (Done Excel, Done CC)CK AngNo ratings yet

- Ch1-Introduction To The Project ManagementDocument21 pagesCh1-Introduction To The Project ManagementReef AlhuzaliNo ratings yet

- Synergy Technical PaperDocument2 pagesSynergy Technical PaperAnandmohanNo ratings yet

- Job Profile-Opretaions Excellence-1Document3 pagesJob Profile-Opretaions Excellence-1Ayansh patnaikNo ratings yet

- Change in Designated Managing Partners & Partners (For Partnership Firms)Document25 pagesChange in Designated Managing Partners & Partners (For Partnership Firms)Sãmpãth Kûmãř kNo ratings yet

- 6 Customizing Asset AccountingDocument33 pages6 Customizing Asset AccountingChirag SolankiNo ratings yet

- 4 Ways To Make Money Online ReportDocument13 pages4 Ways To Make Money Online ReportMichael IdoroNo ratings yet