Professional Documents

Culture Documents

Feb 2021

Feb 2021

Uploaded by

Muhammad ZulhisyamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feb 2021

Feb 2021

Uploaded by

Muhammad ZulhisyamCopyright:

Available Formats

CONFIDENTIAL 1 AC/FEB 2021/FAR670

UNIVERSITI TEKNOLOGI MARA

FINAL ASSESSMENT

COURSE : FINANCIAL STATEMENT ANALYSIS

COURSE CODE : FAR670

EXAMINATION : FEBRUARY 2021

TIME : 2 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of three (3) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of :

i) the Question Paper

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 4 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

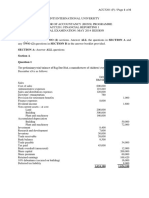

CONFIDENTIAL 2 AC/FEB 2021/FAR670

QUESTION 1

Presented below is a balance sheet for two hypothetical companies, company AB and

company XY as at 31 December 2020.

Company AB Company XY

(RM Thousands) (RM Thousands)

ASSETS

Current assets

Cash and equivalents 1,000 200

Short-term marketable securities 900 -

Accounts receivable 500 1,050

Inventory 300 950

Total current assets 2,700 2,200

Property, plant and equipment, net. 1,200 750

Intangible assets 200

Goodwill - 100

Total assets 3,900 3,250

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities

Accounts payable 650 1,200

Total current liabilities 650 1,200

Long term bonds 450 800

Total Liabilities 1,100 2,000

Total shareholders ‘ equity 2,800 1,250

Total liabilities and shareholders’ equity 3,900 3,250

You are required:

i. Prepare a vertical common-size balance sheet for both companies.

(7 marks)

ii. Based on the above vertical common-size balance sheet:

a. Elaborate the companies financial position as at 31 December 2020.

(18 marks)

b. Compare the ability of both firms in meeting their short term obligation.

(20 marks)

(Total: 45 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/FEB 2021/FAR670

QUESTION 2

a.

2017 2018 2019

Accounts receivable turnover 10 times 15 times 20 times

Inventory turnover in days 25 30 30

Operating cycle ? ? ?

You are required to calculate:

i. Company operating cycle (in days) for year 2017, 2018 and 2019.

(4 marks)

ii. Evaluate the changes in operating cycle of the company for the three years

above.

(12 marks)

b. Sinar Bhd has a loan covenant requiring the company to maintain a minimum curret

ratio of 1.5 or above. At the end of 2019, current assets are RM40 million (RM2

million in cash, 18 million in accounts receivable, and RM20 million in inventory). Its

current liabilities are RM26 million.

i. If Sinar sells RM4 million in inventory on credit at a profit, how will this affect

its current ratio?

ii. If Sinar sells RM4 million in inventory on credit at its carrying value, how will

this affect its current ratio?

iii. If Sinar sells RM2 million in inventory at its carrying calue and pays off

accounts payable, how will this affect a quick ratio?

(9 marks)

(Total: 25 marks)

QUESTION 3

a. Abadi Bhd purchased new machine to be used in their manufacturing plant. The cost

of the machine is RM150,000 including RM5000 Freight charges. Abadi paid

RM10,000 to install the machine and RM5,000 to train their employees to use the

machine. Assuming the company have an option to either capitalize or expensing the

training cost incurred. Explain the impact of capitalizing the training expenses on

income statement.

(6 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/FEB 2021/FAR670

b. For the year ended 31 December 2020, Angler Bhd had net income of RM2,500,000.

The company declared and paid RM200,000 of dividends on preferred shares. The

company also had the following common stock share information:

Share outstanding on 1 January 2020 2,000,000

Shares issued on 1 April 2020 400,000

Shares repurchased (treasury share) on 1 October/ 2020 (200,000)

Shares outstanding on 31 December 2020 2,200,000

You are required to calculate:

i. The company’s weighted average number of shares outstanding on

31/12/2020.

ii. The company’s basic earnings per share.

(5 marks)

c. Given the following information for Aspen Berhad

2018 2019 2020 (now)

Basic EPS 2.20 1.48 1.15

P/E ratio 12 25 37

i. Based on fundamental of investing, explain whether investor should purchase

the Aspen Bhd stock now?

(4 marks)

ii. Explain one possible reason for the PE ratio continue to increase despite a

decreasing trend in basic EPS.

(4 marks)

d. Explain the implication of poor cash flow position to the profitability of the firm.

(11 marks)

(Total: 30 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Wells Fargo StatementDocument8 pagesWells Fargo StatementJohn Bean100% (3)

- CRG660 Past Year AnswersDocument85 pagesCRG660 Past Year AnswersMuhammad Zulhisyam100% (3)

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Document10 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Alyn AdnanNo ratings yet

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- MT 199Document2 pagesMT 199loc kha50% (2)

- Far670 - Feb 2021 - QuestionDocument4 pagesFar670 - Feb 2021 - QuestionnurulsyafiqahNo ratings yet

- Far670 - Q - Feb 2021Document5 pagesFar670 - Q - Feb 2021AMIRA BINTI AMRANNo ratings yet

- Dec22 Maf503 Test1 QDocument4 pagesDec22 Maf503 Test1 QNik Fatehah NajwaNo ratings yet

- Far670 - July 2021 - QuestionDocument4 pagesFar670 - July 2021 - QuestionnurulsyafiqahNo ratings yet

- Far160 (CT XXX 2022) QuestionDocument4 pagesFar160 (CT XXX 2022) QuestionFarah HusnaNo ratings yet

- Q Far270 July2021 - Set 1Document8 pagesQ Far270 July2021 - Set 1nafisah rahmanNo ratings yet

- Indian Institute of Management Ahmedabad: Financial Reporting and Analysis End ExaminationDocument4 pagesIndian Institute of Management Ahmedabad: Financial Reporting and Analysis End ExaminationPulkit SethiaNo ratings yet

- Common Test - Dec 2021 QDocument6 pagesCommon Test - Dec 2021 QNur Anis AqilahNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR3202021202082No ratings yet

- Aug 2022 Final Exam Far 160Document9 pagesAug 2022 Final Exam Far 160adreanamarsyaNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082No ratings yet

- 2021 - Final Exam FRADocument4 pages2021 - Final Exam FRAAshutosh KumarNo ratings yet

- Far270 Q Feb2021 FaDocument9 pagesFar270 Q Feb2021 Fa2024786333No ratings yet

- Fa5 Nov20Document8 pagesFa5 Nov20Ridzuan SharifNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- Far670 Tutorial Basis of AnalysisDocument3 pagesFar670 Tutorial Basis of Analysis2020482736No ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- Common Test May2022 QDocument5 pagesCommon Test May2022 QNur Anis AqilahNo ratings yet

- BAC1614 - 2110 - Final ExaminationDocument9 pagesBAC1614 - 2110 - Final ExaminationNABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Assignment/ TugasanDocument21 pagesAssignment/ Tugasanhafiz azuanNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Test Acc406 0917Document4 pagesTest Acc406 09172024963073No ratings yet

- Assignment QuestionDocument13 pagesAssignment QuestionShalini DeviNo ratings yet

- Act3129 - Past Years Exercises On Employee Benefits - Insolvency - Capital Recons - 3may2020Document9 pagesAct3129 - Past Years Exercises On Employee Benefits - Insolvency - Capital Recons - 3may2020Muadz KamaruddinNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Far670 - Sept 2020Q - SuppDocument4 pagesFar670 - Sept 2020Q - SuppnurulsyafiqahNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- Audit Risk Question - Week 7Document5 pagesAudit Risk Question - Week 7ThafizhanNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far160Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far160Irzam ZairyNo ratings yet

- Assignment FarDocument5 pagesAssignment FarALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- MMPC-004 Accounting For ManagersDocument4 pagesMMPC-004 Accounting For Managersbhavan pNo ratings yet

- Af QP - CFSDocument4 pagesAf QP - CFSaman KumarNo ratings yet

- MMPC-004 Dec 2021-June 2023Document16 pagesMMPC-004 Dec 2021-June 2023sydatharNo ratings yet

- Question Bbaw2103 Financial AccountingDocument9 pagesQuestion Bbaw2103 Financial AccountingZakey Zainal0% (1)

- June 2019 QDocument8 pagesJune 2019 Q2024786333No ratings yet

- Bbaw2103 Financial AccountingDocument15 pagesBbaw2103 Financial AccountingSimon RajNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Final Exam July 2021 QQDocument8 pagesFinal Exam July 2021 QQLampard AimanNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- FA Dec 2022Document8 pagesFA Dec 2022Shawn LiewNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Topic 11 & 12 Capital Financing and Debt FinancingDocument46 pagesTopic 11 & 12 Capital Financing and Debt FinancingMuhammad ZulhisyamNo ratings yet

- Topic 10 Meetings & ResolutionsDocument32 pagesTopic 10 Meetings & ResolutionsMuhammad ZulhisyamNo ratings yet

- Topic 1 & 2 - Legal Framework For CSP & Forms of Business OwnershipDocument58 pagesTopic 1 & 2 - Legal Framework For CSP & Forms of Business OwnershipMuhammad ZulhisyamNo ratings yet

- Segment & Interim ReportDocument12 pagesSegment & Interim ReportMuhammad ZulhisyamNo ratings yet

- Write UpDocument5 pagesWrite UpMuhammad ZulhisyamNo ratings yet

- Source: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathDocument19 pagesSource: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathMelanie SamsonaNo ratings yet

- Chapter 12 - Other Long-Term InvestmentsDocument3 pagesChapter 12 - Other Long-Term InvestmentsJEFFERSON CUTENo ratings yet

- Questions, Anwers Chapter 22Document3 pagesQuestions, Anwers Chapter 22basit111No ratings yet

- Module 1 FMGT 80Document41 pagesModule 1 FMGT 80Novel LampitocNo ratings yet

- Revised PMJJBY Enrolment Form - 30.5.2022-1Document2 pagesRevised PMJJBY Enrolment Form - 30.5.2022-1Sathish Varma KosuriNo ratings yet

- Module 1 - Bonds Payable: Dalubhasaan NG Lungsod NG Lucena Intercompany Accounting Part 3 Faye Margaret P. Rocero, CPADocument3 pagesModule 1 - Bonds Payable: Dalubhasaan NG Lungsod NG Lucena Intercompany Accounting Part 3 Faye Margaret P. Rocero, CPABrein Symon DialaNo ratings yet

- IMC UNIT 1 Mock 1 KitDocument9 pagesIMC UNIT 1 Mock 1 KitSabinaNo ratings yet

- EW Ch3 Case Audit Planning MemoDocument7 pagesEW Ch3 Case Audit Planning MemoNursalihah Binti Md NorNo ratings yet

- IncorrectDocument6 pagesIncorrectViola LeviNo ratings yet

- Acctng 1Document1 pageAcctng 1LilyNo ratings yet

- Loan AgreementDocument25 pagesLoan Agreementayan5913No ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- PreviewDocument4 pagesPreviewblessingfaladebamideleNo ratings yet

- Turkey: Country Specific FeaturesDocument12 pagesTurkey: Country Specific FeaturesUdayraj SinghNo ratings yet

- Q221 - ACEN 17Q (FINAL) SGDDocument118 pagesQ221 - ACEN 17Q (FINAL) SGDSeifuku ShaNo ratings yet

- Auditing Specialized IndustryDocument2 pagesAuditing Specialized Industryangelicadecipulo0828No ratings yet

- A Study On Role of Technology in Banking SectorDocument6 pagesA Study On Role of Technology in Banking SectorEditor IJTSRD50% (2)

- Incometax Case Study 2021-22Document3 pagesIncometax Case Study 2021-22ATSI InstituteNo ratings yet

- Financial Markets and Institutions: ReadingsDocument10 pagesFinancial Markets and Institutions: ReadingsQuang NguyenNo ratings yet

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- Assignment Merchandising AnswerDocument5 pagesAssignment Merchandising AnswerReighjon Ashley C. TolentinoNo ratings yet

- ULOa Answer KeyDocument2 pagesULOa Answer KeyAyah Layson100% (3)

- Oke Management of Petty Cash FundDocument14 pagesOke Management of Petty Cash FundulaNo ratings yet

- Financial Leasing RegulationsDocument30 pagesFinancial Leasing RegulationsZaminNo ratings yet

- Financial Modelling and ValuationDocument17 pagesFinancial Modelling and ValuationSHIKHA CHAUHANNo ratings yet

- The Impact of Pandemic On Digital Payments in India: February 2021Document12 pagesThe Impact of Pandemic On Digital Payments in India: February 2021ShameerNo ratings yet

- Repot On SBIDocument76 pagesRepot On SBIPrasad SawantNo ratings yet

- 10 Chapter 3Document42 pages10 Chapter 3SANJU8795No ratings yet