Professional Documents

Culture Documents

Gr11 Acc P1 (English) November 2019 Marking Guidelines

Gr11 Acc P1 (English) November 2019 Marking Guidelines

Uploaded by

Shriddhi MaharajCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gr11 Acc P1 (English) November 2019 Marking Guidelines

Gr11 Acc P1 (English) November 2019 Marking Guidelines

Uploaded by

Shriddhi MaharajCopyright:

Available Formats

testpapers.co.

za

GAUTENG DEPARTMENT OF EDUCATION

PROVINCIAL EXAMINATION

NOVEMBER 2019

GRADE 11

ACCOUNTING

PAPER 1

MARKING GUIDELINES

MARKS: 150

MARKING PRINCIPLES:

1. Unless otherwise stated in the marking guideline, penalties for foreign items are applied only if the

candidate is not losing marks elsewhere in the question for that item (no penalty for misplaced item).

No double penalty applied.

2. Penalties for placement or poor presentation (e.g. details) are applied only if the candidate is earning

marks on the figures for that item.

3. Full marks for correct answer. If answer incorrect, mark the workings provided.

4. If a pre-adjustment figure is shown as a final figure, allocate the part-mark for the working for that

figure (not the method mark for the answer). Note: If figures are stipulated in memo for components

of workings, these do not carry the method mark for the final answer as well.

5. Unless otherwise indicated, the positive or negative effect of any figure must be considered to award

the mark. If no + of – sign or brackets is provided, assume that the figure is positive.

6. Where indicated, part-marks may be awarded to differentiate between differing qualities of answers

from candidates.

7. This memorandum is not for public distribution, as certain items might imply incorrect treatment. The

adjustments made are due to nuances in certain questions.

8. Where penalties are applied, the marks for that section of the question cannot be a final negative.

9. Where method marks are awarded for operation, the marker must inspect the reasonableness of the

answer and at least one part must be correct before awarding the mark.

10. Operation means ‘check operation’. ‘One part correct’ means operation and one part correct. Note:

check operation must be +, -, x, ÷, or per memo.

11. In calculations, do not award marks for workings if numerator & denominator are swapped – this also

applies to ratios.

12. In awarding method marks, ensure that candidates do not get full marks for any item that is incorrect

at least in part. Indicate with a .

13. Be aware of candidates who provide valid alternatives beyond the marking guideline.

14. Codes: f = foreign item; p = placement / presentation.

8 pages

Copyright reserved Please turn over

Accounting-P1 2 GP/November 2019

Grade 11 – Marking guidelines

QUESTION 1: CONCEPTS AND INCOME STATEMENT

1.1 CONCEPTS

1.1.1 Current liabilities ✓

1.1.2 Operating expenses ✓

1.1.3 Non-current liabilities ✓

1.1.4 Operating income ✓ 4

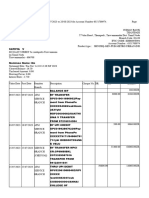

1.2 MADUNA TRADERS

INCOME STATEMENT FOR THE YEAR ENDED 28 FEBRUARY 2019

Sales (800 000 – 14 600✓- 4 500✓) one part correct 780 900

Cost of sales ( 390 000 - 2 500) one part correct ✓ (387 500)

Gross Profit check operation 393 400

Other Operating Income 39 100

Rent income (42 000✓ - 3 300✓ ✓) one part correct 38700

Provision for bad debts ✓ 400

Gross Operating income check operation 354 300

Operating Expenses check operation ( 220 203)

Employer's contribution 10 520

Bad debts 3 600

Discount allowed 530

Telephone 6 300

Salaries and wages (150 000 +12 000✓✓) 162 000

Bank charges ✓ 748

Insurance (9 800 -1 400✓✓) one part correct 8 400

Packing material( 8 305 -2 300) ✓✓ 6 005

Trading stock deficit (68 000 +2 500 -66 400) ✓✓ 4 100

Depreciation ✓ 18 000

Operating Profit 134 097

Interest income 9 600

Profit Before Interest Expense 143 697

Interest expense (205 000+ 8 000-260 000) ✓ (25 000)

Net Profit for the year check operation 118697 32

Total marks

36

Copyright reserved Please turn over

Accounting P1 3 GP/November 2019

Grade 11 – Marking guidelines

QUESTION 2: CONCEPTS, TANGIBLE ASSETS AND ETHICS

2.1 CONCEPTS

2.1.1 False ✓

2.1.2 True ✓

2.1.3 False ✓ 5

2.1.4 False ✓

2.1.5 True ✓

2.2.1 NOTE TO THE FINANCIAL STATEMENTS ON 31 DECEMBER 2018

TANGIBLE ASSETS

Vehicles Equipment

Carrying value at the beginning of year 64 800 ✓18 800

Cost ✓90 000 26 000

Accumulated depreciation ✓✓✓✓ (25 200) ✓ (7 200)

Movements: 23 140 22 225

Additions at cost (Check Allocation below) ✓✓✓38 000 ✓✓27 000

Asset disposal at carrying value - 5 marks, check below

(740)

Depreciation (40 060✓ -25 200*) (14 860) 11 marks, check below

(4 035)

Carrying value at the end of the year 87 940 41 025

Cost 128 000 50 600

Accumulated depreciation (40 060) 3 marks, check below

(9 575)

40

*Check accumulated depreciation at beginning

Copyright reserved Please turn over

Accounting P1 4 GP/November 2019

Grade 11 – Marking guidelines

VEHICLES

Depreciation for old vehicle

2016 90 000 x 20% x 6/12✓ = 9 000✓

2017 81 000✓ x 20% = 16 200✓

90 000-9 000 25 200 Acc Depr on 1 Jan 2018

2018 64 800✓ x 20% = 12 960✓ Depreciation for current

year

90 000-9 000-16 200

Depreciation for the year

40 060 - 25 200 =14 860

Depreciation for the new vehicle

14860 -12 960 =1900

Cost price of new vehicle

x x 20%✓ x 3✓ = 1900✓ 1 900 ✓x 12/3✓÷ 20%✓= 38 000

12 OR

0,05 x = 1900

0,05 0,05

x = 38 000

Copyright reserved Please turn over

Accounting P1 5 GP/November 2019

Grade 11 – Marking guidelines

EQUIPMENT

Depreciation

New 27 000✓✓ x 10% x 7/12✓ = 1 575 A

25 000 one mark +2 000 one mark

Asset sold

2 4 00✓ x 10% x 5/12✓ = 100 B

Old asset 26 000 -2 400 =23 600

23 600✓ x10% = 2 360 C

= 4 035 11 marks

Carrying value of asset sold

Accumulated depreciation (01.01.2018)

2 400- 840 = 1 560

2 400✓ -1 560✓ -100 =740 ( Carrying value on date of sale)

Check C

Accumulated depreciation at the end of the year

7 200 + 4 035 - 1 660 = 9 575

2.2.2 Peter Majoro is not happy that his brother Joe Majoro purchased the

old equipment at an amount below the carrying value from the 3

business. Provide ONE reason why he had to be unhappy about this

transaction and provide calculations / figures to motivate your answer.

• Peter feels that they could have sold the asset at a profit OR at carrying value. ✓

• Sold for 740 at carrying value OR 740 plus profit✓ [Check 2.2 asset disposal at carrying value]

Total marks

48

Copyright reserved Please turn over

Accounting P1 6 GP/November 2019

Grade 11 – Marking guidelines

QUESTION 3: CURRENT ACCOUNT NOTE AND BALANCE SHEET

3.1 SAPA TRADERS

BALANCE SHEET FOR THE YEAR ENDED 28 FEBRUARY 2019

R

ASSETS

Non-Current Assets check operation 3 495 810

Fixed assets 423 810

Fixed deposit (77 000 -5 000) ✓✓72 000

Current Assets check operation 7 76 476

Inventory (39 900 ✓ - 940 ✓ + 101 ✓) one part correct 39 061

Trade and other receivables 10 205

Cash and cash equivalents (22 210 + 5 000) one part correct ✓27 210

TOTAL ASSETS check operation 1 572 286

EQUITY AND LIABILITIES

Owner’s Equity 4 484 725

Capital (216 000 + 180 000) ✓✓396 000

Current accounts ✓88 725

Non-Current Liabilities 60 000

Long Term-Loan 60 000

Current Liabilities 4 27 561

Trade and other payables (25 491 + 670✓+1400 ✓✓) one part correct 27 561

TOTAL EQUITY AND LIABILITIES check operation 1 572 286

20

3.2 CURRENT ACCOUNT NOTE FOR THE YEAR ENDED 28 FEBRUARY 2019

S. Saul P. Paul

Net profit according to the Income Statement 130 630 121 230

Partners salaries ✓93 600 ✓93 600

Interest on capital ✓32 400 ✓27 000

Partners bonus ✓4 000 -

Primary distribution of profit check operation 130 000 120 600

Final distribution of profit 630 630

Drawings (Saul: 80 120 ✓+ 1 200✓✓) (81 320) ✓ (90 520)

Retained income for the year check operation 49 310 30 710

Retained income at beginning of year operation 4 201 4 504

Retained income at end of year 53 511 35 214

18

Total marks

38

Copyright reserved Please turn over

Accounting P1 7 GP/November 2019

Grade 11 – Marking guidelines

QUESTION 4: ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS

4.1 Calculate the following indicators for 28 February 2019

4.1.1 Calculate Clyde’s current ratio. 3

Current assets : Current liabilities (Clyde)

590 000 ✓ : 370 000 ✓

1,6 : 1 one part correct

4.1.2 Calculate Bonny’s stock turnover rate. 4

Cost of sales .

Average stock

= 1 300 000 ✓

½(130 000 ✓ + 150 000 ✓)

= 9,3 time per year one part correct

4.1.3 Clyde’s average debtors collection period 5

Average Debtors x 365

Credit sales 1

= ½(310 000 ✓ + 344 000 ✓) x 365

80% ✓ x 2 500 000 ✓ 1

= 59,7 days one part correct

4.1.4 Calculate the return on average equity of Bonny’s Clothing. 5

Net profit (Bonny) x 100

Average owners’ equity 1

= 200 000 ✓ x 100

½(385 000 ✓ + 405 000 ✓) 1

= 200 000 x 100

395 000 ✓ 1

= 50,6% one part correct

Copyright reserved Please turn over

Accounting-P1 8 GP/November 2019

Grade 11 – Marking guidelines

4.2.1 Compare and comment on the liquidity position of the two

businesses, quote TWO financial indicators. 8

Any two indicators ✓✓ compare figures / indicators of two businesses ✓✓

Indicators Comparison of Bonny and Clyde’s

Businesses

Current ratio Bonny’s ratio is 2.1: 1, is higher / better than

Clyde’s ratio of 1.6:1 (see 4.1.1)

Acid Test Bonny’s ratio is 1.1: 1, is higher / better than

ratio: Clyde’s ratio of 0.9 :1

Stock Bonny’s 9,3 times (see 4.1.2),is higher / better than

Turnover rate Clyde’s 5,5 times

Stock Holding Bonny’s 39 days is better or shorter than Clyde’s

Period 66 days

Debtors Bonny’s 26 days is better or faster than Clyde’s

Collection 59.7 days (see 4.1.3)

Creditors Bonny’s 58 days is shorter compared to Clyde’s

Payment payment period of 90 days

Explanation

Two Points ✓✓ ✓✓ (One mark for partially correct answer)

• Bonny’s Clothing liquidity position is better than Clyde’s. Cash flow is

good, they are not likely to have cash problems within the near future.

• Bonny’s Clothing will be able to settle her short-term debts with ease.

• Bonny has good control over the debtor’s collection policy, Bonny

could negotiate for a longer payment period for creditors’ payments,

e.g. 90 days.

• Clyde is going to struggle to settle her short-term debts. She will

experience serious cash flow problems.

4.2.2 By making reference to the rates of return on owners’ equity, do

you think Bonny’s Clothing is making a good decision to partner

with Clyde? Provide ONE point of advice. 3

Indicators ✓Explanation ✓

The decision to combine assets with Clyde is not good, Bonny’s return

on equity of 50.5% (check 4.1.4) is far greater than Clyde’s return of

(36,6%) which means Clyde’s business is less effective.

Advice ✓

• Bonny to look for another partner

• To continue running his business as a sole trader

• Any valid explanation

Total marks

28

TOTAL: 150

Copyright reserved

You might also like

- Summer Internship Project HDFC Bank PDFDocument109 pagesSummer Internship Project HDFC Bank PDFarunima60% (10)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- A Project Report On Group InsuranceDocument64 pagesA Project Report On Group Insurancesharinair1393% (15)

- National Senior Certificate: Grade 12Document9 pagesNational Senior Certificate: Grade 12Raeesa SNo ratings yet

- Accounting NSC P1 MEMO May June 2023 Eng Eastern CapeDocument13 pagesAccounting NSC P1 MEMO May June 2023 Eng Eastern CapebsamashabaneNo ratings yet

- 2024 Accn P1 MG June GR 12 LP - 240516 - 194916Document10 pages2024 Accn P1 MG June GR 12 LP - 240516 - 194916kssekasi21No ratings yet

- Acc G11 Ec Nov 2022 P1 MGDocument8 pagesAcc G11 Ec Nov 2022 P1 MGTshenoloNo ratings yet

- ACCOUNTING P1 GR12 MEMO SEPT - EnglishDocument11 pagesACCOUNTING P1 GR12 MEMO SEPT - EnglishSthockzin EntNo ratings yet

- 2022 KZN June P1 Memo 2Document8 pages2022 KZN June P1 Memo 2shandren19No ratings yet

- ACCOUNTING P1 GR12 MEMO JUNE 2023 - EnglishDocument12 pagesACCOUNTING P1 GR12 MEMO JUNE 2023 - Englishfanelenzima03No ratings yet

- Grade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305Document6 pagesGrade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305hobyanevisionNo ratings yet

- Acc GR 10 p1 (A) 2018 Eng Memo Exemplar-4 2Document8 pagesAcc GR 10 p1 (A) 2018 Eng Memo Exemplar-4 2mishomabunda20No ratings yet

- Gr11 Accounting P1 (ENG) NOV Possible Answers-2Document9 pagesGr11 Accounting P1 (ENG) NOV Possible Answers-2Shriddhi MaharajNo ratings yet

- Accounting NSC P1 Memo Nov 2022 EngDocument12 pagesAccounting NSC P1 Memo Nov 2022 EngItumeleng MogoleNo ratings yet

- GR 10 Accounting P2 (English) November 2022 Possible AnswersDocument9 pagesGR 10 Accounting P2 (English) November 2022 Possible AnswersRea SeremaNo ratings yet

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaNo ratings yet

- Accounting P1 Nov 2022 MG EngDocument11 pagesAccounting P1 Nov 2022 MG Engmthethwathando422No ratings yet

- Accounting Grade 12 Test 1 Self-Study (Lockdown Period)Document5 pagesAccounting Grade 12 Test 1 Self-Study (Lockdown Period)pleasuremaome06No ratings yet

- GR 11 Accounting P1 (English 2023 Possible AnswerDocument9 pagesGR 11 Accounting P1 (English 2023 Possible Answert86663375No ratings yet

- Grade 12 NSC Accounting P1 (English) September 2022 Preparatory Examination Possible AnswersDocument13 pagesGrade 12 NSC Accounting P1 (English) September 2022 Preparatory Examination Possible Answersseemaneletlhogonolo30No ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- Accounting Grade 11 Revision Solutions Term 2 - 2024Document16 pagesAccounting Grade 11 Revision Solutions Term 2 - 2024Ongeziwe BokiNo ratings yet

- Accounting Grade 12 Trial 2021 P1 and MemoDocument32 pagesAccounting Grade 12 Trial 2021 P1 and Memotsholofelokgomane29No ratings yet

- ACCOUNTING P1 GR11 MEMO NOVEMBER 2023 - EnglishDocument8 pagesACCOUNTING P1 GR11 MEMO NOVEMBER 2023 - EnglishChantelle IsaksNo ratings yet

- Accounting p1 September 2023 Grade 12 MG - 231115 - 141635Document8 pagesAccounting p1 September 2023 Grade 12 MG - 231115 - 141635zahrahjafter26No ratings yet

- 2024 Grade 12 Controlled Test MG 1 2Document4 pages2024 Grade 12 Controlled Test MG 1 2Zenzele100% (1)

- Accounting P1 Memo May June 2023 Eng Free StateDocument11 pagesAccounting P1 Memo May June 2023 Eng Free StateSimiNo ratings yet

- National Senior Certificate: Grade 12Document10 pagesNational Senior Certificate: Grade 12Roseline SibekoNo ratings yet

- Accounting 2020 P1 MemoDocument11 pagesAccounting 2020 P1 MemoodiantumbaNo ratings yet

- Accounting P2 May-June 2021 MG EngDocument9 pagesAccounting P2 May-June 2021 MG Engpapungcobo82No ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- Grade 10 Provincial Examination Accounting (English) 2020 Exemplars Possible Answers - 050049Document8 pagesGrade 10 Provincial Examination Accounting (English) 2020 Exemplars Possible Answers - 050049hobyanevisionNo ratings yet

- Accounting P1 Prep Sept 2022 Memo EngDocument11 pagesAccounting P1 Prep Sept 2022 Memo EngSweetness MakaLuthando LeocardiaNo ratings yet

- Accounting Nov 2019 Nov 2019 Memo EngDocument17 pagesAccounting Nov 2019 Nov 2019 Memo Engkekedieketseng561No ratings yet

- 2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Possible AnswersDocument10 pages2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Possible AnswersChantelle IsaksNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksNo ratings yet

- Accounting P1 Nov 2020 Memo EngDocument9 pagesAccounting P1 Nov 2020 Memo EngBurning PhenomNo ratings yet

- 72034bos57955 p1 6Document12 pages72034bos57955 p1 6Fs printNo ratings yet

- Accounting Activity Manual MemorandumDocument29 pagesAccounting Activity Manual Memorandummavuyanaledi07No ratings yet

- FMA Assignment Sem1 2019HB58032Document7 pagesFMA Assignment Sem1 2019HB58032rageshNo ratings yet

- Acc G11 Ec Nov 2022 P2 MGDocument8 pagesAcc G11 Ec Nov 2022 P2 MGTshenoloNo ratings yet

- Accounting P2 May-June 2022 MG EngDocument10 pagesAccounting P2 May-June 2022 MG Englindort00No ratings yet

- CAG Financials 2019Document4 pagesCAG Financials 2019AzliGhaniNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 9Document15 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 9Hung LeNo ratings yet

- Accounting Nov 2016 Memo EngDocument16 pagesAccounting Nov 2016 Memo Engsiyandamabuza789No ratings yet

- Accounting Feb-March 2016 Memo EngDocument16 pagesAccounting Feb-March 2016 Memo Engmanganyiforget58No ratings yet

- Ratio AnalysisDocument17 pagesRatio Analysisdora76pataNo ratings yet

- Ass Intacc 3 - GonzagaDocument12 pagesAss Intacc 3 - GonzagaLalaine Keendra GonzagaNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- 2019 Unit 3 Outcome 2 Solution BookDocument10 pages2019 Unit 3 Outcome 2 Solution BookLachlan McFarlandNo ratings yet

- Lembar Kerja AkuntansiDocument9 pagesLembar Kerja AkuntansiSu MiniNo ratings yet

- ACCOUNTING P1 GR11 MEMO NOVEMBER 2020 - EnglishDocument8 pagesACCOUNTING P1 GR11 MEMO NOVEMBER 2020 - EnglishmkharimbuyeloNo ratings yet

- Acc GR 10 P2 (A) Exemplar Nov 2018 Eng MemoDocument12 pagesAcc GR 10 P2 (A) Exemplar Nov 2018 Eng Memomishomabunda20No ratings yet

- Accounting P2 May June 2022 MG EngDocument11 pagesAccounting P2 May June 2022 MG EngReese SejakeNo ratings yet

- Accounting Nov 2018 MemoDocument18 pagesAccounting Nov 2018 Memombalentledaniso035No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- ProblemDocument6 pagesProblemTina AntonyNo ratings yet

- Unit 12-Question 12-C Sol (2023)Document2 pagesUnit 12-Question 12-C Sol (2023)shirleygebenga020829No ratings yet

- Acc 2018 MemoDocument12 pagesAcc 2018 Memokyle.govender2004No ratings yet

- Financial Reporting Week 1 Class 1 Important!Document18 pagesFinancial Reporting Week 1 Class 1 Important!Lin SongNo ratings yet

- Accounting PracticeDocument24 pagesAccounting PracticeLloydNo ratings yet

- Fidp FabmDocument5 pagesFidp FabmEve Intapaya100% (1)

- Overview and Conclusions: BIS Papers No 71 - The Finances of Central Banks 3Document2 pagesOverview and Conclusions: BIS Papers No 71 - The Finances of Central Banks 3ManavNo ratings yet

- Entrereneurship 1.44Document32 pagesEntrereneurship 1.44Shiela Jean H. RescoNo ratings yet

- ABSLI Vision Endowment Plus Plan PresentationDocument11 pagesABSLI Vision Endowment Plus Plan PresentationManishNo ratings yet

- Samart Bank Form - V 310118 PDFDocument2 pagesSamart Bank Form - V 310118 PDFJoe Pianist Samart RukpanyaNo ratings yet

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Document2 pagesBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNo ratings yet

- Comparative Analysis of Financial Performance Before and During The Covid-19 Pandemic at BTPN SyariahDocument16 pagesComparative Analysis of Financial Performance Before and During The Covid-19 Pandemic at BTPN SyariahdesmyNo ratings yet

- Banco de Oro V. Rrepublic of The Philippines G.R. No. 198756 January 13, 2015Document2 pagesBanco de Oro V. Rrepublic of The Philippines G.R. No. 198756 January 13, 2015Crisbon ApalisNo ratings yet

- Action Code (Actioncode) : Cod E Description Cod E DescriptionDocument4 pagesAction Code (Actioncode) : Cod E Description Cod E Descriptionbongo128No ratings yet

- WSJ Jpmfiling0510Document191 pagesWSJ Jpmfiling0510Reza Abusaidi100% (1)

- Ethiopia Cracks Down On Black Market Forex Exchange As $1 Trades For Over Br.100Document1 pageEthiopia Cracks Down On Black Market Forex Exchange As $1 Trades For Over Br.100BernabasNo ratings yet

- New REportDocument44 pagesNew REportPrashant MahawarNo ratings yet

- BM+DDPI - Version 9Document5 pagesBM+DDPI - Version 9Nicemon George JosephNo ratings yet

- CakemonkeyDocument4 pagesCakemonkeyszymon.kierusNo ratings yet

- Take-Home Exam 1Document9 pagesTake-Home Exam 1Okuhle MqoboliNo ratings yet

- ATR Answers - 5Document43 pagesATR Answers - 5Christine Jane AbangNo ratings yet

- StatementOfAccount 6351700974 14112023 101336Document3 pagesStatementOfAccount 6351700974 14112023 101336sakthisundaresan36No ratings yet

- Chapter 2 Recording Business Transactions: Acid)Document29 pagesChapter 2 Recording Business Transactions: Acid)Farhan Osman ahmedNo ratings yet

- Members AreaDocument1 pageMembers Areasipho gumbiNo ratings yet

- BSMA 3A SQ Part 2Document3 pagesBSMA 3A SQ Part 2Mj Galario IINo ratings yet

- Chapter 3 (Arcadia)Document22 pagesChapter 3 (Arcadia)sweetangle98No ratings yet

- 6.1 Government of Pakistan's Treasury Bills: PeriodsDocument13 pages6.1 Government of Pakistan's Treasury Bills: PeriodsKidsNo ratings yet

- Selected Items:: Receipt Mr. Jian Bin Li Learner ID: X012765Document2 pagesSelected Items:: Receipt Mr. Jian Bin Li Learner ID: X012765Johnson LiNo ratings yet

- Working Capital ManagementDocument60 pagesWorking Capital ManagementkirubelNo ratings yet

- Unit 3 Exam Review - Chapters 7-9Document6 pagesUnit 3 Exam Review - Chapters 7-9Vhia Rashelle GalzoteNo ratings yet

- Financial Accounting and AnalysisDocument4 pagesFinancial Accounting and Analysisbhupendra mehraNo ratings yet

- Mobile Money - Investment Opportunities For SACCOsDocument20 pagesMobile Money - Investment Opportunities For SACCOsKivumbi WilliamNo ratings yet

- Bond ValuationDocument36 pagesBond ValuationBhavesh RoheraNo ratings yet