Professional Documents

Culture Documents

Foreign Experience of Organizing Remote Banking Services

Foreign Experience of Organizing Remote Banking Services

Uploaded by

Academic JournalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Experience of Organizing Remote Banking Services

Foreign Experience of Organizing Remote Banking Services

Uploaded by

Academic JournalCopyright:

Available Formats

European Multidisciplinary Journal of

Modern Science

EUROPEAN MULTIDISCIPLINARY JOURNAL OF MODERN SCIENCE

MS ISSN 2750-6274 https://emjms.academicjournal.io Volume: 16 | Mar-2023

Foreign Experience of Organizing Remote Banking Services

Nozimov Eldor Anvarovich

Assistant of Samarkand Institute of Economics and Service, eldornozimov@gmail.com

Abstract: In this article, one of the important directions of the development of the banking sector

in modern conditions - the foreign experience of the remote service system for bank customers is

considered. Also, a set of specific services is analyzed, with the help of which bank customers can carry

out various banking operations remotely, and remote banking services in the USA, European countries,

and Russia, which are leaders in this direction, are studied.

Keywords: banking sector, remote banking, customer banking, internet banking, SMS banking,

and mobile banking.

In today's digital economy, as a result of technological development, great positive changes

are taking place in the environment of business, banking and financial system. In the market

of banking services, the application and use of Internet and mobile technologies are causing

unprecedented changes in the history of banking services, and the development of remote

banking services allows providing additional convenience to customers.

Also, the increasing number of financial services in the banking system of developed

countries has increased the importance of remote banking, as a result of which various

options of banking services are offered online by major banks around the world.

In recent years, a number of measures aimed at the development of the banking system,

especially the widespread introduction of modern IT technologies into the sector, and the

acceleration of digitization processes, have been taken in our republic. It's not for nothing,

because every bank will be able to be competitive not only in the domestic market, but also in

the foreign market, if they start their activities on the basis of modern technologies.

In the conditions of today's pandemic, the quality and speed of remote service of banks on a

global scale, as well as in our country, is becoming more important than ever. After all, the

increase in service processes by them is directly related to the quality of remote service. This,

in turn, sets the tasks of improving the existing infrastructure, identifying problems in this

regard, paying special attention to the quality of personnel training, studying foreign

experience and introducing the necessary ones into the banking sector of our country.

Remote banking is sometimes called electronic banking, including Internet banking, mobile

banking, WAP banking, SMS, etc. Let's take a closer look at each direction and highlight its

features.

Remote service channels. Service delivery channels are called the first criteria for

differentiating remote banking systems. Here, the technological and functional characteristics

of each channel are clearly indicated. Banks have the following types of channels for

providing remote services:

by phone;

via the Internet;

Copyright (c) 2023 Author (s). This is an open-access article

distributed under the terms of Creative Commons Attribution Volume 16, Mar -2023

License (CC BY). To view a copy of this license, visit

https://creativecommons.org/licenses/by/4.0/

Page: 10

EUROPEAN MULTIDISCIPLINARY JOURNAL OF MODERN SCIENCE ISSN: 2750-6274

Special self-service devices.

Telephone banking service. First of all, telephone communication appeared, and it was a

very common channel before the advent of modern technologies for the development of the

Internet. Customers could get any account information, as well as product advice, with just a

phone call to the bank. A similar mechanism has survived today, although it has been greatly

reduced by the introduction of the Internet communication channel, because it was too

expensive. Banks maintained a large staff of call center staff to provide their services over the

phone, but they were not charged a commission, which created significant costs for their

operations.

Payment and information terminals and ATMs. As another channel for providing remote

banking services, experts single out self-service mechanisms, such as payment terminals,

ATMs, etc. In the early stages of development, this type of remote banking services required

high investments from the bank, the production and purchase of appropriate equipment, the

creation of a technical base for use, the development of the entire infrastructure and the

development of logistics for assembling such devices. Nevertheless, ATMs have appeared

everywhere, and today major banks have extensive networks of these machines for the

convenience of their customers. The list of provided services is also expanding, the security

of use is improving, and the most important advantage over other remote banking systems is

that ATMs allow the customer to provide the necessary cash.

Internet banking. Today, one of the most promising and rapidly developing channels for

providing banking services is the Internet. The development of various information

technologies has enabled banks to provide their customers with not only information and

consulting services, but also active operations such as a large number of customer requests,

payments and money transfers. They are generated through a client's PC or mobile phone

with Internet access.

"Client-bank". The ability to provide remote banking services through a personal computer is

called "Client-Bank". Often, the bank helps its customers to install and use such systems,

which increases the level of service in the bank. This system is usually divided into two

types:

Classic Bank-client, in which a special program is installed on the bank client's personal

computer. With it, all customer information is stored on the computer: payment orders,

account statements, etc.

Internet client — interaction with the bank directly through the Internet through a

browser. In this case, all information about the user's actions is stored on the bank's

servers.

Remote banking services in countries around the world. For the first time, remote banking

services appeared in the United States of America, which is quite fair, the banking system of

this country was one of the first, and today it is the largest and most reliable in the world.

Another reason for the emergence and development of Internet banking in America is the

restriction that existed in the mid-1990s of the last century in opening branches of their

banks. Thus, in 1995, the first bank to provide its services via the Internet was opened -

Security First Network Bank.

In remote banking services, the United States is the leading country in the modern world. The

development of all areas of information technology serves this. Today, almost every second

household in the US has a computer, let alone a telephone.

At the moment, almost 90% of American banks serve their customers remotely. They offer a

wide variety of services, including currency exchange, lending, the ability to open and insure

Copyright (c) 2023 Author (s). This is an open-access article

distributed under the terms of Creative Commons Attribution Volume 16, Mar -2023

License (CC BY). To view a copy of this license, visit

https://creativecommons.org/licenses/by/4.0/

Page: 11

EUROPEAN MULTIDISCIPLINARY JOURNAL OF MODERN SCIENCE ISSN: 2750-6274

deposits, monitor the movement of funds in accounts, and participate in stock exchange

trading.

The main feature of the operation of remote banking systems in the United States is that the

client receives most of the provided services for free, and only for some of them the bank

receives a very small commission. American banks also pride themselves on the fact that

their security system is one of the most reliable when using Internet banking.

After America, remote banking services became widespread in Europe. Most of the types of

transactions presented and the remote banking system itself were similar to the American

model, but some innovations brought by European internet banking should be noted. There

was an opportunity to pay for utilities and other mandatory services, as well as to plan their

financial expenses.

The main trends in the development of remote banking services in Europe in order to reduce

costs and increase the speed of services provided are:

implementing multi-channel strategies for serving individuals;

outsourcing remote customer service systems;

creation of joint systems of remote service by different banks;

improving the quality of services and their safety;

Comprehensive service provision by increasing the types of available services.

Remote banking services in modern Russia. Compared to the USA and Europe, the

development of remote banking services in Russia lags far behind. There are objective

reasons for this, for example, do not forget that these systems have developed relatively

recently in Russia and show good growth rates.

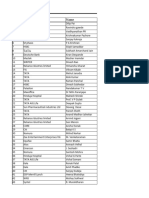

Analytical agency Markswebb Rank&Report presented the results of research conducted

among users of remote banking systems in 2021. The study was based on a survey of more

than three thousand Russians, which was then related to the total population of the country

41.6 million Russians perform at least one active operation on the Internet every month;

39.4 million active users of mobile and SMS banking;

35.4 million people use internet banking services, 70% of them are Sberbank Online

customers;

29 million people make payments by bank card on the Internet;

17.5 million e-wallet owners.

Not all indicators are given here, but the trend is clear. People in Russia want to further

develop remote banking systems, and they are ready for it. They are adopting modern

technologies, increasing their economic literacy and increasing the level of trust in banks,

which is very important when conducting any financial transactions remotely.

It should be noted that information flows are rapidly circulating in the world, and it is

effective to use the experience of developed countries and the opinions of foreign and local

scientists to improve remote banking services.

In order to develop remote banking services, first of all, it is necessary to identify the

problems in the development of these services in the banking system of Uzbekistan and take

measures to eliminate them. In the future, further development of the banking system will

require innovations in the field of digital banking, automatic data analysis and improvement

of remote service systems.

Copyright (c) 2023 Author (s). This is an open-access article

distributed under the terms of Creative Commons Attribution Volume 16, Mar -2023

License (CC BY). To view a copy of this license, visit

https://creativecommons.org/licenses/by/4.0/

Page: 12

EUROPEAN MULTIDISCIPLINARY JOURNAL OF MODERN SCIENCE ISSN: 2750-6274

In particular, in the concept of the Development Strategy of the Republic of Uzbekistan until

2035, the development of the payment system in Uzbekistan is divided into two periods, the

first period includes the period until 2020 and includes the creation of applications that

provide banking services, single payment for customers tasks such as connecting to the

platform, establishing a customer support service on this payment platform, introducing

cardrider and mobile POS terminals into the payment system, conducting R2R calculations

have been defined. The second period includes the period up to 2025 and includes the portal

for accounting and sales of goods, transaction management system, mobile banking

cryptographic identifiers, integration of various services into digital platforms of banks,

introduction of B2B, B2C quick transfers, open software programming interface, banking it is

envisaged to create opportunities for providing banking products and services based on

remote identification, artificial intelligence and automated machine learning.

In the conditions where traditional banking services are being replaced by digital banking

services in Uzbekistan, the development of payment systems based on mobile technologies

and digital banks in the country's payment system is of great importance. As a result, it will

lead to fewer visits to banks by bank customers, the possibility of remote banking services;

lower banking costs and the transformation of banking departments.

Reference

1. Decree of the President of the Republic of Uzbekistan dated May 12, 2020 No. PF-5992

"On the strategy of reforming the banking system of the Republic of Uzbekistan for 2020-

2025". www.lex.uz.

2. Nozimov, E. A., & Kholmirzayev, E. B. (2022). MAIN PROBLEMS OF THE

BANKING SYSTEM OF THE REPUBLIC OF UZBEKISTAN. Miasto Przyszłości, 24,

143-145.

3. Koshcheev V.A., Tsvetkov Yu.A. Digital transformation of the banking sector.

https://cyberleninka.ru/article/n/tsifrovaya-transformatsiya-bankovskogo-sektora

4. https://review.uz/oz/post/diqamli-iktisodiyot-mamlakatimiz-taraqqiyoti-garovidir

5. Anvarovich, N. E. (2022). Problems of Growth in Investment Activity of Banks of

Uzbekistan. EUROPEAN JOURNAL OF INNOVATION IN NONFORMAL

EDUCATION, 2(2), 349-352.

6. Mamadiyarov Z.T. Analysis of factors affecting the use of remote banking services in

commercial banks // "Economics and Education" scientific journal. - Tashkent, 2019. -

No. 1, January-February. -71-77 p.

7. https://bankir.ru/avtori/1659981/ Dmitriy Miroshkinov is the manager of the company

"Bank's soft business".

8. Nozimov, E. A. (2022). DEVELOPMENT OF BLOCKCHAIN TECHNOLOGIES IN

COMMERCIAL BANKS. In European research forum (pp. 67-71).

9. Anvarovich, N. E. (2021). Evolutionary Development of Distance Banking Services in

the Digital Economy. International Journal on Economics, Finance and Sustainable

Development, 3(3), 78-84.

10. Analyticheskoe agentstvo MarksWebb Rank & Report: Official site [Electronic resource]

— Electronic data — http://markswebb.ru/.

Copyright (c) 2023 Author (s). This is an open-access article

distributed under the terms of Creative Commons Attribution Volume 16, Mar -2023

License (CC BY). To view a copy of this license, visit

https://creativecommons.org/licenses/by/4.0/

Page: 13

You might also like

- OUAF - Application Framework For CCB and RMB - Overview Part 1 of 3Document93 pagesOUAF - Application Framework For CCB and RMB - Overview Part 1 of 3chinna100% (3)

- E-Banking in MoroccoDocument21 pagesE-Banking in Moroccopse100% (1)

- Executive Summary of e BankingDocument24 pagesExecutive Summary of e BankingKiranShetty0% (1)

- Foreign Experience of Organizing Remote Banking ServicesDocument4 pagesForeign Experience of Organizing Remote Banking ServicesAcademic JournalNo ratings yet

- The Main Directions of Remote Banking ServicesDocument3 pagesThe Main Directions of Remote Banking ServicesOpen Access JournalNo ratings yet

- E BankingDocument74 pagesE BankingKritika Shiva100% (2)

- KKNDocument5 pagesKKNkhushbushaleshNo ratings yet

- E-Banking in MoroccoDocument14 pagesE-Banking in MoroccopseNo ratings yet

- Risks of Digital BankingDocument3 pagesRisks of Digital BankingAcademic JournalNo ratings yet

- Project On E BankingDocument57 pagesProject On E BankingPartik Bansal100% (1)

- Development And Application Of Mobile Banking Concept: ТEME, г. XLI, бр. 2, априлDocument3 pagesDevelopment And Application Of Mobile Banking Concept: ТEME, г. XLI, бр. 2, априлKimberly ManradgeNo ratings yet

- An Analysis of Opportunities and Risk of E-Banking in Rural AreasDocument12 pagesAn Analysis of Opportunities and Risk of E-Banking in Rural AreasHemlatas RangoliNo ratings yet

- Internet Banking Adoption in ADocument11 pagesInternet Banking Adoption in AFeral DsouzaNo ratings yet

- A B C D of E-BankingDocument75 pagesA B C D of E-Bankinglove tannaNo ratings yet

- Mobile Banking SekDocument141 pagesMobile Banking SekLoveday OsiagorNo ratings yet

- Behavioral Factors Tend To Use The Internet Banking Services Case Study: System (SABA), The Melli Bank, Iran, ArdabilDocument7 pagesBehavioral Factors Tend To Use The Internet Banking Services Case Study: System (SABA), The Melli Bank, Iran, ArdabilHarshita DwivediNo ratings yet

- E BankingDocument3 pagesE Bankingsindhuja singhNo ratings yet

- IJCRT2105956Document5 pagesIJCRT2105956Suny PaswanNo ratings yet

- A Study of Customer Perception Towards E-Banking Services Offered in Banking Sector (Accf)Document56 pagesA Study of Customer Perception Towards E-Banking Services Offered in Banking Sector (Accf)Saurabh Chawla100% (1)

- Axisbnk OnlineDocument27 pagesAxisbnk OnlineAjmal KhanNo ratings yet

- 10 Chapter - 1Document22 pages10 Chapter - 1suryavanshimanish034No ratings yet

- E BankingDocument76 pagesE BankingPramod PNo ratings yet

- Project FileDocument5 pagesProject FileRavi JadonNo ratings yet

- Kalpana Bisen Paper On Dress CodeDocument19 pagesKalpana Bisen Paper On Dress CodeKalpana BisenNo ratings yet

- Online BankingDocument10 pagesOnline Bankingamir_saheedNo ratings yet

- Online Dimple 41 PagesDocument42 pagesOnline Dimple 41 PagesAbhishek ThakurNo ratings yet

- An Analysis of Factors Affecting Mobile Banking AdoptionDocument28 pagesAn Analysis of Factors Affecting Mobile Banking Adoptionpiyumi sewwandiNo ratings yet

- Project Report ON "Consumer Behaviour Towards E-Banking in Private Sector BanksDocument23 pagesProject Report ON "Consumer Behaviour Towards E-Banking in Private Sector BanksRAHULNo ratings yet

- Driga IsacDocument10 pagesDriga IsacSahil AcharyaNo ratings yet

- Synopsis 1Document11 pagesSynopsis 1rani adhauNo ratings yet

- INTRODUCTION of ProjectDocument16 pagesINTRODUCTION of ProjectSiddhi mahadikNo ratings yet

- Ashutosh Project (PR)Document56 pagesAshutosh Project (PR)Rohit MandyalNo ratings yet

- The Impact of E Banking On The Use of Banking Services and Customers SatisfactionDocument4 pagesThe Impact of E Banking On The Use of Banking Services and Customers SatisfactionEditor IJTSRDNo ratings yet

- Project Report Infinite 11155Document69 pagesProject Report Infinite 11155jaueshmahale1234No ratings yet

- The Role and Importance of Internet Banking in The Modern Banking SystemDocument6 pagesThe Role and Importance of Internet Banking in The Modern Banking SystemResearch ParkNo ratings yet

- Dessert at Ion FinalDocument5 pagesDessert at Ion FinalRizwan NasirNo ratings yet

- Risk ManagementDocument21 pagesRisk ManagementNgọc NgọcNo ratings yet

- Mobile Banking in BangladeshDocument35 pagesMobile Banking in BangladeshAnupam SinghNo ratings yet

- Online Banking:: Definition of Electronic BankingDocument3 pagesOnline Banking:: Definition of Electronic BankingTuqa Al HussainiNo ratings yet

- Electronic Banking: Tele-Banking: Tele-Banking Service Is Provided by Phone. To Access An Account It IsDocument10 pagesElectronic Banking: Tele-Banking: Tele-Banking Service Is Provided by Phone. To Access An Account It IsFahimKhanDeepNo ratings yet

- 692 3415 2 PBDocument8 pages692 3415 2 PBFarah AinNo ratings yet

- Mod 1 Mbfs PDF NewDocument22 pagesMod 1 Mbfs PDF NewWalidahmad AlamNo ratings yet

- Chapter 1.editedDocument15 pagesChapter 1.editedamrozia mazharNo ratings yet

- E BbankingDocument10 pagesE Bbankingraqa1441No ratings yet

- Impact of Information Technology On Banking Industry: AbhinavDocument4 pagesImpact of Information Technology On Banking Industry: AbhinavAmruta RaskarNo ratings yet

- Impact of Internet On Banking SectorDocument13 pagesImpact of Internet On Banking SectorInamul HaqueNo ratings yet

- Full PaperDocument11 pagesFull Paperasra_ahmedNo ratings yet

- Financial Markets and Services Cia Iii: Topic: Modern Channels in Banking ServicesDocument3 pagesFinancial Markets and Services Cia Iii: Topic: Modern Channels in Banking ServicesValencia DonsonNo ratings yet

- e Banking ReportDocument40 pagese Banking Reportleeshee351No ratings yet

- Komal Gajula 12Document71 pagesKomal Gajula 12Gayatri ChiliveriNo ratings yet

- E BankingDocument23 pagesE Bankingimnagin100% (1)

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- The Fabric of Mobile Services: Software Paradigms and Business DemandsFrom EverandThe Fabric of Mobile Services: Software Paradigms and Business DemandsNo ratings yet

- Impact of E-Commerce On Supply Chain ManagementFrom EverandImpact of E-Commerce On Supply Chain ManagementRating: 3.5 out of 5 stars3.5/5 (3)

- Usability Design for Location Based Mobile Services: in Wireless Metropolitan NetworksFrom EverandUsability Design for Location Based Mobile Services: in Wireless Metropolitan NetworksNo ratings yet

- Beyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3From EverandBeyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3No ratings yet

- Fintech: Innovations, Challenges, and Opportunities in the Digital EraFrom EverandFintech: Innovations, Challenges, and Opportunities in the Digital EraNo ratings yet

- Results of Quality of Life Indicators in Patients With OsteoarthritisDocument4 pagesResults of Quality of Life Indicators in Patients With OsteoarthritisAcademic JournalNo ratings yet

- The Usаge of Vаrious Interаctive Methods in TeаchingDocument6 pagesThe Usаge of Vаrious Interаctive Methods in TeаchingAcademic JournalNo ratings yet

- Pedagogical Skills of The Tennis Coach in Effective Organization of Tennis Sports and Health Promotion Activities To Strengthen Women's Social Activity and Health, Which Is Its BasisDocument4 pagesPedagogical Skills of The Tennis Coach in Effective Organization of Tennis Sports and Health Promotion Activities To Strengthen Women's Social Activity and Health, Which Is Its BasisAcademic JournalNo ratings yet

- Psychology Empirical Analysis of The Relationship Between Learning Motives and Attention Qualities Formed in StudentsDocument5 pagesPsychology Empirical Analysis of The Relationship Between Learning Motives and Attention Qualities Formed in StudentsAcademic JournalNo ratings yet

- Preliminary Information About Dragonflies Fauna Distributed in Kashkadarya RegionDocument6 pagesPreliminary Information About Dragonflies Fauna Distributed in Kashkadarya RegionAcademic JournalNo ratings yet

- Faoliyat Xavfsizligini Ta'minlash Vositalari XususidaDocument3 pagesFaoliyat Xavfsizligini Ta'minlash Vositalari XususidaAcademic JournalNo ratings yet

- Unsatisfactory Results After Tympanoplasty Surgery in Patients With Chronic Purulent Otitis MediaDocument4 pagesUnsatisfactory Results After Tympanoplasty Surgery in Patients With Chronic Purulent Otitis MediaAcademic JournalNo ratings yet

- Gender in The Education SystemDocument6 pagesGender in The Education SystemAcademic JournalNo ratings yet

- Welfare Schemes For Tribes in West Bengal (2011-2020)Document6 pagesWelfare Schemes For Tribes in West Bengal (2011-2020)Academic JournalNo ratings yet

- Crisis and Disintegration of The Nogai HordeDocument3 pagesCrisis and Disintegration of The Nogai HordeAcademic JournalNo ratings yet

- The Role of The Principles of International Environmental Law in The Implementation of Environmental Impact AssessmentDocument4 pagesThe Role of The Principles of International Environmental Law in The Implementation of Environmental Impact AssessmentAcademic JournalNo ratings yet

- Internal Affairs Bodies As Subjects of Tort Relations: Theoretical and Legal AnalysisDocument6 pagesInternal Affairs Bodies As Subjects of Tort Relations: Theoretical and Legal AnalysisAcademic JournalNo ratings yet

- Features of Teaching Probabilistic - Statistical ConseptsDocument5 pagesFeatures of Teaching Probabilistic - Statistical ConseptsAcademic JournalNo ratings yet

- Pleonasm As A Phenomenon of Speech RedundancyDocument4 pagesPleonasm As A Phenomenon of Speech RedundancyAcademic JournalNo ratings yet

- Social and Economic Importance of The Formation of Insurance RelationsDocument5 pagesSocial and Economic Importance of The Formation of Insurance RelationsAcademic JournalNo ratings yet

- Impact of Subsidy Removal On Supervision of Schools in NigeriaDocument6 pagesImpact of Subsidy Removal On Supervision of Schools in NigeriaAcademic JournalNo ratings yet

- Concept of Ibn Al-Arabi "Wahdat Ul-Wujud"Document5 pagesConcept of Ibn Al-Arabi "Wahdat Ul-Wujud"Academic JournalNo ratings yet

- A Contextual Analysis of Stylistic Convergences in J. Dryden's Drama "Aureng-Zebe"Document5 pagesA Contextual Analysis of Stylistic Convergences in J. Dryden's Drama "Aureng-Zebe"Academic JournalNo ratings yet

- Linguistic and Specific MetaphorsDocument3 pagesLinguistic and Specific MetaphorsAcademic JournalNo ratings yet

- Strengthening Access To Justice: Empowering Citizens and Businesses For Fairness and Effective Dispute ResolutionDocument10 pagesStrengthening Access To Justice: Empowering Citizens and Businesses For Fairness and Effective Dispute ResolutionAcademic JournalNo ratings yet

- To The Study of Studged Painted Ceramics of The Late Bronze and Early Iron Age in Central AsiaDocument5 pagesTo The Study of Studged Painted Ceramics of The Late Bronze and Early Iron Age in Central AsiaAcademic JournalNo ratings yet

- Acquiring German Language Via Making A DialogueDocument3 pagesAcquiring German Language Via Making A DialogueAcademic JournalNo ratings yet

- Translation Strategies For Pun in William Shakespeare's "King Lear"Document5 pagesTranslation Strategies For Pun in William Shakespeare's "King Lear"Academic JournalNo ratings yet

- Modern Issues of Simultaneous Translation: Theory and PracticeDocument3 pagesModern Issues of Simultaneous Translation: Theory and PracticeAcademic JournalNo ratings yet

- Similarity and Originality of Works About The Travels of English Enlightener Writers and Uzbek Jadid WritersDocument7 pagesSimilarity and Originality of Works About The Travels of English Enlightener Writers and Uzbek Jadid WritersAcademic JournalNo ratings yet

- Principles of Teaching Foreign LanguagesDocument4 pagesPrinciples of Teaching Foreign LanguagesAcademic JournalNo ratings yet

- Expression of Some Phraseological Units of Zoonyms in The Uzbek and German LanguagesDocument6 pagesExpression of Some Phraseological Units of Zoonyms in The Uzbek and German LanguagesAcademic JournalNo ratings yet

- We Select A Variety For Our Republic From Non-Traditional Types of Cabbage To Obtain A High Yield When Planting Kohlrabi Cabbage in ReplantingDocument4 pagesWe Select A Variety For Our Republic From Non-Traditional Types of Cabbage To Obtain A High Yield When Planting Kohlrabi Cabbage in ReplantingAcademic JournalNo ratings yet

- Development of Sports Infrastructure in Physical Education and SportsDocument7 pagesDevelopment of Sports Infrastructure in Physical Education and SportsAcademic JournalNo ratings yet

- MORPHOFUNCTIONAL CHANGES IN THE CORNEA AFTER LONG-TERM WEARING OF CONTACT LENSES, CONTRIBUTING TO THE DEVELOPMENT OF ARTIFICIAL (SECONDARY) DRY EYE SYNDROME (Literature Review)Document6 pagesMORPHOFUNCTIONAL CHANGES IN THE CORNEA AFTER LONG-TERM WEARING OF CONTACT LENSES, CONTRIBUTING TO THE DEVELOPMENT OF ARTIFICIAL (SECONDARY) DRY EYE SYNDROME (Literature Review)Academic JournalNo ratings yet

- Declaration of Original WorkDocument7 pagesDeclaration of Original WorkmoinulmithuNo ratings yet

- A10 Sce70164 enDocument2 pagesA10 Sce70164 enAlexandre GiovaneliNo ratings yet

- BlueSpec by ExampleDocument240 pagesBlueSpec by Examplefannan1234No ratings yet

- FUJITSU Workstation CELSIUS W5010: Data SheetDocument9 pagesFUJITSU Workstation CELSIUS W5010: Data SheetMostafa ShannaNo ratings yet

- Cybercrime: Threats and Security: PPT by Avni Agrawal From Grade 9-ADocument10 pagesCybercrime: Threats and Security: PPT by Avni Agrawal From Grade 9-AAabhaş Agrawał100% (1)

- VPTXTDocument44 pagesVPTXTNir Lad100% (1)

- Projects For Teaching Computer Organization and ArchitectureDocument9 pagesProjects For Teaching Computer Organization and ArchitectureWilliamArthur123No ratings yet

- Building Network: Solutions GuideDocument8 pagesBuilding Network: Solutions GuideElizabeth RazoNo ratings yet

- TCP/IP Chapters 9-11 ReviewDocument18 pagesTCP/IP Chapters 9-11 ReviewemirstukovNo ratings yet

- Chapter 12Document24 pagesChapter 12arunkorathNo ratings yet

- Class 5 - Timing Constraints - 2019Document31 pagesClass 5 - Timing Constraints - 2019Nat AshaNo ratings yet

- El Etihad Steel FactoryDocument9 pagesEl Etihad Steel FactoryudhayNo ratings yet

- Sensitivity: Internal & RestrictedDocument4 pagesSensitivity: Internal & RestrictedNiharika BesthaNo ratings yet

- Java Programming II - Lab Report (Hari Rijal)Document28 pagesJava Programming II - Lab Report (Hari Rijal)DeviBhaktaDevkotaNo ratings yet

- SANDEEP Business Card 6.02..2012Document12 pagesSANDEEP Business Card 6.02..2012Nidhi ShahNo ratings yet

- Help Me Tuning This Wait Event - Log File SyncDocument12 pagesHelp Me Tuning This Wait Event - Log File SyncOsmanNo ratings yet

- Civil3D TrainingDocument58 pagesCivil3D TrainingAnkit Bhatt100% (2)

- 42,0410,2012Document85 pages42,0410,2012Bouzekri ARIOUANo ratings yet

- IBM SPSS Modeler 14.2 Scripting and Automation GuideDocument312 pagesIBM SPSS Modeler 14.2 Scripting and Automation GuideAdvise FBNo ratings yet

- Outlook 2003 Part IDocument97 pagesOutlook 2003 Part IoceanpinkNo ratings yet

- Unit No. 8Document24 pagesUnit No. 8vishal phuleNo ratings yet

- How Singapore Is Paving The Way For Global Smart Cities: Sumeet Puri VP, Systems Engineering, InternationalDocument25 pagesHow Singapore Is Paving The Way For Global Smart Cities: Sumeet Puri VP, Systems Engineering, InternationalГоша ЗемлянкоNo ratings yet

- 3RDQ - Week 8 G10Document3 pages3RDQ - Week 8 G10Tabangao NhsNo ratings yet

- IOT in APACDocument30 pagesIOT in APACLim Siew LingNo ratings yet

- Itwr 6355 - Kob1Document3 pagesItwr 6355 - Kob1RaviNo ratings yet

- Being An Electrical EngineerDocument2 pagesBeing An Electrical Engineeryasir hafeezNo ratings yet

- HP Pavilion Dv7 - Quanta Up6 7 Jones Cujo 2.0 Dis - Rev 1.0 26out2009Document42 pagesHP Pavilion Dv7 - Quanta Up6 7 Jones Cujo 2.0 Dis - Rev 1.0 26out2009Hans PeterNo ratings yet

- InfoDocument5 pagesInfoAndrei ZahariaNo ratings yet

- nTAP FullDuplex WPDocument5 pagesnTAP FullDuplex WPElwell Paul Rebacca PacificoNo ratings yet