Professional Documents

Culture Documents

Payroll

Payroll

Uploaded by

April Jean TubisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payroll

Payroll

Uploaded by

April Jean TubisCopyright:

Available Formats

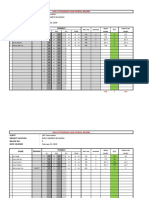

GIVEN: Monthly RATE(Refer to computations) Night

EMP Salary SCHEDULE HOURLY DAILY Differential

X 20,000 6:00AM 2:00PM M-F only 115.38 923.08 0

Y 15,000 3:00PM 11:00PM M-F only 86.54 692.30 190.38

Z 30,000 12:00MN 8:00AM M-F only 173.08 1,384.64 2,284.66

SOLUTION:

1. Salaries expense To record the monthly payroll 67,475.04

Witholding tax payable 2,290.33

SSS payable 2,700.00

PH payable 2,600.00

HDMF payable 600.00

Cash in bank 59,284.71

2. Employee benefits To record ER contribution 8,390.00

SSS payable 5,190.00

PH payable 2,600.00

HDMF payable 600.00

3. Witholding tax payable Remittance to government agencies 2,290.33

SSS payable 7,890.00

PH payable 5,200.00

HDMF payable 1,200.00

Cash in bank 16,580.33

4. COMPUTATIONS 6-2pm 3-11pm 12-8am

2022 December 2022 December

X Y Z X Y Z

01 Th 8 8 8 16 Fr 8 8 8

02 Fr 8 8 8 17 Sat

03 Sat 18 Sun

04 Sun 19 Mon 8 8 8

05 Mon 8 8 8 20 Tue 8 8 8

06 Tue 8 8 8 21 Wed 8 8 8

07 Wed 8 8 8 22 Th 8 8 8

08 Th 8 8 8 23 Fr 8 8 8

09 Fr 8 8 8 24 Sat

10 Sat 25 Sun

11 Sun 26 Mon 8 8 8

12 Mon 8 8 8 27 Tue 8 8 8

13 Tue 8 8 8 28 Wed 8 8 8

14 Wed 8 8 8 29 Th 8 8 8

15 Th 8 8 8 30 Fr 8 8 8

31 Sat

88 88 88 88 88 88

Total Hours 176 176 176 Legend: YELLOW - HOLIDAYS

22 days 22 days 22 days

work work work

Analysis and Computations:

1. X Since X is scheduled from 6am to 2pm

Gross Compensation is only the Monthly Salary of P 20,000

No night differential, since 6am to 2pm only

But, since, Dec 8 and Dec. 30 is a holiday, and since, X went to work as

scheduled, no additional pay is needed

COMPUTATIONS: X

Hourly rate Multiply the hours per week by the number of weeks in a year (52)

Divide this number from the annual salary

Php 115.385 = 240,000 /2,080 (40hours x 52 weeks)

Daily pay Hourly Pay x Hours Per Day

Php 923.08 = 115.385 x 8 hours

Summary: Regular pay Php 20,000.00 X

Overtime -

Night differential -

Holiday pay - Dec. 8 and 30 special holiday

GROSS PAY Php 20,000.00 He is scheduled to work

2. Y Since Y is scheduled from 3 to 11pm

On top of the 8 hour duty

Y is entitled to a NIGHT DIFERENTIAL

But, since, Dec 8 and Dec. 30 is a holiday, and since, X went to work as

scheduled, no additional pay is needed

COMPUTATIONS: Y

Hourly rate Multiply the hours per week by the number of weeks in a year (52)

Divide this number from the annual salary

Php 86.538 = 180,000 /2,080 (40hours x 52 weeks)

Daily pay Hourly Pay x Hours Per Day

Php 692.304 = 86.538 x 8 hours

Meaning: Every employee is entitled to a Night Differential of Night Shift pay of not less than

10% of his regular wage for each hour of work performed between 10pm and 6am

Formula: = Ordinary Day night differential = Hourly rate x 10% x no. of hours worked

1 hour per day x total no. of days = 22days

190.385 = 86.538 x 10% x 22days

Summary: Regular pay Php 15,000.00 Y

Overtime -

Night differential 190.38

Holiday pay - Dec. 8 and 30 special holiday

GROSS PAY Php 15,190.38 He is scheduled to work

3. Z Since Z is scheduled from 12pm to 6am the next day

On top of the 8 hour duty

Z is entitled to a NIGHT DIFERENTIAL

But, since, Dec 8 and Dec. 30 is a holiday, and since, Z went to work as

scheduled, no additional pay is needed

COMPUTATIONS: Z

Hourly rate Multiply the hours per week by the number of weeks in a year (52)

Divide this number from the annual salary

Php 173.08 = 360,000 /2,080 (40hours x 52 weeks)

Daily pay Hourly Pay x Hours Per Day

Php 1,384.64 = 173.08 x 8 hours

Meaning: Every employee is entitled to a Night Differential of Night Shift pay of not less than

10% of his regular wage for each hour of work performed between 10pm and 6am

Formula: = Ordinary Day night differential = Hourly rate x 10% x no. of hours worked

12pm to 8am next day is equals to: 6 hours daily

132 6 hours x 22 days

2,284.66 = 173.08 x 10% x 132hours

Summary: Regular pay Php 30,000.00 Z

Overtime -

Night differential 2,284.66

Holiday pay - Dec. 8 and 30 special holiday

GROSS PAY Php 32,284.66 He is scheduled to work

JOURNAL ENTRIES, Payroll and Computations:

DEBIT CREDIT

1. Salaries expense To record the monthly payroll 67,475.04

Witholding tax payable 2,290.33

SSS payable 2,700.00

PH payable 2,600.00

HDMF payable 600.00

Cash in bank 59,284.71

2. Employee benefits To record ER contribution 8,390.00

SSS payable 5,190.00

PH payable 2,600.00

HDMF payable 600.00

3. Witholding tax payable Remittance to government agencies 2,290.33

SSS payable 7,890.00

PH payable 5,200.00

HDMF payable 1,200.00

Cash in bank 16,580.33

Regular DEDUCTIONS

EMPLOYEE Monthly OT ND Others GROSS With SSS PH HDMF NET SIGNATURE

TOTAL

Pay Tax Cont Cont Cont PAY

X 20,000 - - 20,000.00 - 900.00 800.00 200.00 1,900.00 18,100.00 Signed

Y 15,000 - 190.38 - 15,190.38 - 675.00 600.00 200.00 1,475.00 13,715.38 Signed

Z 30,000 - 2,284.66 - 32,284.66 2,290.33 1,125.00 1,200.00 200.00 4,815.33 27,469.32 Signed

TOTALS 65,000 - 2,475.04 - 67,475.04 2,290.33 2,700.00 2,600.00 600.00 8,190.33 59,284.71

Signed

Supporting Schedule:

Basis: 32,284.66 Monthly salaries Monthly salaries Monthly salaries

Witholding Tax SSS Contributions Ph Contributions HDMF Contributions

EE ER EE ER EE ER EE ER

X 0 0 900.00 1,730.00 800.00 800.00 200.00 200.00

Y 0 0 675.00 1,305.00 600.00 600.00 200.00 200.00

Z 2,290.33 0 1,125.00 2,155.00 1,200.00 1,200.00 200.00 200.00

2,290.33 2,700.00 5,190.00 2,600.00 2,600.00 600.00 600.00

Witholding Tax: Z General Rule: 15,000 2% 300

32,284.66 20,000 2% 400

20,833.00 30,000 2% 600

on 11,451.66 Option: Employee can pay P 200 per month

x 20% 2,290.33 May shoulder the ER contribution

as well

You might also like

- BPCL Case StudyDocument10 pagesBPCL Case StudyRimjhim ShrivastavaNo ratings yet

- Grade 12: Mathematical Literacy: Assignment 1Document21 pagesGrade 12: Mathematical Literacy: Assignment 1Johan Rina100% (3)

- Cost AccountingDocument71 pagesCost AccountingEnis ErenözlüNo ratings yet

- All in AMA 1st Sem SourcesDocument31 pagesAll in AMA 1st Sem SourcesEmmanuel Isles60% (5)

- Fisa 10.05.2021 Excel-1Document2 pagesFisa 10.05.2021 Excel-1Luiza MonfortNo ratings yet

- Fisa Pontaj Personal MedicalDocument4 pagesFisa Pontaj Personal MedicalLuiza MonfortNo ratings yet

- Est 000088Document2 pagesEst 000088Guilherme VenturaNo ratings yet

- Answer Key Q2 PDFDocument6 pagesAnswer Key Q2 PDFNonami AbicoNo ratings yet

- Tel: 0720365765 Milka, 0721526538 BernardDocument2 pagesTel: 0720365765 Milka, 0721526538 BernardLucious LightNo ratings yet

- Midterm Exam IntaxDocument20 pagesMidterm Exam IntaxJane TuazonNo ratings yet

- Budget ExpensesDocument2 pagesBudget Expensesjcasaysay.netcorpNo ratings yet

- Apostol, Joe Grandell A Payslip: Netpay 7,274.47Document1 pageApostol, Joe Grandell A Payslip: Netpay 7,274.47joegrandellapostol2No ratings yet

- AMC 1000 LPH StandardDocument5 pagesAMC 1000 LPH Standarddivsi1701No ratings yet

- 1 Pfrs 15 SoltnDocument2 pages1 Pfrs 15 Soltnmartinfaith958No ratings yet

- CostingDocument2 pagesCostingManokaran RamalingamNo ratings yet

- June 2018 0400029701747 - 721005565186Document2 pagesJune 2018 0400029701747 - 721005565186Saad MirzaNo ratings yet

- Rfo ComputationDocument1 pageRfo ComputationMyraNo ratings yet

- Mr. Teddy Acedo: Rambel EnterprisesDocument1 pageMr. Teddy Acedo: Rambel EnterprisesTeddy AcedoNo ratings yet

- Van Der Walt, B & T 949 Beacon Street Claremont 0082 5016590876Document2 pagesVan Der Walt, B & T 949 Beacon Street Claremont 0082 5016590876bashNo ratings yet

- Betageri Extra Labour Payment 03.11.2019Document14 pagesBetageri Extra Labour Payment 03.11.2019KA25 ConsultantNo ratings yet

- Daily Cashcheck Collection SEPTEMBER 2021Document13 pagesDaily Cashcheck Collection SEPTEMBER 2021Marlhen Euge SanicoNo ratings yet

- Trexy 1 YrDocument8 pagesTrexy 1 YrcootaraktarakNo ratings yet

- PF Interest CalculatorDocument6 pagesPF Interest CalculatorSelvan KstNo ratings yet

- Service Invoice: Boyce Excavating, Co. IncDocument1 pageService Invoice: Boyce Excavating, Co. IncjulescjmNo ratings yet

- Prob 5Document5 pagesProb 5LNo ratings yet

- 2 Lösung PDFDocument2 pages2 Lösung PDFAnil ÜlgerNo ratings yet

- Musterlösung Übungsaufgabe 2 Buchungssätze: Wiesbaden Business SchoolDocument2 pagesMusterlösung Übungsaufgabe 2 Buchungssätze: Wiesbaden Business SchoolAnil ÜlgerNo ratings yet

- Call Centre 2 - StudentDocument116 pagesCall Centre 2 - StudentDuncan WekesaNo ratings yet

- Sri Skanda Enterprises: Sathish Chellan Sir StatementDocument2 pagesSri Skanda Enterprises: Sathish Chellan Sir Statementdevi.gokhale8265No ratings yet

- Wara-White Commercial WorksheetDocument2 pagesWara-White Commercial WorksheetScribdTranslationsNo ratings yet

- 18-Month Gen Automotive Servicing Payment SchemeDocument1 page18-Month Gen Automotive Servicing Payment SchemeEDUARDO ALCANTARA JRNo ratings yet

- LQP Contruction: Euro Generics Building: 2: February 10, 2020Document16 pagesLQP Contruction: Euro Generics Building: 2: February 10, 2020Joreymon DiazNo ratings yet

- Workbook 1Document47 pagesWorkbook 1api-3344203120% (1)

- 04 Slip Gaji April 2021 An - Adib UbaidilahDocument1 page04 Slip Gaji April 2021 An - Adib Ubaidilahempo netNo ratings yet

- UntitledDocument89 pagesUntitledGYAN BHUSHAN PatelNo ratings yet

- Zodiaco 1663Document1 pageZodiaco 1663mariateresa87.xNo ratings yet

- Nikhil Ice FactoryDocument11 pagesNikhil Ice FactorynalawadenikhilNo ratings yet

- Invoice Tomisin 15828071866608Document1 pageInvoice Tomisin 15828071866608tomitaiwotestsNo ratings yet

- Budgeting Template by RCODocument31 pagesBudgeting Template by RCOrolly_obedencioNo ratings yet

- Dec. EarningsDocument1 pageDec. Earningsmorotasheila.smdcNo ratings yet

- Ate SacredDocument22 pagesAte SacredClaire SagradaNo ratings yet

- DVP - Payroll Dec3 9 2022Document2 pagesDVP - Payroll Dec3 9 2022maebalbinNo ratings yet

- GA55 Reportdetail BillwiseDocument2 pagesGA55 Reportdetail BillwiseSmith AgrawalNo ratings yet

- Chemical 2018Document35 pagesChemical 2018Made WidreNo ratings yet

- Wages Candra PDFDocument1 pageWages Candra PDFruntorudiyanto99No ratings yet

- Onyze) : Monday 0cnot X /cyes)Document6 pagesOnyze) : Monday 0cnot X /cyes)Kaivaly DagaNo ratings yet

- Rencana Anggaran Biaya (Rab) : Daftar Kuantitas Dan HargaDocument2 pagesRencana Anggaran Biaya (Rab) : Daftar Kuantitas Dan HargasolehsolihinNo ratings yet

- FinancesDocument16 pagesFinancesIsh JoNo ratings yet

- Cash BudgetDocument9 pagesCash BudgetColter SodjaNo ratings yet

- Cash BudgetDocument9 pagesCash BudgetColter SodjaNo ratings yet

- Trial BalanceDocument1 pageTrial Balancesiti nur aisyahNo ratings yet

- Construction FormatDocument2 pagesConstruction FormatRham Andrae BagatsingNo ratings yet

- DVP - Payroll Sep3 9 2022Document2 pagesDVP - Payroll Sep3 9 2022maebalbinNo ratings yet

- Entity 2Document2 pagesEntity 2Camelia BoabesNo ratings yet

- INCOME TAX of Gazi Moshieur RahmanDocument13 pagesINCOME TAX of Gazi Moshieur RahmanMoshieur RahmanNo ratings yet

- Khatabook-Customer-Transactions-27 10 2020-11 14 15 AM PDFDocument1 pageKhatabook-Customer-Transactions-27 10 2020-11 14 15 AM PDFAchanta Venkata Satish KumarNo ratings yet

- Invoice Number DateDocument1 pageInvoice Number DateMaa BHAGWATINo ratings yet

- Date Product Region Name Units Sales: Name-Yuvraj Singh Rana SAP ID - 500084281 Bba-Fas 2Nd YearDocument5 pagesDate Product Region Name Units Sales: Name-Yuvraj Singh Rana SAP ID - 500084281 Bba-Fas 2Nd YearYuvraj singh RanaNo ratings yet

- Alok GDocument1 pageAlok GmithileshsutharpcNo ratings yet

- 8790Document2 pages879009023168No ratings yet

- CH 3 Problems and Solutions Cost Accounting BookDocument10 pagesCH 3 Problems and Solutions Cost Accounting Bookninocastillo316No ratings yet

- Opex3month (Version 1)Document5 pagesOpex3month (Version 1)leonard.aurlianusNo ratings yet

- Social Community Home Care and Disability Services Industry Award Ma000100 Pay GuideDocument14 pagesSocial Community Home Care and Disability Services Industry Award Ma000100 Pay GuideAbjiNo ratings yet

- Activity03 01Document2 pagesActivity03 01Alexis ThomasNo ratings yet

- People Soft Materials-HrmsDocument339 pagesPeople Soft Materials-HrmsVENKATA RAVI KUMAR.GNo ratings yet

- Andit LABOR REVIEWDocument58 pagesAndit LABOR REVIEWAtty. Angelica DeiparineNo ratings yet

- Daily Time Record Daily Time Record: John Philip D. Tiongco John Philip D. TiongcoDocument2 pagesDaily Time Record Daily Time Record: John Philip D. Tiongco John Philip D. TiongcoIssey Mari TiongcoNo ratings yet

- Barge V DHR InternationalDocument17 pagesBarge V DHR InternationalDonaldNo ratings yet

- Explanation Letter. EspenillaDocument5 pagesExplanation Letter. EspenillaRalph Christian Lusanta FuentesNo ratings yet

- Case Studies Pom NotesDocument45 pagesCase Studies Pom Notessindhu sNo ratings yet

- Module 6 Good Manner and Right Conduct.Document8 pagesModule 6 Good Manner and Right Conduct.Jorge RonquilloNo ratings yet

- Community Tax Relief LLC Epic Financial LLC Adam Dayan Bradley Jacob Dayan Chicago Illinois Complaint Mellul Orticelli NavasDocument13 pagesCommunity Tax Relief LLC Epic Financial LLC Adam Dayan Bradley Jacob Dayan Chicago Illinois Complaint Mellul Orticelli NavasghostgripNo ratings yet

- Quamto Labor Law 2017Document53 pagesQuamto Labor Law 2017Robert Manto88% (8)

- William V Lopez-DigestDocument2 pagesWilliam V Lopez-DigestRose Mary G. EnanoNo ratings yet

- CHED Memorandum Order CMO Guidelines For Student Internship Abroad Program SIAPDocument9 pagesCHED Memorandum Order CMO Guidelines For Student Internship Abroad Program SIAPlucille p modestoNo ratings yet

- Showfile PDFDocument19 pagesShowfile PDFJafarNo ratings yet

- Case NoDocument13 pagesCase NoLaurente JessicaNo ratings yet

- Usali12 PresentationDocument139 pagesUsali12 PresentationRelawanNo ratings yet

- Kfpl-Internal Audit Report - 01-04-2021Document6 pagesKfpl-Internal Audit Report - 01-04-2021Anand KumarNo ratings yet

- Erectors Inc. v. NLRC 256 SCRA 629 (1996)Document4 pagesErectors Inc. v. NLRC 256 SCRA 629 (1996)Rosel RamsNo ratings yet

- Solving Aggregate Planning Problem Using LINGO: December 2017Document7 pagesSolving Aggregate Planning Problem Using LINGO: December 2017Debasish SahooNo ratings yet

- Evidence Pick-Up LinesDocument12 pagesEvidence Pick-Up Linessantiagonica23No ratings yet

- Compensation Review of Hameem GroupDocument37 pagesCompensation Review of Hameem GroupMehedi Hassan0% (1)

- Budget in HousekeepingDocument15 pagesBudget in Housekeepingtanmay jain100% (1)

- ANZDocument82 pagesANZGharayaNo ratings yet

- Abdus Salam PDFDocument32 pagesAbdus Salam PDFsattom halderNo ratings yet

- Consent Judgment Against Miles WalkerDocument9 pagesConsent Judgment Against Miles WalkerEllie ParkerNo ratings yet