Professional Documents

Culture Documents

This Is A Computer Generated Advice and No Signature Is Required.

This Is A Computer Generated Advice and No Signature Is Required.

Uploaded by

haymanpens usOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Is A Computer Generated Advice and No Signature Is Required.

This Is A Computer Generated Advice and No Signature Is Required.

Uploaded by

haymanpens usCopyright:

Available Formats

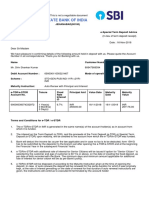

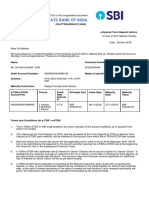

ADS -CITIN22338635933

Ref No : CITIN22338635933

Date : 26.09.2022

We certify that we have received the following remittance and proceeds thereof were paid

To STATE BANK OF INDIA, SECTOR 20 PANCHKULA

For Rs. 689.82 On 21.09.2022

For credit to Jain Jewelelrs

Account no 39988484502

Name & Place of residence of Remitter : Amazon.com

Name & address of the Remitting Bank : CITIBANK NEWYORK

DD/TT/MT NO : A40220920027555

Foreign. Currency Amount USD *8.74* Equivalent INR *689.82*

Amount in words : Rupees Six Hundred Eighty-Nine and Eighty-Two Paise Only

Rate Applied : 78.93

Purpose of remittance as stated by * Remitter /Beneficiary : P0108/USD 8.74/Goods sold under merchanting /

Rece

We also certify that the payment thereof has not been received in non-convertible

Rupees or under any special trade or payments agreement.

We confirm that we have obtained reimbursement in an approved manner.

* Strike out whichever is inapplicable.

“This is a computer generated advice and no signature is required.”

“In case the funds have been received in INR only through the vostro route, no FCY amount / rate would be mentioned in the

Advice and the said remittance should be construed as having been received through the vostro route.”

“Please note as per terms 16 (1) (i), (ii), (iii) under notifications of FEMA 23/2000-RB , Master Direction – Export of Goods

and Services dated January 1,2016 that relates to the export of goods and services, where an exporter receives an advance

payment from a buyer outside India, the exporter is under obligation to ensure that the shipment of goods is made within one

year from the date of receipt of advance payment. The Exporter is also under obligation to route the export documents

through the authorized dealer through whom the advance payment is received.”

“If you find the purpose of remittance mentioned in this Foreign Inward Remittance Advice be incorrect, you are requested to

inform your nearest Citibank Branch within 48 hours of receipt of the same.”

“In the event the remittance constitutes External Commercial Borrowing (ECB) / Loan draw down, the beneficiary must

ensure that prevailing FEMA guidelines with regards to ECB are complied.”

Citibank N.A

You might also like

- Icici Settlement LetterDocument3 pagesIcici Settlement LetterSHAWNo ratings yet

- Subject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Document3 pagesSubject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Noble InfoTechNo ratings yet

- Ad00100972 16112018071600 PDFDocument1 pageAd00100972 16112018071600 PDFBalmukund kumarNo ratings yet

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchDocument6 pagesCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchAkhbar-ul- AkhyarNo ratings yet

- This Is A Computer Generated Advice and No Signature Is Required.Document1 pageThis Is A Computer Generated Advice and No Signature Is Required.jasodaglobalNo ratings yet

- Export Advance Payment - Branch ProposalDocument2 pagesExport Advance Payment - Branch ProposalKumar SwamyNo ratings yet

- PK Letter of UnderstandingDocument4 pagesPK Letter of UnderstandingHabib Sultan KhelNo ratings yet

- Remittances: Pay Order / Cashier's Cheque / Banker's ChequeDocument12 pagesRemittances: Pay Order / Cashier's Cheque / Banker's ChequeHussnain NaneNo ratings yet

- Signed AgreementDocument3 pagesSigned AgreementBedabati PadhyNo ratings yet

- Thirdiproperty Pty LTD Level 2 343 Pacific Hwy North Sydne Y NSW 2060 Australia 25-05-2016 SOFTWARE (P0802)Document2 pagesThirdiproperty Pty LTD Level 2 343 Pacific Hwy North Sydne Y NSW 2060 Australia 25-05-2016 SOFTWARE (P0802)Prakash WarrierNo ratings yet

- Gmail - Successful Allocation of UIN For The Form ODI Part I (Automatic Route) Transaction Reported OnlineDocument4 pagesGmail - Successful Allocation of UIN For The Form ODI Part I (Automatic Route) Transaction Reported OnlineZofoNo ratings yet

- 8514923A30Z0001Document1 page8514923A30Z0001shekarprabhas51No ratings yet

- FEMA RegulationsDocument38 pagesFEMA RegulationsRamakrishnan AnantapadmanabhanNo ratings yet

- HSBC Inward AdviceDocument1 pageHSBC Inward Advice9507686476bkNo ratings yet

- LetterDocument3 pagesLetteranupam_saha_9No ratings yet

- KFS PB Mashreq Millionaire Certificate 2021 EngDocument2 pagesKFS PB Mashreq Millionaire Certificate 2021 EngKunjemy EmyNo ratings yet

- Western Union PDFDocument40 pagesWestern Union PDFRobin Hoodxii100% (1)

- TNC MitcDocument2 pagesTNC Mitcashok9702No ratings yet

- Credit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchDocument6 pagesCredit Card Statement: Payment Amount in PKR Debit My Silkbank A/C # Accept My Payment Through Cheque # Bank BranchTri Adi NugrohoNo ratings yet

- SOC - CC MITC 2.01 - With Schedule of ChargesDocument8 pagesSOC - CC MITC 2.01 - With Schedule of Chargessyed imranNo ratings yet

- Bank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Document16 pagesBank of India (Card Products Department) Most Important Terms and Conditions (Mitcs)Arun CHNo ratings yet

- Disposal Instructions Retail FormatDocument2 pagesDisposal Instructions Retail FormatPrince SharmaNo ratings yet

- International Trade Finance and Risk Hedging - NDocument51 pagesInternational Trade Finance and Risk Hedging - NastrolearnNo ratings yet

- 107 ExtraDocument47 pages107 ExtraDhawan SandeepNo ratings yet

- Compensation PolicyDocument17 pagesCompensation Policymehevishali39No ratings yet

- MMT Platinum TNCDocument9 pagesMMT Platinum TNCezaza3108No ratings yet

- BMO Business MasterCard - AgreementDocument9 pagesBMO Business MasterCard - AgreementAlex LondonoNo ratings yet

- Chapter On Export and Import CreditDocument8 pagesChapter On Export and Import CreditGeorgeNo ratings yet

- STLMNT - Letter - 4748XXXXXXXX5001 - SAVAN PATELDocument3 pagesSTLMNT - Letter - 4748XXXXXXXX5001 - SAVAN PATELshivagencies2021No ratings yet

- 5810722a22g0001 2007193Document1 page5810722a22g0001 2007193Soumya SahuNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- Merchant Integration Services: E-Stamp: IN-DL62129004404861PDocument6 pagesMerchant Integration Services: E-Stamp: IN-DL62129004404861Pmkd2000No ratings yet

- For Office Use: Request Letter For Issuing Bank GuaranteeDocument2 pagesFor Office Use: Request Letter For Issuing Bank GuaranteeladmohanNo ratings yet

- Master Direction On Import of Goods and ServicesDocument31 pagesMaster Direction On Import of Goods and Serviceseknath2000No ratings yet

- 8413123k18a0001 5064077Document1 page8413123k18a0001 5064077Payal KumariNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- Payment NotificationDocument2 pagesPayment NotificationfinopectradingNo ratings yet

- KYC AML Presentation For 9 March PDFDocument43 pagesKYC AML Presentation For 9 March PDFAnagha LokhandeNo ratings yet

- Agreement On Delivery of Cash Funds For Investments Via IPIPDocument12 pagesAgreement On Delivery of Cash Funds For Investments Via IPIPPit GeisNo ratings yet

- Buyers CreditDocument2 pagesBuyers Creditrao_gmailNo ratings yet

- Terms & ConditionsDocument4 pagesTerms & ConditionsRavi Kishore PaturiNo ratings yet

- HF Markets (SV) LTD: Withdrawal ConditionsDocument5 pagesHF Markets (SV) LTD: Withdrawal ConditionsseintitusNo ratings yet

- Hand Out No 12 Remittances Hand OutDocument9 pagesHand Out No 12 Remittances Hand OutAbdul basitNo ratings yet

- Merchant Integration Services: E-Stamp: IN-DL17949517426799QDocument6 pagesMerchant Integration Services: E-Stamp: IN-DL17949517426799QbaraniNo ratings yet

- Bio Medical ProposalDocument5 pagesBio Medical ProposalAbdulsalam ZainabNo ratings yet

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- E-KYC, CKYC, ReKYC and V KYCDocument4 pagesE-KYC, CKYC, ReKYC and V KYCSusvitha SankarNo ratings yet

- Eftnet 17593053999Document2 pagesEftnet 17593053999saimohan SubudhiNo ratings yet

- Most Important Terms and ConditionsDocument7 pagesMost Important Terms and Conditionsyour mdrahamanNo ratings yet

- Ad12459992 26112018095403 PDFDocument1 pageAd12459992 26112018095403 PDFAKSNo ratings yet

- Deposit Slip PDFDocument2 pagesDeposit Slip PDFLalit PardasaniNo ratings yet

- Deposit SlipDocument2 pagesDeposit SlipLalit PardasaniNo ratings yet

- Compensation Policy 28 03 2019Document10 pagesCompensation Policy 28 03 2019Arnab MitraNo ratings yet

- SBI ReceiptDocument1 pageSBI ReceiptVenkata Sujith ChNo ratings yet

- Application For EPC DisbursementDocument2 pagesApplication For EPC DisbursementSanjayNo ratings yet

- International Trade Settlement in Indian RupeesDocument4 pagesInternational Trade Settlement in Indian Rupeesdipak kambleNo ratings yet

- In Smartcard Product Terms and ConditionsDocument3 pagesIn Smartcard Product Terms and ConditionsIshan ShahNo ratings yet

- STLMNT - Letter - LTDEXXXXXXXX8915 - DEVINDER .Document3 pagesSTLMNT - Letter - LTDEXXXXXXXX8915 - DEVINDER .arjuniieiehdhNo ratings yet

- Icici Bank: METRO BRANCH (13398)Document1 pageIcici Bank: METRO BRANCH (13398)Mayank chauhan100% (1)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Bpi Family Bank vs. Franco G.R. No. 123498 - November 23, 2007 - J. Nachura FactsDocument2 pagesBpi Family Bank vs. Franco G.R. No. 123498 - November 23, 2007 - J. Nachura FactsCZARINA ANN CASTRO100% (1)

- Vic Open Ended 6 7 8Document7 pagesVic Open Ended 6 7 8victoriamuiruri28No ratings yet

- (WNAzni) Edited IIMMDocument4 pages(WNAzni) Edited IIMMwanazniNo ratings yet

- Credit-Policy-2017-18 - Pahal FinancialDocument13 pagesCredit-Policy-2017-18 - Pahal FinancialJ ANo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedHr BlackbucksNo ratings yet

- Treasury and Risk Management PDFDocument25 pagesTreasury and Risk Management PDFShanidNo ratings yet

- Banking Project Rajat SharmaDocument14 pagesBanking Project Rajat Sharmaarpit.agarwal.855No ratings yet

- Literature Review On Loans and AdvancesDocument5 pagesLiterature Review On Loans and Advancesc5rnbv5r100% (1)

- Abysina Bank 2020Document116 pagesAbysina Bank 2020Yared Deribew0% (1)

- Financial Literacy Project 660 760 763 443 867 907 PDFDocument33 pagesFinancial Literacy Project 660 760 763 443 867 907 PDFSanchit Gupta 660No ratings yet

- StatementDocument4 pagesStatementmaoraccesoriesNo ratings yet

- Literature Review On Financial Performance of BanksDocument4 pagesLiterature Review On Financial Performance of BanksafdtzvbexNo ratings yet

- Format SPSS BenarDocument12 pagesFormat SPSS BenarAmbar WatiNo ratings yet

- Axis Bank ProjectDocument85 pagesAxis Bank Projectsv net100% (1)

- Survey For Bank EmployeesDocument1 pageSurvey For Bank EmployeesFardin KhanNo ratings yet

- MEFA - 4th UnitDocument24 pagesMEFA - 4th UnitP.V.S. VEERANJANEYULUNo ratings yet

- Providence College School of Business: FIN 417 Fixed Income Securities Fall 2021 Instructor: Matthew CallahanDocument36 pagesProvidence College School of Business: FIN 417 Fixed Income Securities Fall 2021 Instructor: Matthew CallahanAlexander MaffeoNo ratings yet

- Dutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshDocument2 pagesDutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshNur NobiNo ratings yet

- ACCTG 6 Midterm ExaminationDocument16 pagesACCTG 6 Midterm ExaminationJudy Anne RamirezNo ratings yet

- Study of Growing Popularity of Payment Apps in India: ArticleDocument11 pagesStudy of Growing Popularity of Payment Apps in India: ArticleRizwan Shaikh 44No ratings yet

- Water For Every Resident (WATER) Program - Development Bank of The PhilippinesDocument9 pagesWater For Every Resident (WATER) Program - Development Bank of The Philippinesymgqt2gc2nNo ratings yet

- Lecture 10 - Introduction To Math of FinanceDocument36 pagesLecture 10 - Introduction To Math of FinancejunainhaqueNo ratings yet

- Business Finance: Mr. Dave Kieth J. Lappay Subject TeacherDocument26 pagesBusiness Finance: Mr. Dave Kieth J. Lappay Subject TeacherNathaniel BocautoNo ratings yet

- Third Day Tally Contents (Journal Entry Part - 1)Document12 pagesThird Day Tally Contents (Journal Entry Part - 1)Kamlesh Kumar100% (1)

- PayMe Hong Kongs E-WalletDocument12 pagesPayMe Hong Kongs E-Walletachmad.zulfikarNo ratings yet

- BKP 9 Accounting EquationDocument16 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- K 2 Khajane 2 ChallanDocument3 pagesK 2 Khajane 2 ChallanVinutha MBNo ratings yet

- How To Take Money From ATM: Procedure TextDocument1 pageHow To Take Money From ATM: Procedure TextOctavinaNo ratings yet

- Debit VS Credit11Document3 pagesDebit VS Credit11For YoutubeNo ratings yet

- Merchant BankingDocument55 pagesMerchant Bankingsuhaspatel84No ratings yet