Professional Documents

Culture Documents

Scs 4

Scs 4

Uploaded by

LokiOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document• Instructions

• Objectives

• Study Tips

• Overview

• Accounting Applications

• Class Interaction and Discussion

• Optional Small Group Extension Activity

• Optional Internet Exploration and Research Activity

• Summary Questions

Instructions:

1. Print and read the following case study.

2. On your own, complete the Accounting Application questions.

3. As a class, complete the Class Interaction and Discussion questions.

4. Optional: Complete the Small Group Extension Activity and Internet

Exploration and Research Activity.

5. Complete the Summary Questions.

Objectives:

After completing the following case study, you will be able to:

Describe several security procedures used by businesses to discourage employee

theft

Compare the effect of employee theft on net income

Discuss different examples of employee theft

Identify four internal cash controls described in the text

Study Tips:

Complete this case study after Chapter 11 or Chapter 29, Glencoe Accounting, First-Year

Course. Approximate time to complete: 45 minutes.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 1

Overview:

The following information was obtained from “The Heavy Burden of Light Fingers,”

BusinessWeek (December 16, 1996), by Barbara Hetzer.

One day while his bookkeeper was at lunch, Ron Knight, owner of a construction

business in Gilbert, Arizona, happened to open the mail. Usually only the bookkeeper

reviewed bank statements, but on this afternoon, Knight discovered a cancelled check

made out to the bookkeeper for $1,000. After some exploration, Knight learned that

during the past six months, the bookkeeper had taken a total of $20,000.

Most experts believe that while all businesses have some problems with employee theft,

small businesses are more affected by it. A fraud examiners’ study found that small

businesses suffered a median loss of $120,000 per incident, but the loss for companies

with 10,000 or more employees was reported to be $126,000. As you can imagine,

$120,000 is much more important to smaller businesses than $126,000 is to companies

with 10,000 employees. Therefore, the loss to smaller businesses is more devastating.

Small businesses also run a greater risk for employee theft because of the high level of

trust that exists between owners and employees. Chris Daniel, who owns a small

advertising firm in Charlotte, North Carolina, treated employees like family until his

bookkeeper allegedly took $122,000.

Small businesses can defend themselves. By adding a few security procedures, they can

discourage employee theft or catch it early. The following are safeguards against theft:

1. Limit the number of persons who handle cash.

2. Separate accounting tasks to decrease the likelihood of theft. The person who

handles cash receipts and payments should not keep the accounting records that

show amounts received or paid out.

3. Insure or bond employees who handle cash.

4. Use a safe or a cash register.

5. Deposit cash receipts daily.

6. Use checks to make as many cash payments as possible.

7. Prepare a written code of ethics. Owners should spell out which uses of company

resources they view as theft.

8. Screen prospective employees very thoroughly. Use court records and credit

references. This can reduce fraud losses by as much as 30%.

9. Examine the company’s bank statements.

10. Motivate employees by tying a portion of compensation to a reduction in

shrinkage (company losses due to theft, paperwork errors, and so on).

Copyright © Glencoe/McGraw-Hill. All rights reserved. 2

Accounting Applications:

Instructions: Now that you have reviewed the case study above, answer the following

questions on your own.

Consider the following scenario. Richard, A-1 Rental’s bookkeeper, had complete control

of cash. This past year, he misrepresented the expense of building maintenance by $250

per month and, by explaining to the owner that the maintenance company preferred to be

paid in cash, cashed the maintenance fee check, keeping the extra $250. Over the course

of the year he accumulated $3,000 in cash.

Revenue for this year ended December 31 was $85,674 in fees.

Expenses were recorded as:

Salaries $45,000

Advertising 12,000

Maintenance 9,000

Rent 14,400

Utilities 1,500

1. Prepare an income statement using the amounts given.

Copyright © Glencoe/McGraw-Hill. All rights reserved. 3

2. Prepare another income statement that reflects the true expenses for the year.

3. Compare net incomes. What is the difference in net income?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

4. Richard also often takes office supplies for his use at home. The cost of a box of

pens is $15. Over the course of one month, the company uses 2.5 boxes of pens.

Richard takes a box home per month. What does this cost the company in a year?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 4

Class Interaction and Discussion:

Instructions: Read the following question. As a class, discuss your responses.

Discuss examples of employee theft.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Optional Small Group Extension Activity:

Instructions: Break into small groups of three or four students. Discuss your answers to

the following.

Imagine that you are the owners of a small business. After choosing a

small business, write the part of your company’s code of ethics that

describes which uses of company resources you would view as theft.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 5

Optional Internet Exploration and Research Activity:

Instructions: Using your favorite search engine, research the following activity.

Find two articles about employee theft written in the past five years. They

can be newspaper or magazine articles. You could use a newspaper or

magazine Web site; e.g., BusinessWeek’s site at www.businessweek.com

or Entrepeneur’s site at www.entrepeneur.com. Write a brief report giving

the title, author, publisher, and date of each article.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 6

Summary Questions:

1. Describe the purpose of cash controls.

__________________________________________________________________

__________________________________________________________________

2. List four internal cash controls.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

Copyright © Glencoe/McGraw-Hill. All rights reserved. 7

You might also like

- Package 1 (LT 1 - 6) Includes TutorialsDocument102 pagesPackage 1 (LT 1 - 6) Includes TutorialsjacechanNo ratings yet

- Ch. 8 Financing A BusinessDocument6 pagesCh. 8 Financing A BusinessHANNAH GODBEHERE100% (1)

- HEALTH Teaching PlanDocument4 pagesHEALTH Teaching PlanChippy Nova50% (2)

- Fabm1 Module 6Document20 pagesFabm1 Module 6Randy Magbudhi100% (4)

- Chapter 2 Problems and SolutionDocument19 pagesChapter 2 Problems and SolutionSaidurRahaman100% (1)

- Chapter 11 Balance SheetDocument12 pagesChapter 11 Balance SheetSha HussainNo ratings yet

- Transactions For The Hartman Company For The Month of NovemberDocument4 pagesTransactions For The Hartman Company For The Month of NovemberthunyanNo ratings yet

- 4.1 - Exam QuestionsDocument2 pages4.1 - Exam QuestionsSneha HiraniNo ratings yet

- 2019 June 03 Chapter 2 Problems and SolutionDocument23 pages2019 June 03 Chapter 2 Problems and SolutionZisanNo ratings yet

- Accounting PrelimDocument5 pagesAccounting PrelimAliyah Monique BenitezNo ratings yet

- FINANCIAL MANAGEMENT - New BookletDocument29 pagesFINANCIAL MANAGEMENT - New BookletElla JohnstonNo ratings yet

- Article: Lesson 42 Chapter-13 Accounts-Receivables Management Unit 5 Management of Working CapitalDocument37 pagesArticle: Lesson 42 Chapter-13 Accounts-Receivables Management Unit 5 Management of Working CapitalTakreem AliNo ratings yet

- BusinessPlan Coldwell BankerDocument38 pagesBusinessPlan Coldwell BankerDiana HerreraNo ratings yet

- Activity Sheet Entrepreneuship Module 8 2Document4 pagesActivity Sheet Entrepreneuship Module 8 2Eleah Melly TamayoNo ratings yet

- (Template) Lesson 1 - ActivityDocument4 pages(Template) Lesson 1 - ActivityarianeNo ratings yet

- FABM2 Supp - Mat 1 AquinoDocument11 pagesFABM2 Supp - Mat 1 AquinoryzajarabejoNo ratings yet

- Senior High School: Rules of Debit and CreditDocument19 pagesSenior High School: Rules of Debit and CreditIva Milli Ayson50% (2)

- SLHT Besr Q1 Week 910Document4 pagesSLHT Besr Q1 Week 910Ian OcheaNo ratings yet

- 1 Sitxfin004 Wa V92020Document8 pages1 Sitxfin004 Wa V92020Kamal Saini100% (1)

- Take Home TestDocument3 pagesTake Home TestRADHIKA VERMANo ratings yet

- P L Exercise ActivityDocument4 pagesP L Exercise ActivitysabinaNo ratings yet

- Module 3: Book of Accounts: UNIT 1: The JournalDocument10 pagesModule 3: Book of Accounts: UNIT 1: The Journallol u’re not harry stylesNo ratings yet

- Fastest Way BusinessDocument10 pagesFastest Way BusinessNikki NowakNo ratings yet

- TFD SoFi Worksheet V1-1Document2 pagesTFD SoFi Worksheet V1-1Andrei LeonteNo ratings yet

- Grade 10 - Accounting - Case StudyDocument2 pagesGrade 10 - Accounting - Case StudyJohn AssadNo ratings yet

- Scs 7Document6 pagesScs 7LokiNo ratings yet

- 10K Case Study - Understanding 10K Case StudyDocument5 pages10K Case Study - Understanding 10K Case StudyÄurora YangNo ratings yet

- Certificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisDocument19 pagesCertificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisGurvinder SinghNo ratings yet

- Besr W5-6Document4 pagesBesr W5-6Leinel Macutay MalazzabNo ratings yet

- Answer 1.: Straight Line DepreciationDocument11 pagesAnswer 1.: Straight Line DepreciationDanish ShaikhNo ratings yet

- Organization and Management LAS - Week 2Document4 pagesOrganization and Management LAS - Week 2Louie MunsayacNo ratings yet

- Fabm1 Quarter1 Module 6.2 Week 6Document22 pagesFabm1 Quarter1 Module 6.2 Week 6Danny BulacsoNo ratings yet

- Business Financing Opportunities - 08 - 2010Document22 pagesBusiness Financing Opportunities - 08 - 2010asdfasdfadfadsf1No ratings yet

- Correct The Mistakes: Final Test Name Teacher ProgrammeDocument3 pagesCorrect The Mistakes: Final Test Name Teacher ProgrammeData BaseNo ratings yet

- Abm 12 Fabm2 q1 Clas1 Elements of Sci v8 - Rhea Ann NavillaDocument13 pagesAbm 12 Fabm2 q1 Clas1 Elements of Sci v8 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Draft Fabm1 Module 5Document8 pagesDraft Fabm1 Module 5Abegail AlegreNo ratings yet

- Practice Questions 1 (AIS)Document8 pagesPractice Questions 1 (AIS)UroobaShiekhNo ratings yet

- EntrepreneurshipDocument12 pagesEntrepreneurshipjhonnyNo ratings yet

- Ethics in Accounting & The Business World: Mr. ValanzanoDocument14 pagesEthics in Accounting & The Business World: Mr. ValanzanoSahilNo ratings yet

- FABM2 Quarter 1 Module and WorksheetsDocument27 pagesFABM2 Quarter 1 Module and WorksheetsHeart polvos100% (1)

- 5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A PlanDocument6 pages5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A Planapi-245262597100% (1)

- ABM FABM1 AIRs LM Q3 W7) M7.1Document9 pagesABM FABM1 AIRs LM Q3 W7) M7.1MEDILEN O. BORRESNo ratings yet

- FABMDocument2 pagesFABMTinNo ratings yet

- BAM 127 Day 5 - TGDocument6 pagesBAM 127 Day 5 - TGPaulo BelenNo ratings yet

- Melc 7 Applied EconDocument6 pagesMelc 7 Applied EconCLARISE LAURELNo ratings yet

- Practice Questions 1Document9 pagesPractice Questions 1Ahsan IqbalNo ratings yet

- BSA1B Activity 1Document2 pagesBSA1B Activity 1ShorinNo ratings yet

- How To Perform An Accurate Physical Inventory Fac 10-2005Document103 pagesHow To Perform An Accurate Physical Inventory Fac 10-2005api-307368258No ratings yet

- All Product BplanDocument18 pagesAll Product BplansaurabhmanitNo ratings yet

- CHAPTERS 1& 2 Class ExeerciseDocument4 pagesCHAPTERS 1& 2 Class ExeerciseBigAsianPapiNo ratings yet

- Business Enterprise Module 2 - Fourth QuarterDocument3 pagesBusiness Enterprise Module 2 - Fourth QuarterBernadette Hernandez PatulayNo ratings yet

- Mid-Term Exam - AccountingDocument9 pagesMid-Term Exam - AccountingRuba MohamedNo ratings yet

- Account ReceivableDocument14 pagesAccount ReceivableMahdi ManNo ratings yet

- BA 1 Module Revised For FB Page Activties Extend Evaluate and Post Assessment - ProjectDocument7 pagesBA 1 Module Revised For FB Page Activties Extend Evaluate and Post Assessment - ProjectChicos tacos100% (1)

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument36 pagesFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (47)

- Exam 1 PDFDocument4 pagesExam 1 PDFFiraa'ool YusufNo ratings yet

- Exam 1 PDFDocument4 pagesExam 1 PDFFiraa'ool YusufNo ratings yet

- Accounting Principles I - Online: Chapters 3 & 4 - Exam - Part IIDocument7 pagesAccounting Principles I - Online: Chapters 3 & 4 - Exam - Part IILouie CraneNo ratings yet

- Summary of Peter Frampton & Mark Robilliard's The Joy of AccountingFrom EverandSummary of Peter Frampton & Mark Robilliard's The Joy of AccountingNo ratings yet

- Language Learning With Free PodcastsDocument3 pagesLanguage Learning With Free PodcastsLokiNo ratings yet

- Scs 3Document8 pagesScs 3LokiNo ratings yet

- Food - The GuardianDocument7 pagesFood - The GuardianLoki100% (1)

- Unmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018Document1 pageUnmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018LokiNo ratings yet

- Notes To The Financial Statements27Document1 pageNotes To The Financial Statements27LokiNo ratings yet

- Culture - The GuardianDocument8 pagesCulture - The GuardianLokiNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- 2019 Country Reports On Human Rights Practices - United States Department of StateDocument10 pages2019 Country Reports On Human Rights Practices - United States Department of StateLokiNo ratings yet

- Tax Assessments: Required Supplementary Information (Unaudited) 208Document1 pageTax Assessments: Required Supplementary Information (Unaudited) 208LokiNo ratings yet

- Tax Gap: Corporate Income Tax Liability For Tax Year 2016Document1 pageTax Gap: Corporate Income Tax Liability For Tax Year 2016LokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Largest Income Tax Expenditures As of September 30, 2019Document2 pagesLargest Income Tax Expenditures As of September 30, 2019LokiNo ratings yet

- Social Insurance: Social Security and MedicareDocument26 pagesSocial Insurance: Social Security and MedicareLokiNo ratings yet

- Sustainability of Fiscal PolicyDocument11 pagesSustainability of Fiscal PolicyLokiNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Note 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsDocument1 pageNote 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsLokiNo ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Deferred Maintenance and RepairsDocument1 pageDeferred Maintenance and RepairsLokiNo ratings yet

- Note 15. Insurance and Guarantee Program LiabilitiesDocument2 pagesNote 15. Insurance and Guarantee Program LiabilitiesLokiNo ratings yet

- Note 17. Collections and Refunds of Federal RevenueDocument3 pagesNote 17. Collections and Refunds of Federal RevenueLokiNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

- Note 13. Environmental and Disposal LiabilitiesDocument2 pagesNote 13. Environmental and Disposal LiabilitiesLokiNo ratings yet

- Notes To The Financial Statements14Document1 pageNotes To The Financial Statements14LokiNo ratings yet

- Notes To The Financial Statements18Document7 pagesNotes To The Financial Statements18LokiNo ratings yet

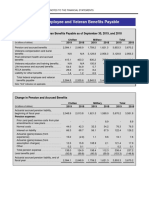

- Note 12. Federal Employee and Veteran Benefits PayableDocument10 pagesNote 12. Federal Employee and Veteran Benefits PayableLokiNo ratings yet

- Notes To The Financial Statements20Document6 pagesNotes To The Financial Statements20LokiNo ratings yet

- Notes To The Financial Statements16Document2 pagesNotes To The Financial Statements16LokiNo ratings yet

- Note 11. Federal Debt Securities Held by The Public and Accrued InterestDocument4 pagesNote 11. Federal Debt Securities Held by The Public and Accrued InterestLokiNo ratings yet

- Advance Expert Test 1Document2 pagesAdvance Expert Test 1Несс ШварцNo ratings yet

- Intro To Britain I Scotland - Devolution New - pptx2020 With AudioDocument32 pagesIntro To Britain I Scotland - Devolution New - pptx2020 With AudioVivien KovácsNo ratings yet

- ERP Implementation: Why Organizations Go in For ERPDocument10 pagesERP Implementation: Why Organizations Go in For ERPAbhinav ShrivastavaNo ratings yet

- Final Manual For Specification StandardsDocument192 pagesFinal Manual For Specification Standardsbhargavraparti100% (1)

- 2011-07-28Document32 pages2011-07-28Southern Maryland OnlineNo ratings yet

- School Form 2 (SF2) Daily Attendance Report of Learners: 104646 2019 - 2020 June Old Alion ES Grade 4 1Document8 pagesSchool Form 2 (SF2) Daily Attendance Report of Learners: 104646 2019 - 2020 June Old Alion ES Grade 4 1EMMA RETUTANo ratings yet

- Mercy KillingDocument2 pagesMercy KillingDebasisNo ratings yet

- Phthalic Anhydride Part 2 PDFDocument3 pagesPhthalic Anhydride Part 2 PDFAjay YadavNo ratings yet

- Varieties of SpanishDocument12 pagesVarieties of SpanishmiomirmNo ratings yet

- If Only U Sleep-Walking Americans Have A Thousand Men Like This Joe CortinaDocument19 pagesIf Only U Sleep-Walking Americans Have A Thousand Men Like This Joe CortinaYusuf (Joe) Jussac, Jr. a.k.a unclejoeNo ratings yet

- Introduction To Natural Textile FibresDocument13 pagesIntroduction To Natural Textile FibresNidia GarciaNo ratings yet

- 30 Prayer Points For Workers by Revd Harrison AyinteteDocument64 pages30 Prayer Points For Workers by Revd Harrison AyinteteKelvin100% (1)

- Sanjay Industries Ltd. Balance Sheet and Income StatementDocument5 pagesSanjay Industries Ltd. Balance Sheet and Income Statementramki073033No ratings yet

- Rules 113 114 126Document202 pagesRules 113 114 126Anthony RoblesNo ratings yet

- Advice PrintingDocument10 pagesAdvice PrintingKA SO RINo ratings yet

- 17musala ParvaDocument21 pages17musala ParvaNIRAV PANDYANo ratings yet

- Internship Syllabus PDFDocument4 pagesInternship Syllabus PDFJessame De Guzman VallejosNo ratings yet

- Frequency Spectrum Fees and Pricing RegulationsDocument14 pagesFrequency Spectrum Fees and Pricing RegulationsAyo FashinaNo ratings yet

- Analysis of The Role of Cooperatives in Agricultural InputDocument147 pagesAnalysis of The Role of Cooperatives in Agricultural InputmogesgirmayNo ratings yet

- Developing A Quadcopter Frame and Its Structural AnalysisDocument6 pagesDeveloping A Quadcopter Frame and Its Structural AnalysisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Structural Consideration & Type of StructureDocument19 pagesStructural Consideration & Type of Structurepopat vishalNo ratings yet

- Csm-Form SchoolDocument2 pagesCsm-Form SchoolLove MaribaoNo ratings yet

- Human Act Act of Man Versus Human ActDocument2 pagesHuman Act Act of Man Versus Human Actgiezele ballatanNo ratings yet

- Hoba AcctgDocument5 pagesHoba Acctgfer maNo ratings yet

- RPH (Reflection and Kartilya)Document3 pagesRPH (Reflection and Kartilya)Jirah Joy PeañarNo ratings yet

- PEB Foundation Certificate Trade Mark Law FC5 (P7)Document13 pagesPEB Foundation Certificate Trade Mark Law FC5 (P7)Pradeep KumarNo ratings yet

- IP Strategy OverviewDocument12 pagesIP Strategy OverviewGali SowryaNo ratings yet

- Starcraft II Basic Terran HotkeysDocument1 pageStarcraft II Basic Terran HotkeysstiversbNo ratings yet

- Industrial Relations and PolicyDocument3 pagesIndustrial Relations and Policyshikher027598No ratings yet