Professional Documents

Culture Documents

Assignment 1

Assignment 1

Uploaded by

Tran NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Assignment 1

Uploaded by

Tran NguyenCopyright:

Available Formats

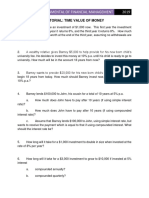

CORPORATE FINANCE – TERM 2/2023

GROUP ASSIGNMENT 1

Note: The cover sheet must be attached.

Problem 1 (5 marks)

Lisa will join a company and sign a brand-new contract. The contract states that she will receive

$14,500,000 per year for five years. The appropriate interest rate is 7.1%.

a. What is the present value of the payments if:

- The payments are in the form of an ordinary annuity.

- The payments are an annuity due.

b. Suppose Lisa wants to invest the payments for five years in an emerging market. What is the future

value of her investment if:

- The payments are an ordinary annuity.

- The payments are an annuity due.

c. Which has the highest present value, the ordinary annuity or annuity due? Which has the highest

future value? Can you provide some comments about your findings?

Problem 2 (5 marks)

Rosie will invest $1,500,000 in an account. What is the future value of her investment in 18 years if

the bank offers an annual percentage rate of 6.8%:

a. Compounded annually.

b. Compounded quarterly.

c. Compounded monthly.

d. Compounded continuously.

Why does the future value increase as the compounding periods shortens?

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Assignment CH 4Document3 pagesAssignment CH 4Bill YoulerNo ratings yet

- Tutorial QuestionsDocument15 pagesTutorial QuestionsWowKid50% (2)

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- 1a. Question - Chapter 1Document4 pages1a. Question - Chapter 1plinhcoco02No ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Aynur Efendiyeva - Maliye 1Document7 pagesAynur Efendiyeva - Maliye 1Sheen Carlo AgustinNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Exam 2022 SeptemberDocument11 pagesExam 2022 Septembergio040700No ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- DraftDocument2 pagesDraftYUDITA NUR'AININNo ratings yet

- Financial Management Source 4Document13 pagesFinancial Management Source 4John Llucastre CortezNo ratings yet

- Problem Set #2 Financial Management Professor KuhleDocument2 pagesProblem Set #2 Financial Management Professor KuhleYuRi LuvNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- Assignment 2 1 Warm-Up Exercises Chapter 5Document1 pageAssignment 2 1 Warm-Up Exercises Chapter 5drjones5No ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- Chapter 2 - Practice Problem - Part 1Document11 pagesChapter 2 - Practice Problem - Part 1Thoa Vũ100% (1)

- Assignment of Time Value of MoneyDocument3 pagesAssignment of Time Value of MoneyMuxammil IqbalNo ratings yet

- Assignment 01-Financial ManagementDocument3 pagesAssignment 01-Financial Managementsofiamubarak453No ratings yet

- TCDN1Document27 pagesTCDN1venicepham2004No ratings yet

- Time Value of MoneyDocument11 pagesTime Value of MoneyRajesh PatilNo ratings yet

- Business FinanceDocument221 pagesBusiness FinanceMatthew GonzalesNo ratings yet

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- Assignment 1Document7 pagesAssignment 1Camilo Andres MesaNo ratings yet

- FM2 Câu hỏi ôn tậpDocument7 pagesFM2 Câu hỏi ôn tậpĐoàn Trần Ngọc AnhNo ratings yet

- R05 Time Value of Money Practice QuestionsDocument10 pagesR05 Time Value of Money Practice QuestionsAbbas100% (1)

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Introduction To Finance BUSFIN 1030: Problem Set 2Document3 pagesIntroduction To Finance BUSFIN 1030: Problem Set 2ΧριστόςκύριοςNo ratings yet

- Mid-Term Managerial Finance - Uts - 15 May 2024Document1 pageMid-Term Managerial Finance - Uts - 15 May 2024Ani MarianiNo ratings yet

- Chapter 3 - Practice ProblemsDocument2 pagesChapter 3 - Practice Problemslevukhanhlinh2262004No ratings yet

- Revision For Midterm - Wo AnswersDocument3 pagesRevision For Midterm - Wo AnswersNghinh Xuan TranNo ratings yet

- Assignment 2 - Annuity - Ordinary Simple General AnnuityDocument3 pagesAssignment 2 - Annuity - Ordinary Simple General Annuitystudent.devyankgosainNo ratings yet

- Chapter 4 Part 2Document29 pagesChapter 4 Part 2Aditya GhoshNo ratings yet

- Concept Questions: Compound Interest: Future Value and Present ValueDocument4 pagesConcept Questions: Compound Interest: Future Value and Present ValuelinhNo ratings yet

- Business Finance 2-2 PDFDocument4 pagesBusiness Finance 2-2 PDFThomas nyadeNo ratings yet

- FM - Lecture3 Handouts 2020NCTDocument3 pagesFM - Lecture3 Handouts 2020NCTnhu1582004No ratings yet

- University of Saint LouisDocument3 pagesUniversity of Saint LouisRommel RoyceNo ratings yet

- Fundamental of Financial Management January 1, 2015: Tutorial: Time Value of MoneyDocument5 pagesFundamental of Financial Management January 1, 2015: Tutorial: Time Value of MoneyNgoc HuynhNo ratings yet

- Chapter 6 Tutorial QuestionsDocument2 pagesChapter 6 Tutorial QuestionsEritabeta TonyNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and Exercisesmin - radiseNo ratings yet

- Activity 2Document1 pageActivity 2Brixter AdvientoNo ratings yet

- Assignment On Stock ValuationDocument3 pagesAssignment On Stock ValuationSidra KhanNo ratings yet

- 05 03 04 Ann Sinkfund AmortDocument7 pages05 03 04 Ann Sinkfund AmortLöshini Priscilla EgbunikeNo ratings yet

- Assignemt - Chapter 2 - Time Value of MoneyDocument3 pagesAssignemt - Chapter 2 - Time Value of Money721d0042No ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesAnh TramNo ratings yet

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Document7 pagesFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanNo ratings yet

- AnnuityDocument3 pagesAnnuityJeffrey Del Mundo50% (2)

- Activity 1: Now That You Review The Most Essential Principles in Engineering EconomyDocument9 pagesActivity 1: Now That You Review The Most Essential Principles in Engineering EconomyRegine Mae Lustica YanizaNo ratings yet

- Practise Chapter 5+6+7 (For Quiz 2)Document17 pagesPractise Chapter 5+6+7 (For Quiz 2)Phạm Hồng Trang Alice -No ratings yet

- 2022-Sesi 8-Bond Valuation-Ed 12Document3 pages2022-Sesi 8-Bond Valuation-Ed 12Gabriela ClarenceNo ratings yet

- Cost of CapitalDocument166 pagesCost of Capitalmruga_12350% (2)

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet