Professional Documents

Culture Documents

MAS-Results-Presentation-and-Company-Profile-30-June-2022 13

MAS-Results-Presentation-and-Company-Profile-30-June-2022 13

Uploaded by

Vlad IonescuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAS-Results-Presentation-and-Company-Profile-30-June-2022 13

MAS-Results-Presentation-and-Company-Profile-30-June-2022 13

Uploaded by

Vlad IonescuCopyright:

Available Formats

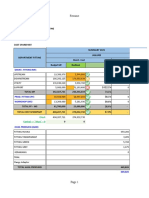

DEVELOPMENT PROPERTY SCHEDULE Jun 22

Destination Asset MAS’ share

Location Type Status Stake Completion GLA GLA/GSA Units ERV Budget Spent ERV Budget Spent Margin ERV/Budget

% year m 2

m 2

# €m €m €m €m €m €m % %

DEVELOPMENTS 930.8 95.9

DJV preferred equity outstanding commitment (60% of notional) 10.5 140.0 7.5%

Development Property 1,592,800 14,398 71.3 1,970.3 238.5 28.8 790.8 95.9

Enclosed Malls 319,000 207,700 34.9 412.1 56.7 14.2 167.3 22.6 8.4%

EM-Cluj Mall RO, Cluj-Napoca Super-regional Zoning 40% Oct 26 73,300 73,300 12.5 140.3 – 5.0 56.1 – 8.9%

EM-Mall Moldova - phase II RO, Iasi Super-regional Permitted 40% May 24 101,300 53,700 9.9 118.6 21.1 4.0 47.4 8.4 8.3%

EM-Arges Mall RO, Pitesti Regional Permitted 40% May 24 51,300 51,300 8.2 101.9 18.0 3.3 40.8 7.2 8.0%

EM-Alba Iulia Mall RO, Alba Iulia Regional WIP 40% Sep 23 28,900 28,900 4.0 47.2 17.6 1.6 18.9 7.0 8.5%

EM-Galleria Burgas - refurbishment BG, Burgas Regional Zoning 100% Apr 24 64,200 500 0.3 4.1 – 0.3 4.1 – 6.2%

Open-air Malls 202,300 74,000 9.4 109.9 13.0 3.8 44.0 5.7 8.4%

OM-IMGB Value Centre RO, Bucharest Community Zoning 40% Dec 24 60,600 28,000 3.9 47.0 – 1.6 18.8 – 8.2%

OM-Brasov Value Centre RO, Brasov Community Zoning 40% Apr 24 29,200 19,800 2.4 28.2 – 0.9 11.3 – 8.3%

OM-Giurgiu Value Centre RO, Giurgiu Community Zoning 40% Oct 24 18,600 14,200 1.7 19.6 – 0.7 7.8 – 8.7%

OM-Baia Mare Value Centre - extension RO, Baia Mare Community WIP 40% Oct 22 52,200 4,300 0.5 5.4 4.9 0.2 2.2 2.0 8.3%

OM-Slobozia Value Centre - extension RO, Slobozia Convenience Permitting 40% Sep 23 19,500 4,300 0.5 5.4 2.2 0.2 2.2 0.9 9.2%

OM-Roman Value Centre - extension RO, Roman Community WIP 40% Dec 22 22,200 3,400 0.4 4.3 1.1 0.2 1.7 0.5 9.4%

Land RO Land 40% 4.1 1.6

Land PL Land 100% 0.7 0.7

Office 380,200 153,600 27.0 254.0 27.9 10.8 101.6 11.2 10.6%

Office-Silk District RO, Iasi Office WIP 40% 2023/26 217,500 104,400 19.1 177.7 27.9 7.6 71.1 11.2 10.7%

Office-Cluj RO, Cluj-Napoca Office Zoning 40% 2026/28 162,700 49,200 7.9 76.3 – 3.2 30.5 – 10.3%

Residential 1,157,500 14,398 1,194.3 140.9 477.9 56.4 24.3%

RZ-Spumotim Residential RO, Timisoara Residential Zoning 40% 2026/28 181,700 2,287 193.5 – 77.4 – 22.3%

RZ-IMGB Residential RO, Bucharest Residential Zoning 40% 2025/27 242,400 3,149 188.0 – 75.2 – 24.5%

RZ-Roman Residential RO, Brasov Residential Zoning 40% 2024/27 166,000 2,137 156.7 0.2 62.7 0.1 24.9%

RZ-Silk District RO, Iasi Residential WIP 40% 2023/25 113,100 1,491 128.1 27.1 51.3 10.8 23.0%

RZ-Elba Residential RO, Timisoara Residential Zoning 40% 2025/26 104,900 1,251 127.6 – 51.1 – 25.7%

RZ-Avalon Estate RO, Bucharest Residential WIP 40% 2022/24 93,300 746 125.7 60.4 50.3 24.2 25.8%

RZ-Cluj Residential RO, Cluj-Napoca Residential Zoning 40% 2027/29 113,500 1,461 119.2 0.1 47.7 – 24.7%

RZ-Other Residential Pipeline RO Residential Zoning 40% 2025/27 65,500 920 67.5 – 27.0 – 23.8%

RZ-Marmura Residence* RO, Bucharest Residential WIP 40% 2022 36,100 458 49.9 49.4 20.0 19.8 24.0%

RZ-Pleiades Residence RO, Ploiesti Residential Permitting 40% 2023/25 41,000 498 38.1 3.7 15.2 1.5 25.5%

Spent: includes land, hard & soft costs.

Note: The planned extensions of directly-owned properties Militari Shopping and Nova Park remain on hold, with further updates to be provided in due course.

13

* At Marmura Residence 308 units have been handed over to clients by 30 June 2022.

You might also like

- H&M Minimum Manufacturer ReqDocument8 pagesH&M Minimum Manufacturer ReqAshok LakshmananNo ratings yet

- Finishes On KidswearDocument10 pagesFinishes On KidswearPrakritiNo ratings yet

- Pow 17J00016Document48 pagesPow 17J00016amroussyNo ratings yet

- Type 4 - The IndividualistDocument8 pagesType 4 - The IndividualistMarkus van der Westhuizen100% (1)

- Traditional or Contemporary The Prevalence of Performance MeasurementDocument20 pagesTraditional or Contemporary The Prevalence of Performance MeasurementSivaKumar SivarajasinghamNo ratings yet

- Hero Moto Q4FY22 Result SnapshotDocument3 pagesHero Moto Q4FY22 Result SnapshotBaria VirenNo ratings yet

- Banking Sector Update: 2QCY10 Report Card - Lower Impairment Allowances For Loans Help Beat Forecasts - 02/09/2010Document14 pagesBanking Sector Update: 2QCY10 Report Card - Lower Impairment Allowances For Loans Help Beat Forecasts - 02/09/2010Rhb InvestNo ratings yet

- Create One For ThisDocument74 pagesCreate One For ThisYogi WijayaNo ratings yet

- War 8Document81 pagesWar 8Josh Allen Gojo CruzNo ratings yet

- 1 - 1b Reference 2 Table 2. Number, Floor Area, Value of Construction 4Q2021Document2 pages1 - 1b Reference 2 Table 2. Number, Floor Area, Value of Construction 4Q202109 IGCASAN, Joel J.No ratings yet

- 5 November 2022Document1 page5 November 2022Ega DarmawanNo ratings yet

- Cost AnalysisDocument13 pagesCost Analysisnaveen yadavNo ratings yet

- MODEC, Inc. 2019 Half-Year Financial Results Analysts PresentationDocument16 pagesMODEC, Inc. 2019 Half-Year Financial Results Analysts Presentationfle92No ratings yet

- Weight ChartDocument19 pagesWeight ChartHimang JainNo ratings yet

- Calculo Wacc - AlicorpDocument14 pagesCalculo Wacc - Alicorpludwing espinar pinedoNo ratings yet

- Progress MingguanDocument181 pagesProgress MingguanPriyo AnggoroNo ratings yet

- Analisa Pelaksanaan Kerja - KONTRAK MININGDocument19 pagesAnalisa Pelaksanaan Kerja - KONTRAK MININGyaniyuliani007No ratings yet

- Cloud Computing in BPODocument15 pagesCloud Computing in BPORahul KunwarNo ratings yet

- Growth Rate and Composition of Real GDPDocument27 pagesGrowth Rate and Composition of Real GDPpallavi jhanjiNo ratings yet

- Industry Ranking As of March 2021Document1 pageIndustry Ranking As of March 2021joyceNo ratings yet

- Economic Spotlight - Nuvama ReportDocument8 pagesEconomic Spotlight - Nuvama Reportsonika.arora1417No ratings yet

- R107 - Report Daily Store - 09mar24Document3 pagesR107 - Report Daily Store - 09mar24Xxx XbxbNo ratings yet

- Fiscal Year Market Size (Rs. Crore)Document6 pagesFiscal Year Market Size (Rs. Crore)Milan MisraNo ratings yet

- Jadual TransaksiDocument15 pagesJadual TransaksiVenice ChenNo ratings yet

- Jadual Transaksi Harta Tanah Pahang Q3 2023Document46 pagesJadual Transaksi Harta Tanah Pahang Q3 2023ibrahimzamil29No ratings yet

- DAP & PAP Project Cost EstimateDocument8 pagesDAP & PAP Project Cost EstimateSantosh JayasavalNo ratings yet

- 8 Negsembilanq12021Document41 pages8 Negsembilanq12021Afiq KhidhirNo ratings yet

- BLUE STAR LTD - Quantamental Equity Research Report-1Document1 pageBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarNo ratings yet

- SCHGDocument1 pageSCHGSUNIL JHILMILNo ratings yet

- Key Performance Indicators Y/E MarchDocument1 pageKey Performance Indicators Y/E Marchretrov androsNo ratings yet

- Equity Weekly: Equity Research - Monday, December 14, 2009Document5 pagesEquity Weekly: Equity Research - Monday, December 14, 2009naudaslietasNo ratings yet

- Sterlite Technologies - Q4'10 Result Update - (23!04!2010)Document3 pagesSterlite Technologies - Q4'10 Result Update - (23!04!2010)kotler_2006No ratings yet

- Equity Weekly: Equity Research - Monday, September 21, 2009Document5 pagesEquity Weekly: Equity Research - Monday, September 21, 2009naudaslietasNo ratings yet

- RINA S FLEET GROWS Y O Y by 15 7 IN MARCH 2023 1683079984Document1 pageRINA S FLEET GROWS Y O Y by 15 7 IN MARCH 2023 1683079984Kittipong SookchaiNo ratings yet

- GDP 8th PlanDocument1 pageGDP 8th PlanDavid WykhamNo ratings yet

- LOM Exam PrepDocument8 pagesLOM Exam PrepPaul EshanNo ratings yet

- Key Ratios: Years Mar-09 Mar-08 Mar-07 Mar-06 Mar-05Document3 pagesKey Ratios: Years Mar-09 Mar-08 Mar-07 Mar-06 Mar-05md_ali19862968No ratings yet

- 2021Q4Document6 pages2021Q409 IGCASAN, Joel J.No ratings yet

- Head Count Jan 2017 As of 12-20-2016Document35 pagesHead Count Jan 2017 As of 12-20-2016Rigoberto ChairezNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- 2021 08 CBT Pemakaian Sparepart Fitting - Rev.01Document590 pages2021 08 CBT Pemakaian Sparepart Fitting - Rev.01winda listya ningrumNo ratings yet

- Declining BalanceDocument15 pagesDeclining BalanceGigih Adi PambudiNo ratings yet

- 1st Sem 2015 Poverty - Publication - 0Document44 pages1st Sem 2015 Poverty - Publication - 0mp dcNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No P.O No Rev. No Project Details Technical Requirement ConsumablesDocument10 pagesWelding Consumable Calculation (WCC) : Doc. No P.O No Rev. No Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Analyse Bus 28-02-2018Document75 pagesAnalyse Bus 28-02-2018n.02thierryNo ratings yet

- Monthly Info 2023.08Document10 pagesMonthly Info 2023.08onlychess96No ratings yet

- SCURVEDocument1 pageSCURVEMans LaderaNo ratings yet

- Tandag Financial EstimateDocument710 pagesTandag Financial EstimateHashiru JīpuNo ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabNo ratings yet

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212No ratings yet

- FCF AIRTHREAD 222çbbbbbbDocument18 pagesFCF AIRTHREAD 222çbbbbbbGuillermo DiazNo ratings yet

- 2018S1POV Tab4 Adjko v2Document14 pages2018S1POV Tab4 Adjko v2Jacket TralalaNo ratings yet

- ConsoDocument11 pagesConsoRJNo ratings yet

- 4 November 2022Document1 page4 November 2022Ega DarmawanNo ratings yet

- Value Added ReportDocument55 pagesValue Added ReportJhon JairoNo ratings yet

- EBLSL Daily Market Update 5th August 2020Document1 pageEBLSL Daily Market Update 5th August 2020Moheuddin SehabNo ratings yet

- 2023 REMAX Vs The IndustryDocument1 page2023 REMAX Vs The IndustryApple SolutionsNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- A/b/ A/b/: Source: Philippine Statistics AuthorityDocument3 pagesA/b/ A/b/: Source: Philippine Statistics AuthorityJacket TralalaNo ratings yet

- Napic Q3 2020Document8 pagesNapic Q3 2020HenryNo ratings yet

- Bronch AdDocument23 pagesBronch AdAbdelrahman NazmiNo ratings yet

- Frequency Fall 2013Document56 pagesFrequency Fall 2013bluegorilla108No ratings yet

- HAPIPOLA Catalogue CompDocument66 pagesHAPIPOLA Catalogue CompTROUBLESOME 18No ratings yet

- Module 3 - Lesson 1 and 2-FINALDocument18 pagesModule 3 - Lesson 1 and 2-FINALRANIE MAY V. PIÑERONo ratings yet

- Four Cylinder Engine: Figure 1-Slider Crank Mechanism in An EngineDocument6 pagesFour Cylinder Engine: Figure 1-Slider Crank Mechanism in An EngineRamsey MejiNo ratings yet

- TÀI LIỆU NGHE - NEP 1Document37 pagesTÀI LIỆU NGHE - NEP 1Trinh NguyễnNo ratings yet

- Đề KT HKII - Tiếng Anh 2 Smart StartDocument6 pagesĐề KT HKII - Tiếng Anh 2 Smart Startarmy munNo ratings yet

- A2 U4 Extra Grammar Practice Reinforcement PDFDocument1 pageA2 U4 Extra Grammar Practice Reinforcement PDFVick BastinNo ratings yet

- Attributes: Physical Mental SocialDocument4 pagesAttributes: Physical Mental SocialCreepyrightsNo ratings yet

- Micron User GuideDocument57 pagesMicron User GuidetaliamatNo ratings yet

- Music Appreciation ReportDocument11 pagesMusic Appreciation ReportMichael FrancisNo ratings yet

- Chai PointDocument5 pagesChai PointSARGAM JAINNo ratings yet

- Dahua Ip CamDocument33 pagesDahua Ip CamNovri ZaldiNo ratings yet

- LI L2 Unit Test 8ADocument2 pagesLI L2 Unit Test 8ASandra BinstokNo ratings yet

- Zip Grade 50 Questionv 2Document1 pageZip Grade 50 Questionv 2zainal ahmadNo ratings yet

- Winter 2024 Swimming Lesson BrochureDocument11 pagesWinter 2024 Swimming Lesson Brochureheidigirard1985No ratings yet

- Inglés Primaria Tercero 3Document20 pagesInglés Primaria Tercero 3Javier Medrano Sánchez100% (1)

- Distance Vs DisplacementDocument1 pageDistance Vs DisplacementNila OlagueraNo ratings yet

- Summative Test CSSDocument1 pageSummative Test CSSVincent Librea100% (1)

- Summercat by Billie The Vision and The DancersDocument2 pagesSummercat by Billie The Vision and The Dancersvanesa.campillejo1673No ratings yet

- ACCOMODATION CATEGORIES FOR GRADING-ZambiaDocument3 pagesACCOMODATION CATEGORIES FOR GRADING-ZambiaRodgers Nsama KazembeNo ratings yet

- Department of Moquegua: Historical ReviewDocument2 pagesDepartment of Moquegua: Historical ReviewRosaMorales100% (1)

- Number System Solution (2011-2021)Document83 pagesNumber System Solution (2011-2021)Sampathkumar MtechNo ratings yet

- TazaTicket PresentationDocument13 pagesTazaTicket Presentationilyas shabbirNo ratings yet

- Eggless Lava CakesDocument7 pagesEggless Lava CakesDimple ModugulaNo ratings yet

- Classic Love PoemsDocument82 pagesClassic Love PoemsjmusopoleNo ratings yet

- Extremely Entertaining Short StoriesDocument27 pagesExtremely Entertaining Short StoriesSajid Chowdhury83% (6)

- Four Pack, Six Pack Beer Bottle CarrierDocument7 pagesFour Pack, Six Pack Beer Bottle CarrierDiego Francisco Porta TalaveraNo ratings yet