Professional Documents

Culture Documents

What Is The Economic Value Added (EVA) ?

What Is The Economic Value Added (EVA) ?

Uploaded by

Heaven Heart0 ratings0% found this document useful (0 votes)

3 views1 pageThe document provides financial information for an investment center, segment A of an unnamed company, and the Motor Division of Eurosun Company. It asks three questions: 1) What is the investment center's economic value added (EVA)? 2) What is segment A's controllable segment profit margin? 3) What is the Motor Division's return on investment? The financial details include assets, liabilities, revenues, costs, capital amounts, interest rates and required returns for each section.

Original Description:

Original Title

5

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for an investment center, segment A of an unnamed company, and the Motor Division of Eurosun Company. It asks three questions: 1) What is the investment center's economic value added (EVA)? 2) What is segment A's controllable segment profit margin? 3) What is the Motor Division's return on investment? The financial details include assets, liabilities, revenues, costs, capital amounts, interest rates and required returns for each section.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageWhat Is The Economic Value Added (EVA) ?

What Is The Economic Value Added (EVA) ?

Uploaded by

Heaven HeartThe document provides financial information for an investment center, segment A of an unnamed company, and the Motor Division of Eurosun Company. It asks three questions: 1) What is the investment center's economic value added (EVA)? 2) What is segment A's controllable segment profit margin? 3) What is the Motor Division's return on investment? The financial details include assets, liabilities, revenues, costs, capital amounts, interest rates and required returns for each section.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

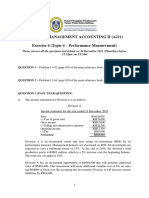

Consider the following:

Investment center’s after tax operating profit 50000

Investment center’s total assets 800000

Investment center’s current liabilities 80000

Weighted-average cost of capital 6.5%

Minimum required ROI 8%

What is the economic value added (EVA)?

Segment A generated sales revenue of 400000 and variable operating expenses of 180000. Its

controllable fixed expenses were 40000. It was assigned 20% of 200000 of fixed costs controlled by

others. The common fixed costs were 25000.

What was segment A’s controllable segment profit margin?

The following data relate to the Motor Division of Eurosun Company:

Sales 10M

Variable Cost 3M

Direct Fixed Cost 5M

Invested capital 8M

Allocated actual interest cost 800k

Capital charge 12%

The divisional return on investment is?

You might also like

- MODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodDocument16 pagesMODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodJohn Mark FernandoNo ratings yet

- Submitted By: Cabling, Alvin Hachiles, Jomari Honera, Shawn Michael Miranda, Christopher Odonzo, Aldwin Salvador, ChristianDocument32 pagesSubmitted By: Cabling, Alvin Hachiles, Jomari Honera, Shawn Michael Miranda, Christopher Odonzo, Aldwin Salvador, ChristianKimberly Claire AtienzaNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- 44Document2 pages44Heaven HeartNo ratings yet

- Return On InvestmentDocument5 pagesReturn On Investmentela kikay100% (1)

- Lecture 8 ExercisesDocument13 pagesLecture 8 ExercisesprofbruceNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- Responsibility Accounting Discussion ProblemsDocument6 pagesResponsibility Accounting Discussion ProblemsMicaela Pascua AloyNo ratings yet

- Management Advisory Services Responsibility AccountingDocument13 pagesManagement Advisory Services Responsibility AccountingLumingNo ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- Solving ProblemsDocument1 pageSolving Problemstryingacc2No ratings yet

- Capital Structure.Document22 pagesCapital Structure.Puneet ShirahattiNo ratings yet

- 1.1 Responsibility Accounting HandoutDocument2 pages1.1 Responsibility Accounting HandoutAsnarizah PakinsonNo ratings yet

- ManaccccDocument24 pagesManaccccJaynalyn MonasterialNo ratings yet

- Return On Investment Return On Investment ComputationDocument27 pagesReturn On Investment Return On Investment ComputationARISNo ratings yet

- FM EcoDocument30 pagesFM Ecoovais kanojeNo ratings yet

- Sales Forecast Unit SalesDocument7 pagesSales Forecast Unit SalesSyed ShaheerNo ratings yet

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- 09 Quiz 1Document2 pages09 Quiz 1ChiLL MooDNo ratings yet

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- Acctg205 ResponsibilityCentersPerformanceMeasures-SampleQuestions PDFDocument2 pagesAcctg205 ResponsibilityCentersPerformanceMeasures-SampleQuestions PDFEliseNo ratings yet

- Acc7 Ho 3 Ri EvaDocument3 pagesAcc7 Ho 3 Ri EvaShao BajamundeNo ratings yet

- Bos 51397 Interp 8Document30 pagesBos 51397 Interp 8Yogita SoniNo ratings yet

- AY2223 ACCO 30153 MS Review 2nd Evaluation Exam LMTDocument4 pagesAY2223 ACCO 30153 MS Review 2nd Evaluation Exam LMTBanna SplitNo ratings yet

- A 2021MBA010 NiraliOswal Case Scenarios RBCDocument3 pagesA 2021MBA010 NiraliOswal Case Scenarios RBCmohammedsuhaim abdul gafoorNo ratings yet

- Eastermarginalcosting 2020Document22 pagesEastermarginalcosting 2020GodfreyFrankMwakalingaNo ratings yet

- Advanced Analysis and Appraisal of PerformanceDocument7 pagesAdvanced Analysis and Appraisal of PerformanceAnn SalazarNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- Accounting TP MIDTERMDocument3 pagesAccounting TP MIDTERMDonnabel DonioNo ratings yet

- Net Operating Income ApproachDocument4 pagesNet Operating Income Approachurmila ranaNo ratings yet

- Exercise - Ratio AnalysisDocument4 pagesExercise - Ratio AnalysisMuhammad Zaki AfifiNo ratings yet

- Paper - 5: Advanced Management Accounting Questions CVP AnalysisDocument20 pagesPaper - 5: Advanced Management Accounting Questions CVP AnalysisRohit KasbeNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even AnalysisRachit DixitNo ratings yet

- Casos Analisis de PerformanceDocument4 pagesCasos Analisis de PerformanceJohan UsecheNo ratings yet

- A211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Document3 pagesA211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Amirul Hakim Nor AzmanNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- Inter Budget QuestionsDocument9 pagesInter Budget Questionsmanishasasmal63No ratings yet

- DocxDocument12 pagesDocxNothingNo ratings yet

- Hafiz Muhammad Maaz MBL (64287) AFS ProjectDocument13 pagesHafiz Muhammad Maaz MBL (64287) AFS ProjectMaaz MahmoodNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- ProblemSet Cash Flow EstimationQA-160611 - 021520Document25 pagesProblemSet Cash Flow EstimationQA-160611 - 021520Jonathan Punnalagan100% (2)

- ProblemSet Cash Flow EstimationQA 160611 021520 PDFDocument25 pagesProblemSet Cash Flow EstimationQA 160611 021520 PDFCucumber IsHealthy96No ratings yet

- LeverageDocument7 pagesLeverageKomal ThakurNo ratings yet

- Responsibility Accounting: Chapter Study ObjectivesDocument7 pagesResponsibility Accounting: Chapter Study ObjectivesLive LoveNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- LeverageszddzDocument10 pagesLeverageszddzKrutika JainNo ratings yet

- Cost Behavior and CVP AnalysisDocument2 pagesCost Behavior and CVP AnalysisShaira VillaflorNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- Exercise Topic 4Document7 pagesExercise Topic 4jr ylvsNo ratings yet

- CPVDocument1 pageCPVA.K.M. Rubyat Hasan ApuNo ratings yet

- MAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer PricingDocument4 pagesMAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer PricingAlliahData100% (1)

- Cost of DebtDocument2 pagesCost of Debtbekalgagan29No ratings yet

- FM & Eco Grand Test 1Document8 pagesFM & Eco Grand Test 1moniNo ratings yet

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- Lesson 1 CVP AnalysisDocument2 pagesLesson 1 CVP AnalysisLorille LeonesNo ratings yet

- Mallare, Reign - Exercise 4 - Responsibility Center ClassworkDocument3 pagesMallare, Reign - Exercise 4 - Responsibility Center ClassworkReign Juliana MallareNo ratings yet

- Leverages ProblemsDocument4 pagesLeverages Problemsk,hbibk,n50% (2)

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- 3Document1 page3Heaven HeartNo ratings yet

- Problem 1Document2 pagesProblem 1Heaven HeartNo ratings yet

- Restructuring ProvisionsDocument1 pageRestructuring ProvisionsHeaven HeartNo ratings yet

- Share For Share ExchangesDocument1 pageShare For Share ExchangesHeaven HeartNo ratings yet

- Bonds PayableDocument1 pageBonds PayableHeaven HeartNo ratings yet