Professional Documents

Culture Documents

R45 Derivative Markets and Instruments

R45 Derivative Markets and Instruments

Uploaded by

Sumair ChughtaiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R45 Derivative Markets and Instruments

R45 Derivative Markets and Instruments

Uploaded by

Sumair ChughtaiCopyright:

Available Formats

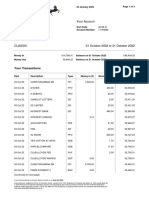

R45 Derivative Markets and Instruments 2022 Level I Notes

R45 Derivative Markets and Instruments

1. Derivatives: Introduction, Definitions, and Uses ................................................................................2

2. The Structure of Derivative Markets .......................................................................................................3

2.1 Exchange-Traded Derivatives Markets ...........................................................................................3

2.2 Over-the-counter Derivatives Markets ............................................................................................4

3. Types of Derivatives: Introduction, Forward Contracts ..................................................................5

3.1 Forward Commitments ..........................................................................................................................6

4. Types of Derivatives: Futures.....................................................................................................................8

5. Types of Derivatives: Swaps .......................................................................................................................9

6. Contingent Claims: Options .........................................................................................................................9

6.1 Options .........................................................................................................................................................9

7. Contingent Claims: Credit Derivatives ................................................................................................. 12

8. Types of Derivatives: Asset-Backed Securities and Hybrids ....................................................... 13

8.1 Hybrids ...................................................................................................................................................... 13

9. Derivatives Underlyings ............................................................................................................................ 13

10. The Purposes and Benefits of Derivatives ....................................................................................... 14

11. Criticisms and Misuses of Derivatives ............................................................................................... 15

12. Elementary Principles of Derivative Pricing ................................................................................... 16

Summary .............................................................................................................................................................. 17

Practice Questions ............................................................................................................................................ 20

This document should be read in conjunction with the corresponding reading in the 2022 Level I CFA®

Program curriculum. Some of the graphs, charts, tables, examples, and figures are copyright

2021, CFA Institute. Reproduced and republished with permission from CFA Institute. All rights

reserved.

Required disclaimer: CFA Institute does not endorse, promote, or warrant the accuracy or quality of

the products or services offered by IFT. CFA Institute, CFA®, and Chartered Financial Analyst® are

trademarks owned by CFA Institute.

Version 1.0

© IFT. All rights reserved 1

R45 Derivative Markets and Instruments 2022 Level I Notes

1. Derivatives: Introduction, Definitions, and Uses

This reading covers what is a derivative, why derivatives are needed, the different types of

derivatives and how they are priced.

Derivatives: Definitions and Uses

A derivative is a financial instrument that derives its value from the performance of an

underlying asset. In simple terms, a derivative is a legal contract between a buyer and a

seller, entered into today, regarding a transaction that will be fulfilled at a specified time in

the future. This legal contract is based on an underlying asset.

A derivative contract defines the rights of each party involved. There are two parties

participating in the contract: a buyer and a seller.

• Long: Buyer of the derivative is said to be long on the position. He has the right to buy

the underlying according to the conditions mentioned in the contract.

• Short: Seller of the derivative is said to be short. Remember “s” is for short and seller.

Let us take an example. Assume A is planning a family vacation to Fiji after six months and is

saving money for the trip. He estimates he will need 15,000 Fijian dollars (FJD) which in

today’s terms translates to 500,000 in his local currency (LCR). But he is worried that FJD

may appreciate, and the 500,000 will buy less FJD after six months. So he enters into a

contract with B to buy 15,000 FJD at a certain exchange rate six months from now – a week

before his travel. What has A done?

In a way, he has removed any uncertainty with respect to exchange rates in the future and

limited his risk. This agreement between A and the other party is a derivative where the

underlying is the exchange rate. The value of the contract fluctuates based on the underlying

exchange rate. A is long, and the party that agrees to deliver 15,000 FJD six months later is

short on the position. This agreement is shown in the exhibit below.

Derivatives are sometimes compared to insurance as they offer protection against

something. Like insurance, they have a value based on what they are protecting (usually the

asset), a definite life span, and an expiration date.

© IFT. All rights reserved 2

R45 Derivative Markets and Instruments 2022 Level I Notes

Risk management is the process by which an organization or individual defines the level of

risk it wishes to take, measures the level of risk it is taking, and adjusts the latter to equal the

former. Derivatives are an important tool for companies to manage risk effectively.

2. The Structure of Derivative Markets

In this section, we look at the characteristics of exchange-traded and over-the-counter

markets. The exhibit below shows the structure of the derivatives market.

2.1 Exchange-Traded Derivatives Markets

Derivatives traded on exchanges are called exchange-traded derivatives. Examples include

stock futures, currency futures. The exchange is the intermediary between the long and

short parties. It takes an initial margin from both the parties as a guarantee.

Exchange-traded derivatives are standardized. To standardize a derivative implies that the

contract is bound by terms and conditions, and there is little ability to alter those terms. The

contract clearly specifies when it can be traded, when it will expire, what is the lot size, a

minimum amount, and settlement price. There is no room for customization. The only aspect

not defined is the price. The price is determined by the buyers and sellers. For example, a

gold contract on CME defines its quality (995 fineness), contract size (100 troy ounces), how

it will be settled (physical), and so on.

The advantages of standardization are as follows:

• Liquidity: Standardization boosts liquidity as there is no ambiguity, unlike an OTC

market. All market participants are aware when a particular currency/stock future

will trade and when it will expire.

• Clearing and settlement process: Standardization facilitates in clearing and settlement.

After the trade is executed, the clearing and settlement process kicks in. The flow of

money and securities does not happen directly between the investors, as you can see

© IFT. All rights reserved 3

R45 Derivative Markets and Instruments 2022 Level I Notes

from the diagram below. Instead, it flows through a third party called the

clearinghouse. Clearing is the process by which the clearinghouse verifies the

execution of the transaction and the identity of the participants. Settlement refers to

the process in which the exchange transfers money from one party to another, or from

a participant to the exchange or vice versa.

• More transparent: The presence of a clearinghouse makes the whole process

transparent and minimizes the impact of default between the parties. All the

information regarding prices, settlement, and daily turnover is disclosed within

exchanges and clearinghouse which means there is a lack of privacy and flexibility.

• Credit guarantee: It goes without saying that one party loses while the other wins in a

derivative contract as it is based on the performance of the underlying. Clearinghouses

guarantee that the winning party gets paid by requiring participants to post a margin

(cash deposit) called margin or performance bonds, and uses these deposits to make a

payment in the event of default.

2.2 Over-the-counter Derivatives Markets

Unlike an exchange-traded derivative, OTC contracts are negotiated directly between two

parties without an exchange. The characteristics of OTC markets are as follows:

• OTC market comprises an informal network of dealers, typically banks, linked

electronically. These are also called dealer markets.

• Contracts are customized as per the client’s needs.

• Unlike an exchange-traded system where the clearinghouse guarantees settlement,

OTC derivatives have credit risk. Each party bears the risk that the other party will

default.

The key differences between exchange-traded and OTC markets are summarized below:

Differences between exchange-traded and OTC markets

Feature Exchange-traded OTC

Rules Standardized Customized

Where are the contracts traded Exchanges Dealer network

Intermediary Yes, an exchange No intermediary

Trading, clearing, and settlement Centralized Decentralized

© IFT. All rights reserved 4

R45 Derivative Markets and Instruments 2022 Level I Notes

Liquidity More Almost the same

Transparent Yes No

Level of regulation High Low

Flexibility/privacy No Yes

Margin required Yes May or may not be

Examples Futures and options Forwards and Swaps

Market Makers

Market makers can operate in both exchange-traded and OTC markets. The market makers

make money through the bid-ask spread. For instance, if party A wants to take a long

position, the market maker will take the opposite position, i.e., a short position. The market

maker will then look for another party, suppose B, with whom the market maker will take a

long position. In other words, the market maker will sell to party A and buy from party B.

The overall effect is cancelled out, and no matter what happens to the underlying, the market

maker is covered. The bid amount will be lesser than the ask price, and the difference

between both will generate a profit for the market maker.

3. Types of Derivatives: Introduction, Forward Contracts

The following exhibit shows the different types of derivatives.

© IFT. All rights reserved 5

R45 Derivative Markets and Instruments 2022 Level I Notes

3.1 Forward Commitments

A forward commitment is a contract that requires both parties to engage in a transaction at a

later point in time (the expiration) on terms agreed upon today. The parties establish the

identity and quantity of the underlying, the manner in which the contract will be executed or

settled when it expires, and the fixed price at which the underlying will be exchanged. Both

the parties – the buyer and the seller - have an obligation to engage in the transaction at a

future date in a forward commitment.

We will look at the three types of forward commitments: forward contracts, futures

contracts, and swaps.

Forward Contracts

A forward contract is an over-the-counter derivative contract in which two parties agree to

exchange a specific quantity of an underlying asset at a later date at a fixed price they agree

on when the contract is signed. It is a customized and private contract between two parties.

Terms of a forward contract

• Price.

• Where the asset will be delivered.

• Identity of the underlying.

• Number of units or quantity of the underlying. For example, if the underlying is gold

and the price is fixed per gram, the number of grams to be delivered must be specified.

• It is a customized contract between two parties and not traded over the exchange.

Risk of a forward contract

• The long hopes the underlying will increase in value while the short hopes the asset

will decrease in value. One of the two will happen and whoever owes money may

default.

• With forward contracts, no money is exchanged at the start of the contract. Further,

the value of the contract is zero at initiation.

Payoff for long and short:

The diagram below illustrates the payoff diagram for long and short in a forward contract:

© IFT. All rights reserved 6

R45 Derivative Markets and Instruments 2022 Level I Notes

Notation:

• S0 = price of the underlying at time 0; ST = price of the underlying at time T

• FT = forward price fixed at inception at time t = 0

• T = when the forward contract expires

The long party benefits if the spot price increases and goes above the forward price. The

short party benefits if the spot price decreases and goes below the forward price.

Example

Whizz wants to sell 500 shares of beverage maker FTC to Fizz at $50 per share after 180

days. What happens if the market price of FTC at expiry is $50, $60, $70 or $40?

Solution:

Fizz is the long party and Whizz is the short party.

At expiry from Fizz’s perspective (long) when market price is:

$50: payoff is 0 and no one gains or loses

$60: long gains by $10

$70: long gains by $20

$40: long loses by $10 as he can buy the asset cheaper by $10 directly from the market

instead of paying $50 to Whizz

© IFT. All rights reserved 7

R45 Derivative Markets and Instruments 2022 Level I Notes

From Whizz’s perspective, it is exactly the opposite to that of Fizz. When the share price

increases to $70, he loses $20 as he can sell it in market for $70 but is selling for only $50 to

Fizz.

The payoff for the long is depicted diagrammatically below:

4. Types of Derivatives: Futures

A futures contract is a standardized derivative contract created and traded on a futures

exchange such as the Chicago Mercantile Exchange (CME). In a futures contract, two parties

agree to exchange a specific quantity of the underlying asset at an agreed-upon price at a

later date. The buyer agrees to purchase the underlying asset from the other party, the seller.

The agreed-upon price is called the futures price.

There are some similarities with a forward contract: two parties agreeing on a contract, an

underlying asset, a fixed price called the futures price, a future expiry date, etc. But the

following characteristics differentiate futures from a forward:

• The contracts are standardized.

• They are traded on a futures exchange.

• The fixed price is called futures price and is denoted by f. (Forward prices are usually

represented by F.)

• The biggest difference is that gains or losses are settled on a daily basis by the

exchange through its clearinghouse. This process is called mark to market.

• Settlement price is the average of final futures trades and is determined by the

clearinghouse.

• The futures price converges to a spot price at expiration.

• At expiry: the short delivers the asset and the long pays the spot price.

Let us take an example. Assume Ann enters into a contract to buy 100 grams of gold at $55

per gram after 90 days. The futures price is $55. At the end of day 1, the futures price is $58.

There is a gain of $3. So, $300 ($3 per gram x 100 grams) is credited to Ann’s account. This is

called marking to market. The account maintained by Ann is called the margin account.

© IFT. All rights reserved 8

R45 Derivative Markets and Instruments 2022 Level I Notes

Initial margin is the amount that must be deposited in a futures account before a trade is

made. Associated with the initial margin is another figure called the maintenance margin

which is the amount of money each participant must maintain in their accounts after the

trade is initiated. If the margin balance falls below the maintenance margin additional funds

must be deposited to bring the balance up to the initial margin amount.

5. Types of Derivatives: Swaps

A swap is an over-the-counter contract between two parties to exchange a series of cash

flows based on some pre-determined formula.

The simplest swap is a plain vanilla interest rate swap. Consider two companies A and B in

Hong Kong that enter into a swap agreement; Company A agrees to pay a fixed 10% interest

per year to company B for three years on a notional principal of HKD 90,000. Company B, in

turn, agrees to pay a floating rate of HIBOR + 150 basis points per year to company A for the

same period and on the same notional principal. Swaps allow participants to convert their

fixed rate to floating rate and vice versa and take a bet on the anticipated direction of

interest rates.

6. Contingent Claims: Options

We now move to the other major category of derivative instruments called contingent

claims. The holder of a contingent claim has the right, but not the obligation to make a final

payment contingent on the performance of the underlying.

In a contingent claim, two parties, A and B, sign a contract at time 0 to engage in a

transaction at time T. Unlike a forward or futures contract, A has the right, but not the

obligation to make a payment and take delivery of the asset at time T.

There are three types of contingent claims: options, credit derivatives, and asset-backed

securities.

6.1 Options

An option is a derivative contract in which one party, the buyer, pays a sum of money to the

other party, the seller or writer, and receives the right to either buy or sell an underlying

asset at a fixed price either on a specific expiration date or at any time prior to the expiration

date. Options trade on exchanges, or they can be customized in the OTC market.

The buyer/holder of an option is said to be long.

The seller/writer of an option is said to be short.

There are two types of options based on when they can be exercised:

• European option: This type of option can be exercised only on the expiration date.

• American option: This type of option can be exercised on or any time before the

option’s expiration date.

There are two types of options based on the purpose it serves:

© IFT. All rights reserved 9

R45 Derivative Markets and Instruments 2022 Level I Notes

• Call option: Gives the buyer the right to buy the underlying asset at a given price on a

specified expiration date. The seller of the option has an obligation to sell the

underlying asset.

• Put option: Gives the buyer the right to sell the underlying asset at a given price on a

specified expiration date. The seller of the option has an obligation to buy the

underlying asset.

Assume there are two parties: A and B. A is the seller, writer, or the short party. B is the

buyer or the long party. A and B sign a contract, according to which B has the right to buy

one share of Strong Steel Inc. for $50 after six months.

In our example, B has bought the right to buy, which is called a call option. The right to sell is

called a put option. If B has the right to buy a share (exercise the option) of Strong Steel Inc.

anytime between now and six months, then it is an American-style option. But if he can

exercise the right only at expiration, then it is a European-style option. $50, the price fixed at

which the underlying share can be purchased, was fixed at inception and is called the strike

price or exercise price.

B bought the right to buy the share at expiration from A. So B has to pay A, a sum of money

called the option premium for holding this right without an obligation to purchase the share.

The call premium B paid is $3. An investor would buy a call option if he believes the value of

the underlying would increase.

The diagram below shows the call option payoff and profit for both a buyers and sellers

perceptive.

© IFT. All rights reserved 10

R45 Derivative Markets and Instruments 2022 Level I Notes

Call option buyer and seller payoff at expiration:

cT = Max (0,ST – X)

where:

ST = stock’s price

X = exercise price

For example, suppose you buy a call option with an exercise price of 30 and an expiration of

three months for a premium of 1.00 when the stock is trading at 25. At expiration, consider

the outcomes when the stock’s price is 25, 30, or 35. The buyer’s payoffs would be:

For ST = 25, payoff = cT = Max(0,ST – X) = Max(0,25 – 30) = Max(0, –5) = 0.

For ST = 30, payoff = cT = Max(0,ST – X) = Max(0,30 – 30) = Max(0, 0) = 0.

For ST = 35, payoff = cT = Max(0,ST – X) = Max(0,35 – 30) = Max(0, 5) = 5.

To the seller, who received the premium at the start, the payoff is:

–cT = –Max(0,ST – X)

At expiration, the call seller’s payoffs are:

For ST = 35, payoff = –cT = –Max(0,ST – X) = –Max(0,35 – 30) = 0.

For ST = 30, payoff = –cT = –Max(0,ST – X) = –Max(0,30 – 30) = 0.

For ST = 35, payoff = –cT = –Max(0,ST – X) = –Max(0,35 – 30) = –5.

The call buyer’s profit would be:

Profit = Max(0,ST – X) – c0

where:

c0 = option premium

For ST = 25, profit = Max(0,ST – X) – c0 = Max(0,25 – 30) – 1.00 = – 1.

For ST = 30, profit = Max(0,ST – X) – c0 = Max(0,30 – 30) – 1.00 = – 1.00.

For ST = 35, profit = Max(0,ST – X) – c0 = Max(0,35 – 30) – 1.00 = 4.00.

The call seller’s profit is:

Π = –Max(0,ST – X) + c0

At expiration, the call seller’s profit for each underlying price at expiration are:

For ST = 35, profit = –Max(0,ST – X) + c0 = –Max(0,35 – 30) + 1.00 = 1.00.

For ST = 30, profit = –Max(0,ST – X) + c0 = –Max(0,30 – 30) + 1.00 = 1.00.

For ST = 35, profit = –Max(0,ST – X) + c0 = –Max(0,35 – 30) + 1.00 = –4.00.

Put option buyer and seller payoff at expiration:

An investor would buy a put option if he believes the value of the underlying would

decrease. If it decreases by expiration date, the investor has a right to exercise the option to

sell the underlying at the exercise price, which will be greater than the then market price.

© IFT. All rights reserved 11

R45 Derivative Markets and Instruments 2022 Level I Notes

The payoff to the put holder is:

pT = Max(0,X – ST)

The put buyer’s profit would be:

Π = Max(0,X – ST) – p0

where: p0 is option premium.

The payoff for the seller is:

–pT = –Max(0,X – ST)

The put seller’s profit would be:

Π = –Max(0,X – ST) + p0

7. Contingent Claims: Credit Derivatives

A credit derivative is a class of derivative contracts between two parties, a credit protection

buyer and a credit protection seller, in which the latter provides protection to the former

against a specific credit loss. The main type of credit derivative is a credit default swap.

Credit Default Swap

A credit default swap is a derivative contract between two parties, a credit protection buyer

and a credit protection seller, in which the buyer makes a series of cash payments to the seller

and receives a promise of compensation for credit losses resulting from the default of a third

party.

• A CDS is a form of insurance.

• The objective of a CDS is to buy protection to cover the loss of par value of the bond, if

a credit event occurs. A credit event is like bankruptcy, restructuring, or failure to pay

that impairs the borrower’s ability to make timely payments.

• The CDS transfers the credit risk of the borrower from one party (protection buyer) to

another (protection seller).

© IFT. All rights reserved 12

R45 Derivative Markets and Instruments 2022 Level I Notes

• If the borrower defaults, the CDS seller pays the CDS buyer.

8. Types of Derivatives: Asset-Backed Securities and Hybrids

An asset-backed security is a derivative contract in which a portfolio of debt instruments is

assembled and claims are issued on the portfolio in the form of tranches, such that the

prepayments or credit losses are allocated to the most junior tranches first and the most

senior tranches last.

The following exhibit shows how asset-backed securities are created.

Listed below are the major points related to asset-backed securities:

• A pool of loans are grouped together to form a portfolio of loans.

• Financial institutions such as banks, auto companies, and credit card companies that

lend these loans, package them into marketable securities through a process called

securitization, and sell them to a special purpose vehicle. These financial institutions

are the originators of an ABS.

• These securities are called asset-backed securities because they are backed by the

receivables of an asset, such as home loan, auto loan, etc.

• Unlike investors of a bond, all the investors of an ABS do not receive the same rate of

return because it is affected by the prepayments of the underlying loans.

• ABS is typically divided into tranches or bond classes. The prepayment risk and credit

risk are typically different across the bond classes.

8.1 Hybrids

Hybrid instruments combine derivatives, fixed-income securities, currencies, equities, and

commodities. An example of a hybrid is a callable bond or a convertible bond that is created

by combining bonds and options.

9. Derivatives Underlyings

We have seen that derivatives are contracts that derive their value from an underlying. The

© IFT. All rights reserved 13

R45 Derivative Markets and Instruments 2022 Level I Notes

commonly used underlyings are listed below:

• Equities: Individual stocks and stock indices. Options on stocks and equity swaps are

the most commonly used derivatives.

• Fixed-Income Instruments: Bonds, notes. Options, forwards, futures, and swaps on

bonds are used.

• Interest Rates: Most widely used derivative. But the underlying is not an asset.

• Currencies: Currency is the underlying. Options, forwards, futures, and swaps on

currencies are used.

• Commodities: Any commodity such as food, oil, gold, silver, etc. Futures are the most

used commodity derivatives.

• Credit: Underlying is credit of some form. Examples of derivatives created on credit as

an underlying include CDS or CDO.

• Other: Contracts can also be based on several different types of underlying such as

weather, electricity, natural disasters, etc.

10. The Purposes and Benefits of Derivatives

The modern derivatives market finds its origin with the formation of the Chicago Board of

Trade in 1848. In the mid-1800s, Chicago was becoming a major hub of transportation and

commerce where farmers gathered to sell their agricultural produce every year from

September to November. As the city’s storage capacity was not adequate to store all the

grains during this period, some farmers found it economical to dump the grains in the

Chicago River (literally!) than cart it all the way back to their farms. The rest of the year, the

prices of the grains would rise sharply.

The Chicago Board of Trade introduced a financial instrument called a “to-arrive” contract

that a farmer could sell anytime of the year that specified the price and delivery date for the

grain. On that pre-determined date, he could deliver the grain. This ensured the farmers got

a fair price for their produce all through the year by entering into a contract ahead of time to

deliver the grains at some point in the future.

Some of the benefits of derivatives are listed below:

Risk Allocation, Transfer, and Management

Derivatives are a cost-effective way of transferring risk from one party to another. For

example, if an investor has a substantial investment in a stock that he does not want to sell

but reduce the risk, he can do so by taking a short position in a futures contract or buying a

put option.

Information Discovery

There are two primary advantages of futures markets:

• Price discovery: Futures prices reveal more information than spot prices. For

commodities that trade worldwide like gold, a futures contract expiring soon is a

© IFT. All rights reserved 14

R45 Derivative Markets and Instruments 2022 Level I Notes

better indicator of its value than gold price in India or the U.S. which may be wide

apart.

• Implied volatility: Implied volatility measures the risk of the underlying or the

uncertainty associated with options. With the models such as BSM to price an option,

it is possible to determine the implied volatility, and hence the risk.

Operational Advantages

Some of the major operational advantages associated with derivatives are given below:

• Lower transaction costs than the underlying.

• Greater liquidity than the underlying spot markets.

• Easy to take a short position.

Margin requirements and option premiums are low relative to the cost of the underlying

Market Efficiency

Any mispricing is corrected more quickly in the derivatives market than the spot market

because of operational advantages: low transaction costs, easier to take a short position, etc.

The market is more liquid as it attracts more market participants because of its low cost to

trade.

They allow investors to participate in price movements, both long and short positions are

allowed.

Some instruments may not be bought directly, but an investor can gain exposure to these

instruments through derivatives. For example, the weather.

11. Criticisms and Misuses of Derivatives

Studies researching the cause of a crash over the past 30 years always point to derivatives as

one of the primary reasons. The sub-prime crisis of 2007-08 was also caused by a derivative

– Credit Default Swap.

Speculation and Gambling

Derivatives are often compared to gambling as it involves a lot of speculation and risk taking.

An important distinction between speculation and gambling is that a very few benefit from

gambling. But speculation makes the whole financial markets more efficient.

Destabilization and Systemic Risk

Derivatives are often blamed to have destabilizing consequences on the financial markets.

This is primarily due to the high amount of leverage taken by speculators. If the position

turns against them, then they default. This triggers a ripple effect causing their creditors to

default, creditors’ creditors to default, and so on. A default by speculators impacts the whole

system. For example, the credit crisis of 2008.

© IFT. All rights reserved 15

R45 Derivative Markets and Instruments 2022 Level I Notes

Complexity

Another criticism of derivatives is their complexity. The models are highly complex and are

not easily comprehensible by everyone.

12. Elementary Principles of Derivative Pricing

Derivative pricing is based on the hedge portfolio concept: combination of a derivative and

underlying such that risk is eliminated. The hedge portfolio should earn the risk-free rate. A

derivative’s value is the price of the derivative that forces the hedge portfolio to earn the

risk-free rate. It is also important to understand the concepts of storage and arbitrage.

Storage

Certain kinds of derivatives like forward/future contracts where the underlying is a

commodity like food grain, gold, or oil require storage. Storage incurs costs and

consequently the forward/future price must be adjusted upwards.

Arbitrage

Arbitrage is the condition that if two equivalent assets or derivatives or combinations of

assets and derivatives sell for different prices, then this leads to an opportunity to buy at a

low price and sell at a high price, thereby earning a risk-free profit without committing any

capital.

Let us consider an example of a stock selling in two markets A and B. The stock is selling in

market A for $51 and in market B for $52. An arbitrage opportunity exists here as an

investor can buy the stock at a lower price in market A and sell it at a higher price in market

B.

The combined actions of arbitrageurs bring about a convergence of prices. Hence, arbitrage

leads to the law of one price: transactions that produce equivalent results must sell for

equivalent prices. If more people buy the stock in market A, and more people sell the stock in

market B, the stock’s price will converge in both the markets.

© IFT. All rights reserved 16

R45 Derivative Markets and Instruments 2022 Level I Notes

Summary

LO.a: Define a derivative, and distinguish between exchange-traded and over-the-

counter derivatives.

A derivative is a financial instrument that derives its value from the performance of an

underlying asset. It is a legal contract between a buyer and seller entered into today,

regarding a transaction that will be fulfilled at a specified time in the future.

Differences between exchange-traded and OTC markets

Feature Exchange-traded OTC

Rules Standardized Customized

Where are the contracts traded Exchanges Dealer network

Intermediary Yes, an exchange No intermediary

Trading, clearing, and settlement Centralized Decentralized

Liquidity More Almost the same

Transparent Yes No

Level of regulation High Low

Flexibility/privacy No Yes

Margin required Yes May be or not

Examples Futures and options Swaps

LO.b: Contrast forward commitments with contingent claims.

Forward commitments are contracts entered into at one point in time that require both

parties to engage in a transaction at a later point in time (the expiration), on terms agreed

upon at the start. Examples: forward contracts, futures contracts, and swaps.

The holder of a contingent claim has the right, but not the obligation, to make a final

payment, contingent on the performance of the underlying.

Example: call option and put option.

LO.c: Define forward contracts, futures contracts, options (calls and puts), swaps, and

credit derivatives, and compare their basic characteristics.

Forward contract is an over-the-counter derivative contract in which two parties agree to

exchange a specific quantity of an underlying asset on a later date, at a fixed price they agree

on when the contract is signed. It is a customized and private contract between two parties.

A futures contract is a standardized derivative contract, created and traded on a futures

exchange. In a futures contract, two parties agree to exchange a specific quantity of the

underlying asset at an agreed-upon price at a later date.

A swap is an over-the-counter contract between two parties to exchange a series of cash

flows based on some pre-determined formula.

© IFT. All rights reserved 17

R45 Derivative Markets and Instruments 2022 Level I Notes

A call option gives the buyer the right to buy the underlying asset at a given price on a

specified expiration date. The seller of the option has an obligation to sell the underlying

asset.

A put option gives the buyer the right to sell the underlying asset at a given price on a

specified expiration date. The seller of the option has an obligation to buy the underlying

asset.

Credit derivative is a class of derivative contracts between two parties, a credit protection

buyer and a credit protection seller, in which the latter provides protection to the former

against a specific credit loss.

LO. d. Determine the value at expiration and profit from a long or a short position in a

call or put option.

The call option buyer’s payoffs at expiration is:

cT = Max(0,ST – X)

To the seller, who received the premium at the start, the payoff is:

–cT = –Max(0,ST – X)

The call buyer’s profit is:

Max(0,ST – X) – c0

The call seller’s profit is:

Π = –Max(0,ST – X) + c0

The payoff to the put holder is:

pT = Max(0,X – ST)

The put buyer’s profit is:

Π = Max(0,X – ST) – p0

The payoff for the seller is:

–pT = –Max(0,X – ST)

The put seller’s profit is:

Π = –Max(0,X – ST) + p0

LO.e: Describe purposes of, and controversies related to, derivative markets.

Benefits

• Risk allocation, transfer, and management protection with minimum investment.

• Information discovery.

• Price discovery.

• Implied volatility.

• Market efficiency.

© IFT. All rights reserved 18

R45 Derivative Markets and Instruments 2022 Level I Notes

Criticisms

• Speculation and gambling.

• Destabilization of financial markets.

LO.f: Explain arbitrage and the role it plays in determining prices and promoting

market efficiency.

Arbitrage

• Arbitrage is the condition under which two equivalent assets or derivatives or

combination of assets and derivatives sell for different prices.

• This allows us to buy at a low price and sell at a high price, and earn a risk-free profit

from this transaction without committing any capital.

Role

• The combined actions of arbitrageurs force the prices of similar securities to

converge.

• Hence, arbitrage leads to the law of one price: transactions that produce equivalent

results must sell for equivalent prices.

© IFT. All rights reserved 19

R45 Derivative Markets and Instruments 2022 Level I Notes

Practice Questions

1. Which of the following statements most accurately describes a derivative? A derivative:

A. passes through the returns of the underlying.

B. duplicates the performance of the underlying.

C. transforms the performance of the underlying.

2. In contrast to over-the-counter derivatives, exchange-traded derivatives would most likely

be:

A. customized.

B. less regulated.

C. more transparent.

3. Which of the following least likely describes exchange-traded derivatives relative to over-

the-counter (OTC) derivatives? exchange-traded derivatives are:

A. more liquid.

B. less customized.

C. more transparent.

4. An agreement to purchase a specific stock next month for $100 is:

A. a forward commitment.

B. a contingent claim.

C. both a forward commitment as well as a contingent claim.

5. Which of the following best describes an interest rate swap?

A. An agreement where two parties agree to exchange a series of cash flows.

B. An agreement where the credit seller provides protection to the credit buyer.

C. An agreement where the buyer has the right to purchase the underlying from the seller.

6. Which of the following statements about futures is most accurate?

A. They are non-standardized

B. They are subject to daily price limits.

C. Their payoffs are received at settlement.

7. Analyst 1: Options provide payoffs that are linearly related to the payoffs of the underlying.

Analyst 2: Forwards provide payoffs that are linearly related to the payoffs of the

underlying.

A. Analyst 1 is correct.

B. Analyst 2 is correct.

C. Both analysts are correct.

© IFT. All rights reserved 20

R45 Derivative Markets and Instruments 2022 Level I Notes

8. Which of the following derivatives will most likely have a non-zero value at initiation of the

contract?

A. Futures

B. Forwards

C. Options

9. A market participant has a view regarding the potential movement of a stock. He sells a

customized over-the-counter put option on the stock when the stock is trading at $52. The

put has an exercise price of $50 and the put seller receives $3 in premium. The price of the

stock is $48 at expiration. The profit or loss for the put seller at expiration is:

A. $(1.0).

B. $1.0.

C. $2.0.

10. Consider a call option selling for $1.90 in which the exercise price is $78. If the price of the

underlying at expiration is $81, the payoff and profit for a buyer is

A. 0

B. $3.00 and $1.10, respectively.

C. $3.00 and $4.90, respectively.

11. Which of the following is most likely to be an advantage of the derivative markets?

A. facilitates speculation and risk taking.

B. Greater opportunities to go short compared to the spot market.

C. Similar payoffs to those of underlying.

12. Compared to the underlying spot market, the derivatives market is most likely to have:

A. lower liquidity.

B. higher transaction costs.

C. lower capital requirements.

13. Which of the following statements about derivatives is most accurate?

A. Options convey the volatility of the underlying.

B. Futures convey the most widely used strategy of the underlying.

C. Swaps do not convey the price at which uncertainty in the underlying can be

eliminated.

14. Derivatives are least likely to:

A. provide more opportunities to go short compared with the spot market.

B. prevent arbitrage.

C. improve liquidity.

© IFT. All rights reserved 21

R45 Derivative Markets and Instruments 2022 Level I Notes

15. Which of the following statements about arbitrage is least accurate?

A. Arbitrage can cause markets to be less efficient.

B. Arbitrage allows making a profit without risk.

C. Arbitrage allows making a profit without investment.

16. Which of the following is least likely to be a criticism of the derivatives market?

A. Derivatives provide price information but only at a cost of increasing transaction costs.

B. Derivatives are highly speculative instruments and effectively permit legalized

gambling.

C. Derivatives have destabilizing consequences on the financial markets.

© IFT. All rights reserved 22

R45 Derivative Markets and Instruments 2022 Level I Notes

Solutions

1. C is correct. A derivative is a financial instrument that transforms the performance of the

underlying.

2. C is correct. Exchange traded derivatives are more transparent than over-the- counter

derivatives. They are also standardized and more regulated as compared to over-the-

counter derivatives.

3. A is correct. There is a tendency to think that exchange-traded derivative is more liquid

relative to the OTC market, but this is not necessarily true. Other two statements are

correct.

4. A is correct. Forward commitments represent an obligation to buy/sell, whereas

contingent claims represent a right to buy/sell.

5. A is correct. Interest rate swap is an agreement between two parties to exchange a series

of cash flows. Option B describes a credit default swap. Option C describes a call option.

6. B is correct. Any payoffs in the future contracts are settled on daily basis by the exchange

through its clearinghouse. This process is called mark to market. Other two statement are

false.

7. B is correct. Forwards provide payoffs that are linearly related to the payoffs of the

underlying. Whereas, the payoffs of options are non-linear, for example a call option will

provide a payoff only if the underlying crosses the strike price, otherwise it will expire

worthless and have a zero payoff.

8. C is correct. Futures and forwards have a zero value at initiation of the contract. Options

however have a non-zero value at initiation, equal to the option premium.

9. B is correct. Profit = max (0, premium – value of put at expiration) = max (0, premium-(X-

S)) = 3 – 2 = 1.0.

10. B is correct.

Payoff = cT = Max (0,ST – X) = Max (0, 81– 78) = $3

Profit = Max (0,ST – X) – c0 = Max (0, 81 – 78) – 1.90 = $1.1

11. B is correct. An operational advantage of derivative markets is the ease of going short in

comparison to the underlying spot market. Derivative markets provide for effective risk

management and thus result in payoffs different than those of the underlying. Therefore

© IFT. All rights reserved 23

R45 Derivative Markets and Instruments 2022 Level I Notes

similar payoffs are least likely to be an advantage to consider. Speculation and risk taking

represent disadvantage of derivative markets.

12. C is correct. Compared to the underlying spot market, the derivatives market has higher

liquidity, lower transaction costs and lower capital requirements.

13. A is correct. It is possible to determine the implied volatility of the options through models

such as BSM. Derivatives do not convey any information about the use of the underlying in

strategies. Swaps convey the price at which uncertainty in the underlying can be

eliminated.

14. B is correct. Derivatives facilitate arbitrage transactions not prevent them. Option A and C

are correct statements.

15. A is correct. Arbitrage makes a market more efficient. Option B and C are correct

statements.

16. A is correct. Derivative markets do provide price information but also lower transaction

costs. B and C are correct criticisms of derivatives market.

© IFT. All rights reserved 24

You might also like

- Zipcar: Influencing Customer BehaviorDocument4 pagesZipcar: Influencing Customer BehaviorSashitaroor100% (1)

- Clearing and Settlement ProcessDocument22 pagesClearing and Settlement ProcessmNo ratings yet

- R48 Derivative Markets and InstrumentsDocument179 pagesR48 Derivative Markets and InstrumentsAaliyan Bandealy100% (1)

- R48 Derivative Markets and Instruments IFT NotesDocument22 pagesR48 Derivative Markets and Instruments IFT NotesShehroz JamshedNo ratings yet

- Cash Money Markets: Minimum Correct Answers For This Module: 6/12Document15 pagesCash Money Markets: Minimum Correct Answers For This Module: 6/12Jovan SsenkandwaNo ratings yet

- Contemporary Issues in Finance: This Module Covers The Followings: 1. Types of Financial MarketsDocument6 pagesContemporary Issues in Finance: This Module Covers The Followings: 1. Types of Financial Marketsmaquesurat ferdousNo ratings yet

- CFD T NG QuanDocument35 pagesCFD T NG QuanChjk PinkNo ratings yet

- Forwards Contract:: Futures and Forwards Are Financial Contracts Which Are Very Similar in Nature But ThereDocument7 pagesForwards Contract:: Futures and Forwards Are Financial Contracts Which Are Very Similar in Nature But ThereFardeen KhanNo ratings yet

- Derivatives - Ch. 2 - May 21Document13 pagesDerivatives - Ch. 2 - May 21Horeya KhalilNo ratings yet

- Derivatives - Zell Education 2024Document67 pagesDerivatives - Zell Education 2024harshNo ratings yet

- IFM Home AssignmentDocument6 pagesIFM Home AssignmentAnshita GargNo ratings yet

- Derivatives and Risk Management PDFDocument7 pagesDerivatives and Risk Management PDFYogesh GovindNo ratings yet

- Ab3dbe6f 1600068587890 PDFDocument64 pagesAb3dbe6f 1600068587890 PDFAasthaNo ratings yet

- Financial Market PresentationDocument15 pagesFinancial Market PresentationAashray PandeyNo ratings yet

- Collateral Presentation FAI Final2Document31 pagesCollateral Presentation FAI Final2amitsh20072458No ratings yet

- Assignment - Methods of Hedging Against RiskDocument14 pagesAssignment - Methods of Hedging Against RiskGeorge OtienoNo ratings yet

- Capital-markets-Midterm With ExplanationDocument9 pagesCapital-markets-Midterm With ExplanationfroelanangusatiNo ratings yet

- Jahangirnagar University: Merchant and Investment Banking 1.0 Investment BankingDocument5 pagesJahangirnagar University: Merchant and Investment Banking 1.0 Investment BankingFarjana Hossain DharaNo ratings yet

- Markit Credit Indices PrimerDocument63 pagesMarkit Credit Indices Primersa.vivek1522No ratings yet

- Finance Questions Generally Asked in Interview On Equity MarketDocument26 pagesFinance Questions Generally Asked in Interview On Equity MarketshubhamNo ratings yet

- No. Particulars No. Introduction To DerivativesDocument48 pagesNo. Particulars No. Introduction To DerivativesHarshad PatelNo ratings yet

- T3 FMP 4 Ch4 Derivatives v5 6121c64371ea2Document20 pagesT3 FMP 4 Ch4 Derivatives v5 6121c64371ea2Christian Rey Magtibay100% (1)

- WORK SHEET - Financial Derivatives: Q1) Enumerate The Basic Differences Between Forward and Futures ContractsDocument5 pagesWORK SHEET - Financial Derivatives: Q1) Enumerate The Basic Differences Between Forward and Futures ContractsBhavesh RathiNo ratings yet

- Future & Options FinalDocument8 pagesFuture & Options Finalabhiraj_bangeraNo ratings yet

- Financial Institutions: Submitted To: Sharique Ayubi Submitted By: Abdul Samad Munaf ID: 8905 Date: 9 December 2009Document18 pagesFinancial Institutions: Submitted To: Sharique Ayubi Submitted By: Abdul Samad Munaf ID: 8905 Date: 9 December 2009Muzammil YounusNo ratings yet

- Notes For FRMDocument6 pagesNotes For FRMAshutosh PandeyNo ratings yet

- Basics of Financial ManagementDocument23 pagesBasics of Financial ManagementCONTENT TUBENo ratings yet

- Chapter-11 Equity Derivatives: Certificate in Risk ManagementDocument27 pagesChapter-11 Equity Derivatives: Certificate in Risk ManagementmmkattaNo ratings yet

- UMA WhitepaperDocument26 pagesUMA WhitepaperKNo ratings yet

- CW ReportDocument6 pagesCW ReportZainab SarfrazNo ratings yet

- Master of Business Administration 42Document7 pagesMaster of Business Administration 42ali_rahim1988No ratings yet

- Evolution of Derivatives Market in IndiaDocument4 pagesEvolution of Derivatives Market in IndiaSujeet GuptaNo ratings yet

- BLBL Product Disclosure Statement 20200626Document26 pagesBLBL Product Disclosure Statement 20200626silvofNo ratings yet

- SEC GME ReportDocument45 pagesSEC GME ReportZerohedge100% (1)

- Risk Disclosure EZInvest-1Document9 pagesRisk Disclosure EZInvest-1Petros JosephidesNo ratings yet

- Collateral ManagementDocument19 pagesCollateral ManagementChirdeep PareekNo ratings yet

- Chapter 7 - EndnotesDocument4 pagesChapter 7 - EndnotesHuu DuyNo ratings yet

- Value Is Derived in Part From The Value and Characteristics of Another An Underlying AssetDocument9 pagesValue Is Derived in Part From The Value and Characteristics of Another An Underlying AssetAbhijeet Gupta 1513No ratings yet

- © FINANCE TRAINER International Fixed Income / Page 1 of 48Document48 pages© FINANCE TRAINER International Fixed Income / Page 1 of 48subrat nandaNo ratings yet

- Chapter 4 FMIDocument13 pagesChapter 4 FMItame kibruNo ratings yet

- 6.debt Market and Forex Market-TheoriticalDocument27 pages6.debt Market and Forex Market-TheoriticaljashuramuNo ratings yet

- Forward and Futures Contracts: by Surya B. RanaDocument30 pagesForward and Futures Contracts: by Surya B. RanaUbraj NeupaneNo ratings yet

- Types of Money Market Instruments EditedDocument2 pagesTypes of Money Market Instruments EditedJansen Alonzo BordeyNo ratings yet

- Global Module 2 and 3Document14 pagesGlobal Module 2 and 3Neha SachdevaNo ratings yet

- OTC Derivatives ModuleDocument7 pagesOTC Derivatives ModulehareshNo ratings yet

- Unit # 2 CAPITAL AND MONY MARKETDocument9 pagesUnit # 2 CAPITAL AND MONY MARKETDija AwanNo ratings yet

- C CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CDocument34 pagesC CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CJayprakash MahantaNo ratings yet

- Money Market and Its InstrumentsDocument18 pagesMoney Market and Its InstrumentsSandip KarNo ratings yet

- Unit # 2 Capital and Mony MarketDocument9 pagesUnit # 2 Capital and Mony MarketDija Awan100% (1)

- What Is A Derivative?Document65 pagesWhat Is A Derivative?devNo ratings yet

- Ryan Sinha Contracts (1) 1059Document13 pagesRyan Sinha Contracts (1) 1059Ryan SinhaNo ratings yet

- DerivativesDocument16 pagesDerivativesMukul Kr Singh ChauhanNo ratings yet

- Chatham Financial Counterparty Risk and Collateral ProtectDocument8 pagesChatham Financial Counterparty Risk and Collateral ProtectjitenparekhNo ratings yet

- Derivatives NotesDocument81 pagesDerivatives NotespritamNo ratings yet

- WLH Finance CompilationDocument58 pagesWLH Finance CompilationSandhya S 17240No ratings yet

- Questions (FMIS)Document22 pagesQuestions (FMIS)Onkar Ashok Kelji0% (1)

- Fmo PVT 2021 Ans KeyDocument8 pagesFmo PVT 2021 Ans KeyVictor VargheseNo ratings yet

- Fin 4303 Chapter 8 ContentDocument10 pagesFin 4303 Chapter 8 Contentsxsy8124100% (1)

- Project DerivativesDocument63 pagesProject DerivativescdineshcNo ratings yet

- IFRS 9 - What Is A Financial InstrumentDocument4 pagesIFRS 9 - What Is A Financial InstrumentMuhammad Moin khanNo ratings yet

- Quality Ranking Whitepaper FinalDocument38 pagesQuality Ranking Whitepaper Finalpeter990xNo ratings yet

- Sdvgeger ECONDocument2 pagesSdvgeger ECONtahmeemNo ratings yet

- New DuffyTanis1993Document7 pagesNew DuffyTanis1993e_o_fNo ratings yet

- Review: Dr.B.G.Cetiner Cetinerg@itu - Edu.trDocument20 pagesReview: Dr.B.G.Cetiner Cetinerg@itu - Edu.trkhawarayubNo ratings yet

- O'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Document16 pagesO'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Ioana Ionescu85% (13)

- April 2023 FS CANTEEN REportDocument5 pagesApril 2023 FS CANTEEN REportYyahm YserolfNo ratings yet

- Week 1-Introduction-V3-classDocument81 pagesWeek 1-Introduction-V3-classRutuja PabaleNo ratings yet

- Cca Notes..Document6 pagesCca Notes..Hajji Iršłäñ ÂkrämNo ratings yet

- CBSE Sample Papers For Class 11 Accountancy-1Document65 pagesCBSE Sample Papers For Class 11 Accountancy-1Sushraavya RaoNo ratings yet

- From Nobility To Novelty The Legal Profession at A CrossroadDocument19 pagesFrom Nobility To Novelty The Legal Profession at A CrossroadEcnerolAicnelavNo ratings yet

- Mahindra & MahindraDocument6 pagesMahindra & MahindraAbhishek MishraNo ratings yet

- Cece and SusanDocument28 pagesCece and SusanCece J MarieNo ratings yet

- Effect of Customer Experience in Business and Financial Performance of BanksDocument9 pagesEffect of Customer Experience in Business and Financial Performance of BanksCathaline MeganNo ratings yet

- Application of OR in Fashion IndustryDocument7 pagesApplication of OR in Fashion IndustryManali ThakkarNo ratings yet

- Gokongwei v. SecDocument26 pagesGokongwei v. SecReghz De Guzman Pamatian100% (4)

- The Very Best of 5SDocument32 pagesThe Very Best of 5SxyalfaxyzNo ratings yet

- IFA AssignmentDocument5 pagesIFA AssignmentAdnan JawedNo ratings yet

- Unit 6 - Recruitment - SelectionDocument36 pagesUnit 6 - Recruitment - SelectionKeesha CharayaNo ratings yet

- BPO Future Forward IVDocument40 pagesBPO Future Forward IVSaurabh GuptaNo ratings yet

- Terms and Conditions of The Vertiv Partner ProgramDocument4 pagesTerms and Conditions of The Vertiv Partner Programacarlessi1No ratings yet

- Statement 2022 10Document4 pagesStatement 2022 10wconceptouNo ratings yet

- SynopsisDocument4 pagesSynopsispirdada100% (1)

- Ed SyllabusDocument4 pagesEd SyllabusVenkatesh PrasadNo ratings yet

- Sloan - Brochur BBBDocument24 pagesSloan - Brochur BBBarunpdnNo ratings yet

- NPH ResumeDocument1 pageNPH Resumeapi-222822034No ratings yet

- Philippine Long Distance TelephoneDocument31 pagesPhilippine Long Distance TelephoneAhnJelloNo ratings yet

- DB-regulation Eng PDFDocument23 pagesDB-regulation Eng PDFOmer HayatNo ratings yet

- Internship Project Ravish KumarDocument42 pagesInternship Project Ravish KumarManish SharmaNo ratings yet

- How To Write A Business PlanDocument7 pagesHow To Write A Business PlanDhiraj Kumar PalNo ratings yet