Professional Documents

Culture Documents

Tanzania MFP

Tanzania MFP

Uploaded by

Oswin alexCopyright:

Available Formats

You might also like

- Government's White PaperDocument59 pagesGovernment's White PaperAbhinav Bhatt100% (5)

- Example Business Plan For MicrofinanceDocument38 pagesExample Business Plan For MicrofinanceRh2223db85% (13)

- Assignment 1Document9 pagesAssignment 1Celsozeca2011No ratings yet

- Glassbox Phil Company ProfileDocument148 pagesGlassbox Phil Company Profileflip06No ratings yet

- The Effect of Inflation To The Economic Growth of The PhilippinesDocument27 pagesThe Effect of Inflation To The Economic Growth of The PhilippinesDivina Gonzales64% (14)

- Botswana MFPDocument2 pagesBotswana MFPAbimbola PotterNo ratings yet

- Uganda GB 2016 WebDocument14 pagesUganda GB 2016 WebAmos OkechNo ratings yet

- Chapter 2Document25 pagesChapter 2Jawad KareemNo ratings yet

- Deolite Tanzania Country OverviewDocument26 pagesDeolite Tanzania Country OverviewNand KishorNo ratings yet

- ADO2018 KGZ Final EngDocument4 pagesADO2018 KGZ Final Engaliman.temirbekNo ratings yet

- SDGs Research BriefDocument8 pagesSDGs Research BriefMomin IqbalNo ratings yet

- Jurnal Baba JiDocument9 pagesJurnal Baba Jisukma watiNo ratings yet

- Of Financial InclusionDocument9 pagesOf Financial InclusionIbrahim PekerNo ratings yet

- Abel - 3 - A Review of Determinants of Financial Inclusion PDFDocument8 pagesAbel - 3 - A Review of Determinants of Financial Inclusion PDFAbd Al-Rahman IIINo ratings yet

- 3.17 Country Evaluation Brief - SomaliaDocument36 pages3.17 Country Evaluation Brief - SomaliaWaafi LiveNo ratings yet

- 33 GhanaGAPbrief HPP 508Document4 pages33 GhanaGAPbrief HPP 508ermamalNo ratings yet

- Kingdom of Cambodia: Fao Country Programming Framework 2016 - 2018Document24 pagesKingdom of Cambodia: Fao Country Programming Framework 2016 - 2018kithchetrashchNo ratings yet

- FY 2015 DBCC Year-End Report v7Document44 pagesFY 2015 DBCC Year-End Report v7HayjackNo ratings yet

- FY 2016 DBCC Year-End Report - 092517 - Final VersionDocument66 pagesFY 2016 DBCC Year-End Report - 092517 - Final VersionHayjack100% (1)

- Tanzania: Recent DevelopmentsDocument2 pagesTanzania: Recent DevelopmentsEllis ElliseusNo ratings yet

- Ghana - Eco Project ReportDocument24 pagesGhana - Eco Project ReportBilal VaidNo ratings yet

- SSRN Id3480082Document35 pagesSSRN Id3480082Abhishek SharmaNo ratings yet

- GDP Sectoral Growth Rates: What Is Driving Growth?Document3 pagesGDP Sectoral Growth Rates: What Is Driving Growth?Sunny singhNo ratings yet

- Balance of Payments With A Focus On NigeriaDocument33 pagesBalance of Payments With A Focus On NigeriaJohn KargboNo ratings yet

- THE IMPACT OF REMITTANCES ON EthiopiaDocument16 pagesTHE IMPACT OF REMITTANCES ON EthiopiaTariku WorkuNo ratings yet

- UnescoDocument2 pagesUnescoysabelle rocoNo ratings yet

- Bangladesh: Country SnapshotDocument56 pagesBangladesh: Country SnapshotFaim HasanNo ratings yet

- Assessing Fiscal Sustainability in SwazilandDocument12 pagesAssessing Fiscal Sustainability in SwazilandGideonNo ratings yet

- Ghana - Total Debt Service (% of Exports of Goods, Services and Primary Income)Document4 pagesGhana - Total Debt Service (% of Exports of Goods, Services and Primary Income)ravi bodhaneNo ratings yet

- Inflation, Government Expenditure, AND Economic Growth in IndonesiaDocument10 pagesInflation, Government Expenditure, AND Economic Growth in IndonesiaFebianti Danu SyaputriNo ratings yet

- World Development: Takaaki MasakiDocument14 pagesWorld Development: Takaaki MasakiWidya SetiyawanNo ratings yet

- Ejbmr 1325-1Document9 pagesEjbmr 1325-1Abdul Nafiu YussifNo ratings yet

- 2369-Article Text-4440-1-10-20210217Document15 pages2369-Article Text-4440-1-10-20210217epiphaneNo ratings yet

- Ghana's Macroeconomic Crisis: Causes, Consequences, and Policy ResponsesDocument32 pagesGhana's Macroeconomic Crisis: Causes, Consequences, and Policy ResponsesDHANANJAY MIRLEKARNo ratings yet

- KPMG South Sudan FinaleeDocument4 pagesKPMG South Sudan FinaleeNoahIssaNo ratings yet

- NPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaDocument63 pagesNPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaMahamudu BawumiaNo ratings yet

- DETERMINANTS AND BARRIERS TO FINANCIAL INCLUSION What Eterminants Waht HindersDocument19 pagesDETERMINANTS AND BARRIERS TO FINANCIAL INCLUSION What Eterminants Waht HindersRajendra LamsalNo ratings yet

- Inequality of Interregional Development in Riau Indonesia Panel Data Regression ApproachDocument6 pagesInequality of Interregional Development in Riau Indonesia Panel Data Regression ApproachDay NunoNo ratings yet

- Invest in MoroccoDocument35 pagesInvest in MoroccoMaya LeelahNo ratings yet

- Economic Transformation in Africa From The Bottom Up: Evidence From TanzaniaDocument48 pagesEconomic Transformation in Africa From The Bottom Up: Evidence From TanzaniaHa HoangNo ratings yet

- MONGOLIA ECONOMIC UPDATE - World BankDocument16 pagesMONGOLIA ECONOMIC UPDATE - World Bankshinkaron88No ratings yet

- Macro Poverty Outlook: Europe and Central AsiaDocument50 pagesMacro Poverty Outlook: Europe and Central AsiaLiubomir Gutu0% (1)

- EconSurveyEng2018 19Document170 pagesEconSurveyEng2018 19rishu_thakurNo ratings yet

- 07 Factor Affecting Gross Domestic Product GDP Growth in Malaysia1Document7 pages07 Factor Affecting Gross Domestic Product GDP Growth in Malaysia1ahmadNo ratings yet

- WFP Sao Tome Country Brief November 2019Document2 pagesWFP Sao Tome Country Brief November 2019kheusssNo ratings yet

- Eco 004 KunalDocument15 pagesEco 004 KunalKunal BagadeNo ratings yet

- Reporter: Saeed Fathalla G. CasimDocument17 pagesReporter: Saeed Fathalla G. CasimNor-ayn mautenNo ratings yet

- Paggugol Na Matuwid:: Saligan NG Tuloy-Tuloy Na KaunlaranDocument2 pagesPaggugol Na Matuwid:: Saligan NG Tuloy-Tuloy Na KaunlaransandrexNo ratings yet

- 2016 Press Briefing by MEP 0Document43 pages2016 Press Briefing by MEP 0Ohioya OnyebukeNo ratings yet

- Western Australia Economic Profile - September 2013: Gross State (Domestic) Product GrowthDocument10 pagesWestern Australia Economic Profile - September 2013: Gross State (Domestic) Product GrowthRt SaragihNo ratings yet

- The Effect of Inflation On The Economic Growth of The Philippines For Year 1984 UP TO 2013Document25 pagesThe Effect of Inflation On The Economic Growth of The Philippines For Year 1984 UP TO 2013qwerty1785No ratings yet

- FRBM 1Document7 pagesFRBM 1Deepsekhar ChoudhuryNo ratings yet

- Zimbabwe-2017H2 KPMG PDFDocument4 pagesZimbabwe-2017H2 KPMG PDFElingtonNo ratings yet

- MPRA Paper 99708Document17 pagesMPRA Paper 99708JorkosNo ratings yet

- Governance and Energy Sector Sy&Sow 18052017Document49 pagesGovernance and Energy Sector Sy&Sow 18052017Anonymous Bf6GUCZzxNo ratings yet

- Somalia: Recent DevelopmentsDocument2 pagesSomalia: Recent DevelopmentsPatrickLnanduNo ratings yet

- Uganda Economic Snapshot H2, 2017: Trade & Investment SWOT Strengths WeaknessesDocument4 pagesUganda Economic Snapshot H2, 2017: Trade & Investment SWOT Strengths Weaknesses842janxNo ratings yet

- Reserve Bank of India First Quarter Review of Monetary Policy 2010-11Document12 pagesReserve Bank of India First Quarter Review of Monetary Policy 2010-11ranjithalimiNo ratings yet

- Impact of Internally Generated Revenue Igr On Total Revenue of Lagos StateDocument10 pagesImpact of Internally Generated Revenue Igr On Total Revenue of Lagos StateJust EmmyNo ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Investment Decision Case StudyDocument87 pagesInvestment Decision Case Studypraveena urs rNo ratings yet

- HDFC Balanced Advantage Fund - IDCW Illustration March 2022Document2 pagesHDFC Balanced Advantage Fund - IDCW Illustration March 2022Shravan RatheeshNo ratings yet

- Chapter Four Data Presentation, Analysis and Interpretation: 4.0 PreambleDocument60 pagesChapter Four Data Presentation, Analysis and Interpretation: 4.0 PreambleADAMNo ratings yet

- MECO Lecture24Document24 pagesMECO Lecture24Syed AhmedNo ratings yet

- Bahasa Inggris Niaga Kel. 5 Term Strated With FDocument17 pagesBahasa Inggris Niaga Kel. 5 Term Strated With FPutra RakhmadaniNo ratings yet

- Joe Grad Has Just Arrived at The Big U HeDocument2 pagesJoe Grad Has Just Arrived at The Big U Hetrilocksp SinghNo ratings yet

- Hubungan Iklan Le Minerale Dengan Kesadaran MerekDocument6 pagesHubungan Iklan Le Minerale Dengan Kesadaran MerekSarah IstiqomahNo ratings yet

- TOEFL Additional Score Report Request FormDocument2 pagesTOEFL Additional Score Report Request Formvishwa tejaNo ratings yet

- Working Towards A Better Brazil: National Strategy For Financial Education (Enef)Document164 pagesWorking Towards A Better Brazil: National Strategy For Financial Education (Enef)Carlos NetoNo ratings yet

- CenvatDocument10 pagesCenvatincometaxreckonerNo ratings yet

- District Wise Exports of India - 2021Document13 pagesDistrict Wise Exports of India - 2021MNo ratings yet

- 395-Article Text-1362-2-10-20220720Document13 pages395-Article Text-1362-2-10-20220720PipingNo ratings yet

- CORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 CompleteDocument8 pagesCORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 Completeruth san joseNo ratings yet

- CH 01 - QS 1-17-18 Ac 3-4Document14 pagesCH 01 - QS 1-17-18 Ac 3-4Sharmi laNo ratings yet

- Strategic Management (MBA 7002) Exam Feb 2012 - Past PaperDocument10 pagesStrategic Management (MBA 7002) Exam Feb 2012 - Past Papertg67% (3)

- Pulsador de Aborto y DescargaDocument2 pagesPulsador de Aborto y DescargaFernando gutierrezNo ratings yet

- Urban and Regional Planning Theories and Issues PDFDocument172 pagesUrban and Regional Planning Theories and Issues PDFJohn Michael BlancaflorNo ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument7 pagesThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsMercury17No ratings yet

- IntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Document137 pagesIntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Bella Flair100% (1)

- Rfaq PDFDocument69 pagesRfaq PDFsaurabh yadavNo ratings yet

- Shipping Wood To Market - orDocument2 pagesShipping Wood To Market - orrajsacksNo ratings yet

- Business Law Assignment ATW103Document19 pagesBusiness Law Assignment ATW103eshakaurNo ratings yet

- Rieter C 81 Card Brochure 3586 v1 98697 enDocument28 pagesRieter C 81 Card Brochure 3586 v1 98697 enAyan MukherjeeNo ratings yet

- Vairt PresentationDocument16 pagesVairt PresentationMount ViewsNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- Tutorial MSDocument4 pagesTutorial MSVidhya NairNo ratings yet

- Dwnload Full Introductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14th Edition Paul Test Bank PDFDocument36 pagesDwnload Full Introductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14th Edition Paul Test Bank PDFdheybarlowm100% (13)

- Summary of Chapter 2Document1 pageSummary of Chapter 2AkiNo ratings yet

Tanzania MFP

Tanzania MFP

Uploaded by

Oswin alexOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tanzania MFP

Tanzania MFP

Uploaded by

Oswin alexCopyright:

Available Formats

MACRO-FISCAL PROFILE

TANZANIA

May 2016

Key Indicators Overview

Population (2014) 51.8 million Tanzania continues to enjoy a strong and stable economy, driven

Per capita GDP (constant USD, 2015) $601 by the construction, communications, and manufacturing sectors.

The country’s performance has been bolstered by a stable polity,

Average population growth rate

3.2% as evidenced by a smooth transition to a new president in 2015.

(2010-2014)

However, growth has not been broad based. Poverty remains

Government revenue, % of GDP (2014) 20.7% high, with the majority of the workforce employed in the

Country income classification Low income agriculture sector, which is characterized by low productivity.

Source: World Bank, 2015. Prudent monetary policy has stabilized inflation, which was

6.1% in 2014. Export performance is strong, driven by gold and

tourism, but imports of capital and intermediate goods,

Country Policy and Institutional

SSA particularly oil, keep the current account deficit wide, at 11% of

Assessment Ratings National

Mean gross domestic product (GDP). Tanzania is not a resource-

(1 = low, 6 = high) dependent country; resource rents account for 7% of GDP. The

Efficiency of revenue mobilization 4.0 3.5 foreign reserves position is healthy, maintaining 4.1 months of

Equity of public resource use 4.0 3.3 import cover, as is the fiscal deficit, projected at sustainable

Fiscal policy 3.5 3.1 levels around 5–6% of GDP (Emenuga, Dhliwayo, and Charle,

2016). Overall, the broad macroeconomic outlook is favorable,

Macroeconomic management 4.5 3.5 with growth on track to reach 7% in fiscal year (FY) 2015/16.

Quality of budgetary and financial

4.0 3.5

management Political Economy

Source: World Bank, 2014.

Tanzania Country Policy and Institutional Assessment values for

policy response and governance efficiency are higher than the

Macroeconomic Forecasts corresponding mean values for sub-Saharan African (SSA)

2015 2016 2017 countries. In 2015, Tanzania elected a new president, John

Indicator 2013 2014 (est.) (proj.) (proj.) Magufuli, committed to reducing government waste and

Real GDP corruption. Tanzania is maintaining medium-term (3–5 years)

7.3% 7.0% 7.0% 7.2% 7.2%

growth macroeconomic stability without adversely affecting the private

GDP per sector. Fiscal policy is able to meet public financing targets

capita 4.3% 3.8% 3.9% 4.0% 4.0% across ministerial sectors as planned through the Government’s

growth Medium Term Expenditure Framework, although the country has

Source: IMF, 2014; Emenuga, Dhliwayo, and Charle, 2016.

met government wage payments and unforeseen fiscal needs

unevenly. The country should be seeking improvement in linking

policies and priorities to budgeting. Poverty measurement tools

1,400 are in place, with vulnerable populations mostly identified. In

$1,263

1,200

2000, the Government of Tanzania (GOT) formed the Social

USD (constant, 2005)

Action Fund which focused on providing social and economic

1,000

$911 services, including conditional cash transfers, as part of its

800

$601 poverty reduction measures.

600

$362

400

$405 GDP and Economic Growth

200 $326

Since 2000, Tanzania has experienced an average annual real

0 GDP growth rate of 6.6%. Going forward, growth is projected to

remain strong, at at least 7% for 2015 and 2016. From 2000 to

2015, per capita GDP in 2005 constant U.S. dollars increased by

an average of 3.7% annually, from US$362 to US$601 (Figure

Tanzania SSA LIC SSA LMIC 1), outpacing the regional average for low-income countries

(LICs) and lower middle-income countries (LMICs)—

Source: World Bank, 2015.

Macro-fiscal Profile

30 40

35

25 30

% of GDP or exports

20 25

20

35.7

% of GDP

15 15

26.9 25.7 29.2

10 20.7 21.6 10 6.2

17.4 4.1

5 5.5 8.7

5 0

Budget Deficit Debt Servicing External Debt

0

(% of GDP) (% of exports) (% of GDP)

Total Expenditure Total Revenue Revenue

(excluding grants) Tanzania SSA LIC average

Tanzania SSA LIC average

Source: Emenuga, Dhliwayo, and Charle, 2016. Source: Emenuga, Dhliwayo, and Charle, 2016.

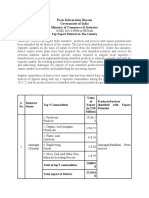

Figure 4: GOT Revenue and Grants (FY 2014/15)

1.6% and 2.4%, respectively. Given its current trajectory, Tanzania

is poised to graduate into middle-income status based on the World Income

Grants/dev.,

Bank threshold; this achievement has financing implications, taxes, 12%

21%

including losing access to highly concessional International Corporate

tax, 7%

Development Association loans.

Government Revenue and Expenditure Regions,

3%

Other

direct, 8%

Revenue, excluding grants, accounts for 17.4% of GDP—nearly Other

Excise

US$5 billion in current prices. Revenue generation schemes are MDAs, 6% Customs (domestic)

Other (excise, VAT, , 6%

generally stablethe GOT is collecting non-distortionary amounts of sources, and levies),

revenue (Figure 2) from firms and individual income, VAT, and 2% 28%

VAT, 7%

import and excise duties (Figure 4), though revenue typically has

fallen short of its ambitious collection targets. The GOT continues to

identify new sources for widening domestic revenue, such as value-

added tax (VAT) and excise duty reform, and strengthen its

Source: IMF, 2014.

administration of current sources. It has focused on reducing MDAs = Ministries, Departments, or Agencies

recurrent expenditure in areas considered to be “non-priority,” such

as exhibitions, travel, and salaries; in the mid-term, the level of total Figure 5. Expenditure (FY 2014/15)

expenditure (Figure 5) is forecasted to remain at around 26% of

GDP. Actual expenditure for FY 2014/15 was US$6.8 billion (current

prices), an increase of 5% compared to the previous year. In line with Development Wages and

ceilings established by the International Monetary Fund’s Policy 32% salaries

Support Instrument program, non-concessional financing is budgeted 28%

at 2% of GDP (Emenuga, Dhliwayo, and Charle, 2016).

References and Works Consulted Goods,

services, Interest

Emenuga, C., R. Dhliwayo, and P. Charle. 2016. “African Economic Outlook – Tanzania.” and 6%

Available at: http://www.africaneconomicoutlook.org/en/country-notes/tanzania. transfers

Government of Tanzania (GOT), Ministry of Finance. 2015. Full Year Budget Performance and

Economic Review. Dar es Salaam: GOT. 34%

International Monetary Fund (IMF). 2014. IMF Country Report No. 15/175– 2015 Article IV Source: IMF, 2014.

Consultation. Washington, DC: IMF.

World Bank. 2014. “Country Policy and Institutional Assessment.” Available at:

http://data.worldbank.org/data-catalog/CPIA.

World Bank. 2015. “World Development Indicators.” Available at:

http://data.worldbank.org/products/wdi.

Contact Us The Health Policy Project is a five-year cooperative agreement funded by the U.S. Agency for International

Development under Agreement No. AID-OAA-A-10-00067, beginning September 30, 2010. The project’s HIV

Health Policy Project activities are supported by the U.S. President’s Emergency Plan for AIDS Relief (PEPFAR). HPP is implemented by

1331 Pennsylvania Ave NW, Suite 600 Futures Group, in collaboration with Plan International USA, Avenir Health (formerly Futures Institute), Partners in

Washington, DC 20004 Population and Development, Africa Regional Office (PPD ARO), Population Reference Bureau (PRB), RTI

International, and the White Ribbon Alliance for Safe Motherhood (WRA).

www.healthpolicyproject.com

policyinfo@futuresgroup.com The information provided in this document is not official U.S. Government information and does not necessarily

represent the views or positions of the U.S. Agency for International Development.

You might also like

- Government's White PaperDocument59 pagesGovernment's White PaperAbhinav Bhatt100% (5)

- Example Business Plan For MicrofinanceDocument38 pagesExample Business Plan For MicrofinanceRh2223db85% (13)

- Assignment 1Document9 pagesAssignment 1Celsozeca2011No ratings yet

- Glassbox Phil Company ProfileDocument148 pagesGlassbox Phil Company Profileflip06No ratings yet

- The Effect of Inflation To The Economic Growth of The PhilippinesDocument27 pagesThe Effect of Inflation To The Economic Growth of The PhilippinesDivina Gonzales64% (14)

- Botswana MFPDocument2 pagesBotswana MFPAbimbola PotterNo ratings yet

- Uganda GB 2016 WebDocument14 pagesUganda GB 2016 WebAmos OkechNo ratings yet

- Chapter 2Document25 pagesChapter 2Jawad KareemNo ratings yet

- Deolite Tanzania Country OverviewDocument26 pagesDeolite Tanzania Country OverviewNand KishorNo ratings yet

- ADO2018 KGZ Final EngDocument4 pagesADO2018 KGZ Final Engaliman.temirbekNo ratings yet

- SDGs Research BriefDocument8 pagesSDGs Research BriefMomin IqbalNo ratings yet

- Jurnal Baba JiDocument9 pagesJurnal Baba Jisukma watiNo ratings yet

- Of Financial InclusionDocument9 pagesOf Financial InclusionIbrahim PekerNo ratings yet

- Abel - 3 - A Review of Determinants of Financial Inclusion PDFDocument8 pagesAbel - 3 - A Review of Determinants of Financial Inclusion PDFAbd Al-Rahman IIINo ratings yet

- 3.17 Country Evaluation Brief - SomaliaDocument36 pages3.17 Country Evaluation Brief - SomaliaWaafi LiveNo ratings yet

- 33 GhanaGAPbrief HPP 508Document4 pages33 GhanaGAPbrief HPP 508ermamalNo ratings yet

- Kingdom of Cambodia: Fao Country Programming Framework 2016 - 2018Document24 pagesKingdom of Cambodia: Fao Country Programming Framework 2016 - 2018kithchetrashchNo ratings yet

- FY 2015 DBCC Year-End Report v7Document44 pagesFY 2015 DBCC Year-End Report v7HayjackNo ratings yet

- FY 2016 DBCC Year-End Report - 092517 - Final VersionDocument66 pagesFY 2016 DBCC Year-End Report - 092517 - Final VersionHayjack100% (1)

- Tanzania: Recent DevelopmentsDocument2 pagesTanzania: Recent DevelopmentsEllis ElliseusNo ratings yet

- Ghana - Eco Project ReportDocument24 pagesGhana - Eco Project ReportBilal VaidNo ratings yet

- SSRN Id3480082Document35 pagesSSRN Id3480082Abhishek SharmaNo ratings yet

- GDP Sectoral Growth Rates: What Is Driving Growth?Document3 pagesGDP Sectoral Growth Rates: What Is Driving Growth?Sunny singhNo ratings yet

- Balance of Payments With A Focus On NigeriaDocument33 pagesBalance of Payments With A Focus On NigeriaJohn KargboNo ratings yet

- THE IMPACT OF REMITTANCES ON EthiopiaDocument16 pagesTHE IMPACT OF REMITTANCES ON EthiopiaTariku WorkuNo ratings yet

- UnescoDocument2 pagesUnescoysabelle rocoNo ratings yet

- Bangladesh: Country SnapshotDocument56 pagesBangladesh: Country SnapshotFaim HasanNo ratings yet

- Assessing Fiscal Sustainability in SwazilandDocument12 pagesAssessing Fiscal Sustainability in SwazilandGideonNo ratings yet

- Ghana - Total Debt Service (% of Exports of Goods, Services and Primary Income)Document4 pagesGhana - Total Debt Service (% of Exports of Goods, Services and Primary Income)ravi bodhaneNo ratings yet

- Inflation, Government Expenditure, AND Economic Growth in IndonesiaDocument10 pagesInflation, Government Expenditure, AND Economic Growth in IndonesiaFebianti Danu SyaputriNo ratings yet

- World Development: Takaaki MasakiDocument14 pagesWorld Development: Takaaki MasakiWidya SetiyawanNo ratings yet

- Ejbmr 1325-1Document9 pagesEjbmr 1325-1Abdul Nafiu YussifNo ratings yet

- 2369-Article Text-4440-1-10-20210217Document15 pages2369-Article Text-4440-1-10-20210217epiphaneNo ratings yet

- Ghana's Macroeconomic Crisis: Causes, Consequences, and Policy ResponsesDocument32 pagesGhana's Macroeconomic Crisis: Causes, Consequences, and Policy ResponsesDHANANJAY MIRLEKARNo ratings yet

- KPMG South Sudan FinaleeDocument4 pagesKPMG South Sudan FinaleeNoahIssaNo ratings yet

- NPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaDocument63 pagesNPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaMahamudu BawumiaNo ratings yet

- DETERMINANTS AND BARRIERS TO FINANCIAL INCLUSION What Eterminants Waht HindersDocument19 pagesDETERMINANTS AND BARRIERS TO FINANCIAL INCLUSION What Eterminants Waht HindersRajendra LamsalNo ratings yet

- Inequality of Interregional Development in Riau Indonesia Panel Data Regression ApproachDocument6 pagesInequality of Interregional Development in Riau Indonesia Panel Data Regression ApproachDay NunoNo ratings yet

- Invest in MoroccoDocument35 pagesInvest in MoroccoMaya LeelahNo ratings yet

- Economic Transformation in Africa From The Bottom Up: Evidence From TanzaniaDocument48 pagesEconomic Transformation in Africa From The Bottom Up: Evidence From TanzaniaHa HoangNo ratings yet

- MONGOLIA ECONOMIC UPDATE - World BankDocument16 pagesMONGOLIA ECONOMIC UPDATE - World Bankshinkaron88No ratings yet

- Macro Poverty Outlook: Europe and Central AsiaDocument50 pagesMacro Poverty Outlook: Europe and Central AsiaLiubomir Gutu0% (1)

- EconSurveyEng2018 19Document170 pagesEconSurveyEng2018 19rishu_thakurNo ratings yet

- 07 Factor Affecting Gross Domestic Product GDP Growth in Malaysia1Document7 pages07 Factor Affecting Gross Domestic Product GDP Growth in Malaysia1ahmadNo ratings yet

- WFP Sao Tome Country Brief November 2019Document2 pagesWFP Sao Tome Country Brief November 2019kheusssNo ratings yet

- Eco 004 KunalDocument15 pagesEco 004 KunalKunal BagadeNo ratings yet

- Reporter: Saeed Fathalla G. CasimDocument17 pagesReporter: Saeed Fathalla G. CasimNor-ayn mautenNo ratings yet

- Paggugol Na Matuwid:: Saligan NG Tuloy-Tuloy Na KaunlaranDocument2 pagesPaggugol Na Matuwid:: Saligan NG Tuloy-Tuloy Na KaunlaransandrexNo ratings yet

- 2016 Press Briefing by MEP 0Document43 pages2016 Press Briefing by MEP 0Ohioya OnyebukeNo ratings yet

- Western Australia Economic Profile - September 2013: Gross State (Domestic) Product GrowthDocument10 pagesWestern Australia Economic Profile - September 2013: Gross State (Domestic) Product GrowthRt SaragihNo ratings yet

- The Effect of Inflation On The Economic Growth of The Philippines For Year 1984 UP TO 2013Document25 pagesThe Effect of Inflation On The Economic Growth of The Philippines For Year 1984 UP TO 2013qwerty1785No ratings yet

- FRBM 1Document7 pagesFRBM 1Deepsekhar ChoudhuryNo ratings yet

- Zimbabwe-2017H2 KPMG PDFDocument4 pagesZimbabwe-2017H2 KPMG PDFElingtonNo ratings yet

- MPRA Paper 99708Document17 pagesMPRA Paper 99708JorkosNo ratings yet

- Governance and Energy Sector Sy&Sow 18052017Document49 pagesGovernance and Energy Sector Sy&Sow 18052017Anonymous Bf6GUCZzxNo ratings yet

- Somalia: Recent DevelopmentsDocument2 pagesSomalia: Recent DevelopmentsPatrickLnanduNo ratings yet

- Uganda Economic Snapshot H2, 2017: Trade & Investment SWOT Strengths WeaknessesDocument4 pagesUganda Economic Snapshot H2, 2017: Trade & Investment SWOT Strengths Weaknesses842janxNo ratings yet

- Reserve Bank of India First Quarter Review of Monetary Policy 2010-11Document12 pagesReserve Bank of India First Quarter Review of Monetary Policy 2010-11ranjithalimiNo ratings yet

- Impact of Internally Generated Revenue Igr On Total Revenue of Lagos StateDocument10 pagesImpact of Internally Generated Revenue Igr On Total Revenue of Lagos StateJust EmmyNo ratings yet

- Bangladesh Quarterly Economic Update: September 2014From EverandBangladesh Quarterly Economic Update: September 2014No ratings yet

- Investment Decision Case StudyDocument87 pagesInvestment Decision Case Studypraveena urs rNo ratings yet

- HDFC Balanced Advantage Fund - IDCW Illustration March 2022Document2 pagesHDFC Balanced Advantage Fund - IDCW Illustration March 2022Shravan RatheeshNo ratings yet

- Chapter Four Data Presentation, Analysis and Interpretation: 4.0 PreambleDocument60 pagesChapter Four Data Presentation, Analysis and Interpretation: 4.0 PreambleADAMNo ratings yet

- MECO Lecture24Document24 pagesMECO Lecture24Syed AhmedNo ratings yet

- Bahasa Inggris Niaga Kel. 5 Term Strated With FDocument17 pagesBahasa Inggris Niaga Kel. 5 Term Strated With FPutra RakhmadaniNo ratings yet

- Joe Grad Has Just Arrived at The Big U HeDocument2 pagesJoe Grad Has Just Arrived at The Big U Hetrilocksp SinghNo ratings yet

- Hubungan Iklan Le Minerale Dengan Kesadaran MerekDocument6 pagesHubungan Iklan Le Minerale Dengan Kesadaran MerekSarah IstiqomahNo ratings yet

- TOEFL Additional Score Report Request FormDocument2 pagesTOEFL Additional Score Report Request Formvishwa tejaNo ratings yet

- Working Towards A Better Brazil: National Strategy For Financial Education (Enef)Document164 pagesWorking Towards A Better Brazil: National Strategy For Financial Education (Enef)Carlos NetoNo ratings yet

- CenvatDocument10 pagesCenvatincometaxreckonerNo ratings yet

- District Wise Exports of India - 2021Document13 pagesDistrict Wise Exports of India - 2021MNo ratings yet

- 395-Article Text-1362-2-10-20220720Document13 pages395-Article Text-1362-2-10-20220720PipingNo ratings yet

- CORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 CompleteDocument8 pagesCORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 Completeruth san joseNo ratings yet

- CH 01 - QS 1-17-18 Ac 3-4Document14 pagesCH 01 - QS 1-17-18 Ac 3-4Sharmi laNo ratings yet

- Strategic Management (MBA 7002) Exam Feb 2012 - Past PaperDocument10 pagesStrategic Management (MBA 7002) Exam Feb 2012 - Past Papertg67% (3)

- Pulsador de Aborto y DescargaDocument2 pagesPulsador de Aborto y DescargaFernando gutierrezNo ratings yet

- Urban and Regional Planning Theories and Issues PDFDocument172 pagesUrban and Regional Planning Theories and Issues PDFJohn Michael BlancaflorNo ratings yet

- The Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsDocument7 pagesThe Lean Canvas: Problem Solution Unique Value Prop. Unfair Advantage Customer SegmentsMercury17No ratings yet

- IntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Document137 pagesIntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Bella Flair100% (1)

- Rfaq PDFDocument69 pagesRfaq PDFsaurabh yadavNo ratings yet

- Shipping Wood To Market - orDocument2 pagesShipping Wood To Market - orrajsacksNo ratings yet

- Business Law Assignment ATW103Document19 pagesBusiness Law Assignment ATW103eshakaurNo ratings yet

- Rieter C 81 Card Brochure 3586 v1 98697 enDocument28 pagesRieter C 81 Card Brochure 3586 v1 98697 enAyan MukherjeeNo ratings yet

- Vairt PresentationDocument16 pagesVairt PresentationMount ViewsNo ratings yet

- DCF Model - Blank: Strictly ConfidentialDocument5 pagesDCF Model - Blank: Strictly ConfidentialaeqlehczeNo ratings yet

- Tutorial MSDocument4 pagesTutorial MSVidhya NairNo ratings yet

- Dwnload Full Introductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14th Edition Paul Test Bank PDFDocument36 pagesDwnload Full Introductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14th Edition Paul Test Bank PDFdheybarlowm100% (13)

- Summary of Chapter 2Document1 pageSummary of Chapter 2AkiNo ratings yet