Professional Documents

Culture Documents

Dharwad Mishra Pedha and Food Processing Industry

Dharwad Mishra Pedha and Food Processing Industry

Uploaded by

M.n KCopyright:

Available Formats

You might also like

- St. Augustine Choir Booklet-1Document255 pagesSt. Augustine Choir Booklet-1Henry Kaweesa97% (58)

- Dlp-Triangle CongruenceDocument8 pagesDlp-Triangle CongruenceJoan B. Basco100% (3)

- A Smart Motor Controller For E-Bike Applications PDFDocument4 pagesA Smart Motor Controller For E-Bike Applications PDFaungwinnaing100% (1)

- Paul G. Barash, Bruce F. Cullen, Michael Cahalan, M. Christine Stock, Rafael Ortega, Sam R. Sharar, Robert K. Stoelting - Clinical Anesthesia Fundamentals-LWW (2015) (1) - Pages-141-276 PDFDocument136 pagesPaul G. Barash, Bruce F. Cullen, Michael Cahalan, M. Christine Stock, Rafael Ortega, Sam R. Sharar, Robert K. Stoelting - Clinical Anesthesia Fundamentals-LWW (2015) (1) - Pages-141-276 PDFDidiNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- PR Indreshwar SugarMills 29sep22Document6 pagesPR Indreshwar SugarMills 29sep22waykulevinod41No ratings yet

- Sri Balamurugan Modern Rice MillDocument4 pagesSri Balamurugan Modern Rice MillDon't knowNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Devyani Food Industries LimitedDocument7 pagesDevyani Food Industries LimitedRahulNo ratings yet

- Britannia Term PaperDocument19 pagesBritannia Term PaperKhushii NaamdeoNo ratings yet

- Financial AccountingDocument23 pagesFinancial AccountingAnkit SinghNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Adani Wilmar Limited: All You Need To Know AboutDocument8 pagesAdani Wilmar Limited: All You Need To Know AboutMihir RanjanNo ratings yet

- RR 20190917Document4 pagesRR 20190917omkarambale1No ratings yet

- Buisness RareDocument22 pagesBuisness RareALINA ZohqNo ratings yet

- Haldiram Products Private LimitedDocument7 pagesHaldiram Products Private LimitedAman GuptaNo ratings yet

- MSL 302 Indian Institute of Technology, DelhiDocument19 pagesMSL 302 Indian Institute of Technology, DelhiKhushii NaamdeoNo ratings yet

- Project ProposalDocument20 pagesProject ProposalKhushii NaamdeoNo ratings yet

- Neelkanth Salt Chem India Private LimitedDocument5 pagesNeelkanth Salt Chem India Private LimitedcharananwarNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Devyani International LTD - IPO Note-1Document4 pagesDevyani International LTD - IPO Note-1chinna rao100% (1)

- Globe Automobiles Private LimitedDocument7 pagesGlobe Automobiles Private LimitedRAMODSNo ratings yet

- Press Release Vijay Sales (India) Private Limited: Experienced PromotersDocument4 pagesPress Release Vijay Sales (India) Private Limited: Experienced PromoterssriharikosaNo ratings yet

- SVR Drugsprivate LimitedDocument4 pagesSVR Drugsprivate Limitedlalit rawatNo ratings yet

- Far340 - Ratio AnalysisDocument13 pagesFar340 - Ratio Analysisnurma haryatiNo ratings yet

- Mrs. Bectors Food Specialities Ltd. Ipo: All You Need To Know AboutDocument7 pagesMrs. Bectors Food Specialities Ltd. Ipo: All You Need To Know AboutJayantSinghJeenaNo ratings yet

- PR Chennai Rice 24june22Document8 pagesPR Chennai Rice 24june22RaviNo ratings yet

- HealthCaps India Limited - R - 02122020Document8 pagesHealthCaps India Limited - R - 02122020DarshanNo ratings yet

- Sample Crisil Grading ReportDocument24 pagesSample Crisil Grading ReportSamNo ratings yet

- NainpreetDocument12 pagesNainpreetNainpreet KaurNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- JK-MKT-20126 ProjectDocument55 pagesJK-MKT-20126 ProjectPriyanka MoreNo ratings yet

- Hindustan - Associates - 4 Tanishq Stores in UPDocument5 pagesHindustan - Associates - 4 Tanishq Stores in UPJai PhookanNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Course - 307, LINDEBD VALUATION REPORT PDFDocument26 pagesCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNo ratings yet

- Bhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREDocument4 pagesBhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREPuneet367No ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Zomato Limited - Research ReportDocument6 pagesZomato Limited - Research ReportSunil ManoharNo ratings yet

- Medreich LimitedDocument7 pagesMedreich LimitedAnishNo ratings yet

- Windlas Biotech - IPO Note-1Document4 pagesWindlas Biotech - IPO Note-1chinna raoNo ratings yet

- Incorporated in 1995: Add A Footer 1Document18 pagesIncorporated in 1995: Add A Footer 1Yashika ChandraNo ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- DaburDocument45 pagesDaburMandeep BatraNo ratings yet

- PR Baidyanath 19dec22Document6 pagesPR Baidyanath 19dec22tusharj0934No ratings yet

- Cooperate Accounting CiaDocument20 pagesCooperate Accounting Ciaarpit bagariaNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Samunnati Rating Rationale b764561b41Document8 pagesSamunnati Rating Rationale b764561b41PratyushNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- Time Allowed - 3 Hours Total Marks - 100: Business AnalysisDocument5 pagesTime Allowed - 3 Hours Total Marks - 100: Business Analysisswarna dasNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Term Paper Group 1 Section ADocument20 pagesTerm Paper Group 1 Section AAbdullah Al Imran ShuvoNo ratings yet

- EdgeReport BRITANNIA CaseStudy 07 09 2022 994Document34 pagesEdgeReport BRITANNIA CaseStudy 07 09 2022 994aadil suhailNo ratings yet

- Care RatingsDocument32 pagesCare Ratingskrishna_buntyNo ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- Press Release DFM Foods Limited: Details of Facilities in Annexure-1Document4 pagesPress Release DFM Foods Limited: Details of Facilities in Annexure-1Puneet367No ratings yet

- Dabur 1Document2 pagesDabur 1sandeep mishraNo ratings yet

- Anupam Rasayan India Limited ReportDocument8 pagesAnupam Rasayan India Limited Reportankur taunkNo ratings yet

- 40.payroll Components in Meghana Foods IndustriesDocument23 pages40.payroll Components in Meghana Foods IndustriesrajNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- BCN 4th and 5th Chapter NotesDocument21 pagesBCN 4th and 5th Chapter NotesM.n KNo ratings yet

- 2022 Mba Mba Batchno 90Document104 pages2022 Mba Mba Batchno 90M.n KNo ratings yet

- 2023mahindrasubsidiary Reportlow Res 1Document3,136 pages2023mahindrasubsidiary Reportlow Res 1M.n KNo ratings yet

- ln1 PDFDocument20 pagesln1 PDFM.n KNo ratings yet

- Chapter 2 Indian Economy 1950-1990Document27 pagesChapter 2 Indian Economy 1950-1990Ajay pandeyNo ratings yet

- Chapter 24 Practice QuestionsDocument7 pagesChapter 24 Practice QuestionsArlene F. Montalbo100% (1)

- The Effect of Emotional Freedom Technique On Stress and Anxiety in Nursing StudentsDocument119 pagesThe Effect of Emotional Freedom Technique On Stress and Anxiety in Nursing StudentsnguyenhabkNo ratings yet

- The Sabbath As FreedomDocument14 pagesThe Sabbath As Freedomapi-232715913No ratings yet

- A Practical Grammar of The Sanskrit LanguageDocument408 pagesA Practical Grammar of The Sanskrit LanguageungulataNo ratings yet

- DKE344 BibDocument2 pagesDKE344 BibMohamad SleimanNo ratings yet

- Week 10 RPH ENGLISHDocument4 pagesWeek 10 RPH ENGLISHAin HazirahNo ratings yet

- Vizsgaanyag PDFDocument30 pagesVizsgaanyag PDFSipka GergőNo ratings yet

- Indonesian Sign Language Visualization Model (BISINDO) Website-Based Oral Health On Tooth Brushing Behavior in Deaf ChildrenDocument6 pagesIndonesian Sign Language Visualization Model (BISINDO) Website-Based Oral Health On Tooth Brushing Behavior in Deaf ChildrenInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Pipe Pressure Drope ASEREHDocument3 pagesPipe Pressure Drope ASEREHSenghou MeasNo ratings yet

- Ghinea Gabriela Nouella and Manea Madalina ElenaDocument25 pagesGhinea Gabriela Nouella and Manea Madalina ElenaAlexandria Firdaus Al-farisyNo ratings yet

- New Opportunities in Transmission Electron Microscopy of PolymersDocument30 pagesNew Opportunities in Transmission Electron Microscopy of PolymersJoão Vitor ZanattaNo ratings yet

- Stamens PDFDocument10 pagesStamens PDFAmeya KannamwarNo ratings yet

- Tda 7419Document30 pagesTda 7419heviandriasNo ratings yet

- PET-UT-U4 Without AnswersDocument2 pagesPET-UT-U4 Without AnswersAlejandroNo ratings yet

- Tone and MoodDocument8 pagesTone and MoodKristine PanalNo ratings yet

- Manual Tesa Portable ProgrammerDocument39 pagesManual Tesa Portable ProgrammeritmNo ratings yet

- Strategy RenaultDocument28 pagesStrategy RenaultTaoufiq SmhNo ratings yet

- IEC61850 Substation Communication ArchitectureDocument326 pagesIEC61850 Substation Communication ArchitectureMichael Parohinog Gregas100% (1)

- Make Wire Transfers Through Online Banking From AnywhereDocument2 pagesMake Wire Transfers Through Online Banking From AnywhereDani PermanaNo ratings yet

- RHA Market Study 2020Document6 pagesRHA Market Study 2020N SayNo ratings yet

- CAPEX Acquisition ProcessDocument5 pagesCAPEX Acquisition ProcessRajaIshfaqHussainNo ratings yet

- Notes On Jean Piaget DeweyDocument2 pagesNotes On Jean Piaget DeweyfadzillahNo ratings yet

- Supervisi Akademik Melalui Pendekatan Kolaboratif Oleh Kepala Sekolah Dalammeningkatkan Kualitas Pembelajarandisd Yari DwikurnaningsihDocument11 pagesSupervisi Akademik Melalui Pendekatan Kolaboratif Oleh Kepala Sekolah Dalammeningkatkan Kualitas Pembelajarandisd Yari DwikurnaningsihKhalid Ibnu SinaNo ratings yet

- The Aravind Eye Hospital, Madurai, India: in Service For SightDocument4 pagesThe Aravind Eye Hospital, Madurai, India: in Service For Sighttirth viraNo ratings yet

- Food Contact Surfaces 2Document27 pagesFood Contact Surfaces 2AliNo ratings yet

Dharwad Mishra Pedha and Food Processing Industry

Dharwad Mishra Pedha and Food Processing Industry

Uploaded by

M.n KOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dharwad Mishra Pedha and Food Processing Industry

Dharwad Mishra Pedha and Food Processing Industry

Uploaded by

M.n KCopyright:

Available Formats

Press Release

Dharwad Mishra Pedha and Food Processing Industry (Revised)

May 25, 2023

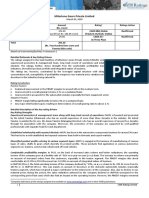

Facilities/Instruments Amount (₹ crore) Rating1 Rating Action

Long Term Bank Facilities 50.00 CARE BB (RWN) Placed on Rating Watch with Negative Implications

Details of instruments/facilities in Annexure-1.

Rationale and key rating drivers

CARE Ratings Limited has placed the ratings of Dharwad Mishra Pedha and Food Processing Industry’s (DMP) bank facilities on

Rating Watch with Negative Implications (RWN). This is in response to material event triggered by another rating agency

assigning Rating of D (Un accepted) to the firm.

CARE Ratings Limited is in the process of getting all the relevant details from DMP and its lenders and will be taking a final

rating action once the clarification is received from its lenders. The material event triggered is as defined by SEBI vide circular

No. SEBI/ HO/ MIRSD/ MIRSD4/ CIR/ P/ 2017/ 71 dated June 30, 2017.

Rationale and key rating drivers

At the time of last rating on March 24, 2023, the following were the key rating strengths and weaknesses

Key weaknesses

Moderate scale of operations with partnership nature of constitution: Despite being in business operations as

partnership firm since 2006, along with consistent growth in past three years ending FY22, DMP scale of operations continued

to remain moderate marked by total operating income of Rs. 142.12 crore in FY22.

The networth of the firm remained moderate at Rs 20.82 Crs as on March 31, 2022. The small scale limits the firm’s financial

flexibility in times of stress and deprives it from scale benefits. Further, being a partnership firm DMP is exposed to inherent risk

of the partner’s capital being withdrawn at time of personal contingency and firm being dissolved upon the

death/retirement/insolvency of the partners. Moreover, partnership business has restricted avenues to raise capital which could

prove a hindrance to its growth. Over the past few years, there has not been any additional fund infusion by the partners apart

from adding back part of the profits.

Full utilization of working capital facility: The working capital facility sanctioned to the firm remains fully utilised for the

last 12 months which leaves no headroom for any liquidity cushion in the event of any crisis. Any disruption in the industry or

any untoward circumstances which leads to cash flow mismatch can adversely impact the liquidity profile of the firm.

Risk profile marked by leveraged capital structure and debt coverage indicators: The capital structure of the DMP

remained leveraged as on March 31, 2012, as reflected by debt-equity ratio 1.16 times and overall gearing of 2.63 times. The

total debt profile of the firm consists of working capital borrowings of Rs 24.93 crore, term loan of Rs 24.12 crore and other

interest free unsecured loans from friends and relatives of Rs 5.67 crore. The networth of the firm remained moderate at Rs

20.82 crore. The total debt to Gross Cash accruals and total debt to PBILDT improved to 6.26 times and 3.25 times as on March

31, 2022 as compared to that of 13.77 times and 4.86 times as on March 31, 2021 respectively . However, the same still

continues to be on a higher side.

Competition from unorganized local players and organized branded companies: The firm is engaged in

manufacturing of sweets, savouries, bakery items and milk products which involves limited value addition and hence results in

thin profitability. Moreover, on account of large number of units operating in similar business, there is high competition from

local players in the market. Further the firm has competition from other organized players through packaged food products like

Haldirams, Lays and Bingo etc. The competition among the players remains very high resulting in high fragmentation and

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

further restricts the profitability. However the firm has been in this business from a considerable time and hence they have

been able to sustain their operations with improvement over the years.

Key strengths

Long track record of operations with experienced promoters: DMP was established in 2006 as a partnership firm and

has established track record of the business operations. The firm has a rich legacy of more than 90 years which started as a

small shop during 1933. The partners have been in the business of sweets and savouries for more than five decades. The firm

sells its products through a well-established dealer network and franchise outlets across the states of Karnataka, Andhra

Pradesh, Goa and Maharashtra. Mr. Sanjay Ganesh Mishra aged about 52 years has completed his Pre University Education

Course and has more than 35 years of experience in the same line of business and looks after production and other operational

activities. The partners are assisted by a work force of around 349 employees. The firm is in the process of scaling up their

operations with foraying into other markets.

Recognized brands with an established presence in Southern market: Dharwad Pedha is a sweet delicacy, unique to

the state of Karnataka, India. It derives its name from the city of Dharwad in Karnataka and has a GI tag attached to its name.

The partners have been into business from 1933 and have created an own brand in the local market. As on November 30, 2022

the firm has total of 172 franchises in the states of Karnataka, Maharashtra, Goa and Andhra Pradesh.

Growth in total operating income coupled with increase in profitability margins :

Total Operating Income (TOI) of the firm has registered a Compounded Annual Growth Rate (CAGR) of ~12% during FY20-

FY22 and registered a total operating income of Rs. 142.12 crore in FY22 as against Rs. 105.37 crore in FY21. There has been a

consistent increase in TOI fo the firm for the last few years. The increase in total operating income was backed by higher

demand for the products in the domestic market. The PBILDT margin of the firm increased marginally from 11.56% in FY21 to

11.84% in FY22 on account of increased sales with lower material consumption and operating costs on account of economies of

scale. The PBILDT margins have remained stable in the range from 10 to 12% over the past few years. The PAT margin of the

firm remained at same level at 1.07% in FY22 despite increase in PBILDT in absolute terms due to increase in Depreciation

cost.

Liquidity: Stretched

The liquidity position of the firm remained stretched with 100% utilization of their working capital facilities for the last 12

months ended October 2022. As per the management, the firm maintains cash balance of approximately two days of sales.

Rating sensitivities: Factors likely to lead to rating actions

Positive factors

• Increased scale of operations above Rs. 180 crore.

• Improvement in PBILDT margin on or above 12 % on sustained basis.

• Improvement in liquidity profile of the company with average working capital utilisation below 90%.

Negative factors

• Overall gearing not exceeding 3 times on sustained basis.

• Reduction in PBILDT margins below 9% on a sustained basis.

Analytical approach: Standalone

Assumptions/Covenants: Not applicable

2 CARE Ratings Ltd.

Press Release

Environment, social, and governance (ESG) risks: Not applicable

Applicable criteria

Policy on default recognition

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Manufacturing Companies

About the company and industry

Industry classification

Macro-Economic Indicator Sector Industry Basic Industry

Fast Moving Consumer Goods Fast Moving Consumer Goods Food Products Other Food Products

Established in 1933, Dharwad Mishra Pedha and Food Processing Industry, a Dharwad, Karnataka-based partnership firm is

engaged in manufacturing of sweets and bakery products. Dharwad was founded by Mr. Avadhbihari Mishra and currently it is

being managed by its third generation Mr. Sanjay Ganesh Mishra. The firm's operations are spread across Karnataka,

Maharashtra and Goa. Currently the firm has installed capacity for manufacturing of 21.25 lakh kilogram of Dharwad Pedha,

3.50 lakh kilogram of Kaju Katli, and 88 lakh kilogram of Big Bread respectively. It sells its products under the brand name ‘Big

Mishra Pedha’. The firm currently has 349 employees, and the day-to-day affairs of the firm are managed by the partners.

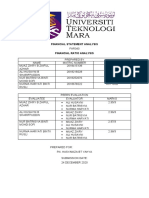

Brief Financials (₹ crore) March 31, 2021 (A) March 31, 2022 (A) 11MFY23 (UA)

Total operating income 105.37 142.12 163.27

PBILDT 12.18 16.83 27.49

PAT 1.14 1.53 N/A

Overall gearing (times) 3.12 2.63 N/A

Interest coverage (times) 1.58 2.32 3.31

A: Audited UA: Unaudited; Note: ‘the above results are latest financial results available’

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating history for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated: Annexure-4

Lender details: Annexure-5

Annexure-1: Details of instruments/facilities

Name of the Date of Coupon Maturity Size of the Rating

ISIN

Instrument Issuance Rate (%) Date (DD- Issue Assigned

3 CARE Ratings Ltd.

Press Release

(DD-MM- MM-YYYY) (₹ crore) along with

YYYY) Rating

Outlook

Fund-based - CARE BB

- - Jan 2030 50.00

LT-Term Loan (RWN)

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s)

Name of the Date(s)

and and and

Sr. No. Instrument/Bank Amount and

Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating Rating(s)

assigned assigned assigned

(₹ crore) assigned in

in 2023- in 2022- in 2021-

2020-2021

2024 2023 2022

Fund-based - LT- 1)Withdrawn

1 LT - - - - -

Bank Overdraft (30-Apr-20)

Fund-based - LT- 1)Withdrawn

2 LT - - - - -

Cash Credit (30-Apr-20)

1)CARE

Fund-based - LT- CARE BB BB; Stable

3 LT 50.00 - - -

Term Loan (RWN) (24-Mar-

23)

*Long term/Short term.

Annexure-3: Detailed explanation of covenants of the rated instruments/facilities: Not applicable

Annexure-4: Complexity level of the various instruments rated

Sr. No. Name of the Instrument Complexity Level

1 Fund-based - LT-Term Loan Simple

Annexure-5: Lender details

To view the lender wise details of bank facilities please click here

Note on the complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

4 CARE Ratings Ltd.

Press Release

Contact us

Media Contact Analytical Contacts

Name: Mradul Mishra Name: Sudarshan Shreenivas

Director Director

CARE Ratings Limited CARE Ratings Limited

Phone: +91-22-6754 3596 Phone: 022- 6754 3566

E-mail: mradul.mishra@careedge.in E-mail: Sudarshan.Shreenivas@careedge.in

Relationship Contact Name: Nikhil Joshi

Assistant Director

Name: Saikat Roy CARE Ratings Limited

Senior Director Phone: : 022- 6754 3456

CARE Ratings Limited E-mail: Nikhil.Joshi@careedge.in

Phone: 022 67543404 /136

E-mail: Saikat.Roy@careedge.in Name: Ravi Jangid

Analyst

CARE Ratings Limited

E-mail: Ravi.Jangid@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not recommendations to

sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or hold any security. These ratings do not convey suitability or price for the investor.

The agency does not constitute an audit on the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible

sources. CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions

and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE Ratings have paid a credit rating fee,

based on the amount and type of bank facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions

with the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the capital deployed by the

partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in case of withdrawal of capital, or the unsecured loans brought

in by the partners/proprietors in addition to the financial performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it

has no financial liability whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger clauses as

per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced

and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information, please visit www.careedge.in

5 CARE Ratings Ltd.

You might also like

- St. Augustine Choir Booklet-1Document255 pagesSt. Augustine Choir Booklet-1Henry Kaweesa97% (58)

- Dlp-Triangle CongruenceDocument8 pagesDlp-Triangle CongruenceJoan B. Basco100% (3)

- A Smart Motor Controller For E-Bike Applications PDFDocument4 pagesA Smart Motor Controller For E-Bike Applications PDFaungwinnaing100% (1)

- Paul G. Barash, Bruce F. Cullen, Michael Cahalan, M. Christine Stock, Rafael Ortega, Sam R. Sharar, Robert K. Stoelting - Clinical Anesthesia Fundamentals-LWW (2015) (1) - Pages-141-276 PDFDocument136 pagesPaul G. Barash, Bruce F. Cullen, Michael Cahalan, M. Christine Stock, Rafael Ortega, Sam R. Sharar, Robert K. Stoelting - Clinical Anesthesia Fundamentals-LWW (2015) (1) - Pages-141-276 PDFDidiNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- PR Indreshwar SugarMills 29sep22Document6 pagesPR Indreshwar SugarMills 29sep22waykulevinod41No ratings yet

- Sri Balamurugan Modern Rice MillDocument4 pagesSri Balamurugan Modern Rice MillDon't knowNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Devyani Food Industries LimitedDocument7 pagesDevyani Food Industries LimitedRahulNo ratings yet

- Britannia Term PaperDocument19 pagesBritannia Term PaperKhushii NaamdeoNo ratings yet

- Financial AccountingDocument23 pagesFinancial AccountingAnkit SinghNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Adani Wilmar Limited: All You Need To Know AboutDocument8 pagesAdani Wilmar Limited: All You Need To Know AboutMihir RanjanNo ratings yet

- RR 20190917Document4 pagesRR 20190917omkarambale1No ratings yet

- Buisness RareDocument22 pagesBuisness RareALINA ZohqNo ratings yet

- Haldiram Products Private LimitedDocument7 pagesHaldiram Products Private LimitedAman GuptaNo ratings yet

- MSL 302 Indian Institute of Technology, DelhiDocument19 pagesMSL 302 Indian Institute of Technology, DelhiKhushii NaamdeoNo ratings yet

- Project ProposalDocument20 pagesProject ProposalKhushii NaamdeoNo ratings yet

- Neelkanth Salt Chem India Private LimitedDocument5 pagesNeelkanth Salt Chem India Private LimitedcharananwarNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Devyani International LTD - IPO Note-1Document4 pagesDevyani International LTD - IPO Note-1chinna rao100% (1)

- Globe Automobiles Private LimitedDocument7 pagesGlobe Automobiles Private LimitedRAMODSNo ratings yet

- Press Release Vijay Sales (India) Private Limited: Experienced PromotersDocument4 pagesPress Release Vijay Sales (India) Private Limited: Experienced PromoterssriharikosaNo ratings yet

- SVR Drugsprivate LimitedDocument4 pagesSVR Drugsprivate Limitedlalit rawatNo ratings yet

- Far340 - Ratio AnalysisDocument13 pagesFar340 - Ratio Analysisnurma haryatiNo ratings yet

- Mrs. Bectors Food Specialities Ltd. Ipo: All You Need To Know AboutDocument7 pagesMrs. Bectors Food Specialities Ltd. Ipo: All You Need To Know AboutJayantSinghJeenaNo ratings yet

- PR Chennai Rice 24june22Document8 pagesPR Chennai Rice 24june22RaviNo ratings yet

- HealthCaps India Limited - R - 02122020Document8 pagesHealthCaps India Limited - R - 02122020DarshanNo ratings yet

- Sample Crisil Grading ReportDocument24 pagesSample Crisil Grading ReportSamNo ratings yet

- NainpreetDocument12 pagesNainpreetNainpreet KaurNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- JK-MKT-20126 ProjectDocument55 pagesJK-MKT-20126 ProjectPriyanka MoreNo ratings yet

- Hindustan - Associates - 4 Tanishq Stores in UPDocument5 pagesHindustan - Associates - 4 Tanishq Stores in UPJai PhookanNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Course - 307, LINDEBD VALUATION REPORT PDFDocument26 pagesCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNo ratings yet

- Bhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREDocument4 pagesBhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREPuneet367No ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Zomato Limited - Research ReportDocument6 pagesZomato Limited - Research ReportSunil ManoharNo ratings yet

- Medreich LimitedDocument7 pagesMedreich LimitedAnishNo ratings yet

- Windlas Biotech - IPO Note-1Document4 pagesWindlas Biotech - IPO Note-1chinna raoNo ratings yet

- Incorporated in 1995: Add A Footer 1Document18 pagesIncorporated in 1995: Add A Footer 1Yashika ChandraNo ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- DaburDocument45 pagesDaburMandeep BatraNo ratings yet

- PR Baidyanath 19dec22Document6 pagesPR Baidyanath 19dec22tusharj0934No ratings yet

- Cooperate Accounting CiaDocument20 pagesCooperate Accounting Ciaarpit bagariaNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Samunnati Rating Rationale b764561b41Document8 pagesSamunnati Rating Rationale b764561b41PratyushNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- Time Allowed - 3 Hours Total Marks - 100: Business AnalysisDocument5 pagesTime Allowed - 3 Hours Total Marks - 100: Business Analysisswarna dasNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Term Paper Group 1 Section ADocument20 pagesTerm Paper Group 1 Section AAbdullah Al Imran ShuvoNo ratings yet

- EdgeReport BRITANNIA CaseStudy 07 09 2022 994Document34 pagesEdgeReport BRITANNIA CaseStudy 07 09 2022 994aadil suhailNo ratings yet

- Care RatingsDocument32 pagesCare Ratingskrishna_buntyNo ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- Press Release DFM Foods Limited: Details of Facilities in Annexure-1Document4 pagesPress Release DFM Foods Limited: Details of Facilities in Annexure-1Puneet367No ratings yet

- Dabur 1Document2 pagesDabur 1sandeep mishraNo ratings yet

- Anupam Rasayan India Limited ReportDocument8 pagesAnupam Rasayan India Limited Reportankur taunkNo ratings yet

- 40.payroll Components in Meghana Foods IndustriesDocument23 pages40.payroll Components in Meghana Foods IndustriesrajNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- BCN 4th and 5th Chapter NotesDocument21 pagesBCN 4th and 5th Chapter NotesM.n KNo ratings yet

- 2022 Mba Mba Batchno 90Document104 pages2022 Mba Mba Batchno 90M.n KNo ratings yet

- 2023mahindrasubsidiary Reportlow Res 1Document3,136 pages2023mahindrasubsidiary Reportlow Res 1M.n KNo ratings yet

- ln1 PDFDocument20 pagesln1 PDFM.n KNo ratings yet

- Chapter 2 Indian Economy 1950-1990Document27 pagesChapter 2 Indian Economy 1950-1990Ajay pandeyNo ratings yet

- Chapter 24 Practice QuestionsDocument7 pagesChapter 24 Practice QuestionsArlene F. Montalbo100% (1)

- The Effect of Emotional Freedom Technique On Stress and Anxiety in Nursing StudentsDocument119 pagesThe Effect of Emotional Freedom Technique On Stress and Anxiety in Nursing StudentsnguyenhabkNo ratings yet

- The Sabbath As FreedomDocument14 pagesThe Sabbath As Freedomapi-232715913No ratings yet

- A Practical Grammar of The Sanskrit LanguageDocument408 pagesA Practical Grammar of The Sanskrit LanguageungulataNo ratings yet

- DKE344 BibDocument2 pagesDKE344 BibMohamad SleimanNo ratings yet

- Week 10 RPH ENGLISHDocument4 pagesWeek 10 RPH ENGLISHAin HazirahNo ratings yet

- Vizsgaanyag PDFDocument30 pagesVizsgaanyag PDFSipka GergőNo ratings yet

- Indonesian Sign Language Visualization Model (BISINDO) Website-Based Oral Health On Tooth Brushing Behavior in Deaf ChildrenDocument6 pagesIndonesian Sign Language Visualization Model (BISINDO) Website-Based Oral Health On Tooth Brushing Behavior in Deaf ChildrenInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Pipe Pressure Drope ASEREHDocument3 pagesPipe Pressure Drope ASEREHSenghou MeasNo ratings yet

- Ghinea Gabriela Nouella and Manea Madalina ElenaDocument25 pagesGhinea Gabriela Nouella and Manea Madalina ElenaAlexandria Firdaus Al-farisyNo ratings yet

- New Opportunities in Transmission Electron Microscopy of PolymersDocument30 pagesNew Opportunities in Transmission Electron Microscopy of PolymersJoão Vitor ZanattaNo ratings yet

- Stamens PDFDocument10 pagesStamens PDFAmeya KannamwarNo ratings yet

- Tda 7419Document30 pagesTda 7419heviandriasNo ratings yet

- PET-UT-U4 Without AnswersDocument2 pagesPET-UT-U4 Without AnswersAlejandroNo ratings yet

- Tone and MoodDocument8 pagesTone and MoodKristine PanalNo ratings yet

- Manual Tesa Portable ProgrammerDocument39 pagesManual Tesa Portable ProgrammeritmNo ratings yet

- Strategy RenaultDocument28 pagesStrategy RenaultTaoufiq SmhNo ratings yet

- IEC61850 Substation Communication ArchitectureDocument326 pagesIEC61850 Substation Communication ArchitectureMichael Parohinog Gregas100% (1)

- Make Wire Transfers Through Online Banking From AnywhereDocument2 pagesMake Wire Transfers Through Online Banking From AnywhereDani PermanaNo ratings yet

- RHA Market Study 2020Document6 pagesRHA Market Study 2020N SayNo ratings yet

- CAPEX Acquisition ProcessDocument5 pagesCAPEX Acquisition ProcessRajaIshfaqHussainNo ratings yet

- Notes On Jean Piaget DeweyDocument2 pagesNotes On Jean Piaget DeweyfadzillahNo ratings yet

- Supervisi Akademik Melalui Pendekatan Kolaboratif Oleh Kepala Sekolah Dalammeningkatkan Kualitas Pembelajarandisd Yari DwikurnaningsihDocument11 pagesSupervisi Akademik Melalui Pendekatan Kolaboratif Oleh Kepala Sekolah Dalammeningkatkan Kualitas Pembelajarandisd Yari DwikurnaningsihKhalid Ibnu SinaNo ratings yet

- The Aravind Eye Hospital, Madurai, India: in Service For SightDocument4 pagesThe Aravind Eye Hospital, Madurai, India: in Service For Sighttirth viraNo ratings yet

- Food Contact Surfaces 2Document27 pagesFood Contact Surfaces 2AliNo ratings yet