Professional Documents

Culture Documents

Upgrad Payslip

Upgrad Payslip

Uploaded by

Santanu SauOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Upgrad Payslip

Upgrad Payslip

Uploaded by

Santanu SauCopyright:

Available Formats

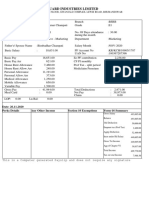

upGrad Educaton Pvt. Ltd.

Ground Floor, 75, Nishuvi, Dr. Annie Besant Road, Worli,, Mumbai - 400018

PaySlip for the month of May 2023

Emp. Code UPG9548 Group DOJ Bank A/c No. 921010036028091

Name NILANJANA DHAR PAN No. FFXPD5556P

Designaton Admissions Counselor PF No. MH/BAN/1355074/17381

Department SALES Pay Days 31.00 ESI NO

Sub Function CT LWOP 0.00 UAN NO. 101524424934

Locaton West Bengal Arrear Days 1.00

DOJ 03/01/2022 Arrear LWOP 1.00

Earnings Deductons Reimbursements

Descripton Rate Monthly Arrear Total Descripton Amount Descripton Claimed Reimb

Basic 24,728 24,728 -824 23,904 Provident Fund 1,740

HRA 12,364 12,364 -412 11,952 P Tax 200

Special Allowance 31,759 31,759 -1,059 30,700 Income Tax 5,547

Incentve 11,700 11,700

GROSS PAY 80,551 -2,295 78,256 GROSS DED 7,487 TOTAL

NET PAY 70769.00

Income Tax Worksheet for the Period April 2023 - March 2024 Tax Calculation Based on : Old Regime

Descripton Gross Exempt Taxable Deducton Under Chapter VI-A

Basic 294,567 294,567 Investments u/s 80C

HRA 147,283 66,543 80,740 P F. 21,424

Special Allowance 378,339 378,339 PPF 60,000

Incentve 48,017 48,017

Gross Salary 868,206 66,543 801,663 Total of Investment u/s 80C 81,424

Deducton U/S 80C 81,424

Standard Deduction 50,000

Professional Tax 2,400

Previous Employer Professional Tax

Under Chapter VI-A 81,424

Any Other Income

Taxable Income 667,839

Total Tax 46,068

Tax Rebate

Surcharge

Tax Due 46,068

Educatonal Cess 1,843

Net Tax 47,911

Tax Deducted (Previous Employer) Leave Balances

Tax Deducted Till Date 11,231 Type Opening Enttle Availed Closing

Tax to be Deducted 36,680

Tax / Month 3,113 Total of Ded Under Chapter VI-A 81,424

Tax on Non-Recurring Earnings 2,434

Tax Deducton for this month 5,547 Interest on Housing Loan

HRA Calculaton

From To Rent Paid Actual HRA 40/50% of Basic Rent - 10% of Basic Exempt HRA

01/04/2023 31/03/2024 96,000 147,283 147,284 66,543 66,543

Total 96,000 147,283 147,284 66,543 66,543

You might also like

- Payslip May 2024 WIPRODocument1 pagePayslip May 2024 WIPROamitsinghhhh000078666No ratings yet

- Hotel Standard Operating Procedures ListDocument74 pagesHotel Standard Operating Procedures Listokta737389% (9)

- Business Studies Formula Sheet - AS PDFDocument4 pagesBusiness Studies Formula Sheet - AS PDFAdnan Haider NoorNo ratings yet

- Serv Let ControllerDocument1 pageServ Let ControllerParas PareekNo ratings yet

- Indiabulls Securities LimitedDocument1 pageIndiabulls Securities Limitedraj200224No ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- PAYSLIPDocument11 pagesPAYSLIPSaran ManiNo ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Payslip 233108 CIN Jan 2024Document1 pagePayslip 233108 CIN Jan 20245213482saiNo ratings yet

- Pay Slip April-22Document1 pagePay Slip April-22B RameshNo ratings yet

- Offer Letter Parag Chandak App3414742504503388 Version 2Document3 pagesOffer Letter Parag Chandak App3414742504503388 Version 2Parag ChandakNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Pay Slip - 8482157 - May-23Document1 pagePay Slip - 8482157 - May-23Valorant SmurfNo ratings yet

- July 23Document1 pageJuly 23Điwakar MudhirajNo ratings yet

- PAYSLIP2Document1 pagePAYSLIP2sanjayNo ratings yet

- Salary SlipDocument1 pageSalary SlipAmmie LachicaNo ratings yet

- March 2022Document1 pageMarch 2022Urmila UjgareNo ratings yet

- Offer LetterDocument3 pagesOffer LetterrudraNo ratings yet

- CTB Hike SDocument1 pageCTB Hike SSOGALA NAVEEN KUMAR YADAVNo ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- Apr PayslipDocument1 pageApr PayslipSidvik InfotechNo ratings yet

- Rahul Gangarekar - Offer LetterDocument2 pagesRahul Gangarekar - Offer Letterrahul gangarekarNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- DEVARAJ RAMESH India Offer Letter 11-03-2022 210108Document4 pagesDEVARAJ RAMESH India Offer Letter 11-03-2022 210108Darwin RdNo ratings yet

- As124583 Jan2023 PayslipDocument2 pagesAs124583 Jan2023 PayslipAKM Enterprises Pvt LtdNo ratings yet

- SarjaPayslip Jun22Document1 pageSarjaPayslip Jun22Anand TNo ratings yet

- Offer Letter - PawanDocument5 pagesOffer Letter - PawanPawan YadavNo ratings yet

- May 2020 PDFDocument1 pageMay 2020 PDFshaklainNo ratings yet

- Karan Peshwani-Payslip - Sep-2023Document1 pageKaran Peshwani-Payslip - Sep-2023Karan PeshwaniNo ratings yet

- S Feb 2017 PDFDocument1 pageS Feb 2017 PDFHanumanthNo ratings yet

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- d5eb67b6-6d69-484a-aa38-b800024e6693Document14 pagesd5eb67b6-6d69-484a-aa38-b800024e6693pixeljoyNo ratings yet

- Pay SlipDocument1 pagePay SlipNicky HussainNo ratings yet

- Jan 2023Document1 pageJan 2023Rishabh JethwaniNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- Payslip NOV 23Document1 pagePayslip NOV 23finox.servicesNo ratings yet

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiNo ratings yet

- Subject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionDocument4 pagesSubject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionAshish SinghNo ratings yet

- November PayslipDocument1 pageNovember PayslipGnana BetsyNo ratings yet

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Krishna Salary SlipDocument1 pageKrishna Salary SlipBilludeen KhiljiNo ratings yet

- FormDocument1 pageFormSatishSathyamevaJayatheNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- FormDocument1 pageFormhemant vatsaNo ratings yet

- CG JUL 2022 46134875 PayslipDocument1 pageCG JUL 2022 46134875 PayslipSoniNo ratings yet

- Salary SlipDocument3 pagesSalary SlipPooja GuptaNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Sunil PayslipDocument1 pageSunil PayslipSiyaram MeenaNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023love entertainmentNo ratings yet

- UnknownDocument1 pageUnknownrahulagarwal33No ratings yet

- Symbiotic Automation Systems (P) Ltd. Bangalore Pay Slip For The Month of March - 2017Document1 pageSymbiotic Automation Systems (P) Ltd. Bangalore Pay Slip For The Month of March - 2017Anindya BasuNo ratings yet

- JUN - 2023 PayslipDocument1 pageJUN - 2023 Payslipgpsexy7No ratings yet

- Accenture PaySlip PDFDocument1 pageAccenture PaySlip PDFSumit ChakrabortyNo ratings yet

- March 2022 - SS OPJGUDocument1 pageMarch 2022 - SS OPJGUmohitmohapatra08No ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- UGUGFUGDocument1 pageUGUGFUGDhirendra JenaNo ratings yet

- Offer LetterDocument3 pagesOffer LetterLikithaNo ratings yet

- PDF To WordDocument1 pagePDF To WordThe Great Indian TipsNo ratings yet

- Atos SyntelDocument2 pagesAtos SyntelSharad MoreNo ratings yet

- JUL 2023 PayslipDocument1 pageJUL 2023 Payslipgpsexy7No ratings yet

- FUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFDocument5 pagesFUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFdilipkhanaman1980No ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- HS Marks SheetDocument1 pageHS Marks SheetSantanu SauNo ratings yet

- MU ZeroDocument1 pageMU ZeroSantanu SauNo ratings yet

- 10th Mark SheetDocument1 page10th Mark SheetSantanu SauNo ratings yet

- Purvalay Communications Private LimitedDocument1 pagePurvalay Communications Private LimitedSantanu SauNo ratings yet

- Aadhar CardDocument2 pagesAadhar CardSantanu SauNo ratings yet

- p67662 Lcci Level 2 Certificate in Bookkeeping and Accounting Ase20093 RB Dec 2021Document8 pagesp67662 Lcci Level 2 Certificate in Bookkeeping and Accounting Ase20093 RB Dec 2021Ei Ei TheintNo ratings yet

- Himanshu Sharma PDFDocument1 pageHimanshu Sharma PDFHimanshu SharmaNo ratings yet

- Questions On Financing DecisionDocument4 pagesQuestions On Financing DecisionBRYNA BHAVESH 2011346No ratings yet

- AE 114 MidtermDocument7 pagesAE 114 MidtermMa Angelica BalatucanNo ratings yet

- Market Value MethodDocument21 pagesMarket Value MethodUndebaynNo ratings yet

- Ifrs 10: Consolidated Financial InstrumentDocument5 pagesIfrs 10: Consolidated Financial InstrumentAira Nhaira Mecate100% (1)

- Post-Closing Trial BalanceDocument1 pagePost-Closing Trial BalanceCamelliaNo ratings yet

- 2019 TANGLAW WP A011-V2Document95 pages2019 TANGLAW WP A011-V2Isaac Dominic MacaranasNo ratings yet

- SSS Webinar Short Term LoanDocument12 pagesSSS Webinar Short Term Loanmelvanne tamboboyNo ratings yet

- Shinsegae (004170 KS - Buy)Document7 pagesShinsegae (004170 KS - Buy)PENo ratings yet

- Illustration: Accounting For Non-Controlling InterestDocument17 pagesIllustration: Accounting For Non-Controlling Interestwarsidi100% (1)

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- Auditing 4 Chapter 1Document19 pagesAuditing 4 Chapter 1Mohamed Diab100% (1)

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- Quizzer On Withholding of Annual Tax Compensation IncomeDocument5 pagesQuizzer On Withholding of Annual Tax Compensation IncomeRyDNo ratings yet

- Istilah Istilah EkoTekDocument24 pagesIstilah Istilah EkoTeki putu andre artha wardanaNo ratings yet

- Financial Standards Measures (Farms Sorted by Farm Type) Avg. of Crop and Crop and Crop and All Farms Crop Dairy Hog Beef Dairy Hog Beef OtherDocument2 pagesFinancial Standards Measures (Farms Sorted by Farm Type) Avg. of Crop and Crop and Crop and All Farms Crop Dairy Hog Beef Dairy Hog Beef OtherkhabiranNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- Payslip 5 2022Document1 pagePayslip 5 2022All in OneNo ratings yet

- Partnership Deed: Partnership Agreement Between Three PartnersDocument8 pagesPartnership Deed: Partnership Agreement Between Three PartnersShivam DagaNo ratings yet

- Quiz Bee ReviewerDocument6 pagesQuiz Bee ReviewerFeliz Victoria CañezalNo ratings yet

- Financial Accounting Valix Summary 1 7Document12 pagesFinancial Accounting Valix Summary 1 7notsogoodNo ratings yet

- INCOME TAX OF INDIVIDUALS Part 1Document3 pagesINCOME TAX OF INDIVIDUALS Part 1Abby TañafrancaNo ratings yet

- Peter Navarro PFDDocument12 pagesPeter Navarro PFDThinkProgressNo ratings yet

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguNo ratings yet

- Consolidatd Digest Imp Case Laws Jan Dec 2017Document564 pagesConsolidatd Digest Imp Case Laws Jan Dec 2017Rajeev Ranjan KumarNo ratings yet

- A7 Audit of Intangible AssetsDocument4 pagesA7 Audit of Intangible AssetsKezNo ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet