Professional Documents

Culture Documents

Next Era Energy 1 Pager

Next Era Energy 1 Pager

Uploaded by

Nikos DiakogiannisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Next Era Energy 1 Pager

Next Era Energy 1 Pager

Uploaded by

Nikos DiakogiannisCopyright:

Available Formats

Company NextEra Energy Ticker NEE Current Price Industry: Utilties Sub-Industry Electric Utilities

Target Price $79.03 TTM P/E 28.12 Beta 0.49 Mkt Cap (bn) 155.28

Stop Loss $63.20 Forward 26.80 $79.03 Credit Rating A- Avg Vol (12M) 1978

52 wk High/Low 93.73-67.22 EPS $1.81 Rating Outlook Above Average Div Yield 2.15%

Company Background

NextEra Energy, Inc. is an American energy company with about 58 GW of generating capacity (24 GW of which were from fossil fuel sources), revenues of over $18 billion in 2020, and about 14,900 employees throughout the

US and Canada. It is the largest electric utility holding company by market capitalization. Its subsidiaries include Florida Power & Light (FPL), NextEra Energy Resources (NEER), NextEra Energy Partners, Gulf Power

Company, and NextEra Energy Services.

Industry Outlook

Electric utilities sub-industry is neutral, balancing the negative impact of several near-term operating headwinds against projected record levels of capital spending (capex) that should support earnings growth, in our view. U.S.

retail electric demand growing slowly in the near term as U.S. economic conditions, such housing starts and unemployment, could began to deteriorate in a potential recessionary environment. The U.S. Energy Information

Administration (EIA) currently forecasts annual residential electricity sales to grow between 0.0% and 1.0% in 2022, while commercial and industrial sales are expected to grow 3.2% and 4.0%, respectively, in 2022. In 2023, the

EIA expects flat to negative 0.5% growth in residential and commercial, while industrial sales grow 3.1% annually

Investment Thesis

The recent FPL rate case order should add $692 million to 2022 revenue and $560 million to 2023 revenue. We see additional revenue from renewable investment projects at NEER and currently forecast 25.5%-26.0% growth

in 2022, followed by more moderate 9.0%-9.5% growth in 2023. The company also has a strong ESG score with their business model relying on producing clean energy using solar power and wind power. The company also

provides dividends and the dividend growth has been steady at 2.53% YoY

Investment Risks

- Unfavourable regulatory or legislative outcomes for NEE’s service territory

- NEER has 19.6 GW renewables and storage backlog as of Q2

- Revenue stability at present is due to the multiyear rate plan at FPL in 2021

- Increase in inflation can lead to increase in the electricity costs

3-5 takeaways

- The recent FPL rate case order should add $692 million to 2022 revenue and $560 million to 2023 revenue.

- Margins are expected near 34.0%-34.5% in 2022 and 35.0% in 2023, as completed capital projects and new rates support higher earnings.

- 2022 adjusted EPS estimate is $2.86 (+12.2% Y/Y) while 2023 adj. EPS estimate is $3.08 (+7.7% Y/Y

Financial Performance Discounted Cash Flow

2017 2018 2019 2020 2021 2018-21 2022-31

Revenue 17,173 16,727 19,204 17,997 17,069 Avg Revenue Growth 0.2% 27.1%

Operating Profit 5,637 3,365 4,865 5,127 2,768 Avg Gross Margin 77.2% 69.6%

Net Income 5,380 6,638 3,769 2,919 3,573 Avg EBITDA Margin 49.0% 40.3%

Revenue Growth 0 0.0% 0.0% 0.0% Avg NOPAT Margin 22.7% 12.8%

EBITDA% 45.5% 50.4% 51.7% 52.93.% 42.3% Avg FCF Margin -35.5% -49.0%

Operating Profit % -% 0.0% 0.0% 0.0% 0.0% Tax Rate 21%

Net Income Margin 17.9% 21.1% 21.2% 23.7% 28.7% WACC 7%

D/E 118.60 99.55 102.95 108.24 121.27 Perpetuity growth rate 8%

EPS 2.87 3.51 1.95 1.49 1.82

PE Ratio 23.96 23.60 28.95 35.59 37.61 Analyst Opinion

Current Ratio 0.64 0.36 0.53 0.47 0.53 Buy: 15 Sell: 0 Hold: 4

RoE 20.47 21.28 10.59 7.94 9.69 Rating Target

RoA 5.72 6.58 3.40 2.38 2.66 S&P NetAdvantage Hold $82.00

Dividend per share 0.98 1.11 1.25 1.40 1.54 Bloomberg Buy $93.00

FCF -4,319.0 -6,734.0 -4,294.0 -5,799.0 -8,057.0 Yahoo Finance Buy $92.80

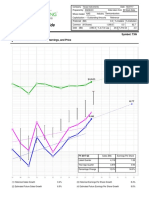

Financial Performance Total Return

Rating Company S&P 500 Industry Sect.

YTD -17% -18.72% -6.74%

2021 21.01% 26.89% 13.99%

Last 3 years 114.84% 90.13% 35.40%

Last 5 years 212.61% 112.89% 47.35%

CSR Characteristics Company Peers (Median)

ESG Disclosure score 27.53 24.67

Governance disclosure score 6.15 7.06

Social Disclosure score 4.41 4.41

Environmental disclosure score 5.44 4.26

Prepared by Team Hartford (Month Day, Year) using Bloomberg, S&P Net Advantage, Morning

*Industry Avg. includes companies listed

Star, Yahoo Finance

You might also like

- FPL BillDocument2 pagesFPL Billnaiedelgado02No ratings yet

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Freay Hans BillDocument1 pageFreay Hans BillJohn Bean100% (2)

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- Current Bill: Hello Jacklyne Alviar, Here's What You Owe For This Billing Period. Keep in MindDocument2 pagesCurrent Bill: Hello Jacklyne Alviar, Here's What You Owe For This Billing Period. Keep in Mindharolds sobeNo ratings yet

- 107 10 DCF Sanity Check AfterDocument6 pages107 10 DCF Sanity Check AfterDavid ChikhladzeNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- FNKAW19 Reg ListDocument13 pagesFNKAW19 Reg ListVasanth KumarNo ratings yet

- UOB_Company_Results_FY22_BBNI_26_Jan_2023_maintain_buy_TP_Rp11,200Document5 pagesUOB_Company_Results_FY22_BBNI_26_Jan_2023_maintain_buy_TP_Rp11,200financialshooterNo ratings yet

- DCFTemplateDocument5 pagesDCFTemplateRob Keith100% (1)

- 1 - BK - Can Fin HomesDocument9 pages1 - BK - Can Fin HomesGirish Raj SankunnyNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- BF 07arDocument86 pagesBF 07arAlexander HertzbergNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Valuation - NVIDIADocument27 pagesValuation - NVIDIALegends MomentsNo ratings yet

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- Stock Selection Guide: Symbol: TXNDocument2 pagesStock Selection Guide: Symbol: TXNMayank PatelNo ratings yet

- 2 B&K 3qfy20Document7 pages2 B&K 3qfy20Girish Raj SankunnyNo ratings yet

- Mudassar (Fa19-Baf-067)Document4 pagesMudassar (Fa19-Baf-067)Mudassar Gul Bin AshrafNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Exxon Mobil Corporation NYSE XOM FinancialsDocument117 pagesExxon Mobil Corporation NYSE XOM Financialsdpr7033No ratings yet

- BANKBARODA - Investor Presentation - 03-Feb-23 - TickertapeDocument42 pagesBANKBARODA - Investor Presentation - 03-Feb-23 - Tickertapedeepak pareekNo ratings yet

- 2020-09-02-SHJ - AX-Moelis Australia Sec-SHINE CORPORATE - Back in Growth Mode-89665112Document5 pages2020-09-02-SHJ - AX-Moelis Australia Sec-SHINE CORPORATE - Back in Growth Mode-89665112ssdebNo ratings yet

- SL2-Corporate Finance Ristk ManagementDocument17 pagesSL2-Corporate Finance Ristk ManagementKrishantha WeerasiriNo ratings yet

- AbbVie 20210806 (BetterInvesting)Document5 pagesAbbVie 20210806 (BetterInvesting)professorsanchoNo ratings yet

- Italy Innovazioni SpADocument6 pagesItaly Innovazioni SpAterradasbaygualNo ratings yet

- SVA ModelDocument15 pagesSVA ModelArshdeep SaroyaNo ratings yet

- Corporate ValuationDocument32 pagesCorporate ValuationNishant DhakalNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Celgene Corporation: Price, Consensus & SurpriseDocument1 pageCelgene Corporation: Price, Consensus & Surprisederek_2010No ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Financial Analysis - WalmartDocument3 pagesFinancial Analysis - WalmartLuka KhmaladzeNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Finacial Ratio Mar 21Document9 pagesFinacial Ratio Mar 21VishNo ratings yet

- 2024 04 12 PH e FgenDocument8 pages2024 04 12 PH e Fgenphilnabank1217No ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Current Price (BDT) : BDT 1,010.0Document6 pagesCurrent Price (BDT) : BDT 1,010.0Uzzal AhmedNo ratings yet

- Creating Winning Event Proposals SecretsDocument16 pagesCreating Winning Event Proposals SecretsAnonymous 5z7ZOpNo ratings yet

- 040821-SBI Press Release Q1FY22Document2 pages040821-SBI Press Release Q1FY22Prateek WadhwaniNo ratings yet

- RocheDocument5 pagesRochePrattouNo ratings yet

- Financial Model of Infosys: Revenue Ebitda Net IncomeDocument32 pagesFinancial Model of Infosys: Revenue Ebitda Net IncomePrabhdeep Dadyal100% (1)

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Investor PPT March 2023Document42 pagesInvestor PPT March 2023Sumiran BansalNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- VIP Industries - 4QFY24 Result Update - 10 May 24Document10 pagesVIP Industries - 4QFY24 Result Update - 10 May 24Purva ZanwarNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Class 9 SolutionsDocument14 pagesClass 9 SolutionsvroommNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- Mayes 8e CH07 SolutionsDocument32 pagesMayes 8e CH07 SolutionsRamez AhmedNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- NVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Document10 pagesNVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Andrei SeimanNo ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Amgen 1 PagerDocument1 pageAmgen 1 PagerNikos DiakogiannisNo ratings yet

- Ally 1 PagerDocument1 pageAlly 1 PagerNikos DiakogiannisNo ratings yet

- Apple 1 PagerDocument1 pageApple 1 PagerNikos DiakogiannisNo ratings yet

- Prof. Alex Asandei: InstructorDocument26 pagesProf. Alex Asandei: InstructorNikos DiakogiannisNo ratings yet

- CHEM 2445 - Aldol: Dr. EddyDocument21 pagesCHEM 2445 - Aldol: Dr. EddyNikos DiakogiannisNo ratings yet

- Music 1003 Final SG Apr 11Document2 pagesMusic 1003 Final SG Apr 11Nikos DiakogiannisNo ratings yet

- Questions To Chapter 5 TQMDocument6 pagesQuestions To Chapter 5 TQMAbdulhmeed MutalatNo ratings yet

- Florida Power & Light CompanyDocument13 pagesFlorida Power & Light CompanyNalin GoelNo ratings yet

- O-677-10 (FPL Franchise Agreement)Document8 pagesO-677-10 (FPL Franchise Agreement)al_crespoNo ratings yet

- Florida Power & Light Company 700 Universe Boulevard, Juno Beach, FL 33408Document3 pagesFlorida Power & Light Company 700 Universe Boulevard, Juno Beach, FL 33408Yasir NASSERALLAHNo ratings yet

- Distribution Engineering Reference FPL PDFDocument189 pagesDistribution Engineering Reference FPL PDFRosmer Ocando MoralesNo ratings yet

- Next Era Energy 1 PagerDocument1 pageNext Era Energy 1 PagerNikos DiakogiannisNo ratings yet

- Power Play - Political Influence of Florida's Top Energy Corporations FINALDocument23 pagesPower Play - Political Influence of Florida's Top Energy Corporations FINALIntegrity FloridaNo ratings yet

- Robb EmailDocument1,149 pagesRobb EmailMy-Acts Of-SeditionNo ratings yet

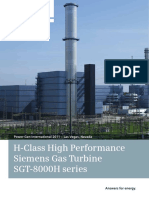

- Gasturbine sgt5 8000h H Klasse Performance PDFDocument10 pagesGasturbine sgt5 8000h H Klasse Performance PDFAbd Elrahman HamdyNo ratings yet

- XXX USA Electric Service StandardsDocument146 pagesXXX USA Electric Service StandardsSabri GünaydınNo ratings yet

- F Sacetasfoe Nrcscopingcomments Tp3&4 062118Document12 pagesF Sacetasfoe Nrcscopingcomments Tp3&4 062118Alan FaragoNo ratings yet

- Saj 1995 0155Document4 pagesSaj 1995 0155alfadogNo ratings yet

- ML18309A020Document7 pagesML18309A020Nathan BlockNo ratings yet

- Florida Power & Light: Presented byDocument8 pagesFlorida Power & Light: Presented byavi6192No ratings yet

- Electric-Service-Standards Florida Power Light FPL PDFDocument118 pagesElectric-Service-Standards Florida Power Light FPL PDFLuisRubioLopezNo ratings yet

- Electric Service Standards PDFDocument132 pagesElectric Service Standards PDFLuiz Fernando AlvesNo ratings yet

- Book 1Document368 pagesBook 1Chitta KarthikNo ratings yet

- PowerPoint Presentation - Slide 1Document41 pagesPowerPoint Presentation - Slide 1techbhazNo ratings yet

- STEP UP GENERATOR TRANSFORMERS (1990-2014 Jun)Document7 pagesSTEP UP GENERATOR TRANSFORMERS (1990-2014 Jun)Syed Moiz NaqviNo ratings yet

- Fin201 Assignment by SHAHERZADDocument16 pagesFin201 Assignment by SHAHERZADNayeem Rumman Julhash 1911185642No ratings yet

- Global Energy Storage Opportunity 2018Document42 pagesGlobal Energy Storage Opportunity 2018Tadgh CullenNo ratings yet

- Audubon Martin County: Send Santa To Possum LongDocument4 pagesAudubon Martin County: Send Santa To Possum LongAudubon of Martin CountyNo ratings yet

- GIS Analysis of The Bobwhite-Manatee Transmission Line: Erin S. Ganzenmuller May 1, 2014 UWF GIS4043/LDocument18 pagesGIS Analysis of The Bobwhite-Manatee Transmission Line: Erin S. Ganzenmuller May 1, 2014 UWF GIS4043/Leganz111No ratings yet

- LTC 013-2014 Reports and Informational Items For Jan 15 2013 CMDocument68 pagesLTC 013-2014 Reports and Informational Items For Jan 15 2013 CMDonPeeblesMIANo ratings yet

- SOUTHWIRE - Novinium-Cable-Technology-WhitepaperDocument5 pagesSOUTHWIRE - Novinium-Cable-Technology-WhitepapermiguelpaltinoNo ratings yet