Professional Documents

Culture Documents

Offer Letter

Offer Letter

Uploaded by

zig zack3999Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Offer Letter

Offer Letter

Uploaded by

zig zack3999Copyright:

Available Formats

Ref No: - 1MG/HRD/OL/2022/JAN/01

Date: - 1st Jan 2022

Dear Rinkesh,

Congratulations!

We are thrilled to welcome you to the TATA 1MG team as Operations Executive reporting to the Manager.

Founded in 2015, TATA 1mg’s mission is to “Make Healthcare Understandable, Affordable and Accessible”.

Through our innovative products and nation-wide presence, TATA 1mg has established itself as a clear leader and

as a trusted brand in the digital healthcare space.

At TATA 1mg, we also pride ourselves on our values which we believe help each employee perform to their

highest potential. These values are stated as:

1. Be your own CEO

2. Team before individual

3. Accountability with empathy

4. Done is better than perfect

We strongly believe that you will be a great addition to our team and will help us uphold and further our values

based culture so that TATA 1mg can continue to make a difference to people’s lives.

We can’t wait to have you join us on this journey.

Details of the terms and conditions of offer are as under:

1. Your date of commencement of employment will be on or before 3rd January 2022.

2. You will be entitled to receive compensation and benefits with an annual CTC of INR 3,00,000. Details

attached in Annexure 1.

3. Your employment would be subject to the Terms and Conditions, mentioned in your appointment letter,

which will be issued to you after your joining.

4. You will be on a standard probationary period of 3 months from the date of joining.

5. If considered expedient and necessary, we may conduct background checks via references provided by

you or through third party. You hereby consent to any such background checks and undertake to co-

operate if so requested by us

6. Employment as per this offer is subject to your being medically fit

7. Your employment is contingent on your ability to furnish the following documents:

a) Copy of Pan Card

b) Latest passport size photograph – 4 nos.

c) ID proof (Voter ID Card / Passport / Driving License / Aadhar Card - Mandatory)

d) Bank account details along with a cancelled cheque

e) Self-attested documents of your high school and degree certificates (Class 10 th to highest

qualification)

f) Permanent and temporary address proof

g) Current and previous “Employer Relieving Letter” and “Experience Letter”

h) Current Employer Appointment Letter

i) Last 3 months of salary slip or Form 16

j) UAN and PF numbers

1. You will be eligible for:

• Medical insurance coverage for self and immediate dependents (spouse and 2 children) of INR 2,00,000

per annum over and above your CTC.

• Group Personal Accident Insurance of 4 times of the Total annual CTC or 2cr whichever is lower.

You will be offered components to save tax on the date of joining. The components will be non-taxable only

against documentary proof which needs to be submitted quarterly.

Kindly return the duplicate copy of this offer letter, signed as a token of your acceptance. We look forward to a

long mutually beneficial and rewarding association.

For TATA 1MG Technologies Private Limited

Authorized Signatory Employee Signature

Annexure

(Compensation & Benefits)

Break up for offer letter

Name Rinkesh

Designation (Title) Operations Executive

Grade 1

Function Fulfilment

Business Unit E-Diagnostics

Department Diagnostics

Sub Department Diagnostics

Job Role Operations Executive

Particulars Monthly Annual

Fixed CTC 25,000 3,00,000

Performance based Variable - -

Total CTC 25,000 3,00,000

Breakup

Basic Salary & DA 11,500 1,38,000

HRA 11,127 1,33,524

Gross Salary 22,627 2,71,524

Provident Fund (Employer's Cont.) 1,380 16,560

Statuary Bonus 993 11,916

Total Fixed CTC 25,000 3,00,000

Performance based Variable - -

Total CTC 25,000 3,00,000

1. Performance Variable: If offered Bi-annually, will be paid as per below and disbursement

Bi-annually: Paid twice in an year. For the period April to Sept, will be paid with Oct month salary. For the period

Oct to March, will be paid with April month salary

The disbursement is subject to Individual and Business Performance.

2. Statutory Bonus: Paid annually as per the THE PAYMENT OF BONUS ACT, 1965

3. CTC Reimbursements: Will be offered after joining, it will be non-taxable only against documentary proofs

which needs to be submitted quarterly

4. The above compensation will be subject to Income Tax regulations in force from time to time.

5. Statutory deductions are applicable as per STATE government regulations.

You might also like

- Movie Analysis AssignmentDocument3 pagesMovie Analysis AssignmentDawn Caldeira67% (3)

- Offer LetterDocument8 pagesOffer LetterMadhavi Latha100% (3)

- BDE-OfferLetter ArbabChatopadhayDocument2 pagesBDE-OfferLetter ArbabChatopadhaydeb67730% (1)

- Payslip For 16831Document1 pagePayslip For 16831omkass100% (1)

- Phillip Glass Buys A Loaf of BreadDocument32 pagesPhillip Glass Buys A Loaf of Breadsmtony10No ratings yet

- Job Offer-EXECUTIVE - ARDocument5 pagesJob Offer-EXECUTIVE - ARJagadeesh Sura100% (1)

- Registered OfficeDocument2 pagesRegistered OfficeSanket JadhavNo ratings yet

- Employment Application Form Tata ProjectsDocument6 pagesEmployment Application Form Tata ProjectsSheezan Khan0% (1)

- Service LetterDocument1 pageService LetterMedi Srikanth NethaNo ratings yet

- Appointment LetterDocument4 pagesAppointment LetterHarshal Tapadiya50% (2)

- A Summer Internship Project Report OnDocument49 pagesA Summer Internship Project Report Ongoodboy guduNo ratings yet

- Terms & Conditions 1. Job Title:: Page 1 of 6Document6 pagesTerms & Conditions 1. Job Title:: Page 1 of 6Santosh AmzareNo ratings yet

- Morris & Willner: or byDocument1 pageMorris & Willner: or byPavan Kumar VasudhaNo ratings yet

- June SalaryDocument1 pageJune Salaryaruna nadagouniNo ratings yet

- Review Letter - Oct 19 - Chandan TatiDocument2 pagesReview Letter - Oct 19 - Chandan Tatimadali sivareddyNo ratings yet

- Guideline For Grade and Compensation FitmentDocument5 pagesGuideline For Grade and Compensation FitmentVijit MisraNo ratings yet

- Hyundai India Interview Call Letter PDFDocument2 pagesHyundai India Interview Call Letter PDFIam Abhisek0% (1)

- Value Added Tax (SEMI - FINALS)Document10 pagesValue Added Tax (SEMI - FINALS)Lou Anthony A. Calibo100% (3)

- Shekhar Gajendar Mandhare - Offer Letter2Document2 pagesShekhar Gajendar Mandhare - Offer Letter2shekhar mandhareNo ratings yet

- Salary Break UpDocument17 pagesSalary Break UpRam Surya Prakash DommetiNo ratings yet

- Rupesh Brahme: QUESS Corp Limited (Formerly IKYA Human Capital Solutions)Document6 pagesRupesh Brahme: QUESS Corp Limited (Formerly IKYA Human Capital Solutions)deveshNo ratings yet

- Suman's Experience LetterDocument1 pageSuman's Experience LetterSuman LamaNo ratings yet

- CompensationDocument28 pagesCompensationSomalKantNo ratings yet

- Appointment LetterDocument7 pagesAppointment LetterArun Mohanty100% (1)

- Payslip MarDocument1 pagePayslip Marabhijitj0555No ratings yet

- Pre Joining Formalities Campus Medical FormDocument18 pagesPre Joining Formalities Campus Medical Formrafii_babu1988No ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300No ratings yet

- Salary Slip Format For 25000Document2 pagesSalary Slip Format For 25000Saravanan KNo ratings yet

- 2020 HQ Holidays CircularDocument1 page2020 HQ Holidays CircularSumanth Gundeti0% (1)

- Ref: "Maruti Suzuki" Direct Recruitments Offer.: (10:00 Am To 5:30 PM) Speak English Only or Send SmsDocument2 pagesRef: "Maruti Suzuki" Direct Recruitments Offer.: (10:00 Am To 5:30 PM) Speak English Only or Send SmsSumit Malhotra0% (1)

- Just Dial Joining Salary ChartDocument2 pagesJust Dial Joining Salary ChartPritam SamantaNo ratings yet

- Impulse Offer LetterDocument6 pagesImpulse Offer LetterJaiGaneshNo ratings yet

- Confidential: Sub: Offer Letter To Neha Chauhan For Customer Support Executive PositionDocument2 pagesConfidential: Sub: Offer Letter To Neha Chauhan For Customer Support Executive PositionNeha ChauhanNo ratings yet

- Letter To Gram PanchayatDocument2 pagesLetter To Gram PanchayatSumit DixitNo ratings yet

- Work Experience KFCDocument1 pageWork Experience KFCsham_code0% (1)

- krisAR 2016 2017Document86 pageskrisAR 2016 2017sharkl123No ratings yet

- Accenture LetterDocument1 pageAccenture LettersdrfNo ratings yet

- Shriram Transport Finance Company Limited: Website: WWW - Stfc.in - Corporate Identity Number (CIN) - L65191TN1979PLC007874Document1 pageShriram Transport Finance Company Limited: Website: WWW - Stfc.in - Corporate Identity Number (CIN) - L65191TN1979PLC007874AkshayNo ratings yet

- Hero Mot0Corp LTD: Subject-Appointment LetterDocument7 pagesHero Mot0Corp LTD: Subject-Appointment LetterSatendar PandeyNo ratings yet

- PAY SLIP FOR THE MONTH: February 2020: Apollo Nayana Balaram Birwadkar AP93668 PharmacistDocument1 pagePAY SLIP FOR THE MONTH: February 2020: Apollo Nayana Balaram Birwadkar AP93668 Pharmacistniranjan balaramNo ratings yet

- Appointment OrdersDocument115 pagesAppointment OrdersM NageshNo ratings yet

- Paytm Offer LetterDocument4 pagesPaytm Offer Letterralesh6940% (1)

- Employee Joining Form LivosoDocument2 pagesEmployee Joining Form LivosoKali RathNo ratings yet

- Bajaj Allianz Life Insurance Company LTD.: Issuing OfficeDocument4 pagesBajaj Allianz Life Insurance Company LTD.: Issuing Officesai kiranNo ratings yet

- Consolidated StatementDocument1 pageConsolidated StatementParameswararao BillaNo ratings yet

- Offer LetterDocument2 pagesOffer LetterTanmay VashishthaNo ratings yet

- Joining Documents ListDocument1 pageJoining Documents ListAbhijeet JoshiNo ratings yet

- Hcil - Honda Cars Interview Call Letter.Document3 pagesHcil - Honda Cars Interview Call Letter.qwerty1871900% (1)

- Offer LetterDocument1 pageOffer LetterRajesh PaniNo ratings yet

- NTT Data Offer LetterDocument2 pagesNTT Data Offer LetterutsavNo ratings yet

- MURALI Hero Honda Ltd.Document1 pageMURALI Hero Honda Ltd.balki123No ratings yet

- Infosys HR PolicyDocument5 pagesInfosys HR Policyevk870% (1)

- ARUN SHARMA Sr. Executive HR & Admin (Gurgaon)Document5 pagesARUN SHARMA Sr. Executive HR & Admin (Gurgaon)Tejas JasaniNo ratings yet

- Payslip FormatDocument1 pagePayslip FormatAjit AttreeNo ratings yet

- Bank Offer Letter RawaliDocument3 pagesBank Offer Letter RawaliAnurag SinghNo ratings yet

- Auto CTC Salary CalculatorDocument1 pageAuto CTC Salary CalculatorSathvika SaaraNo ratings yet

- HCL Call Letter PDFDocument3 pagesHCL Call Letter PDFUtkarsh AnandNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- Alphonse Irudayaraj Offer LetterDocument4 pagesAlphonse Irudayaraj Offer Letteralphonse INo ratings yet

- 1Document3 pages1manojNo ratings yet

- Letter of Offer - Chodavarapu RatnakumarDocument3 pagesLetter of Offer - Chodavarapu Ratnakumarvenkat tNo ratings yet

- Cogoport Private Limited Offer Letter - Rishu KumarDocument4 pagesCogoport Private Limited Offer Letter - Rishu KumarRishu GuptaNo ratings yet

- Offer LetterDocument8 pagesOffer LetterengineerkartikekNo ratings yet

- Fce TestsDocument5 pagesFce TestsKimLiênNguyễn100% (1)

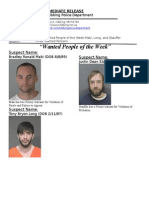

- Wanted People of The Week-Maki, Stauffer, LongDocument2 pagesWanted People of The Week-Maki, Stauffer, LongHibbing Police DepartmentNo ratings yet

- CH 1 IntroDocument5 pagesCH 1 IntroJawad AhmadNo ratings yet

- Cover Letter For Fresher - Sample, Format, Templates - Leverage EduDocument11 pagesCover Letter For Fresher - Sample, Format, Templates - Leverage EduJP ComputersNo ratings yet

- Supreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)Document17 pagesSupreme Court Quarterly Digest - Constitution of India (Jan-Mar, 2024)muhammed iqbalNo ratings yet

- Curnon Bai Thuyet Trinh Giua KyDocument29 pagesCurnon Bai Thuyet Trinh Giua Ky22004079No ratings yet

- Summary - Pivot PointsDocument3 pagesSummary - Pivot PointsTermureAronNo ratings yet

- IJMOT-Paper Acceptance Letter On Letterhead IJMOT-2017!7!1354Document1 pageIJMOT-Paper Acceptance Letter On Letterhead IJMOT-2017!7!1354Nitin KumarNo ratings yet

- 31 Shubham Dangat Mind Mapping 30.07.2021Document1 page31 Shubham Dangat Mind Mapping 30.07.2021Anand VirwaniNo ratings yet

- Film Analysis Class EnemyDocument2 pagesFilm Analysis Class EnemyAnnaScribdNo ratings yet

- A Descriptive Catalogue of Sinhalese Pali and Sinhalese Literary v1 1000691126Document282 pagesA Descriptive Catalogue of Sinhalese Pali and Sinhalese Literary v1 1000691126Asgiriye Seelananda100% (1)

- GO Ms No 38Document93 pagesGO Ms No 38SubhashNo ratings yet

- Andaya, A History of Malaysia.Document24 pagesAndaya, A History of Malaysia.CQOT92No ratings yet

- Interpretation - Public ServantDocument5 pagesInterpretation - Public ServantSwarnika GuptaNo ratings yet

- GRADE 8 ART HandoutsDocument2 pagesGRADE 8 ART HandoutsJulie Ann SaquilayanNo ratings yet

- Comprehensive Scheme For Regulation of SisDocument158 pagesComprehensive Scheme For Regulation of SispatrickNo ratings yet

- Breathless by Serife Suleyman: Serifesuleyman97@Hotmail - Co.UkDocument5 pagesBreathless by Serife Suleyman: Serifesuleyman97@Hotmail - Co.UksahraahmedaliNo ratings yet

- RRA UniformsDocument7 pagesRRA UniformsGilbert KamanziNo ratings yet

- Darden PDFDocument37 pagesDarden PDFRizal ApriyanNo ratings yet

- Allan Symes CV 1Document3 pagesAllan Symes CV 1api-368993634No ratings yet

- Roadmap Template Guide by ProductPlanDocument46 pagesRoadmap Template Guide by ProductPlanDeepak Gupta100% (1)

- Primary / Admin Entrance: Zone-B Zone-ADocument1 pagePrimary / Admin Entrance: Zone-B Zone-AMohammed AzharNo ratings yet

- AmazonDocument4 pagesAmazonbonnieNo ratings yet

- Topic: Summary:: Discussion Relevant To TopicDocument3 pagesTopic: Summary:: Discussion Relevant To TopicAmber AncaNo ratings yet

- The Image of MaheshwaraDocument50 pagesThe Image of MaheshwaraShiva PNo ratings yet

- Establishing Internal Audit FunctionDocument52 pagesEstablishing Internal Audit FunctionKhalid100% (1)

- A Summary Critique - The Works of M. Scott Peck by Howard PepperDocument4 pagesA Summary Critique - The Works of M. Scott Peck by Howard PepperthunderdomeNo ratings yet