Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

17 viewsFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 10012023

Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 10012023

Uploaded by

Raghunathan IyengarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ac 118221Document47 pagesAc 118221Raghunathan IyengarNo ratings yet

- Ac 118271Document46 pagesAc 118271Raghunathan IyengarNo ratings yet

- Gundukkal ECDocument4 pagesGundukkal ECRaghunathan IyengarNo ratings yet

- Government Of Tamilnadu Registration Department: Document No.& Year/ஆவண எண் மற்றும் ஆண்டு: 3294/1984Document2 pagesGovernment Of Tamilnadu Registration Department: Document No.& Year/ஆவண எண் மற்றும் ஆண்டு: 3294/1984Raghunathan IyengarNo ratings yet

- Dindigul District District Disaster Management Plan - 2021 2021-2022Document210 pagesDindigul District District Disaster Management Plan - 2021 2021-2022Raghunathan IyengarNo ratings yet

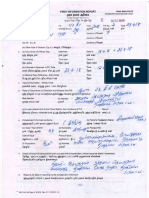

- Ta M JL Na Du Police: Integrated Investigation I Okm-IDocument4 pagesTa M JL Na Du Police: Integrated Investigation I Okm-IRaghunathan IyengarNo ratings yet

- First Information Report: R .SubDocument7 pagesFirst Information Report: R .SubRaghunathan IyengarNo ratings yet

- Year - JWF Firno:: First Information ReportDocument5 pagesYear - JWF Firno:: First Information ReportRaghunathan IyengarNo ratings yet

Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 10012023

Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 10012023

Uploaded by

Raghunathan Iyengar0 ratings0% found this document useful (0 votes)

17 views16 pagesOriginal Title

Copy of Financial Staements Duly Authenticated as Per Section 134 (Including Boards Report, Auditors Report and Other Documents)-10012023

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

17 views16 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 10012023

Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 10012023

Uploaded by

Raghunathan IyengarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 16

0 LTD.

HEET

tn thousands)

o

Particulars berate 31.03.2022 31603.2021

L z z a ofa

T [EOUITY AND LIABILITIES

\Sharcholders’ funds

(a) Share capital 2 4300.00) 300.0

(b) Reserves and susplie 3 1938.46 19759.58|

2363846 23059.54)

2|Non-current labilifes

(a) Long-term borrowings 4 1902.09} 1902.02]

(b) Deferred tx tiebilities (Net) 5 240.42] 251.39}

24nd 534i

3 Current tabitities

(a) Trade payzbles ‘ 7133.29] 4266.64

(@) Other Current Liabilities * 60,00) 0.00

7193.29) 4426.68)

‘TOrAL| sara Bea

IL, |ASSETS .

-urvent wats

J}(a) Property, Plant & Equipments and

Inangibe asics

@) fopaiy, Pw kEquipmmes| | 461921

(i) Intangible assets: & 462.20|

{iy Capital Work-in- Props > |_ mass]

aa e310 49

2 {Current assets

Kia) Inventory w -38,02| 79.09]

l(b) Trade receivables ot 20120.26) 1683188)

\id) Cosh and cash equivalents R 504507] 3863.93]

l(c) Short-term loans and advances: 3 1987.25} 1314.38)

"| 2150.60 099.19

TOTAL yr 20)

cts o Balance Shot Statement

orProfs Low Ai 140

FORSH VRE & CO. FOR THE PROFESSIONAL COURIERS PVT.LTD,

CHARTERED ACCOUNTANTS

QD san won ke.

H.WENKATA SUBRAMANIAN AHAMED MEERAN 00!

PARTNER MANAGING DIRECTOR DIRECTOR-FIM

MEMBERSHIP NO:039952 ~ DIN 00094209 DIN 056429)

FRN NO:1S674W TH

Uppy: 2203p9s2aToIMes1a1 ae a ESSIONAL COURIERS PVT. LTD

PLACH: THANE #; 1203/4, 12th Foot, BhumirajCostarca,

DATED -07.09.32 Plot No.1.8 2, Sector -18, San,

Mavi tums 40784 na0 tan

CIN No. Usgggayr HSS37PT COMIN

fn howeande)

sam

£06.11

2,09

30.98

405s.)

6.89

932.52

1739.12

S0g.2021

2236376) 1442.54)

336.98)

34937]

02

433)

ina]

sia ta}

a8 92

+ pomsuvRK aco.

ACCOUNTANTS

wane

HVENKATASUBIAMANIAN.

PARTHER

MEMBERSHIP N0-019952

RN NO:1 15674

[UDIN: 20}0082ATGTMES 121

PLACE THANE

DATED: 0708-22

POR THE PROFESSIONAL COURIERS PYTETD,

=,

;AMED MEERAN

MANAGING DIRECTOR

DIN 90094209

THE PROFESSIONAL COURIERS PVT. LTD.

Regd. Office: 1203/A, 12th Floor, Bhumirs) Costariea,

Plot No. 16 2, Sector -18,Sanpada,

Navi Mumbai 606 705. Tel. Wo. 022- 27813308.

CIN No. USSO99MH 1867PTCD4530

“The financial statements are prepared under the historical cost coventian on an sccrual basis of ascounting in socordence

wits the Generally Accepted Accounting Principles, Accounting Sinsdards as prescribed by Companies (Accounting

‘Stusdards) Rules,2000, the provision af the Companics Aet201 3 to dhe extoms noxifled}, the Companies ei2013 (Lo the

extent applicable, and! the relevant provisions thereof

(6) Revenue Recognition

1, Revesue from service transtctans is recognized as soon as the service it performed and itis reasonable 10 expect

ultimate calleetion ofthe Rewer,

2. In case itis detormised on the basis of various faetors that the Viabliies for risk elated Yo monperformance is not

significant ot the tke of banding over containers 0 the exter he Company may consider the performance as

substantnlly complete and aceosdingly recogrie the reverue a the titte of handing over the comtamer to he carir.

3. Revenue is recognized on complation of contract method

(eo) Tamgible sssets

‘Tangible assets are stated at cost leas acoumolated depreciation and oct of impairment, if-any. Preaperative expeatos

including rid run expenses (net of revenue) are capitalized. Borrowing costs Guting ths period of consirvetion is added 1

the cost of eligible tangible aocets.

(d) [ntungible Assets

Intangible assets wre stated ot cost less accumulated depreciation and net of impuerent.

@

Asamortization on leasehold land is insignificant, amortization is not provided for.

GG) In case of other fixed assets depreciation hus been provided on wrinen down values at the rates specified in

Part C of Sehedule (11) tothe Companies Act, 201.8,

0) losin

ived aascls are reviewed for impairment wltenever events or changes in circumstances indicate thar heir carrying

‘amount may not be recovernble.

‘Am impairment loss ix recognized in the Statement of Profit and Loss if the carrying amount of an asset exceeds its

recoverable amount,

(g) laventoriee: NA

(h) Employee Beneftir

{0) All employee benefits payable wholly within twelve months of rendering the service ate classifies shox? term

‘employee Benefits. Benefits cuck as ealaries, wages, eantract labor chirges-and short term commpensated absences are

recognized in the period in which the employee! contractual labor renders the relat service.

{b) Contribations tothe Providest Fund and Superannuation Funds are madein accordance with the rules of the Funds,

(0) Deferred Tax

Deferred tax is accounted for by computing the tax effeet-of timing differences which arise during the pexiod and

reversed in subsequent periods

(i) Aecouming for Taxes on Lacome:

‘Provision for Income Tax (Current tax) ia determined on the basis of the estimated taaable insme and amount to be pal

‘0 the ux authorities in accordance with the provisions of Insome Tan Act, 1961

Raga tho. 4

sierew jE]

sore

SHARE CAPITAL.

(DESCRIPTION

jdbc

|50100 Equity Shares of 100 anck

|Innweal Subscribe & Pula

4380044 9600) Equity Sharesof 1U0cech 4300] 4300]

sito) 30a

Tat b Ba

Soa sean

Isr ‘Name of Sharehuleer Woof Saree Wacet Shares

Seocnotng | SST os ectetng

1 cas ee as Tas

AGRA PARAYEL MATEO a Taste] a3

3 DOMEN CHACKALAYI: CHACKD a3 ire a

&TrvowaS one a3 aaa a

Shain goon a3 taza] a3

+ SoReaa arRATIOOE a aan — ai

+ Wabi SNATH ai Tae —— ai

E as ani ans]

‘Statement showine sarticubirs of promoture hetiines,

RNC oe of Sharcbalder

nad t

a0

TOUMEN CHACKALAYIL CHACED. a Tas)

r sus sl HFS]

i

TER Tat)

‘The een, owen relting io each cheno sry cant ead the austen Viti a etn

‘beraf are consid inthe Mermarandim ard Aste of Asaceiaton of tae Commacw. The ariacole eh area fellows

‘AL Bouly Shares off. 10D! each

‘The Commun hun ane aes of sure capital rae Eau Snes having a ace value of Rs. |0/-er share

Uleresoeet af every fase Share whether fll ed er arty ane) vat risk le i he cxme cron a he

‘ape mid uo ea seh Eni Share Beast be tl aid Un ced case of Ue Cees

“The vend prapoeed by the Bound af Cureton subset i ts ineeoval fe shareholders i theersure Annual

General Metin excel sneaes of stern dls

rte sent ef Houston the shoals of Eauirv Shares ar elise wo receive the freaining arcs of the Comma

stay bun of a pefeeetil aaa. n poten thse shavshelnes

sae

tssi.26

25839

NON-CUINNIT LiamL iors

NOTES B

‘LONG TERM BORROWINGS

Sait

[SECURED LOAN

rem Dire ses ssx2eal

From Ssarcblers anos nl

Teal a= a mak

Noms

‘CALCULATION OF DEFERRED TAX LIABILITY

Deferred tay ability carried forward

231.9]

NOTES

‘TRADEPAVAMLES

DESCRIPTION ae

aNOUNT | —ANOUNT

Santry Cry 21643 eo

crete ur Lapeses o766

[Cissed ar under

SME: -enpuied 00 on

[orecioe estan I yes Uediepund 7133.29 06568

713338 es

‘NOTED

‘OUME CURRENT LIABILITIES

pecunoy ‘suusamz | sister

awouNT_| AMOUNT

[Tras Despont 0.00) 000)

Tea a] Ta

‘THE PROFESSIONAL COURIER PVT.LTD,

= Exe re

‘rene los ees fem, pasar [aco

Jer ro Last vas

Jorrce cwuses carne] 00] caal eavosa] sears} exes] aemn.re] ctsoa] esa.

Jorrce scxctees: siz.0] 0.00] oan} size) sos] ous] nod azo] era

frucucrune armours ovr] vo] cml aoarne) — amazs] rust] arr] aaa] sa}

owners eceze] eas] anal 4007 si275] somas] -exnse] —oes.oe

Jeermoca msrnitanion | 25325 oon] ao] aesas) —asz.0s} sas] mse] © unas} a0n.a}

TS Bevan fe rr

soyepute ©

EAPITAL WORK Ih PROGRESS

PRBIECT UNCER PROGRESS

‘CURRY EAR.

‘PREVIOUS YEAR

INVENTORY.

Sia: aaa

DESCRIPTION a

CLOSING SIOGK OF HNISHED GOODS

[tse 3058] 92]

awvaans: 243] 978

Toa ———

‘NOTE

TRADE RECEIVABLES

DESCRIPTION ara a

[aMounr | amount.

[insisputes, Conddered Govd

ILee than ss mouths 423680 4

(Six mont to Ona yeu -undtaputsd eatsred good 222809 sna.)

(ee year tm 40 seats - unig! considered wd 250509 iste.

[Tmo yanrto thee years unbispuied cxosidened pod as272 sites

[Thee years and above -undispuied secured go ‘S01s.al 4536.

[Tce years ad above - undispuied considered doubt 41539] 2459.09

[Thee year hel stove - snipe soniered bad 24594 on}

2257976 ‘eit tl

[oat Bou! bas writen 245949 0a

l ota eras

NOTELa

Parilesars aon | —ayeg0a7

‘aMouNT | aMounT

ae

Accrund Interest On Fixed Depot 6579 sil

jst INPUT CREDIT 21099) a)

ere Tax Refund Reeetenie 16. ss.)

[tepid Expense 2433 9]

[toma Saf? ti} 1.09}

liner Caran ee 1.84) ie

Tei 757 23 Ta

Paricars

Suns Hales Rear

To

Taal 7 a

CHANGES IN INVENTORY

ine 31.03.2022 | 31.03.2021

(Opeing Steck

Less: Closing Stock of finished woods 38.02 73.00]

Tonk EIED) 19573]

NOTE 18

EMPLOYEES BENEFIT EXPENSES

Pca 31.03.2022 | 31.03.2021

‘Amount | Amount

(Gj Salaries and incemives 2o6aif 3028.97)

116.77 23.05)

93.70 72.00)

(iw) Directors Renuineration 1800.00 60100)

‘Total 405687| 3724.02]

NOTEI9

EINANCE COST.

ies 31432022 | 31.93.20201

NOTED

| QUMER EXPENSES

(Particulars AE

SP Sees: aT

x 29 7637]

eset i 30.00 1.95]

(ROC Foxe 28.06 ag]

"Telegbone-& Mabie 30.49 2]

Teva 65. Toe]

Pease te Autre 35s. 200.00

ised ests Baa Ba

lecciy Exponen 116.36] 737]

[Prning & Sisionssy 32.07 726.88

‘Cour

fee Mang pers = Ta6.6) 3178

ka Be de Tene 22.0 39.40]

[neery Carpe 31.46 0.0]

ele Maes Charen — 7a as

[Sova Mais Servet & Branding [an 72920

Fe Usps Cre Sr0i.7¢] Hs 00

Peston pl ase 34.00) 353.55)

ne mis pe 300] 0.00

[Trade Mae: Exe

Sone re

Sit No Partieatars

1 [adie fas 220 20000)

1 [Inconse Taxation Marrs 35.0 0.09

3 esr Mates 30.00 7010

Taial 335.00 90.00)

In the opinion of the Board, the current assets, loans and advances are not less than the value stated, if

realized in the ordinary course of business. The provision for all known liabilities is edequate and not in

‘excess of the amount reasonably necessary,

NOTE23

It was not possible for the Company to obtain confirmation of balances from debtors, creditors and

advances to suppliers and trade deposits, In view of this, the balance of debtors, creditors, advances and

trade deposits as on 31" March, 2022 a8 appearing in the books have been certified as correct by the

Directors and accepted as such by the Auditors.

10’ MIC!

List ofamount due to suppliers falling under Micro and Small Enterprises has not been compiled, henee it

iS not possible to determine the amount! duc and interest thereon as required by the Interest in delayed

payments to “The Micro, Small and Medium Enterprises Development Act, 2006". The amount of

interest if any is not expected to be material,

NOTE 25

Eamings per share:

Eaming per Equity Share (Basic / Diluted) is arrived at based on Profit after tax

divided by weighted average number of equity shares as under :

Earnings per share Yearended Year ended

34.03.2022 31.03.2021

‘Nat profit efter Tax as por Profit and Loss 573882 258387

‘Number of shares 43000 #3000

Face Value per share Rs 100 Rs 100

Basic earnings per share 13.46 601

Diluted carnings per share 13.46 601

NOTE 26

Previous year’s figures have been regrouped and rearranged wherever necessery, to confirm the current

year’s classification. Paise has heen rounded off to the nearest Rupee.

“ie

ss

‘There are no proceedings initiated or are pending against the company for holding any benamsi property

under the Benami Transactions (Prohibition) Act, 1988 (45 of 1988) and rules made there under,

‘NOTE 29: Disclosure on willful defaulter to any Banks / For any other lender,

‘The Company is not declared as wilful defaulter by any bank or financial Institution or other lenders.

Company is not having any immovable property as of now and there is no property held in any other

person name.

‘NOTE 31: Disclosure on revaluation of Property, Plant and Equipment if any

‘There is no revaluation of assets during this Financial Year

NOTE 32:

‘The Company did not trade or invest in Crypto Currcney or virtual cumency during the financial year,

Hence, disclosures relating to it are not applicable.

‘There no transaction which is not recorded in the book oFaccounts but shown for the purpase af Income

Tax. As per the management report the ex-directors did not share the registered email and mobile.

Because of this IT returns are pending and the matter isin the Court.

NOTE 34: of not han i anies under Section 248 of

Companies Act 2013.

‘The Company did not have any tansactions with Companies struck off under Section 248 of Companies

Act, 2013 considering the information available with the Company,

NOTE 35: ilizati wremium for any i] ic for the

benefit of any third parties,

‘There ‘is no such transection is held in the Financial Year.

There is no Scheme of Arrangements spproved by the Competent Authority in ierms of sections 230 to

237 of the Companies Act, 2013 during the year.

‘The Company is in compliance with the number of layers prescribed under clause {87} of section 2 of the

Act read with Companies (Restriction on number of Layers) Rules, 2017 for the year under consideration.

Itis not applicable in this Financial Year.

Signature to Note 1-40

For SHVRK & Co. For The Professional Couriers Privaty imited

Chartered Accountants

Fi ‘No: 1156780

Ngai we ed Metin fen Chacko

‘Managing Director Director - Finance:

noe = THE PROFESSIONAL COURIERS PVT. LTD,

MEMBERSHIP NO: 039952 Regd. Office: 1203/4, 12th Floor, Bhumira| Costaria,

UDIN NO: 22039952ATGIMPS121 Flot No. 182, Sectat- 18, Sanpada

PLACE: THANE. avi Mumbal 400-705. Tel. No.022-27813309,

DATE: 07.09.22

GIN No, Usoggamit1987PTC044530

ANNENXURE A - ANNEXURE TO NOTE NO. 27 ON RATIO ANALYSIS

For year Ended For year Ended INCREASE/

RaTios: 3203-2022 31-03-2021 DECREASE

‘Current Ratio 3.78 522 28%

Debt Equity Ratio 0.08 0.08 “ti

‘Debt Service Coverage Ratio 86.09 80.87 43%

Return on Equity Ratio 245 az 119%

Inventory Turnover Ratio NA NA NA

“Trade Receivables Tumover Ratio 325.47 425.38 23%

‘Trade Payables Turnover Ratio 320.22 12030 O%

Net Capital Turnover Ratio 0.95 53 52%

‘Net Profit ratio 203% 175% 42%

Return on Capital Employed 6.73% 6.21% 8%

Return on Investment 249% 142% 119%

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ac 118221Document47 pagesAc 118221Raghunathan IyengarNo ratings yet

- Ac 118271Document46 pagesAc 118271Raghunathan IyengarNo ratings yet

- Gundukkal ECDocument4 pagesGundukkal ECRaghunathan IyengarNo ratings yet

- Government Of Tamilnadu Registration Department: Document No.& Year/ஆவண எண் மற்றும் ஆண்டு: 3294/1984Document2 pagesGovernment Of Tamilnadu Registration Department: Document No.& Year/ஆவண எண் மற்றும் ஆண்டு: 3294/1984Raghunathan IyengarNo ratings yet

- Dindigul District District Disaster Management Plan - 2021 2021-2022Document210 pagesDindigul District District Disaster Management Plan - 2021 2021-2022Raghunathan IyengarNo ratings yet

- Ta M JL Na Du Police: Integrated Investigation I Okm-IDocument4 pagesTa M JL Na Du Police: Integrated Investigation I Okm-IRaghunathan IyengarNo ratings yet

- First Information Report: R .SubDocument7 pagesFirst Information Report: R .SubRaghunathan IyengarNo ratings yet

- Year - JWF Firno:: First Information ReportDocument5 pagesYear - JWF Firno:: First Information ReportRaghunathan IyengarNo ratings yet