Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsAssignment For Students

Assignment For Students

Uploaded by

SURINDERThis document provides instructions for manually filing income tax returns and calculating deductions. It includes a form to fill out with information like gross salary, exempted income, total income from different sources, applicable deductions under sections 80C, 80CCG, 80D, 80DD, 80CCD, 80G, and total tax liability. The second part provides steps for online filing of returns through the e-filing portal, which includes registering on the portal, selecting the ITR form and assessment year, and filling out details on general information, income and tax computation, tax paid, and donations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- TDS Py 2021-22davDocument2 pagesTDS Py 2021-22davSURINDERNo ratings yet

- Circular For I.tax Statement For Fy2022-2023-NbagrDocument9 pagesCircular For I.tax Statement For Fy2022-2023-NbagrS S PradheepanNo ratings yet

- Noti Self Declaration FormDocument4 pagesNoti Self Declaration FormRamya RameshNo ratings yet

- Application Form MPSSIRS 2014Document5 pagesApplication Form MPSSIRS 2014Ar Raj YamgarNo ratings yet

- Income Tax Calculation Form 2019-20Document2 pagesIncome Tax Calculation Form 2019-20Ishwar MittalNo ratings yet

- Saving Declaration 20-21Document3 pagesSaving Declaration 20-21pankajNo ratings yet

- Annexure - Iii: ScheduleDocument3 pagesAnnexure - Iii: ScheduleJay reyNo ratings yet

- Chapter 3/unit 4 Review Sheet 4/preparing The Income StatementDocument2 pagesChapter 3/unit 4 Review Sheet 4/preparing The Income Statementkamaljeet kaurNo ratings yet

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Document4 pagesCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNo ratings yet

- FORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyDocument6 pagesFORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyHem Ch DeuriNo ratings yet

- Financial Assessment FormDocument3 pagesFinancial Assessment Formmikecreatives745No ratings yet

- Commission On Higher Education-Regional Office - : Areas/Aspects Actual Situation RemarksDocument2 pagesCommission On Higher Education-Regional Office - : Areas/Aspects Actual Situation RemarksAbby TrinidadNo ratings yet

- Notes To Capital Work-In-progressDocument3 pagesNotes To Capital Work-In-progressJitendra Vernekar100% (1)

- Final Compution of Income Tax 2008-09Document2 pagesFinal Compution of Income Tax 2008-09Vimal Patel100% (4)

- Leave Form For SH or Principal 1 Day 29 DaysDocument4 pagesLeave Form For SH or Principal 1 Day 29 Daysneri jadeNo ratings yet

- Branch Office - Dholewal - : 4a.notional Concessions For 6 MonthsDocument7 pagesBranch Office - Dholewal - : 4a.notional Concessions For 6 Monthsifb.ludhianaNo ratings yet

- Cs Form No. 6 Application For Leave 2021 1 1Document1 pageCs Form No. 6 Application For Leave 2021 1 1mark jerald ritaNo ratings yet

- 2018-19 Investment DeclarationDocument2 pages2018-19 Investment DeclarationManish SarmaNo ratings yet

- CSC Form. Form 6, Revised 2020Document4 pagesCSC Form. Form 6, Revised 2020jeanethmendezbostonNo ratings yet

- FABM2 Quarter 1 Module and WorksheetsDocument27 pagesFABM2 Quarter 1 Module and WorksheetsHeart polvos100% (1)

- Application Cum Proposal Form For Star Pensioner'S Loan (To Be Filled in by The Applicant)Document6 pagesApplication Cum Proposal Form For Star Pensioner'S Loan (To Be Filled in by The Applicant)chetan jNo ratings yet

- Quiz 3-Part 3Document1 pageQuiz 3-Part 3JCNo ratings yet

- BLANK CS Form No. 6, Revised 2020 (Application For Leave)Document1 pageBLANK CS Form No. 6, Revised 2020 (Application For Leave)vimNo ratings yet

- Application For Family PensionDocument14 pagesApplication For Family PensionRashid NaeemNo ratings yet

- GPF PDFDocument24 pagesGPF PDFHimanshuKaushikNo ratings yet

- Application For Leave: de Guzman Theresa Faye Aquino Adas Ii AccountingDocument2 pagesApplication For Leave: de Guzman Theresa Faye Aquino Adas Ii AccountingTheresa Faye De GuzmanNo ratings yet

- SBIapplicationformDocument5 pagesSBIapplicationformSufi DarweshNo ratings yet

- Simplified Business Plan On - : Name of ProjectDocument6 pagesSimplified Business Plan On - : Name of ProjectKrisannNo ratings yet

- Leave Form For SH or Principal (1 Day-60 Days)Document3 pagesLeave Form For SH or Principal (1 Day-60 Days)mark joseph quichoNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave2021Document2 pagesCS Form No. 6 Revised 2020 Application For Leave2021Jo Baraquiel100% (2)

- NEW CS Form No. 6 Revised 2020 Application For Leave Fillable 1Document3 pagesNEW CS Form No. 6 Revised 2020 Application For Leave Fillable 1Reymart BorresNo ratings yet

- ProceduresDocument89 pagesProceduresmayur_jadav54No ratings yet

- CS Form No. 6 Revised 2023Document2 pagesCS Form No. 6 Revised 2023ANA CELLA MARZONo ratings yet

- 2019 Federal Tax Return Summary: Total IncomeDocument3 pages2019 Federal Tax Return Summary: Total IncomerayNo ratings yet

- Leave FormDocument4 pagesLeave FormAilljim Remolleno ComilleNo ratings yet

- 2 Galgo Form 6Document3 pages2 Galgo Form 6Charito YusonNo ratings yet

- 145905Document1 page145905Tarun GodiyalNo ratings yet

- DIRECTIONS: Each of The Following Statements Is True or False. Indicate YourDocument5 pagesDIRECTIONS: Each of The Following Statements Is True or False. Indicate YourDipNo ratings yet

- Income Tax PerformaDocument1 pageIncome Tax PerformaAmandeep Singh0% (1)

- CS Form No. 6, Revised 2020 (Application For Leave) (Fillable)Document2 pagesCS Form No. 6, Revised 2020 (Application For Leave) (Fillable)ODENG CHAN100% (1)

- Dilg Xi Employees Multi-Purpose CooperativeDocument2 pagesDilg Xi Employees Multi-Purpose CooperativeDILG STA MARIANo ratings yet

- Service - Financial Statements TemplateDocument5 pagesService - Financial Statements TemplateJoemar DionaldoNo ratings yet

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- 3.diary 2010Document41 pages3.diary 2010jmr_1980No ratings yet

- SSDTDocument1 pageSSDTCeejay RosalesNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave FillableDocument2 pagesCS Form No. 6 Revised 2020 Application For Leave FillabledorisdeananeasNo ratings yet

- Btìgò Atéßò BTQ Tèvt: Bank of BarodaDocument4 pagesBtìgò Atéßò BTQ Tèvt: Bank of BarodaDebargha 2027No ratings yet

- My Personal Financial Plan and StrategyDocument1 pageMy Personal Financial Plan and StrategyJohn Oswald JunioNo ratings yet

- 2 CopiesDocument1 page2 CopiesBency MendozaNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave Fillable 1Document4 pagesCS Form No. 6 Revised 2020 Application For Leave Fillable 1Kiven ArdenoNo ratings yet

- PNB 1055 Application For Vehicle - Car LoanDocument5 pagesPNB 1055 Application For Vehicle - Car LoanDesikan0% (2)

- CS Form No. 6 Revised 2020 Application For Leave Fillable 1Document4 pagesCS Form No. 6 Revised 2020 Application For Leave Fillable 1Gabriel De Los ReyesNo ratings yet

- Full Audit Practicing Certificate FormDocument3 pagesFull Audit Practicing Certificate Formkellz accountingNo ratings yet

- Application For Leave: Philippine Statistics AuthorityDocument1 pageApplication For Leave: Philippine Statistics AuthorityNah ReeNo ratings yet

- Mohit Liquors (Audit) : 1 Conducted by GHP & Associates (Baldevsingh & Minaal)Document3 pagesMohit Liquors (Audit) : 1 Conducted by GHP & Associates (Baldevsingh & Minaal)Komal TalrejaNo ratings yet

- Application For MonetizationDocument2 pagesApplication For MonetizationHELENNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave FillableDocument2 pagesCS Form No. 6 Revised 2020 Application For Leave FillableXJ Bhevz OlsNo ratings yet

- Supreme Court of The Philippines: Application For LeaveDocument4 pagesSupreme Court of The Philippines: Application For LeaveChristian Cabang EntilaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- XT-1 DiaryDocument2 pagesXT-1 Diarygautisingh100% (1)

- Form 52Document1 pageForm 52fcanitinjainNo ratings yet

- Payslip Feb2022Document1 pagePayslip Feb2022SiddharthNo ratings yet

- Tally Prime Course GSTDocument9 pagesTally Prime Course GSTElakiyaaNo ratings yet

- Imran Shehzad Tax Lectures and MaterialDocument9 pagesImran Shehzad Tax Lectures and Materialsheraz akramNo ratings yet

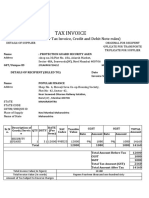

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- Account Owner Information: IRA Single Distribution RequestDocument9 pagesAccount Owner Information: IRA Single Distribution RequestJenkins Isaías Perez MontillaNo ratings yet

- RR 1-98Document9 pagesRR 1-98Crnc NavidadNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- Perfoma InvoiceDocument1 pagePerfoma InvoiceashishNo ratings yet

- RMC No. 69-2023 v2Document1 pageRMC No. 69-2023 v2Jomar CorunoNo ratings yet

- W8-Eci 2021-06-01 Preview DocDocument1 pageW8-Eci 2021-06-01 Preview Docfuture warriorNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- Mohan Glu 27 59.5 DelDocument2 pagesMohan Glu 27 59.5 DelgmmobileknpNo ratings yet

- Taxation Law Bar Exam Questions 2012 Essay Bar QuestionnaireDocument5 pagesTaxation Law Bar Exam Questions 2012 Essay Bar QuestionnaireParkEdJopNo ratings yet

- E-Trade Marketing Private Limited: Party DetailsDocument1 pageE-Trade Marketing Private Limited: Party DetailsSandeepNo ratings yet

- GST Credit Note Format in ExcelDocument4 pagesGST Credit Note Format in ExcelSoumya Ghosh0% (1)

- Sorostt 35 OpenDocument237 pagesSorostt 35 OpenJeffrey Dunetz0% (1)

- Cagayan Electric Power Vs CIRDocument2 pagesCagayan Electric Power Vs CIRJosephine Huelva VictorNo ratings yet

- Tax Case DigestsDocument2 pagesTax Case DigestsRed HoodNo ratings yet

- CP575Notice 1713807363521Document2 pagesCP575Notice 1713807363521ngochungth6391No ratings yet

- Cybernet INV # 124288 Feb-23Document1 pageCybernet INV # 124288 Feb-23Samra ShahzadNo ratings yet

- Biocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Document1 pageBiocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Siddiq MohammedNo ratings yet

- Bill PaymentDocument1 pageBill Paymentvirusop2001No ratings yet

- Salary Slip (31705442 November, 2015) PDFDocument1 pageSalary Slip (31705442 November, 2015) PDFنایاب یونسNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet

- Lisc 2020 990 PublicinspectionDocument832 pagesLisc 2020 990 PublicinspectionShannon DavisNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Cir VS SutterDocument2 pagesCir VS SutterjhammyNo ratings yet

Assignment For Students

Assignment For Students

Uploaded by

SURINDER0 ratings0% found this document useful (0 votes)

14 views3 pagesThis document provides instructions for manually filing income tax returns and calculating deductions. It includes a form to fill out with information like gross salary, exempted income, total income from different sources, applicable deductions under sections 80C, 80CCG, 80D, 80DD, 80CCD, 80G, and total tax liability. The second part provides steps for online filing of returns through the e-filing portal, which includes registering on the portal, selecting the ITR form and assessment year, and filling out details on general information, income and tax computation, tax paid, and donations.

Original Description:

Original Title

assignment for students

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides instructions for manually filing income tax returns and calculating deductions. It includes a form to fill out with information like gross salary, exempted income, total income from different sources, applicable deductions under sections 80C, 80CCG, 80D, 80DD, 80CCD, 80G, and total tax liability. The second part provides steps for online filing of returns through the e-filing portal, which includes registering on the portal, selecting the ITR form and assessment year, and filling out details on general information, income and tax computation, tax paid, and donations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views3 pagesAssignment For Students

Assignment For Students

Uploaded by

SURINDERThis document provides instructions for manually filing income tax returns and calculating deductions. It includes a form to fill out with information like gross salary, exempted income, total income from different sources, applicable deductions under sections 80C, 80CCG, 80D, 80DD, 80CCD, 80G, and total tax liability. The second part provides steps for online filing of returns through the e-filing portal, which includes registering on the portal, selecting the ITR form and assessment year, and filling out details on general information, income and tax computation, tax paid, and donations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 3

ASSIGNMENT

Filing of Returns Manually

INCOME TAX DEDUCTION AT SOURCE – PROFORMA

For the Financial Year 2019-2020 Assessment Year 2020-21

Name of Assessee _________________________________________________________________

Designation ____________________________________ PAN _________________________

1. Gross Salary __________________________________________________________________

(Including B.P., GP/AGP, D.A., S.P., H.C.A., F.P.A., F.M.A., H.R.A. & Arrears)

2. Exempted Salary Income u/s 10

i) Exempted HCA ________

ii) Exempted HRA (which ever is less)

a) HRA Received __________

b) Rent Paid – 10% of salary ___________

c) 40% of Salary ____________

________ _____________

3. Balance Salary Income (1-2) _____________

4. Standard Deduction u/s 16 Max. upto Rs.40000 _____________

5. Net Salary Income (3-4) _____________

6. Income/Loss from House on Property _____________

7. Income from Business & Profession _____________

8. Income from Capital Gain _____________

9. Income from other Sources

i. University/ income _____________

ii. Interest Income _____________

iii. Any other _____________

Total Income (i+ii+iii) _____________

10. Gross Total Income i.e. (5+6+7+8+9)

11. Deduction u/s 80

i).u/s 80C: No. Amount

a) Own contribution to GPF/CPF _____________ _____________

b) Amount deposited in PPF _____________ _____________

c) Tuition Fees _____________ _____________

d) LIC Premium _____________ _____________

e) GIS _____________ _____________

f) Repayment of HBA _____________ _____________

Total Saving u/s 80C Maximum Rs. 150000 ______________

ii) U/s 80CCG RGESS in Equity Shares Deduction 50% of Max. Inv. upto Rs. 50000 ____________

(Eligible if gross salary upto Rs. 12,00000)

iii). U/s 80D: Medi claim Insurance _____________

iv).U/s 80DD/U: Medically Handicapped dependent/Employee _____________

v) U/s 80CCD (IB) NPS up to Rs. 50000 ____________

vi).U/s 80G: Donations Amount Eligible Amount

P.M/Chief Minister's Relief Fund _____________ ____________

vii). U/s 80E/EE/TTA /GG ____________

viii). Any other ____________

Total Deduction u/s 80 (i) + (ii) + (iii)+(iv)+(v) +(vi) +(vii) ____________

12. Taxable Income (10-11) ___________

13. Tax on Total Income

upto Rs. 250000 Nil _____________

Next Rs. 250000 5% _____________

Next Rs. 5, 00,000 20% _____________

Above Rs. 10, 00,000 30% _____________

Total Tax _____________

14. Less Tax Credit maximum Rs.2500 ( If taxable salary up to Rs.3.5 Lakhs) ____________

15. Total Tax _____________

16. Health & Education cess @ 4% ____________

17. Total Tax Liability i.e. (15+16) _____________

18. Less Relief u/s 89 (i) _____________

19. Balance Tax (17-18) _____________

20. Less Tax already deducted _____________

21. Balance Tax to be deducted (19-20) ____________

22. Refund _____________

Dated: Signature of Students

Class

Class Roll No.

PRACTICAL

Online filing of Returns

Steps to file income tax return online

1. Go to e-filing portal at http:// incometaxindiaefiling.gov.in.

2. If not already registered on the portal click on register yourself

3. If already registered on the portal, click on Login Here to Login on e-filing portal

4. Go to e-file , prepare & submit ITR online.

5. Select the income tax return form & assessment year.

6. Fill in the details

(i) General information

(ii) Computation of income & tax

(iii) Tax details

(iv) Tax paid & verification

(v) Donation 80-G & 80- GGA

7. Click the submit button

You might also like

- TDS Py 2021-22davDocument2 pagesTDS Py 2021-22davSURINDERNo ratings yet

- Circular For I.tax Statement For Fy2022-2023-NbagrDocument9 pagesCircular For I.tax Statement For Fy2022-2023-NbagrS S PradheepanNo ratings yet

- Noti Self Declaration FormDocument4 pagesNoti Self Declaration FormRamya RameshNo ratings yet

- Application Form MPSSIRS 2014Document5 pagesApplication Form MPSSIRS 2014Ar Raj YamgarNo ratings yet

- Income Tax Calculation Form 2019-20Document2 pagesIncome Tax Calculation Form 2019-20Ishwar MittalNo ratings yet

- Saving Declaration 20-21Document3 pagesSaving Declaration 20-21pankajNo ratings yet

- Annexure - Iii: ScheduleDocument3 pagesAnnexure - Iii: ScheduleJay reyNo ratings yet

- Chapter 3/unit 4 Review Sheet 4/preparing The Income StatementDocument2 pagesChapter 3/unit 4 Review Sheet 4/preparing The Income Statementkamaljeet kaurNo ratings yet

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Document4 pagesCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNo ratings yet

- FORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyDocument6 pagesFORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyHem Ch DeuriNo ratings yet

- Financial Assessment FormDocument3 pagesFinancial Assessment Formmikecreatives745No ratings yet

- Commission On Higher Education-Regional Office - : Areas/Aspects Actual Situation RemarksDocument2 pagesCommission On Higher Education-Regional Office - : Areas/Aspects Actual Situation RemarksAbby TrinidadNo ratings yet

- Notes To Capital Work-In-progressDocument3 pagesNotes To Capital Work-In-progressJitendra Vernekar100% (1)

- Final Compution of Income Tax 2008-09Document2 pagesFinal Compution of Income Tax 2008-09Vimal Patel100% (4)

- Leave Form For SH or Principal 1 Day 29 DaysDocument4 pagesLeave Form For SH or Principal 1 Day 29 Daysneri jadeNo ratings yet

- Branch Office - Dholewal - : 4a.notional Concessions For 6 MonthsDocument7 pagesBranch Office - Dholewal - : 4a.notional Concessions For 6 Monthsifb.ludhianaNo ratings yet

- Cs Form No. 6 Application For Leave 2021 1 1Document1 pageCs Form No. 6 Application For Leave 2021 1 1mark jerald ritaNo ratings yet

- 2018-19 Investment DeclarationDocument2 pages2018-19 Investment DeclarationManish SarmaNo ratings yet

- CSC Form. Form 6, Revised 2020Document4 pagesCSC Form. Form 6, Revised 2020jeanethmendezbostonNo ratings yet

- FABM2 Quarter 1 Module and WorksheetsDocument27 pagesFABM2 Quarter 1 Module and WorksheetsHeart polvos100% (1)

- Application Cum Proposal Form For Star Pensioner'S Loan (To Be Filled in by The Applicant)Document6 pagesApplication Cum Proposal Form For Star Pensioner'S Loan (To Be Filled in by The Applicant)chetan jNo ratings yet

- Quiz 3-Part 3Document1 pageQuiz 3-Part 3JCNo ratings yet

- BLANK CS Form No. 6, Revised 2020 (Application For Leave)Document1 pageBLANK CS Form No. 6, Revised 2020 (Application For Leave)vimNo ratings yet

- Application For Family PensionDocument14 pagesApplication For Family PensionRashid NaeemNo ratings yet

- GPF PDFDocument24 pagesGPF PDFHimanshuKaushikNo ratings yet

- Application For Leave: de Guzman Theresa Faye Aquino Adas Ii AccountingDocument2 pagesApplication For Leave: de Guzman Theresa Faye Aquino Adas Ii AccountingTheresa Faye De GuzmanNo ratings yet

- SBIapplicationformDocument5 pagesSBIapplicationformSufi DarweshNo ratings yet

- Simplified Business Plan On - : Name of ProjectDocument6 pagesSimplified Business Plan On - : Name of ProjectKrisannNo ratings yet

- Leave Form For SH or Principal (1 Day-60 Days)Document3 pagesLeave Form For SH or Principal (1 Day-60 Days)mark joseph quichoNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave2021Document2 pagesCS Form No. 6 Revised 2020 Application For Leave2021Jo Baraquiel100% (2)

- NEW CS Form No. 6 Revised 2020 Application For Leave Fillable 1Document3 pagesNEW CS Form No. 6 Revised 2020 Application For Leave Fillable 1Reymart BorresNo ratings yet

- ProceduresDocument89 pagesProceduresmayur_jadav54No ratings yet

- CS Form No. 6 Revised 2023Document2 pagesCS Form No. 6 Revised 2023ANA CELLA MARZONo ratings yet

- 2019 Federal Tax Return Summary: Total IncomeDocument3 pages2019 Federal Tax Return Summary: Total IncomerayNo ratings yet

- Leave FormDocument4 pagesLeave FormAilljim Remolleno ComilleNo ratings yet

- 2 Galgo Form 6Document3 pages2 Galgo Form 6Charito YusonNo ratings yet

- 145905Document1 page145905Tarun GodiyalNo ratings yet

- DIRECTIONS: Each of The Following Statements Is True or False. Indicate YourDocument5 pagesDIRECTIONS: Each of The Following Statements Is True or False. Indicate YourDipNo ratings yet

- Income Tax PerformaDocument1 pageIncome Tax PerformaAmandeep Singh0% (1)

- CS Form No. 6, Revised 2020 (Application For Leave) (Fillable)Document2 pagesCS Form No. 6, Revised 2020 (Application For Leave) (Fillable)ODENG CHAN100% (1)

- Dilg Xi Employees Multi-Purpose CooperativeDocument2 pagesDilg Xi Employees Multi-Purpose CooperativeDILG STA MARIANo ratings yet

- Service - Financial Statements TemplateDocument5 pagesService - Financial Statements TemplateJoemar DionaldoNo ratings yet

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- 3.diary 2010Document41 pages3.diary 2010jmr_1980No ratings yet

- SSDTDocument1 pageSSDTCeejay RosalesNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave FillableDocument2 pagesCS Form No. 6 Revised 2020 Application For Leave FillabledorisdeananeasNo ratings yet

- Btìgò Atéßò BTQ Tèvt: Bank of BarodaDocument4 pagesBtìgò Atéßò BTQ Tèvt: Bank of BarodaDebargha 2027No ratings yet

- My Personal Financial Plan and StrategyDocument1 pageMy Personal Financial Plan and StrategyJohn Oswald JunioNo ratings yet

- 2 CopiesDocument1 page2 CopiesBency MendozaNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave Fillable 1Document4 pagesCS Form No. 6 Revised 2020 Application For Leave Fillable 1Kiven ArdenoNo ratings yet

- PNB 1055 Application For Vehicle - Car LoanDocument5 pagesPNB 1055 Application For Vehicle - Car LoanDesikan0% (2)

- CS Form No. 6 Revised 2020 Application For Leave Fillable 1Document4 pagesCS Form No. 6 Revised 2020 Application For Leave Fillable 1Gabriel De Los ReyesNo ratings yet

- Full Audit Practicing Certificate FormDocument3 pagesFull Audit Practicing Certificate Formkellz accountingNo ratings yet

- Application For Leave: Philippine Statistics AuthorityDocument1 pageApplication For Leave: Philippine Statistics AuthorityNah ReeNo ratings yet

- Mohit Liquors (Audit) : 1 Conducted by GHP & Associates (Baldevsingh & Minaal)Document3 pagesMohit Liquors (Audit) : 1 Conducted by GHP & Associates (Baldevsingh & Minaal)Komal TalrejaNo ratings yet

- Application For MonetizationDocument2 pagesApplication For MonetizationHELENNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave FillableDocument2 pagesCS Form No. 6 Revised 2020 Application For Leave FillableXJ Bhevz OlsNo ratings yet

- Supreme Court of The Philippines: Application For LeaveDocument4 pagesSupreme Court of The Philippines: Application For LeaveChristian Cabang EntilaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- XT-1 DiaryDocument2 pagesXT-1 Diarygautisingh100% (1)

- Form 52Document1 pageForm 52fcanitinjainNo ratings yet

- Payslip Feb2022Document1 pagePayslip Feb2022SiddharthNo ratings yet

- Tally Prime Course GSTDocument9 pagesTally Prime Course GSTElakiyaaNo ratings yet

- Imran Shehzad Tax Lectures and MaterialDocument9 pagesImran Shehzad Tax Lectures and Materialsheraz akramNo ratings yet

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- Account Owner Information: IRA Single Distribution RequestDocument9 pagesAccount Owner Information: IRA Single Distribution RequestJenkins Isaías Perez MontillaNo ratings yet

- RR 1-98Document9 pagesRR 1-98Crnc NavidadNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- Perfoma InvoiceDocument1 pagePerfoma InvoiceashishNo ratings yet

- RMC No. 69-2023 v2Document1 pageRMC No. 69-2023 v2Jomar CorunoNo ratings yet

- W8-Eci 2021-06-01 Preview DocDocument1 pageW8-Eci 2021-06-01 Preview Docfuture warriorNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- Mohan Glu 27 59.5 DelDocument2 pagesMohan Glu 27 59.5 DelgmmobileknpNo ratings yet

- Taxation Law Bar Exam Questions 2012 Essay Bar QuestionnaireDocument5 pagesTaxation Law Bar Exam Questions 2012 Essay Bar QuestionnaireParkEdJopNo ratings yet

- E-Trade Marketing Private Limited: Party DetailsDocument1 pageE-Trade Marketing Private Limited: Party DetailsSandeepNo ratings yet

- GST Credit Note Format in ExcelDocument4 pagesGST Credit Note Format in ExcelSoumya Ghosh0% (1)

- Sorostt 35 OpenDocument237 pagesSorostt 35 OpenJeffrey Dunetz0% (1)

- Cagayan Electric Power Vs CIRDocument2 pagesCagayan Electric Power Vs CIRJosephine Huelva VictorNo ratings yet

- Tax Case DigestsDocument2 pagesTax Case DigestsRed HoodNo ratings yet

- CP575Notice 1713807363521Document2 pagesCP575Notice 1713807363521ngochungth6391No ratings yet

- Cybernet INV # 124288 Feb-23Document1 pageCybernet INV # 124288 Feb-23Samra ShahzadNo ratings yet

- Biocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Document1 pageBiocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Siddiq MohammedNo ratings yet

- Bill PaymentDocument1 pageBill Paymentvirusop2001No ratings yet

- Salary Slip (31705442 November, 2015) PDFDocument1 pageSalary Slip (31705442 November, 2015) PDFنایاب یونسNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet

- Lisc 2020 990 PublicinspectionDocument832 pagesLisc 2020 990 PublicinspectionShannon DavisNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Cir VS SutterDocument2 pagesCir VS SutterjhammyNo ratings yet