Professional Documents

Culture Documents

Descriptive Stats 0424

Descriptive Stats 0424

Uploaded by

Van Joshua NunezCopyright:

Available Formats

You might also like

- Ethical Principles For Pharmacy TechniciansDocument6 pagesEthical Principles For Pharmacy TechniciansGilbert OfeiNo ratings yet

- Corporate Governance and Financial Characteristic Effects On The Extent of Corporate Social Responsibility DisclosureDocument23 pagesCorporate Governance and Financial Characteristic Effects On The Extent of Corporate Social Responsibility DisclosurePrahesti Ayu WulandariNo ratings yet

- Determinants of Corporate Social Responsibility Reporting in IndiaDocument10 pagesDeterminants of Corporate Social Responsibility Reporting in IndiadessyNo ratings yet

- Role of Corporate Governance On The Performance of Insurance Companies of NepalDocument14 pagesRole of Corporate Governance On The Performance of Insurance Companies of NepalShikta TopsheNo ratings yet

- The Determinants Influencing The Extent of CSR DisclosureDocument25 pagesThe Determinants Influencing The Extent of CSR DisclosurePrahesti Ayu WulandariNo ratings yet

- Neil NagyDocument32 pagesNeil Nagymasyuki1979No ratings yet

- The Role of Corporate Social Responsibility in Consumption 20vqr098Document7 pagesThe Role of Corporate Social Responsibility in Consumption 20vqr098liona efrinaunajaNo ratings yet

- Blind ManuscriptDocument18 pagesBlind ManuscriptSandra Ofelia Marmolejo MedranoNo ratings yet

- Measuring Firm Size in Empirical Corporate Finance: Journal of Banking & Finance January 2013Document60 pagesMeasuring Firm Size in Empirical Corporate Finance: Journal of Banking & Finance January 2013Rafif IrfanNo ratings yet

- Corporate Governance and Fraud Detection A Study FDocument21 pagesCorporate Governance and Fraud Detection A Study FsowmiyaNo ratings yet

- Audit Committee Effectiveness and Corporate Sustainable GrowthDocument34 pagesAudit Committee Effectiveness and Corporate Sustainable GrowthReni Mustika SariNo ratings yet

- Corporate Governance and Firm Performance - A Study of Bse 100 CompaniesDocument11 pagesCorporate Governance and Firm Performance - A Study of Bse 100 CompaniesAbhishek GagnejaNo ratings yet

- Umer & Usman 2018Document9 pagesUmer & Usman 2018Babar NawazNo ratings yet

- A Study of Selected Manufacturing Companies Listed On Colombo Stock Exchange in Sri LankaDocument10 pagesA Study of Selected Manufacturing Companies Listed On Colombo Stock Exchange in Sri LankaAlexander DeckerNo ratings yet

- 1.6 Review of LiteratureDocument8 pages1.6 Review of LiteratureMaha LakshmiNo ratings yet

- Literature Review Financial Ratios AnalysisDocument8 pagesLiterature Review Financial Ratios Analysisfyh0kihiwef2100% (1)

- Credit Scoring Model For Smes in India: 1. Calculation of RatiosDocument4 pagesCredit Scoring Model For Smes in India: 1. Calculation of RatiosKushal KapoorNo ratings yet

- 5267 PDFDocument9 pages5267 PDFmaria saleemNo ratings yet

- VIJUDocument1 pageVIJUVijay ShanigarapuNo ratings yet

- Alternative Disclosure and Performance Measurement of Islamic BanksDocument51 pagesAlternative Disclosure and Performance Measurement of Islamic BanksDr. Shahul Hameed bin Mohamed Ibrahim100% (9)

- Financial Statement As Instrument For PredictingDocument18 pagesFinancial Statement As Instrument For PredictingnanakethanNo ratings yet

- CAC 10+ (138) Ok (1429 1437)Document9 pagesCAC 10+ (138) Ok (1429 1437)Fagbile TomiwaNo ratings yet

- Impact of Corporate Governance On Corporate Financial PerformanceDocument5 pagesImpact of Corporate Governance On Corporate Financial PerformanceneppoliyanNo ratings yet

- Akinlo and Asaolo, 2012 PDFDocument9 pagesAkinlo and Asaolo, 2012 PDFJason KurniawanNo ratings yet

- Tax Avoidance CG and CSR - The Egyptian Case PDFDocument44 pagesTax Avoidance CG and CSR - The Egyptian Case PDFJoseNo ratings yet

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Document7 pagesRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08No ratings yet

- Analisis Pengaruh Rasio Likuiditas, SolvabilitasDocument15 pagesAnalisis Pengaruh Rasio Likuiditas, SolvabilitashansolNo ratings yet

- Corporate Governance and Market ReactionsDocument16 pagesCorporate Governance and Market ReactionsAmruta JangamNo ratings yet

- Social Disclosure and Profitability: Study in Indonesian Companies Fida Muthia, IsnurhadiDocument14 pagesSocial Disclosure and Profitability: Study in Indonesian Companies Fida Muthia, IsnurhadiMoudruy AnastaNo ratings yet

- International Journalof Economic ResearchDocument10 pagesInternational Journalof Economic Researchhilman fauziNo ratings yet

- Balance ScorecardDocument21 pagesBalance ScorecardEdha LiaNo ratings yet

- Some Clarity On Mutual Fund Fees: Stewart Brown Steven PomerantzDocument28 pagesSome Clarity On Mutual Fund Fees: Stewart Brown Steven PomerantzGhulam NabiNo ratings yet

- Business Failure Prediction 18 Sept 2010Document41 pagesBusiness Failure Prediction 18 Sept 2010Shariff MohamedNo ratings yet

- A Transparency Disclosure Index Measuring Disclosures (Eng)Document31 pagesA Transparency Disclosure Index Measuring Disclosures (Eng)AndriNo ratings yet

- Sypnosis-I (2) FinalDocument2 pagesSypnosis-I (2) FinalAshish KarnNo ratings yet

- Critical Review of Research Journals 1Document10 pagesCritical Review of Research Journals 1Re PimNo ratings yet

- ScienceDirect Citations 1522851638967Document42 pagesScienceDirect Citations 1522851638967Manoj KumarNo ratings yet

- Rameez Shakaib MSA 3123Document7 pagesRameez Shakaib MSA 3123OsamaMazhariNo ratings yet

- Small vs. Young Firms Across The World: Policy Research Working Paper 5631Document43 pagesSmall vs. Young Firms Across The World: Policy Research Working Paper 5631ahmedrostomNo ratings yet

- Guiso Sapienza Zingales Sept 2013Document45 pagesGuiso Sapienza Zingales Sept 2013SAAHIL4UNo ratings yet

- Research Context: MGT 631: Graduate Seminar: Corporate GovernanceDocument2 pagesResearch Context: MGT 631: Graduate Seminar: Corporate GovernanceAshish KarnNo ratings yet

- Journal Critique AssignmentDocument6 pagesJournal Critique AssignmentJesy Joaquin AmableNo ratings yet

- External AssesmentDocument17 pagesExternal AssesmentAlthea Faye RabanalNo ratings yet

- The Effect of Firm Size On Firms Profitability in NigeriaDocument6 pagesThe Effect of Firm Size On Firms Profitability in NigeriaAndiNo ratings yet

- "Corporate Governance" Importance, Pillars and Principle (Road To Corporate Transparency)Document7 pages"Corporate Governance" Importance, Pillars and Principle (Road To Corporate Transparency)BUS18F029 MansoorkhanNo ratings yet

- Journal of Accounting, Business and ManagementDocument16 pagesJournal of Accounting, Business and ManagementWiduri PutriNo ratings yet

- Corporate Governance in Terms With SEC GuidelinesDocument13 pagesCorporate Governance in Terms With SEC Guidelinesasif29mNo ratings yet

- A Comparative Analysis of Annual Report of "United Spirits LTD" Across Industries by Rishi MaheshDocument13 pagesA Comparative Analysis of Annual Report of "United Spirits LTD" Across Industries by Rishi Maheshrishimahesh2005No ratings yet

- Accounting Ratios As A Veritable Tool For Corporate Investment Decisions: A Study of Selected Organizations in Delta StateDocument12 pagesAccounting Ratios As A Veritable Tool For Corporate Investment Decisions: A Study of Selected Organizations in Delta StateOffiaNo ratings yet

- LiteratureDocument7 pagesLiteraturegn.metheNo ratings yet

- Mergers, Acquisitions and Firms' Performance: Experience of Indian Pharmaceutical IndustryDocument6 pagesMergers, Acquisitions and Firms' Performance: Experience of Indian Pharmaceutical IndustryPriha AliNo ratings yet

- For Plag CheckDocument259 pagesFor Plag CheckAftab TabasamNo ratings yet

- The Impact of Corporate Governance On The Profitability of Nepalese EnterpriseDocument10 pagesThe Impact of Corporate Governance On The Profitability of Nepalese EnterpriseAyush Nepal100% (1)

- Thesis On Corporate Governance and Firm Performance PDFDocument9 pagesThesis On Corporate Governance and Firm Performance PDFErin Taylor100% (2)

- Tax 1Document4 pagesTax 1Soumik KunduNo ratings yet

- Management ReportDocument12 pagesManagement ReportaryahashNo ratings yet

- I202122059+Wang Yuhang+CSRDocument9 pagesI202122059+Wang Yuhang+CSRAbu Saeed PalashNo ratings yet

- Enhancing Success of Smes Through Risk ENTERPRISE MANAGEMENT: Evidence From A Developing Country Blessward JENYA and Maxwell SANDADADocument16 pagesEnhancing Success of Smes Through Risk ENTERPRISE MANAGEMENT: Evidence From A Developing Country Blessward JENYA and Maxwell SANDADAichiyo akagiNo ratings yet

- Intoducation To LastDocument20 pagesIntoducation To LastBekar JibonNo ratings yet

- Maman Setiawan and Darmawan (2011)Document6 pagesMaman Setiawan and Darmawan (2011)IgotmypointNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- ISO 9001 Version 2008Document4 pagesISO 9001 Version 2008balotellis721No ratings yet

- History of Sri LankaDocument2 pagesHistory of Sri LankaBlue RainNo ratings yet

- Understand: Bohol BoholDocument5 pagesUnderstand: Bohol BoholRamil GofredoNo ratings yet

- Ravenshaw University PHD RulesDocument12 pagesRavenshaw University PHD RulesAJITAV SILU100% (1)

- GOV - UK - Redundancy - Your RightsDocument7 pagesGOV - UK - Redundancy - Your RightsMayowa OlatoyeNo ratings yet

- Greatest Robbery of A Government Guinness World RecordsDocument1 pageGreatest Robbery of A Government Guinness World Recordsrex ceeNo ratings yet

- EL112 SURVEY OF AFRO ReviewerDocument5 pagesEL112 SURVEY OF AFRO ReviewerUkulele PrincessNo ratings yet

- Tumasik or Old SingaporeDocument6 pagesTumasik or Old SingaporeAdrian TanNo ratings yet

- Chapter 1Document25 pagesChapter 1Naman PalindromeNo ratings yet

- Daedalus and IcarusDocument8 pagesDaedalus and IcarusMuhammad AnsarNo ratings yet

- Ucsp 2Document40 pagesUcsp 2Junjun CaturaNo ratings yet

- Tausug (Any)Document15 pagesTausug (Any)Fharhan Dacula100% (2)

- Kami Export - Lucas Perez - Prohibitions WebquestDocument3 pagesKami Export - Lucas Perez - Prohibitions WebquestTactical DogeNo ratings yet

- STR502 Workplace Project Task 3 Assessors ChecklistDocument9 pagesSTR502 Workplace Project Task 3 Assessors ChecklistCong Tuan HuynhNo ratings yet

- 26-DJR Nagpur - Co-Operative Officer Grade-1Document61 pages26-DJR Nagpur - Co-Operative Officer Grade-1Abdul Raheman ShaikhNo ratings yet

- Comparison Between RELIANCE Telecom and MTNLDocument22 pagesComparison Between RELIANCE Telecom and MTNLMoin KhanNo ratings yet

- Discuss VS Defend Essay - Writing A Defend' Essay Plan and IntroductionDocument18 pagesDiscuss VS Defend Essay - Writing A Defend' Essay Plan and IntroductionNohaEl-SherifNo ratings yet

- Vacuum Cleaner ®Document5 pagesVacuum Cleaner ®pukymottoNo ratings yet

- Religions of - Rome2 PDFDocument427 pagesReligions of - Rome2 PDFmichaelgillham100% (1)

- Kelvion Walker Vs Amy WilburnDocument63 pagesKelvion Walker Vs Amy WilburnHorrible CrimeNo ratings yet

- Listes Additives Groupe 5 - MefDocument23 pagesListes Additives Groupe 5 - MefPaul KolomouNo ratings yet

- Kelompok 10 PronounsDocument19 pagesKelompok 10 PronounssariNo ratings yet

- 1PE ACI Vs CoquiaDocument7 pages1PE ACI Vs CoquiaVladimir ReidNo ratings yet

- Ajay Gehlot CVDocument8 pagesAjay Gehlot CVRvi MahayNo ratings yet

- Gee DETAILSDocument42 pagesGee DETAILSvinay_kNo ratings yet

- 4th Semester (Previous YEar Question Paper)Document88 pages4th Semester (Previous YEar Question Paper)HassanNo ratings yet

- Codeigniter4 Github Io UserguideDocument5 pagesCodeigniter4 Github Io UserguidexserverNo ratings yet

- Transkrip Sementara Universitas Wahid Hasyim: (Certificate of Establishment)Document3 pagesTranskrip Sementara Universitas Wahid Hasyim: (Certificate of Establishment)Lailatuz ZakiyahNo ratings yet

- Paparan UNDP IndonesiaDocument19 pagesPaparan UNDP IndonesiaAFA shopNo ratings yet

Descriptive Stats 0424

Descriptive Stats 0424

Uploaded by

Van Joshua NunezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Descriptive Stats 0424

Descriptive Stats 0424

Uploaded by

Van Joshua NunezCopyright:

Available Formats

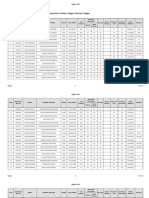

Descriptive Statistics

The table contains the descriptive statistics that answers the first objective of the study by describing the

statistics of the variables, which include financial performance, corporate social responsibility, board

characteristics, firm characteristics, and country-level institutional factors. The sample includes 600 firm-

year observations for the years 2020 - 2021. The firms in the sample come from a wide range of

industries. Specifically, table 1 presents the mean, median, standard deviation, minimum, and maximum

values of the variables, which were calculated to describe the central tendency and variability of the data.

Regarding the financial performance, the statistics show that the mean for ROA is 0.0561 with a standard

deviation of 0.0355, and the ROE’s mean is 0.787, with a standard deviation of 16.0. Additionally, the

mean for Tobin’s Q is 1.81, with a standard deviation of 4.42. These measures indicate the profitability

and market value of the firms in the sample.

Furthermore, for corporate social responsibility, the firms’ environmental, social, and governance (ESG)

combined scores show that the mean value for ESGscore is 53.2. Additionally, its standard deviation

value of 18.200 indicates that the scores are widely spread out from the mean. The minimum and

maximum values for ESGscore are 2.660 and 92.000, respectively. These values indicate the lowest and

highest scores in the dataset.

The board characteristics include gender diversity, board size, board independence, CEO duality, and

CSR committee. The mean for gender diversity score is 18.5, indicating that on average, boards have

18.5% female representation. The mean for board size is 9.69, and the mean for board independence score

is 49.0. The CSR committee exists in 75.7% of the companies studied. These figures indicate that the

sample firms have a relatively diverse board in terms of gender, have a medium-sized board, and have a

moderate level of board independence.

Other factors such as firm size, leverage, government effectiveness, and country development status are

also included in the analysis. For firm characteristics, the mean for firm size is 9.60, and the mean for

leverage is 0.567. These measures indicate that the companies in the sample are relatively small and have

moderate levels of leverage. Furthermore, the descriptive statistics show that the mean for the government

effectiveness variable is 0.837, and the majority of the firms are from developing countries as it occurred

79% of the time. These country-level institutional factors may affect the financial performance and

corporate social responsibility practices of the companies (Wang et al., 2019). Overall, these descriptive

statistics provide an initial understanding of the financial performance, corporate social responsibility,

board characteristics, firm characteristics, and country-level institutional factors of ASEAN publicly

listed companies.

You might also like

- Ethical Principles For Pharmacy TechniciansDocument6 pagesEthical Principles For Pharmacy TechniciansGilbert OfeiNo ratings yet

- Corporate Governance and Financial Characteristic Effects On The Extent of Corporate Social Responsibility DisclosureDocument23 pagesCorporate Governance and Financial Characteristic Effects On The Extent of Corporate Social Responsibility DisclosurePrahesti Ayu WulandariNo ratings yet

- Determinants of Corporate Social Responsibility Reporting in IndiaDocument10 pagesDeterminants of Corporate Social Responsibility Reporting in IndiadessyNo ratings yet

- Role of Corporate Governance On The Performance of Insurance Companies of NepalDocument14 pagesRole of Corporate Governance On The Performance of Insurance Companies of NepalShikta TopsheNo ratings yet

- The Determinants Influencing The Extent of CSR DisclosureDocument25 pagesThe Determinants Influencing The Extent of CSR DisclosurePrahesti Ayu WulandariNo ratings yet

- Neil NagyDocument32 pagesNeil Nagymasyuki1979No ratings yet

- The Role of Corporate Social Responsibility in Consumption 20vqr098Document7 pagesThe Role of Corporate Social Responsibility in Consumption 20vqr098liona efrinaunajaNo ratings yet

- Blind ManuscriptDocument18 pagesBlind ManuscriptSandra Ofelia Marmolejo MedranoNo ratings yet

- Measuring Firm Size in Empirical Corporate Finance: Journal of Banking & Finance January 2013Document60 pagesMeasuring Firm Size in Empirical Corporate Finance: Journal of Banking & Finance January 2013Rafif IrfanNo ratings yet

- Corporate Governance and Fraud Detection A Study FDocument21 pagesCorporate Governance and Fraud Detection A Study FsowmiyaNo ratings yet

- Audit Committee Effectiveness and Corporate Sustainable GrowthDocument34 pagesAudit Committee Effectiveness and Corporate Sustainable GrowthReni Mustika SariNo ratings yet

- Corporate Governance and Firm Performance - A Study of Bse 100 CompaniesDocument11 pagesCorporate Governance and Firm Performance - A Study of Bse 100 CompaniesAbhishek GagnejaNo ratings yet

- Umer & Usman 2018Document9 pagesUmer & Usman 2018Babar NawazNo ratings yet

- A Study of Selected Manufacturing Companies Listed On Colombo Stock Exchange in Sri LankaDocument10 pagesA Study of Selected Manufacturing Companies Listed On Colombo Stock Exchange in Sri LankaAlexander DeckerNo ratings yet

- 1.6 Review of LiteratureDocument8 pages1.6 Review of LiteratureMaha LakshmiNo ratings yet

- Literature Review Financial Ratios AnalysisDocument8 pagesLiterature Review Financial Ratios Analysisfyh0kihiwef2100% (1)

- Credit Scoring Model For Smes in India: 1. Calculation of RatiosDocument4 pagesCredit Scoring Model For Smes in India: 1. Calculation of RatiosKushal KapoorNo ratings yet

- 5267 PDFDocument9 pages5267 PDFmaria saleemNo ratings yet

- VIJUDocument1 pageVIJUVijay ShanigarapuNo ratings yet

- Alternative Disclosure and Performance Measurement of Islamic BanksDocument51 pagesAlternative Disclosure and Performance Measurement of Islamic BanksDr. Shahul Hameed bin Mohamed Ibrahim100% (9)

- Financial Statement As Instrument For PredictingDocument18 pagesFinancial Statement As Instrument For PredictingnanakethanNo ratings yet

- CAC 10+ (138) Ok (1429 1437)Document9 pagesCAC 10+ (138) Ok (1429 1437)Fagbile TomiwaNo ratings yet

- Impact of Corporate Governance On Corporate Financial PerformanceDocument5 pagesImpact of Corporate Governance On Corporate Financial PerformanceneppoliyanNo ratings yet

- Akinlo and Asaolo, 2012 PDFDocument9 pagesAkinlo and Asaolo, 2012 PDFJason KurniawanNo ratings yet

- Tax Avoidance CG and CSR - The Egyptian Case PDFDocument44 pagesTax Avoidance CG and CSR - The Egyptian Case PDFJoseNo ratings yet

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Document7 pagesRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08No ratings yet

- Analisis Pengaruh Rasio Likuiditas, SolvabilitasDocument15 pagesAnalisis Pengaruh Rasio Likuiditas, SolvabilitashansolNo ratings yet

- Corporate Governance and Market ReactionsDocument16 pagesCorporate Governance and Market ReactionsAmruta JangamNo ratings yet

- Social Disclosure and Profitability: Study in Indonesian Companies Fida Muthia, IsnurhadiDocument14 pagesSocial Disclosure and Profitability: Study in Indonesian Companies Fida Muthia, IsnurhadiMoudruy AnastaNo ratings yet

- International Journalof Economic ResearchDocument10 pagesInternational Journalof Economic Researchhilman fauziNo ratings yet

- Balance ScorecardDocument21 pagesBalance ScorecardEdha LiaNo ratings yet

- Some Clarity On Mutual Fund Fees: Stewart Brown Steven PomerantzDocument28 pagesSome Clarity On Mutual Fund Fees: Stewart Brown Steven PomerantzGhulam NabiNo ratings yet

- Business Failure Prediction 18 Sept 2010Document41 pagesBusiness Failure Prediction 18 Sept 2010Shariff MohamedNo ratings yet

- A Transparency Disclosure Index Measuring Disclosures (Eng)Document31 pagesA Transparency Disclosure Index Measuring Disclosures (Eng)AndriNo ratings yet

- Sypnosis-I (2) FinalDocument2 pagesSypnosis-I (2) FinalAshish KarnNo ratings yet

- Critical Review of Research Journals 1Document10 pagesCritical Review of Research Journals 1Re PimNo ratings yet

- ScienceDirect Citations 1522851638967Document42 pagesScienceDirect Citations 1522851638967Manoj KumarNo ratings yet

- Rameez Shakaib MSA 3123Document7 pagesRameez Shakaib MSA 3123OsamaMazhariNo ratings yet

- Small vs. Young Firms Across The World: Policy Research Working Paper 5631Document43 pagesSmall vs. Young Firms Across The World: Policy Research Working Paper 5631ahmedrostomNo ratings yet

- Guiso Sapienza Zingales Sept 2013Document45 pagesGuiso Sapienza Zingales Sept 2013SAAHIL4UNo ratings yet

- Research Context: MGT 631: Graduate Seminar: Corporate GovernanceDocument2 pagesResearch Context: MGT 631: Graduate Seminar: Corporate GovernanceAshish KarnNo ratings yet

- Journal Critique AssignmentDocument6 pagesJournal Critique AssignmentJesy Joaquin AmableNo ratings yet

- External AssesmentDocument17 pagesExternal AssesmentAlthea Faye RabanalNo ratings yet

- The Effect of Firm Size On Firms Profitability in NigeriaDocument6 pagesThe Effect of Firm Size On Firms Profitability in NigeriaAndiNo ratings yet

- "Corporate Governance" Importance, Pillars and Principle (Road To Corporate Transparency)Document7 pages"Corporate Governance" Importance, Pillars and Principle (Road To Corporate Transparency)BUS18F029 MansoorkhanNo ratings yet

- Journal of Accounting, Business and ManagementDocument16 pagesJournal of Accounting, Business and ManagementWiduri PutriNo ratings yet

- Corporate Governance in Terms With SEC GuidelinesDocument13 pagesCorporate Governance in Terms With SEC Guidelinesasif29mNo ratings yet

- A Comparative Analysis of Annual Report of "United Spirits LTD" Across Industries by Rishi MaheshDocument13 pagesA Comparative Analysis of Annual Report of "United Spirits LTD" Across Industries by Rishi Maheshrishimahesh2005No ratings yet

- Accounting Ratios As A Veritable Tool For Corporate Investment Decisions: A Study of Selected Organizations in Delta StateDocument12 pagesAccounting Ratios As A Veritable Tool For Corporate Investment Decisions: A Study of Selected Organizations in Delta StateOffiaNo ratings yet

- LiteratureDocument7 pagesLiteraturegn.metheNo ratings yet

- Mergers, Acquisitions and Firms' Performance: Experience of Indian Pharmaceutical IndustryDocument6 pagesMergers, Acquisitions and Firms' Performance: Experience of Indian Pharmaceutical IndustryPriha AliNo ratings yet

- For Plag CheckDocument259 pagesFor Plag CheckAftab TabasamNo ratings yet

- The Impact of Corporate Governance On The Profitability of Nepalese EnterpriseDocument10 pagesThe Impact of Corporate Governance On The Profitability of Nepalese EnterpriseAyush Nepal100% (1)

- Thesis On Corporate Governance and Firm Performance PDFDocument9 pagesThesis On Corporate Governance and Firm Performance PDFErin Taylor100% (2)

- Tax 1Document4 pagesTax 1Soumik KunduNo ratings yet

- Management ReportDocument12 pagesManagement ReportaryahashNo ratings yet

- I202122059+Wang Yuhang+CSRDocument9 pagesI202122059+Wang Yuhang+CSRAbu Saeed PalashNo ratings yet

- Enhancing Success of Smes Through Risk ENTERPRISE MANAGEMENT: Evidence From A Developing Country Blessward JENYA and Maxwell SANDADADocument16 pagesEnhancing Success of Smes Through Risk ENTERPRISE MANAGEMENT: Evidence From A Developing Country Blessward JENYA and Maxwell SANDADAichiyo akagiNo ratings yet

- Intoducation To LastDocument20 pagesIntoducation To LastBekar JibonNo ratings yet

- Maman Setiawan and Darmawan (2011)Document6 pagesMaman Setiawan and Darmawan (2011)IgotmypointNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- ISO 9001 Version 2008Document4 pagesISO 9001 Version 2008balotellis721No ratings yet

- History of Sri LankaDocument2 pagesHistory of Sri LankaBlue RainNo ratings yet

- Understand: Bohol BoholDocument5 pagesUnderstand: Bohol BoholRamil GofredoNo ratings yet

- Ravenshaw University PHD RulesDocument12 pagesRavenshaw University PHD RulesAJITAV SILU100% (1)

- GOV - UK - Redundancy - Your RightsDocument7 pagesGOV - UK - Redundancy - Your RightsMayowa OlatoyeNo ratings yet

- Greatest Robbery of A Government Guinness World RecordsDocument1 pageGreatest Robbery of A Government Guinness World Recordsrex ceeNo ratings yet

- EL112 SURVEY OF AFRO ReviewerDocument5 pagesEL112 SURVEY OF AFRO ReviewerUkulele PrincessNo ratings yet

- Tumasik or Old SingaporeDocument6 pagesTumasik or Old SingaporeAdrian TanNo ratings yet

- Chapter 1Document25 pagesChapter 1Naman PalindromeNo ratings yet

- Daedalus and IcarusDocument8 pagesDaedalus and IcarusMuhammad AnsarNo ratings yet

- Ucsp 2Document40 pagesUcsp 2Junjun CaturaNo ratings yet

- Tausug (Any)Document15 pagesTausug (Any)Fharhan Dacula100% (2)

- Kami Export - Lucas Perez - Prohibitions WebquestDocument3 pagesKami Export - Lucas Perez - Prohibitions WebquestTactical DogeNo ratings yet

- STR502 Workplace Project Task 3 Assessors ChecklistDocument9 pagesSTR502 Workplace Project Task 3 Assessors ChecklistCong Tuan HuynhNo ratings yet

- 26-DJR Nagpur - Co-Operative Officer Grade-1Document61 pages26-DJR Nagpur - Co-Operative Officer Grade-1Abdul Raheman ShaikhNo ratings yet

- Comparison Between RELIANCE Telecom and MTNLDocument22 pagesComparison Between RELIANCE Telecom and MTNLMoin KhanNo ratings yet

- Discuss VS Defend Essay - Writing A Defend' Essay Plan and IntroductionDocument18 pagesDiscuss VS Defend Essay - Writing A Defend' Essay Plan and IntroductionNohaEl-SherifNo ratings yet

- Vacuum Cleaner ®Document5 pagesVacuum Cleaner ®pukymottoNo ratings yet

- Religions of - Rome2 PDFDocument427 pagesReligions of - Rome2 PDFmichaelgillham100% (1)

- Kelvion Walker Vs Amy WilburnDocument63 pagesKelvion Walker Vs Amy WilburnHorrible CrimeNo ratings yet

- Listes Additives Groupe 5 - MefDocument23 pagesListes Additives Groupe 5 - MefPaul KolomouNo ratings yet

- Kelompok 10 PronounsDocument19 pagesKelompok 10 PronounssariNo ratings yet

- 1PE ACI Vs CoquiaDocument7 pages1PE ACI Vs CoquiaVladimir ReidNo ratings yet

- Ajay Gehlot CVDocument8 pagesAjay Gehlot CVRvi MahayNo ratings yet

- Gee DETAILSDocument42 pagesGee DETAILSvinay_kNo ratings yet

- 4th Semester (Previous YEar Question Paper)Document88 pages4th Semester (Previous YEar Question Paper)HassanNo ratings yet

- Codeigniter4 Github Io UserguideDocument5 pagesCodeigniter4 Github Io UserguidexserverNo ratings yet

- Transkrip Sementara Universitas Wahid Hasyim: (Certificate of Establishment)Document3 pagesTranskrip Sementara Universitas Wahid Hasyim: (Certificate of Establishment)Lailatuz ZakiyahNo ratings yet

- Paparan UNDP IndonesiaDocument19 pagesPaparan UNDP IndonesiaAFA shopNo ratings yet