Professional Documents

Culture Documents

Beneficiary Designation m6463

Beneficiary Designation m6463

Uploaded by

Saravpreet Singh DhillonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beneficiary Designation m6463

Beneficiary Designation m6463

Uploaded by

Saravpreet Singh DhillonCopyright:

Available Formats

This document contains both information and form fields.

To read information, use the Down Arrow from a form field.

For CL Head Office Use Only

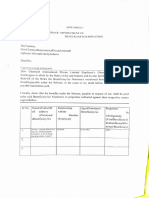

BENEFICIARY DESIGNATION CL Certificate Number

Please print clearly and complete this form in INK. Plan Member should return the completed form to your Plan Administrator. If you use GroupNet for Plan Admin,

completed form should be maintained by the Plan Administrator.

1. General Enrolment Plan number: Division number: Plan member ID:

Information

Plan sponsor:

Plan member name (print):

last name first name middle initial

2. Beneficiary Designation I hereby revoke all previous beneficiary designations and designate the following as beneficiary(ies).

This section must be completed to

Percent Relationship

Primary Beneficiary allocated to plan member

designate a beneficiary for your life

benefits, if applicable.

An original or copy of this form last name first name middle initial

will be required for a life claim.

Crossed out beneficiary last name first name middle initial

designations must be initialed.

Please print clearly in INK. last name first name middle initial

To be divided as follows: • As per the percentage indicated above, or

• In equal shares to the survivor(s)

You may change this beneficiary designation at any time upon notice to Canada Life. If you wish to make the beneficiary

designation irrevocable (meaning you may not change the designation or make certain changes to your coverage under

the plan without the written consent of the beneficiary) please complete form #M6348 BIL.

Note: Where Quebec law applies and you have designated your married spouse or civil union spouse as beneficiary,

the designation will be irrevocable unless you check the box marked “Revocable”, below.

I hereby make the above beneficiary designation:

• Revocable, I may change this beneficiary designation at any time

For Quebec Applicants Only - Benefits payable under this plan to a beneficiary who, at the time payment is to be made, is

a minor or lacks legal capacity, will be paid to their tutor(s) or curator(s), unless a valid trust has been established for the

benefit of the beneficiary, by Will or by separate contract, to receive any such payment and Canada Life has been provided

notice of the trust. If a valid trust has already been established, designate the trust as the beneficiary in this section.

Before designating a trust, you should seek legal advice.

3. Contingent Beneficiary If there are no surviving beneficiaries at the time of my death, I declare that the following Contingent Beneficiaries shall

Designation receive the proceeds. If there are no surviving Contingent Beneficiaries at the time of my death, the proceeds shall be paid

to my estate.

If you wish to appoint a contingent Percent Relationship

beneficiary in the event that Contingent Beneficiary allocated to plan member

there are no surviving primary

beneficiaries at the time of your

death, please complete this last name first name middle initial

section.

last name first name middle initial

last name first name middle initial

To be divided as follows: • As per the percentage indicated above, or

• In equal shares to the survivor(s)

You may change this beneficiary designation at any time upon notice to Canada Life. If you wish to make the beneficiary

designation irrevocable (meaning you may not change the designation or make certain changes to your coverage under

the plan without the written consent of the beneficiary) please complete form #M6348 BIL.

Note: Where Quebec law applies and you have designated your married spouse or civil union spouse as beneficiary,

the designation will be irrevocable unless you check the box marked “Revocable”, below.

I hereby make the above beneficiary designation:

• Revocable, I may change this beneficiary designation at any time

For Quebec Applicants Only - Benefits payable under this plan to a beneficiary who, at the time payment is to be made, is

a minor or lacks legal capacity, will be paid to their tutor(s) or curator(s), unless a valid trust has been established for the

benefit of the beneficiary, by Will or by separate contract, to receive any such payment and Canada Life has been provided

notice of the trust. If a valid trust has already been established, designate the trust as the beneficiary in this section. Before

designating a trust, you should seek legal advice.

For All Other Applicants - If designating a beneficiary who is a minor or who lacks legal capacity you may wish to appoint a

trustee/administrator by completing form #M6242 BIL. This appointment may not be suitable for all purposes.

Before designating a trustee, you should seek legal advice.

CONTINUED ON NEXT PAGE

www.canadalife.com • 1-800-957-9777 Page 1 of 2

M6463-6/20 ©The Canada Life Assurance Company, all rights reserved. Canada Life and design are trademarks of The Canada Life Assurance

Company. Any modification of this document without the express written consent of Canada Life is strictly prohibited.

4. Trustee Appointment DO NOT COMPLETE THIS SECTION IF YOU ARE A QUEBEC RESIDENT

You may wish to appoint a trustee/ If designating a beneficiary who is a minor or who lacks legal capacity you may wish to appoint a trustee/administrator by

administrator by completing this completing this form. This appointment may not be suitable for all purposes.

section If you are designating a trustee/administrator, we recommend you consult with a legal advisor, and with any proposed

An original or copy of this form trustee/administrator.

will be required for a life claim. Do not complete this section if you have made another trustee/administrator appointment.

Please print clearly, in INK. I hereby appoint the following trustee to receive and to hold in trust, on behalf of any beneficiary, money payable to the

beneficiary under this group benefits plan where, at the time payment is to be made, the beneficiary is a minor or otherwise

lacks legal capacity. Any such payment, to its extent, will release The Canada Life Assurance Company from further liability.

The trustee shall act prudently and may use the money, including any returns on it or investments made, for the education

and/or maintenance of the beneficiary. The trust will terminate once the beneficiary is of the age of majority and has legal

capacity. At that time, the trustee shall deliver to the beneficiary all assets held in trust.

Trustee last name first name middle initial Relationship to plan member

5. Privacy At The Canada Life Assurance Company we recognize and respect the importance of privacy.

This section explains Canada Life’s Your personal information:

commitment to privacy. When you apply for coverage, we establish a confidential file that contains your personal information like your name,

contact information, and products and coverage you have with us. Depending on the products or services you apply for and

are provided with, this may also include financial or health information. Your information is kept in the offices of

Canada Life or the offices of an organization authorized by Canada Life. You may exercise certain rights of access and

rectification with respect to the personal information in your file by sending a request in writing to Canada Life.

Who has access to your information:

We limit access to personal information in your file to Canada Life staff or persons authorized by Canada Life who require it

to perform their duties and to persons to whom you have granted access. In order to assist in fulfilling the purposes

identified below, we may use service providers located within or outside Canada. Your personal information may also be

subject to disclosure to public authorities or others authorized under applicable law within or outside Canada.

What your information is used for:

Personal information that we collect will be used for the purposes of determining your eligibility for products, services or

coverage for which you apply, providing, administering or servicing products or coverage you have with us, and for

Canada Life’s and its affiliates’ internal data management and analytics purposes. This may include investigating and

assessing claims, paying benefits, and creating and maintaining records concerning our relationship.The consent given in this

form will be valid until we receive written notice that you have withdrawn it, subject to legal and contractual restrictions. For

example, if you withdraw your consent, we may not be able to continue to adjudicate or administer a claim for benefits.

If you want to know more:

For a copy of our Privacy Guidelines, or if you have questions about our personal information policies and practices (including

with respect to service providers), write to Canada Life’s Chief Compliance Officer or refer to www.canadalife.com.

6. Authorizations and I have read and understand and agree with the contents of the section on this form entitled “Privacy”.

Declarations I authorize:

This section must be signed and • Canada Life, any healthcare provider, my plan administrator, other insurance or reinsurance companies, administrators

dated in INK by the plan member. of government benefits or other benefits programs, other organizations, or service providers working with Canada Life

or the above to exchange personal information, when relevant and necessary to determine my eligibility for coverage

and to administer the plan.

I agree that a photocopy or electronic copy of the Authorizations and Declarations section is as valid as the original.

I certify that the information given is true, correct and complete to the best of my knowledge.

For Quebec applicants: I request that this form be in English.

Je demande que ce formulaire me soit remis en anglais.

Plan member signature: Date:

Clear Page 2 of 2

You might also like

- PDSM Example Assessment Instrument CPPDSM4080A Work in The Real Estate Industry 2Document29 pagesPDSM Example Assessment Instrument CPPDSM4080A Work in The Real Estate Industry 2Macauley Parker Burton100% (1)

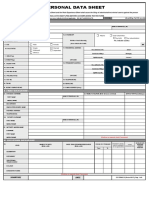

- CS Form No 212 - Personal Data Sheet (Editable)Document6 pagesCS Form No 212 - Personal Data Sheet (Editable)jecelle nochete0% (1)

- Beneficiary Designation Form: Policy and Member Information Rogers Communications IncDocument2 pagesBeneficiary Designation Form: Policy and Member Information Rogers Communications IncLiliana GomezNo ratings yet

- Sun Life Beneficiary FormDocument2 pagesSun Life Beneficiary FormNihal PednekarNo ratings yet

- RSP - Application FormDocument3 pagesRSP - Application FormTamara Julia HannestoNo ratings yet

- TIAABeneficiary FormDocument12 pagesTIAABeneficiary Formibrahimanass002No ratings yet

- GL1435Document2 pagesGL1435Rochelle Joy CulasNo ratings yet

- HDFC Life Youngstar Super PremiumDocument6 pagesHDFC Life Youngstar Super PremiumabbastceNo ratings yet

- India Statutory Forms - SampleDocument10 pagesIndia Statutory Forms - Samplesahith sunnyNo ratings yet

- Barrick Enrollment Form Apr 2022Document3 pagesBarrick Enrollment Form Apr 2022jorge ordinolaNo ratings yet

- MC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochureDocument9 pagesMC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochureManish MauryaNo ratings yet

- Payable On Death (POD) Designation: A. Primary Member InformationDocument2 pagesPayable On Death (POD) Designation: A. Primary Member InformationNdoublePNo ratings yet

- Defined Benefit Plan (S) : Member Information FormDocument4 pagesDefined Benefit Plan (S) : Member Information FormtatiNo ratings yet

- MC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochureDocument8 pagesMC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochuresapmayanNo ratings yet

- Illustration (3) - 3Document1 pageIllustration (3) - 3Navneet PandeyNo ratings yet

- Beneficiary Change: 1. General InformationDocument1 pageBeneficiary Change: 1. General InformationAndy De GuzmanNo ratings yet

- SBI+Life+-+Smart+Annuity+Plus NPS+Single+Pager V03Document3 pagesSBI+Life+-+Smart+Annuity+Plus NPS+Single+Pager V03Mangal SinghNo ratings yet

- MetLife Bachat Yojana - Brochure - tcm47-27823Document5 pagesMetLife Bachat Yojana - Brochure - tcm47-27823sarthakNo ratings yet

- HDFC SL Youngstar Super Premium20170302 080208Document8 pagesHDFC SL Youngstar Super Premium20170302 080208Bharadwaj TegalaNo ratings yet

- KanLive NMCDDocument18 pagesKanLive NMCDLordy Jessah AggabaoNo ratings yet

- Afterburner - Spring-Summer 2019-Final Crcted-FinalDocument12 pagesAfterburner - Spring-Summer 2019-Final Crcted-FinalArt SanchezNo ratings yet

- Isecure: Bajaj AllianzDocument4 pagesIsecure: Bajaj AllianzSudipt SenguptaNo ratings yet

- Binding Death Benefit Nomination For Super MembersDocument4 pagesBinding Death Benefit Nomination For Super Membersd33nac3No ratings yet

- MEB001 FundsAtWork Umbrella Funds Withdrawal FormDocument5 pagesMEB001 FundsAtWork Umbrella Funds Withdrawal FormdlndlaminiNo ratings yet

- KanLive NMCDDocument23 pagesKanLive NMCDSincerely ReynNo ratings yet

- Ola OlaolaDocument3 pagesOla Olaolabhanu rajawatNo ratings yet

- Shubh Nivesh Brochure - BRDocument15 pagesShubh Nivesh Brochure - BRSumit RpNo ratings yet

- Premier Endowment PlanDocument12 pagesPremier Endowment Planumar zaid khanNo ratings yet

- Policy Details ChangeDocument1 pagePolicy Details ChangeKim Espart CastilloNo ratings yet

- Dividends PDFDocument2 pagesDividends PDFAnnalene Ramores OlitNo ratings yet

- Pre-Mature Exit Form Jan 19Document2 pagesPre-Mature Exit Form Jan 19antriksh82No ratings yet

- Application For Alteration Form 2-UpdateDocument4 pagesApplication For Alteration Form 2-UpdateShareen TeoNo ratings yet

- New PdsDocument5 pagesNew PdsnadiaNo ratings yet

- AC 2202 CHAPTER 17 NotesDocument8 pagesAC 2202 CHAPTER 17 NotesKemuel TantuanNo ratings yet

- Change of Benificiary Non Financial Amedment FormDocument2 pagesChange of Benificiary Non Financial Amedment FormDhin PadayaoNo ratings yet

- Futuregensurrenderform 25Document2 pagesFuturegensurrenderform 25accountsNo ratings yet

- Standard Enrollment Form EEGDocument3 pagesStandard Enrollment Form EEGscribd scribdNo ratings yet

- MILTON F11468 BeneficiaryDesignationFormDocument13 pagesMILTON F11468 BeneficiaryDesignationFormryandNo ratings yet

- New - Elite - Plus Brochure - V2Document11 pagesNew - Elite - Plus Brochure - V2Deepak GulwaniNo ratings yet

- Medical Insurance Application Form - FillableDocument12 pagesMedical Insurance Application Form - FillablevolauruciNo ratings yet

- Standard Application Form 6 Pager FATCA Change 31052016Document6 pagesStandard Application Form 6 Pager FATCA Change 31052016आज़ाद पटेलNo ratings yet

- 2 - J FanakaDocument8 pages2 - J FanakaElephant MNo ratings yet

- HDFC Life Group Credit Protect Plus Insurance PlanDocument8 pagesHDFC Life Group Credit Protect Plus Insurance PlanManas Jain MJNo ratings yet

- Ulip-Fund Switch & Redirection Form: Guidelines For Filling The FormDocument1 pageUlip-Fund Switch & Redirection Form: Guidelines For Filling The FormGanesh PrasadNo ratings yet

- DR Singh Claim FormDocument2 pagesDR Singh Claim Formgagandeep.sharma196No ratings yet

- USA Full-Time Employee Benefits Summary - All GradesDocument2 pagesUSA Full-Time Employee Benefits Summary - All Gradesvktm9r2x7nNo ratings yet

- Evelyn Sayson-AGENCY-Az - protect-PHP-03042023134157Document3 pagesEvelyn Sayson-AGENCY-Az - protect-PHP-03042023134157jasleh ann villaflorNo ratings yet

- Shubh Nivesh BrochureDocument15 pagesShubh Nivesh Brochurejagan eswaranNo ratings yet

- Great American: FORM TO FILL OUTDocument8 pagesGreat American: FORM TO FILL OUTMax PowerNo ratings yet

- HDFC Life Immediate Annuity Benefit IllustrationsDocument2 pagesHDFC Life Immediate Annuity Benefit IllustrationsgitirNo ratings yet

- Graduate Fellowship Deferment RequestDocument4 pagesGraduate Fellowship Deferment RequestrhNo ratings yet

- Salesforce Frequently Asked Question: 1. When Does My Coverage Begin Under The "Salesforce Flexible Benefits" Plan?Document10 pagesSalesforce Frequently Asked Question: 1. When Does My Coverage Begin Under The "Salesforce Flexible Benefits" Plan?Krishna ChaitanyaNo ratings yet

- MetlifeDocument5 pagesMetlifeblogs414No ratings yet

- Gratuity FormDocument4 pagesGratuity Formsravan1760No ratings yet

- Surrender / Partial Withdrawal Form SRN No:: Surname First Name Middle Name TitleDocument2 pagesSurrender / Partial Withdrawal Form SRN No:: Surname First Name Middle Name Titlesofich rosaNo ratings yet

- Unit 3 Life Insurance Products: ObjectivesDocument24 pagesUnit 3 Life Insurance Products: ObjectivesPriya ShindeNo ratings yet

- Morgan Stanley Pension MaxDocument8 pagesMorgan Stanley Pension MaxbblouseNo ratings yet

- New Sme For MdselamaDocument3 pagesNew Sme For MdselamaHS INNOVATORNo ratings yet

- FWD The One For Life Accident and Critical IllnessDocument49 pagesFWD The One For Life Accident and Critical IllnessEmzs VlogNo ratings yet

- I Barnes - MIRF-withdrawalretreanchmentretDocument8 pagesI Barnes - MIRF-withdrawalretreanchmentretridbastraNo ratings yet

- Cash Management Account Application TrustDocument20 pagesCash Management Account Application TrustVinod BCNo ratings yet

- The Book of Answers for Federal Employees and Retirees - New 4th EditionFrom EverandThe Book of Answers for Federal Employees and Retirees - New 4th EditionNo ratings yet

- Rise To: ExcellenceDocument27 pagesRise To: ExcellenceSubid ChoudhuryNo ratings yet

- Table NamesDocument11 pagesTable NamesChandra sekharNo ratings yet

- National Policies That Address The Ethical and Moral Concerns in The Technological EraDocument6 pagesNational Policies That Address The Ethical and Moral Concerns in The Technological EraSenrabil Libarnes DelfinadoNo ratings yet

- Parliamentary Questions July 13 2022Document2 pagesParliamentary Questions July 13 2022BernewsAdminNo ratings yet

- Sample Terms and Conditions 2Document13 pagesSample Terms and Conditions 2Jai KaNo ratings yet

- 12go Booking 10425534Document11 pages12go Booking 10425534renierjohndiaz48No ratings yet

- RSN Application Form 21-22Document6 pagesRSN Application Form 21-22vandiaz89No ratings yet

- Imus Campus Cavite Civic Center Palico IV, Imus, CaviteDocument13 pagesImus Campus Cavite Civic Center Palico IV, Imus, CaviterueNo ratings yet

- Personal Data Protection Bill 2020 UpdatedDocument32 pagesPersonal Data Protection Bill 2020 UpdatedZain BabaNo ratings yet

- Death Claim Procedure: Documents RequiredDocument7 pagesDeath Claim Procedure: Documents RequiredMilanie NoriegaNo ratings yet

- The Discourse of Control and Consent Over Data in EU Data Protection Law and BeyondDocument16 pagesThe Discourse of Control and Consent Over Data in EU Data Protection Law and BeyondHoover InstitutionNo ratings yet

- EUSurvey - SurveyDocument9 pagesEUSurvey - SurveyadrianmaiarotaNo ratings yet

- DIN-66399Document2 pagesDIN-66399Rina RachmanNo ratings yet

- Online Privac Y: Essay by Dak Al Bab AminaDocument2 pagesOnline Privac Y: Essay by Dak Al Bab AminaMina DakNo ratings yet

- Data Privacy AgreementDocument3 pagesData Privacy Agreementkara albueraNo ratings yet

- EDUC 270 OutlineDocument15 pagesEDUC 270 OutlineIsaiah Paul-ColeNo ratings yet

- Product - Retail CASA - Privacy Policy v2 - 08jun2021Document6 pagesProduct - Retail CASA - Privacy Policy v2 - 08jun2021SorryNo ratings yet

- Citi Private Bank Emea Privacy Statement Aw WebDocument7 pagesCiti Private Bank Emea Privacy Statement Aw Webandres.rafael.carrenoNo ratings yet

- Nepal GEA 2 - 0 Security ArchitectureDocument115 pagesNepal GEA 2 - 0 Security ArchitecturePrawesh AcharyaNo ratings yet

- Union Bank - Recruitment Consent Form PDFDocument1 pageUnion Bank - Recruitment Consent Form PDFkelvinNo ratings yet

- SLU Data Privacy Policy Consent FormDocument6 pagesSLU Data Privacy Policy Consent FormBudong BernalNo ratings yet

- Rcs Privacy PolicyDocument2 pagesRcs Privacy PolicyAng MattaNo ratings yet

- STATISTIKDocument18 pagesSTATISTIKnurmawati abdullahNo ratings yet

- Disposable Email For A Social Media (Facebook, Etc... )Document5 pagesDisposable Email For A Social Media (Facebook, Etc... )coseri5No ratings yet

- It Group 2 Reporting FinalDocument51 pagesIt Group 2 Reporting FinalShaira CogollodoNo ratings yet

- Father Saturnino Urios University College Guidance Center Butuan City Student Individual Inventory FormDocument4 pagesFather Saturnino Urios University College Guidance Center Butuan City Student Individual Inventory FormKuro HanabusaNo ratings yet

- OCA Circular No. 53 2023Document2 pagesOCA Circular No. 53 2023Katheleen Celiz del SocorroNo ratings yet

- The Importance of Comuters in The 21st CenturyDocument13 pagesThe Importance of Comuters in The 21st Centuryihate websitesNo ratings yet